Kerala Plus Two Accountancy Chapter Wise Questions and Answers Chapter 4 Reconstitution of a Partnership Firm-Retirement/Death of a Partner

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner One Mark Questions and Answers

Question 1.

A partner who severs his connection with his firm is known as

(a) Retiring partner

(b) Outgoing partner

(c) Incoming partner

(d) None of these

Answer:

(b) Outgoing partner

Question 2.

On retirement of a partner

(a) The partnership is dissolved

(b) The firm is dissolved

(c) The business is dissolved

(d) None of these

Answer:

(a) The partnership is dissolved

Question 3.

The retiring partner is not liable for

(a) The losses of the firm

(b) The losses of the firm till the date of retirement

(c) The losses at the time of his retirement

(d) The losses after his retirement

Answer:

(d) The losses after his retirement

Question 4.

If the firm is not in a position to pay the amount due to the retiring partner, the amount is transferred to

(a) The retiring partner’s capital account

(b) The retiring partner’s loan account

(c) All the partner’s capital account

(d) None of these

Answer:

(b) The retiring partner’s loan account

Question 5.

The amount due to the deceased partner is transferred to

(a) His capital account

(b) His loan account

(c) His executor’s capital account

(d) His executor’s loan account

Answer:

(d) His executor’s loan account

Question 6.

When premium paid on Joint Life Policy is treated as an investment not as a business expense, it is transferred to

(a) Trading account

(b) Profit and Loss Account

(c) Joint Life Policy Account

(d) Joint Life Policy account and Balance Sheet

Answer:

(d) Joint Life Policy account and Balance Sheet

Question 7.

When partner retiring from the firm, the ratio relevant is_______.

(a) Sacrificing ratio

(b) Gaining ratio

(c) New ratio Gaining ratio

Answer:

(b) Gaining ratio

Question 8.

Write the narration of the given journal entry

Continuing Partners Capital A/c Dr.

To Retiring Partners capital A/c

(______________________)

Answer:

Give share of goodwil to retiring partners.

Question 9.

P/L Suspense A/c Dr.

To Deceased partners capital A/c What is the entry stands for?

Answer:

Credit of deceased partners share of profit in the in terim period.

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner Two Mark Questions and Answers

Question 1.

What do you mean by retirement of a partner?

Answer:

Withdrawal of a partner from a partnership firm either by giving a notice of retirement or with the consent of the other partners or as per the provisions of the partnership agreement is called retirement.

Question 2.

What do you mean by Gaining Ratio? How it is calculated?

Answer:

At the time of retirement of a partner, the ratio in which the continuing partners share the profit of the outgoing partner’s profit is called the gaining ratio.

Gaining ratio = New ratio – Old ratio.

Question 3.

How a retiring partner’s share of goodwill is compensated?

Answer:

A retiring partner has the right to get his share of goodwill because the goodwill of the firm has been earned with his efforts too. So he should be compensated by the other partners in their gaining ratio.

Question 4.

What is the treatment of accumulated profits or losses on the retirement of a partner?

Answer:

The general reserve and accumulated profits or losses are transferred to all partners’ capital accounts in their profit sharing ratio. The general reserve and accumulated profits are transferred to the credit side of the account and the accumulated losses to the debit side.

Question 5.

What are the differences between retirement and death, from the accounting point of view?

Answer:

- Retirement is a known thing, so usually takes place at the end of an accounting period, but death may take place at any time.

- On retirement, a partner severs his connection with the firm Voluntarily. But in death, it is automatic.

- On retirement, the amount due to the retiring partner is transferred to his Loan Account, while in death; the total amount due to the deceased partner is transferred to his Executor’s Loan Account.

Question 6.

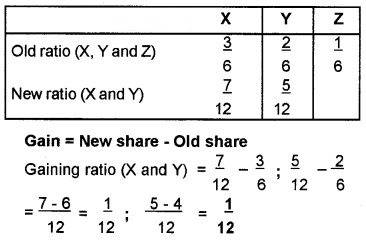

X, Y, and Z were sharing profits in the ratio of 3:2:1. Z retires from the firm. X and Y decide to share future profits in the ratio of 7:5. Calculate the gaining ratio.

Answer:

Question 7.

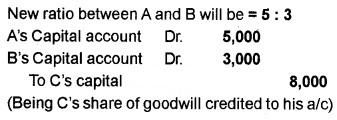

A, B and C are partners sharing profits in the ratio of 5 : 3: 2. C retires and the goodwill is valued at Rs. 40,000. Give entries in the books of the firm regarding treatment of goodwill.

Answer:

C’s share of goodwill = 40,000 × \(\frac{2}{10}\) = Rs. 8,000

Question 8.

