Kerala Plus Two Computerised Accounting Chapter Wise Questions and Answers Chapter 5 Accounting Software Package – GNUKhata

Plus Two Accountancy Accounting Software Package – GNUKhata One Mark Questions and Answers

Question 1.

_________ is a free and open-source software for accounting, developed by Digital Freedom Foundation.

Answer:

GNUKhata

Question 2.

The first step in GNUKhata is ________

(a) To create an organisation

(b) To create Ledger account

(c) Voucher entry

(d) None of these

Answer:

(a) To create an organisation

Question 3.

Write the path for starting GNUKhata

Answer:

Applications → Office → GNUKhata

Question 4.

Which among the following is not a level of users in GNUKhata

(a) Managing Director

(b) Admin

(c) Manager

(d) Operator

Answer:

(a) Managing Director

Question 5.

GNUKhata has ………… (a) …………… predetermined groups and ……… (b) ……….. subgroups

Answer:

(a) 13

(b) 16

Question 6.

Amount received by way of cash or cheque is recorded in GNUKhata by using ________ voucher type

Answer:

Receipt Voucher (F4)

Question 7.

Short cut keys for activating Credit Note is _______

(a) Ctrl + 1

(b) Ctrl + 2

(c) Ctrl + 3

(d) Ctrl + 3

Answer:

(d) Ctrl + 3

Question 8.

To clone a voucher means

(a) To delete a voucher

(b) To copy a voucher

(c) To edit a voucher

(d) To print a voucher

Answer:

(b) To copy a voucher

Question 9.

From ________ menu, we will enable to view Ledger,

Trial Balance, Balance sheet, Profit and Loss AC etc.

Answer:

Report menu

Question 10.

Which among the following is NOT a feature of GNUKhata?

(a) Free and open source accounting software

(b) Based on double entry book keeping

(c) Coding of Ledger account

(d) Linking of sales and purchase transactions to invoices

Answer:

(c) Coding of Ledger account

Question 11.

What is FOSS?

(a) Free and Open Security Software

(b) Financial Accounting Open Source Software

(c) Free and Open System Software

(d) Free and Open Source Software

Answer:

(c) Free and Open Source Software

Question 12.

Left side of the GNUKhata welcome screen shows __________

(a) Three buttons and dialog box

(b) Description about double entry principles

(c) Printer settings and network

(d) Description about the advantages and developer of GNUKhata

Answer:

(d) Description about the advantages and developer of GNUKhata

Question 13.

Short Cut keys Shift + Ctrl + R is used for ________

Answer:

Create Organisation

Question 14.

Choose the statement which is NOT True

(a) We can create a new group but a new sub group can not be created

(b) We can not create a new group but a new sub group can be created

(c) We cannot delete a group or a sub group

(d) We cannot create a sub group of a sub group

Answer:

(a) We can create a new group but a new sub group can not be created

Question 15.

______________ is prepared by an account holder to check whether all cheques deposited by him are cleared and all cheques

issued by him are presented on not.

(a) Bank Reconciliation statement

(b) Trading, Profit and Loss Account & Balance Sheet

(c) Cash Book and Pass Book

(d) Trial Balance

Answer:

(a) Bank Reconciliation statement

Question 16.

Sub Group “Sundry Debtors” coming under ________ Group

Answer:

Current Asset

Question 17.

Choose the right statement

(a) Once organisation is created, the financial year can be changed whenever necessary

(b) Once organisation is created, the financial year can not be changed.

Answer:

(b) Once organisation is created, the financial year can not be changed.

Question 18.

Create is mandatory in GNUkhata

(a) Internal Auditor

(b) Operator

(c) Manager

(d) Admin

Answer:

(d) Admin

Question 19.

Which one of the following is free and open source software for Accounting

(a) Tally

(b) PeechTree

(c) GNUKhata

(d) None of these

Answer:

(c) GNUKhata

Question 20.

Which accounting software can be easily transformed into Indian languages?

Answer:

GNUKhata

Question 21.

When we open GNUKhata for the first time, we will see ______

(a) Create Organisation window

(b) Voucher Entry window

(c) Welcome screen

(d) User name and Password window

Answer:

(c) Welcome screen

Question 22.

Which type of organisation can be created in GNUKhata?

(a) Profit Making Organisations

(b) Not for Profit Organisations

(c) (a) and (b)

(d) None of these.

Answer:

(c) (a) and (b)

Question 23.

Only ______ user can log in as ‘Admin’

(а) One

(b) Two

(c) Many

(d) None

Answer:

(a) One

Question 24.

Write path for deleting an organisation.

Answer:

Log in as ‘Admin user’ → Administration menu → Select ‘Delete Organisation’.

Question 25.

The sub Group ‘Plant and Machinery’ is coming under _______________ group.

Answer:

Fixed Assets

Question 26.

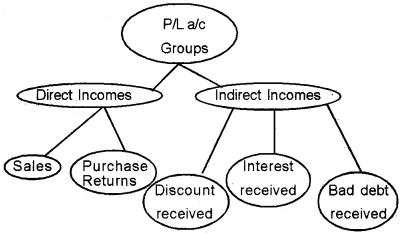

Which among the following is not a Profit and loss A/c Group in GnuKhata.

(a) Direct Income

(b) Direct Expenses

(c) Indirect Income

(d) None of these

Answer:

(d) None of these

Question 27.

There are system generated ledger accounts in GNUkhata

(a) One

(b) Two

(c) Three

(d) Four

Answer:

(d) Four

Question 28.

In GNUKhata, while creating a Ledger account, we have to enter opening balance only if _________

(a) The account belongs to Trading, P/La/c group

(b) The account belongs to a Balance sheet group

(c) It is a cash account

(d) It is a Liability account

Answer:

(b) The account belongs to a Balance sheet group

Question 29.

Contra Voucher is used to record.

(a) Deposits or withdrawals of cash from the bank

(b) Transfer of fund from one bank to another

(c) Transfer of cash to petty cash

(d) All the above

Answer:

(d) All the above

Plus Two Accountancy Accounting Software Package – GNUKhata Two Mark Questions and Answers

Question 1.

Write the Path to display Trial Balance.

Answer:

Report → Trial Balance → Enter Date → Select Trial Balance Type → Click on view button

Question 2.

What is BRS?

