Kerala Plus Two Accountancy Previous Year Question Paper March 2018 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 60

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part-A

ACCOUNTING

I. Answer all questions from 1 to 3, each carries 1 score. (3 × 1 = 3)

Question 1.

Complete the series:

a) Receipts and Payments Account → Cash in Hand and Cash at Bank

b) Income and Expenditure Account → ………. ? ……….

Answer:

Surplus or Deficit

Question 2.

On admission of a partner, the Debit Balance of Profit and Loss Account shown in the Balance Sheet of the firm, denotes:

а) Accumulated Profit

b) Accumulated Loss

c) Revaluation Loss

d) General Reserve

Answer:

b) Accumulated loss

Question 3.

On death of a partner, his legal representatives were settled by paying ₹ 1,20,000. As per his Capital Account, the amount due to him after all adjustments was ₹ 1,05,000. Ascertain the deceased partner’s share of goodwill from the firm.

(Hint: Case of hidden goodwill)

Answer:

Share of goodwill = 1,20,000 – 1,05,000 = 15,000

II. Answer any 2 questions from 4 to 6, each carries ‘2’ scores. (2 × 2 = 4)

Question 4.

List out any four items to be credited to a Partner’s Current Account, when capitals are fixed.

Answer:

Items to be credited to a partner’s current Account are:

- Salary

- Interest on capital

- Commission

- Profit & loss appropriation a/c

- General Reserve

Question 5.

Mention two situations in which ‘Compulsory Dissolution’ of a partnership business takes place.

Answer:

A firm is dissolved compulsorily in the following cases:

- When all the partners or all except one become insane or insolvent.

- When the business of the firm become illegal.

- When all the partners except one retire.

- When all the partners or all except one die.

Question 6.

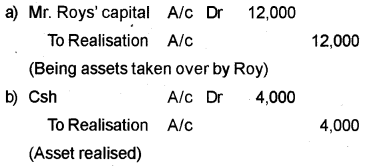

Pass Journal Entries on dissolution of a firm, in connection with relation of assets, in the following cases:

a) Furniture worth ₹ 12,000 taken over by Mr. Roy. one of the partners at the book value.

b) Unrecorded machinery sold out for ₹ 4,000.

Answer:

III. Answer any 5 questions from 7 to 12, each carries 3 scores. (5 × 3 = 15)

Question 7.

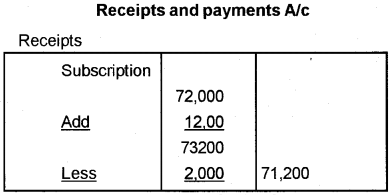

During the year 2016-17, there was 1800 members in a sports club. The yearly subscription was fixed at ₹ 40 per member. There was unearned subscription of ₹ 2,000 at the beginning of the year. The unearned subscription at the end of the year was ₹ 1,200.

Show how the amount of subscription appears in the following financial statements of the club:

a) Income and Expenditure Account.

b) Receipts and Payments Account.

Answer:

a) Amount of subscription credited in income and expenditure a/c is Rs. 72,000/- (1800 × 40)

b)

Question 8.

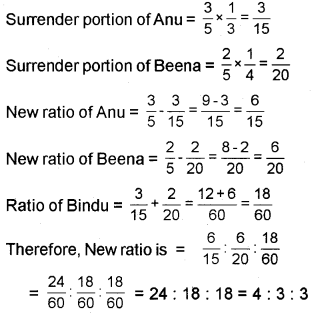

Anu and Beena are partners in a firm sharing profits in 3 : 2 ratio. They admitted Bindu as a new partner. Anu surrendered 1/3 of her share in favour of Bindu and Beena surrendered 1/4 of her share in favour of Bindu Calculate the new Profit sharing ratio.

Answer:

Question 9.

