Sample Letter of Credit: Credit is the trust that bridges the gap that exists between the creditor and the customer. The primary purpose of writing a credit letter could be different. For instance, if you are requesting Credit or demanding Credit that is approved, denied or payment of application or loan for a credit card.

Credit letters or letters of Credit are primarily used to convey the message a creditor wishes to tell a customer, informing them that such an amount is due and may also include time specified on it or payment mode.

A letter of Credit is an official document written formally, clearly designating this letter’s reason, focusing on the subject matter. However, if you are writing a letter denying a person’s request for Credit, ensure to keep the tone of the letter courteous and polite while maintaining professionalism.

Get Other Types of Letter Writing like Formal, Informal and Different Types of Letter Writing Samples.

There are a few possibilities to keep in mind when denying a request for Credit regarding a future business’s open opportunities with the party. So write the letter briefly and to-the-point, which prevents you from accepting the Credit. Also, explain the reasons adequately and in simple terms so that the recipient can understand them properly.

In writing a letter regarding the demand for credit due to the customer, you should point out briefly that the Credit is due and that the payment time has lapsed. If the recipient’s payment is a month behind schedule, you should encourage the customer or ask the recipient to contact you to discuss the lapse of payment and time.

However, while addressing a recipient whose payment is overdue for more than two months and the customer is still not showing any interest in the payment, then inform the person that if the payment lags and is not remunerated, penalties will be fined.

However, refrain from any threatening words, but ensure that you have decided to take action through necessary points. Keep a consistent tone and be clear about the next possible steps towards ignorance.

The most important thing to remember while writing a credit letter is that it should be straightforward and businesslike and encourage the client for future deeds.

Sample Letter of Credit

Here are a few of the samples of letters of Credit based on the occasion or person.

