Kerala Plus Two Macroeconomics Chapter Wise Questions and Answers Chapter 3 Money and Banking

Plus Two Economics Money and Banking One Mark Questions and Answers

Question 1.

At liquidity trap, speculative demand for money becomes:

(a) zero

(b) unity

(c) infinity

(d) negative

Answer:

(c) infinity

Question 2.

RBI was established in:

(a) 1930

(b) 1935

(c) 1947

(d) 1949

Answer:

(b) 1935

Question 3.

Money Multiplier = ?

(a) M – H

(b) M + H

(c) \(\frac{M}{H}\)

(d) \(\frac{H}{M}\)

Answer:

(c) \(\frac{M}{H}\)

Question 4.

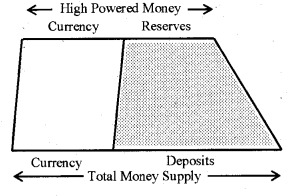

High powered money is equal to:

(a) DD + CU

(b) CU + R

(c) DD + R

(d) None of these

Answer:

(b) CU + R

Question 5.

Identify the agency responsible for issuing Rs. 1 currency note in India.

(a) RBI

(b) Ministry of Finance

(c) Ministry of Commerce

(d) Niti Aayog

Answer:

(b) Ministry of Finance

Question 6.

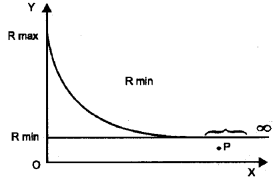

When r = min Speculative Demand for Money becomes

(a) Zero

(b)One

(c) Infinity

(d)GreaterthanOne

Answer:

(c) Infinity

Plus Two Economics Money and Banking Two Mark Questions and Answers

Question 1.

M1 = CU + DD.

M2 = M1+ Savings deposits with Post Office savings banks.

M3= M1 + Net time deposits of commercial banks.

M4 = M3 + Total deposits with Post Office savings.

Answer:

M4 and M2 are narrow money.

M3 and M4 are broad money.

Question 2.

The RBI is known as the lender of last resort. Give reason for this.

Answer:

The Reserve Bank of India plays a crucial role here. In case of a crisis, it stands by the commercial banks as a guarantor and extends loans to ensure the solvency of the latter. This system of guarantee assures individual account holders that their banks will be able to pay their money back in case of a crisis and there is no need to panic thus avoiding bank runs. This role of the monetary authority is known as the lender of last resort.

Question 3.

What do you mean by double coincidence of wants? To which system is it associated with?

Answer:

By double coincidence of wants, we mean the need to have mutually exchangeable goods and the compulsion for exchange. This system is associated with the barter system.

Question 4.

Make pairs.

Credit money, gold coins, full bodied money, representative full-bodied money, cheques, paper money.

Answer:

- Credit money – cheques

- Full bodied money – gold coins

- Representative full bodied money – paper money

Question 5.

Give examples for fiat money and legal tender money.

Answer:

- Fiat money: Money with no intrinsic value Eg. Currency notes, coins.

- Full-bodied money: Money whose face value is equal to the intrinsic value Eg. Gold coins, silver coins.

- Legal tender money: Money issued by the monetary authority or the government which cannot be refused by anyone. Eg. Currency notes.

Question 6.

The speculative demand function is infinitely elastic. Do you agree?

Answer:

Yes, speculative demand for money is infinitely elastic.

Question 7.

Mr. Ramu sells his coconut to purchase tapioca from his neighbour Mr. Bhaskara.

- What type of transaction is this?

- Suggest other types of transaction in an economy

Answer:

- Barter System

- Money transaction

Question 8.

The price of 1 kg rice is ₹50. Identity the functions of money mentioend in the above statement.

(a) Medium of exchange

(b) Unit of account

(c) Store of value

(d) means of deffered payment

Answer:

(b) Unit of account

Question 9.

An individual exchanges coconut for rice.

- Identify the system of exchange mentioned in the above statement.

- List out anyone drawback of such system

Answer:

- Barter system

- Absence of double coincidence of wants

Question 10.

Explain the relationship between the aggregate transaction demand for money and the nominal GDP.

Answer:

There is a positive relationship between the value of transaction and nominal GDP. AN increase in the nominal GDP implies and increase in the total value of transaction and a greater transaction demand for money.

Plus Two Economics Money and Banking Three Mark Questions and Answers

Question 1.

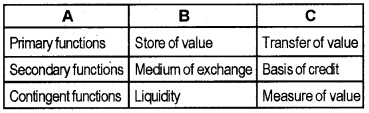

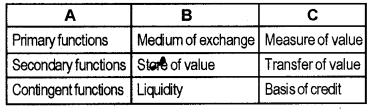

Match columns B and C with A.

Answer:

Question 2.

Classify the following into the functions of central bank and commercial banks.

Note issue, accepting deposits, lender of last resort, lending money, credit creation, discounting bill of exchange, adviser to the government, publication of reports.

Answer:

Functions of the central bank | Functions commercial banks |

|

|

Question 3.

‘Every loan creates a credit’. How can you connect this with the function of commercial bank?

Answer:

Banks can create credit. When a person goes to the bank and asks for a loan by providing required security, the bank grants the loan. The loan amount is not directly paid to the borrower in cash. Instead, it is deposited into an account operated by the borrower. Thus, every loan creates a deposit. This is known as credit creation.

Question 4.

How do changes in cash reserve ratio affect the availability of credit? Explain.

Answer:

The commercial banks have to keep a fraction of its deposits as reserves in the form of cash with the central bank. When this cash reserve ratio is increased, the liquidity of banks reduces and so does their credit creating capacity. This lowers excess demand in an economy. To increase demand, the cash reserve ratio is lowered so that the banks can create more credit.

Question 5.

Point out the instruments of monetary policy.

Answer:

The instruments of monetary policy of RBI are:

- Open market operations

- Bank rate

- Varying reserve requirements

- Margin requirements

- Moral suation

- Direct action

Question 6.

The transaction demand for money is written as, \(\mathrm{M}_{\mathrm{T}}^{\mathrm{d}}\)= K.T. What does \(\mathrm{M}_{\mathrm{T}}^{\mathrm{d}}\), K and T denote?

Answer:

In the equation\(\mathrm{M}_{\mathrm{T}}^{\mathrm{d}}\)= K.T.

- \(\mathrm{M}_{\mathrm{T}}^{\mathrm{d}}\) stands for stock of demand for money.

- K stands for a positive fraction.

- T stands for total value of transactions in the economy.

Question 7.

Define money. What are the main functions of money?

Answer:

Functions of Money:

Nowadays, no economies can sustain without money. Money performs the functions of medium of exchange, measure of value, store of value and the standard of deferred payments. The functions of money are classified into primary functions, secondary functions, and contingent functions.

- Primary functions

- Secondary functions

Question 8.

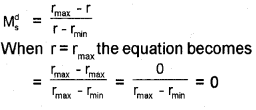

Write down the equation of speculative demand for money. Prove that when r = rmax the speculative demand for money is zero.

Answer:

Question 9.

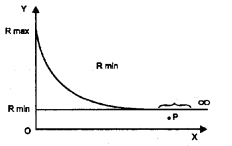

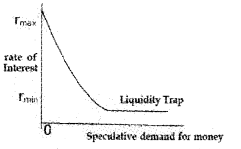

Identify and explain the situation shown in the diagram.

Answer:

Liquidity Trap:

A situation in the economy may arise when everyone will hold their wealth in money balance. If additional money is injected into the economy, it will not be used to purchase bonds. It will be used to satisfy the people’s drawing for money balance without lowering the rate of interest. Such a situation is called ‘liquidity trap’.

Question 10.

K = 1/2, GDP Deflator =1.2, Real GDP = 1000. Cal¬culate Transaction Demand for Money.

Answer:

\(\begin{aligned}

&=\frac{1}{2} \times 1.2 \times 1000\\

&=\frac{1200}{2}=600

\end{aligned}\)

Plus Two Economics Money and Banking Four Mark Questions and Answers

Question 1.

Make a tabular presentation of the measure of money supply in India.

