Kerala Plus Two Accountancy Model Question Paper 1 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 60

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part – A

ACCOUNTANCY

I. Answer all questions from 1 to 5, each question carries 1 score. (5 × 1 = 5)

Question 1.

In the debit side of the Receipt and Payments account of a club showed a pavilion fund of Rs. 10,000. While preparing the final accounts of that club, pavilion fund should be shown on …………

a) Asset side of balance sheet

b) Liability side of balance sheet

c) Debit side of income and expenditure account

d) Credit side of income and expenditure account

Answer:

b) Liability side of balance sheet

Question 2.

P, Q and R are partner in a firm sharing profits and losses in the ratio of 3 : 2 : 1. R retired from the business. Gaining ratio of P and Q will be

a) 2 : 1

b) 3 : 1

c) 3 : 2

d) 1 : 1

Answer:

c) 3 : 2

Question 3.

On dissolution of a firm the loss on realisation is transferred to ………….

a) Debit side of partner’s capital account

b) Credit side of partner’s capital account

c) Debit side of bank account

d) Credit side of bank account

Answer:

a) Debit side of partner’s capital account

Question 4.

A and B are partners in a firm sharing profits and losses in the ratio of 2 : 1. They admitted C into the firm for 1/4th share in future profits. The new profit sharing ratio will be …………

a) 1 : 1 : 1

b) 2 : 2 : 1

c) 2 : 1 : 4

d) 2 : 1 : 1

Answer:

d) 2 : 1 : 1

Question 5.

Receipts and payments account of a not for profit organisation is similar to ……….. of a business organisation.

a) Profit & loss account

b) Cashbook

c) Balance sheet

d) All of the above

Answer:

b) Cashbook

Answer any 3 questions from 6 to 9. Each question carries 2 score. (3 × 2 = 6)

Question 6.

Akhil, a partner withdrew Rs. 4,000 each on the last day of every month throughout an accounting year. Calculate his total interest on drawing at 12% p.a.

Answer:

Total drawings = 4000 × 12 = 48,000

Interest on drawings = 48,000 × \(\frac{12}{100}\) × \(\frac{5.5}{12}\)

= 2640

Question 7.

State any two circumstances under which a partnership firm will be dissolved.

Answer:

- Dissolution by agreement

- Compulsory dissolution

Question 8.

Name the accounts to be prepared on dissolution of a firm, except cash/bank account.

Answer:

- Realisation Account

- Partner’s Capital Account

Question 9.

State any two features of not for profit organisation.

Answer:

- Not for profit organisations are formed for providing services to a specific group or public.

- They do not normally engage in trading activities.

- They are not expected to earn profit.

Answer any 1 question from 10 to 11. Each question carries 3 score. (1 × 3 = 3)

Question 10.

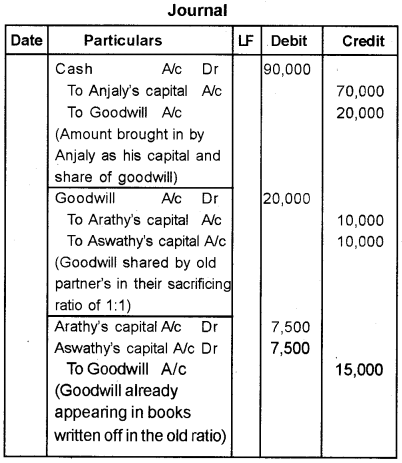

Arathy and Aswathy are partners in a firm. They admitted Anjaly into the firm for 1/4th share in future profits. As per partnership deed Anjaly should bring Rs. 70,000 as her capital and Rs. 20,000 as her share of goodwill. At the time of Admission of Anjaly, the balance sheet of Arathy and Aswathy showed a goodwill of Rs. 15,000.

Pass Journal entry for the above transactions.

Answer:

Question 11.

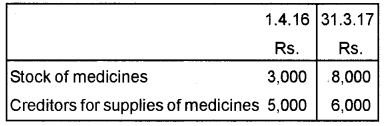

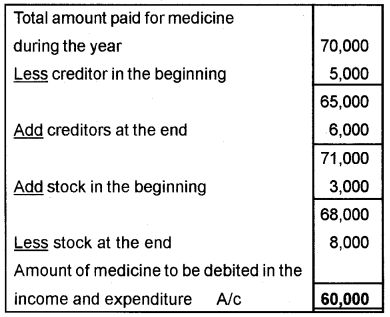

Following information was given by Aditya Hospital for the year ending 31.3.2017.

The total amount paid for medicine during the year was Rs. 70,000.

Calculate total amount of medicine to be debited in the income and expenditure account of the hospital for the year ending 31.3.2017.

Answer:

Answer all questions from 12 to 13. Each question carries 4 score. (2 × 4 = 8)

Question 12.

State any four items appear on the credit side of a deceased partners capital account.

Answer:

- Balance in Capital Account

- Share of goodwill

- Interest on capital

- Salary, commission etc.

- Revaluation profit

- Profit & loss(suspense) Account

- Reserve fund

Question 13.

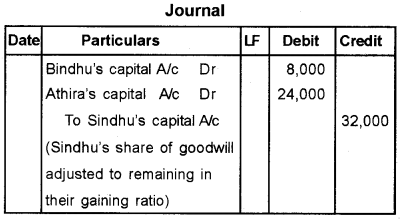

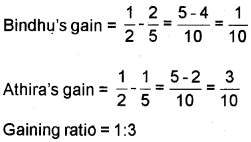

Bindhu, Sindhu and Athira are partners in a firm sharing profits and losses in the ratio of 2 : 2 : 1. On 31.3.2017, Sindhu retired from the business. On that date goodwill of the firm was valued at Rs. 80,000. Bindhu and Athira decided to continue in the business in the ratio of 1 : 1.

Pass journal entry for the Sindhu’s share of goodwill.

Answer:

Note:

1. Sindhu’s share of goodwill = 80,000 × \(\frac{2}{5}\) = 32,000

2. Calculation of gaining ratio

Gaining ratio = New ratio – old ratio

New ratio = 1 : 1, old ratio = 2 : 2 : 1

Answer any 2 questions from 14to 16. Each question carries 5 score (2 × 5 = 10)

Question 14.

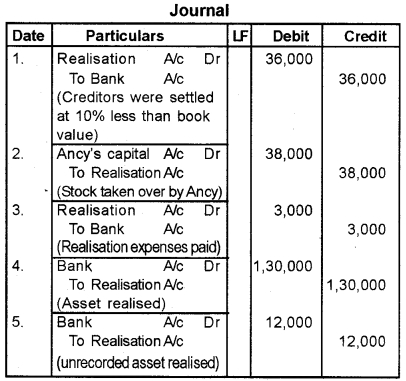

Ancy, Jancy and Bincy are partners in a firm sharing profits and losses in the ratio of 2 : 1 : 1. They dissolved the firm on 31.3.2017. On dissolution following were some of the transaction taken place after the assets and liabilities are transferred to realisation account.

a) Creditors were settled at 10% less than book value (Book value Rs. 40,000)

b) Stock was taken over by Ancy at Rs. 38,000

c) Realisation expenses amounted to Rs. 3,000

d) Total assets realised Rs. 1,30,000

e) There was an unrecorded computer which was sold for Rs. 12,000

Pass journal entries for the above transactions.

Answer:

Question 15.

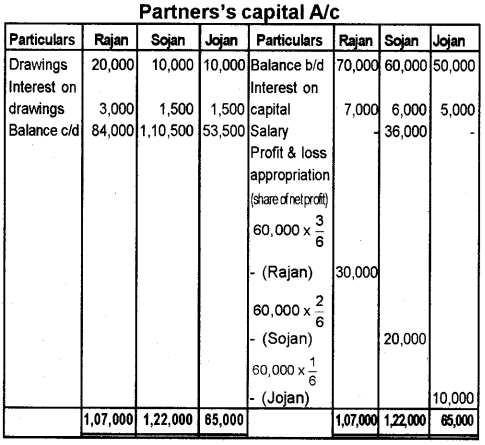

Rajan, Sojan and Jojan are partners in a firm in the ratio of 3 : 2 : 1. Their capital balances as on 1.1.2016 were Rs. 70,000, Rs. 60,000 and 50,000 respectively. According to the partnership deed;

a) All the partners are entitiled to get interest on capital at 10% p.a.

b) Sojan to get a salary of Rs. 3,000 per month.

c) Interest of drawings is to be charged at 15% p.a, irrespective of the period of withdrawal.

Their drawings for the year 2016 were Rs. 20,000, Rs. 10,000 and Rs. 10,000 respectively. During the year 2016, the firm earned a net profit of Rs. 60.000 after making all appropriations (divisible profit).

Prepare capital accounts of partners under fluctuating capital method.

Answer:

Question 16.

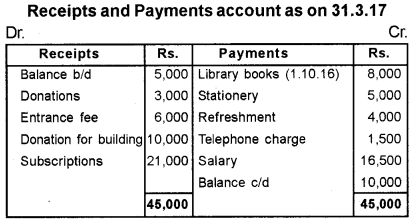

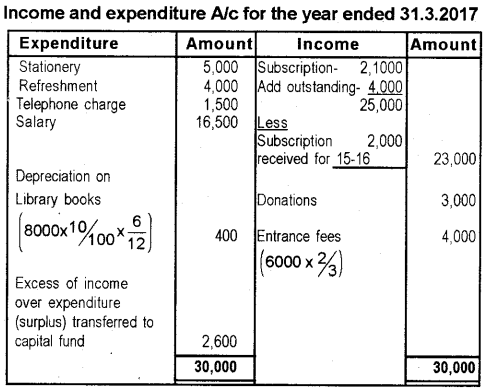

Following is the Receipts and payments account of a club for the year ending 31.3.2017.

Additional information

a) The club had 100 members each paying an annual subscription of Rs. 250/-

b) Subscription received includes Rs. 2,000 relating to the year 2015 – 16.

c) Depreciate library books at 10% p.a.

d) 2/3 of entrance fee is to be treated as income,

Prepare income and expenditure account of the club for the year ending 31.3.2017.

Answer:

Note: Donation of Rs. 3,000 may be treated as income. It may be considered as a general purpose donation.

Answer the following. It carries 8 score. (1 × 8 = 8)

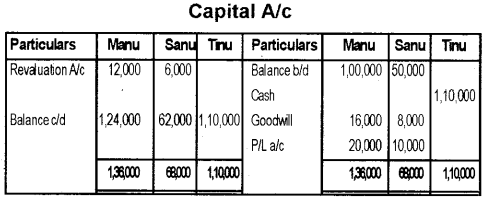

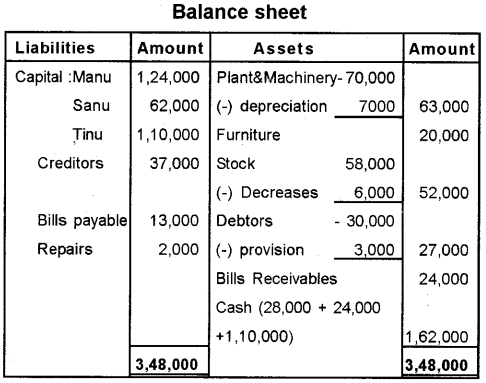

Question 17.

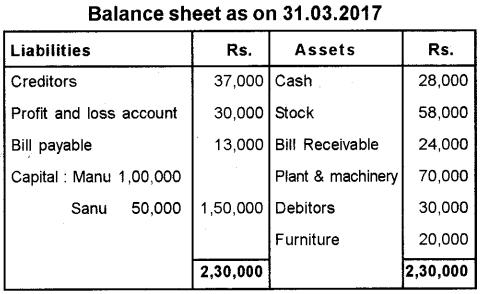

Manu and Sanu are partners in firm sharing profits and losses in the proportion of their capital. Their balance sheet as on 31.3.2017 was as follows.

They admitted Tinu into the firm on the above date for 1/4th share in future profits on the following terms.

a) Tinu should bring Rs. 1,10,000 as his capital and Rs. 24,000 as his share of goodwill.

b) There was an unrecorded liability of Rs. 2,000 to be brought into record relating to repairs.

c) Provision for doubtful debts is to be provided at 10% on debtors.

d) The stock was revalued at Rs. 52,000.

e) Plant and machinery is to be depreciated at 10% pa.

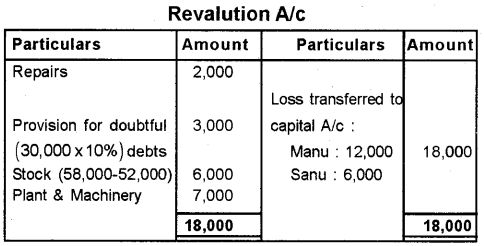

Prepare revaluation account, capital accounts of partners and new balance sheet of the firm.

Answer: