Kerala Plus Two Economics Previous Year Question Paper March 2019 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Economics |

| Category | Plus Two Previous Year Question Papers |

Time: 2½ Hours

Cool off time : 15 Minutes

General Instructions to candidates

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2½ hrs.

- Your are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non programmable calculators are not allowed in the Examination Hall.

Match the column B & C with A: (5 × 1 = 5)

Question 1.

| A | B | C |

| General theory of employment interest and money | CRR | Equilibrium Output |

| SLR | Effective demand | USA |

| AD = AS | 1936 | RBI |

| Public good | 1929 | J.M. Keynes |

| Great depression | Defence | Road |

Answer:

| A | B | C |

| General theory of employment interest and money | 1936 | J.M. Keynes |

| SLR | CRR | RBI |

| AD = AS | Effective demand | Equilibrium Output |

| Public good | Defence | Road |

| Great depression | 1929 | USA |

Qn. No. 2 to 6, write the correct answer. Each question carries 1 score. (5 × 1 = 5)

Question 2.

write the economic term of \(\frac{\text { Change in output }}{\text { Change in input }}\)

Answer:

Marginal output / Marginal product.

Question 3.

Petroleum refining and marketing in India is the closest example of ………..

a) Monopoly

b) Oligopoly

c) Perfect Competition

d) None of these

Answer:

b) Oligopoly

Question 4.

In an open economy, if C = 0.7, m = 0.2. Calculate the value of multiplier.

Answer:

Multiplier = \(\frac{1}{\mathrm{MPS}+\mathrm{MPM}}\)

= \(\frac{1}{0.3+0.2}\) = \(\frac{1}{5}\)

= 2

Question 5.

In a centrally planned economy all major economic decisions are taken by ………..

a) Market

b) Government

C) Private Producers

d) None of these

Answer:

b) Government

Question 6.

When the existing price is higher than the equilibrium price ………..

a) Market demand is higher than market supply.

b) Market supply is higher than market demand.

c) Market demand is equal to market supply.

d) None of these.

Answer:

b) Market supply is higher than market demand.

Answer all questions from 7 – 11. Each carries 2 scores. (5 × 2 = 10)

Question 7.

The supply curve of a firm depends on many factors. Point out any two.

Answer:

The supply curve of a firm depends on different factors.

Two factors are:

- Technological progress.

- Input prices.

Question 8.

Differentiate between Balance of Payment (BoP) and Balance of Trade (BoT).

Answer:

Balance of trade is the difference between the visible export and visible import of a country with the rest of the world. It includes the exchange of goods only balance of payment is the complete record of the financial transaction made between a country and the rest of the world. The BOP includes visible and invisible transactions. The BOP account has 4 parts

- Current account

- Capital account

- Official reserve account

- Errors and omissions

Question 9.

a) Write down two most important characteristics of monopolistic competition.

b) Differentiate the price and output prevailing in the monopolistic competitive market with that of per-fectly competitive market.

Answer:

a) Two important characteristic of monopolistic competition are

- Large number of buyers and sellers.

- Product differentiation.

b) In monopolistic competition, price is greater than that under perfect competition. Just as output is differentiated product.

At the same time price is uniform price and output is homogeneous in perfect competition market.

Question 10.

Beginning on 15 August 2018, severe floods affected Kerala due to unusually high rainfall. The state gov-ernment has hiked the excise duty on liquor and by which, it is expected to raise revenue to ₹ 750 crore. Suppose the MPC (Marginal Propensity to Consume) of the same product is, only 0.8, then calculate the tax multiplier and its effect on income.

Answer:

Tax multiplier = \(\frac{\Delta Y}{\Delta T}=\frac{-C}{1-C}\)

= \(\frac{-0.8}{1-0.8}=\frac{-0.8}{0.2}\)

= – 4

Question 11.

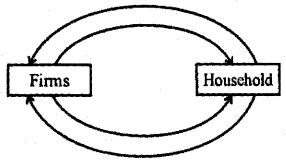

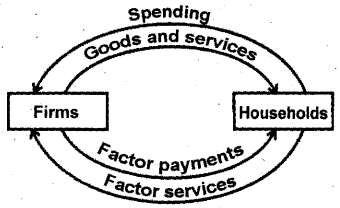

a) Complete the given diagram.

b) Mark the real flow and money flow.

