Privatisation of Banks Advantages and Disadvantages: The term ‘Privatisation’ means the transfer of any business, company, firm, industry, or such service already existing in a society that is shifted from public to private ownership or control.

In other words, privatisation is the name given to the process where a government-owned business or operation is brought under the ownership by any private and non-government body.

Privatisation similarly describes the transformation of a company from being a publicly traded company to converting it into a privately held company.

Enterprises that the government themselves does not run include the majority of the private sector. Individuals can privatise any such company free from direct government ownership.

Students can also find more Advantages and Disadvantages articles on events, persons, sports, technology, and many more.

Private companies constitute the preponderance of firms in industries such as consumer discretionary or staples, banking or investment, information technology, manufacturing sectors, real estate, trade assets, and healthcare quarters in society. All these are examples of firms that We can privatize.

Privatisation is seen to be beneficial for the economy. Privatisation aids in keeping the consumer requirements the topmost cause for economic development. It also helps the government clear company debts and increases long-term jobs in the market.

Privatisation encourages competitive efficiency also an open market economy in the country.

What is Privatisation of Banks? Advantages and Disadvantages of Privatisation of Banks 2021

Under Prime Minister Narsimha Rao’s and the former Prime Minister Manmohan Singh’s, the process of privatisation was brought to the vanguard.

In the year of 1969, the Government of India had nationalised a total of fourteen central private banks. One of which was the bank named Bank of India or BOI.

In the year 1980, again, the government nationalized six more private banks in India. These nationalized banks make up the majority of pawnbrokers in the Indian economy.

Besides the privatisation of the banks, the Central Government played an active and direct role in the depreciation of their activities in the daily activities of the banks mentioned above.

Also, the government would offload the majority stake held by the Centre in favour of private banks, which, in turn, would increase the engagement of PSBs in the exchange with minimum financial dependence on government funds.

This article aims to explain in great detail the following about the Privatisation of Banks:

- Advantages of Privatisation of Banks

- Disadvantages of Privatisation of Banks

- Comparison Table for the Advantages and Disadvantages of Privatisation of Banks

- FAQS on Pros and Cons of Privatisation of Banks

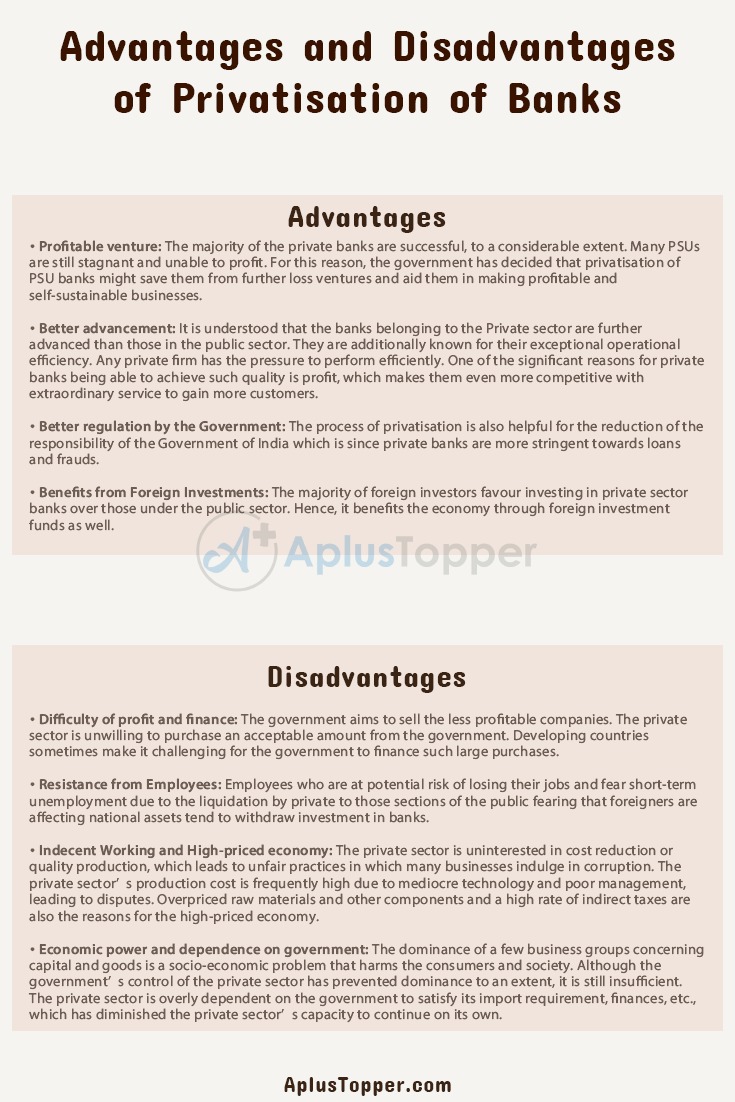

Advantages of Privatisation of Banks

- Profitable venture: The majority of the private banks are successful, to a considerable extent. Many PSUs are still stagnant and unable to profit. For this reason, the government has decided that privatisation of PSU banks might save them from further loss ventures and aid them in making profitable and self-sustainable businesses.

- Better advancement: It is understood that the banks belonging to the Private sector are further advanced than those in the public sector. They are additionally known for their exceptional operational efficiency. Any private firm has the pressure to perform efficiently. One of the significant reasons for private banks being able to achieve such quality is profit, which makes them even more competitive with extraordinary service to gain more customers.

- Better regulation by the Government: The process of privatisation is also helpful for the reduction of the responsibility of the Government of India which is since private banks are more stringent towards loans and frauds.

- Benefits from Foreign Investments: The majority of foreign investors favour investing in private sector banks over those under the public sector. Hence, it benefits the economy through foreign investment funds as well.

- Set practical long-term goals: When banks face a problem, the government usually takes resolutions based on the choices that would be best for citizens for the next election. Banks of the public sector are also constantly dominated for political motives. Implementation of privatisation will allow such banks to set their long-term goals and worry less about government interference.

Disadvantages of Privatisation of Banks

- Difficulty of profit and finance: The government aims to sell the less profitable companies. The private sector is unwilling to purchase an acceptable amount from the government. Developing countries sometimes make it challenging for the government to finance such large purchases.

- Resistance from Employees: Employees who are at potential risk of losing their jobs and fear short-term unemployment due to the liquidation by private to those sections of the public fearing that foreigners are affecting national assets tend to withdraw investment in banks.

- Indecent Working and High-priced economy: The private sector is uninterested in cost reduction or quality production, which leads to unfair practices in which many businesses indulge in corruption. The private sector’s production cost is frequently high due to mediocre technology and poor management, leading to disputes. Overpriced raw materials and other components and a high rate of indirect taxes are also the reasons for the high-priced economy.

- Economic power and dependence on government: The dominance of a few business groups concerning capital and goods is a socio-economic problem that harms the consumers and society. Although the government’s control of the private sector has prevented dominance to an extent, it is still insufficient. The private sector is overly dependent on the government to satisfy its import requirement, finances, etc., which has diminished the private sector’s capacity to continue on its own.

- Unguaranteed of Success: Privatization is unguaranteed in terms of the success rates of any individual unit, due to which many private sector units suffer huge losses.

