Kerala Plus Two Accountancy Chapter Wise Questions and Answers Chapter 5 Dissolution of Partnership

Plus Two Accountancy Dissolution of Partnership One Mark Questions and Answers

Question 1.

Which is not correct in the case of Dissolution of Partnership

(a) The original partnership agreement is terminated

(b) Some partners continue in the business

(c) No partner to continue in the business

(d) A new partnership comes into existence

Answer:

(c) No partner to continue in the business

Question 2.

Dissolution of partnership does not lead to

(a) Termination of the original partnership agreement

(b) Dissolution of the existing partnership

(c) Coming into existence of a new partnership

(d) Dissolution of the firm

Answer:

(d) Dissolution of the firm

Question 3.

Realisation Account is a

(a) Nominal Account

(b) Real Account

(c) Personal Account

(d) None of these

Answer:

(a) Nominal Account

Question 4.

The Account prepared at the time of dissolution of a partnership firm

(a) Revaluation Account

(b) P&L Adjustment A/c

(c) P&L Appropriation A/c

(d) Realisation Account

Answer:

(d) Realisation Account

Question 5.

The Realization account is closed by transferring the profit or loss to

(a) Partner’s Capital Accounts

(b) Partner’s Loan Account

(c) Bank Account

(d) Balance Sheet

Answer:

(a) Partner’s Capital Account

Question 6.

The Loan from Mrs.of a partner is credited to

(a) Her Capital Account

(b) Husband’s Capital Account

(c) Husband’s Loan Account

(d) Realisation Account

Answer:

(d) Realisation Account

Question 7.

On dissolution of partnership Firm, amount realised from unrecorded asset is credited to.

(a) Realisation A/c

(b) Re-Valuation A/c

(c) Capital A/c

(d) Goodwill A/c

Answer:

(a) Realisation A/c.

Question 8.

Entry for closing Provision for Bad debts at the time of dissolution of firm is_______.

Answer:

Provision for baddebt a/c Dr. To Realisation

Question 9.

Should you pass any entry for the payment of creditors worth Rs. 5000 on dissolution. If they accept stock of the same value? If yes, what is the journal entry?

Answer:

Creditors takes over stock of the same value. So no journal entry is need to be passed.

Question 10.

A firm is compulsorily dissolved when all partners or when all except one partner become insolvent – True or False

Answer:

True.

Question 11.

Unrecorded liabilities when paid by a partner are shown in_______.

Answer:

Debit of realisation a/c

Question 12.

On dissolution of a firm, bank overdraft is transferred.

(a) cash a/c

(b) bank a/c

(c) Realisation a/c

(d) capital a/c

Answer:

(c) Realisation a/c

Question 13.

On dissolution of the firm, partners capital accounts are closed through_______account.

Answer:

Cash/Bank Account

Plus Two Accountancy Dissolution of Partnership Two Mark Questions and Answers

Question 1.

What do you mean by Dissolution of partnership?

Answer:

Dissolution of partnership means termination of the existing partnership agreement between the partners. This may due to admission, retirement or death of a partner. In the case of dissolution of the partnership, the firm continues to exist.

Question 2.

What is meant by Dissolution of firm?

Answer:

Termination of the partnership agreement between all the partners is known as dissolution of firm. In the case of dissolution of firm, the firm ceases to exist and the business of the firm is closed.

Question 3.

Why the balance at bank is not transferred to the Realisation A/c on the dissolution of a Partnership? Answer:

On the dissolution of a partnership the balance at bank is not transferred to the Realisation A/c be cause, there is no need to realise the same.

Question 4.

How will you settle firm’s debts and private debts of partner’s on the dissolution of a firm?

Answer:

Since the liability of partners is unlimited their private assets can be used to pay off the firm’s debts. But they will have the right to use their assets for paying their private debts first. They need to contribute only the remaining assets.

Question 5.

What is Realisation Account?

Answer:

Realisation Account is an account prepared at the time of dissolution of a partnership firm. It is to close the assets and liabilities and to find out the profit or loss and for the payment of liabilities.

Question 6.

What is the Accounting treatment of settlement with the creditors through transfer of an asset?

