Kerala Plus Two Macroeconomics Chapter Wise Previous Questions Chapter 3 Money and Banking

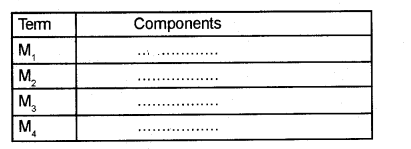

Question 1.

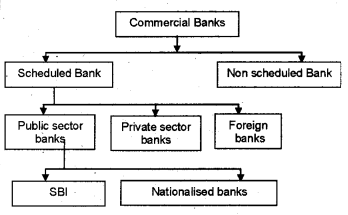

Complete the chart. (MARCH-2008)

Answer:

Question 2.

Imagine an economy without money and point out the difficulties faced in the exchange of commodities. Can you suggest an economic term for that situation? (MARCH-2008)

Answer:

a) Difficulties of commodity exchange system are:

- need of the double coincidence of wants.

- need of divisibility

- lack of common measure of value

- lack of proper store of value.

b) This system is called barter system.

Question 3.

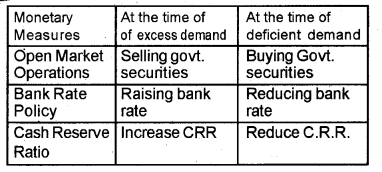

In the following table some important monetary policy measures are given. Complete the table appropriately. (MARCH-2008)

Answer:

Question 4.

the questions given below. (MARCH-2008)

1) Central Government wants advice on a financial crisis.

2) Central Government wants an authority as the custodian of foreign exchange reserves.

3) The country needs an institution to regulate the money supply and credit system.

4) Commercial Banks wants an institution for assistance and advice.

a) Which institution can handle all these issues?

b) Analyse each issue and explain how that institution handle and make decision on them.

Answer:

a) RBI or Central Bank

b) 1) Financial adviser

2) Custodian of nation’s foreign exchange reserves

3) Control of credit

4) Lender of last resort

Question 5.

A recent study on film industry in Kerala reveals that even today majority of the producers depend not on banks but on big money lenders for raising the required capital. (JUNE-2009)

a) Comment on it in the background of Indian monetary system.

b) Suggest a remedy for betterment.

Answer:

a) It is a fact that in Kerala many people depend on private money lenders rather than banks. This is because banking activities are time consuming and will cause unnecessary delay. Money lenders are easily accessable and therefore people depend them for financial requirements,

b) Banking system should be made easily approachable.

- Bank facilities should be provided to all.

- Delay in business should be avoided.

- Unnecessary formalities and practices should be avoided.

- Large security requirements of banks should be relaxed.

Question 6.

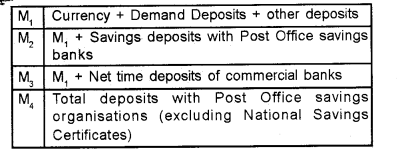

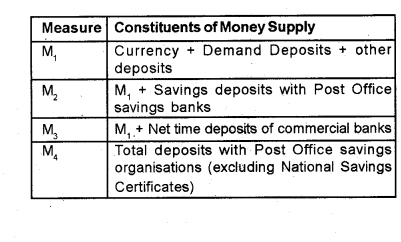

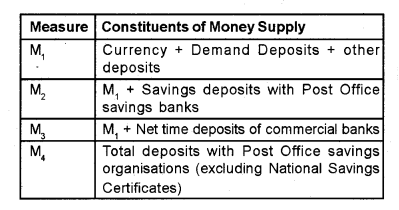

The RBI has been publishing four alternative measures of money supply in India since 1977. On the basis of this.(MARCH-2010)

a) Complete the following table:

b) Identify aggregate monetary resource.

Answer:

Question 7.

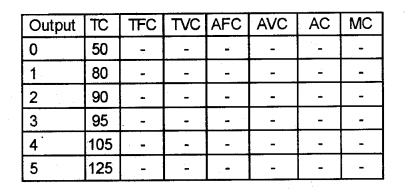

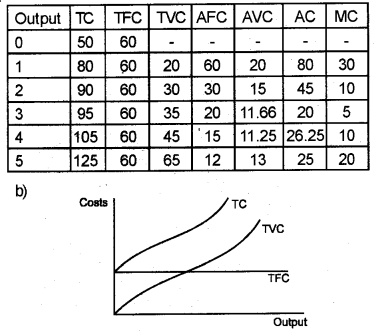

Data regarding the production and cost structure of a firm is given below: (MARCH-2010)

a) If TFC is 60, complete the table.

b) On the same set of axis plot TFC, TVC and TC.

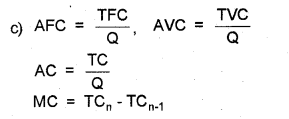

c) Write relevant equations to find out AFC, AVC,

Answer:

a)

Question 8.

Monetary policy is the policy adopted by the RBI to stabilize the economy. One of the instruments of monetary policy is cash reserve ratio. Supplement other three and explain.(MARCH-2010)

Answer:

1) Bank Rate

2) Statutory Liquidity Ratio

3) Open Market Organisations

Question 9.

‘Money supply is a stock variable.’ (JUNE-2010)

a) Define the concept of money supply.

b) Name the four alternative measure of money supply.

c) Classify them into narrow money and broad money.

Answer:

Money supply consists of currency notes and coins issued by the monetary authority of the country.

b) The total stock of money in circulation among the public at a particular point of time is called money supply. RBI publishes figures for four alternative measures of money supply, viz. M1, M2, M3 and M4. They are defined as follows.

c) M1 and M2 are narrow money. M3 and M4 are broad money

Question 10.