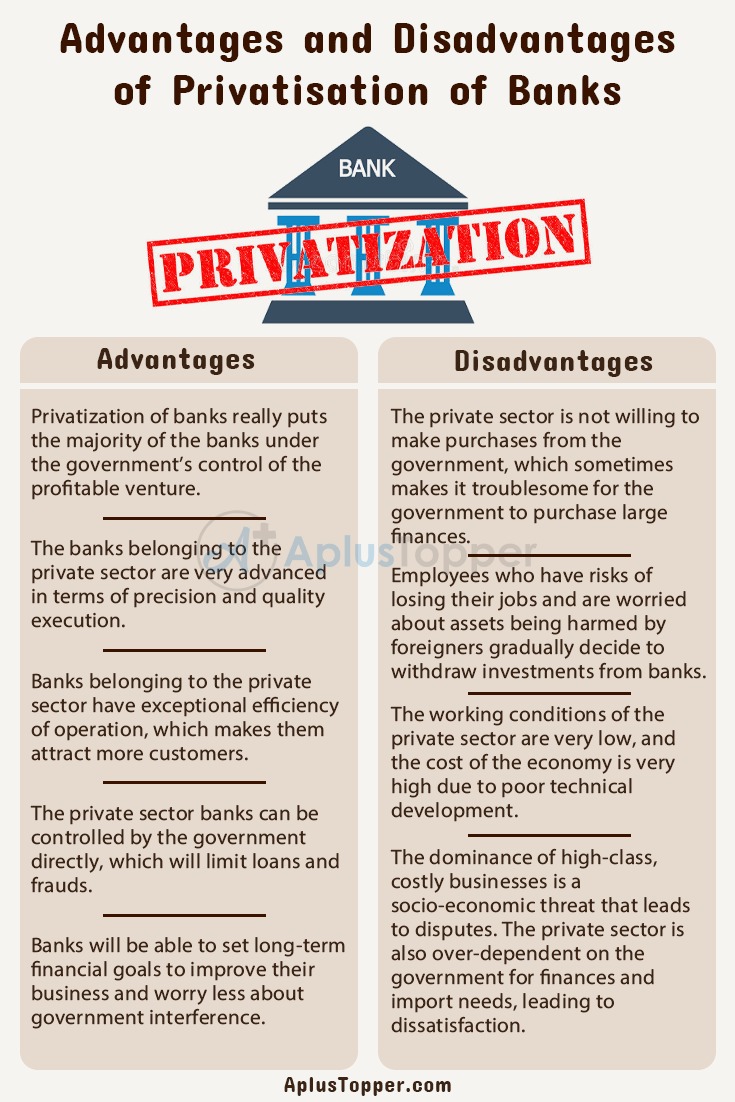

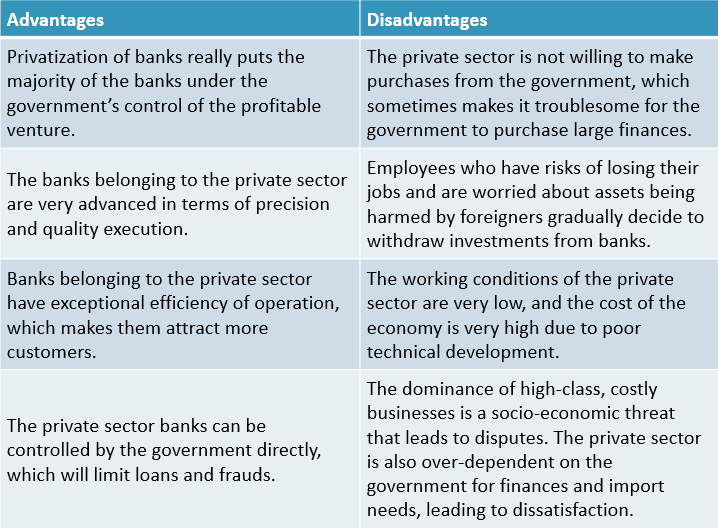

Comparison Table for Advantages and Disadvantages of Privatisation of Banks

| Advantages | Disadvantages |

| Privatization of banks really puts the majority of the banks under the government’s control of the profitable venture. | The private sector is not willing to make purchases from the government, which sometimes makes it troublesome for the government to purchase large finances. |

| The banks belonging to the private sector are very advanced in terms of precision and quality execution. | Employees who have risks of losing their jobs and are worried about assets being harmed by foreigners gradually decide to withdraw investments from banks. |

| Banks belonging to the private sector have exceptional efficiency of operation, which makes them attract more customers. | The working conditions of the private sector are very low, and the cost of the economy is very high due to poor technical development. |

| The private sector banks can be controlled by the government directly, which will limit loans and frauds. | The dominance of high-class, costly businesses is a socio-economic threat that leads to disputes. The private sector is also over-dependent on the government for finances and import needs, leading to dissatisfaction. |

| Banks will be able to set long-term financial goals to improve their business and worry less about government interference. | Privatisation in no way guarantees the success of businesses; hence it may lead to the suffrage of massive losses. |

FAQ’s on Pros and Cons of Privatisation of Banks

Question 1.

What happens when a particular bank gets Privatised?

Answer:

When a private entity buys a particular bank, the government gets its capital in return. The gross amount of this capital depends on the current market’s condition and the bank’s internal strength, such as the number of branches it holds, customers, etc. In any of these cases, it cannot be lower than the current market capitalization.

Question 2.

Why does the privatisation of banks happen?

Answer:

Privatization describes how a particular bank moves from existing by the government to have private ownership.

It is usually to help the government save money and boost efficiency, where the private banks can move goods faster and with higher efficiency.

Question 3.

Which banks should the government privatize?

Answer:

Indian Overseas Bank and Central Bank of India are feasible banks for privatisation. The government has estimated ₹1.75 crores from the stake deals in public sector organizations and financial establishments during the current fiscal year, including one insurance company and two PSU banks.