Answer:

Settlement with the creditors through transfer of assets require no entry. It is because the liability to the creditors has already been closed by transferring the same to realization account. The asset account also was closed by transferring to the same account.

Question 7.

How goodwill is treated on dissolution of the firm ?

Answer:

On dissolution of firm goodwill is treated like the other assets. It is transferred to realization account at its balance sheet amount. The amount realized for goodwill if any, is credited to realization account.

Question 8.

Complete the series

- Sacrificing ratio: admission: Gainining ratio:?

- Dissolution: Realisation A/c: Reconstitution: ?

- Trading A/c: Profit and Loss A/c: Profit and Loss A/c:?

- Balance of capital A/c: Balance sheet Balance of profit and loss appropriation a/c:?

Answer:

- S.R. (Sacrificing Ratio) : Admission, G.R (Gaining Ratio) : Retirement

- Dissolution : Realisation a/c Reconstitution: Revaluation a/c

- Trading a/c : P&La/c, P & L a/c : P & L appropriation a/c

- Balance of capital a/c : B/S, Balance of P & L appropciation a/c : Capital a/c.

Plus Two Accountancy Dissolution of Partnership Three Mark Questions and Answers

Question 1.

Which are the cases where a partnership is dissolved?

Answer:

Following are the cases in which a partnership is dissolved.

- Change in the profit-sharing ratio

- Admission of a partner

- Retirement, death of a partner

- Insolvency of a partner

- Completion of the venture for which it is formed

- Expiry of the period

Question 2.

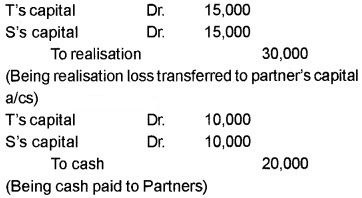

Toya and Soya are partners sharing profits and losses equally. They decided to dissolve the firm on 15th March 2005 which resulted in a loss of Rs. 30,000. The capital accounts of Toya and Soya was Rs. 20,000 and Rs. 30,000 respectively. The cash account showed a balance of Rs. 20,000. You are required to pass journal entries for

- Transfer of loss to the capital accounts of partners.

- Making final payments to the partners.

Answer:

Plus Two Accountancy Dissolution of Partnership Five Mark Questions and Answers

Question 1.

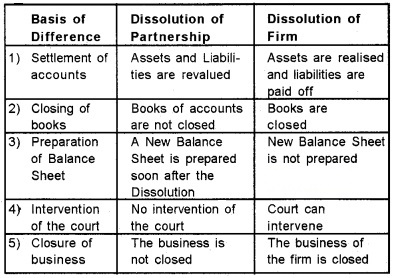

Distinguish between dissolution of partnership and dissolution of firm.

Answer:

Question 2.

How the accounts are settled on dissolution?

Answer:

On dissolution of a firm, the assets are realized (disposed) and the liabilities are paid off. Balance if any is shared among the partners. According to the Partnership Act, the following rules can be followed for the settlement of accounts.

1. Loss is to be paid first out of profits, next out of capital and last out of the private assets of partners in their ratio.

2. Amount realized from the assets of the firm shall be used in the following order

- Paying the realisation expenses

- Paying the liabilities to outsiders

- Paying the loans from partners

- Paying the capital of the partners

- Surplus if any is to be distributed to partners

Question 3.

Explain the different modes of dissolution of a partnership firm.

Answer:

Different modes of dissolution of a partnership firm are the following

(i) Dissolution by Agreement (section 40)

A firm is formed by an agreement between the partners. So it may be dissolved by the partnership agreement or with the consent of all the partners.

(ii) Compulsory Dissolution (Section 41)

A firm is dissolved compulsorily in the following cases

- When all the partners or all except one become insane or insolvent.

- When the business of the firm becomes illegal.

- When all the partners except one retire.

- When all the partners or all except one die.

- When the period of partnership expires,

- When the venture for which the partnership was formed becomes complete.

(iii) Dissolution on the happening of contingencies(42)

A firm may be dissolved on the happening of the following contingencies or events

- On the death of a partner

- On the insolvency of a partner

(iv) Dissolution by Notice (Sec 43)

If the partnership is a partnership at will, it can be dissolved by a partner by giving a notice to the other partners showing his will to dissolve the firm.

