Kerala Plus Two Economics Previous Year Question Paper March 2018 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Economics |

| Category | Plus Two Previous Year Question Papers |

Time: 2½ Hours

Cool off time : 15 Minutes

General Instructions to candidates

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2½ hrs.

- Your are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non programmable calculators are not allowed in the Examination Hall.

(Qn. No. 1 to 4) Choose the correct answer for the following. Each carries one score. (5 × 1 = 5)

Question 1.

Central problems of an economy arises due to which one of the following:

a) Relative scarcity of resources.

b) Abundance of labour and capital.

c) Limited human wants.

d) None of the above.

Answer:

a) Relative scarcity of resources.

Question 2.

The GDP and GNP of an economy will be equal when:

a) The value of Net Factor Income from abroad positive.

b) The value of Net Factor Income from abroad negative.

c) The value of Net Factor Income from abroad zero.

d) The value of Net Factor Income from abroad equals 1.

Answer:

c) The value of Net Factor income from abroad zero.

Question 3.

The ratio between stock of money supply and stock of high powered money is:

a) Currency Deposit Ratio (RDR)

b) Reserve Deposit Ratio (RDR)

c) Open Economy Multiplier

d) Money Multiplier

Answer:

d) Money multiplier

Question 4.

Write the economic term for the following:

a) The situation when people become more thrifty, the economy will end-up saving less.

b) The receipts of the Govt, which create liability or reduce financial assets.

Answer:

a) Paradox of thrift

b) Capital receipts

Question 5.

Match column B and C with A.

| A | B | C |

| a) Monopolistic Competition | i) Single Seller | i) Differentiated products |

| b) Monopoly | ii) A few sellers | ii) Homogeneous or Differentiated products |

| c) Oligopoly | iii) Fairly large number of cells | iii) Absence of substitutes |

Answer:

| A | B | C |

| a) Monopolistic Competition | i) Fairly large number of cells | i) Differentiated products |

| b) Monopoly | ii) Single Seller | ii) Absence of substitutes |

| c) Oligopoly | iii) A few sellers | iii) Homogeneous or Differentiated products |

Answer all questions from 6 to 14. Each question carries 2 Scores. (9 × 2 = 18)

Question 6.

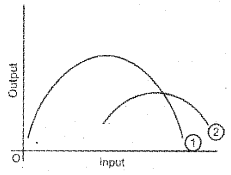

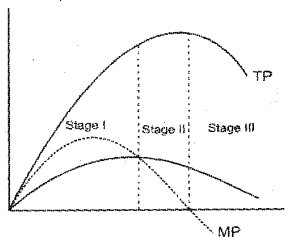

Two short run product curves of a firm are given below:

a) Name the curve (1) and curve (2) in the diagram

b) Write any one relationship between the two curves.

Answer:

a) MP curve (1) and AP curve (2)

b) When the value of MP is greater than ‘AP’ then AP increases.

When the of MP is less than the value of ‘AP’ then AP decreases.

Question 7.

The demand and supply function of a commodity are given below:

qD = 80 – 2P

qS = 60 + 2P

Find the equilibrium price and equilibrium quantity.

Answer:

At equilibrium qD = qs

80 – 2P = 60 + 2P

80 – 60 = 2P + 2P

20 = 4P

qD = 80 – 2p = 80 – 2 × 5 = 80 – 10 = 70

equilibrium price = 5

equilibrium quantity = 70

Question 8.

Following data shows the level of total expenditure of an economy during a particular year. Calculate GDPMP

| Items | ₹ in crores |

| a) Private final consumption expenditure (C) | 6,500 |

| b) Government consumption and investment expenditure (G) | 5,000 |

| c) Private Final Investment Expenditure (I) | 4,000 |

| d) Export (X) | 600 |

| e) Import (M) | 900 |

Answer:

GDPMP = C + I + G + (X – M)

= 6500 + 5000 + 4000 + 600 – 900

GDPMP = 15200

Question 9.

