Kerala Plus Two Accountancy Chapter Wise Previous Questions Chapter 5 Dissolution of Partnership

Plus Two Accountancy Dissolution of Partnership 1 Marks Important Questions

Question 1.

On the dissolution of a firm, which of the following liability shall be paid first of all? (March 2012)

a) Creditors liability

b) Partner’s loan

c) Partner’s capital

d) None of the above

Answer:

a) Creditors liability

Question 2.

Realisation account is a account. (May 2013 (Say)

a) Current

b) Personal

c) Real

d) Nominal

Answer:

d) Nominal

Question 3.

When realisation expenses are paid by a partner on behalf of the firm, A/c. is debited. (March 2016)

Answer:

Realisation A/c

Question 4.

Mention the name of account where profit or loss on realization is transferred. (March 2017)

Answer:

Partner’s capital account/ Partners current account

Question 5.

What journal entry will be passed if realization expenses are paid by a partner on behalf of the firm? (March 2017)

Answer:

Realisation A/c Dr

To partner’s capital A/c

Plus Two Accountancy Dissolution of Partnership 2 Marks Important Questions

Question 6.

On dissolution of a partnership in what order must the proceeds of the realization of assets be applied. (Say 2016)

Answer:

i) Payment of third party liabilities

ii) Paying the loans from partners

iii) Paying the capital of the partners

iv) Surplus if any, is to be distributed to partners.

Question 7.

Anoop and Jony are partner’s in a firm, sharing profits and losses in the ratio of 3:2. The firm was decided to dissolve on 31st (March 2016). Mention any four ways of dissolution of the firm. (March 2017)

Answer:

a) Dissolution by agreement

b) Compulsory dissolution

c) Dissolution by notice

d) Dissolution by court

Plus Two Accountancy Dissolution of Partnership 5 Marks Important Questions

Question 8.

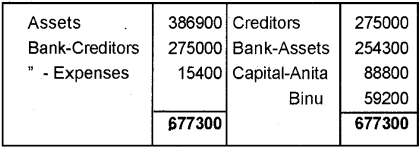

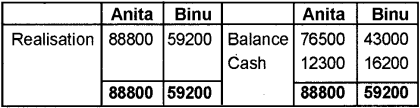

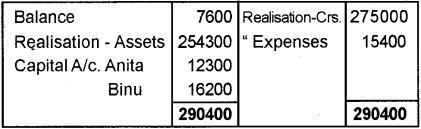

Anita and Binu were partners sharing profits in the ratio of 3:2. On the date of dissolution their capitals were: (March 2009)

Anita – Rs. 76,500 and Binu Rs. 43,000. The creditors amounted to Rs. 2,75,000. The balance of cash was Rs. 7,600. The assets realised Rs. 2,54,300, the expenses of realisation were Rs. 15,400. Anita and Binu were solvent. Close the books of the firm, showing the realisation account, capital accounts and cash account.

Hint: Book value of assets on the date of dissolution is to be ascertained by preparing a Balance Sheet.

Answer:

Opening Balance sheet

| Liabilities | Assets | ||

| Capital-Anita Binu Sundry creditors | 76500 43000 275000 | Cash Assets (Balancing figure) | 7600 386900 |

| 394500 | 394500 |

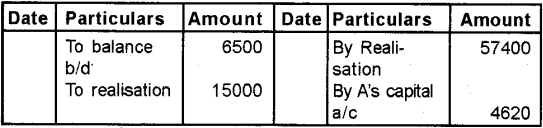

Realisation A/c

Capital A/c

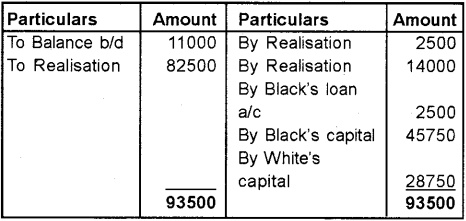

Cash Amount

Question 9.

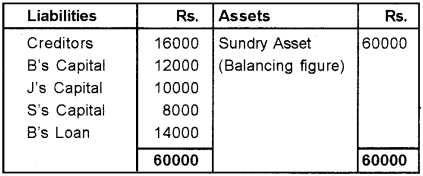

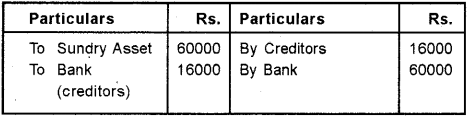

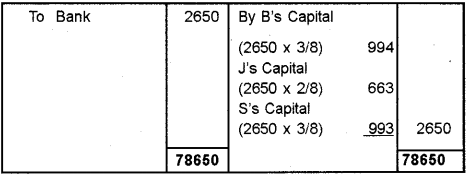

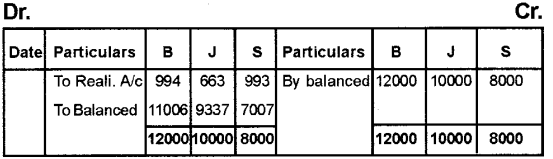

B, J & S are partners in a firm sharing profits and loses in the ratio of 3:2:3. They have decided to dissolve the firm. On the date of dissolution total creditors were Rs. 16,000 Bills discounted Rs. 2,650 during the year has become a real liability which has not paid, though this has not been recorded anywhere in the books of accounts. The capital account balances were: B Rs. 12,000, J Rs. 10,000, S Rs. 8,000. B advanced 14,000 besides his capital account. (Say 2011)

Find out

a) Total Sundry Assets,

b) Profit or Loss on Realization,

c) Capital Balance of Partners.

Answer:

Calculation of total Sundry Asset Balance Sheet

b) Profit or Loss on Realisation

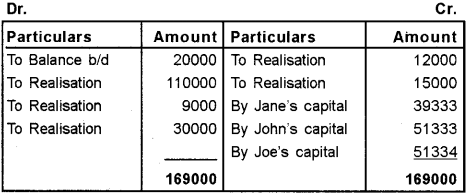

Realisation A/c

Partners Capital A/c

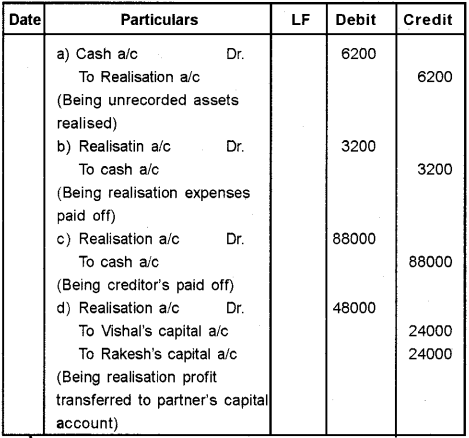

Question 10.