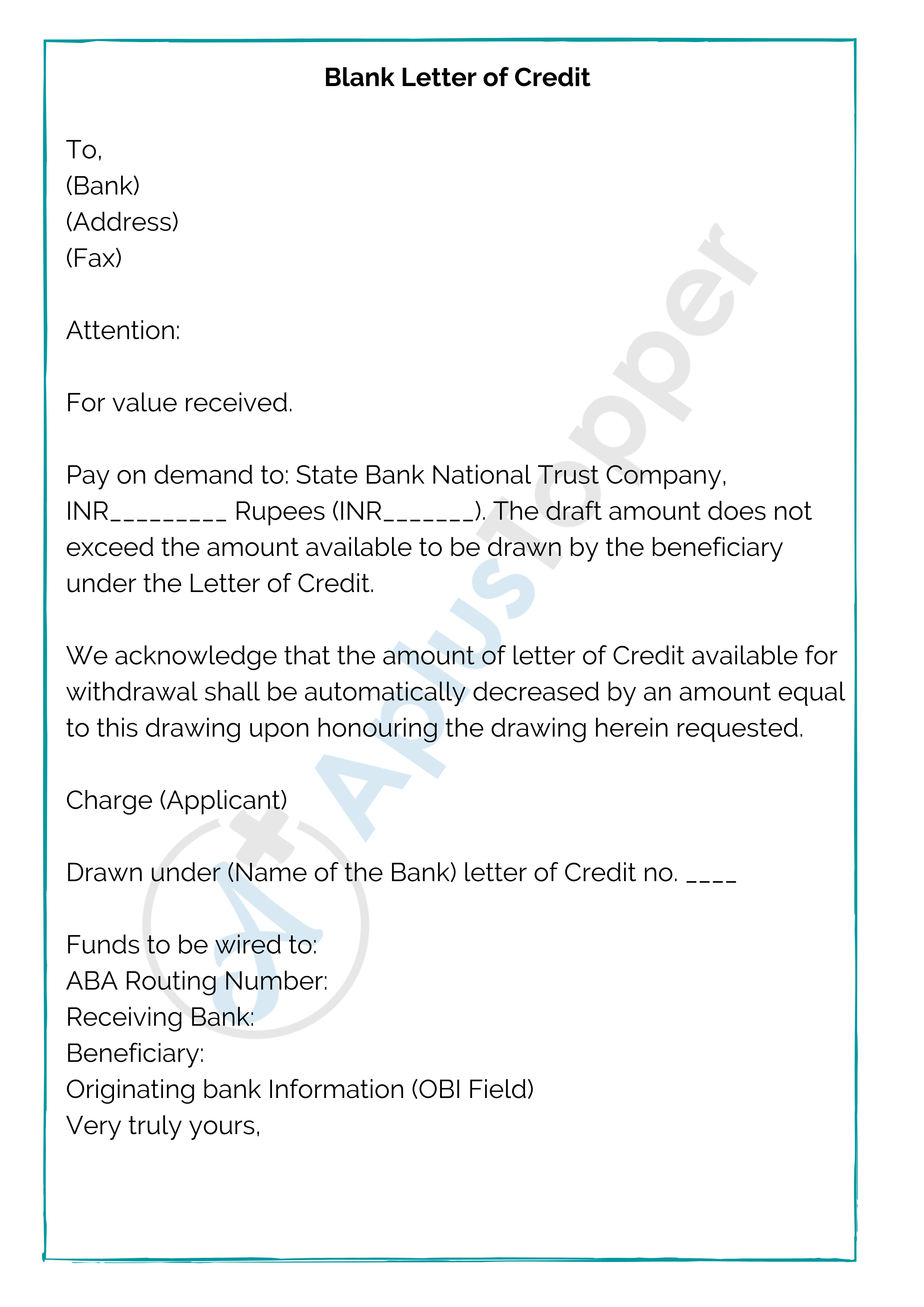

Blank Letter of Credit

To,

(Bank)

(Address)

(Fax)

Attention:

For value received

Pay on demand to: State Bank National Trust Company, INR_________ Rupees (INR_______). The draft amount does not exceed the amount available to be drawn by the beneficiary under the Letter of Credit.

We acknowledge that the amount of letter of Credit available for withdrawal shall be automatically decreased by an amount equal to this drawing upon honouring the drawing herein requested.

Charge (Applicant)

Drawn under (Name of the Bank) letter of Credit no. ____

Funds to be wired to:

ABA Routing Number:

Receiving Bank:

Beneficiary:

Originating bank Information (OBI Field)

Very truly yours,

Official Letter of Credit

Ladies and Gentlemen:

We hereby establish our irrevocable letter of credit in favour for the account of ______ of _______ for an aggregate amount not to exceed _______ (INR_____).

The Letter of Credit is issued in connection with the applicant’s application for a _______ permit.

Funds under this letter of Credit are available by your drafts at sight on _____ and accompanied by a statement signed by your authorized representative certifying that:

“ Address the problem.”

Each drawn draft should be marked as “Drawn under _______ Letter of Credit No. ____.”

We agree that the drafts drawn comply with the terms of the credit letter will be duly honoured if payment presented to our office at ___________ in person or by certified mail on or before the close of the business on the expiration date set forth above.

The Letter of Credit will be deemed automatically extended without amendment for one year from the expiration date hereof or any future expiration date unless at least thirty days before any expiration date. We notify you in writing by certified mail.

