Kerala Plus Two Computerised Accounting Notes Chapter 3 Use of Spread Sheet in Business Application

Business Applications

The following accounting applications are done with the help of a spreadsheet

- Payroll Accounting

- Asset Management

- Loan Repayment

Pay Roll Accounting

Payroll is a statement prepared to show the detailed salary calculation of employees. It contains Basic

Pay, Dearness Allowance, Travelling Allowance, Provident Fund Contribution, ESI Premium, etc. The computation of salary payment is based on the number of days an employee has worked, rate per grade, rate of allowances and deductions to be made therefrom.

1. Preparation of Salary Bill:

The preparation of salary bill should provide for the following:

- Maintaining payroll related data such as Employee No., Name, attendance, Basic Pay, DA, and other allowances, deductions to be made, etc.

- Periodic Payroll Computations: It includes the calculation of various earnings and deductions.

- Preparation of salary statement and employee’s salary slip.

- Generation of advice to bank: It contains the net salary to be transferred to individual bank account of employees and other salary related statutory payments such as provident fund, tax, etc.

2. Pav Roll Components:

The following elements are important for salary computation and its payment.

Earnings:

- Basic Pay (BP): It is the pay in the pay scale

- Grade Pay (GP): It is the pay to be added to the basic pay according to the designation.

- Dearness Pay (DP): Portion of dearness allowance merged with Basic Pay

- Dearness allowance (DA): Compensation for erosion in the purchasing power of wage earner due to Price rise.

- House Rent Allowance (HRA): An amount paid as rent of residential accommodation.

- Transport Allowance (TA): It is an amount to faclitate commuting to the palace of work.

Deductions:

- Professional TAX: Statutory deduction levied by State Government.

- Provident Fund (PF): It is a statutory deduction under provident Fund Act. It is deducted from salary as a part of social security.

- Tax Deducted at Source (TDs)- Monthly deduction towards income Tax liability of an employee.

- Recovery of Loan instalment: An amount deducted on account of any loan taken up by employee.

3. Net Salary Calculation:

Step 1: Calculate Gross salary by using the given formula.

Step 2: Calculate Total Deduction by using the following formula.

Total Deduction = Professional Tax + Provident Fund + Tax deducted at source + Loan Recovery + Any other deductions.

Step 3: Calculate net salary by the given formula

Net Salary = Gross salary – Total Deduction.

Asset Accounting

Assets are resources of the organisation. Assets which are used in the business for more than one year, called Fixed assets. The value of Fixed assets may be reduced due to depreciation. The gradual and permanent diminution in the value of assets due to wear and tear is called depreciation.

The depreciation on fixed assets is provided to recognise the cost of the asset consumed during an accounting period since the life of such assets extends beyond single accounting year.

Total amount of Depreciation – Acquisition cost – Salvage value.

1. Methods of calculation of depreciation:

- Straight Line Method (SLM)

- Written Down Value Method (WDV)

Straight Line Method

Under this method a fixed amount is deducted from the value of an asset year after year on account of depreciation and debited to profit and loss account. This method is also called Fixed Instalment method, or Original Cost method. Under this method value of asset will be reduced to zero.

Depreciation = \(\frac{\text { cost of the asset }-\text { Scrap Value }}{\text { Life of the asset }}\)

1. Cost of the asset/Acquisition cost = Purchase Price + Other expenses directly related with the asset (ie., carriage inward, freight, installation, renewal or reparis, Pre operating expenses).

2. Scap value / salvage value: It is the value of an asset which is realisable at the end of its useful life. Salvage value is the estimated residual value of depreciable asset or property at the end of its economical or useful life.

3. The depreciation under straight line method is computed by using the built in LibreOffice calc function SLN.

Written Down Value Method (WDV)

This method is also known as Diminishing balance method or Reducing balance method. Under this method, a fixed percentage is written off every year on the book value of the asset at the beginning of the year. Here the amount of depreciation goes on decreasing and there fore, the book value of asset will not become zero after its working life.

Amount of depreciation = Written Down Value of asset × Rate of depreciation

1. This method is also called Declining Balance (DB) method and uses the LibreOffice Calc function DB to compute the depreciation.

Loan Repayment Schedule

Loan is a sum of borrowed money for a specified period at a pre-specified rate of interest. The loan is repaid through a number of periodic repayment instalments over the loan repayment period.

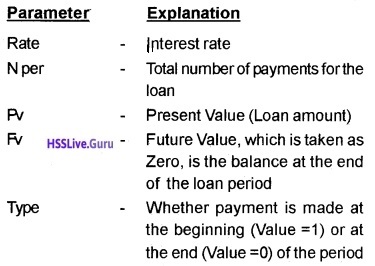

LibreOffice Calc function PMT is used to calculate loan repayment schedule. The parameters of the function PMT are as follows.