RBI is the independent authority for conducting monetary policy in the economy. Explain the instruments which RBI uses for conducting monetary policy. (JUNE-2010)

Answer:

Bank rate

Open market operations

Margin requirements

Question 11.

Anand has an account in State Bank of India. He often withdraws some amount of money either through cheque or through ATM card. (MARCH-2011)

Answer:

Demand deposit/Saving deposit/Current deposit

Question 12.

In order to control inflation, Reserve Bank of India (RBI) raised Cash Reserve Ratio (CRR) by 0.75% during January 2010. As part of monetary policy, the RBI adopts some more measures to counter inflation. Discuss any other 2 measures. (MARCH-2011)

Answer:

The instruments which RBI uses for conducting mon-etary policy are as follows.

1) Open Market Operations:

It refers to the sale and purchase of government securities by the central bank. RBI purchases government securities to the general public in a bid to increase the stock of high powered money in the economy.

2) Bank Rate Policy:

As mentioned earlier, RBI can affect the reserve deposit ratio of commercial banks by adjusting the value of the bank rate-which is the rate of interest commercial banks have to pay RBI – if they borrow money from it in case of shortage of reserves. A low (or high) bank rate encourages banks to keep smaller (or greater) proportion of their deposits as reserves, since borrowing from RBI is now less (or more) costly than before.

Question 13.

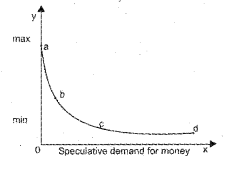

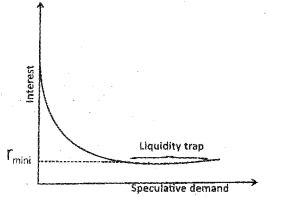

Observe the graph given. Identify the segment of liquidity trap from the figure and choose the answer from bracket. (MARCH-2011)

Answer:

c to d

Question 14.

Distinguish between the ‘legal tender money’ and ‘flat money’.(MARCH-2012)

Answer:

Money issued by the monetary authority or the government which cannot be refused by any one is called legal tender money.

Eg : Currency notes.

On the other hand fiat money refers to money with no intrinsic value.

Eg : Coins

Question 15.

In India RBI has developed alternative measures of money supply and figures are published accordingly. (MARCH-2013)

a) Prepare a chart showing the alternative measures of money supply in India.

b) Categorise them into ‘narrow money’ and ‘broad money’.

c) Also identify the ‘most’ and ‘least’ liquid forms of money.

Answer:

The total stock of money in circulation among the public at a particular point of time is called money supply. RBI publishes figures for four alternative measures of money supply, viz. M1, M2, M3 and M4. They are defined as follows.

b) M1 and M2 are narrow money M3 and M4 are broad money

c) M1 and M2 are known as narrow money. M3 and M4 are known as tad money. These gradations are in decreasing order of liquidity. M1 is most liquid and easiest for transactions whereas M4 is least liquid of all. M3 is the most commonly used measure of money supply. It is also known as aggregate monetary resources.

Question 16.

“People desire to hold money balance broadly from two motives.” Explain. (MAY-2015)

Answer:

The Transaction Motive: The principal motive for holding money is to carry out transactions. In general, the transaction demand for money in an economy, MdT, can be written in the following form

Mt = k.T

where T is the total value of (nominal) transactions in the economy over unit period and k is a positive fraction. The number of times a unit of money changes hands during the unit period is called the velocity of circulation of money. In general, equation can be modified in the following way

Mt = kPY

where Y is the real GDP and P is the general price level or the GDP deflator. The above equation tells us that transaction demand for money is positively related to the real income of an economy and also to its average price level.

The Speculative Motive : An individual may hold her wealth in the form of landed property, bullion, bonds, money, etc. Everyone in the economy will hold their wealth in money balance and if additional money is injected within the economy it will be used up to satiate people’s craving for money balances without increasing the demand for bonds and without further lowering the rate of interest below the floor level. Such situation is called a liquidity trap. The speculative money demand function is infinitely elastic here.

Question 17.

Distinguish between a stock and flow variables. Illustrate with examples. (MARCH-2017)

Answer:

Stock : It is a variable which can be measured at a particular point of time. Stock is a static concept e.g. wealth, money supply, inventory.

Flow: It is a variable which can be measured over a given period of time. It is a dynamic concept, e.g: income, gross value added (GVA), changes in inventory

Question 18.

Write a note on the interest responsiveness of the following motives for the demand for money. (MARCH-2017)

Answer:

i) Translation motive

ii) Precautionary motives

iii) Speculative motives

The amount of money that people keep as cash will be determined by comparing the advantages of liquidity and interest rates. The demand for money – as arises due to

1. Precautionary motive: People will hold liquid cash in order to meet emergencies. This is known as precautionary motive.

2. Transation motive: The desire of people hold cash in order to make transactions is defined as demand for money. The volume of GDP increases transations demand for money will also increase. It has a positive relationship with GDP.

3. Speculative motive: In order to make profits from the purchase and sale of bonds and securities individuals will hold cash. This is known as speculative motive.

The relationship between interest rate and bond price is negative. When the market rate of interest is high the bond price will be less.

When the market rate of interest reaches minium the speculative demand curve will be parallel to ‘x’ axis. This situation is known as liquidity troop.

Question 19.

Match the following: (MARCH-2017)

M1 : Most commonly used measure of money supply

M2: Least liquid form of money supply

M3: M1 + Post Office Savings Deposits M

M4: CU+DD

Answer:

M1: CU + DD

M2: M1 + Post Office Savings Deposits

M3: Most commonly used measure of money supply

M4: Least liquid form of money supply