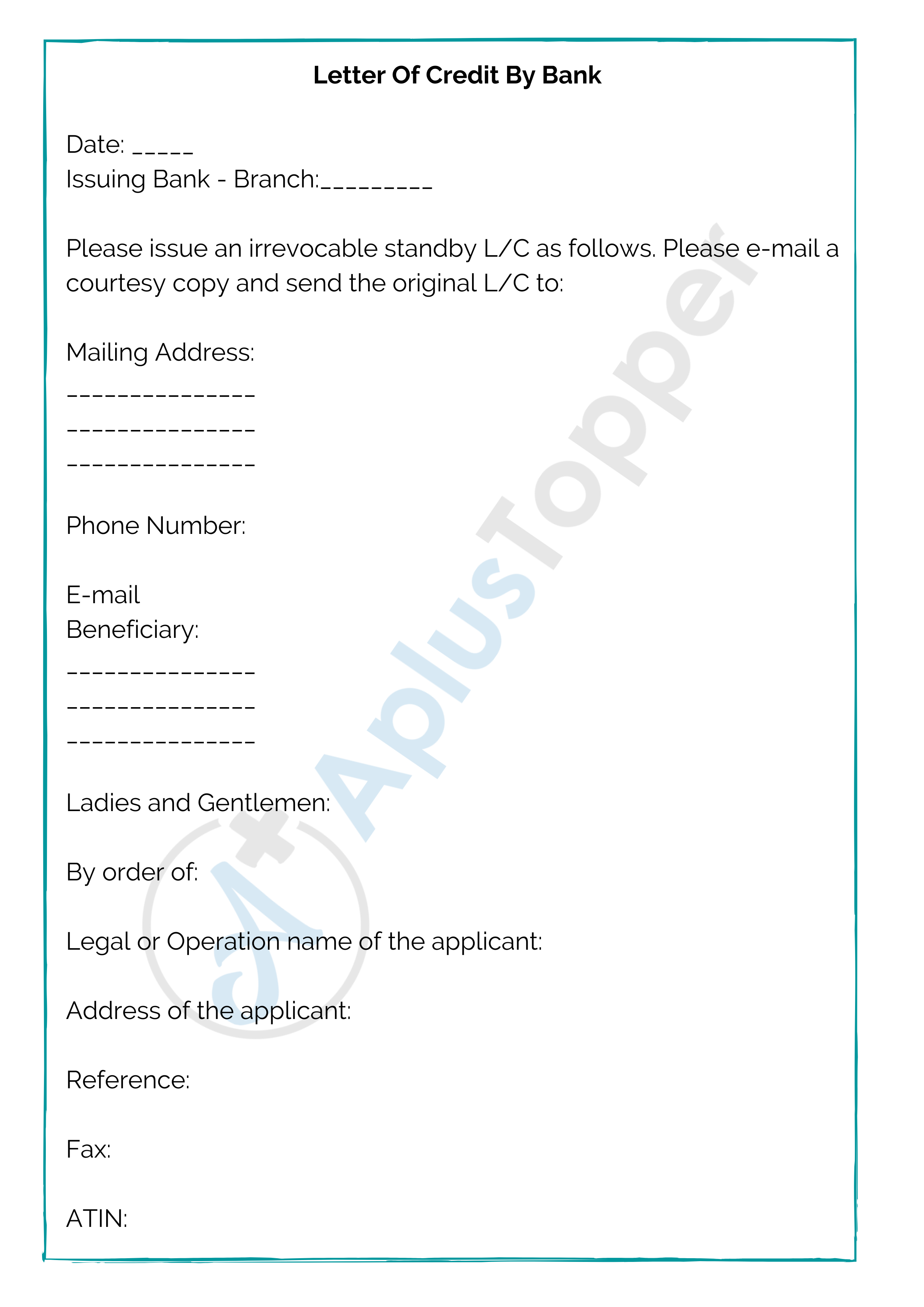

Letter Of Credit By Bank

Date: _____

Issuing Bank – Branch:_________

Please issue an irrevocable standby L/C as follows. Please e-mail a courtesy copy and send the original L/C to:

Mailing Address:

_______________

_______________

_______________

Phone Number:

Beneficiary:

_______________

_______________

_______________

Ladies and Gentlemen:

By order of:

Legal or Operation name of the applicant:

Address of the applicant:

Reference:

Fax:

ATIN:

Letter Of Credit To Treasure

A letter of Credit to treasure is a letter received from the bank guaranteeing that an applicant’s (buyer’s) payment to a recipient (seller) will be received on time for the correct amount.

However, if the applicant (buyer) cannot reimburse the payment on the purchase, the bank is required to cover the total or remaining amount of the purchase, which may be offered as a facility.

Per international dealings, including the differing laws and distance existing in each country and the difficulty in knowing each party personally, the use of letters of credit has become a crucial aspect of international trade.