(v) Dissolution by Court (Sec 44)

A Court may issue an order to a partnership firm to dissolve the same on the suit of a partner in the following circumstances

- If a partner becomes insane

- If a partner becomes in capable of performing his duties

- If a partner is found guilty of misconduct affecting the firm

- If a partner intentionally and continuously commits breach of contract

- If a partner transfers his interest in the firm to an outsider.

- If the business of the firm cannot be carried on except at a loss

- lf the court thinks it just and equitable to dissolve the firm

Question 4.

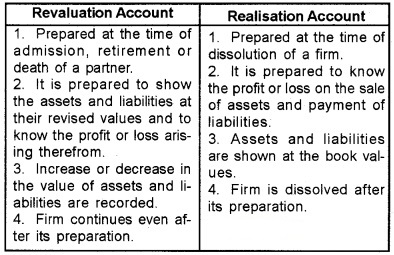

Differentiate between Realisation Account and Revaluation Account.

Answer:

Question 5.

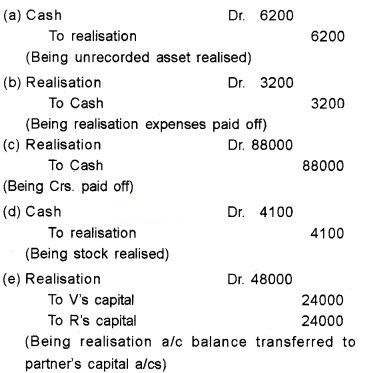

What entry would you pass for the following transaction on the dissolution of a firm having partners Vishal and Rakesh.

- An unrecorded asset realised Rs. 6200.

- Dissolution expenses amounted to Rs. 3200.

- Creditors already transferred to realisation account were paid Rs. 88,000.

- Stock worth Rs. 5400 already transferred to realisation account was sold for Rs. 4100.

- Profit on realisation Rs. 48000 to be distributed between partners, Vishal and Rakesh?

Answer:

Question 6.

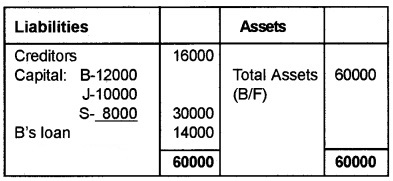

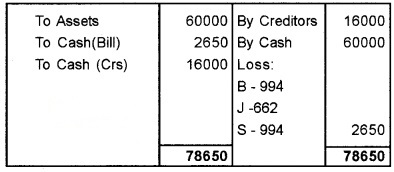

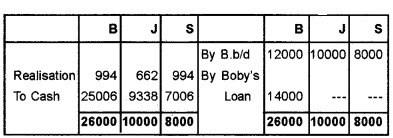

Boby, Jestin, and Sudheer are in partnership in the ratio of 3:2:3. They have decided to dissolve the firm. On the date of dissolution total creditors were Rs.16,000; Bills discounted Rs. 2,650 during the year, has become a real liability which has to be paid, through this has not been recorded anywhere in the books of accounts. Their capital account balances were Boby Rs. 12000; Jestin Rs. 10000; Sudheer Rs. 8000 respectively. Boby advanced Rs. 14000 besides his capital account.

Find out

- Total Sundry Assets

- Realisation Account

- Capital accounts of partners

Answer:

Balance Sheet

Realisation A/c

Capital A/cs

Plus Two Accountancy Dissolution of Partnership Eight Mark Questions and Answers

Question 1.

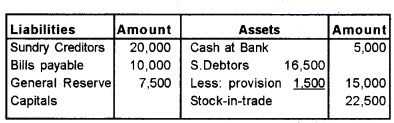

Appu and Chinku were partners in a firm sharing profits and losses in the ratio of 4: 3. Their Balance Sheet as on 31st December 2005 was as follows.

The firm is dissolved as on the Balance sheet date. The assets were realized as follows.

| Sundry Debtors | Rs. 14,000 |

| Stock-in-trade | Rs. 21,000 |

| Furniture | Rs. 17,500 |

| Machinery | Rs. 25,000 |

Sundry Creditors were paid at a discount of 15%. The expenses on realisation amounted to Rs. 2,500. Pass journal entries and prepare ledger accounts on dissolution of the firm.

Answer:

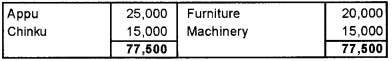

Journal

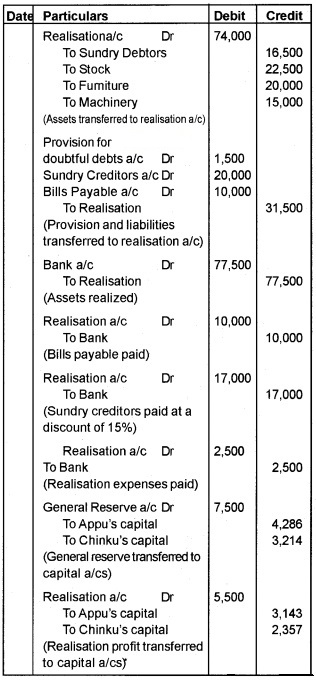

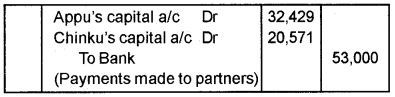

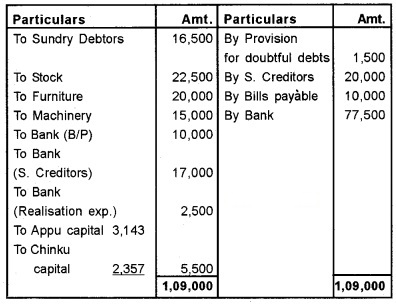

Realisation Account

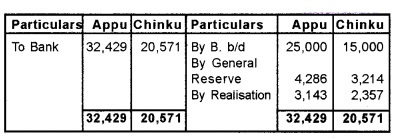

Partners’ Capital Account

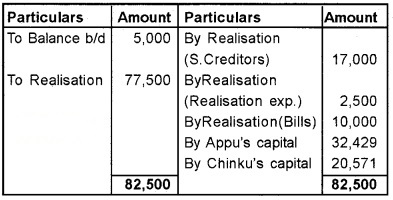

Bank Account

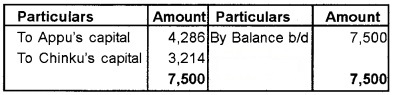

General Reserve Account

Question 2.

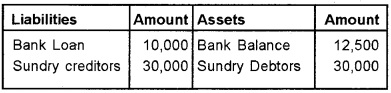

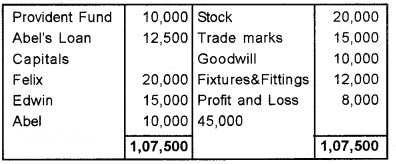

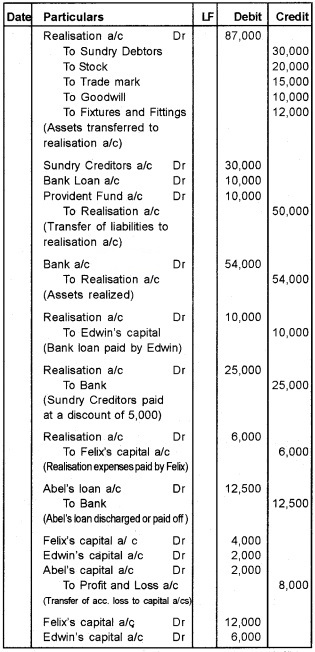

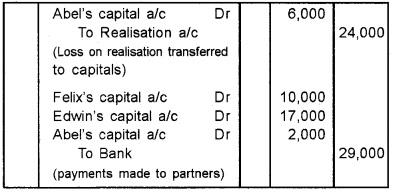

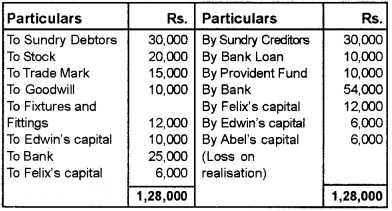

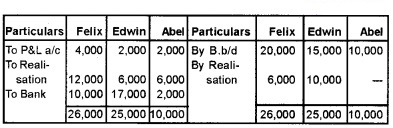

The following is the Balance Sheet of Felix, Edwin, and Abel sharing profits and losses in the ratio of 2: 1: 1 as on 31th March 2005.

The firm is dissolved. Sundry debtors realized Rs. 25.0 and stock Rs. 17,000. Trade mark and goodwill became valueless. Edwin agrees to discharge the bank loan. Creditors are paid Rs. 25,000 in full settlement, realisation expenses amounted to Rs. 6.0 paid by Felix. Pass journal entries and prepare ledger accounts.

Answer:

Journal

Realisation Account

Partner’s Capital Account

Bank Account

Notes:

- If nothing is given in the question, it is assumed that the assets(real) are realized and liabilities are paid off at their book value.

- Partners loan is not transferred to realisation account but paid directly.

Question 3.

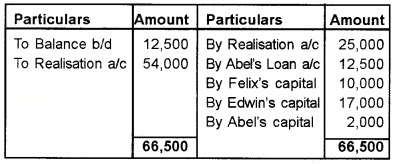

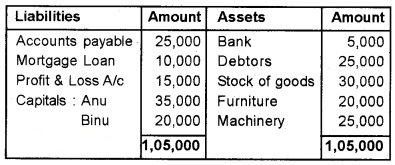

Anu and Binu were partners sharing profits and losses in the ratio of 1/2 and 3/4. Their Balance Sheet as on 30th June 2004 was as follows.

The firm is dissolved. Furniture and Machinery realized 10% less than their book values. Rs.20,000 is collected from debtors. Anu took over the stock at Rs. 25,000. The firm had an unrecorded liability on outstanding expenses Rs.2,500. Realisation expenses amounted to Rs. 2,000. Record journal entries and prepare ledger accounts.

Answer:

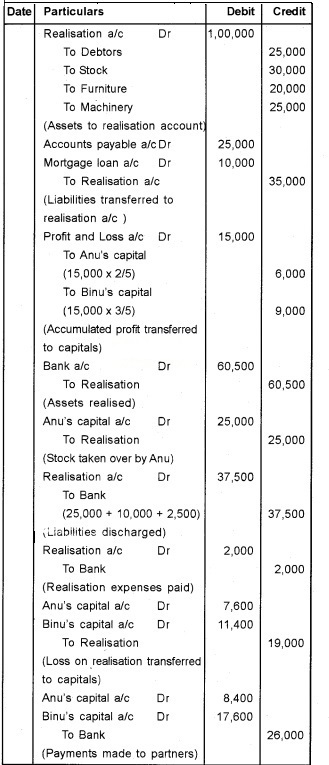

Journal

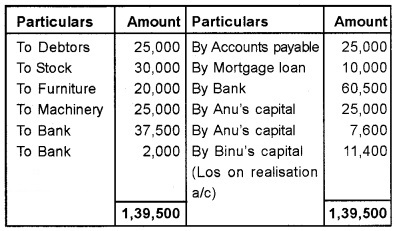

Realisation Account

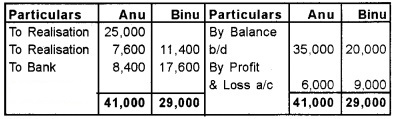

Partner’s Capital Account

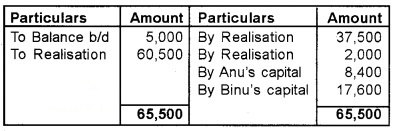

Bank Account

Question 4.

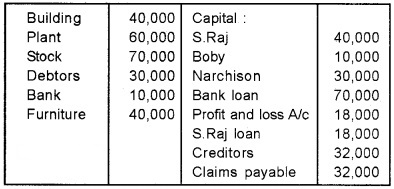

S.Raj, Narchison, and Boby are partners sharing profits in the ratio of 2:2:1, Whose ledger accounts on 31.03.06 reveal the following balances.

The firm dissolved on the above date.

- During the years S.Raj withdraw from Bank Rs. 6,000 for his personal purpose which has not been brought into the records.

- Rs. 10,000 was realised on account of unrecorded investments which was totally utilised for a liability on account of a claim payable to customers and the balance has been paid in cash.

- Fixed Assets realised more than 10% of book value.

- Sundry debtors could be collected only to the extend of 90% of the book value.