Answer:

A Bank Reconciliation Statement (BRS) is a Statement prepared by the depositor for the purpose of reconciling the cash book balance with the passbook balance on a certain date.

Question 3.

There are four levels of users in GNUKhata. Who are they?

Answer:

- Admin

- Manager

- Operator.

- IntemalAuditor.

Question 4.

Match the following

Group Name Sub-Group Name

| Group Name | Sub-Group Name |

| (a) Fixed Assets | (i) Sundry Creditors |

| (b) Current Liability | (ii) Loans and Advances |

| (c) Investments | (iii) Furniture |

| (d) Current Assets | (iv) Fixed Bank Deposits |

Answer:

(a)- (iii); (b) – (i); (c) – (iv); (d) – (ii)

Question 5.

List down the Income and Expenditure account groups in GNUKhata

Answer:

- Direct Income

- Direct Expenses

- Indirect Income

- Indirect Expenses

Question 6.

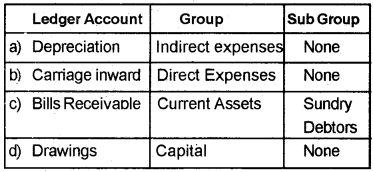

Identify the group and sub group under which the following ledger accounts are to be created.

(a) Depreciation

(b) Carriage inward

(c) Bills Receivable

(d) Drawings

Answer:

Question 7.

List down any two features of GNUKhata.

Answer:

- It is free and open source accounting software.

- It is based on double entry book keeping.

- All financial reports can be prepared.

- Display of dual ledger facility.

- Attachment of source document to vouchers is possible.

- Linking of sales ad purchases tranactions to invoice.

- Export or import of data from spread sheet is possible.

- It ensures password security and data audit facility.

Question 8.

Define Groups and Sub Groups in GNUKhata.

Answer:

Grouping of account is a method of organising the large number of ledger accounts into sequential arrangement. GNUKhata has 29 predefined Groups and Sub Groups. Out of these, 13 are Groups and 16are Sub Groups.

Question 9.

What are the three buttons in Right side of the GNUKhata welcome screen?

Answer:

- Select Existing Organisation

- Create Organisation

- Language

Question 10.

What is the use of the ‘Theme’ tab in the GNUKhata Menu Bar?

Answer:

‘Theme’ tab is used to change the theme Background of the screen.

Plus Two Accountancy Accounting Software Package – GNUKhata Three Mark Questions and Answers

Question 1.

What are the specialties of system generated Ledger Accounts?

Answer:

- GNUKhata has four system-generated ledger account.

- We cannot change the name of these accounts.

- We can not delete these accounts.

Question 2.

What are the limitations of GNUKhata?

Answer:

- Only trained employees can use GNUKhata.

- Updations and additions in GNUKhata Software may seriously affect the accounting system.

Question 3.

Mr. Roby prepared a chart for grouping the ledger account. Some errors are identified by his teacher. Help him to rectify the errors.

| Ledger Account | Group |

| (a) Office expenses | Direct Expenses |

| (b) Carriage Inward | Direct Expenses |

| (c) Salary | Indirect Expenses |

| (d) Sales Tax | Direct Expenses |

| (e) Purchases | Indirect Expenses |

Answer:

| Ledger Account | Group |

| (a) Office expenses | Indirect Expenses |

| (b) Carriage Inward | Direct Expenses |

| (c) Salary | Indirect Expenses |

| (d) Sales Tax | Indirect Expenses |

| (e) Purchases | Direct Expenses |

Question 4.

Three options are available to view Trail Balance. What are they?

Answer:

- Net Trial Balance

- Gross Trial Balance

- Extended Trial Balance

Question 5.

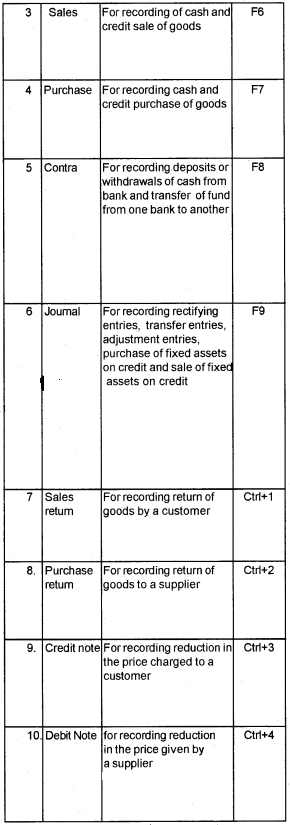

Define the following

(a) Credit note voucher

(b) Journal voucher

(c) Sales voucher

Answer:

| (a) Credit note | For recording a reduction in the price charged to a customer. Function key: Ctrl + 3 |

| (b) Journal | For recording rectifying entries, transfer entries, adjustment entries, purchase of fixed assets on credit and sale of fixed assets on credit. Function key: F9 |

| (c) Sales | For recording the return of goods by a customer Function key: Ctrl + 1 |

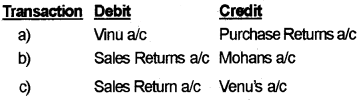

Question 6.

Write the Debit and Credit for the following accounting Transactions

(a) Returned goods to Vinu Rs. 5000

(b) Price of goods sold to Mohan reduced by Rs. 500

(c) Vinu returned goods worth Rs. 3000

Answer:

Question 7.

What is the importance of ‘Admin’ user in GNUKhata?

Answer:

- Only one user can login as Admin

- The creator of organisation is always considered as Admin User

- The ‘Admin’ user can create the other users ‘Admin’ user

Question 8.

List down the major Sub Groups in the Group ‘Fixed Assets”?

Answer:

- Building

- Furniture

- Land

- Plant and Machinery

Question 9.

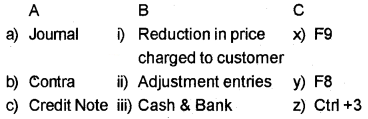

Match the following

Answer:

(a) → ii → x

(b) → iii → y

(c) → i → z

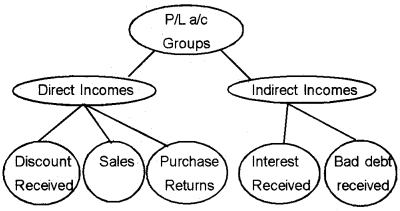

Question 10.