Irrevocable Letter Of Credit

Date:

Irrevocable Letter of Credit No:

Address:

Re:

Gentlemen:

We hereby revoke an irrevocable letter of credit in favour of the _________ for the account of ______________ for a sum not to exceed the aggregate of _____________ available by your draft(s) on ______________ at the sight to be accompanied by the following documents;

Statements indicating that the development or the applicant did not comply with the chapter 4 of the _______ or with the condition of ________ permit after issuance for ______________, (State), (Country).

This letter of credit must be marked as “drawn under ___________, letter of credit no.__________, dated ______.

We now engage with bona fide holders, endorsers, drawers of such drafts drawn and in compliance with the terms of this letter of Credit, the same will meet with due honour of presentation and the delivery of the documents _______.

Very truly yours,

By: (Signature)

Standby Letter Of Credit

A standby letter of credit, commonly known as SLOC, is a legal document that guarantees a bank’s payment commitment to a seller. This letter of Credit is written if the buyer -or the bank’s client- defaults on the agreement.

A standby letter of Credit (SLOC) helps facilitate international trade between strangers and have gone by different laws and regulations.

Although the recipient is sure to receive the goods and the applicant is certain to receive payment, a standby letter of credit does not guarantee that they will be happy with the goods. A standby letter of Credit (SLOC) can also be abbreviated SBLC.

Letter Of Credit Sample

A letter of credit is a legal document that guarantees the applicant’s (buyer’s) payment to the recipient (sellers). A letter of credit is issued by a bank and ensures the timely and full payment to the recipient (seller). However, if the applicant (buyer) cannot make such a payment, the bank covers the full or the remaining amount on behalf of the applicant (buyer).

Avoiding Documentary Credit Problems

- Sending the buyer a letter of credit proforma

To avoid delays and problems in payment, it is recommended that the exporter conveys in writing the guidelines to the buyer. The letter must describe the terms the Credit must contain, the recipient’s complete name, and the bank’s address to which the Letter of Credit should be advised with an opening bank and details regarding the shipment terms.

If the Credit’s issuance is spelled out in advance, then the cost amendments may not be required.

- Complying with Documentary Requirements

Freight forwarders and exporters who frequently assist the exporter in preparing the documents for shipment must remain aware that terms and conditions written in letters of Credit must be fulfilled as stated.

The opening bank has to set forth terms as requested by the buyer or applicant. Neither the opening bank nor the negotiating bank will honour documents other than those specified in the credit letter.

Furthermore, the documents that need to be present under a letter of Credit are described explicitly as to the information and must be contained in the specified form.

