Kerala Plus Two Business Studies Notes Chapter 9 Financial Management

Business Finance

Money required for carrying out business activities is called business finance. Finance is needed to establish a business, to run it, to modernize it, to expand or diversify it.

Financial Management

Financial Management is concerned with optimal procurement as well as usage of finance. For optimal procurement, different available sources of finance are identified and compared in terms of their costs and associated risks. Financial Management aims at reducing the cost of funds procured and ensuring availability of enough funds whenever required.

Objectives of Financial Management

The primary aim of financial management is to maximise shareholder’s wealth. It means maximisation of the market value of equity shares. It is the responsibility of the company to pay reasonable dividend and also to maximize the value of its shares.

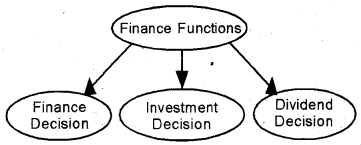

Finance Functions

The finance function is concerned with three broad decisions which are:

1. Finance Decision: It relates to the amount of finance to be raised from various long term sources. The main sources of funds for a firm are shareholders’ funds (equity capital and the retained earnings) and borrowed funds (debentures or other forms of debt). A firm needs to have a judicious mix of both debt and equity in making financing decisions.

2. Investment Decision: The investment decision relates to how the firm’s funds are invested in different assets. Investment decision can be long-term or short-term. A long-term investment decision is also called a Capital budgeting decision.

Short-term investment decisions (also called working capital decisions) are concerned with the decisions about the levels of cash, inventory and receivables.

3. Dividend Decision: Dividend is that portion of profit which is distributed to shareholders. The decision involved here is how much of the profit earned by company (after paying tax) is to be distributed to the shareholders and how much of it should be retained in the business.

Financial Planning

The process of estimating the fund requirement of a business and specifying the sources of funds is called financial planning. It ensures that enough funds are available at right time.

The twin objectives of financial planning are

- To ensure availability of fund at the right time and its possible sources.

- To see that firm does not raise fund unnecessarily.

Importance of Financial Planning

- It ensures adequate funds from various sources.

- It reduces the uncertainty about the availability of funds.

- It integrates the financial policies and procedures.

- It helps the management to eliminate waste of funds and reduce cost.

- It helps to achieve a balance between the inflow and outflow of funds and ensure liquidity.

- It serves as the basis of financial control

- It helps to reduce cost of financing to the minimum.

- It helps to ensure stability and profitability of business.

- It makes the firm better prepared to face the future.

Factors Affecting Capital Budgeting Decisions

- Cash flows of the project: Cash flows are in the form of a series of cash receipts and payments over the life of an investment. The amount of these cash flows should be carefully analysed before considering a capital budgeting decision.

- The rate of return: The expected returns and risk from each proposal should be taken into account to select the best proposal.

- Investment criteria involved: The various investment proposals are evaluated on the basis of capital budgeting techniques.

Factors Affecting Financing Decision

- Cost: The cost of raising funds from different sources is different. The cheapest source should be selected.

- Risk: The risk associated with each of the sources is different.

- Floatation costs: Higher the floatation cost, less attractive the source.

- Cash flow position of the business: In case the cash flow position of a company is good enough, then it can easily use borrowed funds.

- Fixed operating costs: If a business has high fixed operating costs, lower debt financing is better.

- Control considerations: Issues of more equity may lead to dilution of management’s control over the business.

Factors Affecting Dividend Decision

- Stability Earnings: A company having stable earnings can declare higher dividends. Otherwise, pay lower dividend.

- Stability of Dividends: Companies generally follow a policy of stabilising dividend per share. Dividend per share is not altered if the change in earnings is small.

- Growth Opportunities: Companies having good growth opportunities retain more money out of their earnings to finance the required investment. In such a case, they can declare dividend at a lower rate.

- Cash Flow Positions: Availability of enough cash in the company is necessary for declaration of dividend.

- Shareholders’ Preference: While declaring dividends, managements must keep in mind the preferences of the shareholders in this regard.

- Taxation Policy: A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends whereas if tax rates are lower, then more dividends can be declared by the company.

- Capital Market: Reputed companies have easy access to the capital market and, therefore, they can pay higher dividends than the smaller companies.

- Legal Constraints: The companies Act has laid down certain restrictions regarding payment of dividend. No dividend can be paid out of capital.

Capital Structure

Capital structure refers to the mix between owners funds and borrowed funds. Owners fund consists of equity share capital, preference share capital and reserves and surpluses or retained earnings. Borrowed funds can be in the form of loans, debentures, public deposits, etc.

A capital structure will be said to be optimal when the proportion of debt and equity is such that it results in an increase in the value of the equity share.

Factors Affecting Capital Structure

- Trading on Equity (Financial Leverage): It refers to the use of fixed income securities such as debentures and preference capital in the capital structure so as to increase the return of equity shareholders.

- Stability of Earnings: If the company is earning regular and reasonable income, the management can rely on preference shares or debentures. Otherwise issue of equity shares is recommended.

- Cost of Debt: A firm’s ability to borrow at lower rate, increases its capacity to employ higher debt.

- Interest Coverage Ratio (ICR): The interest coverage ratio refers to the number of times earnings before interest and taxes of a company covers the interest obligation. Higher the ratio, better is the position of the firm to raise debt.

- Desire for control: If the management has a desire to control the business, it will prefer preference shares and debentures in capital structure because they have no voting rights.

- Flexibility: Capital structure should be capable of being adjusted according to the needs of changing conditions.

- Capital Market Conditions: In depression, debentures are considered good. In a booming situation, issue of shares will be more preferable.

- Period of Finance: If funds are required for short period, borrowing from bank should be preferred. If funds are required for longer period company can issue shares and debentures.

- Taxation Policy: interest on loan and debentures is deductible item under the Income Tax Act whereas dividend is not deductible. In order to take advantage of this provision, companies may issue debentures.

- Legal Requirements: The structure of capital of a company is also influenced by the statutory requirements. For example, Banking Regulation Act, Indian CompaniesAct, SEBI, etc.

Fixed Capital

Fixed capital refers to the capital needed for the the acquisition of fixed assets to be used for a longer period.

Factors affecting Fixed Capital

- Nature of Business: A trading concern needs lower investment in fixed assets compared with a manufacturing organization.

- Scale of Operations: An organisation operating on large scale require more fixed capital as compared to an organisation operating on small scale.

- Choice of Technique: A capital-intensive organisation requires more amount of fixed capital than labour intensive organisations.

- Technology Upgradation: Organisations using assets which become obsolete faster require more fixed capital as compared to other organisations.

- Growth Prospects: Higher growth of an organisation generally requires higher investment in fixed assets.

- Diversification: The firms dealing in number of products (Diversification) requires more investment in fixed capital.

- Use of Fixed Assets: Companies acquiring fixed assets on hire purchase or lease system require lesser amount as against cash purchases.

Working Capital

Working capital is that portion of capital required for investing in current assets for meeting day to day working of an organization. Current assets can be converted into cash within a period of one year. They provide liquidity to the business.

Working capital is of two types:

- Gross working capital = Total of current asset

- Net working capital = Current assets – Current Liabilities

Factors Affecting Working Capital

- Nature of Business: A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

- Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

- Business Cycle: In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

- Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

- Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

- Credit Policy: A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

- Operating Efficiency: If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

- Availability of Raw Materials: If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.