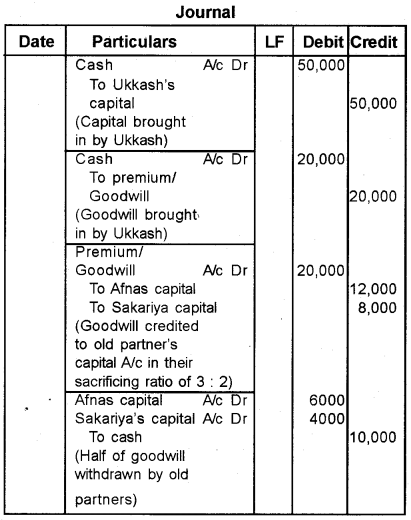

Afnas and Sakariya are partners in a firm sharing profits and losses in the ratio of 3 : 2. Ukkash is admitted as a new partner for 1/4 share in profits. He should bring in ₹ 50,000 as capital and his share of goodwill in cash. Firm’s goodwill is valued at ₹ 80,000 at the time of his admission.

Give necessary Journal Entries, on the assumption that 50% of the premium amount is withdrawn by the old partners.

Answer:

Note: Ukkash’s share of goodwill = 80,000 × \(\frac{1}{4}\) = 20,000 sacrificing ratio = 3 : 2

Question 10.

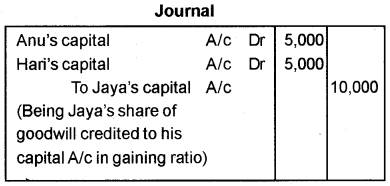

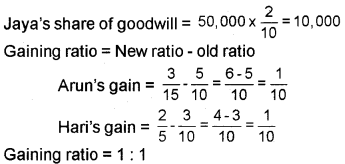

Arun, Hari and Jaya are partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. Jaya retires from the firm and the continuing partners decided to share future profits in the ratio of 3 : 2 respectively. On her retirement firm’s goodwill valued at ₹ 50,000.

Record necessary journal entries for the treatment of goodwill, without opening the Goodwill Account.

Answer:

Note:

Question 11.

Explain the order in which the amounts realised through the sale of assets are to be applied, at the time of dissolution of a partnership firm.

Answer:

Amount realized from assets of the firm shall be used in the following manner

- paying the realisation expenses.

- paying the liabilities to outsiders

- paying the loan from partners

- paying the capital of the partners

- surplus if any is to be distributed to partners

Question 12.

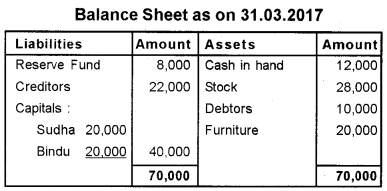

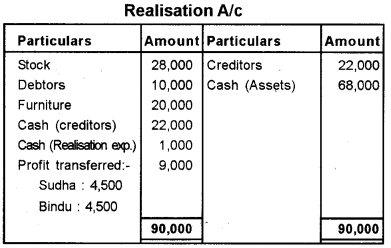

Prepare a Realisation Account from the following details, on dissolution of a firm:

On the date of the balance sheet, the firm was dissolved and all assets were sold out for ₹ 68,000. Firm incurred ₹ 1,000 as the realisation expenses.

Answer:

Note: Profit sharing ratio ofSudhaand Bindu = 1 : 1

IV. Answer any two questions from 13 to 15, each carries 5 scores. (2 × 5 = 10)

Question 13.

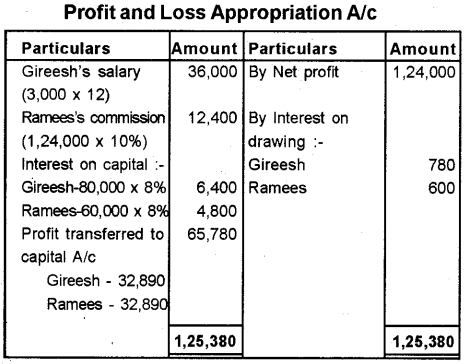

Gireesh and Ramees are equal partners in a firm and their capitals as on 01.04.2016 were ₹ 80,000 and ₹ 60,000 respectively. As per the partnership deed Gireesh is entitled to monthly salary of ₹ 3,000. Ramees gets a commission of 10% on the Net Prof-its of the business before charging such commission. They are also eligible for interest on capital @ 8% p.a. Interest on drawings is charged as 6% p.a. Gireesh withdrew ₹ 2,000 at the beginning of every month for his personal purposes. Total drawings of Ramees during 2016 – 17 was ₹ 20,000.