Answer:

The total stock of money in circulation among the public at a particular point of time is called money supply. RBI publishes figures for four alternative measures of money supply, viz. M1 M2 M3and M4. They are defined as follows.

| Measure | Constituents of money supply |

| M1 | Currency + Demand Deposits + other deposits |

| M2 | M1 + Savings deposits with Post Office savings banks |

| M3 | M1 + Net time deposits of commercial banks |

| M4 | Total deposits with Post Office savings organizations (excluding National Savings Certificates) |

Question 2.

Define money multiplier. Derive the formula of money multiplier.

Answer:

We define money multiplier as the ratio of the stock of money to the stock of high powered money in an economy, viz. MIH. Clearly, its value is greater than 1. We need not always go through the round effects in order to compute the value of the money multiplier. By definition, money supply is equal to currency plus deposits.

M = CU + DD = (1 + cdr) DD where, cdr = CU/DD. Assume, for simplicity, that treasury deposit of the Government with RBI is zero. High powered money then consists of currency held by the public and reserves of the commercial banks, which include vault cash and banks’ deposits with RBI. Thus H = CU + R = cdr.DD + rdr.DD = (cdr+ rdr)DD Thus the ratio of money supply to high powered money.

\(\mathrm{M} / \mathrm{H}=\frac{1+\mathrm{cdr}}{\mathrm{cdr}+\mathrm{rdr}}>1\) as rdr < 1

This is precisely the measure of the money multiplier.

Question 3.

Classify the following into appropriate titles.

Answer:

- national clearinghouse

- agency function

- credit creation

- banker’s bank

- lending money

- custodian of foreign exchange reserves oil

- discounting bills of exchange

- lender of last resort

- adviser of government

Answer:

1. Functions of central bank

- Banker’s bank

- Custodian of foreign exchange reserves

- Lender of last resort

- Adviser of government Functions of

2. commercial banks

- National clearing house

- Agency function

- Credit creation

- Lending money

- Discounting bills of exchange

Question 4.

Prepare a note on High Powered Money.

Answer:

The total liability of the monetary authority of the country, RBI, is called the monetary base or high powered money. It consists of currency (notes and coins in circulation with the public and vault cash of commercial banks) and deposits held by the Government of India and commercial banks with RBI.

If a member of the public produces a currency note to RBI the latter must pay her value equal to the figure printed on the note. Similarly, the deposits are also refundable by RBI on demand from deposit – holders. These items are claims which the general public, government or banks have on RBI and hence are considered to be the liability of RBI.

High powered money then consists of currency held by the public and reserves of the commercial banks, which include vault cash and banks’ deposits with RBI. Thus H = CU + R.

The following figure shows the High Powered Money in relation to Total Money Supply.

Question 5.

Rewrite statement if they are wrong.

- The most liquid form of asset is shares of companies.

- Demand deposit^usually carry high interest rates.

- The responsibility of note issue in India is with the State Bank of India.

- Canara Bank in India is a private sector bank.

Answer:

- The most liquid form of asset is money

- Demand deposits usually carries no interest

- The responsibility of note issue in India is with RBI

- Canara Bank is a private sector bank.

Question 6.

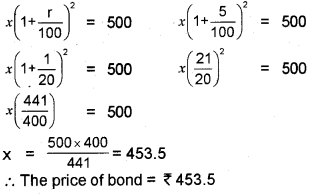

Suppose a bond promises ₹500 at the end of two years with no intermediate return. If the rate of interest is 5 percent per annum, what is the price of the bond?

Answer:

Let the price of the bond = x

Then,

Question 7.

Identify the condition for money market equilibrium.

Answer:

Money market is in equilibrium when money supply and money demand are equal, that is Ms = Md Here money supply is determined by RBI ie. Ms = Ms.

Money demand has 2 components namely Transaction demand (Mtd) and Speculative demand (Msd)

Therefore, the equilibrium condition is, Ms = Mtd + msd

Question 8.

Explain why speculative demand for money is inversely related to the rate of interest.“The speculative money demand function is infinitely elastic”. Prove this statement with the help of a diagram showing the relation between the speculative demand for money and liquidity trap.

Answer:

Total demand for money in an economy is composed of transaction demand and speculative demand. The speculative demand for money is inversely related to the market rate of interest. When the rate of interest is high then everyone expects it to fall in future as there is surety about future capital gain.

Thus everyone becomes ready to convert the speculative money balance into bonds. When rate of interest falls and reach its minimum level, everyone put whatever wealth they acquire in the form of money and the speculative demand for money is infinite.

Question 9.

Distinguish between the CDR and RDR, CDR, RDR

Answer:

Currency Deposit Ratio (CDR) is the ratio of money held by the public in currency to that they hold in bank deposit.

Cdr= CU\DD

The Reserve Deposit Ration (RDR) banks hold a part of the money people keep in this bank deposit as reserve money. Reserve money consists of two things. Vault cash in banks and deposits of commercial banks with RBI. It is the proportion of total deposits commercial banks keep as reserve

Plus Two Economics Money and Banking Five Mark Questions and Answers

Question 1.

The central bank adjusts the monetary instruments in relations with economic situations.

- Do you agree to this statement?

- Also, define the terms

Answer:

- Yes, I do agree to this statement

- The terms

1. Bank Rate:

The rate of interest payable by commercial banks to RBI if they borrow money from the latter in case of a shortage of reserves.

2. Cash Reserve Ratio (CRR):

The fraction of their deposits which the commercial banks are required to keep with RBI.

3. Statutory Liquidity Ratio (SLR):

The fraction of their total demand and time deposits in which the commercial banks are required by RBI to invest in specified liquid assets.

4. Repo rate:

The rate at which commercial banks borrow from the central bank.

5. Reverse Repo Rate:

The rate at which the central bank borrow from the commercial banks.

Question 2.

Give appropriate terms for the following.

- The total liability of the monetary authority of India.

- System of exchange of goods for goods.

- My = K.T.

- The proportion of the total deposits commercial banks keep as resources in RBI

- Revenue expenditure – Revenue Receipts on lays

- Total expenditure – (Revenue receipt + Nondebt creating capital receipts)

Answer:

- High powered money

- Barter system

- Transaction demand for money

- Cash reserve ratio

- Revenue deficit

- Fiscal deficit

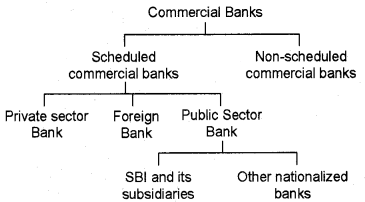

Question 3.

Draw a flow chart showing a broad classification of commercial banks in India.

Answer:

Question 4.

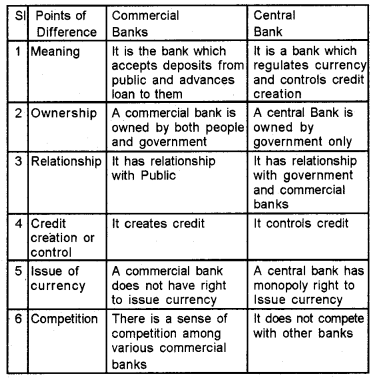

Prepare a table pointing out major differences between commercial banks and central bank.

Answer:

Question 5.

Anand, a 12th class student went to SBT and met the manager. He asked manager about major functions performed by the bank. What may be the answer given by the manager?

Answer:

Functions of commercial banks

A. Accepting deposits of 3 kinds

- Current account deposits

- Fixed-term deposits

- Saving account deposits

B. Giving loans and advances

- Cash credit

- Demand loans

- Short term loans

C. Agency functions

- Transfer of funds

- Collection of funds

- Payments of various items

- Purchase and sale of shares and securities

- Collection of dividends

- Trustees and executors of property

- Letter of references

D. Financing of foreign trade

E. Supply of liquidity

F. Performing general utility functions

Question 6.

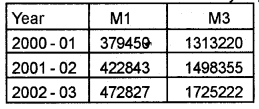

The data is related to the money supply in India

- Distinguish M1 and M3.

- Identify the aggregate monetary resources in 2002 and calculate the percentage change in 2003.

Answer:

1. M1 = Cu + DD

Cu = Currency and coin held by the people.

DD = Demand deposit in commercial banks. M3 = M1 + Net time deposit of commercial banks,

2. M3 is the aggregate monetary resources that is in 2002 it is 1498355.

The percentage change in 2003

\(=\frac{1725222-1498355}{1498355} \times 100=15.14\)

Plus Two Economics Money and Banking Eight Mark Questions and Answers

Question 1.

Prepare a seminar paper on functions of Central Bank.

Respected teacher and dear friends,

I am supposed to present a seminar paper on ‘the functions of the central bank’. In this paper, I would like to include the definition of a central bank in the first part and its functions in the second part of my seminar paper. In the words of R.P. Kent, ‘a central bank is an institution charged with the responsibility of maintaining the expansion and contraction of money in the interest of general public welfare”.

Functions of central bank The central bank in every country performs some common functions which are pointed out below (explain them in detail).

- Note issue

- Banker’s bank

- Banker, agent, and adviserto the government

- Custodian of foreign exchange reserves

- Lender of last resort

- Controller of credit and money supply

- Publication of reports.

Thus it is clear that a central bank performs various functions in order to control the economy as a whole.

Question 2.

Consumer prices in India increased 4.88% in November 2017.

- Name the policy and its three instruments that are used to control inflation.

- Explain how these three policy instruments are used to control the inflation.

Answer:

Monetary policy is the policy used to control inflation. Its three instruments are

1. Open market operation:

The RBI sells and buys government securities in the open market. This is known as open market operation. At the time of high inflation, RBI sells government securities to the public. The money from the economy flow to the RBI. Since the money in the economy falls the demand for goods and services too will fall and the price will come down. So the inflation is controlled.

2. Changes in the bank rate:

When inflation is high RBI will raise the bank rate. At higher bank rate people will demand less loans, they will save more. This will lead to a reduction in the demand, the price level too will fall. An increased bank rate also will lead to a fall in the money supply.

3. Varying the reserve requirement:

At the time of high inflation, the RBI can make necessary changes in the various reserve requirements like CRR, CDR, SLR etc. At the time of inflation RBI raises the CRR, that means more money has to be kept in the RBI. This will reduce the money supply in the economy. So the demand will come down and the general price level too.

Question 3.

Mr. Ramu is a farmer. He has a surplus of rice which he wishes to exchange for clothing. But he may not be able to find any person who demand rice with a surplus of clothing. This is one of the problems in Barter System.

- Can you identify other drawbacks of the Barter System?

- How did invention of money help to overcome these drawbacks of Barter System?

Answer:

1. drawbacks of Barter System.

- Lack of double coincidence of wants

- Difficulty in store of value

- Difficulty in measuring value

2. Functions of Money:

Nowadays, no economy can sustain without money. Money performs the functions of medium of exchange, measure of value, store of value and the standard of deferred payments. The functions of money are clas¬sified into primary functions, secondary functions, and contingent functions.

A. Primary functions:

1. Medium of exchange:

The most important function of money is that it acts as a medium of exchange. It acts as a link between the buyer and the seller. Money mostly solves the issues of barter economy.

2. Standard of value:

Money acts as a conve-nient unit of account. When we purchase or sell goods, its value can be expressed in monetary terms. We express the value of goods in terms of money. Examples are : price per Kg of sugar is Rs. 30, price per meter of cloth is Rs. 25 and price per liter of milk is Rs. 20, etc.

B. Secondary functions:

1. Standard of deferred payments:

Deferred ‘ payments are those payments which are to be made in the future. Money is used as a unit of deferred payments. It helps in credit transactions. The money helps the consumer to purchase goods and services when they require it and the payment can be made in the future.

2. Store of value:

The money can be stored as an instrument for storing the value. The purchasing power of money can be transferred to the future from the current period. Thus, wealth can be stored in liquid form.

3. Transfer of value:

Transfer of value indicates the movement of value of goods from one place to another which are durable and immovable in nature. Money helps in the movement of transfer of value. For instance, the goods or property of a person can transfer to another person in terms of money.

C. Contingent function:

Money performs contingent functions as well. The initiative of the money in terms of development of a nation is termed as contingent function of money. The following are the contingent functions of money.

1. Distribution of national income:

The contribution of various sectors of the economy towards national income is measured in terms of money. Money is used to measure national income and the productivity of various sectors of the economy.

2. Basis of credit:

The industrial activities of a nation are totally depended on the availability of credit facilities. The credit facilities are to-tally depended on the availability of money.