What entry would you pass for the following transaction on the dissolution of a firm having partners Vishal and Rakesh? (June 2012)

a) An unrecorded asset realised Rs. 6200.

b) Dissolution expenses amounted to Rs. 3200.

c) Creditors already transferred to Realisation account were paid Rs. 88,000.

d) Profit on Realisation Rs.48000 to be distributed between partners Vishal and Rakesh.

Answer:

Question 11.

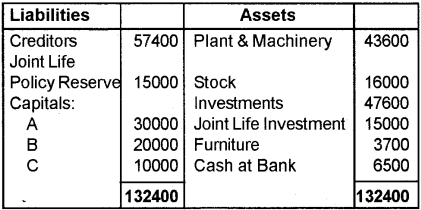

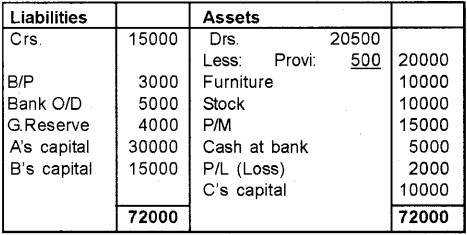

A, B and C are the partners sharing profit and losses in their capital ratio. Balance sheet as on 31st (March 2012) were as follows: (March 2013)

Balance Sheet

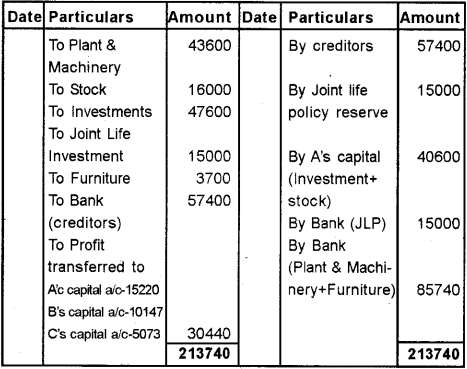

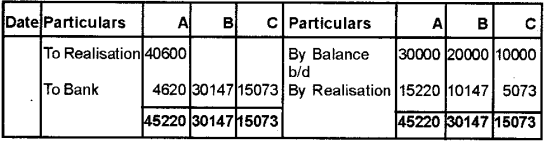

The firm was dissolved on the above date. A took over investments and stock at Rs. 40,600. Joint Life policy was realised at surrender value. Furniture was sold at book value. Plant and Machinery were realised for Rs. 82,040. Creditors were paid in full settlement. Prepare Realisation Account, Bank Account and Partners Capital A/c.

Answer:

Realisation a/c

Capital A/c

Bank A/c

Question 12.

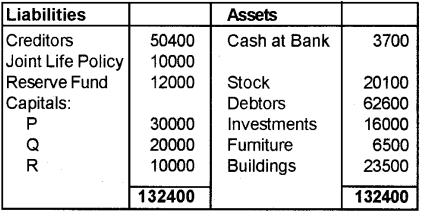

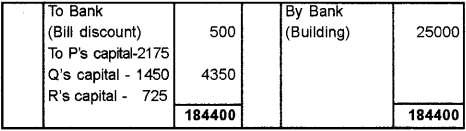

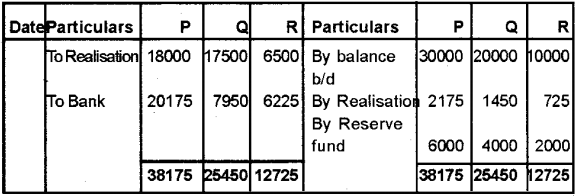

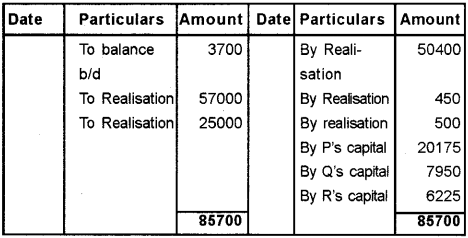

The Balance sheet of P, Q and R sharing profit and losses in the ratio 3:2:1 respectively. The balance sheet on 30th June 2010 was as follows: (March 2013)

Balance Sheet

Answer:

The firm was dissolved on that date. For the purpose of dissolution, the investments were valued at Rs. 18000 and Stock at Rs. 17500. ‘P’ took over investments and ‘Q’ to take over stock. ‘R’ took over furniture at book value. Debtors and buildings realised Rs. 57000 and Rs. 25000 respectively. Expenses of realisation amounted to Rs. 450. In addition one bill forRs. 500 under discount was dishonored and had to be taken up by the firm. Prepare Realisation A/c, Partners Capital a/c and Bank A/c.

Answer:

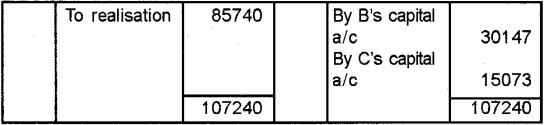

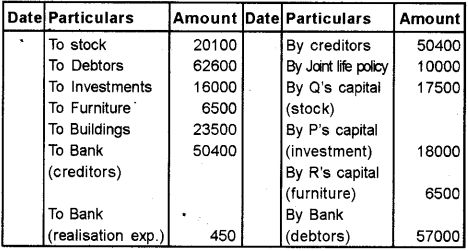

Realisation a/c

Capital A/c

Bank A/c

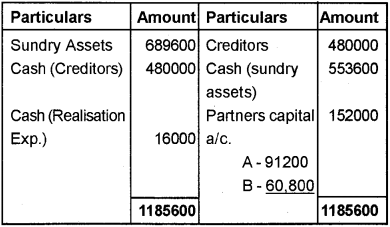

Question 13.