Prepare the Profit and Loss Appropriation Account, to show the distribution of profits among partners. The net profits of the business for the year ended 31.03.2017 was ₹ 1,24,000 (before adjusting above items).

Answer:

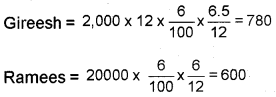

Note: Interest on drawings

Question 14.

Shammu and Viswan are partners sharing profits in the ratio of 2 : 1. Radha is admitted into the firm for 1/4 share of profits. The new partner brings in ₹ 40,000 in respect of his capital. The capitals of old partners after all adjustments were ₹ 90,000 and ₹ 30,000 respectively. It is agreed that partners’ capitals should be according to the new profit sharing ratio.

Determine the new capitals of old partners. Also record necessary journal entries to adjust the capital accounts in cash terms.

Answer:

1) Calculation of total capital of the new firm based on new partner’s capital and his share of profit

= 40,000 × \(\frac{4}{1}\) = 1,60,000

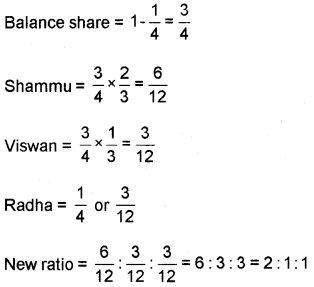

2) New profit sharing ratio

New ratio = Balance share × old ratio

3) Required capital of Shammu and Viswan:

Shammu = 1,60,000 × \(\frac{2}{4}\) = 80,000

Viswan = 1,60,000 × \(\frac{1}{4}\) = 40,000

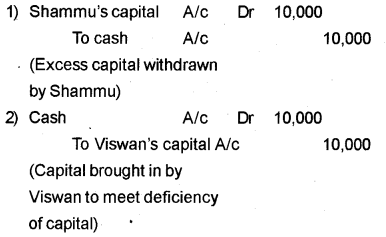

The capital of Shammu and Viswan after all adjustments have been made, are 90,000 and 30,000 respectively. Hence, Shammu will withdraw Rs. 10,000 (90,000 – 80,000) from the firm whereas Viswan will contribute an additional capital of Rs. 10,000 (40,000 – 30,000).

The journal entries will be:

Question 15.

X, Y and Z were partners in a business sharing prof¬its and losses in the ratio of 3 : 2 : 1. ‘X’ died on. October 1.2016. It was agreed between his executors and the remaining partners that:

a) Goodwill to be valued at 2 years purchase of the average profits of previous ‘5’ years.

(Average profit of past 5 years is worked out as ₹ 30,000)

b) Machinery be depreciated by ₹ 12,000 and Build-ing be appreciated by ₹ 24,000.

c) Profits for the year 2016 – 17 be taken as having accured at the same rate as that of the previous year.

(The profits of 2015 – 16 was ₹ 36,000)

d) Interest on capital @ 12% p.a. (X’s capital account has a credit balance of ₹ 60,000 as on 01.04.2016)

e) Accumulated profits or losses are to be shared among partners. (Balance Sheet of the firm as on 31.03.2016 shows a credit balance of ₹ 24,000 in the Profit and Loss Account)

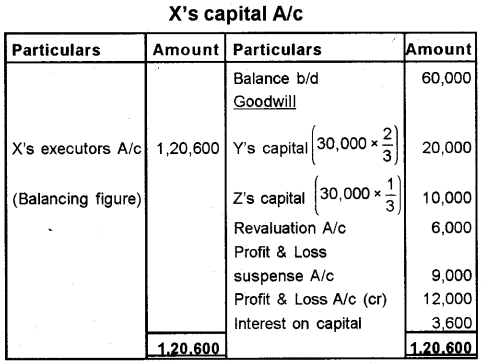

Workout the amount payable to X’s legal representatives and show them in X’s Capital Account.