Answer:

a)

b) Money flow:

- Expenditure on goods and services

- Factor payment

Real flow:

- Goods and services

- Factor services

Answer any 6 questions from 12 – 18. Each carries 3 scores. (6 × 3 = 18)

Question 12.

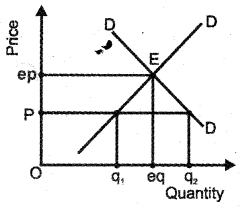

In the open market, the price of rice/kg is ₹ 35. Assume that the poor people cannot afford to purchase rice at this price. To protect the poor people, the government decided to offer rice at a minimum price of ₹ 2/kg through ration shop. Identify the economic term of this situation. Draw a diagram to illustrate this.

Answer:

Price selling:

In the diagram, ‘ep’ is the market determined equilibrium price. If this price is very high then the government will interfere in the market and will fix ‘p’ as the price ceiling. This government fixed price ‘p’ is less than the market determined equilibrium price ‘ep’. This leads to the following situations.

- Rationing

- Black marketing

- Dual marketing

- Huge burden of government as subsidy.

Question 13.

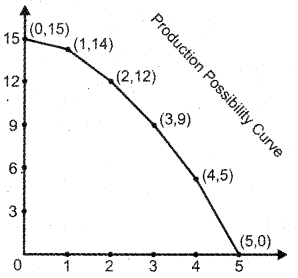

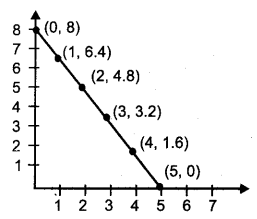

Paul A. Samuelson used the concept Production Possibility Curve to explain the economic problem of a society. Draw the Production Possibility Curve on the basis of the given schedule.

| Possibilities | Wheat (in lakh tonnes) | Machine (in thousands) |

| A | 0 | 15 |

| B | 1 | 14 |

| C | 2 | 12 |

| D | 3 | 9 |

| E | 4 | 5 |

| F | 5 | 0 |

Answer:

Question 14.

Indian Rupee has been on a free fall since past few months. Rupee has lot more than 20% of its value this year when compared to last year. In this context, identify the important factors responsible for such a flexibility in the exchange rate.

Answer:

Factors responsible for flexibility in exchange rate are:

- Inflation rate

- High interest rate

- Government debt

- Recessionary situation

- Increasing oil prices

- Deficit in BOP

Question 15.

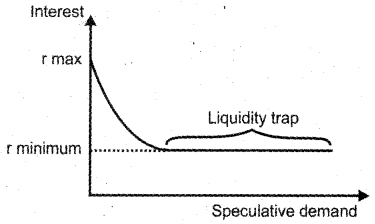

Prepare a short note on the concept of speculative demand for money with the help of a diagram.

Answer:

In order to make profits from the purchase and sale of bonds and securities individuals will hold cash. This is known as speculative demand for money. It can be drawn as follows:

There is a negative relationship between the market rate of interest and speculative demand for money. When the market rate of interest reaches r minimum the speculative demand curve will be parallel to ‘x’ axis. This situation is known as liquidity trap.

Question 16.

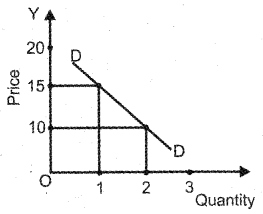

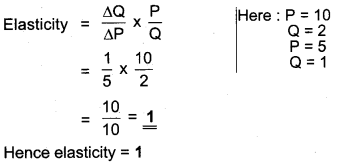

Suppose the price of tomato per kg. is ₹ 10, Ms. Mittu purchase 2 kg of tomato. If the price rises to ₹ 15, she buys 1 kg. Based on this information.

a) Draw the Demand Curve.

b) Find out the Elasticity of Demand.