Rearrange the diagram in the right way

Answer:

Plus Two Accountancy Accounting Software Package – GNUKhata Four Mark Questions and Answers

Question 1.

How to record the opening balance amount in opening Stock Account?

Answer:

stage 1:

- Step 1 → Click on Master tab.

- Step 2 → Select Edit account option from the drop down list.

- Step 3 → Select Stock at the beginning from the edit account window.

- Step 4 → Click on Edit Button.

- Step 5 → Enter opening balance amount.

- Step 6 → Click on Save button to save the amount.

Stage 2:

- Step 1 → Click on Transaction tab.

- Step 2 → Select Journal option to activate Journal Voucher.

- Step 3 → Enter voucher number.

- Step 4 → Enter opening date.

- Step 5 → Select Opening stock a/c in Dr. Account and enter opening stock amount.

- Step 6 → Select stock at the beginning a/c in the Cr. account and enter the opening stock amount.

- Step 7 → Give narration.

- Step 8 → Click on Save button or Press Enter key.

Question 2.

What are the reasons behind the difference in pass book balance and cash book balance.

(a) Cheques issued to suppliers, but not cleared

(b) Cheques deposited, but not honoured

(c) Accounts directly deposited by customers in bank account through electronic transfer

(d) Charges levied by the bank

(e) Interest on deposits credited by the bank

Answer:

S

Question 3.

Give a brief explanation about Bank Reconciliation Statement in GNUKhata

Answer:

- Bank Reconciliation Statement is done to identify why there is difference between the two balances (Cash Book balance and pass book balance)

- The date of transaction is the Transaction Date

- The date on which a particular transaction appears in a Pass Book is called the Clearance Date.

- The period for which Bank Reconciliation is done is called Reconciliation Period.

- The reconciliation is done by comparing the Trans-action Date and Clearance Date.

Question 4.

GNUKhata provides the facility to view Single Ledger Account and Dual Ledger Account. Explain.

Answer:

GNUKhata provides the facility to view two ledger accounts simultaneously for comparing entries. We can view side by side:

- Two different Ledger accounts for the same period.

- Two different ledger accounts, each for different period.

- Same ledger accounts for different periods.

Plus Two Accountancy Accounting Software Package – GNUKhata Five Mark Questions and Answers

Question 1.

What do you mean by ‘Year End Activities’?

Answer:

Year End Activities consists of the following Year End Activities

- Closing Ledger Accounts.

- Opening Ledger Accounts for the next year.

(A) Closing of Accounts:

GNUKhata has a module to Close books at the click of a mouse, when this module is activated, balances in all expenses and incomes accounts are transferred to Profit and Loss/ Income & Expenditure account and the accounts are closed. After Close

books is done, transactions cannot be recorded but ledger accounts can be viewed.

(B) Opening Ledger Accounts for the next year:

GNUKhata has a module to Roll over ledger accounts at the click of a mouse. This module opens accounts for the next year automatically and since it is automatic, it is error free. When Roll over is done.

- New organisation with the same name and type is created by GNUKhata for the next accounting year.

- Assets and liabilities accounts automatically open under its respective Groups and Sub Groups with opening balances.

- Expenses and income accounts are opened under their respective Groups and Sub Groups without opening balances

- The closing stock gets transferred to the next year as opening stock.

This module can only be activated after close Books is done.

Question 2.

Write the steps in the preparation of final accounts by using GNUKhata.

Answer:

- Step 1 – Creation of new organisation

- Step 2 – Creation of Admin and Login

- Step 3 – Creation of Sub Groups

- Step 4 – Creation of Ledger Accounts

- Step5 – Voucher Entry

- Step 6 – Editing opening stock and Closing stock account

- Step 7 – Display Ledger Accounts

- Step 8 – Display Trial Balance

- Step 9 – Display P & L Account

- Step 10 – Display Balance Sheet

Question 3.

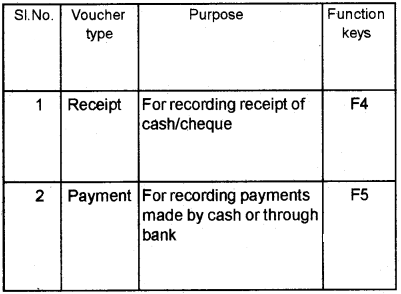

What are the different vouchers in GNUKhata?

Answer:

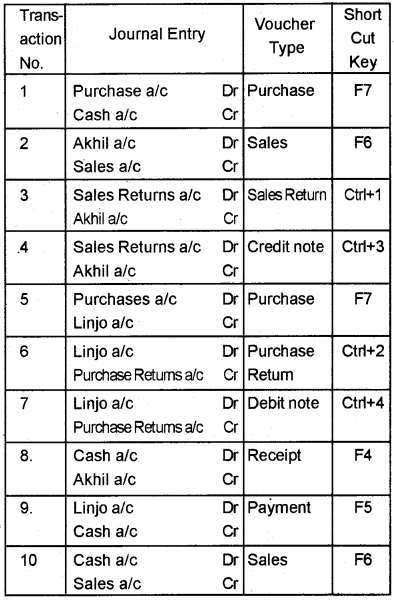

Question 4.

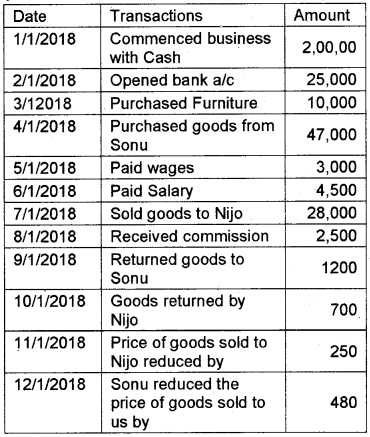

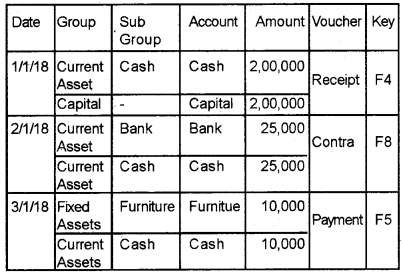

Write the Journal entry, voucher Type and Short cut keys of the following transactions.