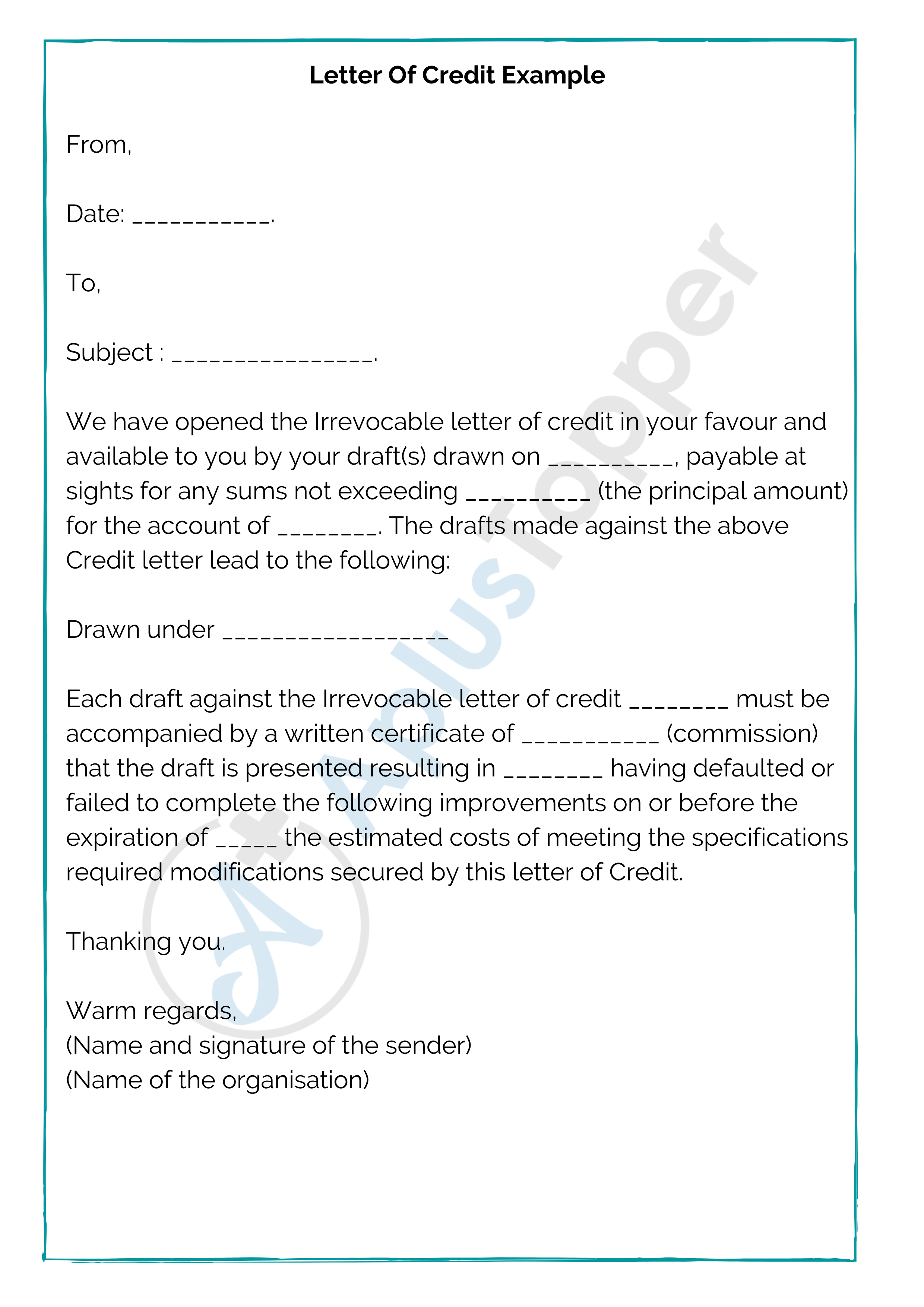

Letter Of Credit Example

From,

Date: ___________.

To,

Subject : ________________.

We have opened the Irrevocable letter of credit in your favour and available to you by your draft(s) drawn on __________, payable at sights for any sums not exceeding __________ (the principal amount) for the account of ________. The drafts made against the above Credit letter lead to the following:

Drawn under __________________

Each draft against the Irrevocable letter of credit ________ must be accompanied by a written certificate of ___________ (commission) that the draft is presented resulting in ________ having defaulted or failed to complete the following improvements on or before the expiration of _____ the estimated costs of meeting the specifications required modifications secured by this letter of Credit.

Thanking you.

Warm regards,

(Name and signature of the sender)

(Name of the organisation)

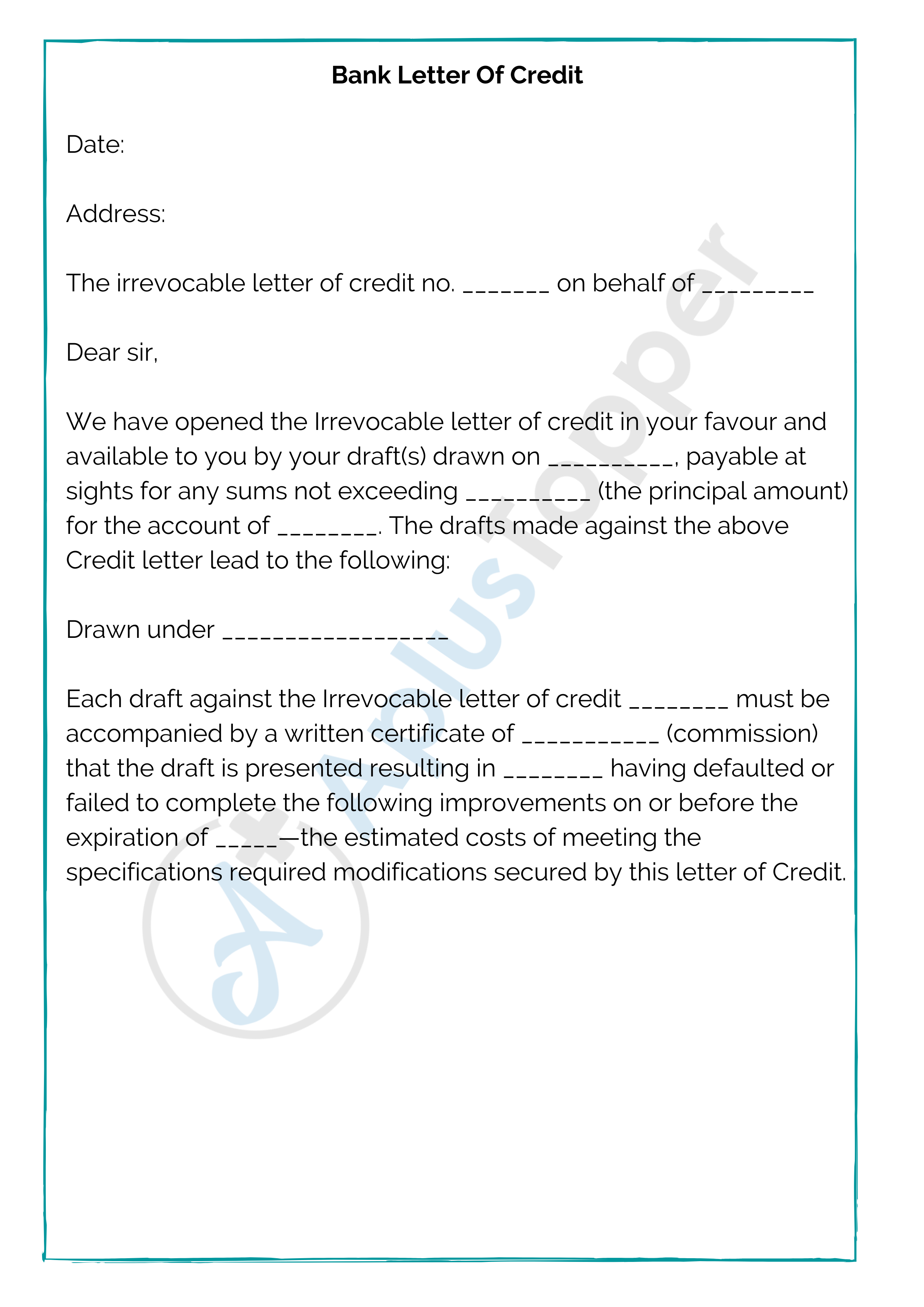

Bank Letter Of Credit

Date:

Address:

The irrevocable letter of credit no. _______ on behalf of _________

Dear sir,

We have opened the Irrevocable letter of credit in your favour and available to you by your draft(s) drawn on __________, payable at sights for any sums not exceeding __________ (the principal amount) for the account of ________. The drafts made against the above Credit letter lead to the following:

Drawn under __________________

Each draft against the Irrevocable letter of credit ________ must be accompanied by a written certificate of ___________ (commission) that the draft is presented resulting in ________ having defaulted or failed to complete the following improvements on or before the expiration of _____—the estimated costs of meeting the specifications required modifications secured by this letter of Credit.

