Kerala Plus Two Business Studies Chapter Wise Previous Questions Chapter 9 Financial Management

Plus Two Business Studies Financial Management 1 Mark Important Questions

Question 1.

Which among the following is the cheapest source of finance? (FEBRUARY – 2009)

a) Equity share capital

b) Debentures

c) Long term loans

d) Retained earnings

Answer:

d) Retained earnings

Question 2.

The main source of finance of K.K. Ltd. is Equity Capital of Rs. 8,00,000. The company also uses Fixed Inter est Bearing sources of debentures of Rs. 3,00,000 and long term loans Rs. 2,00,000 with an intention to enhance the return to equity shareholders.

a) Identify the concept of Financial Management used in this context. (MAY-2009)

Answer:

Trading on equity

Question 3.

Which among the following is not a factor affecting dividend decision? (MARCH-2010)

Nature of industry

b) Taxation policy

c) Competition

d) Legal restrictions

Answer:

Competition

Question 4.

The prime responsibility of a Finance Manager is to determine in advance the amount of capital and its sources. Give a suitable name to this process. (MAY-2011)

Answer:

Financial planning

Question 5.

Choose the correct pair from the following (MAY-2011)

a) Capital – Capitalisation structure

b) Fixed capital – Short term needs of the firm

c) Working capital – Net current assets

d) Investment decision-Distribution of profit Working

Answer:

capital – Net current assets

Question 6.

EPS stands for (MARCH-2013)

a) Equity per share

b) Earning per share

c) Equity pro share

d) Earning pro share

Answer:

Earnings per share

Question 7.

A major decision of the financial management is whether to distribute profits to shareholders or to retain the profits and reinvest into the business. Name the decision with regard to this. (MAY-2013)

Answer:

Dividend decision

Question 8.

‘Shortage of capital leads to over capitalisation.’ Do you agree with this statement? (MARCH-2014)

a) Letters

b) Memos

c) Complaints

d) Orders

Answer:

Complaints

Question 9.

Select the wrong pair from the following : (MARCH-2015)

a) Interest – Debentures

b) Buildings – Working Capital

c) Mix of debt and equity – Capital Structure

d) Dividend – Share Capital

Answer:

Buildings – Working capital

Question 10.

Financial leverage is favourable when, (MARCH-2016)

a) Return on investment is lower than cost of debt.

b) Debt is easily available.

c) The dividends are paid more.

d) Return on investment is higher than cost of debt.

Answer:

Return investment is higher than debt

Question 11.

List out the twin objectives of financial planning. (MAY-2016)

Answer:

a) To ensure availability of funds

b) To see that the firm does not raise resources unnecessarily

Question 12.

Zero working capital means Zero working capital (MARCH-2017)

a) Current Asset > Current Liability

b) Current Asset < Current Liability

c) Current Asset = Current Liability

d) Current Asset * Current Liability

Answer:

c) Current Asset = Current Liability

Question 13.

Ratios which help in determining the ability of the enterprise to service its long term debts are: (MAY-2017)

a) Liquidity

b) Profitability

c) Turnover

d) Solvency

Answer:

Solvency

Plus Two Business Studies Financial Management 2 Marks Important Questions

Question 1.

Mr.Joseph appointed as the Finance Manager of Venus Exporting Company Ltd. As the Finance Manager, point out two important decisions he has to take. (MAY-2010)

Answer:

Investment decisions, Finance decision and Dividend decision.

Question 2.

Following is the details of dividend received by Mr.Amal from a company during the year 2009-10. (MAY-2012)

Decks Ltd. Additional shares What is the type of dividend payment followed by the company?

Answer:

Bonus share

Question 3.

Determination of capital structure of a firm is a crucial management decision. Point out any four factors influencing the determination of capital structure. (MAY-2013)

Answer:

1) Trading on Equity (Financial Leverage)

2) Stability of Earnings

3) Cost of Debt

4) Interest Coverage Ratio (ICR)

Question 4.

Financial planning strive to achieve mainly two objectives. State these objectives. (MAY-2017)

Answer:

The twin objectives of financial planning are

a) To ensure availability of fund at the right time and its possible Sources.

b) To see that firm does not raise fund unnecessarily.

Plus Two Business Studies Financial Management 3 Marks Important Questions

Question 1.

a) Financial Service (MAY-2010)

b) Financial Markets

c) Financial Management

d) Financial institutions

i) Spot the odd one

ii) Justify your answer.

Answer:

Financial management

Question 2.

Briefly explain the term “Financial Planning”. (MARCH-2016)

Answer:

Financial Planning: The process of estimating the fund requirement of a business and specifying the sources of funds is called financial planning.

It ensures that enough funds are available at right time. The twin objectives of financial planning are

a) To ensure availability of fund at the right time and its possible sources.

b) To see that firm does not raise fund unnecessarily.

Question 3.

Capital structure is the ratio between owned capital and borrowed capital. Several factors are to be considered in determining an appropriate capital structure. Prepare a chart showing the factors affecting capital structure. (MARCH-2017)

Answer:

Factors affecting capital structure

1) Trading on Equity

2) Stability of earnings

3) Cost of debt

4) Interest Cover Ratio

5) Desire for control

6) Capital market condition

7) Taxation policy

8) Legal Requirements

Plus Two Business Studies Financial Management 4 Marks Important Questions

Question 1.

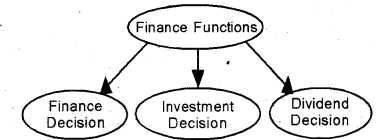

“Finance function is concerned with taking three important decisions”.Comment. (MARCH-2011)

Answer:

Finance Functions: The finance function is concerned with three broad decisions which are :

Finance Decision : It relates to the amount of . finance to be raised from various long term sources.

The main sources of funds for a firm are shareholders’ funds (equity capital and the retained earnings) and borrowed funds (debentures or other forms of debt). A firm needs to have a judicious mix of both debt and equity in making financing decisions.

Investment Decision : The investment decision relates to how the firm’s funds are invested in different assets. Investment decision can be long-term or short-term. A long-term investment decision is also called a Capital budgeting decision.

Short-term investment decisions (also called working capital decisions) are concerned with the decisions about the levels of cash, inventory and receivables.

Dividend Decision : Dividend is that portion of profit which is distributed to shareholders. The decision involved here is how much of the profit earned by company (after paying tax) is to be distributed to the shareholders and how much of it should be retained in the business.

Plus Two Business Studies Financial Management 5 Marks Important Questions

Question 1.

“A Firm’s total investment in the form of Bills Receivable, Debtors, Stock of goods, Cash in hand and at bank were Rs. 5,00,000.” Receivable , Debtors, Stock of goods, Cash in hand and at Bank (MARCH-2011)

a) Identify the type of Capital referred here

b) Explain the factors influencing the investment in these assets.

Answer:

a) Working Capital

b) Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.

Question 2.

The prime responsibility of a finance manager is to determine in advance the amount of capital, its sources and patterns. (MAY-2013)

a) Give a suitable name to this process.

b) Mention the importance of this process.

Answer:

a) Financial Planning

b) Importance of Financial Planning

1) It ensures adequate funds from various sources.

2) It reduces the uncertainty about the availability of funds.

3) It integrates the financial policies and procedures.

4) It helps the management to eliminate waste of funds and reduce cost.

5) It helps to achieve a balance between the inflow and outflow of funds and ensure liquidity.

6) It serves as the basis of financial control

7) It helps to reduce cost of financing to the minimum.

8) It helps to ensure stability and profitability of business.

9) It makes the firm better prepared to face the future

Question 3.

Spencers India a wholesaler of grocery goods, want to start a new branch in Kerala. They are requiring capital for a period of 20 yrs. Briefly explain the factors that determine the size of their capital requirement, (MARCH-2016)

Answer:

Factors affecting Fixed Capital

1) Nature of Business : A trading concern needs lower investment in fixed assets compared with a manufacturing organization.

2) Scale of Operations: An organisation operating on large scale require more fixed capital as compared to an organisation operating on small scale.

3) Choice of Technique : A capital-intensive organisation requires more amount of fixed capital than labour intensive organisations.

4) Technology Upgradation : Organisations using assets which become obsolete faster require more fixed capital as compared to other organisations.

5) Growth Prospects : Higher growth of an organisation generally requires higher investment in fixed assets.

6) Diversification : The firms dealing in number of products (Diversification) requires more investment in fixed capital.

7) Use of Fixed Assets: Companies acquiring fixed assets on hire purchase or lease system require lesser amount as against cash purchases.

Question 4.

“It is a decision regarding the distribution of profit to shareholders.” Identify the decision and explain the factors affecting such decision. (MARCH-2017)

Answer:

a) Dividend decision

b) Factors affecting Dividend Decision

1) Stability Earnings : A company having stable earnings can declare higher dividends. Otherwise, pay lower dividend.

2) Stability of Dividends : Companies generally follow a policy of stabilising dividend per share. Dividend per share is not altered if the change in earnings is small.

3) Growth Opportunities: Companies having good growth opportunities retain more money out of their earnings to finance the required investment. In such a case, they can declare dividend at a lower rate.

4) Cash Flow Positions : Availability of enough cash in the company is necessary for declaration of dividend.

5) Shareholders’ Preference : While declaring dividends, managements must keep in mind the preferences of the shareholders in this regard.

6) Taxation Policy : A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends whereas if tax rates are lower, then more dividends can be declared by the company.

7) Capital Market: Reputed companies have easy access to the capital market and, therefore, they can pay higher dividends than the smaller companies.

8) Legal Constraints: The companies Act has laid down certain restrictions regarding payment of dividend. No dividend can be paid out of capital.

Plus Two Business Studies Financial Management 8 Marks Important Questions

Question 1.

a) What is working capital? (FEBRUARY – 2009)

b) What are the factors determining working capital?

Answer:

a) Working Capital: Working capital is that portion of capital required for investing in current as-sets for meeting day to day working of an organization. Current assets can be converted into cash within a period of one year. They provide liquidity to the business.

Working capital is of two types:

1) Gross working capital = Total of current asset

2) Net working capital = Current assets – Current Liabilities

b) Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.

Question 2.

“It refers to the mix or components of long term sources of funds”. (MARCH-2009)

a) Identify the concept referred above.

b) What are the factors to be considered while determining it?

Answer:

a) Capital structure

b) Factors Affecting Capital Structure

1) Trading on Equity (Financial Leverage) : It refers to the use of fixed income securities such as debentures and preference capital in the capital structure so as to increase the return of equity shareholders.

2) Stability of Earnings: If the company is earning regular and reasonable income, the management can rely on preference shares or debentures. Otherwise issue of equity shares is recommended.

3) Cost of Debt: A firm’s ability to borrow at lower rate, increases its capacity to employ higher debt.

4) Interest Coverage Ratio (ICR) : The interest . coverage ratio refers to the number of times

earnings before interest and taxes of a company covers the interest obligation. Higher the ratio, better is the position of the firm to raise debt.

5) Desire for control : If the management has a desire to control the business, it will prefer preference shares and debentures in capital structure because they have no voting rights.

6) Flexibility: Capital structure should be capable of being adjusted according to the needs of changing conditions.

7) Capital Market Conditions : In depression, debentures are considered good. In a booming situation, issue of shares will be more preferable.

8) Period of Finance: If funds are required for short period, borrowing from bank should be preferred. If funds are required for longer period company can issue shares and debentures.

9) Taxation Policy : interest on loan and debentures is deductible item under the Income Tax Act whereas dividend is not deductible. In order to take advantage of this provision, companies may issue debentures.

10) Legal Requirements : The structure of capital of a company is also influenced by the statutory requirements. For example, Banking Regulation Act, Indian Companies Act, SEBI, etc.

Question 3.

What is working Capital? What are the factors influencing the working capital requirements. (MARCH-2009)

Answer:

Working Capital: Working capital is that portion of capital required for investing in current assets for meeting day to day working of an organization. Current assets can be converted into cash within a period of one year. They provide liquidity to the business.

Working capital is o f two types:

1) Gross working capital = Total of current asset

2) Net working capital = Current assets – Current Liabilities

Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.

Question 4.

Mr. Ganesh, the newly appointed Finance Manager of Soorya Ltd, identified that the poor management of capital required for the day to day operation of the business is one of the problems faced by the Finance Department. He decided to take certain remedial measures to make it efficient. (MAY-2009)

a) State the factors to be considered while deter-mining the amount of capital.

Answer:

Working Capital: Working capital is that portion of capital required for investing in current assets for meeting day to day working of an organization. Current assets can be converted into cash within a period of one year. They provide liquidity to the business.

Working capital is o f two types:

1) Gross working capital = Total of current asset

2) Net working capital = Current assets – Current Liabilities

Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.

Question 5.

What is capital structure and what are the essential features of an appropriate capital structure? (MAY-2010)

Answer:

Capital Structure : Capital structure refers to the mix between owners funds and borrowed funds. Owners fund consists of equity share capital,

preference share capital and reserves and surpluses or retained earnings. Borrowed funds can be in the form of loans, debentures, public deposits, etc.

A capital structure will be said to be optimal when . the proportion of debt and equity is such that it results in an increase in the value of the equity share.

Factors Affecting Capital Structure

1) Trading on Equity (Financial Leverage) : It refers to the use of fixed income securities such as debentures and preference capital in the capital structure so as to increase the return of equity shareholders.

2) Stability of Earnings: If the company is earning regular and reasonable income, the management can rely on preference shares or debentures. Otherwise issue of equity shares is recommended.

3) Cost of Debt: A firm’s ability to borrow at lower rate, increases its capacity to employ higher debt.

4) Interest Coverage Ratio (ICR) : The interest . coverage ratio refers to the number of times earnings before interest and taxes of a company covers the interest obligation. Higher the ratio, better is the position of the firm to raise debt.

5) Desire for control : If the management has a desire to control the business, it will prefer preference shares and debentures in capital structure because they have no voting rights.

6) Flexibility: Capital structure should be capable of being adjusted according to the needs of changing conditions.

7) Capital Market Conditions : In depression, debentures are considered good. In a booming situation, issue of shares will be more preferable.

8) Period of Finance: If funds are required for short period, borrowing from bank should be preferred. If funds are required for longer period company can issue shares and debentures.

9) Taxation Policy : interest on loan and debentures is deductible item under the Income Tax Act whereas dividend is not deductible. In order to take advantage of this provision, companies may issue debentures.

10) Legal Requirements : The structure of capital of a company is also influenced by the statutory requirements. For example, Banking Regulation Act, Indian Companies Act, SEBI, etc.

Question 6.

No business Can run successfully without adequate working capital. By considering this fact, you are required to ‘

a) Narrate the significance of adequacy of working capital and

b) The important factors influencing working capital. (MARCH-2010)

Answer:

Working Capital: Working capital is that portion of capital required for investing in current assets for meeting day to day working of an organization. Current assets can be converted into cash within a period of one year. They provide liquidity to the business.

Working capital is o f two types:

1) Gross working capital = Total of current asset

2) Net working capital = Current assets – Current Liabilities

Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.

Question 7.

A major policy decision of the Financial Manager of a company is whether to distribute profits to shareholders or retain the profits and reinvest into business. (MAY-2010)

a) Name the policy decision of the Financial Manager with regard to this aspect.

b) Explain the various factors affecting the policy of the management in the maximization of the wealth of the owners.

Answer:

a) Dividend Decision

b) Factors affecting Dividend Decision

1) Stability Earnings : A company having stable earnings can declare higher dividends. Otherwise, pay lower dividend.

2) Stability of Dividends : Companies generally follow a policy of stabilising dividend per share. Dividend per share is not altered if the change in earnings is small.

3) Growth Opportunities: Companies having good growth opportunities retain more money out of their earnings to finance the required investment. In such a case, they can declare dividend at a lower rate.

4) Cash Flow Positions : Availability of enough cash in the company is necessary for declaration of dividend.

5) Shareholders’ Preference : While declaring dividends, managements must keep in mind the preferences of the shareholders in this regard.

6) Taxation Policy : A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends whereas if tax rates are lower, then more dividends can be declared by the company.

7) Capital Market: Reputed companies have easy access to the capital market and, therefore, they can pay higher dividends than the smaller companies.

8) Legal Constraints: The companies Act has laid down certain restrictions regarding payment of dividend. No dividend can be paid out of capital.

Question 8.

“Financial planning is one of the important functions of management.” – Explain the statement. Also state various steps and objectives of it. (MARCH-2012)

Answer:

Financial Planning: The process of estimating the fund requirement of a business and specifying the

sources of funds is called financial planning. It ensures that enough funds are available at right time.

The twin objectives of financial planning are

a) To ensure availability of fund at the right time and its possible sources.

b) To see that firm does not raise fund unnecessarily.

Importance of Financial Planning

1) It ensures adequate funds from various sources.

2) It reduces the uncertainty about the availability of funds.

3) It integrates the financial policies and procedures.

4) It helps the management to eliminate waste of funds and reduce cost.

5) It helps to achieve a balance between the inflow and outflow of funds and ensure liquidity.

6) It serves as the basis of financial control

7) It helps to reduce cost of financing to the minimum.

8) It helps to ensure stability and profitability of business.

9) It makes the firm better prepared to face the future

Question 9.

“It is that part of profit of a company which is distributed among the shareholders.” (MARCH-2012)

a) Identify it.

b) Explain internal and external factors affecting it.

Answer:

a) Dividend

b) Factors affecting Dividend Decision

1) Stability Earnings : A company having stable earnings can declare higher dividends. Otherwise, pay lower dividend.

2) Stability of Dividends : Companies generally follow a policy of stabilising dividend per share. Dividend per share is not altered if the change in earnings is small.

3) Growth Opportunities: Companies having good growth opportunities retain more money out of their earnings to finance the required investment. In such a case, they can declare dividend at a lower rate.

4) Cash Flow Positions : Availability of enough cash in the company is necessary for declaration of dividend.

5) Shareholders’ Preference : While declaring dividends, managements must keep in mind the preferences of the shareholders in this regard.

6) Taxation Policy : A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends whereas if tax rates are lower, then more dividends can be declared by the company.

7) Capital Market: Reputed companies have easy access to the capital market and, therefore, they can pay higher dividends than the smaller companies.

8) Legal Constraints: The companies Act has laid down certain restrictions regarding payment of dividend. No dividend can be paid out of capital.

Question 10.

Current assets = Working capital current assets – Current liabilities = Working capital. The above two equations are based on two different concepts of working capital. Describe these two concepts of working capital. Explain factors influencing working capital (MAY-2012)

Answer:

a) 1) Gross Working Capital = Total of Current

Assets

2) Net Working Capital = Current Assets – Current Liabilities

b) Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital.

Question 11.

‘It is a composition of owner, equity and debt in the capitalisation.’ (MARCH-2013)

i) Identify the above definition

ii) Explain the factor, determining its make up

Answer:

Capital Structure : Capital structure refers to the mix between owners funds and borrowed funds. Owners fund consists of equity share capital,

preference share capital and reserves and surpluses or retained earnings. Borrowed funds can be in the form of loans, debentures, public deposits, etc.

A capital structure will be said to be optimal when . the proportion of debt and equity is such that it results in an increase in the value of the equity share.

Factors Affecting Capital Structure

1) Trading on Equity (Financial Leverage) : It refers to the use of fixed income securities such as debentures and preference capital in the capital structure so as to increase the return of equity shareholders.

2) Stability of Earnings: If the company is earning regular and reasonable income, the management can rely on preference shares or debentures. Otherwise issue of equity shares is recommended.

3) Cost of Debt: A firm’s ability to borrow at lower rate, increases its capacity to employ higher debt.

4) Interest Coverage Ratio (ICR) : The interest . coverage ratio refers to the number of times earnings before interest and taxes of a company covers the interest obligation. Higher the ratio, better is the position of the firm to raise debt.

5) Desire for control : If the management has a desire to control the business, it will prefer preference shares and debentures in capital structure because they have no voting rights.

6) Flexibility: Capital structure should be capable of being adjusted according to the needs of changing conditions.

7) Capital Market Conditions : In depression, debentures are considered good. In a booming situation, issue of shares will be more preferable.

8) Period of Finance: If funds are required for short period, borrowing from bank should be preferred. If funds are required for longer period company can issue shares and debentures.

9) Taxation Policy : interest on loan and debentures is deductible item under the Income Tax Act whereas dividend is not deductible. In order to take advantage of this provision, companies may issue debentures.

10) Legal Requirements : The structure of capital of a company is also influenced by the statutory requirements. For example, Banking Regulation Act, Indian Companies Act, SEBI, etc.

Question 12.

i) What is dividend? (MARCH-2013)

ii) What are the factor, affecting dividend decision?

Answer:

i) Dividend is that part of the profits of a company which is distributed among shareholders.

ii) Dividend Decision : Dividend is that portion of profit which is distributed to shareholders. The decision involved here is how much of the profit earned by company (after paying tax) is to be distributed to the shareholders and how much of it should be retained in the business.

iii) Factors affecting Dividend Decision

1) Stability Earnings : A company having stable earnings can declare higher dividends. Otherwise, pay lower dividend.

2) Stability of Dividends : Companies generally follow a policy of stabilising dividend per share. Dividend per share is not altered if the change in earnings is small.

3) Growth Opportunities: Companies having good growth opportunities retain more money out of their earnings to finance the required investment. In such a case, they can declare dividend at a lower rate.

4) Cash Flow Positions : Availability of enough cash in the company is necessary for declaration of dividend.

5) Shareholders’ Preference : While declaring dividends, managements must keep in mind the preferences of the shareholders in this regard.

6) Taxation Policy : A company is required to pay tax on dividend declared by it. If tax on dividend is higher, company will prefer to pay less by way of dividends whereas if tax rates are lower, then more dividends can be declared by the company.

7) Capital Market: Reputed companies have easy access to the capital market and, therefore, they can pay higher dividends than the smaller companies.

8) Legal Constraints: The companies Act has laid down certain restrictions regarding payment of dividend. No dividend can be paid out of capital.

Question 13.

It is the capital required for meeting the permanent or long term needs of the business. (MARCH-2014)

a) Identify it.

b) Explain factors determining it.

Answer:

i) Fixed capital

ii) Fixed Capital : Fixed capital refers to the capital needed for the the acquisition of fixed assets to be used for a longer period.

Factors affecting Fixed Capital

1) Nature of Business : A trading concern needs lower investment in fixed assets compared with a manufacturing organization.

2) Scale of Operations: An organisation operating on large scale require more fixed capital as compared to an organisation operating on small scale.

3) Choice of Technique : A capital-intensive organisation requires more amount of fixed capital than labour intensive organisations.

4) Technology Upgradation : Organisations using assets which become obsolete faster require more fixed capital as compared to other organisations.

5) Growth Prospects : Higher growth of an organisation generally requires higher investment in fixed assets.

6) Diversification : The firms dealing in number of products (Diversification) requires more investment in fixed capital.

7) Use of Fixed Assets: Companies acquiring fixed assets on hire purchase or lease system require lesser amount as against cash purchases.

Question 14.

“Capital budgeting is an important decision making area for the finance manager.” Explain. (MARCH-2014)

Answer:

a) Capital Budgeting

b) Importance of Financial Planning

1) It ensures adequate funds from various sources.

2) It reduces the uncertainty about the availability of funds.

3) It integrates the financial policies and procedures.

4) It helps the management to eliminate waste of funds and reduce cost.

5) It helps to achieve a balance between the inflow and outflow of funds and ensure liquidity.

6) It serves as the basis of financial control

7) It helps to reduce cost of financing to the minimum.

8) It helps to ensure stability and profitability of business.

9) It makes the firm better prepared to face the future.

Question 15.

a) “No business can run successfully without adequate working capital.” By highlighting this fact: Narrate the significance of adequacy of working capital.(MARCH-2015)

ii) Identify the important factors influencing working capital of a firm

Answer:

i) Working Capital : Working capital is that portion of capital required for investing in current as¬sets for meeting day to day working of an organization. Current assets can be converted into cash within a period of one year. They provide liquidity to the business.

Working capital is of two types:

1) Gross working capital = Total of current asset

2) Net working capital = Current assets-Current Liabilities

ii) Factors affecting Working Capital

Factors affecting Working Capital

1) Nature of Business : A trading organisation usually needs a smaller amount of working capital as compared to a manufacturing organisation.

2) Scale of Operations: A large scale organisation requires large amount of working capital as compared to the organisations which operate on a lower scale.

3) Business Cycle : In the boom period larger amount of working capital is needed to meet the demand. In case of depression, demand for goods declines so less working capital is required.

4) Seasonal Factors: During peak season demand of a product will be high and thus high working capital will be required as compared to lean season.

5) Production Cycle: Production cycle is the time span between the receipt of raw material and their conversion into finished goods. Working capital requirement is higher in firms with longer processing cycle and lower in firms with shorter processing cycle.

6) Credit Policy : A liberal credit policy results in higher amount of debtors, increasing the requirement of working capital.

7) Operating Efficiency : If cash, debtors and inventory are efficiently managed, working capital requirement can be reduced.

8) Availability of Raw Materials : If the raw materials are easily available in the market and there is no shortage, huge amount need not be blocked in inventories, so it needs less working capital

Question 16.

“Management of fixed capital involves allocation of firms capital to different long term assets or projects.” By highlighting this statement, you are required to :(MARCH-2015)

i) Identify and explain the various factors influencing the fixed capital requirements of a company, and

ii) State the principles to be followed in managing the fixed assets of a company.

Answer:

i) Fixed Capital: Fixed capital refers to the capital needed for the the acquisition of fixed assets to be used fora longer period.

ii) Factors affecting Fixed Capital

1) Nature of Business : A trading concern needs lower investment in fixed assets compared with a manufacturing organization.

2) Scale of Operations: An organisation operating on large scale require more fixed capital as compared to an organisation operating on small scale.

3) Choice of Technique : A capital-intensive organisation requires more amount of fixed capital than labour intensive organisations.

4) Technology Upgradation : Organisations using assets which become obsolete faster require more fixed capital as compared to other organisations.

5) Growth Prospects : Higher growth of an organisation generally requires higher investment in fixed assets.

6) Diversification : The firms dealing in number of products (Diversification) requires more investment in fixed capital.

7) Use of Fixed Assets: Companies acquiring fixed assets on hire purchase or lease system require lesser amount as against cash purchases.

Question 17.

Mr. Ankit is a newly appointed Finance Manager of Neo Ltd., a manufacturing and trading enterprise. His first assignment with the new employer is about allocation of its capital among projects/assests with long-term implications. Explain the various factors he needs to consider in this regard. (MAY-2016)

Answer:

Factors affecting Fixed Capital

1) Nature of Business : A trading concern needs lower investment in fixed assets compared with a manufacturing organization.

2) Scale of Operations: An organisation operating on large scale require more fixed capital as compared to an organisation operating on small scale.

3) Choice of Technique : A capital-intensive organisation requires more amount of fixed capital than labour intensive organisations.

4) Technology Upgradation : Organisations using assets which become obsolete faster require more fixed capital as compared to other organisations.

5) Growth Prospects : Higher growth of an organisation generally requires higher investment in fixed assets.

6) Diversification : The firms dealing in number of products (Diversification) requires more investment in fixed capital.

7) Use of Fixed Assets: Companies acquiring fixed assets on hire purchase or lease system require lesser amount as against cash purchases.

Question 18.

“Overall financial health of a business enterprise is determined by the quality of its financial management.” Justify the above statement with suitable examples. (MAY-2016)

Answer:

Financial Management: Financial Management is concerned with optimal procurement as well as usage of finance. For optimal procurement, different available sources of finance are identified and compared in terms of their costs and associated risks. Financial Management aims at reducing the cost of funds procured and ensuring availability of enough funds whenever required.

Objectives of Financial Management : The primary aim of financial management is to maximise shareholder’s wealth. It means maximisation of the market value of equity shares. It is the responsibility of the company to pay reasonable dividend and also to maximize the value of its shares.

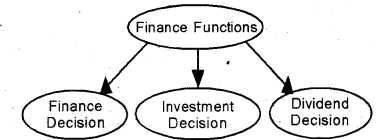

Finance Functions,: The finance function is concerned with three broad decisions which are :

Finance Decision : It relates to the amount of . finance to be raised from various long term sources.

The main sources of funds for a firm are shareholders’ funds (equity capital and the retained earnings) and borrowed funds (debentures or other forms of debt). A firm needs to have a judicious mix of both debt and equity in making financing decisions.

Investment Decision : The investment decision relates to how the firm’s funds are invested in different assets. Investment decision can be long-term or short-term. A long-term investment decision is also called a Capital budgeting decision.

Short-term investment decisions (also called working capital decisions) are concerned with the decisions about the levels of cash, inventory and receivables.

Dividend Decision : Dividend is that portion of profit which is distributed to shareholders. The decision involved here is how much of the profit earned by company (after paying tax) is to be distributed to the shareholders and how much of it should be retained in the business.

Question 19.

Mr.Amitabh has been appointed as the Finance Manager of a newly floated manufacturing and trading concern. Help him in preparing a note addressed to Board of directors citing the relevance of capital structure decision for the concern and any six prominent factors that determine the choice of capital structure. (MAY-2017)

Answer:

Capital Structure : Capital structure refers to the mix between owners funds and borrowed funds. Owners fund consists of equity share capital, preference share capital and reserves and surpluses or retained earnings. Borrowed funds can be in the form of loans, debentures, public deposits, etc.

A capital structure will be said to be optimal when . the proportion of debt and equity is such that it results in an increase in the value of the equity share.

Factors Affecting Capital Structure

1) Trading on Equity (Financial Leverage) : It refers to the use of fixed income securities such as debentures and preference capital in the capital structure so as to increase the return of equity shareholders.

2) Stability of Earnings: If the company is earning regular and reasonable income, the management can rely on preference shares or debentures. Otherwise issue of equity shares is recommended.

3) Cost of Debt: A firm’s ability to borrow at lower rate, increases its capacity to employ higher debt.

4) Interest Coverage Ratio (ICR) : The interest . coverage ratio refers to the number of times

earnings before interest and taxes of a company covers the interest obligation. Higher the ratio, better is the position of the firm to raise debt.

5) Desire for control : If the management has a desire to control the business, it will prefer preference shares and debentures in capital structure because they have no voting rights.

6) Flexibility: Capital structure should be capable of being adjusted according to the needs of changing conditions.

7) Capital Market Conditions : In depression, debentures are considered good. In a booming situation, issue of shares will be more preferable.

8) Period of Finance: If funds are required for short period, borrowing from bank should be preferred. If funds are required for longer period company can issue shares and debentures.

9) Taxation Policy : interest on loan and debentures is deductible item under the Income Tax Act whereas dividend is not deductible. In order to take advantage of this provision, companies may issue debentures.

10) Legal Requirements : The structure of capital of a company is also influenced by the statutory requirements. For example, Banking Regulation Act, Indian Companies Act, SEBI, etc.

Question 20.

The Managing Director of Ellexi Ltd., is not same about the primary objective of financial management and the broad decision making horizons of it. Assist him forgetting a better idea in this regard. (MAY-2017)

Answer:

Financial Management: Financial Management is concerned with optimal procurement as well as usage of finance. For optimal procurement, different available sources of finance are identified and compared in terms of their costs and associated risks. Financial Management aims at reducing the cost of funds procured and ensuring availability of enough funds whenever required.

Objectives of Financial Management : The primary aim of financial management is to maximise shareholder’s wealth. It means maximisation of the market value of equity shares. It is the responsibility of the company to pay reasonable dividend and also to maximize the value of its shares.

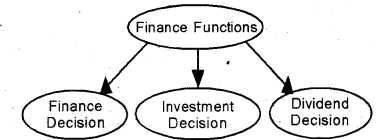

Finance Functions,: The finance function is concerned with three broad decisions which are :

Finance Decision : It relates to the amount of . finance to be raised from various long term sources.

The main sources of funds for a firm are shareholders’ funds (equity capital and the retained earnings) and borrowed funds (debentures or other forms of debt). A firm needs to have a judicious mix of both debt and equity in making financing decisions.

Investment Decision : The investment decision relates to how the firm’s funds are invested in different assets. Investment decision can be long-term or short-term. A long-term investment decision is also called a Capital budgeting decision.

Short-term investment decisions (also called working capital decisions) are concerned with the decisions about the levels of cash, inventory and receivables.

Dividend Decision : Dividend is that portion of profit which is distributed to shareholders. The decision involved here is how much of the profit earned by company (after paying tax) is to be distributed to the shareholders and how much of it should be retained in the business.