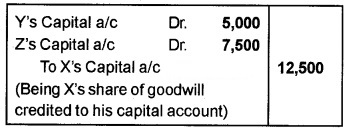

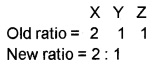

X, Y, Z are partners sharing profits in the ratio of 5:3:2. X retires and for this purpose goodwill is valued at Rs. 25,000. Continuing partners agree that their new profit sharing ratio shall be equal. Record necessary journal entry.

Answer:

Journal

NOTES:

1. Gain of partner = New share – Old share

Y = 1/2 – 3/10 = 5 – 3/10 = 2/10

Z = 1/2 – 2/10 = 5 – 2/10 = 3/10

Gaining ratio is 2 : 3

2. X’s share of goodwill = 25,000 × 5/10 = 12,500

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner Three Mark Questions and Answers

Question 1.

What are the problems that arise with regard to the accounting treatment on the retirement of a partner?

Answer:

- Change in the Profit-sharing ratio.

- Adjustment of goodwill.

- Treatment of accumulated profits and losses.

- Revaluation of the assets and liabilities.

- Calculation of the profit and loss up to the date of retirement.

- Ascertainment of the total amount due to the retiring partner.

- Payment of the amount due to the retiring partner.

- Adjustment of the capitals of the continuing partners.

Question 2.

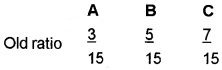

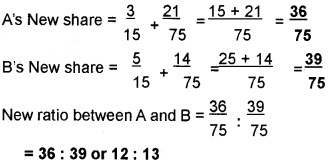

A, B and C were partners sharing profits in the ratio of 3: 5: 7. C retires and his share is taken up by A and B in the ratio of 3: 2. Find out the new profit sharing and gaining ratio of A and B.

Answer:

New share = Old share + Gain

A’s gain is 3/5 of 7/15 = 21/75

B’s gain is 2/5 of 7/15 = 14/75

Gaining ratio is the proportion in which they have acquired C’s share of profit, i.e., 3 : 2. This can be checked by working out in the following way.

Gaining ratio = New share – old share

Question 3.

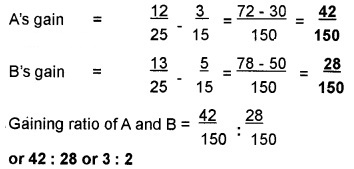

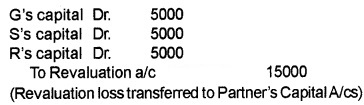

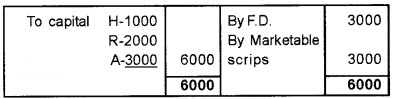

Observe the following journal entry which has been passed at the time of retirement of Ganga Prasad. The other partners were Sheena and Rajani.

- Which account would you prepare to share the profit on revaluation?

- Prepare that account and give a journal entry to share the profit?

Answer:

1. Revaluation a/c

Journal Entry

Question 4.

X, Y, and Z are partners in a firm and they close their books on December 31 every year. They are sharing profits and losses in the ration of 3: 2: 1. The partnership deed provides that if a partner retires from the firm during the course of an accounting year, his share of profit from the date of last balance sheet to the date of retirement should be calculated on the basis of the average profits of the last three completed years.

On 1st April 2004 Y retired from the firm. The profits of the firm during the years 2001, 2002 and 2003 were Rs. 12,500, Rs. 8,500 and Rs. 6,000 respectively. Write the journal entry to record the share of profit of the retiring partner for the year 2004.

Answer:

![]()

(Being Y’s share of profit for 2004 brought into A/c)

Notes: Profits for the last 3 years

= 12,500 + 8.500 + 6,000 = Rs. 27,000

Average profit = 27,000/3 = Rs. 9,000

Profit from the date of last balance sheet to the date . of retirement.

= 9,000 × 3/12 = Rs. 2,250

Y’s share thereof = 2,250 × 2/ 6 = Rs. 750.

Question 5.

Mr. Raj died on 25.08.2006 who was an active partner in a firm. The other partners were Mr. Das and Mrs.Das. The books of accounts reveal the following:

| General Reserve | Rs. 12,000 |

| Capital-Raj | Rs. 30,000 |

| Profit and Loss A/c (Dr) | Rs. 18,000 |

| Drawings of Raj | Rs. 10,000 |

| Mr.Raj’s loan to the firm | Rs. 20,000 |

Interest on loan payable to Raj upto the date of death Rs. 1,000

Value of goodwill estimated at Rs. 24,000

Calculate the amount due to the legal heirs of Mr.Raj.

Answer:

Raj’s Capital A/c

R’s loan to the firm: 20000

R’s interest on loan: 1000

Total amount due to R’s legal heirs = His capital a/c

balance and R’s loan to the firm and interest on loan = 26000 + 20000 + 1000 = 47000.

Question 6.

