Kerala Plus Two Accountancy Previous Year Question Paper March 2019 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 60

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part – A

ACCOUNTING

Answer all questions from T to 4, each carries 1 score. (4 × 1 = 4)

Question 1.

Receipts and Payment Account is equivalent to ………..

a) Profit & Loss A/c

b) Cash Book

c) Balance Sheet

d) Capital A/c.

Answer:

b) Cash Book

Question 2.

Identify the name of account which is prepared to show, how the profits are distributed among partners.

a) Income & Expenditure A/c.

b) Profit & Loss A/c.

c) Profit & Loss Appropriation A/c.

d) None of these

Answer:

c) Profit & Loss Appropriation A/c.

Question 3.

Complete the following Journal Entry:

……….. A/c. Dr.

To Cash A/c.

(The amount of goodwill brought in by the new partner withdrawn by the existing partners).

Answer:

Old Partners capital A/c Dr.

To Cash A/c

Question 4.

The business of the firm is terminated when take place.

a) Dissolution of Partnership

b) Retirement of a partner

c) Death of a partner

d) Dissolution of firm

Answer:

d) Dissolution of firm

Answer any 2 questions from 5 to 7. Each carries ‘2’ scores. (2 × 2 = 4)

Question 5.

Chaithanya and Sandra are partners in a firm, sharing profits and losses equally. During the financial year 2017 – 18. Sandra withdraw ₹ 20,000 quarterly on the beginning of each quarter. Find out the interest on drawing @ 8% p.a.

Answer:

Interest on drawing = Amount × Average period × Rate

Total Amount withdrawn = 20000 × 4(quarterly)

= 80000

Average period = 7.5 months

Interest on drawings 80,000 × \(\frac{7.5}{12} \times \frac{8}{100}\)

= 4000

Note:

If the amount is withdrawn at the beginning of each quarter, the interest is calculated on the total amount withdrawn during the year, for a period of 7.5 months.

Question 6.

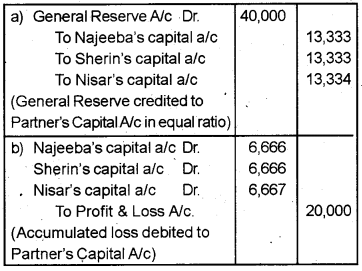

Najeeba, Sherin and Nasar are equal partners. Nasar decides to retire. On the date of his retirement, the Balance sheet of the firm showed a General Reserve of ₹ 40,000 and Profit and Loss Account ₹ 20,000 (Dr.)

Show the accounting treatment for the above.

Answer:

Question 7.

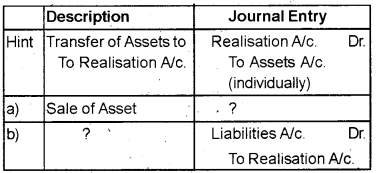

Complete the worksheet based on the hint given below:

Answer:

a) Cash A/c Dr.

To Realisation A/c

b) Transfer of liabilities to realisation A/c

Answer any 2 questions from 8 to 10, each carries 3 scores. (2 × 3 = 6)

Question 8.

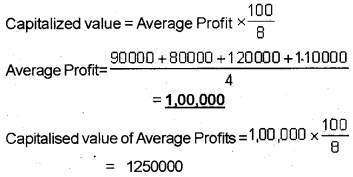

The profits earned by a business firm during the last 4 years were ₹ 90,000, ₹ 80,000, ₹ 1,20,000 and ₹ 1,10,000 respectively. Normal rate of return in similar business is 8%. Calculate the value of goodwill by capitalization of average profit. Assume that the value of net assets is ₹ 9,00,000.

Answer:

Goodwill = Capitalized value – Net Assets

Goodwill = 12,50,000 – 9,00,000

= 3,50,000

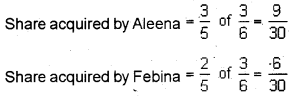

Question 9.

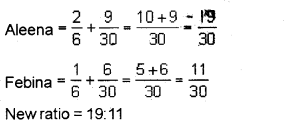

Sruthi, Aleena and Febina are partners in the ratio of 3 : 2 : 1, Sruthi retires and her share is acquired by the remaining partnes in the ratio of 3 : 2. Calculate the new ratio.

Answer:

Old ratio = 3 : 2 : 1

New ratio = Old ratio + Acquired share

Question 10.

Ashina, a Commerce student is in a dilemma that she has no clear idea about the differences between dissolution of partnership and dissolution of firm. Can you help her by giving three points of differences in this regard?

Answer:

| Dissolution of Partnership | Dissolution of Firm |

| 1. The business is not terminated. | 1. The business of the firm is closed. |

| 2. Assets and liabilities are revalued and new balance sheet is drawn. | 2. Assets are sold and liabilities are paid off. |

| 3. Books of accounts are not closed. | 3. Books of accounts are closed. |

Answer all the questions from 11 to 12. Each carries ‘4’ scores. (2 × 4 = 8)

Question 11.

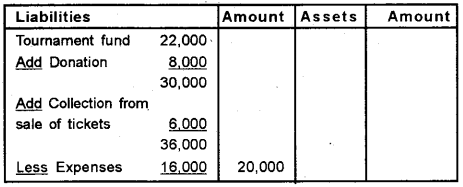

Ms. Bhavya, the secretary of Butterfly Arts’& Sports Club is not aware about the treatment of tournament fund in their Balance Sheet. As a commerce student you are required to help her based on the following details:

| ₹ | |

| Tournament Expenses | 16,000 |

| Tournament Fund | 22,000 |

| Donation for Tournament | 8,000 |

| Collection from the sale of tournament tickets | 6,000 |

Answer:

Balance sheet as on ………..

Question 12.

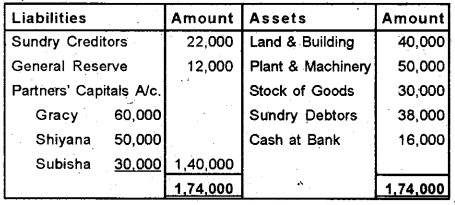

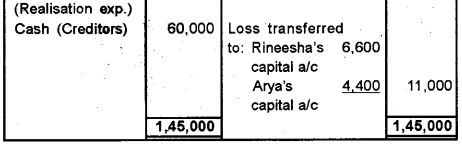

Gracy, Shiyana and Subisha were partners in a firm sharing profits in the ratio of 5 : 3 : 2. Their balance sheet as on 31.03.2017 stood as follows:

Balance Sheet as on 31.03.2017

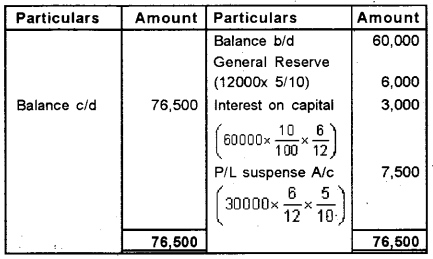

Gracy died on 1.10.2017. her legal heirs are to be settled on the following terms:

a) Interest on capital to be provided @ 10% p.a

b) profit till the date of death may be calculated on the basis of last year’s profit, which was ₹ 30,000.

Prepare the Capital Account of the deceased partner.

Answer:

Gracy Capital A/c

Answer all the questions from 13 to 14. Each carries 5 scores. (2 × 5 = 10)

Question 13.

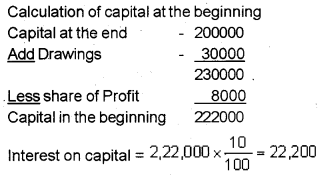

Priya is a partner in a firm, her capital at the end of the financial year 2016 – 17 was ₹ 2,00,000. During the year she had withdrawn ₹ 30,000. Her share of profit before charging interest on capital for the year was ₹ 8,000.

Calculate interest on capital @ 10% p.a.

Answer:

Question 14.

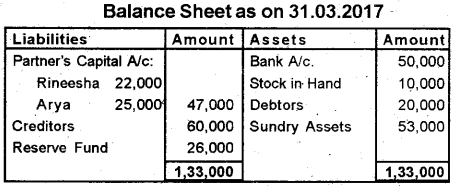

Rineesha and Arya are partners in the ratio of 3 : 2. Their Balance Sheet as on 31.03.2017 is given below:

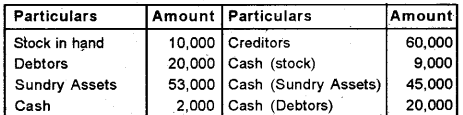

The firm is dissolved on 31.03.2017. Prepare the Realisation account by Considering the following:

1) Stock realized ₹ 9,000

ii) Sundry assets sold for ₹ 45,000

iii) Realisation expenses met ₹ 2,000

iv) Creditors paid in full

Answer:

Realisation A/c

Answer any 1 of the following from 15 and 16, which carries 8 scores. (1 × 8 = 8)

Question 15.

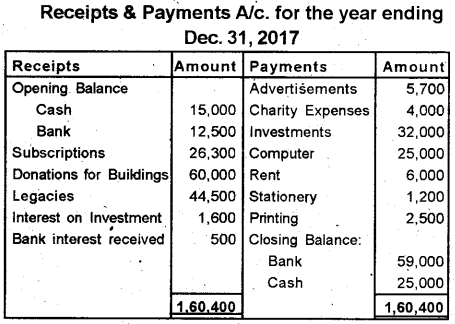

Bright Charitable Society gives you their Receipts and Payments Accounts:

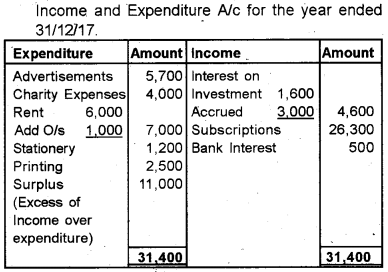

Prepare Income & Expenditure A/c. and the Balance Sheet for the year ended Dec. 31.2017 by giving due attention for the following:

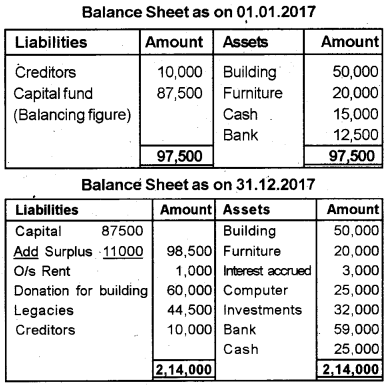

i) On 01.01.2017 the society owned a building worth ₹ 50,000 and Furniture worth ₹ 20,000 and it had creditors of ₹ 10,000.

ii) Donations and legacies are to be capitalised.

iii) Interest on ivestment accrued ₹ 3,000.

iv) Outstanding rent ₹ 1,000.

Answer:

Question 16.

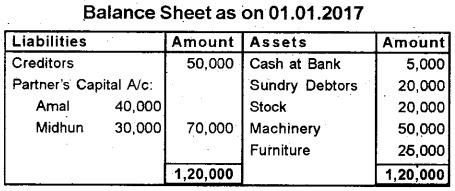

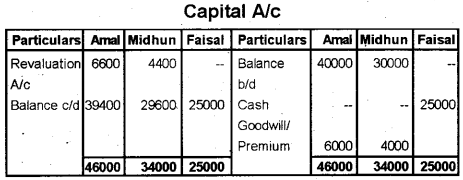

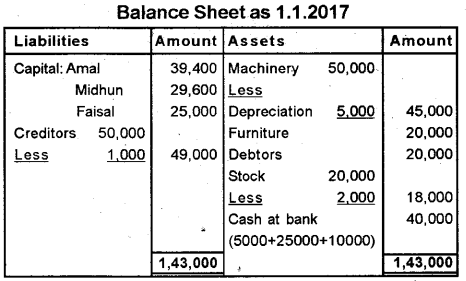

Given below is the Balance Sheet of Amal and Midhun who share profits and losses in the ratio of 3 : 2.

Mr. Faisal is admitted into the partnership on the following terms:

i) New partner has to bring in 25,000 as capital and 10,000 as goodwill for 1/6th share.

ii) A creditor of 1,000 will not claim his amount.

iii) Furniture is revalued at 20,000.

iv) Stock reduced by 2,000.

v) Depreciation on machinery @ 10% PA.

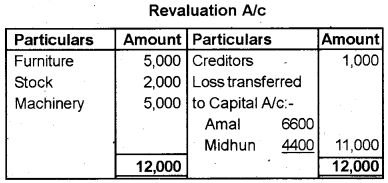

Prepare the Revaluation A/c.,Partners’ Capital A/c. and the Balance Sheet after admission.

Answer:

Part – B

COMPUTERISED ACCOUNTING

Answer all questions from 1 to 3, each carries 1 score. (3 × 1 = 3)

Question 1.

Identify the suitable argument in a financial function representing the number of payments from following

a) FV

b) PV

c) Rate

d) Nper

Answer:

d) Nper

Question 2.

Can you help Mr. Ajith Kumar by pointing out the missing steps to create a chart in spreadsheet from the following:

Enter the data in cells → select the data → ……….. → ……… →Finish.

Answer:

Insert → Chart

Question 3.

In an accounting software, the ledger cash’ comes under ……….. group.

a) Investments

b) Current Assets

c) Fixed Assets

d) Capital

Answer:

b) Current Assets

Answer any 3 questions from 4 to 7. Each carries ‘2’ scores. (3 × 2 = 6)

Question 4.

Develop a coding structure and the code number with assumed figures for allotting register numbers for the students in higher secondary exam with district code, school code and admission number.

Answer:

District Code – 8

School code – 8130

Admission number – 3254

Register Number of the student is 8 8130 3254

Question 5.

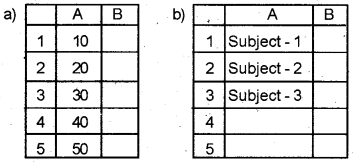

Have a look on the Spreadsheet tables given below and explain the procedure to fill the data in both the cases:

Answer:

Edit → fill series

Or

select a cell and drag using the fill handle

Question 6.

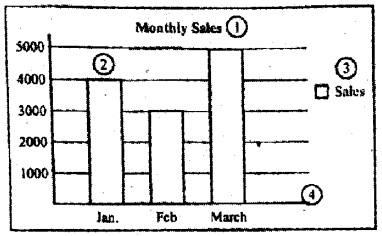

Identify the elements of a chart 1 to 4 from the following figure:

Answer:

1) Chart Title

2) Data series/Data point/plot area

3) Legend

4) X-axis

Question 7.

A Data Base Management System (DBMS) has different components. List out any four of them.

Answer:

a) Table

b) Form

c) Report

d) Module

e) Macros

g) Pages

Answer any 2 questions from 8 to 10. Each carries 3 scores. (2 × 3 = 6)

Question 8.

Mr. Anjay a newly admitted student in the class have no idea about the mathematical functions in Spreadsheet. Can you help him to learn any three mathematical functions and its purpose?

Answer:

a) SUM

b) SUMIF

c) AVERAGE

d) MIN

e) MAX

f) ROUND

g) ROUNDUP

h) ROUNDDOWN

i) COUNT

j) COUNTA

k) COUNT BLANK

l) COUNTIF

SUM (): This function adds all the numbers in a range of cells. The AutoSum (Σ) button can also be used directly for summation ot values from cells.

Syntax : = SUM (number 1, number 2, ………..)

SUM IF (): It returns the sum of the cells as per a given criteria.

a) Range is the range of cells to evaluate.

b) Criteria defines which cells will be added.

c) Sum_range, is the range from which values are summed.

ROUND () : This function rounds a number to specified number of digits or decimal places.

Syntax : = ROUND (Number, Count)

Question 9.

One of your friends argued that there is no difference between SLN and DB functions in Spreadsheet. Do you agree with this? Substantiate your answer.

Answer:

a) No

b) SLN = Depreciation is calculated under fixed instalment method

Syntax = SLN (Cost, Scrap, Life)

c) DB = Depreciation is calculated under diminishing balance method

Syntax = DB (Cost, Salvage, Life, Period, Month)

Question 10.

Explain the procedure for creating ‘Table’ in a database and how to set the primary key.

Answer:

Step 1 = Open Libreoffice base

Applictions → Office → Libreoffice base

Step 2 = Create a new data base

Database wizard → Create new data base → next → Enter Finish button

Step 3 = From the data base panel, select the object Table under design view

Enter Field Type → Save the Table by setting Parimary Key

Answer the question number 11, which carries 5 scores. (1 × 5 = 5)

Question 11.

Ms. Sunitha, a Commerce student, while presenting a seminar on accounting software package, commented that the procedure for entering closing stock and opening stock are one and same. Do you agree? Explain the procedure in detail.

Answer:

a) No

b) Opening stock account

Stage 1:

Step 1 → Click on Master tab

Step 2 → Select Edit account option from the drop

Step3 → Select Stock at the beginning from the edit account window

Step 4 → Click on Edit Button

Step 5 → Enter opening balance amount

Step 6 → Click on Save button to save the amount

Stage 2:

Step 1 → Click on Transaction tab

Step 2 → Select Journal option to activate Journal Voucher

Step3 → Enter voucher number

Step 4 → Enter opening date

Step 5 → Select Opening Stock a/c in Dr. Account and enter opening stock amount

Step 6 → Select stock at the beginning a/c in the Cr. account and enter the opening stock amount

Step 7 → Give narration

Step 8 → Click on Save button or Pres Enter key

c) Closing Stock account

Closing stock is entered through appropriate voucher

Voucher menu/Transaction menu Journal or F9

Closing Stock a/c Dr.

To P/L a/c

(Value of closing stock brought into account)