- Cash purchases worth Rs. 10,000

- Sold goods to Akhil Rs. 6, 000

- Akhil returned goods worth Rs. 2,000

- Price of goods sold to Akhil reduced by Rs. 500

- Credit Purchases from Linjo Rs, 8,000

- Returned goods to Linjo Rs. 3,000

- Linjo reduced the price of goods sold to us by Rs. 1,000

- Cash received from Akhil Rs.3,000

- Cash paid to Linjo Rs. 4,000

- Cash sales ₹ 800

Answer:

Question 5.

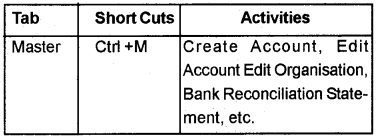

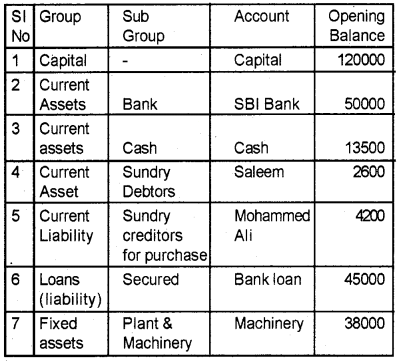

Menu Bar has several Tabs. Can you list down a few of them? Also, mention the short cut keys and activities of such Tabs.

Answer:

Menubar has the following Tabs, The shortcuts for and the activities included in these Tabs are:

Question 6.

Create an organisation with the following particulars.

- Name: JOSHWIN ZIAN Enterprises

- Accounting Year: 01-01-2018 to 31-12-2018

- Type of organisation: Profit Making

- Maintain Inventory: No

- Records Admin Name and Password: Appu, Appose

- Security Question & answer: Best friends name? Chikku

- Address: 1234, M. C. Road, Velappaya, Tcr.

Answer:

- Step1 – Start GNUKhata (Application → Office → GNUKhata)

- Step 2 – Click on “Create Organisation”.

- Step 3 – Enter Organisation Name (JOSHWIN ZIAN Enterprises), Press Enter/Tab

- Step 4 – Select the case, Use down arrow key to select any one of the case and press Enter

- Step 5 – Select organisation type – ‘Profit making’ and press Enter/Tab

- Step 6 – Enter From date – 01-01-2018, Press Enter

- Step 7- Skip the box of Inventory

- Step 8 – Click on Proceed or Press Enter to open Create Admin window

- Step 9 – Enter user Name – Appu, Password – Appose and Press Enter/ Tab

- Step 10 – Enter security Question – “Best friends’s Name’, Press Enter/Tab

- Step 11 – Enter Answer to security Question Chikku, Press Enter to Login as Admin

- Step 12 – Select Edit organisation particulars from Master Menu

- Step13 – Enter Organisation – 1234, MC Road, Velappaya, TCr, and Click on Save

Plus Two Accountancy Accounting Software Package – GNUKhata Practical Work Questions and Answers

Question 1.

Create an organisation with the following particulars

- Name: TALLMEN WELFARE ASSOCIATION

- Accounting year: 1-1-2018 to 31-12-2018

- Type of organisation: Not for profit

- Maintain Inventory Records: No

- Admin Name & password: Visal, TCR2018

- Security Question and Answer Mothers’maiden name? Meenakshy

Procedure:

Step 1 – Start GNUKhata

Applications → Office → GNUKhata

Step 2 – Create New Organisation

Click on ‘Create Organisation’ Tab Enter the following informations.

- Organisation Name: TALLMEN WELFARE ASSOCATION

- Case: As-Is

- Organisation type: Not for Profit

- Financial year: 1-1 -2018 to 31-12-2018

- Inventory: (Leave it blank)

Click on the Proceed button. Now the organisation is created

Step 3 – Create Admin and Login

Press Enter or Alt+Shift+P to Open Create Admin module.

- User Name: Visal

- Password: TCR2018

- Confirm Password: Retype the password

- Security Question: Mothers’ Maiden name

- Answer to the security Question: Meenakshy

Press enter to Login as Admin

Step 4 – Select Edit organisation Particulars from Master Menu. Enter the address of the organisation. Press Enter key to save the details.

Output:

Question 2.

Create an organisation with the following particulars:

- Name: Mahindra Enterprises

- Accounting year: 1-04-2018 to 31-3-2019

- Type of organisation: Profit-making

- Maintain inventory Records: No

- Admin Name & Password: Vinesh, Vinumon

- Security Question & answer: Best friend’s name? Rohit

- Address: 268, Poonkunnam, Thrissur

Procedure:

Step 1 – Start GNUKhata

Applications → Office → GNUKhata

Step 2 – Create New Organisation Click on ‘Create Organisation’ Tab

Enter the following informations.

- Organisation Name: Mahindra Enterprises

- Case: As-Is

- Organisation Type: Profit Making

- Financial year: 1-04-2018 to 31-3-2019

- Inventory : (Leave it blank)

Click on the Proceed button, is created. Now the organisation

Step 3 – Create Admin and Login

Press Enter or Alt+Shift+P to Open Create Admin module.

- User Name: Vinesh

- Password: Vinumon

- Confirm Password: Retype the password

- Security Question: Best friend’s name?

- Answer to the security Question: Rohit

Press enter to log in as Admin

Step 4 – Select Edit organisation Particulars from Master Menu. Enter the address of the organisation

Press Enter key to save the details.

Output:

Question 3.

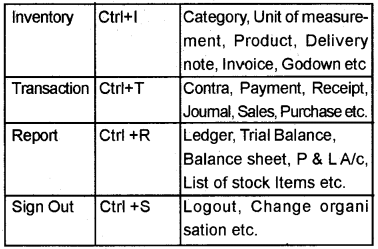

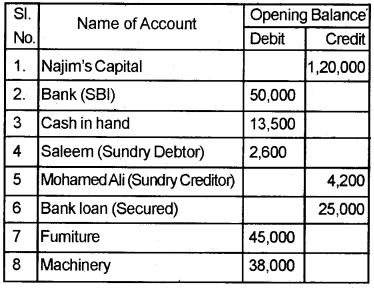

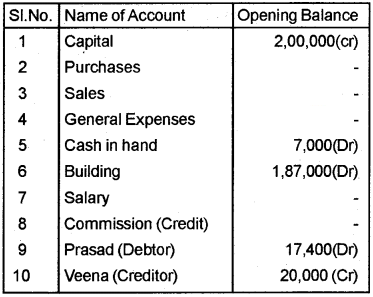

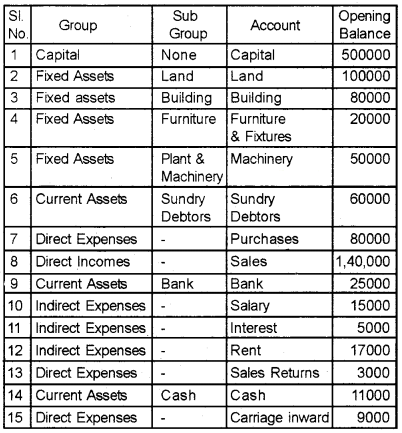

Create the following ledger accounts of Najim Traders

procedure:

Step 1 – Create a New Organisation ‘Najim Traders’- Profit Making with other imaginary data.