Answer:

Note:

1. X’s share of goodwill:

Goodwill of the firm = Average profit × No. of year’s purchase

= 30,000 × 2 = 60,000

X’s share of goodwill = 60,000 × \(\frac{3}{6}\) = 30,000

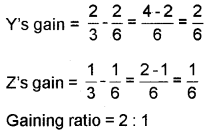

2. Gaining ratio = New ratio – old ratio

New ratio = 2 : 1

3. Revaluation profit

= 24,000 – 12,000 = 12,000

X’s share = 12,000 × \(\frac{3}{6}\) = 6,000

4. Profit from the date of last balancesheet to date of death.(01.04.2016 to 30.09.2016 = 6 months)

Profit for 6 months = 36,000 × \(\frac{6}{12}\) = 18,000

X’s share of profit = 18,000 × \(\frac{3}{6}\) = 9,000

5. Profit and Loss A/c credit balance on 31.03.2016

X’s share of profit = 24,000 × \(\frac{3}{6}\) = 12,000

6. Interest on capital

X’s interest on capital = 60,000 × \(\frac{12}{100}\) × \(\frac{6}{12}\) = 3,600

V. Answer the question no. 16. which carries 8 scores. (1 × 8 = 8)

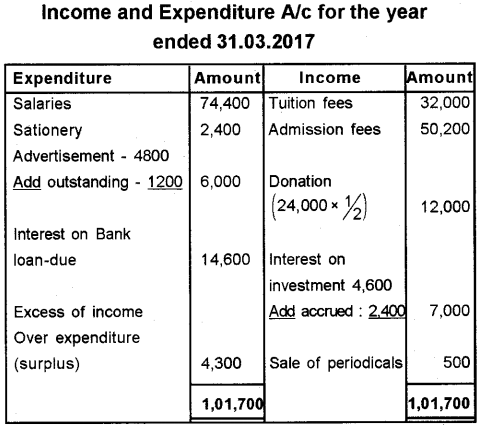

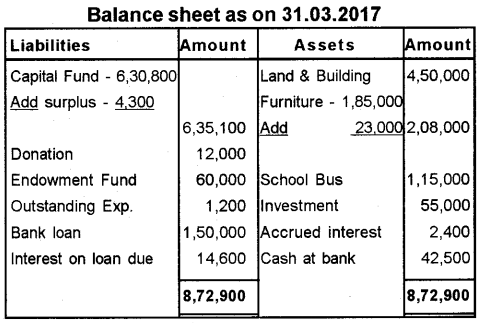

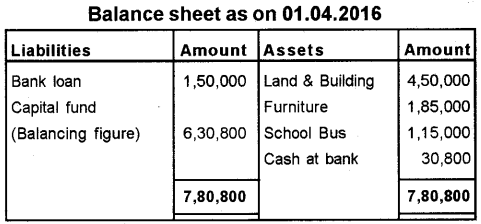

Question 16.

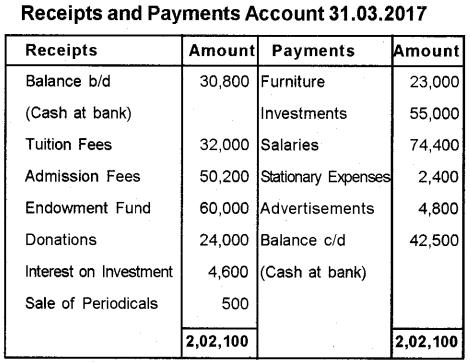

The Receipts and Payments Account of a Private School is given below:

The school has following assets and liabilities as on 01.04.2016:

Land & Buildings – 4,50,000

Furniture – 1,85,000

School Bus – 1,15,000

Bank Loan – 1,50,000

Prepare the Income and Expenditure Account for the year ended 31.03.2017 and the Balance Sheet as on that date by considering the following:

a) Half of the donations should be treated as income.

b) Advertisement expenses outstanding ₹ 1,200.

c) Interest on Bank Loan ₹ 14,600 due for payment.

d) Accrued interest on investments ₹ 2,400.

Answer: