Kerala Plus Two Macroeconomics Chapter Wise Previous Questions Chapter 6 Open Economy Macroeconomics

Question 1.

Indian Economy is having a deficit of Balance of Payment Account. Suggest some measures to improve its balance of payment position. (MARCH-2008)

Answer:

Measures to improve balance of payment deficit are given below:

1) Devaluation of rupee

2) Control of inflation

3) Promotional measures

4) Tariff and quota restrictions

5) Reduction of imports

6) Provision of incentives

Question 2.

Correct the following statements if necessary. (MARCH-2009)

1) Balance of payment at current account rate to both visible and invisible trade.

2) International trade is trade within the boundaries of a country.

3) The theory of comparative cost advantage is stated by David Ricardo

Answer:

1) True/ Correct

2) False. International trade means trade between two or more countries or internal trade is the trade within the boundaries of a country.

3) True/Correct

Question 3.

Devaluation of domestic currency will enable an economy to overcome deficit in balance of payments. Do you agree with the statement? Justify your answer. (JUNE-2009)

Answer:

Yes. I agree with this statement. Because, when there is deficit in balance of payment, the domestic currency is devalued. This will increase our exports and reduce imports. As a result of increased export and less imports, the deficit in balance of payment can be solved.

Question 4.

If C = 0.8 and M = 0.3

a) Calculate open economy and closed economy multiplier. (MARCH-2010)

b) If domestic autonomous demand increases by 100, what will be multiplier effect on output in both economy?

c) Elucidate the result.

Answer:

i) Open economy multiplier

![]()

ii) Closed economy multiplier

![]()

b) Multiplier effect of output on closed economy

5 x 100 = 500

Multiplier effect of output on open economy,

2 x 100 = 200

Question 5.

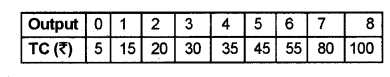

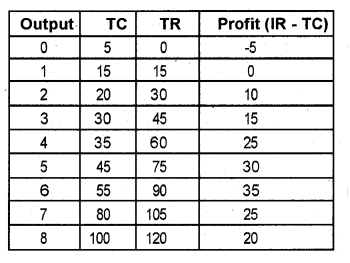

The following table shows the total cost schedule of a competitive firm. It is given that the price of the . good is ₹15. (MARCH-2010)

Answer:

a)

b) The profit maximising level of outputs is ₹6, where the difference between TR and TC is highest.

Question 6.

Mr. Sudheer converted rupees into dollar, he got 20 dollars in exchange of ₹1,000. (JUNE-2010)

a) Calculate profit at each level of output.

b) Find the profit maximising level of output.

Answer:

a) Exchange rate

b) Real exchange rate is the relative price of foreign goods in terms of domestic goods. It is equal to the nominal exchange rate times the foreign price level divided by the domestic price level. When the real exchange rate is equal to one, the two countries are said to be in purchasing power parity.

Question 7.

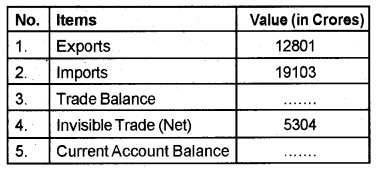

An Imaginary Balance of Payment situation is given in the table. (JUNE-2010)

a) Find out the trade balance, explain the concept.

b) Calculate the Current Account Balance, comment about the figure.

Answer:

a) Export-Import =12801 -19103

= – 6302

b) 998

Question 8.

Economics are classified into open and closed economics. Distinguish between open and closed economy with an example. (MARCH-2011)

Answer:

An open economy is one which has trade relationship with rest of the world.

Eg: A country with exports (India export rubber). On the other hand a closed economy is one which has not trade relation with rest of the world.

Eg: A country which has no exports or imports.

Question 9.

If a toy costs ₹10 in America and exchange rate is at 45 per U.S. dollar, what is the price of this toy in Indian currency? (MARCH-2011)

Answer:

₹450

Question 10.

If inflation is higher in country ‘A’ than in country ‘B’ and the exchange rate between the two countries is fixed, what is likely to happen to the trade balance between the two countries? Justify your answer. (MARCH-2012)

Answer:

When there is inflation, the domestic currency of country A’will depreciate. Depreciation of domestic currency will lead to increase in export and decrease in import. But this will depend on the elasticity of export and import. If the sum of export and import elasticities is greater than T, there will be positive effect on trade balance. However, in short run the elasticities are supposed to be less than T and therefore there may be negative effect on trade balance. The ultimate effect depends on the composition of trade items.

Question 11.

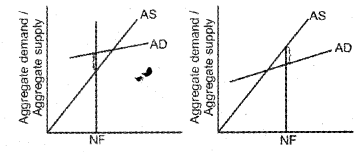

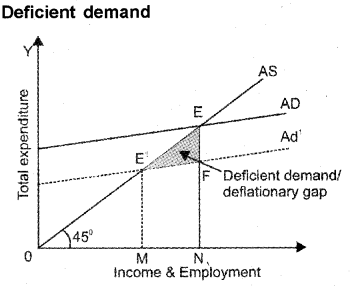

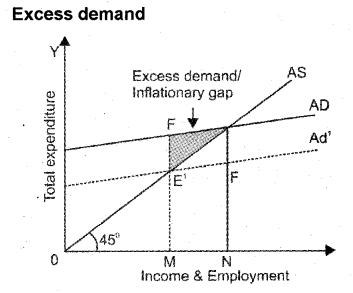

Compare the following graphs and explain the positions of economy that the diagrams represent. Suggest measures to correct these situations. (MARCH-2012)

Answer:

Excess demand

- Increase taxes

- Decrease Government expenditure

- Reduce deficit financing

- Increase public borrowing

Deficient demand

- Decrease taxes

- Increase government expenditure

- Increase deficit financing

- Reduce public borrowing

Question 12.

Among the following, identify the concepts (JUNE-2014)

i) Trade deficit

ii) Budget deficit

a) G + T

b) T + X

c) G-T

d) G + M

e) X-M

f) X+M

Answer:

i) e) X-M

ii) c) G-T

Question 13.

Fill appropriately. (JUNE-2014)

a) Domestic demand for foreign goods leads to ______

b) The tiny production unit is referred as ________

c) The expenses that rise productive capacity is called ________

Answer:

a) import

b) firm

c) investment expenditure

Question 14.

Distinguish nominal exchange rate and real exchange rate. (JUNE-2014)

Answer:

The price of one currency in terms of the other is . known as the exchange rate. Nominal exchange rates are bilateral in the sense that they are exchange rates for one currency against another and they are nominal because they quote the exchange rate in money terms, i.e. so many rupees per dollar or per pound. However, the real exchange rate is the ratio of foreign to domestic prices, measured in the same currency. It is defined as Real exchange rate = ePf / P where P and Pf are the price levels here and abroad, respectively, and e is the rupee price of foreign exchange (the nominal exchange rate).

The real exchange rate is often taken as a measure of a country’s international competitiveness. Therefore, real exchange rate is considered to be more relevant.

Question 15.

Write down the national income identify for an open economy with due explanation of the terms used. (JUNE-2014)

Answer:

National income identity for an open economy

In a closed economy, there are three sources of demand for domestic goods – Consumption (C), government spending (G), and domestic investment (I).

We can write Y =C+ l + G

In an open economy, exports (X) constitute an additional source of demand for domestic goods and services that comes from abroad and therefore must be added to aggregate demand. Imports (M) supplement supplies in domestic markets and constitute that part of domestic demand that falls on foreign goods and services. Therefore, the national income identity for an open economy is

Y+M = C + I + G + X

Rearranging, we get

Y = C + I + G + X-M or

Y = C + I + G + NX

where, NX is net exports (exports – imports). A positive NX (with exports greater than imports) implies a trade surplus and a negative NX (with imports exceeding exports) implies a trade deficit.

Question 16.

Differentiate between: (JUNE-2014)

i) Currency Devaluation and

ii) Currency Depreciation

Answer:

Devaluation means increase in exchange rate. Devaluation is said to occur when the exchange rate is increased by social action under a pegged exchange rate system. Devaluation is used as a tool to bridge the gap of trade deficit.

On the other hand, change in the price of foreign exchange under flexible exchange rate, when it becomes cheaper as compared to domestic currency is known as depreciation.

Question 17.

Two National Income identities are shown below: (MARCH-2015)

i) Y = C + I + G

ii) Y = C + I + G + X – M

a) Pick out the National Income identity for an open economy.

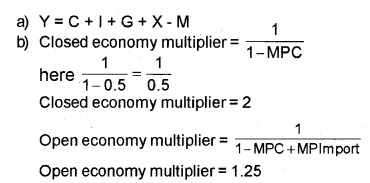

b) If marginal propensity to consume (C) = 0.5 and marginal propensity to import (M) = 0.3, prove that the open economy multiplier is smaller than that of the closed economy

Answer:

the multiplier in closed economy is 2 and open economy is 1.25.

Question 18.

The economic principle of exchange rate determination are different in different systems. Write in one or two sentences how the exchange rate is determined under: (MARCH-2015)

a) Flexible Exchange rate system

b) Fixed Exchange rate system

c) Managed floating Exchange rate system.

Answer:

a) A country’s exchange rate regime where its currency is set by the foreign-exchange market through supply and demand for that particular currency relative to other currencies. Thus, floating exchange rates change freely and are determined by trading in the for ex market. This is in contrast to a “fixed exchange rate” regime.

b) Fixed Exchange Rate’ A country’s exchange rate regime under which the government or central bank ties the official exchange rate to another country’s currency (or the price of gold). The purpose of a fixed exchange rate system is to maintain a country’s currency value within a very narrow band. Also known as pegged exchange rate.

In a fixed exchange-rate system, a country’s central bank typically uses an open market mechanism and is committed at all times to buy and/or sell its currency at a fixed price in order to maintain its pegged ratio and, hence, the stable value of its currency in relation to the reference to which it is pegged. The central bank provides the assets and/or the foreign currency or currencies which are needed in order to finance any payments imbalances.

c) Managed float regime is the current international financial environment in which exchange rates fluctuate from day to day, but central banks attempt to influence their countries exchange by buying and selling currencies. It is also known as a dirty float.

Managed float exchange rates are determined in the foreign exchange market. Authorities can and do intervene, but are not bound by any intervention rule.

Often accompanied by a separate nominal anchor, such as inflation target. The arrangement provides a way to mix market-determined rates with stabilizing intervention in a non-rule-based system. Its potential drawbacks are that it doesn’t place hard constraints on monetary and fiscal policy. It suffers from uncertainty from reduced credibility, relying on the credibility of monetary authorities. It typically offers limited transparency.

Question 19.

Differentiate between fixed and floating exchange rates. (MAY-2015)

Answer:

In a system of flexible exchange rates (also known as floating exchange rates), the exchange rate is determined by the forces of market demand and supply.

Countries have had flexible exchange rate system ever since the breakdown of the Bretton Woods system in the early 1970s. Prior to that, most countries had fixed or what is called pegged exchange rate system, in which the exchange rate is pegged at a particular level. Sometimes, a distinction is made between the fixed and pegged exchange rates.

Under a fixed exchange rate system, such as the gold standard, adjustment to BOP surpluses or deficits cannot be brought about through changes in the exchange rate.

Question 20.

Give one-word for the following: (MAY-2015)

The price of one unit of foreign currency in terms of domestic currency.

Answer:

Exchange rate

Question 21.

Explain Balance of Payments (BOP). What do you mean by balance of payment surplus and balance of payment deficit? (MAY-2015)

Answer:

Balance of trade is the record of a country’s visible export and visible imports. It includes only visible trade and excludes invisible trade of services. However, balance of payment is a more comprehensive term which denoted a country’s total monetary transactions with the rest of the world. It includes both visible and invisible trade of goods and services.

The balance of payments (BOP) records the transactions in goods, services and assets between residents of a country with the rest of the world. There are two main accounts in the BOP – the current account and the capital account.

When the total receipt is larger than the payment the balance of payment is said to be surplus. On the other hand when payments are larger than receipts, balance of payments is said to be deficit.

Question 22.

Differentiate: (MARCH-2016)

a) Currency devaluation

b) Currency depreciation

Answer:

a) Currency devaluation: It is the deliberate reduction of the value of domestic currency in terms of a foreign currency.

b) Currency depreciation: It is the reduction in the value of domestic currency due to the operation of supply for money and demand for money.

Question 23.

Write a note on fixed exchange rate and floating exchange rate. (MAY-2016)

Answer:

In a system of flexible exchange rates (also known as floating exchange rates), the exchange rate is determined by the forces of market demand and supply.

Countries have had flexible exchange rate system ever since the breakdown of the Bretton Woods system in the early 1970’s. Prior to that, most countries had fixed or what is called pegged exchange rate system, in which the exchange rate is pegged at a particular level. Sometimes, a distinction is made between the fixed and pegged exchange rates.

Under a fixed exchange rate system, such as the gold standard, adjustment to BOP surpluses or deficits cannot be brought about through changes in the exchange rate.

Question 24.

The relative price of foreign goods in terms of domestic goods is _____ (MAY-2016)

a) The nominal exchange rate

b) The real exchange rate

c) Floating exchange rate

d) All of the above

Answer:

The real exchange rate

Question 25.

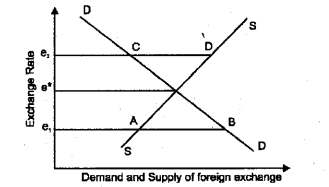

Explain the working of a pegged exchange rate system with suitable diagram. (MARCH-2017)

Answer:

Fixed exchange rate is also known as pegged exchange rate system. Under this system, the exchange rate will be determined by central bank. The intervention made in the foreign exchange market by the central bank to keep exchange rate fixed is known as pegging. This can be explained with the help of diagram. Which is given below.

Here e* is the market determined exchange rate. Suppose that government fixes exchange rate as e1 At e, exchange rate the demand for foreign exchange is greater than the supply of foreign exchange. If there is no.control over exchange rate. It will increase to e*. In order to maintain the exchange rate at e1 the central bank will sell AB amount of foreign exchange in the market. So the exchange will be maintained at e*.

Suppose that the central bank fixes the exchange rate e2. If there is no central bank intervention in the market the exchange rate will fall to e*. In order to maintain the exchange rate at e2 the central bank will purchase CD amount of foreign exchange from the market. Thus fixed exchange rate is maintained.

Question 26.

Differentiate between Devaluation and Depreciation. (MARCH-2017)

Answer:

Devalution: Lowering of the value of domestic currency through official procedure by the central bank under fixed exchange rate system is known as currency devaluation.

Depreciation: The loss in the value of domestic currency when exchanged with foreign currency under flexible exchange rate system is known as currency depreciation.