Kerala Plus Two Accountancy Chapter Wise Previous Questions Chapter 4 Reconstitution of a Partnership Firm – Retirement/Death of a Partner

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner 1 Marks Important Questions

Question 1.

Section – 37 of the Partnership Act provides interest on the amount left by the retiring or deceased partner at (March 2010)

a) 5%

b) 6%

c) Bank rate

Answer:

b) 6%

Question 2.

W,X, Y and Z are partners sharing profit and losses in the ratio of 1/3, 1/6, 1/3 and 1/6 respectively. Y retires and W, X and Z decided to share the profit and losses equally. Calculate the gaining ratio. (March 2013)

Answer:

Gaining ratio – New rato – old ratio

Old ratio = 1/2:1/6:1/3:1/61/2:1/6:1/3:1/6

ie. 2/6:1/6:26:1/62/6:1/6:26:1/6

New ratio = 1 : 1 : 1

W’s gain = 1/3−2/6=0/61/3−2/6=0/6

Z’s gain = 1/3−1/6=1/61/3−1/6=1/6

Z’s gain = 1/3−1/6=1/61/3−1/6=1/6

Gaining ratio = 0:1:1

Question 3.

Retiring Partner’s Capital is transferred to account. (Say 2013 (May))

a) Current

b) Loan

c) Profit & Loss

d) Memorandum Revaluation

Answer:

b) Loan account

Question 4.

Profit or loss on revaluation at the time of retirement must be transferred to the partners in (Say 2016)

a) Capital ratio

b) Old profit sharing ratio

c) Equally

d) Gaining ratio

Answer:

b) old profit sharing ratio

Question 5.

Write a journal entry for recording unrecorded liability at the time of retirement of a partner. (March 2017)

Answer:

Up Revaluation A/c Dr

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner 2 Marks Important Questions

Question 6.

In which case the following journal entries are required? (March 2010)

i) Retiring partner’s Capital account Dr To Retiring partner’s Loan account

ii) Deceased partner’s executor’s account Dr To Cash/Bank account

Answer:

i) The amount due to the retiring partner is transferred to his loan a/c.

ii) The amount due to the deceased partner is immediately paid to the executors in cash.

Question 7.

Manju, Daniel and Joseph are partners in a firm. Joseph decides to retire from the firm due to ill health. You, as their accountant, explain to them the adjustments required in accounts on the retirement of a partner. (March 2011)

Answer:

The following adjustment are required in accounts on the retirement of a partner.

a) Calculation of gaining ratio

b) Revaluation of assets and reassessment of liabilities

c) Treatment of goodwill

d) Adjustment of reserves and accumulated profits or loss.

e) Ascertainment of profit or loss up to the date of retirement.

f) Settlement of the accounts of a retiring partner.

Question 8.

A, B and C are partners sharing profits in the ratio of 4:3:2. ‘C’ retires from the frim. Calculate new profit sharing ratio and gaining ratio. (March 2012)

Answer:

Old ratio = 4:3:2

New ratio after the retirement of C = 4: 3

Gaining ratio A=47−49=863A=47−49=863

B=37−39=663B=37−39=663

Gaining ratio = 8:6 = 4 : 3

Question 9.

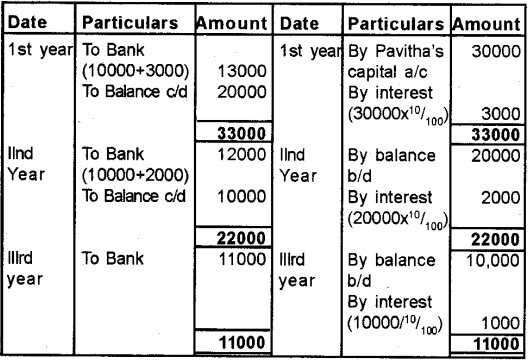

Chithra, Pavitha and Geetha are partners in a firm, Pavitha retires from the firm, on the date of retirement, Rs. 30,000 is due to her. Chithra and Geetha promise to repay the amount in three equal instalments at the end of every year. Prepare Pavitha’s loan a/c if they agreed to pay in three equal yearly instalments together with interest @ 10%. (March 2013)

Answer:

Pavitha’s Loan a/c

Question 10.

