Kerala Plus Two Accountancy Chapter Wise Questions and Answers Chapter 2 Accounting for Partnership-Basic Concepts

Plus Two Accountancy Accounting for Partnership – Basic Concepts One Mark Questions and Answers

Question 1.

A partner is entitled to get 6% per annum as

(a) Profit

(b) Interest on capital

(c) Interest on loan

(d) Remuneration

Answer:

(c) Interest on loan

Question 2.

Profit and Loss Appropriation is an extension of

(a) Capital Account

(b) Current Account

(c) Trading Account

(d) Profit and Loss Account

Answer:

(d) Profit and Loss Account

Question 3.

Find odd one and state the reason

(a) Interest on capital

(b) Interest on drawings

(c) Salary

(d) Commission

Answer:

(b) Interest on drawings

Question 4.

Complete the following

- Interest on loan – Charge against profit.

- Interest on Partners capital – _______.

Answer:

- Appropriation of profit

- Reason: All others are increase to capital A/c.

Question 5.

Find the odd one and state reason.

(a) Interest on partner’s capital

(b) Interest on partner’s loan.

(c) Interest on partner’s drawings

(d) Borrowings from the firm

Answer:

(d) Borrowings from the firm. Others are P/L appropriation A/c items.

Question 6.

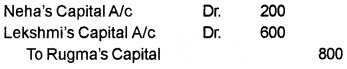

Rugma, Neha and Lekshmi are partners in a firm sharing profits and loses in the ratio of 3:3:4. Their fixed capitals were Rs. 1,00,000, Rs. 2,00,000 and Rs. 3,00,000 respectively. For the year 2005, interest on capital was credited to them @ 10% instead of 9% per annum. You are required to rectify the mistake by passing an adjustment entry.

Answer:

Plus Two Accountancy Accounting for Partnership – Basic Concepts Two Mark Questions and Answers

Question 1.

Define Partnership.

Answer:

According to Section 4 of the Indian Partnership Act 1932, a partnership is “the relation between persons who have agreed to share the profits of a business carried on by all or any of them acting for all”. The persons entered into agreement are individually known as ‘partners’ and collectively as ‘firm’.

Question 2.

What is Partnership Deed?

Answer:

Partnership agreement may be oral or written. When the agreement is written, it is called Partnership Deed. It is also called ‘Articles of Partnership’.

Question 3.

What is meant by Profit and Loss Appropriation Account?

Answer:

Profit and Loss Appropriation Account is an extension of the Profit and Loss Account. It is prepared to show the appropriation (distribution) of profit among partners.

Question 4.

What are the circumstances in which goodwill is need to be valued?

Answer:

- When a new partner is admitted.

- When a partner is retired ordied.

- When two or more firms are amalgamated.

- When a firm is dissolved or its business is sold.

Question 5.

What is divisible profit?

Answer:

Divisible profit is the balance net profit that remains after making all adjustments to net profit regarding interest on capital, salary to partners, interest on partners loan, interest on drawings, etc. and which is distributed among partners in their profit sharing ratio.

Question 6.

Edwin and Abel are partners sharing profits and losses in the ratio of 1:1. Edwin drew Rs. 1000/- at the beginning of every month for the year ending 31st Dec. 2004. Calculate interest on drawings at 6% perannum.

Answer:

Total amount withdrawn by Edwin = 1,000 × 12 = 12,000

1,000 × 12 = 12,000

\(Average period =\frac{\text { Total period (months) }+1}{2}\)

\(=\frac{12+1}{2}\) = 6 : 5 months

Interest on drawings = 12,000 × 6/100 × 6.5/12 = Rs. 390.

Question 7.

Christy and Fiyona are partners in a firm with equal profit sharing ratio. Christy drew regularly Rs. 15000 at the end of every month.