Prepare necessary accounts.

Answer:

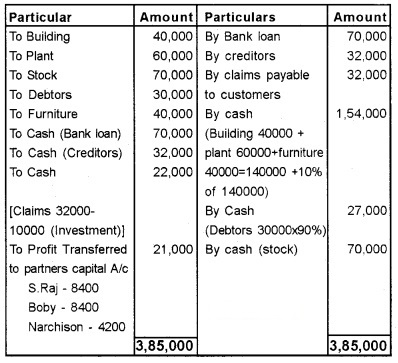

1. Realisation A/c

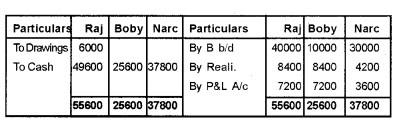

Capital Account

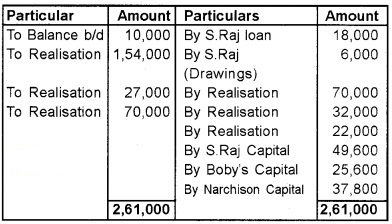

Bank A/c

Question 5.

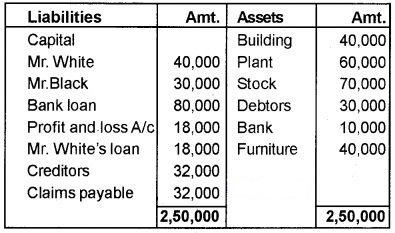

Mr. White and Mr. Black are partners sharing profits in the ratio of 3:2. They decided to close the firm and their Balance sheet is given below.

Balance sheet as on 31.03.2005

Assets realised as follows:

Building – 32,000, Debtors – 28,000, Furniture – 36,000 Liabilities settled as follows. Plant has been taken over by bank at Rs. 66,000 in respect of the loan granted by the bank and the rest has been paid in cash. Creditors are settled at Rs. 30,000. Realisation expenses came to Rs. 1,000 which have been met by Mr. Black. Prepare necessary accounts to dissolve the firm.

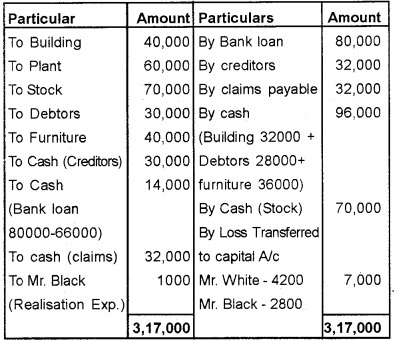

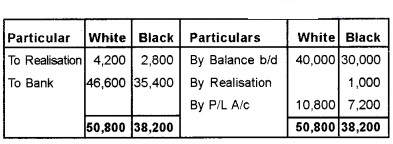

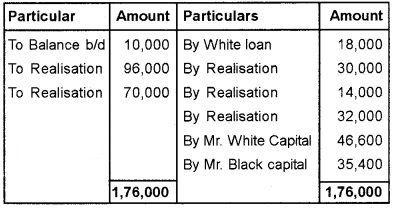

Answer:

Realisation A/c

Capital A/c

Bank A/c

Question 6.

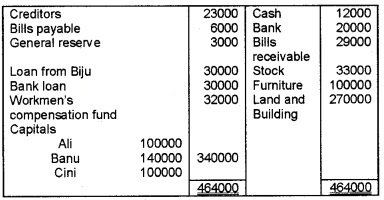

Ali, Banu, and Cini were in partnership who have dissolved their firm on 31.10.2006 on which date their Balance sheet stood as follows.

Balance sheet as on 31.10.2006.

- Bank passbook shows its balance to be Rs. 21,300. The difference is due to realisation of a claim directly credited to Bank Account.

- Bills Receivable collected Rs. 300 less.

- Stock has been utilized to settle the loan with Biju.

- Unrecorded electronic equipments worth Rs.5000 has been utilised for settling the liability on account of Bills payable.

- Land and Buildings was realised at Rs. 2,40,000.

- All other assets were realised and liabilities were settled at book value.

Prepare necessary accounts.

