ICSE Solutions for Class 10 Mathematics – Sales Tax and Value Added Tax

ICSE SolutionsSelina ICSE Solutions

Get ICSE Solutions for Class 10 Mathematics Chapter 2 Sales Tax and Value Added Tax for ICSE Board Examinations on APlusTopper.com. We provide step by step Solutions for ICSE Mathematics Class 10 Solutions Pdf. You can download the Class 10 Maths ICSE Textbook Solutions with Free PDF download option.

Download Formulae Handbook For ICSE Class 9 and 10

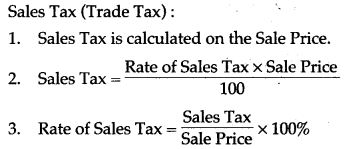

Formulae

The amount of money paid by a customer for an article = The sale price of the article + Sales Tax on it, if any.

VAT (Value Added Tax):

- Unlike sales tax, VAT is also collected by the state government.

- It is not in addition to the existing Sales Tax, but is the replacement of Sales Tax. Presently, a majority of state governments have accepted the VAT system.

- It is tax on the value added at each transfer of goods, from the original manufacturer to the retailer.

Assuming that the rate of tax is 10% and a trader purchases an article for Rs. 800, the tax he pays = 10% Rs. 800 = Rs. 80.

Now, if he sells the same article for Rs. 1,150.

The tax he recovers (gets) = 10% of Rs. 1,150 = 115

∴ VAT = Tax recovered on the sale – Tax he paid on the purchase

= Rs. 115 – Rs. 80 = 35. - The difference of tax recovered on the sale value and paid on the purchase value is deposited with the government as VAT.

Formulae Based Questions

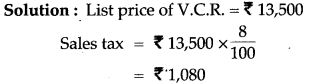

Question 1. Sheela bought a V.C.R., at the list price of Rs. 13,500. If the rate of sale tax was 8%. Find the amount she had to pay for it.

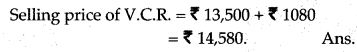

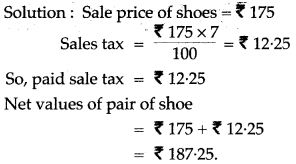

Question 2. Rani purchases a pair of shoe whose sale price is Rs. 175. If she pays sales tax at the rate of 7%, how much amount does she pay as sales tax? Also find the net values of the pair of shoe.

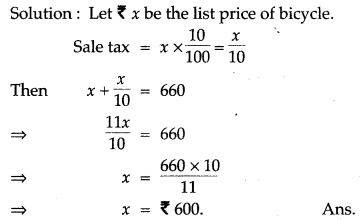

Question 3. Sunita purchases a bicycle for Rs. 660. She has paid a sale tax of 10%. Find the list price of the bicycle.

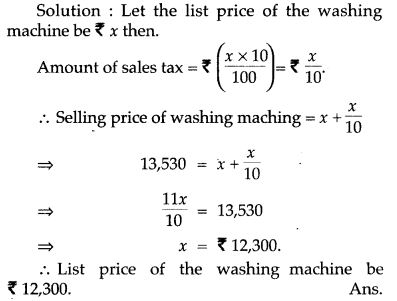

Question 4. The price of a washing machine, inclusive of sales tax i, Rs. 13,530. If the sales tax is 10% find its list (or basic) price.

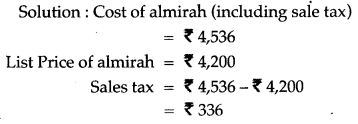

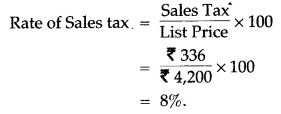

Question 5. Savita purchased an almirah for Rs. 4536 including sale tax. If the list price of the almirah is Rs. 4,200, find the rate of sale tax charged.

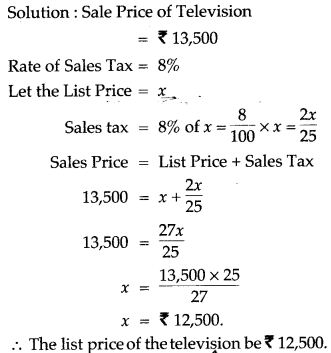

Question 6. The sale price of a television, inclusive of sales tax is Rs. 13,500. If sales tax is charged at the rate of 8% of the list price, find the list price of the television.