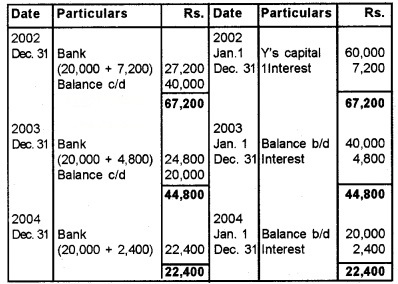

X, Y, and Z are partners in a firm. Y retires from the firm on 1st January, 2002. On his date of retirement, Rs. 60,000 is due to him. X and Z promise to pay in three equal annual instalments together with interest at 12% per annum. Prepare Y’s loan account for the three years.

Answer:

Dr. Y’s Loan Account Cr.

Amount of instalment each year = 60,000/3 = 20,000

Amount paid each year = Rs. 20,000 + Interest.

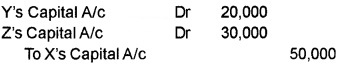

Question 7.

X,Y, and Z were partner sharing profit in proportion to 5:3:2. Good will does not appear in the books, but it is agreed to be worth Rs. 1,00,000. X retires from the firm and Y and Z decide to share future profits equally. You are required to make adjustment entry for good will without opening good will account at all. Show your working clearly.

Answer:

X’s share of goodwill adjusted through capital accounts in the gaining ratio.

Old ratio = 5:3:2

New ratio =1:1

Gaining ratio = New ratio – Old ratio

Gain of Y = 1/2 – 3/10 = 2/10

Gain of Z= 1/2 – 2/10 = 3/10

Gaining ratio of Y and Z = 2 : 3

Value of goodwill of the firm = 1,00,000

X’s share of goowill = 1,00,000 × 5/10 = 50,000

Journal Entry:

[X’s share of goodwill adjusted through the capital accounts of remaining partners in the gaining ratio of 2:3].

Question 8.

Aby, Suby and Minu are partners sharing profits in the ratio of 5:3:2. Minu retired on 31.09.06. The capital account balance and share of reserve due to Minu together amounted to Rs. 1,80,000. But Aby and Suby agreed to pay him Rs. 2,40,000. The new profit sharing ratio of Aby and Suby have been fixed at 3:2.

- Why has Minu been paid over and above the actual amount due to him?

- Give a journal entry to record this through capital a/c adjustments.

Answer:

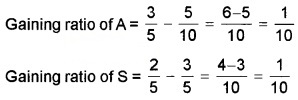

A:S:M = 5:3:2

New ratio of A & S = 3:2

∴ Gaining ratio = New ratio – Old ratio

Gaining ratio = 1:1

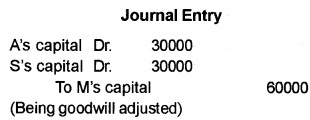

Amount payable to Minu = 2,40,000

Capital + Reserve of Minu = 1,80,000

∴ Share of Goodwill due to Minu

= 240000 – 180000 = 60000

Question 9.

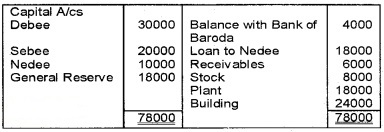

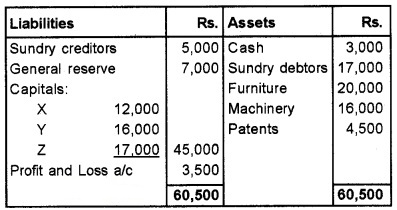

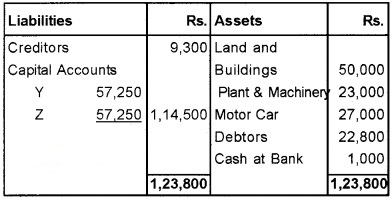

Debee, Sedee and Nedee are in partnership, who were sharing profits in the ratio of 3:2:1. On 31.03.05, Nedee left the firm as per agreement. The following details are available.

Balance Sheet:

- Depreciate fixed assets @10%.

- Only General Reserve is to be credited to the extent of Nedee’s share through capital adjustment of the partners.

- Receivables are sold to a debt collection agency at Rs. 5,400/-

Nedee’s accounts are to be settled soon either by paying off or bringing in necessary cash as the case may be. Prepare the necessary a/c to show the amount due to Nedee.

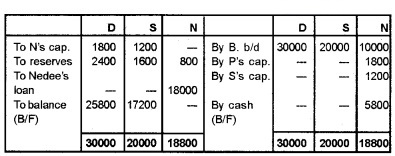

Answer:

Capital A/cs

Amount to be brought in by Nedee is Rs. 5,800.

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner Five Mark Questions and Answers

Question 1.

How will you calculate the amount payable to a retiring partner?

Answer:

If retirement takes place on the closing date of the accounting year ascertainment of profit or loss is easy. But if the retirement occurs during an accounting year, the profit or loss from the date of last Balance Sheet to the date of retirement is also to be determined. Partnership deed provides the method of calculating the profit or loss of that period. It is calculated by any of the following methods.

- On the basis of the last year’s profit.

- On the basis of the average profit of a certain » number of past years.

- By providing interest on the capital .of the retiring partner at. a certain rate.

- By finding out the correct profit till the retirement date.

- On any other basis as provided in the partnership agreement.

The profit or loss calculated above is only an estimate. So the journal entry for the same is; In case of profit.

Profit and Loss Suspense A/c Dr. To Retiring Partner’s Capital A/c:

P&L suspense A/c is shown on the asset side of the Balance Sheet prepared immediately after retirement. At the end of the accounting year; it is closed by transferring to Profit and Loss Account. Reverse is done in case of loss.

For calculating, the total amount payable to the retiring partner, his capital account is prepared.

It is started with the balance in the same on the last.

Balance Sheet and credited with:

- His share of goodwill.

- His share of revaluation profit.

- His share of accumulated profits and reserve.

- His share of profits upto the retirement date since the last Balance Sheet.

- Interest, salary or commission if any due to him.

The capital account is debited with:

- His share of accumulated losses.

- His share of revaluation loss.

- His drawings if any during the period.

- Interest on such drawings.

- His share of loss upto the retirement date since the last Balance Sheet.

If the account shows a credit balance, it is the total amount payable to him. On the other hand, if the account has a debit balance, it represents the amount payable by him to the firm.

Question 2.

X, Y, Z are partners in a firm sharing profits and losses equally. X retired from the firm on which date the balance sheet stood as follows:

Balance Sheet as on____

On the date of retirement it was found that

- Patents have on value.

- Furniture is to be depreciated by 15%.

- Machinery is to be brought down to Rs. 10,000.

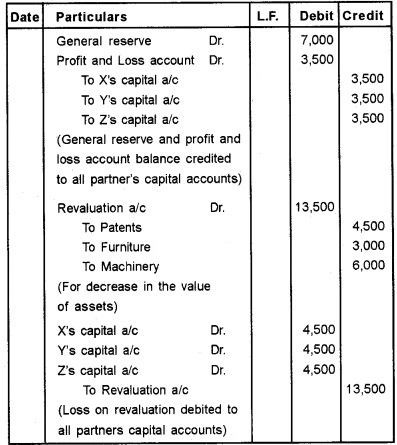

Pass the necessary journal entries to give effect to the revaluation of assets and liabilities at the time of retirement.

Answer:

Journal:

Question 3.

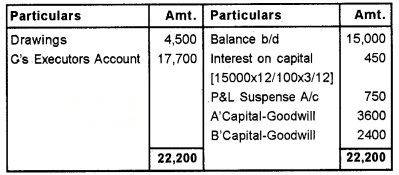

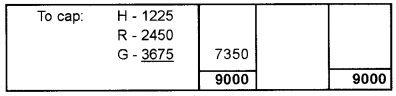

A, B and C were Partner’s sharing Profits and losses in the ratio of 3:2:1. Their capitals were as under as per the balance sheet as on 31-Dec-2010.

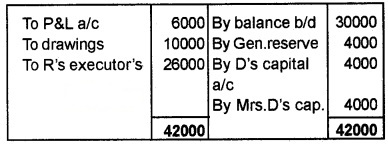

A-Rs. 30,000; B-Rs. 20,000; C-Rs. 15,000. On 31 March 2011, C died, and you are asked to prepare deceased partners Capital account after considering the following facts.

- Capital carried interest at 12% p.a.

- C’ drawings from 1st Jan 2011 to the date of his death amounted to Rs. 4,500.

- C’s share of Profits for the portion of current financial year for which he lived was to betaken at the sum calculated on the average Profit of the last three completed years and good will was to be raised on the basis of two years Purchase of the average Profit of those three years.

The annual Profits were Rs. 19,000, Rs. 16,000 and Rs. 19,000 respectively. Show C’s Capital account, Answer:

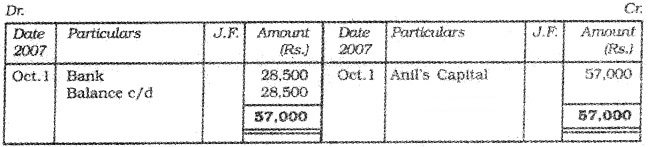

C’s Capital A/c

Working Note:

1. Share of profit to the date of death.

Average profit for past 3 years

![]()

Therefore, C’s share (1/6) for 3 months = 18.000 × 1/6 × 3/12 = 750.

2. Goodwill calculation

Average Profit = 18,000

Goodwill = Average profit × 2’years purchase = 18,000 × 2 = 36,000

C’s share of goodwill = 36,000 × 1/6 = 6,000

C’s share of goodwill adjusted through the capital account of remaining partners in the gaining ratio of 3:2.

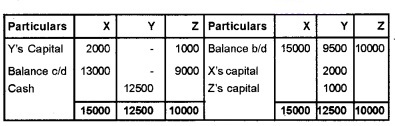

Question 4.

X, Y, and Z were partners in a firm with capitals of Rs. 15,000, Rs. 9,500, Rs. 10,000 respectively and sharing profits in proportions of 1/2, 1/4 and 1/4. On 31st December 2005, Y retires and for the purpose of his retirement, the goodwill of the firm has been valued at Rs. 12,000. Pass the necessary entries assuming that ’Y’ has been paid and show the Capital Accounts of all partners.

Answer:

Capital A/c

Working Note:

Old ratio = 1/2 : 1/4 : 1/4

1 × 2/2 × 2 = 2/4

Goodwill of the form = 12,000

Y’s share of goodwill = 12,000 × 1/4 = 3,000

Gaining ratio = New ratio – Old ratio

X’s Gain = 2/3 – 2/4 = 8 – 6/12 = 2/12

Z’s Gain = 1/3 – 1/4 = 4 – 3 /12 = 1/12

Gaining ratio = 2 :1

Journal:

Question 5.

X, Y, and Z carried on business in partnership, shar¬ing profits in the ratio 3:2:1. The balance sheet on 31st December 2003 showed their capitals to be Rs. 8,400; Rs. 6,800 and Rs. 7,400.

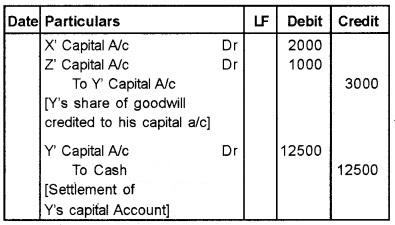

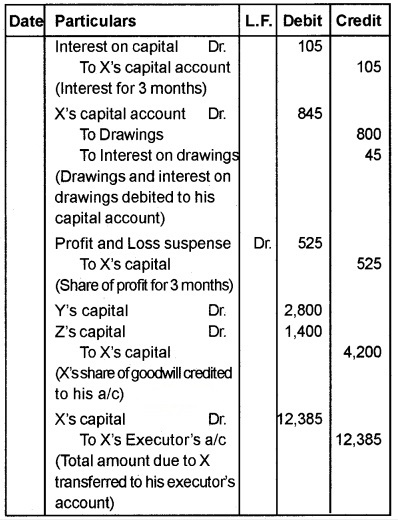

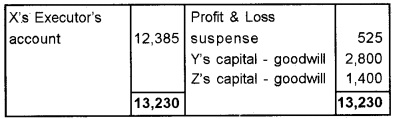

On 31st March, 2004 X died. Write journal entries and prepare an account for presentation to his legal representatives having regard to the following facts:

- Capital earned interest at 5 percent per annum.

- X’s drawings from 1st January, 2004 to the date of his death amounted to Rs. 800; interest on drawings for the period Rs. 45.

- X’s share of profit for the portion of current financial year for which he lived was to be taken a sum calculated on the average of the last three completed years.

- Goodwill was to be raised on the basis of two year’s purchase of average profits of those three years.

The annual profits for the three years were Rs. 4,800; Rs. 3,500 and Rs. 4,300 respectively.

Answer:

Journal:

Notes

1. Share of profit to date of death:

Average profit for past 3 years

\(\frac{4,800+3,500+4,300}{3}\)

= Rs. 4,200

∴ X’s share (3/6) for 3 months 3

= 4,200 × 3/6 × \(\frac{3}{12}\) = RS. 525 12.

2. Calculation of goodwill:

Average profit for past 3 years = Rs. 4,200

2 years purchase = Rs. 4,200× 2 = Rs. 8,400

X’s share (3/6) of goodwill = Rs. 8,400 × 3/ 6 = Rs. 4,200.

Question 6.

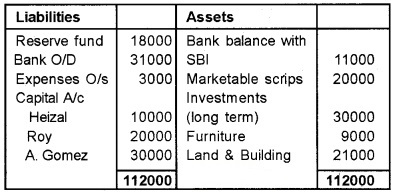

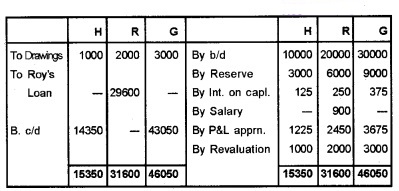

Heisal, Roy and A Gomez are in partnership sharing profits in their capital ratio. The Balance Sheet on 15th March, 2006 is given below.

Balance sheet

Further information on retirement of Roy on 15-6-06.

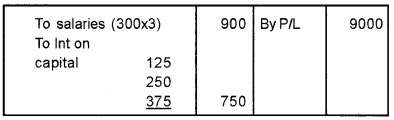

| Profit for 3 months | Rs. 9000 |

| Drawings: Heisal | R.s 1000 |

| Roy | Rs. 2000 |

| A.Gomez | Rs. 3000 |

Interest on capital @ 5% p.a.

Salary to Roy Rs. 300 p.m.

The firm had a fixed deposit worth Rs. 3000 which has not accounted so far, has to be brought into the books. Marketable scrips were valued at Rs. 23,000. Prepare:

- Profit and Loss appropriation a/c

- Capital A/c’s

- Balance sheet

Answer:

P/L Appropriation A/c

Revaluation A/c

Capital A/c

Balance Sheet

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner Eight Mark Questions and Answers

Question 1.

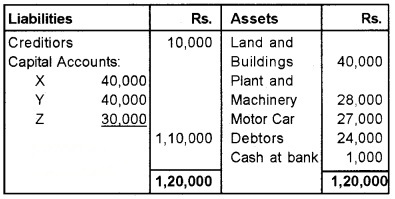

The Balance Sheet of X, Y. Z on 31st March 2003 is given below.

Balance sheet

They were sharing profits and losses in the ratio of 2:2:1. Y decided to retire from the firm. It was agreed that:

- X and Z would share the profit in the ratio of 5:3

- Goodwill was valued at Rs. 1,05,000

- Machinery to be taken at Rs. 75,000

- Buildings should be valued at Rs. 1,50,000

- The value of stock should be Rs. 30,000

- An amount of Rs. 1,500 should be written off as bad debt.

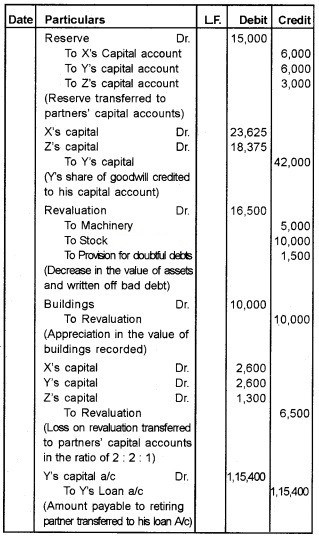

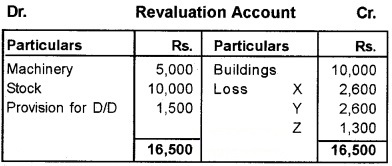

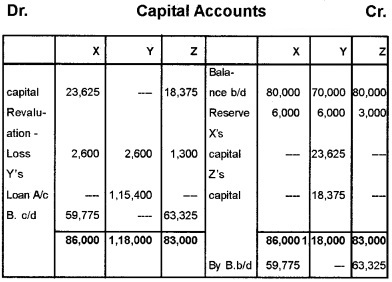

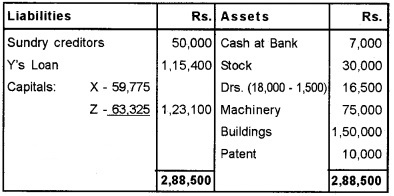

Pass the necessary journal entries and prepare the balance sheet of the new firm.

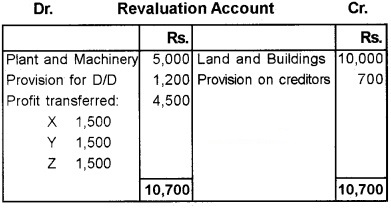

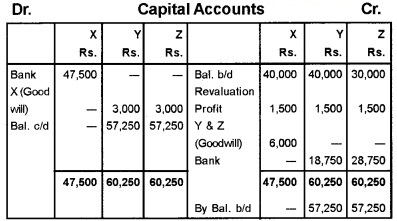

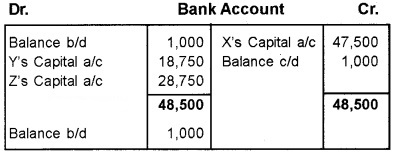

Answer:

Note: Calculation of gaining ratio

X = 5/8 – 2/5 – 25 – 16/40 = 9/40

Z = 3/8 – 1/5 = 15 – 8/40 = 7/40

Therefore, gaining ratio = 9:7

Journal

Balance Sheet of X and Z as on 1st April 2003

Question 2.

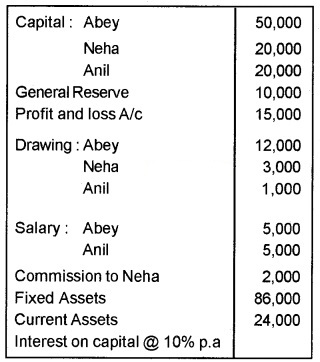

Abey, Neha, and Anil are partners, who share profits and losses in 5:3:2 ratio. The following information is extracted from the books of accounts on 31.03.06.

On the above date Anil decided to retire from the firm as agreed upon. Fixed assets to be revalued at Rs. 86,000. Average profit calculated based on the past 5 year was Rs 15,000. Ascertain the amount due to the retiring partner.

Answer:

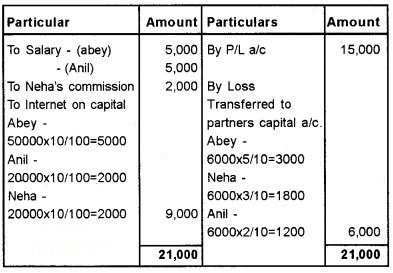

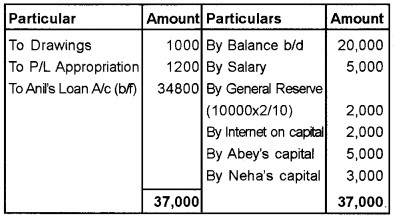

Profit and Loss Appropriation A/c

Anil’s Capital A/c

Working Note

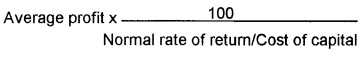

Here, Goodwill is caculated on the basis of capitalization of Average profit method.

∴ Goodwill = Total value of business – Net tangible Asset.

Total value =

= 15,000 × \(\frac{100}{10}\) = 1,50,000

Net tangible asset = Fixed Asset + Current Asset

= 86,000 + 24,000 = 1,10,000

Goodwill = 1,50,000 – 1,10,000 = 40,000

Anil’s share of goodwill = 40,000 × 2/10 = 8,000

Anil’s share of goodwill adjusted through capital accounts in the gaining ratio.

Old ratio = 5:3:2

New ratio = 5:3

Gaining ration = 5 : 3

Abey’s share = 8,000 × 5/8 = 5,000

Neha’s share = 8,000 × 3/8 = 3,000

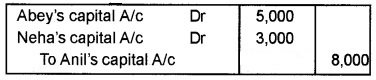

Journal entry:

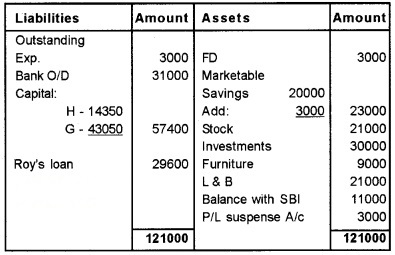

Question 3.

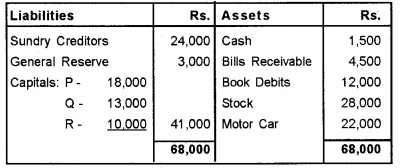

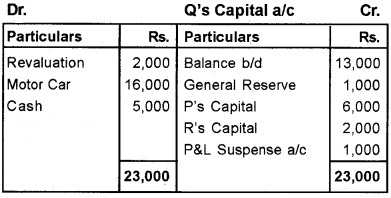

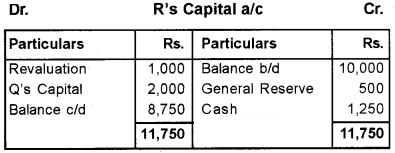

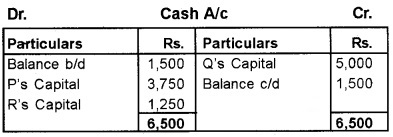

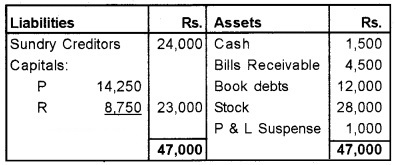

P, Q and R partiners sharing profits and losses in the ratio 3:2:1. The Balance sheet as on 31st December 2003 is given below:

On 31st March 2004, Q decided to retire from the business due to ill-health subject to the following conditions.

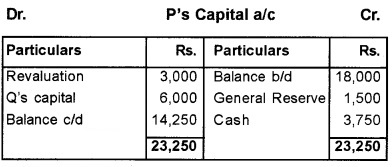

- That the goodwill should be valued at two year’s. purchase of the average profits of the preceding three years. The profits for the three preceding years were, 2001 – Rs. 9,000, 2000 – Rs. 15,000 and 2003-Rs. 12,000.

- The profits for the three months ending 31 st March, 2004 be estimated on the basis of the profits for the year 2003.

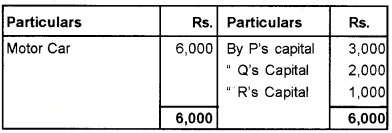

- That the motor car is to be given to Q, at a value of Rs. 16,000 and the balance due to him is to be paid immediately in cash by bringing the required amount by P and R in their profit sharing ratio which is 3: 1.

Answer:

Revaluation a/c

Calculation of Goodwill

Average profit of 3 years

\(=\frac{9,000+15,000+12,000}{3}\) = 12,000

Total goodwill = 12,000 × 2 = Rs. 24,000

Q’s share = 24,000 × 2/6 = Rs. 8,000

Q’s share of profit = 12,000 × 3/12 × 1/3 = 1,000

Balance Sheet as on 31st March 2004

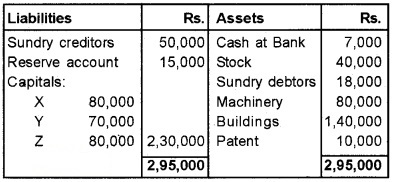

Question 4.

The balance sheet of X, Y, and Z on 31st December, 2003, the date of X’s retirement was as follows:

Balance Sheet

The following terms have been agreed upon:

- Goodwill was valued at Rs. 18,000.

- The value of land and buildings should be appreciated by Rs. 10,000

- Plant and Machinery should be reduced to Rs. 23,000.

- Create provision @ 5% on debtors for bad and doubtful debts and Rs. 700 on creditors.

- The entire sum payable to X is to be brought by Y and Z in such a manner that their capital accounts are in proportion to their profit sharing ratio which is to be equal.

Prepare:

- Revaluation account.

- Partner’s capital accounts

- Bank account, and

- Balance sheet after X’s retirement.

Answer:

Balance Sheet of Y and Z as on 1st January 2004

Notes:

Calculation of goodwill

Total goodwill ‘ = 18,000

X’s share 1/3 = 18,000 × 1/3 = Rs. 6,000

Working Notes:

(i) Gaining Ratio:

X: 3/4 – 3/6 = 9 – 6/12 = 3/12

Z: 1/4 – 1/6 = 3 – 2/12 = 1/12

Y’s share of goodwill of Rs. 12,000 (Rs. 36,000 × 2/6) will be contributed by X Rs. 9,000 and Z Rs. 3,000

(ii) Since the new profit sharing ratio between X and Z being 3:1, they will have to maintain their capitals at Rs. 90,000 and Rs. 30,000 respectively.

Question 5.

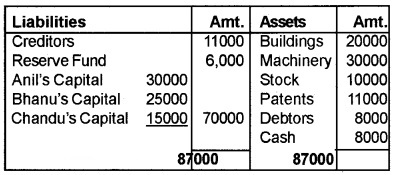

Anil, Bhanu, and Chandu were partners in a firm sharing profits in the ratio of 5:3:2. On March 31, 2007, their Balance Sheet was as under:

Books of Anil, Bhanu, and Chandu Balance Sheet as on March 31, 2007

Anil died on October 1, 2007. It was agreed between his executors and the remaining partners that:

- Goodwill to be valued at 21/2 year’s purchase of the average profits of the previous four years which were:

Year2003-04-Rs. 13,000, Year 2004-05-Rs. 12,000

Year 2005-06-RS.20,000, Year 2006-07 – Rs. 15,000 - Patents be valued at Rs. 8,000. Machinery at Rs. 28,000 and Building at Rs. 25,000

- Profit for the year 2007-08 be taken as having accrued at the same rate as that of the previous year.

- Interest on capital be provided at 10% p.a.

- Half of the amount due to Anil be paid immediately.

Prepare Revaluation Account, Anil’s Capital Account and Anil’s Executor’s Account as on October 1, 2007.

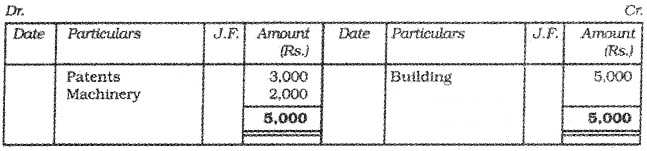

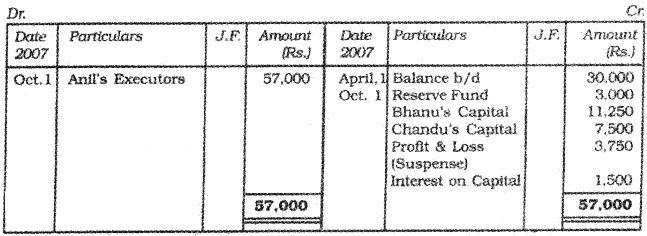

Answer:

Revaluation Account

Anil’s Capital Account

Anil’s Executor’s Account

Working Note:

1. Goodwill = 21/2 years purchase × Average Profit

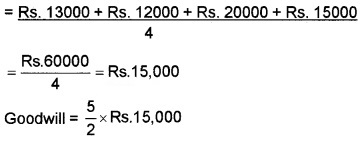

Average Profit

Anil’s share of Goodwill = \(\frac{5}{10}\) × Rs.37,500 = 18750

2. Profit from the date of last balance sheet to date of death (April 1,2007 to October 1,2007) = 6 months

Profit for 6 months = Rs.15,000 × \(\frac{6}{12}\) = Rs.7,500

Anil’s share of profit = Rs.7,500 × \(\frac{5}{10}\) = Rs.3,750.

3. Interest on Capital

(April 1, 2007 to October 1, 2007)

= Rs. 30000 × \(\frac{10}{100}\) × \(\frac{6}{12}\) = Rs. 1,500.