3. Solvency:

The ability or the capacity of a firm or an institution to repay its debt is known as solvency. If a person is financially sound enough to clear off his debt is known as a solvent. On the other hand, if a person fails to clear off his debt is known as a bankrupt.

4. Utilization of resources:

Money is a common measuring of rod. Money helps the producer to measure the value of his output. Money helps the fuller utilization of resources.

Question 4.

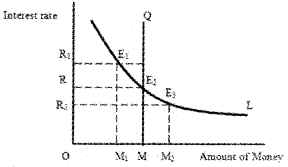

a. Identify and explain the theory behind the diagram.

b. When the economy reaches to Liquidity trap, how does it affect the Speculative demand for money?

Answer:

a. Liquidity Preference theory Keynes defines the rate of interest as the reward for parting with liquidity for a specified period of time. According to him, the rate of interest is determined by the demand for and supply of money.

Demand for money:

Liquidity preference means the desire of the public to hold cash. According to Keynes, there are three motives behind the desire of the public to hold liquid cash:

- the transaction motive,

- the precautionary motive, and

- the speculative motive.

1. Transactions Motive:

The transactions motive relates to the demand for money or the need of cash for the current transactions of individual and business exchanges. Individuals hold cash in order to bridge the gap between the receipt of income and its expenditure. This is called the income motive.

The businessmen also need to hold ready cash in order to meet their current needs like payments for raw materials, transport, wages, etc. This is called a business motive.

2. Precautionary motive:

The precautionary motive for holding money refers to the desire to hold cash balances for unforeseen contingencies. Individuals hold some cash to provide for illness, accidents, unemployment and other unforeseen contingencies.

Similarly, businessmen keep cash in reserve to tide over unfavorable conditions or to gain from unexpected deals.

Keynes holds that the/ransaction and precautionary motives are relatively interesting inelastic, but are highly income elastic. The amount of money held under these two motives (M1 is a function (L)) of the level of income (Y) and is expressed as M1 = L1 (Y)

3. Speculative Motive:

The speculative motive relates to the desire to hold one’s resources in liquid form to take advantage of future changes in the rate of interest or bond prices. Bond prices and the rate of interest are inversely related to each other.

If bond prices are expected to rise, i.e., the rate of interest is expected to fall, people will buy bonds to sell when the price later actually rises. If, however, bond prices are expected to fall, i.e., the rate of interest is expected to rise, people will sell bonds to avoid losses.

According to Keynes, the higher the rate of interest, the lower the speculative demand for money, and lower the rate of interest, the higher the speculative demand for money. Algebraically, Keynes expressed the speculative demand for money as M2 = L2(r)

Where,

L2 is the speculative demand for money, and r is the rate of interest. Geometrically, it is a smooth curve which slopes dovynward from left to right. Now, if the total liquid money is denoted by M, the transactions plus precautionary motives by Mi and the speculative motive by M2, then M = M1 + M2.

Since M1= (Y) and M2= L2 (r), the total liquidity preference function is expressed as M = L (Y, r). Supply of Money : The supply of money refers to the total quantity of money in the country. Though the supply of money is a function of the rate of interest to a certain degree, yet it is considered to be fixed by the monetary authorities. Hence the supply curve of money is taken as perfectly inelastic represented by a vertical straight line.

Determination of the Rate of Interest: Like the price of any product, the rate of interest is determined at the level where the demand for money equals the supply of money. In the following figure, the vertical line QM represents the supply of money and L the total demand for money curve. Both the curve intersect at E2 where the equilibrium rate of interest OR is established. ,

If there is any deviation from this equilibrium position an adjustment will take place through the rate of interest, and equilibrium E2will be re-established. At the point, E1the supply of money OM is greater than the demand for money OM1.

Consequently, the rate of interest will start declining from OR1 till the equilibrium rate of interest OR is reached. Similarly at OR2level of interest rate, the demand for money OM2is greater than the supply of money OM. As a result, the rate of interest OR2will starts rising till it reaches the equilibrium rate OR.

It may be noted that, if the supply of money is increased by the monetary authorities, but the liquidity preference curve L remains the same, the rate of interest will fall. If the demand for money increases and the liquidity preference curve shifts upward, given the supply of money, the rate of interest will rise.

b. Speculative demand for money becomes infinitely elastic.