Step 2 – Creation of Ledger Accounts

Master menu → Create Account

Analysis Table

Step 3 – Create all the ledger accounts and save the details

Step 4 – Display ledger Accounts Report → Ledger view

OR

Display Trial Balance ReportTrial balance → (Select the type of Trial balance) → view

Output:

Question 4.

Create the following Ledger accounts of Anusree agencies.

procedure:

Step 1 – Create New Organisation ‘Anusree Agencies’ – Profit Making with other imaginary data

Enter the following information.

Step 2 – Creation of Ledger Accounts

Master Menu → Create Account

Question 5.

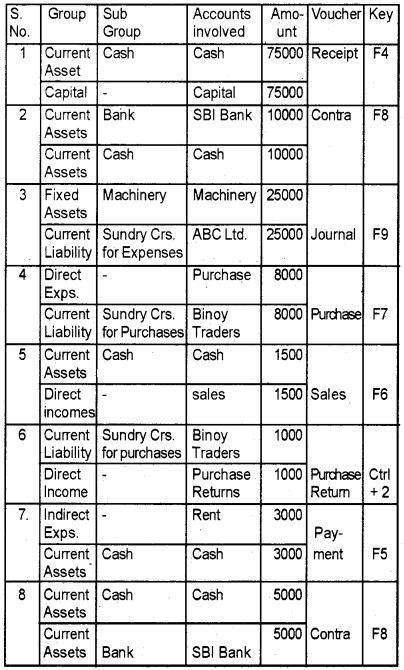

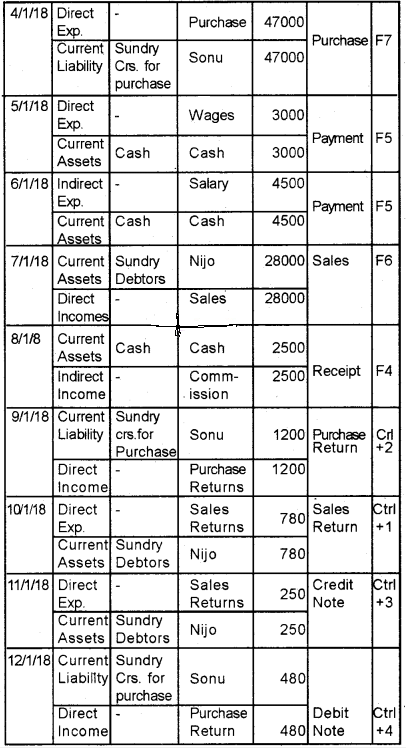

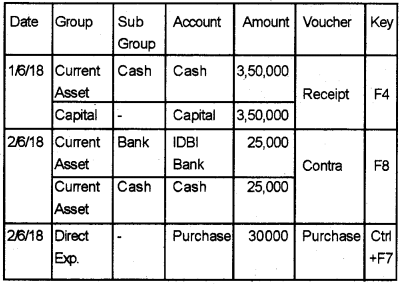

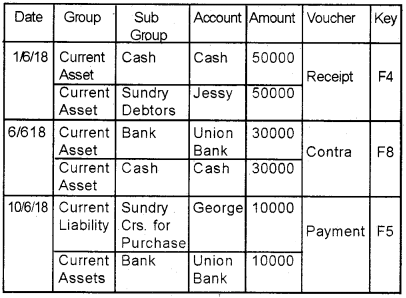

Record the following transactions in appropriate vouchers

- 1/6/2018 – Riyas started a business with cash – Rs. 1,00,000

- 2/6/2018 – Opened a bank account with Canara Bank – Rs. 30,000

- 3/6/2018 – Bought furniture for cash – Rs.10,000

- 4/6/2018 – Purchase goods from Niyastores – Rs,25,000

- 5/6/2018 – Cash sales – Rs.12,500

- 6/6/2018 – Paid for stationery – Rs. 500

- 7/6/2018 – Cash paid to Niya stores – Rs. 20,000

- 8/6/2018 – Cash withdraw from Canara bank – Rs.10,000

Procedure:

Step 1 – Create a New Organisation – Profit Making – with imaginary data

Step 2 – Creation of Ledger Accounts

Master menu → Create Account

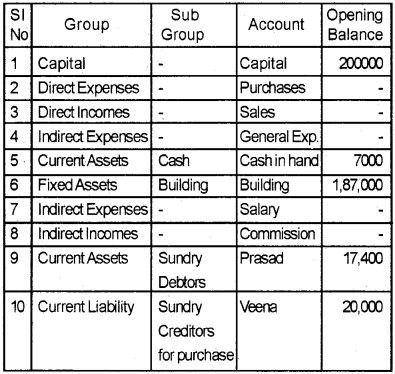

Analysis Table

Step 3 – Create all the ledger accounts and save the details

Step 4 – Enter all the transactions in appropriate vouchers

- Select the appropriate voucher form Voucher menu

- Enter the Voucher Number and date

- Select the Debit account name and enter the amount, then press Enter

- Select the credit account name and enter the amount

- Enter narration and click on Save.

Output:

Question 6.