Answer:

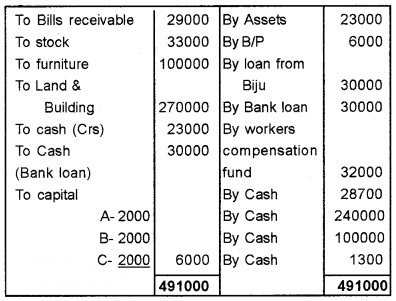

Realisation A/c

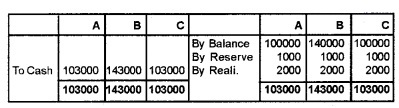

Capital A/cs

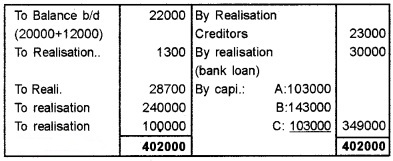

Cash A/c

Question 7.

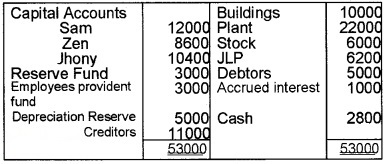

Sam, Zen, and Jhony are in partnership sharing profits and losses in the ratio 3:2:1. Their Balance sheet as on 31st December, 2004 was as follows.

The firm was dissolved on the above date with the following terms.

- Building was taken over by Sam at book value and he agreed to discharge the creditors.

- Accured interest was not collected, where as there was a contingent liability of Rs. 600 which was met.

- Assets realised as follows: Plant – 25000, Stock – 5000, Debtors – 4600

- Realisation expenses amounted to Rs. 600 You are required to prepare

- Realisation account

- Capital accounts

- Cash account

Answer:

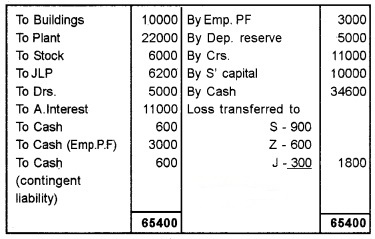

Realisation A/c

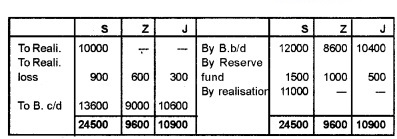

Capital A/cs

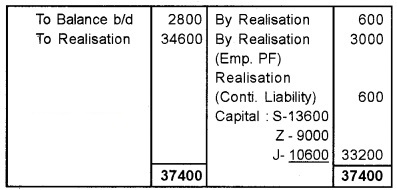

Cash A/c

Question 8.

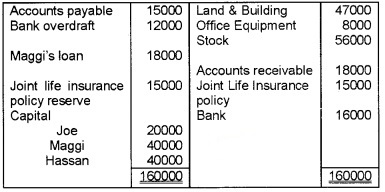

Joe, Maggi, and Hassan were partners sharing profits and losses in the ratio of 1:2:2. Their Balance sheet as on 31 December 2004 was as follows.

The partners agreed to dissolve the firm on the following terms.

- Assets realised as follows:

Land and Building Rs. 1,20,000 Stock 40,000

Accounts receivable 15,000 - Expenses on dissolution is Rs. 3000

- A creditor accepts office equipments for Rs. 7000 and the remaining creditors were paid in full by cheque.

- The joint life insurance policy was surrendered for Rs.9000. Prepare realisation a/c, capital accounts and bank account.

Answer:

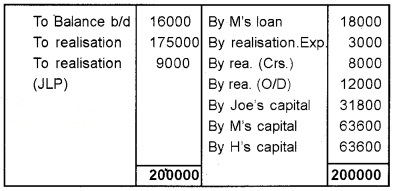

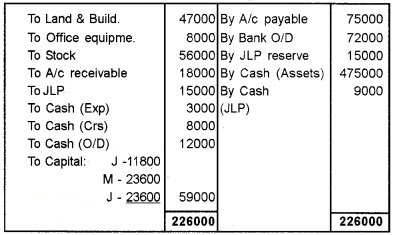

Realisation A/c

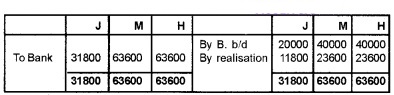

Capital A/c

Bank A/c