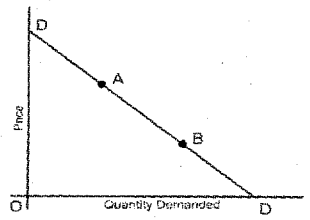

Calculate price elasticity of demand at point A and B by using geometric equation from the following linear demand curve.

Answer:

A = |eD| > I

B = |eD| < I

Question 10.

Following data shows the money supply of an economy. Calculate M1 and M3.

| Items | ₹ in crores |

| a) Total currency notes and coins with the public | 20,000 |

| b) Net demand deposits with commercial banks | 40,000 |

| c) Savings deposits with post office Savings Bank | 1,000 |

| d) Net time deposits with the commercial banks | 3,000 |

Answer:

M1 = Cu + DD

Cu = Currency and coins held by the public

DD = Demand deposits in commercial banks

= 20,000 + 40,000 = 60,000

M3 = M1 + Net time deposits with the commercial banks.

= 60,000 + 3,000 = 63,000

Question 11.

“Total Revenue curve of a firm under perfect competition is an upward sloping straight line passing through origin.” Give two points to support the statement.

Answer:

- When output is zero total revenue will also be zero. So TR curve starts from the origin

- As output level increases total revenue also increases

Question 12.

Following are the two statements that the consumers and investors of an economy can enjoy with foreign trade.

Statement 1: Consumers and firms have the opportunity to choose between domestic and foreign goods.

Statement 2: Investors have the opportunity to choose between domestic and foreign assets.

Identify the linkages that corresponding to each statement.

Answer:

Statement 1: Product market linkage

Statement 2: Financial market linkage

Question 13.

Classify the following items into Revenue Receipts and Capital Receipts.

(i) Government collected ₹ 20 crores as Goods and Service Tax (GST).

(ii) Govt, borrowed ₹ 50 crores from RBI by selling treasury bills.

(iii) Govt. raised an amount of ₹ 10 crores through disinvestment.

(iv) Govt, received ₹ 5 crores as interest receipts of loans given by Central Govt.

Answer:

Revenue receipts: (i), (iv)

Capital receipts: (ii), (iii)

Question 14.

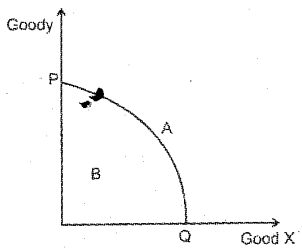

Draw an imaginary production possibility Frontier and mark a point which represents fuller utilization of resources and a point which represents under utilization of resources.

Answer:

Pont A indicates the efficient utilization of available resources.

Point B shows that the available resources of the economy are not fully utilized.

Answer any 6 questions from 15 – 21. Each carries 3 scores. (6 × 3 = 18)

Question 15.

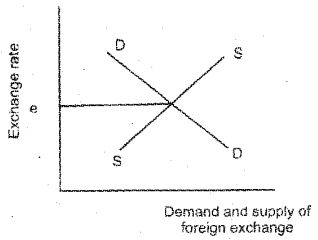

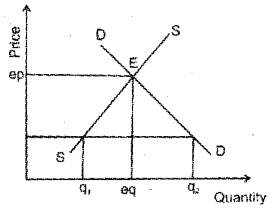

Graphically illustrate the determination of equilibrium exchange rate under flexible exchange rate system.

Answer:

Flexible Exchange Rate

It is also known as floating exchange rate determination. Here the exchange rate is determined by the forces of demand and supply of foreign exchange. The central bank has no role in the determination of exchange rate. They do nothing to directly affect the level of the exchange rate. It can be illustrated with the help of figure.

The exchange rate is determined at the point where the DD curve for foreign exchange cuts the supply curve.

Question 16.

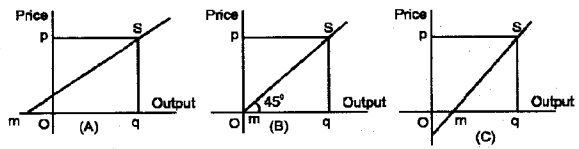

Calculate price elasticity of supply at points ‘s’ in the following diagrams.