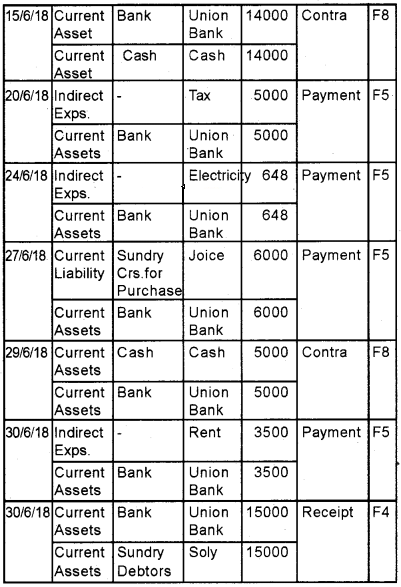

Enter the following transactions of Royal Enterprises and display Trial Balance

Procedure:

Step 1 – Open GNUKhata

Application Office GNUkhata

Step 2 – Create Organisation “Royal Enterprises – Profit making – with Imaginary data.

Step 3 – Create Admin

Enter the details (Imaginary)

Step 4 – Create appropriate Ledger Accounts

Master → Create account → Select Group → Sub Group → Type Account name → Save

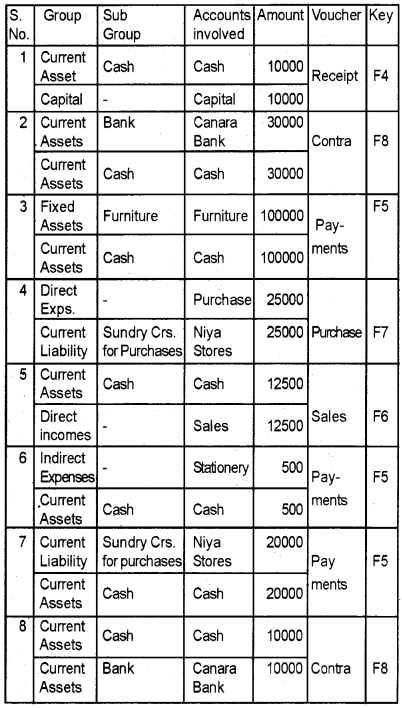

Analysis Table

Step 5 – Enter all transactions in appropriate vouchers

Voucher menu → (appropriate voucher) → Enter voucher number → Date → Select Debit account → enter debit amount → Press Enter → Select Credit Account → Enter credit amount → Press Enters → Enter narration → Click on Save

Step 6 – Display Trial balance Report → Trial Balance

Output:

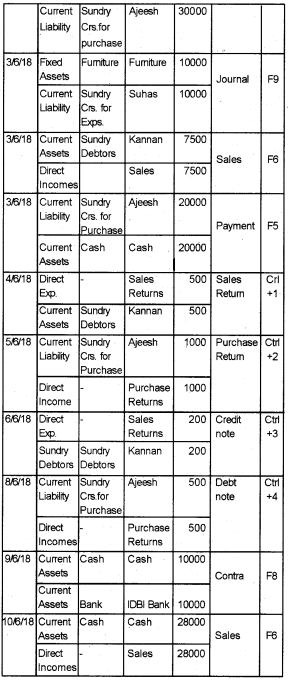

Question 7.

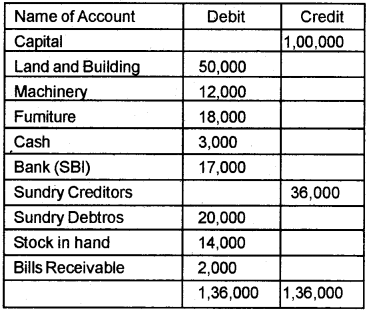

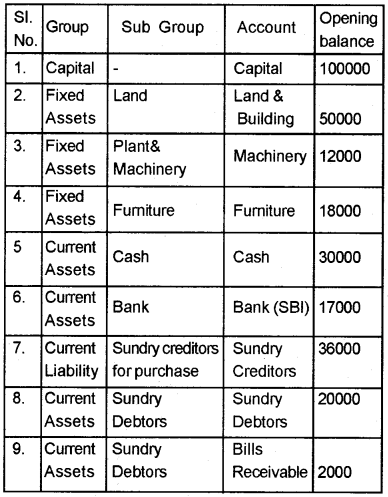

From the following Trial Balance, Prepare Trading Profit and loss account and Balance sheet of Athulya Ltd. as on 31/3/2018

Trial Balance as on 1/4/2017

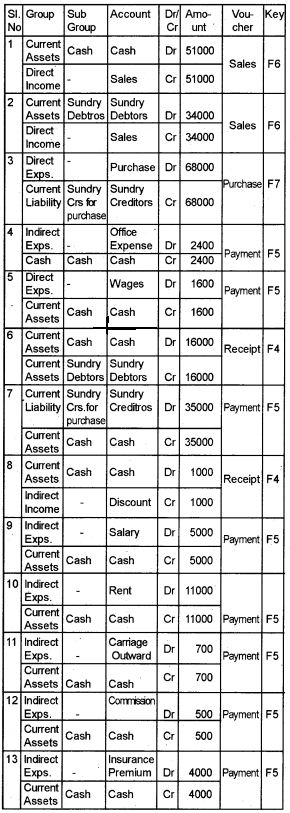

Transaction during the year 2017 – 18 is given below

- Sales (Cash) – Rs. 51000

- Sales (Credit) – Rs. 34000

- Purchases (Credit) – Rs. 68000

- Office expenses – Rs. 2400

- Wages. – Rs. 1.600

- Cash received from Debtors – Rs. 16,000

- Cash paid to creditors – Rs. 35,000

- Discount received – Rs. 1000

- Salary – Rs. 5000

- Rent – Rs. 11,000

- Carriage Outward – Rs. 700

- Commission Paid – Rs. 500

- Insurance Premium – Rs. 4000

Other Adjustments:

- Salalry Prepaid – Rs. 1500

- Rent outstanding – Rs. 1000

- Wages Outstnading – Rs. 800

- Insurance Premium prepaid – Rs. 2000

- Closing stock – Rs. 3700

- Depreciation of Machinery – Rs. 10%

Procedure:

Step 1 – Create an organisation Athulya Ltd- Profit making for the year 1 -4-2017 to 31/3/2018 with imaginary data.

Step 2 – Creation of Ledger Accounts

Master → Create account

Analysis Table (Trail Balance)

Create all the ledger a/c under appropriate group and sub Group.