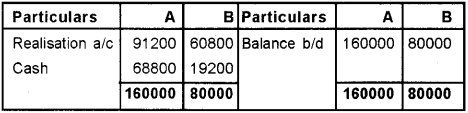

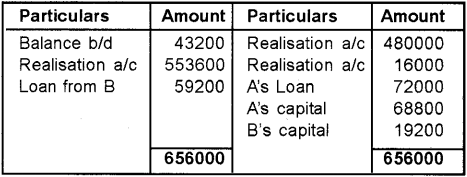

A and B were partners in a firm sharing profits and losses in the ratio of 3:2 respectively. They decided to dissolve the firm on 31st March, 2010. On that date, their capitals stood at Rs. 1,60,000 and Rs. 80.0 respectively. Amount owned by “B” to firm was Rs. 59,200 and there was a loan by “A” for Rs. 72,000. Creditors were Rs. 4,80,000, sundry, assets Rs. 6,89,600 and cash Rs. 43,200. Sundry assets realised Rs. 5,53,600. Realisation expenses amounted to Rs. 16,000. (March 2013)

Prepare realisation account, cash account and capital accounts of partners assuming that both the partners are solvent.

Answer:

Realisation A/c

Capital A/c

Cash A/c

Question 14.

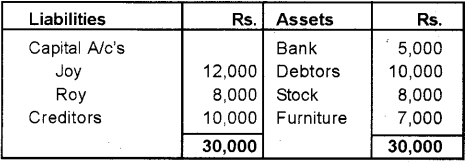

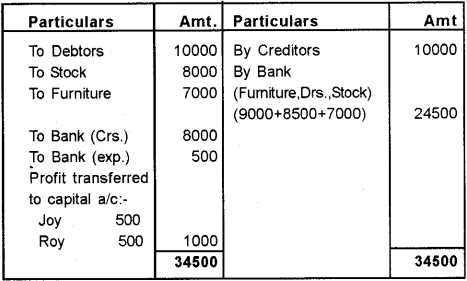

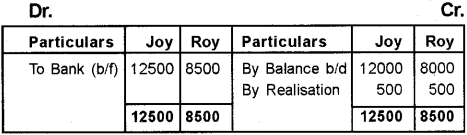

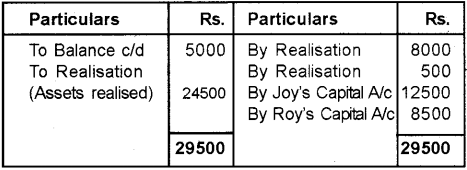

Joy and Roy were in partnership, sharing profits and losses equally. Their Balance Sheet as on 31-03-2012 was as follows : (May 2013 (Say)

Balance Sheet as on 31-03-2012

The firm was dissolved on the date of Balance Sheet. The assets realized as follows. Furniture Rs. 9,000; Debtors Rs. 8,500; Stock Rs. 7,000. Creditors were paid (in full settlement) Rs. 8,000. Realisation expenses amounted to Rs. 500. Prepare necessary Ledger Accounts to close the books of the firm.

Answer:

Realisation A/c

Partners Capital A/c

Bank A/c

Question 15.

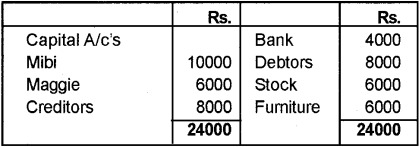

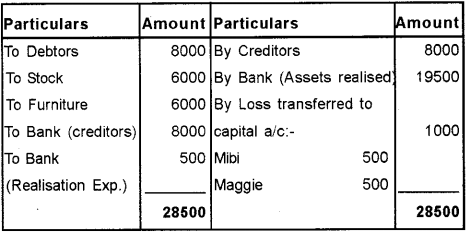

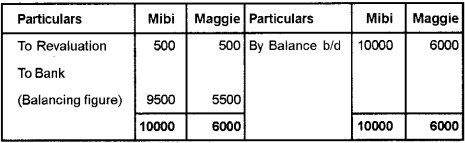

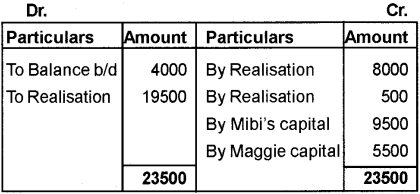

Mibi and Maggie were in partnership, sharing profits and losses equally. Their Balance Sheet as on 31.03.2013 was as follows. (March 2014)

Answer:

Balance Sheet as on 31.03.2013

The firm was dissolved on the date of Balance Sheet. The assets realized as follows:

Furniture Rs. 8000 Debtors Rs. 6,500 Stock Rs. 5,000 Creditors were paid in full.

The Realisation expenses amounted to Rs. 500. Prepare necessary Ledger Accounts.

Answer:

Realisation a/c

Capital A/c

Bank a/c

Question 16.

What journal entries would you pass for the following transactions on the dissolution of the firm of partners X and Y? (Say 2016)

i) Dissolution expenses 1800 were paid by ‘Y’

ii) An unrecorded asset realized 13,000.

iii) Stock 15,000 already transferred to realization account was taken over by ‘X’.

iv) Creditors already transferred to realization account were paid? 4000.

v) Loss on realization 13,000 was distributed among the partners X and Y in their profit sharing ratio 3:2.

Answer:

Realisation A/c Dr 800

To Y’s capital A/c 800

ii) Cash A/c Dr 3000

To realisation 3000

iii) X’s capital A/c Dr 5000

To realisation 5000

iv) Realisation A/c Dr 4000

To cash 4000

v) X’s capital A/c Dr 1800

Y’s capital A/c Dr 1200

To realisation 3000

Question 17.

