Kerala Plus Two Accountancy Notes Chapter 4 Reconstitution of a Partnership Firm-Retirement/Death of a Partner

Summary

Retirement of a partner

A partner’s withdrawal from the business with the consent of other partners or as per the provisions of the partnership deed or by giving notice of retirement is called retirement of a partner.

Accounting problems on retirement

Accounting problems that arise on the retirement of a partner are as follows

(a) New profit sharing ratio:

It is the ratio in which the remaining partners will share future profits after the retirement of any partner.

New share = Old share + acquired share from outgoing partner.

(b) Gaining Ratio:

The ratio in which the continuing partners decide to share the outgoing partner’s profit is called gaining ratio.

Gaining ratio = New ratio – Old ratio

(c) Treatment of goodwill:

A partner who is retiring from the firm is entitled to his share of goodwill. It is fair and equitable to compensate the retiring partner for the respective share of goodwill by the continuing partners in their gaining ratio.

I. When goodwill does not appear in the books.

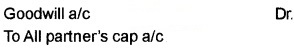

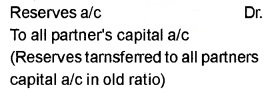

A. Goodwill is raised at its full value and retained-in the books as such. The journal entry is,

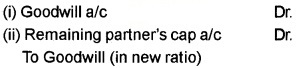

B. Goodwill is raised at its full value and written off immediately.

The journal entry is

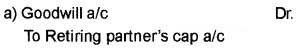

C. Goodwill is raised to the extent of retiring partner’s share and written off immediately.

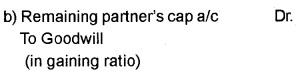

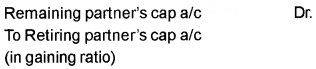

D. No goodwill is raised at all in firm’s books.

Journal entry is

II. When goodwill already appearing in the books.

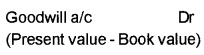

(i) If the book value of goodwill is lower than its present value

Journal entry is:

To All partners cap a/c (in old ratio)

(ii) If the book value of goodwill is greater than its current value:

Journal entry is:

Accumulated profits/losses:

Reserves and accumulated profits/losses belong to all the partners and hence should be transferred to capital accounts of all partners.

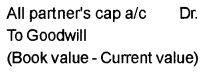

(i) For transfer of accumulated Profits (Reserves)

(ii) For transfer accumulated losses

(e) Revaluation of assets and liabilities:

Same as in the case of admission.

(f) Settlement of accounts:

The total amount due to the retiring partner may be paid in one lump sum or instalments with interest.

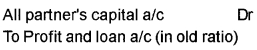

(i) When retiring partner is paid cash in full.

![]()

(ii) When retiring partner’s whole amount is treated as loan.

![]()

(iii) When retiring partner is partly paid in cash and the remaining amount treated as loan.

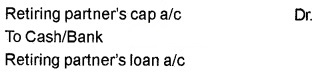

(iv) When loan a/c is settled by paying in instalment includes principal and interest.

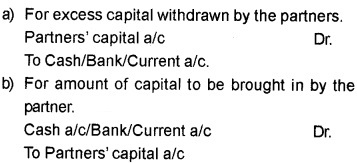

(g) Adjustment of capitals of continuing partners:

At the time of retirement the remaining partners may decide to keep their capitals in their profit sharing ratio.

Total capital = Combined adjusted capital of remaining partners.

Death of a Partner:

Death, being a natural phenomenon, may take place at any time. A partnership comes to an end on the death of any one of the partners, although the firm may continue with the remaining partners. The accounting treatment for various adjustments in case of death of a partner is similar to that of a retiring, partner.

According to Section 37 of the Partnership Act, the executors of the deceased partner are entitled, at their choice, to interest at 6% p.a. on the amount due, from the date of death till the date of payment or that portion of profit earned by the firm with the help of the amount due to the deceased partner.

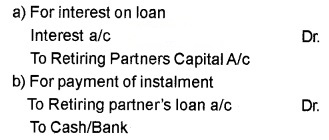

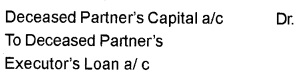

The amount due to the deceased partner may be paid off immediately to his legal heirs, or executors. Whenever a firm is not in a position to make the final payment immediately in cash, the same is transferred to his executor’s loan account. The Journal entry will be:

Afterwards, the balance appearing in this account can be paid off in installments. On payment of installments periodically, as agreed, the journal entry will be:

![]()