Kerala Plus Two Macroeconomics Chapter Wise Questions and Answers Chapter 5 The Government: Budget and The Economy

Plus Two Economics The Government: Budget and The Economy One Mark Questions and Answers

Question 1.

Balanced budget multiplier will be always equal to:

(i) 0

(ii) 1

(iii) ∞

(iv) -1

Answer:

(ii) 1

Question 2.

Which among the following is a tax revenue?

(i) Fees

(ii) Fine

(iii) GST

(iv) Profit

Answer:

(iii) GST

Question 3.

IF MPC = 0.5,What is the value of tax multiplier

(i) 0.5

(ii) 0

(iii) 1

(iv) 2

Answer:

(iii) 1

Question 4.

Identify indirect tax from the following

(i) Income tax

(ii) Profession tax

(iii) Wealth tax

(iv) Customs duty

Answer:

(iv) Customs duty.

Question 5.

Which of the following is not a major item of revenue expenditure?

(i) defence service

(ii) subsidies

(iii) interest payment

(iv) acquisition of land

Answer:

(iv) acquisition of land

Plus Two Economics The Government: Budget and The Economy Two Mark Questions and Answers

Question 1.

Classify the following aspects into a table as Revenue Expenditure and Capital Expenditure

Subsidies, Grants to state, Loans to foreign government, Capital projects of plants, investment in shares, Loans to state government, Salary to government staff, interest payment.

Answer:

Revenue expenditure | Capital Expenditure |

|

|

Question 2.

State the objectives of government budget.

Answer:

- To achieve economic growth

- To reduce inequalities of income and wealth

- To achieve economic stability

Question 3.

Find the odd man out and reason.

- Excise duty, fees, fines, penalties.

- Income tax, sales tax, customs duty, excise duty.

Answer:

- Excise duty. Others are non-tax revenue

- Income tax. Others are indirect taxes.

Question 4.

Which of the following is revenue receipt

(a) Taxes

(b) Revenue from fees, penalties

(c) All the above

(d) None of the above

Answer:

(c) All the above

Question 5.

Classify the following into revenue expenditure and capital expenditure. (2)

(a) Interest payment on debit.

(b) Investment in share

(c) Land and advances by central government to state.

(d) Grant given to state government.

Answer:

- a & d Revenue expenditure

- b & c Capital expenditure

Question 6.

MGNREGA aims to increase the purchasing power of the lower income group.

- How does this affect the value of mpc and Aggregate Demand of our economy?

- Can the government reduce economic inequality through this scheme? How?

Answer:

- High value of mpc and AD increases

- Yes. Income of poor sections increases

Question 7.

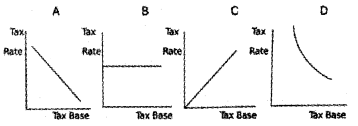

Which of the following diagrams represent proportional taxation? Substantiate your answer.

Answer:

C. Because of tax rate increases in proportion to the change in income.

Question 8.

Name the economic terms.

- The receipts of the government which are non-redeemable

- The receipts of the government which creates liability

Answer:

- Revenue Receipts

- Capital Receipts

Question 9.

Prove that the value of Balanced Budget Multiplier is equal to one.

Answer:

\(\frac{1}{1-c}+\frac{-c}{1-c}\)

Plus Two Economics The Government: Budget and The Economy Three Mark Questions and Answers

Question 1.

Do you agree to the saying the revenue expenditure should not exceed revenue receipts. Substantiate your answer.

Answer:

Yes, I do agree to the saying the revenue expenditure should not exceed revenue receipts. The fact is that the revenue expenditure is non-developmental expenditure. Therefore, borrowing for meeting revenue expenditure has to be avoided.

Question 2.

“The proportional income tax acts as an automatic stabilizer”. Do you agree? Substantiate.

Answer:

Yes, I agree with this statement. The proportional income tax acts as an automatic stabilizer – a shock absorber because it makes disposable income, and thus consumer spending, less sensitive to fluctuations in GDP. When GDP rises, disposable income also rises but by less than the rise in GDP because a part of it is siphoned off as taxes.

This helps limit the upward fluctuation in consumption spending. During a recession when GDP falls, disposable income falls less sharply, and consumption does not drop as much as it otherwise would have fallen had the tax liability been fixed. This reduces the fall in aggregate demand and stabilizes the economy.

Question 3.

‘Deficits are not desirable for a government’ discuss the issue of deficit reduction.