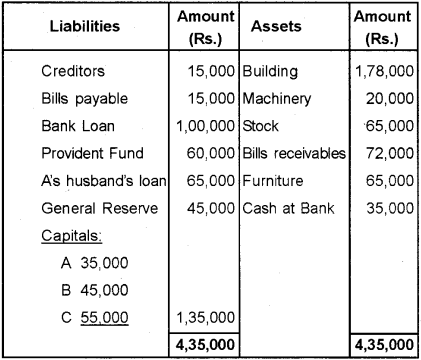

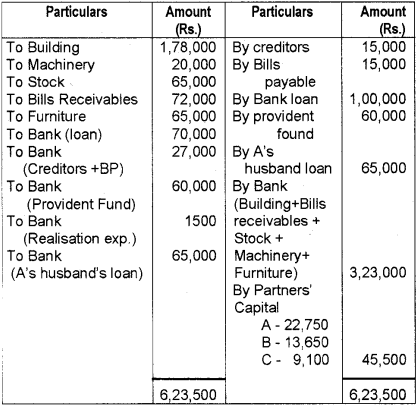

A, B & C are partners sharing profit and losses in the ratio of 5:3:2. Their Balance Sheet as on 31st March 2015 was as follows: (March 2017)

Balance Sheet of A, B & Cas on 31st March 2015

The firm was dissolved on that date. Prepare realization account with the following information:

1) Building realized forRs. 1,20,000; Bills receivables realized for Rs. 70,000; Stock realized for Rs.40,000 and Machinery sold for Rs.33,000 and furniture Rs.60,000.

2) Bank loan was settled for Rs.70,000; Creditors and bills payable were settled at 10% discount.

3) Realisation expenses Rs.1,500.

Answer:

Realisation A/c

Plus Two Accountancy Dissolution of Partnership 8 Marks Important Questions

Question 18.

Arun, Basheerand Christy are in partnership with a profit-sharing ratio of 3:2:1. They decided to dissolve the firm. On the date of dissolution, their capitals were Rs. 20,000/-, Rs. 15,000/- and Rs. 10,000/-respectively. Their books of accounts showed the total creditors as Rs. 20,000/- and bills payables as Rs. 5,000/-. (June 2009 (Say)

Christy advanced an additional Rs. 10,000/ be-sides his capital, to the firm. At the time of dissolution has an unrecorded liability for Rs. 4,000/-. The cost of dissolution amounted to Rs. 2,000/-. The firm is having a cash balance of Rs. 8,000/- as per records.

You are asked to find out:

(a) Sundry assets

(b) Profit or Loss on Realisation

(c) Amount to be received or brought in by each partner.

Answer:

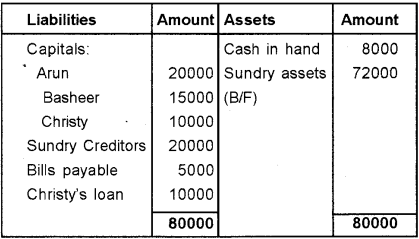

Balance Sheet

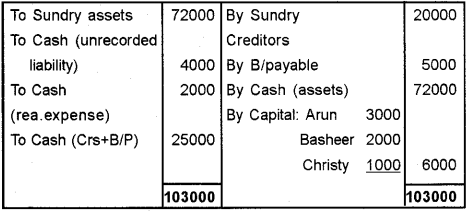

Realisastion A/c

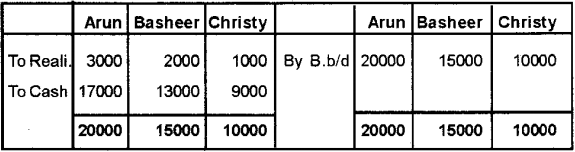

Capital Accounts

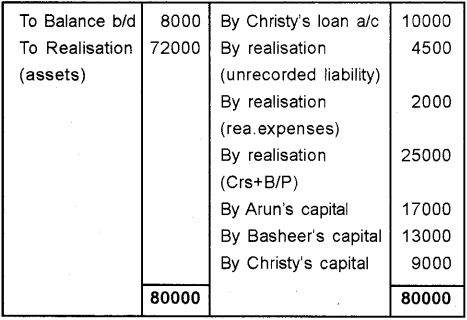

Cash A/c

Question 19.

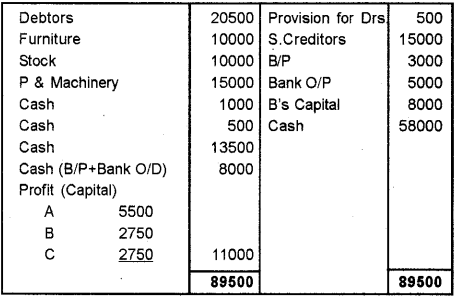

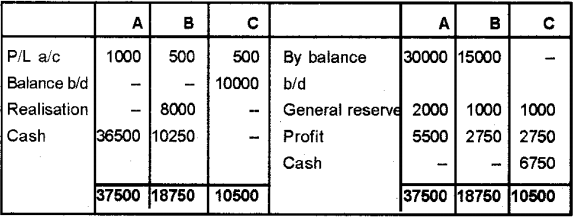

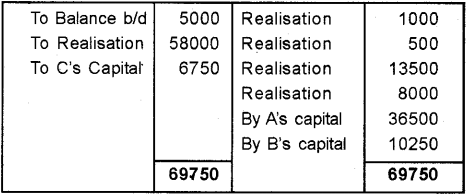

Abu, Bibu and Cebu were sharing profits and losses in the ratio 2:1:1. Their Assets and Liabilities as on 31-12-2007 is as shown below: (June 2009 (Say)

The assets realized on dissolution are :

Sundry Debtors 20,500

Furniture 10,000

Stock 10,000

Plant & Machinery 15,000

Cash at Bank 5,000

Provision for bad debts 500

Sundry Creditors 15,000

Bills Payables 3,000

Bank Overdraft 5,000

In addition to the above the firm had a general re serve for Rs. 4000/- and an accumulated loss of Rs. 2,000/-.

The Partners decided to dissolve the firm on the above said date and their capital balances on that date were:

Abu (Cr.) – Rs. 30,000/-

Bibu(Cr.) – Rs.15,000/-

and Cibu(Dr.) – Rs. 10,000/-

The assets realized on dissolution are:

Sundry Debtors – 18,000/-

Funiture – 15,000/-

Plant & Machinery – 20,000/-

Stock was taken over by Bibu at Rs. 8,000/-

The firm had an unrecorded investment of Rs. 5,000/- and there was a pending case for a claim of Rs. 2,000/- which was settled at Rs. 1,000/- Realisation expenses amounted to Rs. 500/-. The creditors are settled at a discount of 10%. Prepare Realisation ale, Capital a/cs and Bank a/c.

Answer:

Old Balance Sheet

Realisation A/c

Capital A/c

Cash A/c

Question 20.

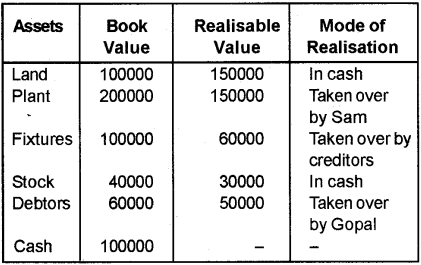

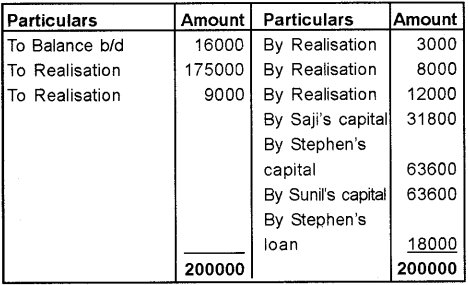

a) Given below is an abstract of particulars related to a dissolved partnership firm on 31.3.2009 where Sam, Gopal and Rahim were partners sharing profits on 5:3:2. (June 2010)

Liabilities: Capital –

Sam : 200000

Gopal: 150000

Rahim:100000

Creditors – 50000

General Reserve- 100000

The firm collects the balance from the creditors after adjustment of fixtures taken over by them.

Prepare: Realisation Account, Capital accounts and Cash account.

Answer:

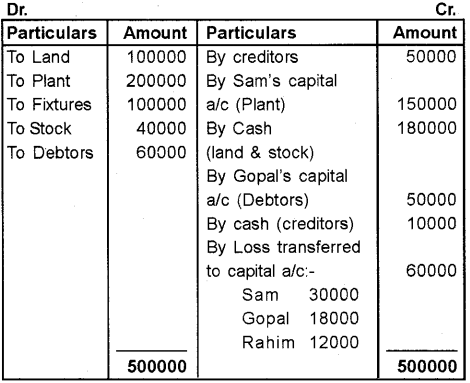

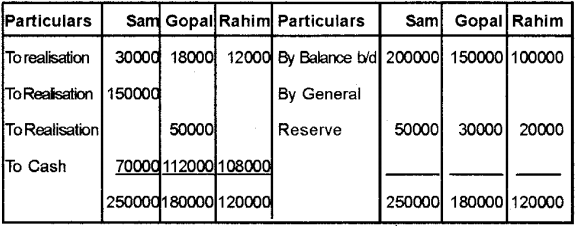

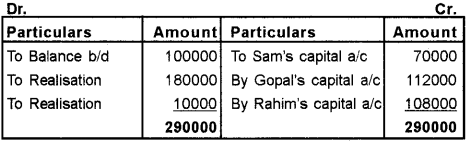

Realisation a/c

Capital A/c

Cash a/c

Note:

When a creditor accepts an asset which has a higher value than the amount due to him, then an entry will be passed only for receiving the excess amount from such creditor. Here, fixture taken over by creditor for Rs.60000, which is higher than the amount due to him ie. 50000. The excess amount Rs.10000/- (60000 – 50000) is credited to Realisation a/c.

Question 21.

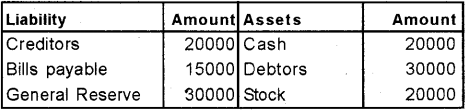

Balance sheet of M/s. J3 is given below: (June 2010)

Balance Sheet as on 31.3.2009

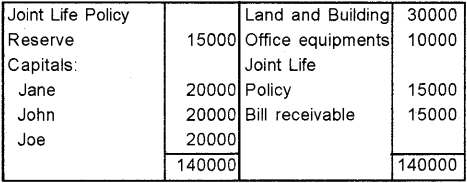

On a dispute between the partners they decide to wind up the firm on the following terms:

1. Assets realised land and buildings -100000 Stock -10000

2. Jane took over Bills Receivable for Rs. 12000

3. A creditor accepts office equipment for Rs.8000 and the balance were paid in cash.

4. The Joint Life Policy was surrendered for Rs.9000.

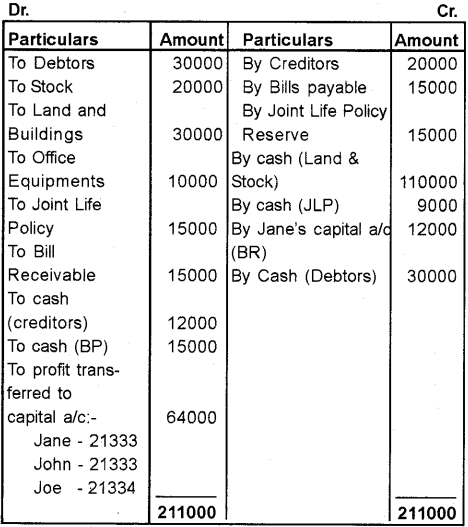

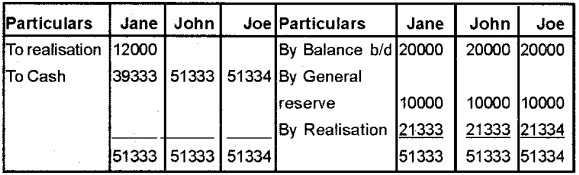

Prepare: Realisation Account, Capital Accounts and Cash Account.

Answer:

Realisation a/c

Capital A/c

Cash A/c

Question 22.

Thara, Sony and Agnes started business on 1st April, 2002 with capitals of Rs. 1,00,000, Rs. 80,000 and Rs. 60,000 respectively sharing profits (losses) in the ratio of 4 : 3 : 3. For the year ending March 31st, 2003, the firm suffered a loss of Rs. 50,000. Each of the partners withdrew Rs. 10,000 during the year. On March 31st, 2003 the firm was dissolved, the creditors of the firm stood at Rs. 24,000 on that date and cash in hand was Rs. 4,000. The assets realised Rs. 3,00,000 and creditors were paid Rs. 23,500 in full settlement of their claim. Prepare realisation ac-count and show your workings clearly. (March 2010)

Hint: Book value of assets on the date of dissolution is to be ascertained by preparing a Balance Sheet.

Answer:

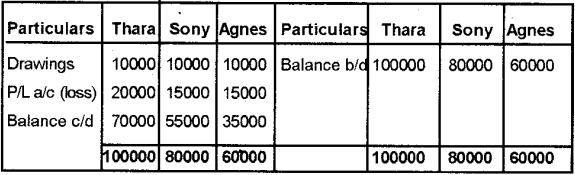

Opening Capital Accounts

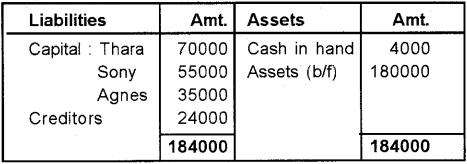

Opening Balance Sheet

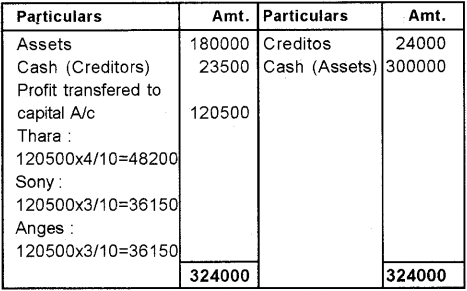

Realisation A/c

Question 23.

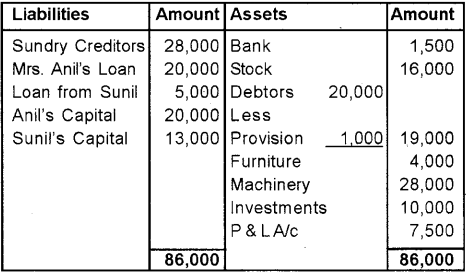

a) Anil and Sunil are partners sharing profits and losses in the ratio of 3:2. Their Balance Sheet as on 31st December 2010. (March 2012)

The firm dissolved on the above date. Following transaction took place:

1) Anil took over investments at Rs. 8,000 and also agreed to pay off his wife’s loan.

2) Other assets were realised as: Stock- 15,000, Debtors- 18,500, Fumiture-4,500, Machinery -25,000.

3) Realisation expenses were Rs. 1,100.

4) Creditors were paid off at a discount of 2.5%. Close the books of the firm.

Answer:

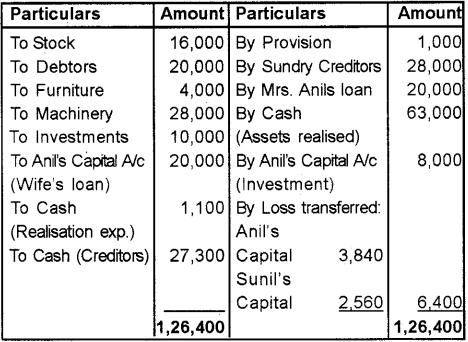

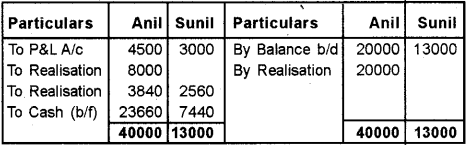

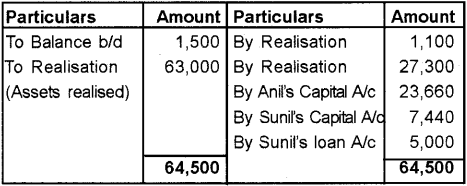

a) Realisation A/c

Capital A/c

Cash A/c

Question 24.

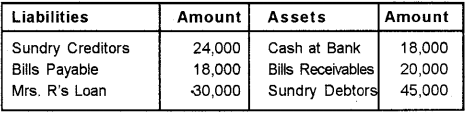

R and S are partners who share profits and losses in the ratio of 3 : 1. They decided to dissolve their partnership on 31 st December 2009, on which date their Balance Sheet stood as under: (March 2012)

Dissolution was effected on the following terms:

i) Mr. R agreed to pay off Mrs. R’s loan.

ii) Assets were realised as under:

Debtors – 44,000; Plant and Machinery – 28,000; Goodwill – 18,000; Furniture – 5,000; Stock – 11,000.

iii) Mr. S took away investments at Rs. 33,000 and bills receivable at 10% discount.

iv) Sundry creditors and Bills payable were settled at 5% discount.

v) Realisation expenses come to Rs. 2,500.

Prepare Realisation Account, Capital Account and Bank Account.

Answer:

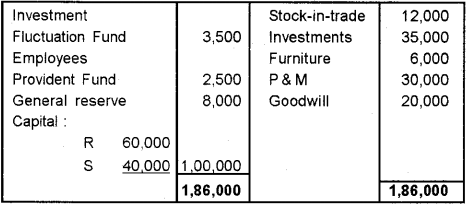

a) Realisation A/c

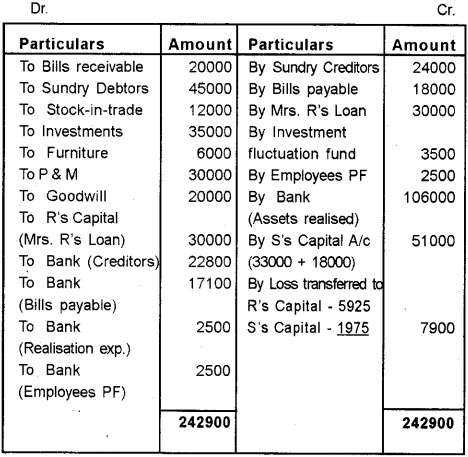

Capital A/c

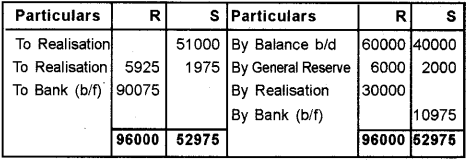

Bank A/c

Question 25.

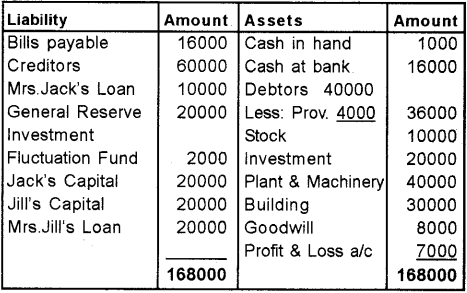

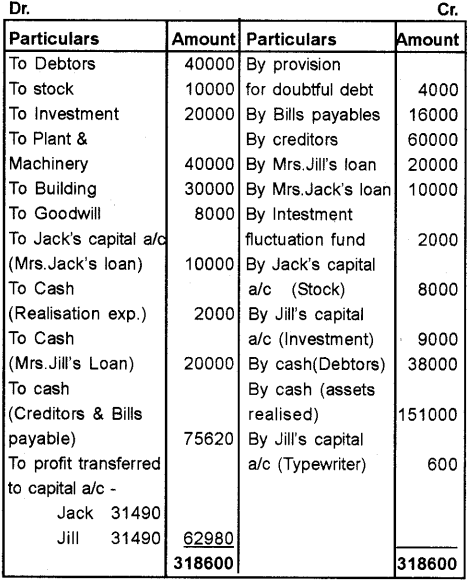

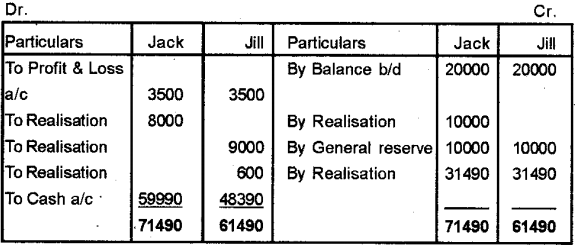

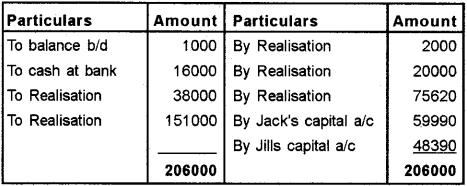

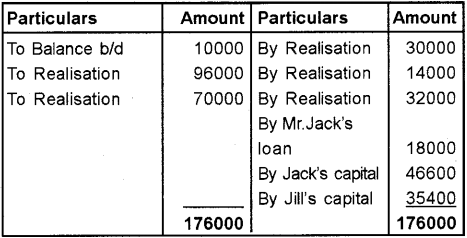

The following is the Balance Sheet of Jack and Jill as on 31 st December 2007. (Score 4) (June 2012)

The firm was dissolved on 31st December 2007 on the following terms:

a) Jack promised to pay off Mrs. Jack loan and took away stock Rs.8000.

b) Jill took away half of the investment at 10% discount.

c) Debtors realised Rs.38000

d) Creditors and bills payable were due on an average basis, one month after 31st December, but they are paid immediately on 31 st December at 6% discount p.a.

e) Plant realised Rs.50000, buildings Rs.80000, goodwill Rs.12000 and remaining investments Rs.9000.

f) There was a old typewriter in the firm which had been written off completely from the books. It is now estimate^ to realise Rs.600. It was taken away by Jill at this estimated price.

g) Realisation expenses were Rs.2000. You are required to give the necessary ledger account. (8 scores)

Answer:

Realisation A/c

Capital A/c

Cash a/c

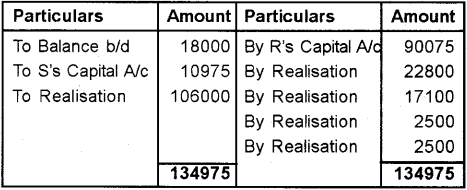

Working Note

1. Investment = 20000 x 1/2 x 10/100 = 1000 Taken over by Jill = 10000 -1000 = 9000

2. Creditors & Bills payable paid off = (76000 x6/100×1/12) = 380 76000-380 = 75620

Question 26.

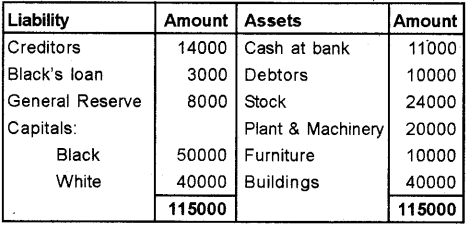

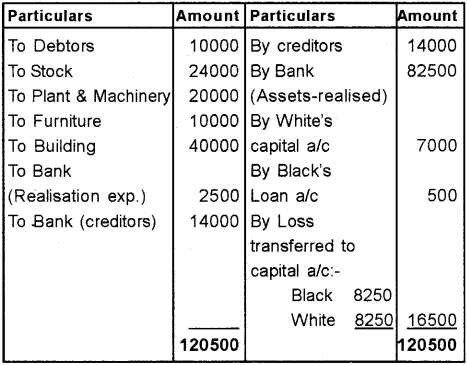

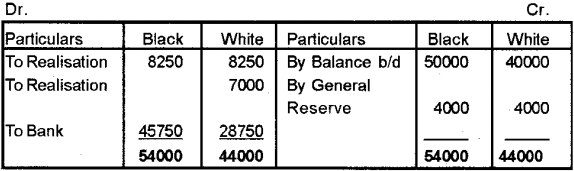

Black and White are equal partners of a firm, the Balance sheet of which is given below as on 31st March 2011, the date at which they decide to dissolve the partnership. (May 2013 (Say)

a) Assets were realized as follows: Stock Rs. 22,000, Debtors 9,500, Machinery Rs.21,000, Buildings rs. 30,000.

b) White took over the furniture at Rs. 7,000.

c) Black agreed to accept Rs. 2,500 in full settlement of his loan account.

d) Dissolution expenses amounted to Rs. 2500.

Prepare Realisation Account, Partner’s Capital Account and Bank Account.

Realisation account, Partner’s Capital Account, Bank Account.

Answer:

a) Realisation a/c

Capital A/c

Bank a/c

Note: Balance of Black’s loan a/c Rs. 500 (3000 – 2500) being profit will be transferred to the Realisation a/c.

