Kerala Plus Two Computerised Accounting Notes Chapter 1 Overview of Computerised Accounting System

Introduction

Computerised Accounting System refers to the process of accounting transaction through the use of hardware and software in order to produce accounting records and reports, i.e. Journals, Ledgers, Trial Balance, Profit and Loss Account and Balance Sheet.

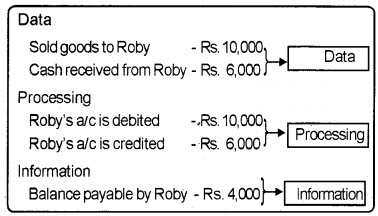

Data and Information

Data is raw, unorganised facts that need to be processed. Data can be something simple and useless until it is organised. When data is processed, organised, structured or presented in a given context so as to make it useful, it is called information. A computer is an information processing machine. Computers process data to produce information.

Example:

Components of Computerised Accounting System (CAS)

- Procedure: A logical sequence of actions to perform a task.

- Data: The raw fact for any business operation.

- People: Users of computerised accounting system

- Hardware: The physical components of a computer.

- Software: A set of programmes to do a work.

Salient Features of Computerised Accounting System (CAS)

1. Simple and Integrated:

Computerised accounting system is designed to integrate all the business operations such as sales, finance, purchase, etc.

2. Accuracy and speed:

Computrised Accounting system provides data entry forms for fast and accurate data entry of the transactions.

3. Scalability:

The system can cope easily with the increase in the volume of business transactions. The software can be used for any size and type of the organisation.

4. Security:

This system is highly secured and the data and information can be kept confidential.

5. Reliability:

Computerised accounting system makes sure that the critical financial information is accurate, controlled and safe from data corruption.

Grouping of Accounts

Grouping of accounts means classifying the ledger accounts and organising them under major heads of accounts. These main groups ascertain whether a ledger affects profits and Loss Account as a revenue item or it affects the Balance Sheet. It helps in presenting summarised reports and information. Basically, there are Five account groups viz. Capital, Assets, Liabilities, Income, and Expenditure.

1. Reserved or Default Groups:

All accounting packages have predefined account groups. They are called reserved groups. They are:

- Account groups of Trading Account

- Account groups of Profit and Loss Account

- Account groups of Balance Sheet

2. Account groups of Trading Account:

- Sales Account

- Purchases Account

- Direct Expenses Account

- Direct Incomes Account

3. Account groups of Profit and Loss Account:

- Indirect Incomes

- Indirect Expenses

4. Account groups of Balance Sheet:

A. Liability Side

- Capital account

- Reserves and Surplus

- Loans

- Long Term Liabilities

- Current Liabilities

- Sundry creditors

- Bank overdraft

- Outstanding expenses

- Provisions

B. Assets side

- Fixed Assets

- Investments

- Current Assets

- Cash in hand

- Cash at bank

- Sundry Detors

- Stock in hand

- Miscellaneous Expenses

Codification of Accounts

Giving a numerical number or alphabet or both to a particular account for identification is known as codification of accounts.

1. Types of Codes:

a. Sequential codes:

Here numbers or alphabets are.assigned in consecutive order. These codes are applied primarily to source documents such as cheques, invoices, etc.

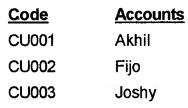

(i) Name of customers:

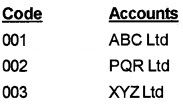

(ii) Name of suppliers:

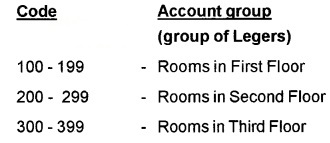

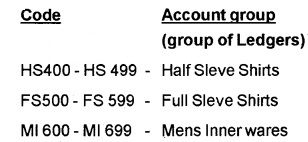

b. Block Codes:

In Block codes, a range of numbers is alloted to a particular account group. Here, numbers within a range follow sequential coding scheme.

Room Numbering System of a Lodge:

Coding of Dresses:

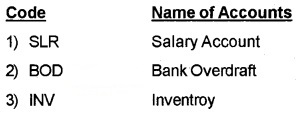

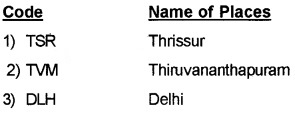

c. Mnemonic codes:

A mnemonic code consists of alphabets or abbreviations as symbols to codify an account.

Methodology to Develop Coding Structure

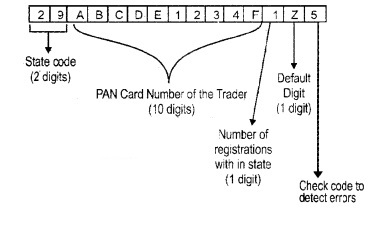

Let us examine the 15 digit Goods and Services Tax Identification Number (GSTIN). GSTIN is a 15 digit unique code which is assigned to each tax payer, which will be statewise and PAN-based.

GSTIN Format or Structure:

From the above details, we can identify that GSTIN is a combination of state code, PAN, number of registration within the state, default digit and check code to detect errors.

Another Example:

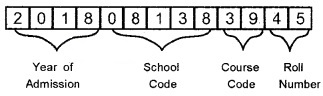

Let us examine how to develp a coding strucutre for students in Thrissur district under DHSE. The first step is to develop hierarchy of the school system and attributes of the students.

| Entry year | 4 digit |

| School code | 5 digit |

| Course code | 2 digit |

| Roll Number | 2 digit |

Thus we allocate 13 digit code to a student.

Security Features of Computerised Accounting Software

Every accounting software ensures data security, safety and confidentiality by providing the features like Password Security, Data Audit and Data Vault.

1. Password Security:

Password is the key to allow the access to the system. Computerised accounting system protects the unauthorised persons from accessing to the business data. Only authorised person, who is supplied with the password, can enter to the system.

2. Data Audit:

It enables one to know as to who and what changes have been made in the original data there by helping and fixing the responsibility of the person who has manipulated the data and ensures data integrity.

3. Data Vault:

Software provides additional security through data encryption. Encryption means scrambling the data so as to make its interpretation impossible.

Advantages of Computerised Accounting System (CAS)

- Financial reports can be prepared in time.

- Alterations and additions in transactions are easy and gives the changed result in all books of accounts instantly.

- It ensures effective control over the system.

- Economy in the processing of accounting data.

- Confidentiality of data is maintained.

- The closing balance of one financial year is automatically carried forward to next financial year.

Limitations of Computerised Accounting System

- Faster Obsolescence of technology necessitates frequently upgradation in accounting software.

- Data may be lost or corrupted due to power interruption.

- Un programmed reports can not be generated.

- Alterations in transactions are easy. This reduces the reliability of accounting work.

- Work with CAS is expensive.

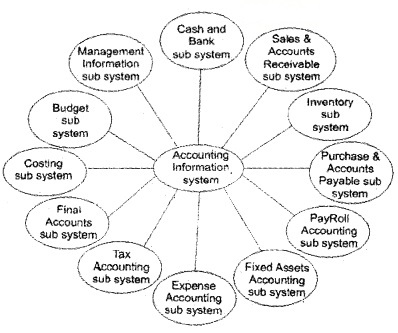

Accounting Information System (AIS)

Accounting Information System (AIS) and its various subsystems may be implemented through Compterised Accounting System (CAS). Such system of AIS are described below.

- Cash and Bank subsystem: Receipts and payments of cash.

- Sales and Accounts Receivable sub system: Maintaining of sales and Receivables ledgers.

- Inventory subsystem: Purchase and sale of goods. Specifying the price, quantity, and date.

- Purchase and Accounts Payable sub system: Maintaing of purchase and payable leadgers.

- Pav Roll Accounting sub system: Payment of salaries and wages.

- Fixed Assets Accounting sub system: Purcahses, additions, sale and usage of fixed assets.

- Expense Accounting sub system: Various types of expenses.

- Tax Accounting sub system: Deals with GSTIN, Income Tax etc.

- Final Accounts sub system: Preparation of final accounts.

- Costing sub system: Ascertainment of cost of goods produced.

- Budget sub system: Preparation of budgets.

- Management information sub system (MIS): Preparation of reports that are vital for management decision making.