Answer:

Government deficit can be reduced by an increase in taxes or reduction in expenditure. In India, the government has been trying to increase tax revenue with greater reliance on direct taxes (indirect taxes are regressive in nature -they impact all income groups equally).

There has also been an attempt to raise receipts through the sale of shares in PSUs. However, the major thrust has been towards reduction in government expenditure. This could be achieved through making government activities more efficient through better planning of programmes and better administration.

Question 4.

The Government of India is spending huge amount of money on various activities. This paved the way for the growth of public expenditure and external borrowings. Do you support external borrowings for meeting public expenditure? Substantiate your answer.

Answer:

1. It is true that the Government of India is spending huge amount of money on various activities such as defence, urbanization, development programmes, welfare activities, etc.

2. It is desirable for the modem state to spend more for the welfare of the people. However, huge expenses have caused burden for the government.

3. Therefore, I do not support external borrowings for meeting public expenditure. This is because; borrowing from abroad will again bring another burden on the government in the form of interest payment.

Question 5.

Are fiscal deficits necessarily inflationary?

Answer:

Fiscal deficits are generally treated as inflationary. Increase in govt, expenditure and cuts in taxes both leads to government deficit. Increased govt, expenditure and reduced taxes tend to increase the aggregate demand. Generally firms are not able to produce higher quantities that are demanded at the going prices.

This leads to inflationary pressure. However, there is a solution to this inflationary pressure. Economy can utilizatfle unutilized resources and raise production. Therefore, the deficit cannot be inflationary when an economy has unutilized resources.

Question 6.

Classify the following into public and private goods. List out two features of public goods. Road, cars, clothes, national defence.

Answer:

- Road, national defence are public goods

- Cars, clothes are private goods

Two features of public goods are nonrivalry in consumption and non-excludability.

Question 7.

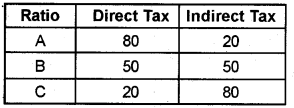

Reducing inequalities is an objective of Indian Five year plans. Observe the following tax proportions in the total tax revenue.

- Which of the above tax proportions help to reduce the economic inequality in society? How?

- Direct taxes are progressive and Indirect taxes are regressive in nature. Substantiate.

Answer:

- A, The higher income group contribute more.

- In progressive taxes more income contributed by the richer sections In regressive taxes more income contributed by the poor sections.

Question 8.

The government of India spent ₹27000 crores under the scheme MGNREGA in 2015-16. Suppose the mpc of India is 0.6. Calculate the impact of this spending on the equilibrium income of the economy.

Answer:

Equilibrium income = Autonomous Govt, expenditure × multiplier Here, multiplier (k) is

\(\frac{1}{1-\mathrm{mpc}}=\frac{1}{1-0.6}=\frac{1}{0.4}=2.5\)

∴ Equilibrium income = 27000 × 2.5 = 67500.

Plus Two Economics The Government: Budget and The Economy Five Mark Questions and Answers

Question 1.

Classify the following aspects into a table as tax revenue and nontax Revenue. Fees and fines, Dividends from PSU, Income tax, Special assessment, Escheats, Excise duties, Customs duties, wealth tax.

Answer:

| Tax Revenue | Non- tax Revenue |

|

|

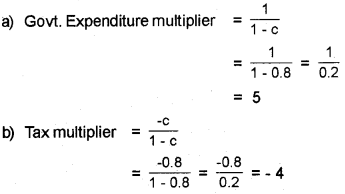

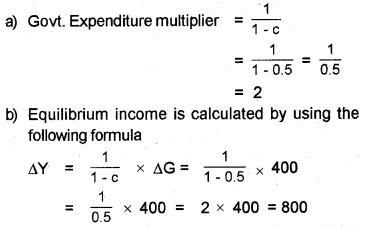

Question 2.

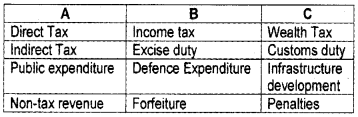

If the marginal propensity to consume

a) Govt. Expenditure multiplier

b) Tax multiplier

Answer:

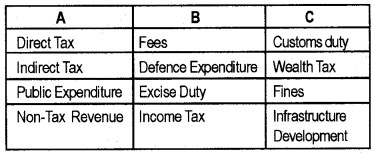

Question 3.

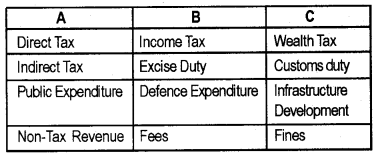

Match column B and C with column A.

Answer:

Question 4.

Find the odd one out

- income tax, sales tax, wealth tax, excise duty

- fine, corporate tax, fees

- dividends, fees and fines, borrowings, grants

- balanced budget, supplementary budget, surplus, budget.

Answer:

- Income tax. Others are indirect taxes

- Corporate tax. Others are non-tax revenues

- Borrowings. Others are non-tax revenues

- Supplementary budget. This is prepared during abnormal times.

Question 5.

Assume that marginal propensity to consume is 0.5, and change in government expenditure is ₹400. Calculate

a) government expenditure multiplier

b) equilibrium income

Answer:

Question 6.

Discuss the issue of deficit reduction.

Answer:

if the government increases taxes or decreases expenditure then the fiscal deficit gets reduced. Indian government is trying to reduce the fiscal deficit by increasing tax revenue by selling the share of PSUs and by reducing the government expenditure.

The deficit reduction influences the different sectors of an economy in different ways. The government is trying to fill the gap of reduced fiscal deficit by making government activities more efficient through better planning of programmes and better administration.

The cutting back government programmes in vital areas like agriculture, education, health, poverty alleviation has adverse effect on the economy. The same fiscal measures can lead to a large or small deficit government by the state of the economy. During recession period GDP falls which reduces tax revenue which increase the fiscal deficit.

Question 7.

Point out the main objectives of public expenditure.

Answer:

The main objectives of public expenditure are pointed out below

- for satisfaction of collective needs of the people

- forsmooth functioning of government machinery

- for economic and social welfare of the people

- for creation of infrastructure

- for controlling depressionary tendencies

- for accelerating the speed of economic development

- for reducing regional disparities of growth.

Question 8.

Explain why the tax multiplier is smaller in absolute value than the government expenditure multiplier.

Answer:

The tax multiplier is smaller in absolute value compared to the govt, expenditure multiplier. This is because, the govt, expenditure directly affect the total expenditure and taxes enter the multiplier, process and put impact on the disposable income.

Disposable income influences the consumption expenditure of households. Therefore, the tax multiplier is always less in absolute value than the govt, expenditure multiplier.

For example, assume that MPC = 0.75, then

Govt, expenditure multiplier \(=\frac{1}{1-c}\), C stands for MPC

\(=\frac{1}{1-0.75}=\frac{1}{0.25}=4\)

Tax multiplier = \(\frac{-c}{1-c}=\frac{-0.75}{1-0.75}=\frac{-0.75}{0.25}\)

= -3 (absolute value is 3)

Thus, it is clear from the example, that tax multiplier is smallerthan govt. expenditure multiplier.

Question 9.

Answer:

Question 10.

Match column B and C with Column A.

Answer:

Question 11.

If MPC = 0.5, calculate

a) Tax multiplier

b) Govt, expenditure multiplier

Answer:

Question 12.

Classify the following budget receipts into revenue receipts and capital receipts.

Borrowing, tax revenue, fines and penalties, fees, Recovery of loans, disinvestment, special assessment, small savings.

Answer:

1. Revenue receipts

- Tax revenue

- Fees

- Fines and penalties

- Special assessment

2. Capital receipts

- Borrowings

- Disinvestment

- Recovery of loans

- Small Savings

Question 13.

Distinguish between deficit and debt. Asses to what extent a government can borrow.

Answer:

Budget deficit is the difference between the yearly revenue and expenditure of the government. Debt is the accumulated deficit. The government can finance the budgetary deficit by borrowing, taxation or printing new currencies. To what extent the government can borrow is based on two issues.

- Whether the debt is a burden

- How the debt is financed.

When the government borrows it transfers the burden of reduced consumption to future generation. The future tax would increase, hence a fall in disposable income and consumption in future. If the government borrows too much the saving available to private sector may fall.

It is also argued that the consumer spending is based not only on their current income but also on their expected future income. There is another argument, debt does not matter because we owe to ourselves. This is because although there is a transfer of resources between generation, purchasing power remain within the nation. Any debt from foreign involves a burden.

Question 14.

Calssify the following into allocation, distribution and stabilization function of the government. (5)

- The government increases the defence expenditure. .

- The government reduces the subsidies on chemical fertilizers.

- The government increases the rate of interest.

- The government increases investment.

- The government spends on building new roads.

- The government increases the income tax.

Answer:

- 1, 5 allocation function

- 2, 6 distribution function

- 3, 4 stabilization function

Allocation function refers to the provision of public goods by the government. Stabilization function refers to the reduction of fluctuations in the economy by influency of the aggregate demand.

Question 15.

“Provision of Public good is inevitable to maintain social justice.”