Question 27.

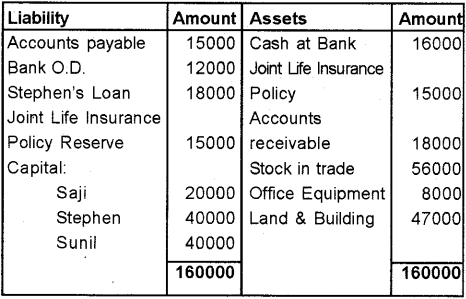

A) Saji, Stephen and Sunil were partners sharing profits and losses in the ratio of 1:2:2. Their Balance Sheet as on 31st March 2013 was as follows: (March 2014).

The partners agreed to dissolve the firm on the following terms:

a) Assets realised as – Land and Buildings – Rs.120000, Stock – Rs. 40000, Accounts receiv-able – Rs.15,000.

b) Expenses on dissolution – Rs. 3000

c) A creditor accepts office equipment for Rs.7000 and the remaining creditors were paid in full by cheque.

d) The Joint Life Insurance Policy was surrendered for Rs.9,000. Prepare realization a/c, capital accounts and bank account.

Answer:

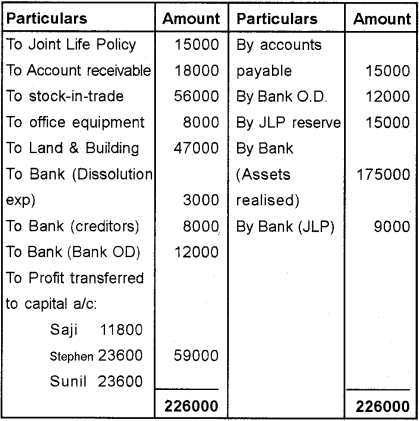

Realisation a/c

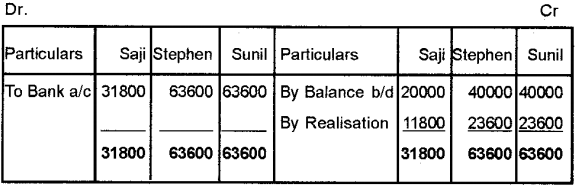

Capital A/c

Bank a/c

Question 28.

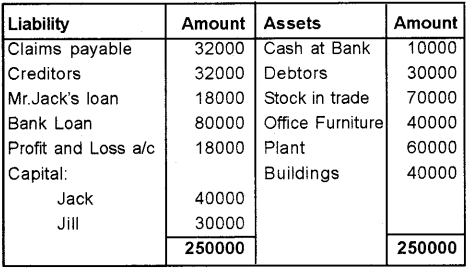

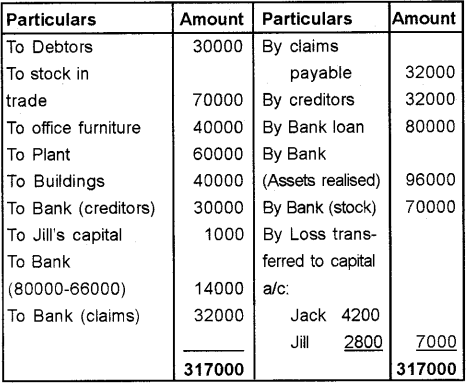

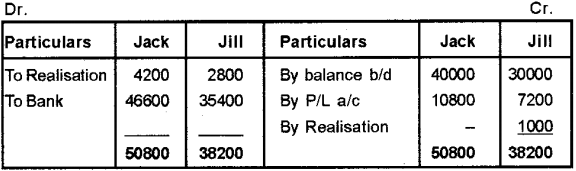

Jack and Jill are partners sharing profits in the ratio of 3:2. They decided to close the firm and their Balance Sheet is given below: (March 2014)

Assets realised as follows:

Buildings Rs. 32000

Debtors Rs.28000

Furniture Rs.36000

Liabilities settled as follows:

Plant has been taken over by Bank at Rs. 66,000 in respect of the loan granted by the Bank and the rest has been paid in cash.

Creditors are settled at Rs. 30,000

Realisation expenses came to Rs. 1000 which have been met by Jill.

Prepare necessary accounts to dissolve the firm and ascertain the amount due to ordue from the partners.

Answer:

Realisation a/c

Capital A/c

Bank a/c

Question 29.

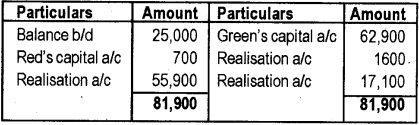

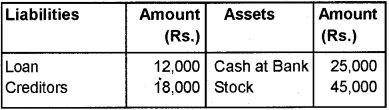

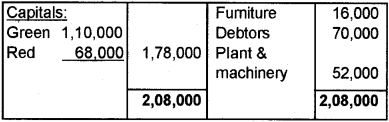

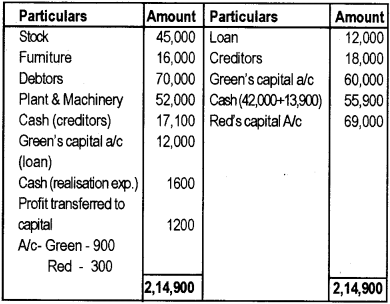

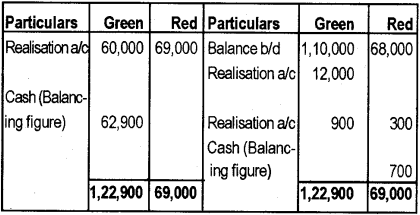

Green and Red sharing profits as 3:1 and they agree upon dissolution. The Balance Sheet as on 31-03-2014 is as under: (March 2016)

Balance Sheet as on 31-03-2014

Green took over plant and machinery at an agreed value of Rs. 60,000. Stock and furniture were sold for Rs. 42,000 and Rs.13,900 respectively. Debtors were taken over by Red at Rs.69,000. Creditors were paid at a discount of Rs.900. Green agreed to pay the loans. Realisation expenses were Rs.1,600. Prepare necessary Ledger A/cs.

Answer:

Realisation A/C

Capital A/c

Cash A/c