Answer:

A) S Elastic supply

B) S Unitary elastic supply

C) S Inelastic supply

Question 17.

“Modern Macro economics is the off shoot of the Great Depression of 1929.” – Write any three points to support the statement.

Answer:

- The classical theory failed to explain the problem of long lasting unemployment in the economy.

- The great depression of 1929 and the subsequent years created huge economic crisis in the coun¬tries of Europe and North America.

- Due to depression production fell down.

Question 18.

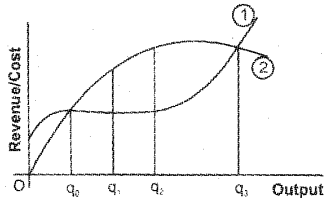

The diagram represents the profit maximizing level of output in a particular market structure.

a) Identify the market structure mentioned in the diagram.

b) Name the curves labelled as curve (1) and curve (2).

c) Identify the profit maximizing level of output.

Answer:

a) Perfect competitive market

b) Curve (1) TC and curve (2) TR

c) q2

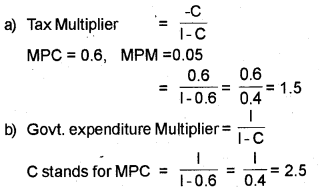

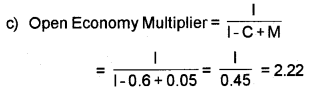

Question 19.

In an economy, if marginal propensity to consume (MPC) = 0.6 and marginal propensity to import (MPM) = 0.05, calculate:

a) Tax Multiplier

b) Govt. Expenditure Multiplier

c) Open Economy Multiplier

Answer:

Question 20.

Governments have mostly depend on borrowings for meeting its budgetary deficits. But this Govt, debt act as a burden on future generation. Do you agree with this statement? Substantiate.

Answer:

I agree with this statement. If the government borrow more, it may lead to a situation that the private investors cannot get enough fund from the capital market for investment. This is known as crowding out effect. So this may help the private sector to borrow more in future. The government can reduce budget deficit either through increasing taxes or by reducing public expenditure.

Question 21.

Classify the followings into short run and long run production function:

a) Law of variable proportion

b) Returns to scale

c) All inputs are variable

d) Some inputs kept constant

e) Factors are changing proportionately

f) Law of diminishing marginal product

Answer:

Short run production function:

- Law of diminishing marginal product

- Law of variable proportion

- Some inputs kept constant

Long run production function:

- Returns to scale

- All inputs are variable

- Factors are changing proportionately

Answer any 4 of the following from 22 – 27. Each carries 5 scores. (4 × 5 = 20)

Question 22.

a) Illustrate graphically the price fixation action of the government to protect the consumers from huge price rise.

b) State any two consequences of this action on consumers.

Answer:

a) The price determined in the market by the forces of demand and supply is very high, the common man will find it very difficult to purchase the goods. Then the government will interfere in the market. The government will fix a price that is less than the market determined price. This is known as price ceiling.

This can be explained with the help of figure.

In the diagram, ‘ep’ is the market determined equilibrium price. If this price is very high then the govt, will fix price ‘p’ which is less than market price ‘ep’.

b) This leads to the following situations

- Rationing: The government will supply goods at ‘p’ price through ration shops.

- This may lead to huge burden to the government as subsidy.

Question 23.

In a two sector economy, consumption function C = 80 + 0.6 y, Autonomous Investment \(\overline{\mathrm{I}}\) = 50 crores.

a) Calculate the value of output multiplier

b) Find the aggregate demand and equilibrium income in the economy.

c) If investment increases to ₹ 60 crores calculate its effect on equilibrium income.