The amount due to the retiring partner may be transferred to a Loan Account ¡n his name to be gradually paid off with interest. In this connection give journal entries. (March 2013)

a) for transfer to Loan A/c.

b) for interest

c) for payment of an instalment

Answer:

1) Retiring partner’s capital a/c Dr.

To Retiring partner’s loan a/c.

ii) Interest a/c Dr.

To Retiring partners Loan a/c.

iii) Retiring partners loan a/c Dr.

To cash a/c

Question 11.

Sachin, Rahul and Lakshmanan are partners in the ratio of 2:1:1. Lakshmanan retires and Sachin and Rahul acquire his share equally. Calculate the new ratio and gaining ratio. (March 2014)

Answer:

Ratio of Sachin, Rahul and Lakshmanan = 2:1:1

Retiring partner – Lakshmanan’s share 1/4 is taken up by Sachin & Rahul equally ie. 1/8 each.

New share of Sachin =24+18=4+18=58=24+18=4+18=58

New share of Rahul =14+18=2+18=38=14+18=2+18=38

New Ratio = 5:3

Gaining ratio = 1:1

Question 12.

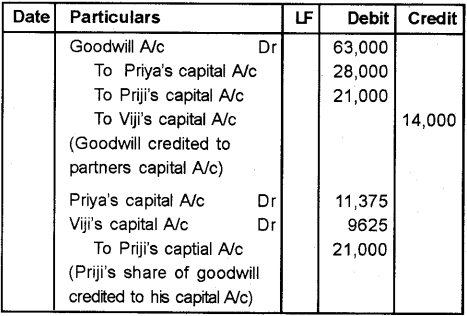

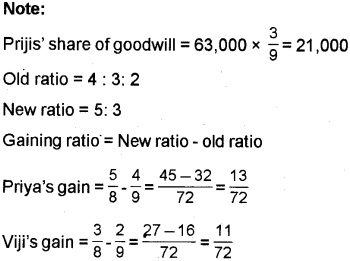

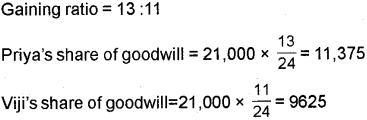

Petya, Pd) and VIJI are panels, shading profit and losses in the ratio 014:32. Pdjl retired and goodwill has valued a Rs. 63,000. Play and Viji are decided to share future profits and losses in the ratio of 5:3. Record necessary Journal entry, when goodwill Is raised at Its full value and wrItten off Immediately. (March 2017)

Answer:

Journal

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner 3 Marks Important Questions

Question 13.

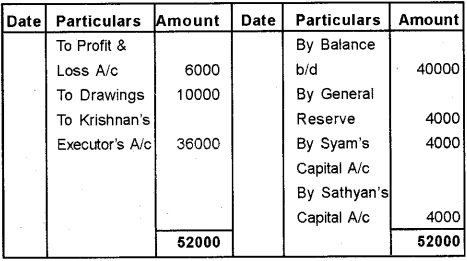

Mr. Krishnan died on 1st (March 2011) who was an – active partner in the firm. The other partners were Syam and Sathyan. The books of account reveal the following: (March 2013)

General reserve Rs. 12,000

Capital of Krishnan Rs. 40,000

P & LA/c (Dr.) Rs. 18,000

Drawings of Krishnan Rs. 10,000

Krishnan’s loan to firm Rs. 20,000

Int. on loan due to Krishnan Rs. 2,000

Value of goodwill Rs. 24,000

They share profit and losses equally. Calculate the amount due to his legal heirs.

Answer:

Krishnan’ Capital a/c

Krishnan’s loan to firm = 20000

Krishnan’s Interest on loan = 2000

Total amount due to Krishnan’s legal heirs = Capital a/c balance + Krishnan’s loan + Interest on loan = 36000 + 20000 + 2000 = 58000

Question 14.

Give three distinctions between ‘gaining’ and ‘sacrificing’ ratio. (March 2013)

Answer:

The distinction between gaining ratio and sacrificing ratio.

| Sacrificing Ratio | Gaining Ratio |

| 1. It is the ratio in which the older partners sacrifice their share of profit in favour of incoming partner. 2. It is calculated at the time of admission of a partner. 3. It is the excess of old ratio over new ratio. | 1. It is the ratio in which the continuing partners share the profit of outgoing partners. 2. It is calculated at the time of retirement or death of a partner. 3. It is the excess of new ratio over old ratio. |

Question 15.

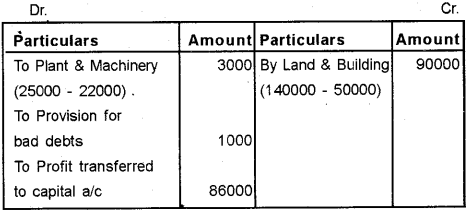

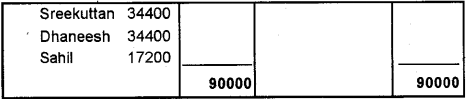

Sreekuttan, Dhaneesh and Sahil were in partnership and were sharing profits in the ratio of 2:2:1. On 31.03.2013, Sahil left the firm as per their agreement. The following details are available from their books. (March 2014)

Balance Sheet as on 31.03.2013

| Capital A/c’s: Sreekuttan Dhaneesh Sahil General Reserve Creditors Bills Payable | 50000 30000 20000 10000 42000 4200 | Cash Debtors Stock Plant & Machinery Land & Building | 1200 30000 50000 25000 50000 |

| 156200 | 156200 |

Land and Buildings had been valued at Rs. 140000. The Plant and Machinery was revalued at Rs.22000 and it was agreed that the provision of Rs. 1,000 be created for doubtful debts. Prepare Revaluation Account.

Answer:

Revaluation A/c

Question 16.

A, B and C were in partnership, sharing profits equally. ‘C’ agreed to retire from the partnership on 30th June, 2007, His share of profits to the date of retirement has to be calculated on the basis of the average profits of the preceding three accounting years. The books showed the profits of the last five accounting years (ending on 31st March) as follows: (Say 2016)

2002 – 03 = ₹ 12,650

2003 – 04 = ₹ 15,400

2004 – 05 = ₹ 9,900

2005 – 06 = ₹ 8,800

2006 – 07 = ₹ 11,000

Calculate C’s share of profit.

Answer:

Profit for the last three years = 9900+8800+11,000 = 29,700

Average profit =29,7003=9900=29,7003=9900

Profit from the date of last balance sheet to the date of retirement =9900×312=2475=9900×312=2475

C’s share of profit =2475×13=825=2475×13=825

Question 17.

K, L, M, N and O are in partnership sharing profits and losses as 625,825,425,225625,825,425,225 and 525525 respectively. ‘K’ retires and others continue to share with their ratios immediately before the retirement of K. Calculate the new profit sharing ratio. (March 2016)

Answer:

New profit sharing ratio is 8:4:2:5

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner 5 Marks Important Questions

Question 18. (March 2009)

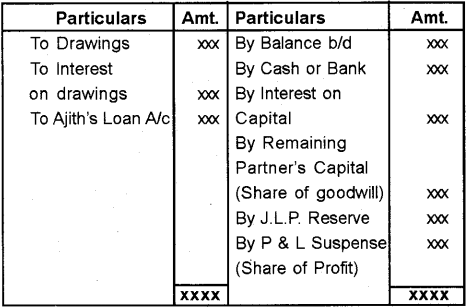

Mr. Ajithkumar, a partner in a profit-earning partnership firm, retired voluntarily due to ill health. He is very eager to know the amount due from the firm. As an accountant, how will you calculate the amount due to him? Explain the procedure by preparing his capital account using imaginary figures, assuming that he had retired on June 30th and the accounts are closed every year on March, 31st.

Answer:

Ajith Kumar’s Capital A/c

Question 19.

Anu, Manu, & Vinu are partners sharing profits and losses in the ratio 3:2:1. Anu retires from the firm and his share is taken over by Manu and Vinu in the ratio 3 : 2. (June 2009 (Say)

On Anu’s retirement, the goodwill of the firm is valued at Rs. 1,20,000/- Finally the amount due to Anu is ‘ transferred to his executor’s loan account. Your valuable suggestions are requested, regarding.

(1) The new profit sharing ratio and gaining ratio.

(2) Treatment of Goodwill on retirement and

(3) Settling the accounts of a retiring partner.

Answer:

Old ratio of Anu, Manu and Vina = 3:2:1

Calculation of gaining ratio.