Answer:

Total amount withdrawn by Christy = Rs. 1,500 × 2 = 18,000

\(Average period =\frac{\text { Total period (months) }-1}{2}\)

\(=\frac{12-1}{2}\) = 5.5 months

Interest ondrawings= 18, 000 × 5/100 × 5.5/12 = Rs. 412.5

Question 8.

After closing the books of accounts, it was discovered that an item, interest on capital was omitted to be recorded in the books of accounts. Even then, there was no difference in the closing balance of capital account, before and after the treatment of the item. What do you infer from this?

Answer:

Partner’s Share of Capital and their profit sharing ratio are in accordance with their capital account balances.

Question 9.

Paul, Kumar, and Lakshman are partners in a firm, sharing profits and losses in the ratio of 3:2:1. After the preparation of final accounts, it was discovered that interest on drawing had not been taken into consideration. The interest on drawings of partners amounted to Rs. 600, Rs. 400 and Rs. 200. Give necessary adjustment journal entry.

Answer:

Items which are omitted while preparing P&L Appropriation A/c can be brought into accounts through P&L adjustment a/c by passing the following entry.

| Paul’s capital Dr. | 600 |

| Kumar’s capital Dr. | 400 |

| Lakshman’s capital Dr. | 200 |

| To P&L Adjustment A/c | 1,200 |

Question 10.

Give your suggestions to the following arguments. “Under capitalisation method, the firm will have good will only if the value of net tangible assets are more than the capitalised value of profit.”

Answer:

Under capitalisation method

Value of goodwill = Total value of business – Net as-sets

Total value of business

![]()

Net assets = Assets – Liabilities The above equation proves that, a firm will have goodwill only if the value of net tangible assets are less than the capitalised value of profit.

Question 11.

Sanu and Manu are in partnership, who have not made any written agreement. Sanu has given a loan of Rs. 12,000/- to the firm in addition to his capital contribution. During the year the firm made a net loss of Rs. 40,000. Regarding the interest on loan, Manu is of the opinion that no interest be paid being the loan was not external one. Is Mr.Manu right in his stand? State your views.

Answer:

Normally partnership deed contains rules and regulations regarding the conduct of partnership business. In such cases partnership may not have a written agreement. In some other firms, partnership deed may be silent on some matter.

Then relevant discussion in the IPA 1932 becomes applicable. As per IPA 1932, interest on loan is payable at 6% p.a. on Partner’s loan. So Manu’s opinion that interest on loan is not payable, is wrong.

Question 12.

A business has been purchased by a firm for Rs. 1,00,000. But its net tangible assets were worth Rs. 92,000.

- What does this difference in value indicate?

- Where is it shown in the Balance sheet of the firm?

Answer:

Total value of business-Net Assets = Value of goodwill 1,00,000 – 92,000 = 8,000

So ‘Rs. 8000’ implies the value of goodwill of the firm. Goodwill refers to the value of reputation of a business. It is an intangible asset. So it is shown on the asset side of B/S.

Plus Two Accountancy Accounting for Partnership – Basic Concepts Three Mark Questions and Answers

Question 1.

Match the following.

| a. Partnership deed | Maximum 10 partners |

| b. Banking business | If no partnership deed |

| c. Profit and losses shared equally | Written agreement of partners |

| d. Registration of partnership | Fixed capital Method |

| e. Current A/c | Not compulsory |

Answer:

| a. Partnership deed | Written agreement of partners |

| b. Banking business | Maximum 10 partners |

| c. Profit and losses shared equally | If no partnership deed |

| d. Registration of partnership | Not compulsory |

| e. Current A/c | Fixed capital Method |

Question 2.

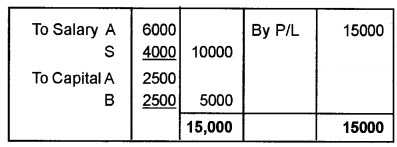

Ameer and Sudheer are partners sharing profits equally. They are entitled to salaries as follows, Ameer Rs. 6000, Sudheer Rs.4000. The partnership has made a profit of Rs. 15,000. How much is the increase in capital of Mr.Ameer?