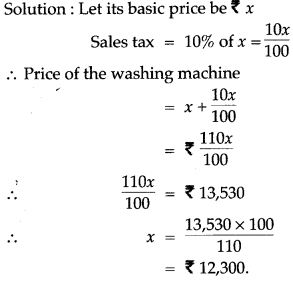

Question 7. The price of a washing machine inclusive of sale tax is Rs. 13,530. If the sale tax is 10% find its basic price.

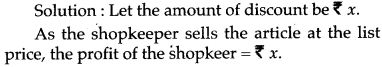

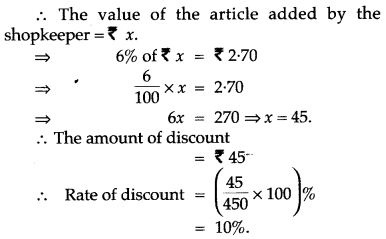

Question 8. A shopkeeper buys on article whose list price is Rs. 450 at some rate of discount from a wholesaler. He sells the article to a consumer at the list price and charges sales tax at the rate of 6%. If the shopkeeper has to pay a VAT of Rs. 2.70, find the rate of discount at which he bought the article from the wholesaler.

Concept Based Questions

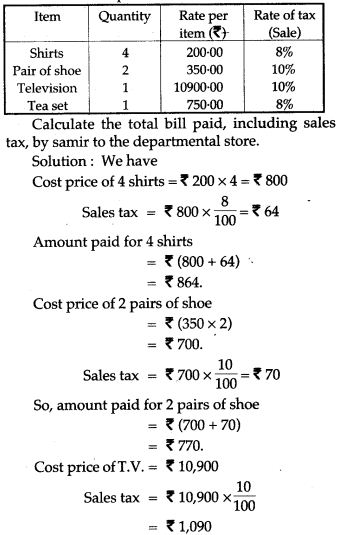

Question 1. Samir bought the following articles from a departmental store:

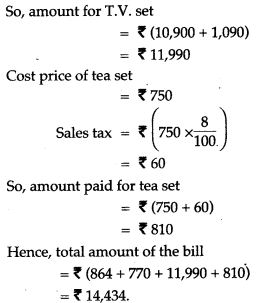

Question 2. A shopkeeper bought a washing machine at a discount of 20% from a wholesaler, the printed price of the washing machine being Rs. 18,000. The shopkeeper sells it to a consumer at a discount of 10% on the printed price. If the rate of sales tax is 8%, find:

(i) the VAT paid by the shopkeeper.

(ii) the total amount that the consumer pays for the washing machine.

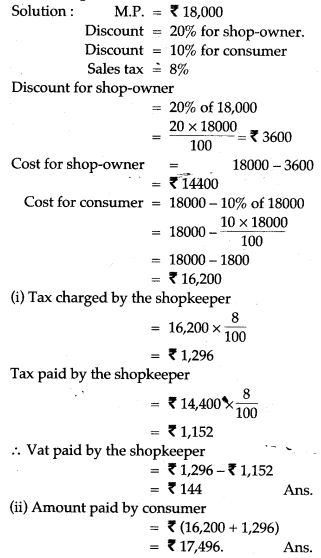

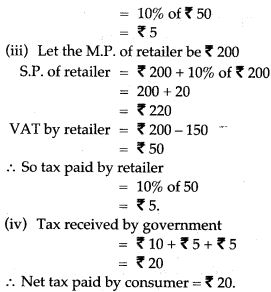

Question 3. Find the tax paid by (i) the manufacturer, (ii) the whole saler, (iii) the retailer, (iv) the customer. If the rate of sales tax be 10%.

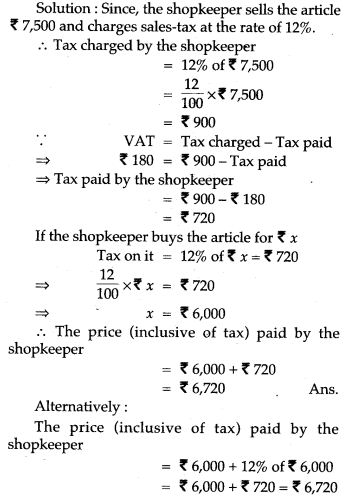

Question 4. A shopkeeper sells an article at its marked price (Rs. 7,500) and charges sales-tax at the rate of 12% from the customer. If the shopkeeper pays a VAT of Rs. 180; calculate the price (inclusive of tax) paid by the shopkeeper.

For More Resources