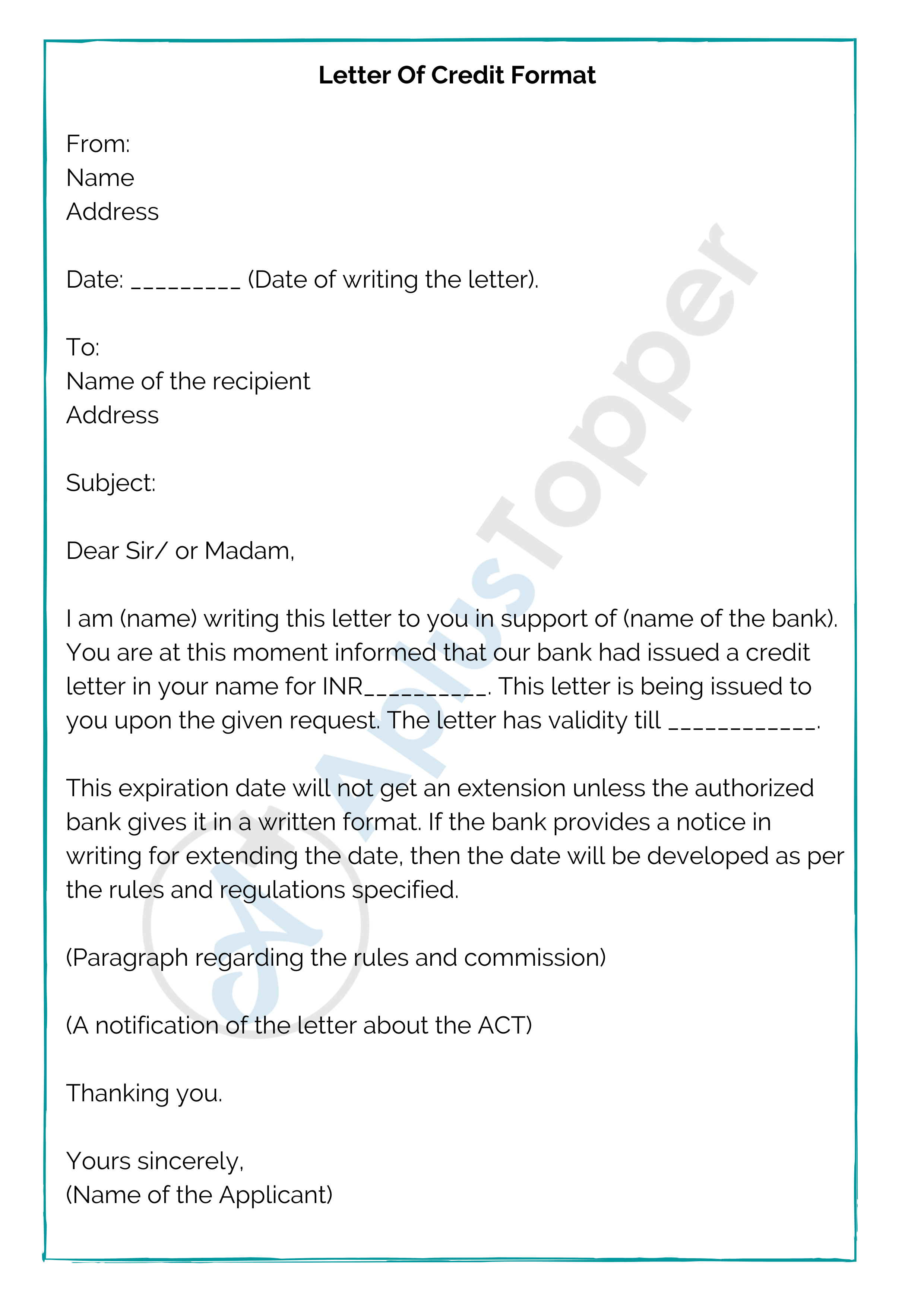

Letter Of Credit Format

From:

Name

Address

Date: _________ (Date of writing the letter).

To:

Name of the recipient

Address

Subject:

Dear Sir/ or Madam,

I am (name) writing this letter to you in support of (name of the bank). You are at this moment informed that our bank had issued a credit letter in your name for INR__________. This letter is being issued to you upon the given request. The letter has validity till ____________.

This expiration date will not get an extension unless the authorized bank gives it in a written format. If the bank provides a notice in writing for extending the date, then the date will be developed as per the rules and regulations specified.

(Paragraph regarding the rules and commission)

(A notification of the letter about the ACT)

Thanking you.

Yours sincerely,

(Name of the Applicant)