(a) 3500

(b) 3900

(c) 8500

(d) 9300

Answer:

(c) 8500

Notes: A:S = 1:1

A’s salary 6000

S’s salary 4000

Out of Net profit of Rs. 15,000.

P/L Appropriation A/c:

A will get salary 6000 and share of profit 2500. So increase in capital is Rs. 8500.

Question 3.

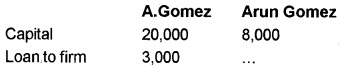

Gomez and Arun Gomez are partners sharing profits and losses in the ratio of 2:1. They are allowed interest at 10% per annum on capitals and loans to the partnership.

The partnership has made a net profit of Rs. 40,000 for the year. How much is the total increase in the net worth of A.Gomez?

(a) 24,800

(b) 25,000

(c) 26,800

(d) 27,100

Answer:

(c) 26,800

Notes:

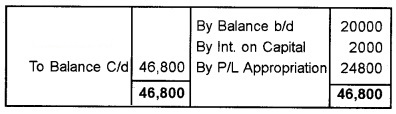

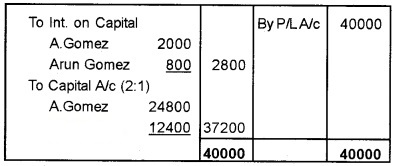

Capital A/c of A.Gomez:

P/L Appropriation A/c:

A Gomez’s opening capital (capital in the begining of the year) is Rs. 20,000 and closing capital (capital at the end of the year) is Rs. 46,800. So total increase in the net worth of A.Gomez is Rs. 26,800. (46,800-20,000).

Question 4.

Lalu and Beena are in partnership. He is also entitled to a salary of Rs. 12,000 per annum. Profits and losses are shared equally. The partnership has made a net profit of Rs. 30,000. How much is Lalu’s total increase in his Capital A/c?

(a) 18,000

(b) 15,000

(c) 21,000

(d) 42,000

Answer:

(c) 21,000

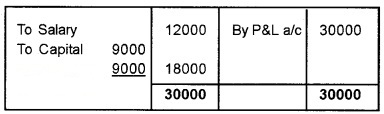

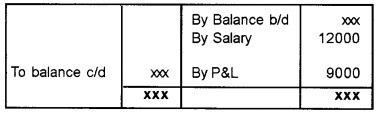

Notes: P&L Appropriation A/c:

Lalu’s capital A/c:

Increase in capital = 12000 + 9000 = 21000.

Question 5.

“Partnership deed must be in writing.” Do you agree with the statement? Give reasons in favour of having partnership deed in writing.

Answer:

Partnership is the result of agreement between two or more persons. The agreement may be oral or written. The written agreement is called Partnership Deed. It is always advisable to put the partnership agreement in writing because of the reasons given below:

- To avoid disputes, quarrels, and misunderstanding among the partners.

- To remind the partners about their rights, duties, and liabilities.

- To maintain healthy atmosphere to carry on business smoothly.

Question 6.

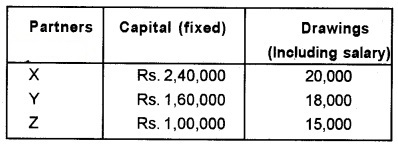

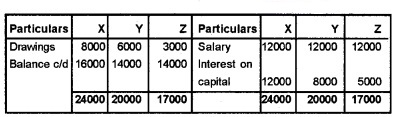

X, Y, and Z are partners in a firm sharing profits and losses in the ratio of 4:3:2. During 2005, their fixed capital and drawings were as follows:

Partners are entitled to a salary of Rs. 12,000 p.a. and interest on capital @ 5% p.a. You are required to prepare the Current Accounts of partners.

Answer:

Current Account:

Plus Two Accountancy Accounting for Partnership – Basic Concepts Five Mark Questions and Answers

Question 1.

Define Partnership Deed. Mention some of its contents.

Answer:

Partnership deed is a written document which contains the rules and regulations regarding the conduct of business.

Contents of Partnership deed:

- Name and address of the firm.

- Name and Address of partners

- Nature of business

- Duration of partnership

- Capital introduced by partners

- Interest on capital

- Drawing made by partner

- Interest on partner drawings

- Salary, commission and other remunerations payable to partners

- Rights, Duties, and Liabilities of Partners.

Question 2.

What are the rules applicable as per the Partnership Act in the absence of an agreement?

Answer:

In India Partnerships are governed by the Indian Partnership Act 1932. The following are the rules applicable as per the Partnership Act in the absence of an agreement.

- Profits and Losses – Profits and losses are to be shared equally among partners.

- Salary or remuneration – Partners are not entitled to salary or any other remuneration.

- Interest on capital- Partners are not entitled to interest on capital.

- Interest on drawings – No interest is charged on drawings made by partners.

- Interest on loan – partners are entitled to get an interest at 6% per annum for any loans they have given to the firm.

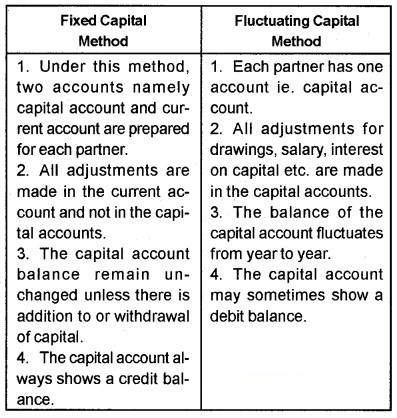

Question 3.

Distinguish between Fluctuating and Fixed Capital methods.

Answer:

Question 4.

What are the general characteristics/ features of a partnership? Explain.

Answer:

1. Number of members:

The minimum member of persons required for a partnership is two (2). Maximum number is ten (10) in case of banking business and twenty (20) in other partnerships.

2. Business Purpose:

The purpose of forming a partnership should be to carry out some business. The business must not be illegal.

3. Agreement:

For the formation of a partnership an agreement is must. The agreement may be oral or written. Only competent persons can enter into a partnership agreement.

4. Profit sharing:

The profits and losses of a partnership business must be shared among the partners. Profits must be shared in an agreed ratio or equally.

5. Mutual agency:

Mutual agency is there in partnership. Every partner is an agent and a principal at a time. He is an agent when he acts for others and a principal when the others act for him.

6. Unlimited liability:

The liability of the partners in a firm is unlimited. Every partner is individually and jointly liable for all the debts of the firm.

7. No legal existence:

A partnership has no legal existence. It has no existence different from its members.

8. No transfer of share:

A partner cannot transfer his share in the firm to outsiders without the consent of the other partners.

Question 5.

Sabu and Sekhar commenced business in partnership on 1st January, 2005. No written agreement was in force between them. They contributed Rs. 40,000 and Rs. 10,000 respectively as capital. In addition, Sabu advanced Rs. 20,000 on 1st July, 2005 as loan to the firm. Sabu met with an accident on 1st April, 2005 and could not attend the partnership business upto 30th June, 2005. The . profits for the year ended on 31st December, 2005 amounted to Rs. 50,600. Dispute arise between them for sharing profits.

Sabu claims:

- He should get an interest @ 10% p.a. on capital. Sekhar claims:

- Net Profit should be shared equally

- He should be allowed remuneration of Rs. 1,000 p.m. during the period of Sabu’s illness.

You are required to:

- In your opinion how much profit will each partner get?

- State your reason.

Answer:

In the absence of agreement, partners are not entitled to interest on capital contributed by them. So Sabu’s claim is not admitted.

- In the absense of agreement, partners are not entitled to any salary or other remuneration.

- In the absence of written agreement, partners are entitled to share profits equally, Here, net profit is divided equally among Sabu and Sekhar.

Profit for the year = 50,600

Less:Interest on Sabus loan (20000 × 6/100 × 6/12) = 600

The actual profit = 50,000

In the absence of agreement, partners are entitled to interest on loan (to the firm) at the rate of 6% p.a. Sabu’s share of profit = 50,000 × 1/2 = 25000

Stephen’s share of profit = 50000 × 1/2 = 25000.

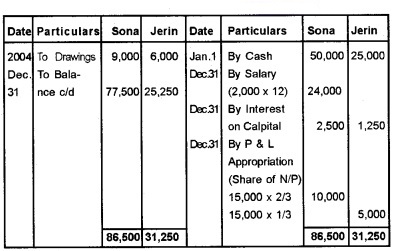

Question 6.

Sona and Jerin started a partnership business on 1st January 2004. Sona contributed Rs. 50,000 and Jerin Rs. 25,000 as capital. They decided to share profits and losses in the ratio of 2:1. Sona was entitled to a salary of Rs. 2000 per month. Partners are entitled to interest on their capitals at 5% per annum. The drawings of Sona and Jerin during the year are Rs. 9,000 and Rs. 6,000 respectively. The profit of the firm after making all the adjustment was Rs. 15,000. Prepare the capital accounts of the partners under fluctuating capital method.

Answer:

Partners Capital Account:

Question 7.

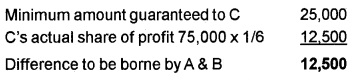

A and B are partners sharing profits in the ratio of 2: 3. On 1st January 2001, they admitted C into the firm for a sixth share of profits with a guaranteed minimum of Rs. 25000. A & B continue to share profits as before but agrees to suffer any excess over 1/6 of profit going to C equally. The profits of the firm for the year was Rs. 75,000. Prepare Profit and Loss appropriation account.

Answer:

Notes:

The ratio in which this difference is to be borne 1: 1 (equally)

Dr. Profit and Loss Appropriation Account Cr.

Question 8.

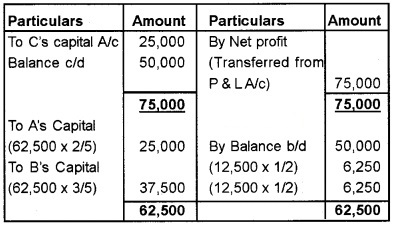

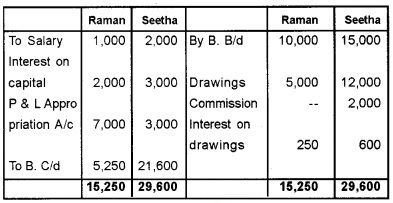

From the following Balance Sheet of Aneesh and Jaya, calculate interest on capital @ 5% per annum, payable to Jaya for the year ending 31.12.05.

Balance Sheet as on 31.12.2005:

During the year, Jaya’s drawings were Rs. 3,000 and the firm made a profit of Rs. 4,000.

Answer:

Interest on capital is payable on the opening capital (ie. capital on 1.1.05)

Opening capital = Closing capital + drawings – Net Profit

Closing capital = Rs. 6000

Drawings = 3000

Net Profit during the year = 4000

P&L appropriation shown in B/S = 2000

∴ Net profit credited to partners capital = 4000 – 2000 = 2000

Net profit credited to Jaya = 2000 × 1/2 (ratio being 1:1) = 1000

Opening capital = 6000 + 3000 – 1000 = 8000

Interest on capital = 8000 × 5/100 = 400.

Question 9.

Aby and Anu are partners sharing profits in the ratio of 4:1. Their capital a/c balances are

Aby : 4,00,000

Anu : 5,00,000

Profit made during the year was Rs. 1,00,000.

Anu is of the opinion that their agreement must include a provision for interest on capital @10% p.a. Otherwise the profit sharing ratio must be made equal. Why did Anu put forward such an opinion? Will it be worthwhile to her if such changes are made. Which of the above condition is more advantageous to her. Give your advice.

Answer:

Profit sharing ratio of Aby and Anu is 4:1.

Net Profit = 1,00,000

As per this ratio Aby will get Rs. 80,000 (1,00,000 × 4/5) and Anu will get 20,000 (1,00,000 × 1/5) as their share of profit. But Anu has contributed Rs. 1,00,000 more than Aby’s capital. Now Anu is in a disadvantageous position.

Conditions:

1. If there is a provision for interest on capital @10%.

Anu’s interest on capital = 5,00,000 × \(\frac{10}{100}\) = 50,000

Her share of profit = (Net Profit – Interest on capital of Aby and Anu) × 1/5

=[1,00,000 – (40,000 + 50,000)] × \(\frac{1}{5}\)

= 1,00,000 – 90,000 × 1/5

=10,000 × \(\frac{1}{5}\) = 2,000

Anu will get interest on capital = 50,000+ share of profit 2000 = 52,000.

2. Profit sharing ratio made equal:

Abu’s share of profit = 1,00,000 × 1/2 = 50,000

Anu’s share of profit = 1,00,000 × 1/2 = 50,000

So First condition is more advantageous to Anu.

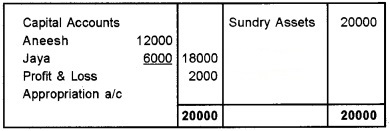

Question 10.

The partner’s capital account prepared by Mr.Jose, an accountant in Gokul and Co, where Mr. Raman and Mrs.Seetha are partners, is given below. Rectify the errors, if any in the capital accounts prepared by him and show the partners capital accounts under fixed capital method. What should have been the profit of the firm as per profit and loss account?

Partners Capital A/c

Answer:

Calculation of NP:

Capital A/c:

Question 11.

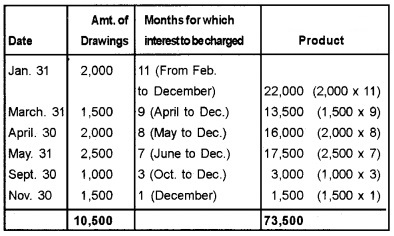

T and S are partners with equal profit sharing ratio. T withdrew the following amounts during the year 2005.

| 31st January | 2,000 |

| 31st March | 1,500 |

| 30th April | 2,000 |

| 31st May | 2,500 |

| 30th Sept | 1,000 |

| 30th Nov | 1,500 |

The interest on drawings charted is at 6% p.a. Assuming that the accounting year ends on 31st December. Calculate the interest on drawings under product method.

Answer:

Calculation of Interest on Drawings:

Interest on drawings = 73,500 × 6/100 = Rs. 4,410

Interest for one month= 4,410 × 1/12 = Rs. 367.5.

Question 12.

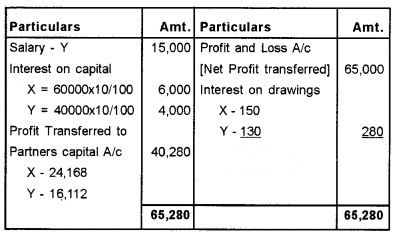

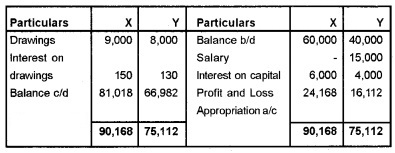

On 1st January 2006, X&Y entered into a partnership contributing Rs. 60,000 and Rs. 40,000 respectively. They agreed to share profits & losses in a ratio of 3 : 2. Y is allowed a salary of Rs. 15,000 per year. Interest on capital is to be allowed at 10% per annum. During the year X withdrew Rs. 9,000 and Y Rs. 8,000 as drawings. The interest on drawings paid by X and Y was Rs.150 and Rs. 130 respectively. Profits as on 31st December 2006 before the above-mentioned adjustments were Rs. 65,000. Show the distribution of Profits by preparing Profit and Loss Appropriation A/c & Prepare Partner’s Capital Accounts.

Answer:

Profit and Loss Appropriation Account:

Capital A/c:

Plus Two Accountancy Accounting for Partnership – Basic Concepts Eight Mark Questions and Answers

Question 1.

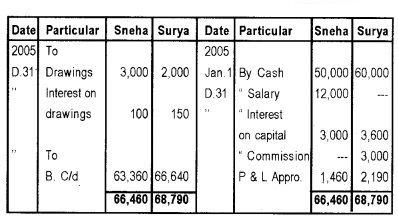

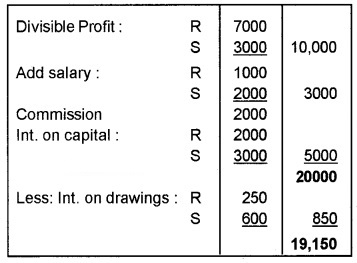

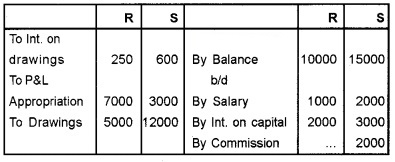

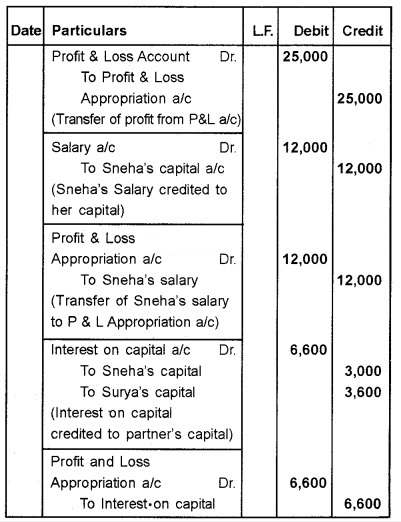

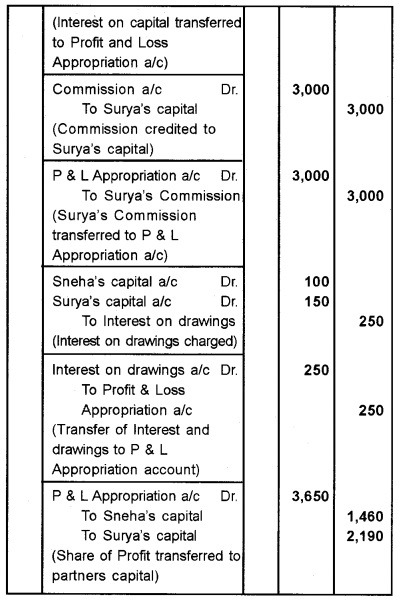

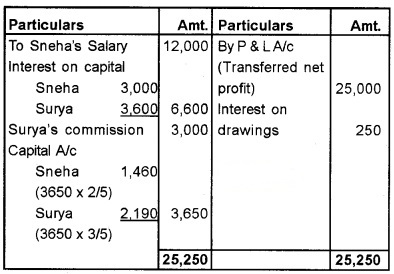

On 1st January 2005 Sneha and Surya started partnership business by contributing capitals of Rs. 50,000 and Rs. 60,000 respectively. They share profits in the ratio of 2 : 3. Sneha is entitled to a salary of Rs. 12,000 per annum. Interest on capital allowed is at 6% p.a. Surya is entitled to a commission of Rs. 3,000. During this year Sneha withdrew Rs. 3,000 and Surya Rs. 2,000. Interest on drawings charged is Rs. 100 and Rs. 150 respectively. Profit in the year before making the adjustments was Rs. 25,000. Pass necessary journal entries, Prepare Profit and Loss Appropriation Account and Partners Capital Accounts.

Answer:

Journal:

Dr. Profit & Loss Appropriation Account Cr.

Dr. Partners Capital Account Cr.