Answer:

a) Output multiplier = [/latex]\frac{I}{I-C}\( = 2.5

Question 24.

a) List out two features of public goods.

b) How does private goods differ from public goods?

c) Give two appropriate examples for each

Answer:

a) i) Non-rivalry ii) Non-excludability

b) Public good is very difficult to charge price but in private good, charge price for the use.

c) Example of public goods are Road and National defence

Example of private goods are car and clothes.

Question 25.

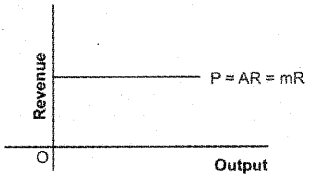

Given the demand curve of a firm:

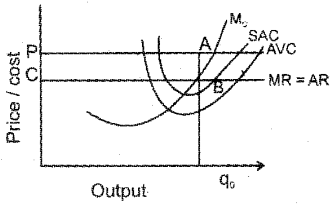

a) Identify the market strcuture represented on the figure.

b) Show grahically the profit maximizing condition of the above market in the short run:

i) With normal profit

ii) With abnormal profit

Answer:

a) Perfect competitive market

b) i) The point at which total revenue (TR) equals total cost (TC) is known as break even point.

At the break even point the firm will get normal profit

In the short run ‘B’ is the break even point or normal profit.

ii) Profit maximisation conditions are :

- Price should be equal to marginal cost

- At equilibrium level of output, MC should not be non decreasing

- Price should be more than or equal to minimum point of AVC

Question 26.

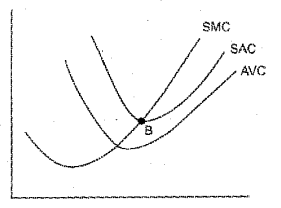

Explain the relationship between TP, AP and MP in the short-run with the help of a diagram.

Answer:

The three stages of returns to a factor can be explained through the following diagram.

First stage: The marginal product (MP) increases i.e. total product (IP) increases at an increasing rate. This stage is known stage of increasing returns to a factor.

Second stage: In this stage the marginal product decreases. Here the TP increases at a decreasing rate. This stage is known as diminishing returns to a factor.

Third stage: Here the marginal product becomes negative. Therefore the total product decreases. This stage is known as stage of negative returns to a factor.

Question 27.

Sometimes duopoly firm behave like a monopoly firm. Some other times they are competing each other. Explain the behaviour and features of Oligopoly/Duopoly firm.

Answer:

Oligopoly:

The term oligopoly has derived from two terms oligo (small) and poly (seller). Thus oligopoly is a market situation characterized by a competition among few sellers. In simple terms, it is a competition among few sellers in the market selling either homogenous or differentiated product. The industries manufacturing car, motor cycle, scooter etc. are some of the examples for oligopolistic competition.

Features:

The main features of oligopolistic competition are as follows:

- Few sellers: The number of sellers or producers would be few under oligopolistic competition.

- Homogneous or differentiated products: The products sold under oligopolistic competition would be either homogneous (e.g. gas, petrol) or differ – entiated (e.g. car, scooter)

- Free entry and exit: Free entry and exit persist under oligopolistic competition.

- Selling cost: Firms spend on advertisement and sales promotion.

- Interdependence of the firms: Since the number of firms under oligopoly are few, they are highly interdependent. The action of one firm will certainly have impact on other firms in terms of price, quality of the product, etc.

- Price leadership: Some of the firms may emerge as price leaders under oligopoly. The price leader could be the first firm in the industry or the firm with largest number of consumers. The price leader takes the important decisions regarding the-vital decisions such as the price of the product or number of units to be produced in the market, etc.

Answer any 2 of the following from 28 – 30. Each question carries 8 scores. (8 × 3 = 24)

Question 28.

RBI reduces its rate of lending to commercial banks at 25 point basis in its third monetary policy review of 2017-18.

a) Which policy instrument is used by RBI in the above context?

b) Briefly explain the operation of any three monetary policy instruments that RBI would adopt during inflation.

c) Name the instrument that RBI often uses for stabilizing the stock of money from external shocks.

Answer:

a) Bank rate policy

b) Instruments of Monetary Policy and the Reserve Bank of India.

