Kerala Plus Two Computerised Accounting Chapter Wise Questions and Answers Chapter 1 Overview of Computerised Accounting System

Plus Two Accountancy Overview of Computerised Accounting System One Mark Questions and Answers

Question 1.

Accounting Packages are developed on the basis of

(a) Accounting concepts

(b) Accounting conventions

(c) Both Accounting concepts and Conventions

(d) None of the above

Answer:

(c) Both Accounting concepts and Conventions

Question 2.

What type of Software is an Accounting Package?

(a) System Software

(b) Application Software

(c) Utility Software

(d) Basic

Answer:

(b) Application Software

Question 3.

The components of computerised accounting system are

(a) Data, Report, Ledger, software, Hardware

(b) Software, Hardware, People, Procedure, Data

(c) Data, Coding, Procedure, Objective, Output

(d) People, Procedure, Hard ware, software

Answer:

(b) Software, Hardware, People, Procedure, Data

Question 4.

Grouping of Accounts means the classification of data from:

(a) Assets, Capital, and Liabilities

(b) Assets, Capital, Liabilities, Revenues & Expenses

(c) Assets, Owners equity, Revenue & Expenses

(d) Capital, Liabilities, Revenues, & Expenses

Answer:

(b) Assets, Capital, Liabilities, Revenues & Expenses

Question 5.

Codification of Accounts required for the purpose of:

(a) Hierarchical relationship between groups and components

(b) Data processing faster and preparing of final accounts

(c) Keeping data and information secured

(d) None of the above

Answer:

(a) Hierarchical relationship between groups and components

Question 6.

Method of codification should be

(a) Such that it leads to grouping of accounts

(b) An identification mark

(c) Easy to understand and leads to grouping of accounts

(d) None of the above

Answer:

(c) Easy to understand and leads to grouping of accounts

Question 7.

Final account subsystem in Accounting Information System (AIS) deals with

(a) Preparation of budgets

(b) Preparation of Pay Roll

(c) Preparation of Final Accounts

(d) None of the above

Answer:

(c) Preparation of Final Accounts

Question 8.

Pick the odd one out

(a) Password security

(b) Data Audit

(c) Data Bank

(d) Data vault

Answer:

(c) Data Bank

Question 9.

Which among the following is an example of mnemonic codes.

(a) AS03, AS04, AS05

(b) 1925, 1926, 1927, 1928

(c) ACC, ECO, ENG, MAL

(d) 001-100, 101-200, 201-300, 301-400

Answer:

(c) ACC, ECO, ENG, MAL

Question 10.

Which among the following deals with generation of reports that are vital for management decision making?

(a) Costing sub system

(b) Pay Roll Accounting Sub system

(c) Budget Sub System

(d) Management Information System

Answer:

(d) Management Information System

Question 11.

The need of codification is

(a) Easy to process data

(b) Keeping proper records

(c) The generation of block codes

(d) The encryption of data

Answer:

(d) The encryption of data

Question 12.

Choose the correct pair

(a) Cash and Bank sub system – Deals with receipts and payments of cash

(b) Inventory subsystem – deals with recording of sales

(c) Payroll Accounting sub system – deals with the preparation of final accounts

(d) Accounts receivable sub system – deals with expenses.

Answer:

(a) Cash and Bank sub system – Deals with receipts and payments of cash

Plus Two Accountancy Overview of Computerised Accounting System Two Mark Questions and Answers

Question 1.

Name the Five pillers of computerised Accounting System.

Answer:

Procedure, Data, people, Hardware and software

Question 2.

What is computerised accounting?

Answer:

Computerised accounting is the process of recording business transactions and generating financial statements and reports with the help of computer.

Question 3.

List down any Five popular accounting softwares available in India.

Answer:

GNUKhata, Tally, Dac Easy, Tata Ex, Peach Tree

Question 4.

Define Data

Answer:

Data is raw, unorganised facts that need to be processed. Data can be something simple and useless until it is organised.

When data is processed, organised, structured or presented in a given context so as to make it useful, it is called information. A computer is an information processing machine. Computers process data to produce information

Question 5.

Write down any two features of computerised accounting system

Answer:

Features of computerised accounting system:

1. Simple and Integrated:

Computerised accounting system is designed to integrate all the business operations such as sales, finance, purchase, etc.

2. Accuracy and speed:

Computrised Accounting system provides data entry forms for fast and accurate data entry of the transactions.

3. Scalability:

The system can cope easily with the increase in the volume of business transactions. The software can be used for any size and type of the organization.

Question 6.

What are the account groups of Trading Account under Computerised Accounting System?

Answer:

- Sales account

- Purchase account

- Direct Expenses Account

- Direct Incomes Account

Question 7.

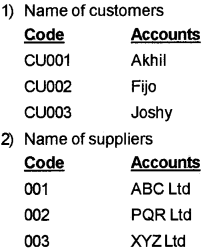

Complete the Table

Name of Account – Account group in financial Account

Sundry Debtors – Balance sheet, Asset side

- Indirect Income __________________________

- Current Liabilities ________________________

- Stock in hand ____________________________

- Sales Account ___________________________

Answer:

- Profit & Loss Account, Credit side

- Balances Sheet, Liability side

- Balance Sheet, Asset side

- Trading Account, Credit side

Question 8.

What do you mean by sequential code? Give example.

Answer:

Sequential codes:

Here numbers or alphabets are assigned in consecutive order. These codes are applied primarily to source documents such as cheques, invoices, etc.

Example:

Question 9.

What are the basic accounting reports prepared by Computerised Accounting System?

Answer:

- Day Book/ Journals

- Ledges

- Trial balance

- Profit and Loss Account

- Balance Sheet

Plus Two Accountancy Overview of Computerised Accounting System Three Mark Questions and Answers

Question 1.

A computerised accounting software is developed for a company. In Ledger Group, Expenses are divided in to direct expenses and indirect expenses. All the possible expenses of the company are listed under these two sub headings. Appropriate identification numbers are assigned to each such items.

- Identify the concepts referred to this context

- Give explanations to each.

Answer:

- Grouping of Accounts and codification of Accounts

- Grouping of accounts means classifying the ledger accounts and organizing them under major heads of accounts

The process of assigning codes to account groups and ledger groups is called codification of accounts.

Question 2.

What are the advantages of computerised Accounting System?

Answer:

- Financial reports can be prepared in time

- Alterations and additions in transactions are easy and gives the changed result in all books of accounts instantly

- It ensures effective control over the system

- Economy in the processing of accounting data

- Confidentiality of data is maintained

- The closing balance of one financial year is automatically carried forward to next financial year

Question 3.

Create an accounting hierarchy for the following ledger account:

- Cash-in-hand

- Provisions for Tax

- Land and Buildings

- Bank Account (Current)

- Trade Investments

- Investments in Govt. Securities

- Deposits with Bank

- Duties and Taxes

- Sundry Debtors

Answer:

- Fixed assets: Land & Building Investment in Govt. Securities

- Current assets: Cash in hand Trade Investments

- Bank: Bank a/c (Current), Deposits with bank

- Sundry debtors: Sundry debtors

- Loans & advances: Provision for Tax

- Duties and Taxes: Duties of Taxes

Question 4.

What are the different types of codes commonly used in CAS?

Answer:

Sequential codes:

Here numbers or alphabets are assigned in consecutive order. These codes are applied primarily to source documents such as cheques, invoices, etc.

Example:

2. Block Codes:

In Block codes, a range of numbers is alloted to a particular account group. Here, numbers within a range follow sequential coding scheme.

Room Numbering System of a Lodge

| Code | Account group (group of Legers) |

| 100 – 199 | Rooms in First Floor |

| 200 – 299 | Rooms in Second Floor |

| 300 – 399 | Rooms in third Floor |

Coding of Dresses

| Code | Account group (group of Legers) |

| HS400 – HS 499 | Half Sleeve Shirts |

| FS500 – FS 599 | Full Sleeve Shirts |

| MI 600 – MI 699 | Mens Inner Wares |

3. Mnemonic codes:

A mnemonic code consists of alphabets or abbreviations as symbols to codify an account.

1.

| Code | Name of Accounts |

| 1) SLR | Salary Account |

| 2) BOD | Bank Overdraft |

| 3) INV | Inventory |

2.

| Code | Name of Places |

| 1) TSR | Thrissur |

| 2) TVM | Thiruvananthapuram |

| 3) DLH | Delhi |

Question 5.

Distinguish between Data Audit and Data Vault

Answer:

Security Features of Computerised Accounting Software

1. Data Audit:

It enables one to know as to who and what changes have been made in the original data there by helping and fixing the responsibility of the person who has manipulated the data and ensures data integrity.

2. Data Vault:

Software provides additional security through data encryption. Encryption means scrambling the data so as to make its interpretation impossible.

Question 6.

What is the activity sequence of computerised Accounting information processing model?

Answer:

- Collect data

- Organise data

- Communicate Accounting Information

Question 7.

Akhil, your class mate, argues that computerised Accounting System suffers some draw

- Do you agree with this?

- Give your justification

Answer:

- I agree

- Limitations of CAS.

- Faster Obsolescence of technology necessitates frequently upgradation in accounting software.

- Data may be lost or corrupted due to power interruption.

- Un programmed reports can not be generated

- Alterations in transactions are easy. This reduces the reliability of accounting work.

- Work with CAS is expensive.

Question 8.

What are the different components of computerised Accounting System?

Answer:

Components of computerised Accounting System:

- Procedure: A logical sequence of actions to perform a task.

- Data: The raw fact for any business operation.

- People: Users of computerised accounting system

- Hardware: The physical components of a computer.

- Software: A set of programmes to do a work.

Plus Two Accountancy Overview of Computerised Accounting System Four Mark Questions and Answers

Question 1.

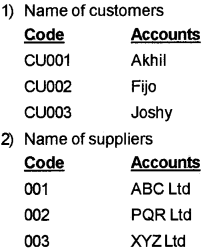

In the computerised accounting package used by a trading concern, the fixed assets and current assets are combined to form the assets group. The fixed assets are sub divided into tangible and intangible assets.

Show the hierarchy of this ledger group, assuming various assets items.

Answer:

Question 2.

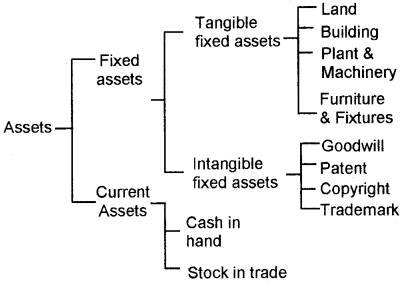

Illustrate with example methodology to develop coding structure.

Answer:

Methodology to Develop Coding Structure:

Let us examine the 15 digit Goods and Services Tax Identification Number (GSTIN). GSTIN is a 15 digit unique code that is assigned to each taxpayer, which will be state-wise and PAN-based.

GSTIN Format or Structure (GSTIN):

From the above details, we can identify that GSTIN is a combination of state code, PAN, number of registration within the state, default digit and check code to detect errors.

Another Example:

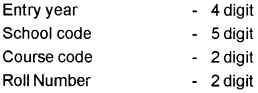

Let us examine how to develop a coding structure for students in Thrissur district under DHSE. The first step is to develop a hierarchy of the school system and attributes

Thus we allocate 13 digit code to a student.

Question 3.

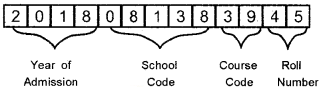

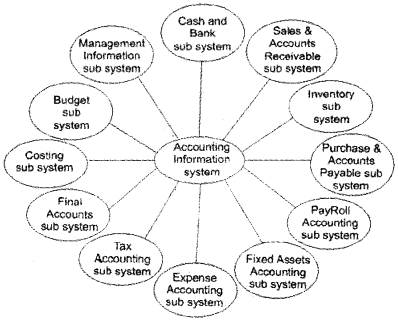

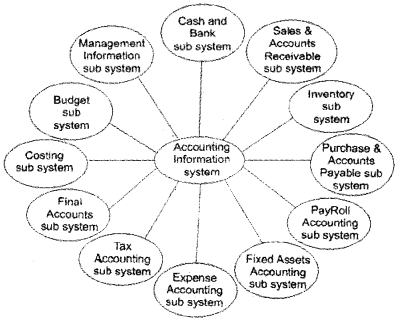

What do you mean by AIS? What are the different subsystems of AIS?

Answer:

Accounting Information System (AIS):

Accounting Information System (AIS) and its various subsystems may be implemented through the Computerised Accounting System (CAS). Such system of AIS are described below.

1. Cash and Bank subsystem:

Receipts and payments of cash

2. Sales and Accounts Receivable sub system:

Maintaining of sales and Receivables ledgers.

3. Inventory sub system:

Purchase and sale of goods, Specifying the price, quantity, and date.

4. Purchase and Accounts Payable Sub system:

Maintaining of purchase and payable leadgers.

5. Pav Roll Accounting sub System:

Payment of salaries and wages.

6. Fixed Assets Accounting Sub system:

Purcahses, additions, sale and usage of fixed assets.

7. Expense Accounting sub system:

Various types of expenses.

8. Tax Accounting Sub system:

Deals with GSTIN, Income Tax etc.

9. Final Accounts sub system:

Preparation of final accounts.

10. Costing sub system:

Ascertainment of cost of goods produced.

11. Budget sub system:

Preparation of budgets.

12. Management information sub system (MIS):

Preparation of reports that are vital for management decision making.

Question 4.

What is DATA Encryption? What are the security features of CAS?

Answer:

Security Features of Computerised Accounting Software:

Every accounting software ensures data security, safety, and confidentiality by providing the features like Password Security, Data Audit and Data Vault.

1. Password Security:

Password is the key to allow the access to the system. Computerised accounting system protects the unauthorised persons from accessing to the business data. Only authorised person, who is supplied with the password, can enter to the system.

2. Data Audit:

It enables one to know as to who and what changes have been made in the original data there by helping and fixing the responsibility of the person who has manipulated the data and ensures data integrity.

3. Data Vault:

Software provides additional security through data encryption. Encryption means scrambling the data so as to make its interpretation impossible.

Question 5.

Draw a chart showing different sub systems of Accounting information system.

Answer:

Accounting Information System (AIS):

Accounting Information System (AIS) and its various sub-systems may be implemented through Compterised Accounting System (CAS). Such system of AIS are described below.

1. Cash and Bank subsystem:

Receipts and payments of cash

2. Sales and Accounts Receivable sub system:

Maintaining of sales and Receivables ledgers.

3. Inventory sub system:

Purchase and sale of goods, Specifying the price, quantity, and date.

4. Purchase and Accounts Payable Sub system:

Maintaing of purchase and payable leadgers.

5. Pav Roll Accounting sub System:

Payment of salaries and wages.

6. Fixed Assets Accounting Sub system:

Purcahses, additions, sale and usage of fixed assets.

7. Expense Accounting sub system:

Various types of expenses.

8. Tax Accounting Sub system:

Deals with GSTIN, Income Tax, etc.

9. Final Accounts sub system:

Preparation of final accounts.

10. Costing sub system:

Ascertainment of cost of goods produced.

11. Budget sub system:

Preparation of budgets.

12. Management information sub system (MIS):

Preparation of reports that are vital for management decision making.

Question 6.

Differentiate between Data and Information.

Answer:

| Data | Information |

| 1. It is used as input | 1. It is the output of processed data |

| 2. Data is the raw material | 2. Information is the product |

| 3. It doesn’t carry a meaning | 3. It must carry a logical meaning |

| 4. It is an independent value | 4. Information depends on data |