Kerala Plus Two Accountancy Previous Year Question Paper March 2017 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers |

Time: 2½ Hours

Cool off time : 15 Minutes

General Instructions to Candidates

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2½ hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and the only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures, and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Question 1:

The ratio in which the old partners agree to sacrifice their share of profit in favor of incoming partner is (1)

a. New ratio

b. Old ratio

c. Sacrificing ratio

d. Gaining ratio

Question 2:

Sanu and Binu are partners in a firm sharing profit and losses in the ratio of 3:1. They admit Jinu for 3/7 share. Calculate the new profit sharing ratio. (1)

Question 3:

Write journal .entry for recording unrecorded liability at the time of retirement of a partner. (1)

Question 4:

Anand sports club received Rs. 1,75,000 as a subscription for the year ended 31st March 2016. Consider the following adjustments and mention whether we should add or deduct each items to find out the subscription for the year. (2)

a. Subscription outstanding on 31st March 2016 Rs. 15,000.

b. Subscription outstanding on 1st April 2015 Rs. 20,000.

c. Subscription received in advance as on 1st April 2015 Rs. 16,000.

d. Subscription received in advance as on 31st March 2016 Rs. 12000.

Question 5:

Firoz and Shahin are partners in a firm. The firm did not have any partnership deed. Specify how the following situations are treated. (1)

a. Sharing of profit and losses

b. Interest on advance given by Firoz to the firm.

Question 6:

Priya, Priji and Viji are partners, sharing profit and losses in the ratio of 4:3:2. Priji retired and goodwill is valued at Rs. 63,000. Priya and Viji are decided to share future profits and losses in the ratio of 5:3. Record necessary journal entry, when goodwill is raised at its full value and written off immediately. (2)

Question 7:

Mention the name of account where profit or loss on realization is transferred. (1)

Question 8:

What journal entry will be passed if realization expenses are paid by a partner on behalf of the firm.? (1)

Question 9:

Partners capital account and current account are not maintained separately under —— method of maintaining capital account. (1)

Question 10:

Anoop and Johny are partners in a firm, sharing profit and losses in the ratio of 3:2. The firm was decided to dissolve on 31st March 2016. Mention any four ways of dissolution of firm. (2)

Question 11:

Anwar a partner in Akbar Travels with draw money during the year ending 31st March 2016 from his capital account for his personal use . Calculate interest on drawings on the following situations if rate of interest is 9% p.a. (3)

a. If he withdrew Rs.2,500 per month at the beginning of the month.

b. If the amount withdrawn were on 1 – 6 – 2015, Rs. 7,500 on 31-8-2015 Rs. 3,000 and 30 – 9 – 2015 Rs.6,500.

Question 12:

The capital of the firm of Mohan and Rissam is Rs. 75,000 and the rate of interest is 15%. Annual salary to partners is Rs. 5,000 each. The profit for the last 3 years were Rs. 36,000, 38000 and 31,000. Goodwill is to be valued at 2 years purchase of the last 3 years average super-profits. Calculate the goodwill of the firm. (3)

Question 13:

Renjith, Sumesh and Aneesh are partners in a firm. Sumesh retires from the firm.

On the date of retirement of Sumesh, Rs.45,000 become due to him. Renjith and Aneesh promise to pay the amount in installments. Prepare Sumesh’s loan account, when they agree to pay three yearly installments of Rs. 15,000 including interest at 12% p.a. on the outstanding balance during the first 3 years and the balance including interest in the fourth year.

Question 14:

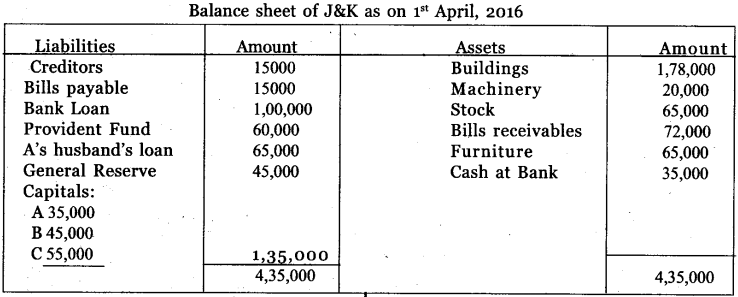

A, B & C are partners sharing profit and losses in the ratio of 5 : 3: 2. Their Balance Sheet as on 31st March 2015 was as follows:

The firm was dissolved on that date.

Prepare realization account with the following information:

a. Building realized for Rs. 120000; Bills receivables realized for Rs. 70,000; Stock realized for Rs. 40,000 and Machinery sold for Rs, 33,000 and furniture Rs.60,000.

b. Bank loan was settled for Rs. 70,000; Creditors and bills payable were settled at 10% discount.

c. Realisation expenses Rs. 1,500.

Question 15:

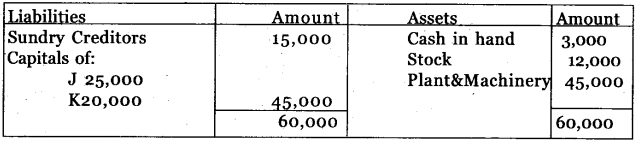

L is admitted on the following terms:

1. L will bring Rs. 15,000 as capital and Rs.5,000 as premium for goodwill for 1/6 share.

2. The value of stock is reduced by 10% and plant and machinery increased by 5%.

3. Investment worth Rs.1,5oo(not mentioned in the Balance Sheet) is to be taken into account.

Prepare revaluation account and capital account of partners.

Question 16:

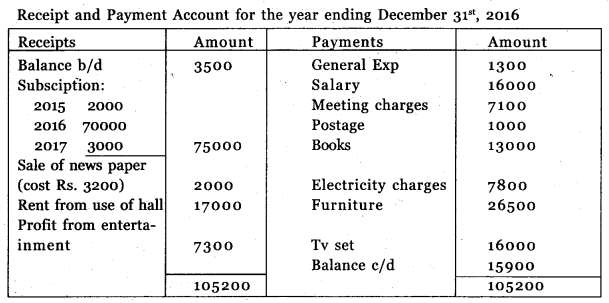

a. From the following Receipt and Payment Account of a club, prepare income and expenditure account for the year ended 31st December 2016 and Balance Sheet as on that date:

Additional information:

a. The club has loo members each paying an annual subscription of Rs. 900. Subscripti ons outstanding on December 31, 2015 were Rs. 3,800.

b.On December 31st, 2016, salary outstanding amounted to Rs. 1,000, salary paid included Rs. 1,000 for the year 2015.

c. On January 1, 2016 the club owned land and building Rs. 25,000, furniture Rs.2,600 and books Rs. 6,200.

OR

b. One of your friend wish to take membership in a cricket club. He does not know anything about Not-for-profit organizations. Can you explain him what it is and what are different accounting records maintained in such organization and steps for preparing final accounts? (8)