The instruments which RBI uses for conducting monetary policy are as follows.

1) Open Market Operations: It refers to the sale and purchase of government securities by the central bank. RBI purchases government securities to the general public in a bid to increase the stock of high powered money in the economy.

2) Bank Rate Policy: As mentioned earlier, RBI can affect the reserve deposit ratio of commercial banks by adjusting the value of the bank rate – which is the rate of interest commercial banks have to pay RBI – if they borrow money from it in case of shortage of reserves. A low (or high) bank rate encourages banks to keep smaller (or greater) proportion of their deposits as reserves, since borrowing from RBI is now less (or more) costly than before.

3) Varying Reserve Requirements: Cash Re¬serve Ratio (CRR) and Statutory Liquidity Ratio (SLR) also work through the rdr-route. A high (or low) value of CRR or SLR helps increase (or decrease) the value of reserve deposit ratio, thus diminishing (or increasing) the value of the money multiplier and money supply in the economy in a similar fashion.

4) Sterilization by RBI: RBI often uses its instruments of money creation for stabilizing the stock of money in the economy from external shocks. This operation of RBI is known as sterilization.

c) Open market operations

Question 29.

a) Write down the identities of calculating GDP of an economy using three methods.

b) There are only 2 producting units, A and B in the economy. Calculate:

i) GVAMP of firm A.

ii) GVAMP if firm B.

c) Calculate GDPMP

| Items | Amount |

| i) Sales by firm A | 10,000 |

| ii) Sales by firm B | 20,000 |

| iii) Change in stock of firm B | 2,000 |

| iv) Change in stock of firm A | 500 |

| v) Purchase of raw materials by firm A | 5,000 |

| vi) Purchase of raw materials by firm B | 6,000 |

| vii) Consumption of fixed capital by firm A & B | 1,800 |

Answer:

a) GDP ≡ [latex]\sum_{i=1}^{N}\) GVAi / GVA1 + GUVA2 + GVAn

≡ \(\sum_{i=1}^{N}\) RVi = C + I + G + X – M = W + P + Iu + R

b) GVAMP → A = Gross value – intermediate consumption = 5500

GVAMP → B → Equation = 16000

c) aDPMP = GVAMP pf firm A + GVAMP of firm B

= 21,500

Question 30.

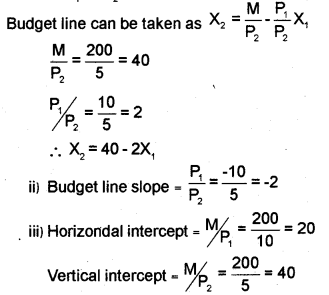

a) Mr. Roy wants to buy rice and milk with the money income of ₹ 200. Its market prices are ₹ 10 and ₹ 5 respectively.

i) Derive the budget line equation.

ii) Find the slope of the budget line.

iii) Find out horizontal and vertical intercept.

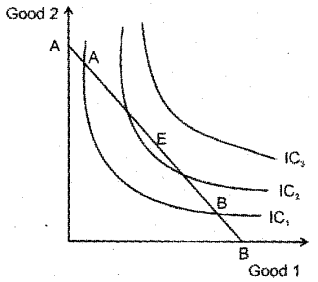

b) Explain the optimum level of the consumer (Consumer’s Equilibrium) with suitable diagram.

Answer:

a) i) P1X1 + P2X2 = M

10X1 + 5X2 = 200

Budget line can be taken as

b) The consumers equilibrium is that point at which the budget line is tangent to the indifference curve. In the diagram ‘E’ is the consumers equilibrium. The consumer will purchase the consumption bundle at the point ‘E’.

The points A & B does not show the equilibrium. The consumer gets more satisfaction on indifference curve IC3 than at IC2. But he cannot go to bundles on IC3 indifference curve as his budget does not allow him to do so. So the consumer will prefer bundles on the indifference curve IC2. So ‘E’ is the consumer’s equilibrium point.