Answer:

a)

b) Elasticity of demand:

Question 17.

Great depression was a severe worldwide economic depression that took place mostly during the 1930s, beginning in the United States. Prepare a brief note on it.

Answer:

The great depression of 1929 and the subsequent years created huge economic crisis in countries of Europe and North America. It affected other countries of the world as well. This depression proved that the classical idea of full employment and the automatic working of the economy was wrong. Due to depression production fell down.

Demand for goods in the market was low. Many factories were lying idel. Unemployment rose severely. The classical theory failed to explain the problem of long lasting unemployment in the economy. Keynes book was an attempt to explain this phenominon and remedial measures for it.

Question 18.

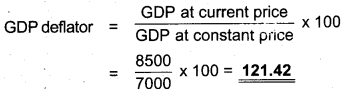

Define the concept of GDP deflator. Calculate the GDP deflator from the following data and analyse it.

- In 2015, the GDP at current price is ₹ 8,500.

- In 2015, the GDP at constant price is ₹ 7,000.

Answer:

It shows that the general price level has increased compared to the base year.

Answer any 6 questions from 19 – 23. Each carries 4 scores. (4 × 4 = 16)

Question 19.

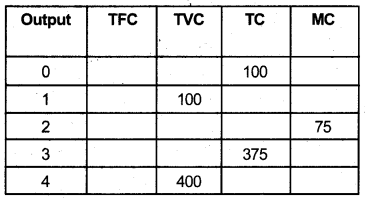

Complete the following table:

Answer:

Question 20.

a) Distinguish between MPC and MPS.

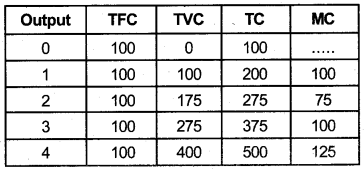

b) Calculate the value of multiplier and income generated when there is an additional investment of ₹ 100 crore in an economy.

| MPC | Value of multiplier | Income generated |

| 0.2 | ||

| 0.5 | ||

| 0.8 |

Answer:

a) MPS + MPC = 1

∴ MPC = 1 – MPC

b)

If the values of MPC in an economy is unity the value of MPS will be zero. Thus, there is close relationship between MPC and MPS.

Question 21.

a) Define the monetary policy.

b) Reserve Bank of India controls the money supply in the country though its instruments. Analyse them.

Answer:

a) The policy adopted by RBI to regulate the fluctuations in the economy is known as monetary policy.

b) RBI contrails the money supply in the country through its monetary instruments which are given below.

- Open market operations: It is the process of increasing or decreasing the volume of high powered money in the economy by purchasing or selling government bonds and securities.

- Bank rate: It is the rate at which the central bank discounts first class bills of exchange of commercial banks or it is the interest rate charged by RBI on loans given to commercial banks.

3) Varying the reserve deposit ratios: Reserve deposit ratios are of two types:

- CRR (Cash Reserve Ration): Commercial banks have to keep a certain percentage of their demand deposits and time deposits as reserves with RBI. This percentage is known as cash reserve ratio.

- SLR (Statutory Liquidity Ratio): Commercial banks have to invest a certain percentage of their demand and time deposits on assets like gold or government securities. This percentage is known as SLR.

RBI in India acts as strong force in controlling credit by monetary policy. The acts of RBI towards control of money supply is also noteworthy.

Question 22.

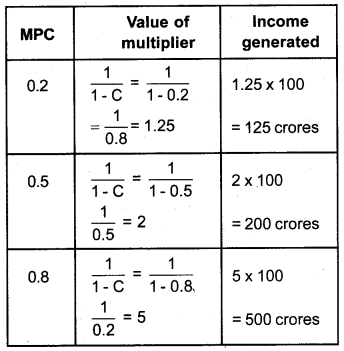

QD = 500 – P

QS = 300 + P

a) Calculate the equilibrium price and quantity.

b) Draw a diagram based on equilibrium price and quantity.

Answer:

a) QD = 500 – P

QS = 300 + P

500 – P = 300 + P

500 – 300 = +P + P

200 = 2P

\(\frac{200}{2}\) = P

P = 100

Equilibrium price is 100

QD = 500 – P

= 500-100 = 400

Equilibrium quantity = 400

b)

Question 23.

Short run production function is different from long run production functions.

a) Identify any two important differences between the two.

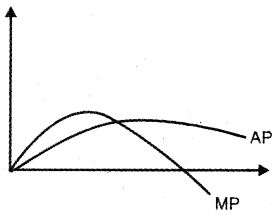

b) Draw the Average Product and Marginal Product Curves. AP, MP

Answer:

a) 1) Under the short run the firm cannot vary all the inputs for a change in output in long run, but in long run firm can vary all inputs for a change in output.

2) Some inputs are fixed under short run while under long run there is no fixed input.

b)

Answer any 2 questions from 24 – 26. Each carries 5 scores. (2 × 5 = 10)

Question 24.

Statement I: Indian Railway (IR) is India’s National railway system operated by the Ministry of Railways.

Statement II: ONGC, ESSAR, Reliance Ltd., etc. are the oil extraction companies in the country.

a) Identify the closest market form associated with the above statements.

b) Point out the features of each market form.

c) List out two differences between these two mar¬ket forms.

Answer:

a) Statement I – associated with monopoly market.

Statement II – associated with oligopoly market

b) Features of monopoly market:

- Only a single seller.

- No close substitues are available.

- Barriers to entry.

- Firm itself is the industry.

- Firm is price maker.

Features of oligopoly market:

- Products may be homogeneous or differentiated.

- There exists selling cost.

- Freedom of entry and exit of firms.

- Interdependence of firms.

c) Difference between these market:

Monopoly:

- Higher price

- Single seller

Oligopoly:

- Price less than monopoly market

- Few sellers

Question 25.

a) Mention the methods of National Income accounting and explain briefly the expenditure method.

b) Caculate the GNP MP from the following data:

| Item | Rupees (in crores) |

| NDPFC | 10,000 |

| Depreciation | 2,000 |

| Net Indirect Tax (NIT) | 1,000 |

| Net Factor Income from Abroad (NFIA) | 5,000 |

Answer:

a) There are mainly three methods for measuring national income. They are product method, income method and expenditure method.

i) Product method: It is the sum of the gross value added by the entire production units in the economy.

GDP = \(\sum_{i=i}^{N} N V A_{i}+\sum_{i=i}^{N} D_{i}\)

ii) Income method: The income method approaches national income from the income side. National income is the sum total of the rewards earned by the factors of production in an economy in the form of rent, wage, interest and profit.

GDP = W + P + In + R

iii) Expenditure method: Expenditure method is an alternative way to calculate the GDP and it looks at the demand side of the production. The expenditure method estimates national income by measuring final expenditure on gross domestic product.

GDP = C + I + G + X – M

b) GNPMP = 18000

= 5000 + 1000 + 2000 + 10000

= 18000

Question 26.

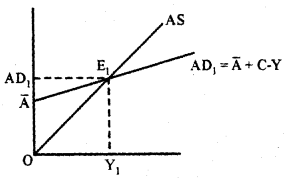

The above figure shows an equilibrium in the product market.

Suppose an Autonomous Investment (Al) increases by ₹ 100 crores, and MPC is equal to 0.8, what happens to the AD and equilibrium income? Explain this with the help of a diagram.

Answer:

Question is incomplete

Answer any 2 questions from 27 – 29. Each carries 8 scores. (2 × 8 = 16)

Question 27.

Ms. Sudha wants to consume apple and oranges. Her income is ₹ 400. The price of apple (Good 1) is ₹ 80/kg. and the price of orange is ₹ 50/kg. On the basis of this data.

a) Draw the budget line.

b) Write the equation of budget line.

c) How much kg of apple that Ms. Sudha can consume if she spend the whole income on that good alone?

d) What is the slope of the budget line?

e) Draw the new budget line in the same graph if her income falls to ₹ 200 remaining same the price of two goods.

f) What happens to the budget line if the price of apple rises to ₹ 100 but income and price of orange are remaining constant? Draw a new budget line.

Answer:

a)

b) P1X1 + P2X2 = M

80 X1 + 50 X2 = 400

c) \(\frac{400}{80}\)

d) Slope = \(\frac{-P_{1}}{P_{2}}=\frac{-80}{50}\)

e) Question is wrong.

f) Question is wrong.

Question 28.

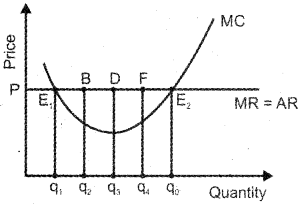

In a perfectly competitive market, the firm wishes to maximize its profit.

a) Identify the conditions with the help of a diagram.

b) Explain the profit maximization of a firm in the short run.

c) In the long run, a perfectly competitive firm earns the normal profit. Do you agree with this? Graphically substantiate.

Answer:

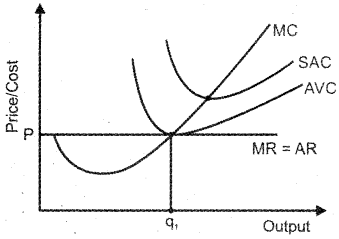

a) The main air of a firm under perfect competition is the maximization of profit. The output level at which the firm maximises its profits is called equilibrium of the firm. The following conditions are necessary for the profit maximization. If firm

Condition – 1

Market price (P) should be equal to MC. ‘P’ should not be greater than MC or ‘P’ should not be less than MC.

If the market price (P) is less than MC then for producing each unit of output the firm incurs loss. When the firm produces output at q0 the gross profit is maximum. If q0 is equilibrium output then at q0 level of output market price (P) should be equal to MC.

Condition – 2

At the profit maximising level of output MC should not be decreasing or MC curve should cut MR curve from below.

Condition – 3

In the short run the price (P) should be more than or equal to minimum point of AVC.

Here the equilibrium output is q1 and equilibrium price is p. If the price line is aboue the minimum point of AVC the loss will decrease. Thus in the short run the price of the firm should be more than or equal to minimum point of AVC.

b) Profit of a firm can be denoted as π. It is the difference between total revenue and total cost. Profit maximisation of firm in the short run takes place through following situations in the market which are given below.

1) P = MC

2) MC curve should cut the MR curve from below.

3) P > AVC.

In the short riff the firm should get at least minimum point of AVC as price, inorder to remain in the production process. So the minimum point of AVC is known as shut down point in the short run. In the short run the minimum point of SAC curve is the break even point.

c) Yes. I agree with this statement.

Each firm in the market will take the price determined in the market by the forces of demand and supply. If a firm changes a higher price than the market determined price then it will loose its entire customers. Since the firm gets only the normal profit he cannot sell below the market determined price.

Question 29.

| SI NO. | Item | Amount (₹) |

| 1. | Revenue Receipts | 50,000 |

| 2. | Capital Receipts a) Borrowing and other liabilities (₹ 15,000) b) Non-debt creating capital receipts (₹ 15,000) | 30,000 |

| 3. | Revenue Expenditure (including interest payments) | 65,000 |

| 4. | Capital Expenditure | 15,000 |

| 5. | Interest Payments | 10,000 |

a) Write down the equation for calculating Revenue deficit, Fiscal deficit and Primary deficit.

b) Calculate Revenue deficit, Fiscal deficit and Primary deficit from the given data.

c) Suggest any two measures to reduce the Fiscal deficit in the country.

Answer:

Revenue deficit = Revenue expenditure – Revenue receipts

Fiscal deficit = Total expenditure – Total revenue excluding borrowing

OR

Fiscal deficit = Total expenditure – Revenue receipt + Capital receipts excluding borroiwng

Primary deficit = Fiscal deficit – Interest payments

b) Revenue deficit = 65000 – 50000 = 15000

Fiscal deficit = 90000 – 50000 – 15000

= 90000 – 65000 = 25000

Primary deficit = 25000 – 10000

= 15000

c) 1) Reduction in subsidies by the government will also help to reduce the deficit.

2) Borrowing from domestic sources