Step 3 – Voucher Entry

Enter all the transactions using appropriate voucher type

Voucher menu /Transaction menu → Select appropriate voucher type → Enter voucher number → Enter voucher Date → Enter Debit account and amount → Enter Credit account and amount → Save

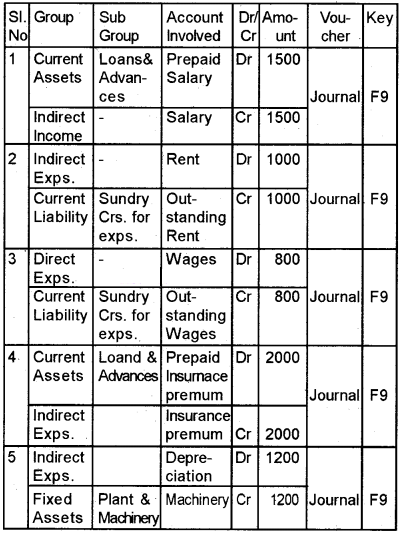

Analysis Table (Transactions)

Analysis Table (Transactions)

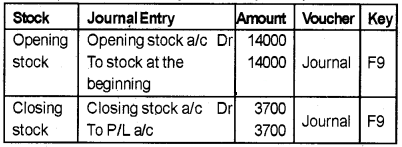

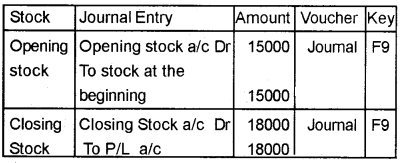

Step 4 – Enter the value of opening stock and closing stock

- Master menu → Edit Account → Select Stock at the beginning a/c → Click Edit Button

- Enter 14000 as Opening Balance. Click on Save button

- Enter the values of Opening Stock and closing stock through appropriate voucher

Voucher menu/Transaction menu → Journal

Analysis Table (Stock)

Step 5 – Display Trial Balance

Report → Trial Balance → Enter Date → Type → Click on the View button

Step 6 – Display Profit and loss Account

Report → Profit and loss → Enter Date → Click on View Button

Step 7 – Display Balance Sheet

Report → Balance sheet → Enter Date → Type → Click on View Button

Output:

Question 8.

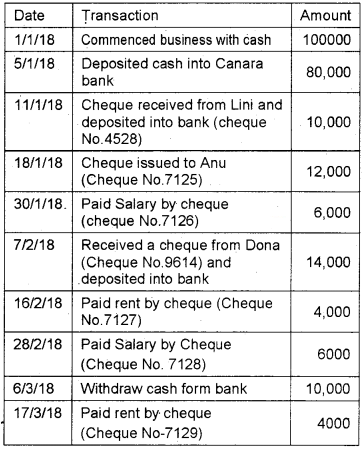

Prepare a Bank Reconciliation Statement of Cili Traders, a Profit making organisation, for the period 1-1-2018 to 31-3-2018

While comparing with Cash book with Pass book, the following details were noted.

- Clearance date of cheque No.7125 was on 7/4/18

- Cheque No. 9614 cleared only on 2/4/2018

- Cheque No. 7127 is cleared on 1/4/18

- Clearance date of cheque No.4528 was on 12/2/18

- Cheque No. 7129 was cleared on 19/3/2018

- All other transaction’s clearance date is same as transaction date

procedure:

Step 1 – Start GNUKhata

Application → Office → GNUKhata

Step 2 – Create Organisation

Create an organisation → Cili Traders → Profit making → 1-1-18 to 31-12-2018 → Create admin with imaginary data.

Step 3 – Create Ledger accounts

Master Menu → Create Account → Select Group → SubGroup → Account Name → Save

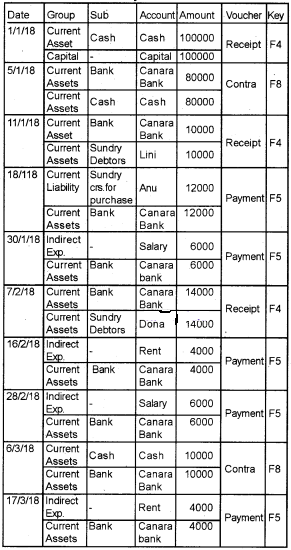

Analysis Table

Step 4 – Voucher Entry

Transaction/Voucher → Select appropriate voucher → Number → Date → DebitCredit → Save

Step 5 – Preparation of Bank Reconciliation Statement Press Alt +R

OR

- Master → Bank rEconciliation statement → Select Bank’s Name (Canara Bank) → Set Reconciliation period → Click on view button to view Bank reconciliation screen

- Enter clearance date → Click on View statement button

- To show the cleared Transactions, click on cleared items

- To show the uncleared transactions, click on uncleared items

Output:

Question 9.

Enter the following transactions of Sibi Traders and Display Final Accounts as on 31/3/2018

procedure:

Step 1 – Open GNUKhata

Application Office → GNUKhata

Step 2 – Create Organisation

Click on Create organisation → Enter Details → Sibi Traders → Proft Making → 1-1-2018 to 31-12-2018

Step 3 – Create Admin

Enter imaginary data

Step 4 – Creation of Ledger accounts

Master Menu → Create account → Select Group → SubGroup → Type Account name → Save

Analysis Table

Step 5 – Voucher Entry (based on above Analysis Table)

Transaction menu/Voucher menu → Select appropriate voucher → Enter voucher No → Date → Debit account and amount → Credit account and amount → Narration → Save

Step 6 – Display Trial balance

Report → Trial balance

Display Profits and loss Account

Report → Profits Loss account

Step 8 – Display Balance Sheet

Report → Balance sheet

Output:

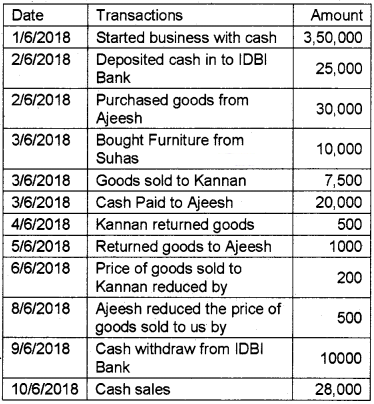

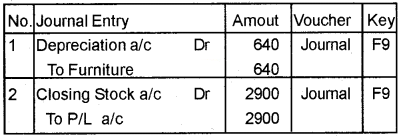

Question 10.

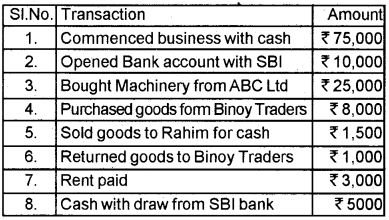

From the following transactions of Fijo and Joshy associates, prepare Trial Balance, Trading Profit, and Loss account and Balance Sheet.

Adjustments

- Depreciation of Furniture Rs. 640

- Closing stock valued at Rs.2900

Procedure:

Step 1 – Create Organisation

Click on create Organisation Tab Enter the details

Fijo and Joshy Associates – Profit Making- 1/1/2018-31/12/2018. Enter all other details with imaginary data.

Step 2 – Create Ledger Account

Master → Create Account

Analysis Table

Create all the above ledger accounts under appropriate Groups and Subgroups.

Step 3 – Voucher Entry

Enter the adjustment entries in appropriate voucher type

Voucher menu/Transaction menu → Select Voucher type → Number → Date → Debit & Credit → Save

Analysis Table (Adjustments)

Step 4 – Display Trial Balance

Report → Trial Balance

Step 5 – Display Profit & Loss Account

Reports → Profit & Loss Account

Step 6 – Display Balance Sheet

Report → Balance Sheet

Output:

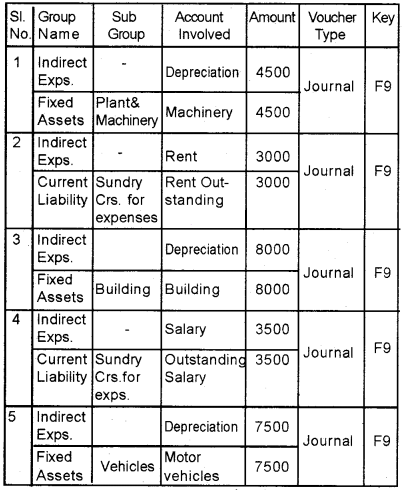

Question 11.

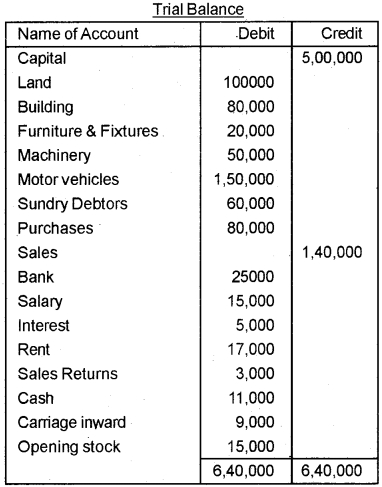

Given below the Trial Balance of Akhil &Athulya associates as a 31/3/2018. Prepare Final Account for the year 2018-19

Other Information:

- Depreciation of Machinery-4500

- Rent outstanding-3000

- Building depreciated at 1.0%

- Salary Outstanding – 3500

- Value of closing stock -18000

- Value of Motor vehicle depreciated by 5%

Procedure:

Step 1 – Open GNUKhata

Applications → Office → GNUKhata

Step 2 – Create Organisation

Click on Create Organisation tab. Enter the details

Akhil and Athulya Associates – Profit making 1-4-2018 to 31-3-2019.

Step 3 – Create Admin & Login Use imaginary data.

Step 4 – Creation of new subgroup

Here we need to create a new Sub Group Vehicles under the Group Fixed Assets. Master → Create Account → Select Group Fixed Assets → Select New Sub Group in Sub Group Name → Enter the new Sub Group Name ‘Vehicles’ → Enter the Account Name Motor Vehicles in that Sub Groups Enter the Opening Balance Rs. 1,50, 000 → Save.

Step 5 – Create Ledger Account

Master → Create Account

Analysis Table (Trial Balance)

Create all the ledger accounts under ap¬propriate Groups and Sub Groups

Step 6 – Voucher Entry

Enter all adjustments in appropriate voucher type

Voucher menu/Transaction Menu → Select Voucher → Type → Number → Date Debit account and amount → Credit account and amount → Save.

Analysis Table (Adjustments)

Step 7 – Enter the value of opening stock and closing stock

- Master Menu → Edit Account → Select stock at the beginning a/c → Click Edit button

- Enter 15000 as opening balances click on. Save button

- Enter the values of opening stock and closing stock through appropriate voucher

Voucher Menu/Transaction menu → Journal

Analysis Table (Stock)

Step 8 – Display Trial Balance

Report → Trial Balance

Step 9 – Display profit and loss Account

Report → Profit & Loss

Step 10 – Display Balance Sheet

Report → Balance Sheet

Output:

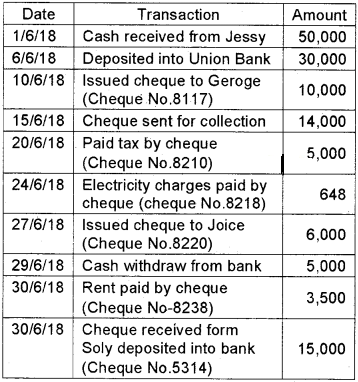

Question 12.

Enter the following transactions in appropriate vouchers of Jos & Rejina Enterprises and prepare Bank Reconciliation Statement

Step 1 – Open GNUKhata

Verification of the Cash Book with Bank Pass Book revealed that the Cheque Nos. 8117, 8238 & 5314 were cahsed only on 3rd, 5th and 8th July respectively and the clearance date of all other transactions are same as transaction date.

Procedure:

Step 1 – Open GNUKhata

Application → Office → GNUKhata

Step 2 – Create Organisation

Click on Create Organisation → Enter Name → Jos & Rejina Enterprises – Profit Making → (other imaginary data)

Step 3 – Create Admin – Enter the details (imaginary Data)

Step 4 – Create Ledger Account

Master → Create account → Select Group → Sub Group → Type Account name → Save

Analysis Table

Step 5 – VoucherEntry

Transaction / Voucher → Select Appropriate → Enter details.

Step 6 – Preparation of Bank reconciliation statement Press Alt + R

OR

- Master → Bank Reconciliation statement → Select Bank’s Name (Union Bank) → Set Reconciliation period → Click on the View button to view Bank Reconciliation screen

- Enter clearance data Click on View Statement button

- To show the cleared Reconciliation click on cleared items

- To know the uncleared Transactions, Click on Uncleared items.