Evaluate the statement in light of the experience of our State in General Education and Public Health.

Answer:

Health and Education Indicators of Kerala. Government can achieve this which Market economy can’t.

\(=\frac{1-c}{1-c}=1\)

Plus Two Economics The Government: Budget and The Economy Eight Mark Questions and Answers

Question 1.

Calculate

- fiscal deficit,

- revenue deficit and

- primary deficit

on the basis of the facts given below.

Borrowing – 40,000

Budget deficit – 60,000

Revenue receipts – 60,000

Interest payments – 20,000

Revenue expenditure – 80,000

Answer:

1. Fiscal deficit = Budget deficit + borrowing

= 60000 + 40000 = 1,00,000

2. Revenue deficit = Revenue expenditure – Revenue receipts

= 80000 – 60000 = 20,000

3. Primary deficit = Fiscal deficit – Interest payments

= 100000 – 20000 = 80,000

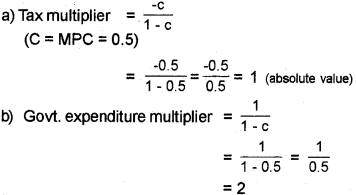

Question 2.

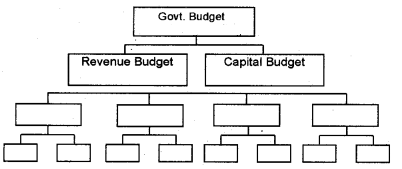

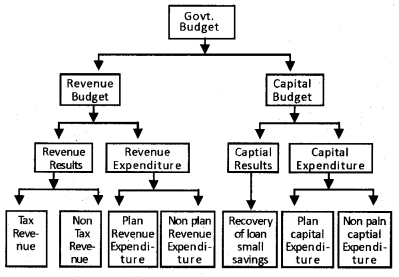

Construct a flow chart showing budget receipts and expenditure of the government.

Answer:

Budget Receipts and Expenditure of the government

Question 3.

Conduct a discussion on different concepts of deficits.

Answer:

When a government spends more than it collects by way of revenue, it incurs a budget deficit. There are various measures that capture government deficit and they have their own implications for the economy. The important concepts of deficits are discussed below.

1. Revenue Deficit:

The revenue deficit refers to the excess of government’s revenue expenditure over revenue receipts.

2. Fiscal Deficit:

Fiscal deficit is the difference between the government’s total expenditure and its total receipts excluding borrowing.

Gross fiscal deficit = Total expenditure – (Revenue receipts + Non-debt creating capital receipts

3. Primary Deficit:

We must note that the borrowing requirement of the government includes interest obligations on accumulated debt. To obtain an estimate of borrowing on account of current expenditures exceeding revenues, we need to calculate what has been called the primary deficit. It is simply the fiscal deficit minus the interest payments.

Gross primary deficit = Gross fiscal deficit – net interest liabilities.

Question 4.

Represent in the diagram the effect of the following on the equilibrium level of income

- Effect of higher government expenditure

- Effect of a reduction in taxes

Answer:

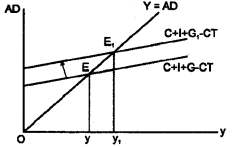

1. Effect of higher government expenditure

When there is higher government expenditure, the aggregate expenditure curve will shift upward. This will lead to an increase in equilibrium level of income. This effort is shown in the diagram.

2. Effect of a reduction in taxes

When there is a tax cut, there will be an increase in consumption and output. Therefore, the equilibrium level Of income increases as shown in the diagram.

Question 5.

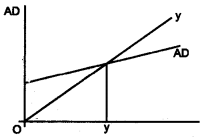

The equilibrium of an economy is given below.

- What is fiscal policy?

- Identify the level of equilibrium in an economy and show the seperate diagram the effect of an increased govt, expenditure and an increased tax on the level of output.

Answer:

1. The policy of the government related to taxation and govt, expenditure is known as fiscal policy.

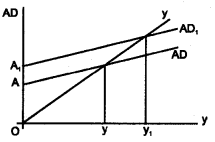

2. OY is the equilibrium level of output. The effects of an increased govt, expenditure is shown in the diagram below.

Govt, expenditure is one of the components of AD. AD = C + I + G + (x – m)

So the AD curve shifts upward when there is an increase in the govt, expenditure. As a result, the equilibrium changes from e to e1. The level of output increases from y to y1.

It can be seen from the diagram that the increase in govt, expenditure is from A to A1 But the output increased from y to y1 This is because of multiplier effect. The effect of an increased tax on the level of output is given in the diagram below.