Anu’s share taken over by Manu =3/6×3/5=9/30=3/6×3/5=9/30

Anu’s share taken over by Vinu =3/6×2/5=6/30=3/6×2/5=6/30

∴ Gaining ratio =9/30:6/30=9/30:6/30

New ratio = Old ratio + gaining ratio

New ratio of Manu =26+930=10+930=1930=26+930=10+930=1930

New ratio of Vinu =16+630=5+630=1130=16+630=5+630=1130

New ratio = 19:11

Total goodwill of the firm = 1,20,000

Anus share of goodwill = 1,20,000 x 3/6 = 60,000

Manu’s capital Dr. 36,000

Vin us capital Dr. 24,000

To Anus capital 60,000

(Being goodwill adjusted in the gaining ratio)

The amount due Anu can be paid in cash at the time of his retirement or amount can be transferred to his loan account or it can be partly paid in cash and the balance amount can be transferred to his loan account.

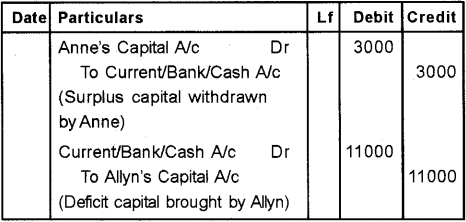

Question 20.

Anne, Allyn and Anita are partners sharing profits and losses in 5: 3: 2 ratio. Anita retires from the business. On Anita’s retirement, the respective capitals of Anne and Allyn are Rs. 38,000 and Rs. 24,000 after making all adjustments. The new profit sharing ratio betweenAnneandAllynwillbeequal. It was decided that the capital of the new firm will be Rs. 70,000 and it will be in the new profit sharing ratio. The partners will bring in additional capital or withdraw the excess capital as the case may be. Calculate the amount of capital to be brought in or withdrawn by Anne and Allyn and also draw the necessary journal entries for the same. (March 2010)

Answer:

Total capital of the new firm = Rs. 70,000

New ratio = 1: 1

New Capital of Anne = 70,000 x 1/2 = 35,000

New capital of Allyn = 70,000 x 1/2 = 35,000

Required capital of Anne = 35000

Balance existing in account = 38000

Surplus capital withdraw by Anne = +3000

Required capital of Allyn = 35000

Balance existing in account = 24000

Amount to be brought in by Allyn = -11000

Jurnal

Question 21.

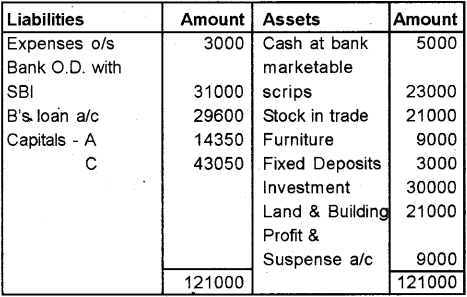

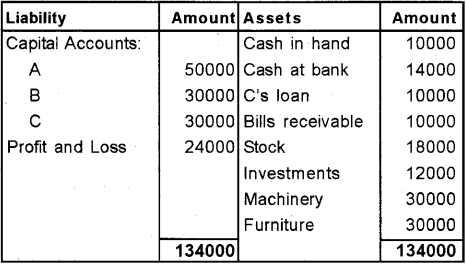

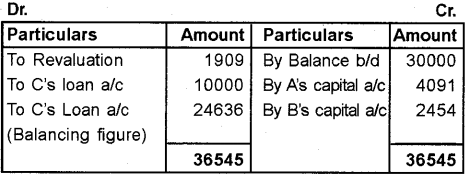

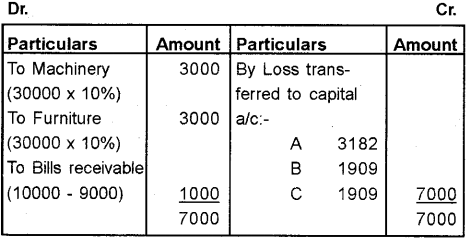

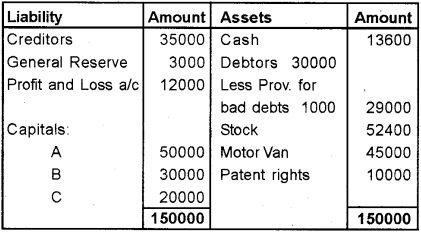

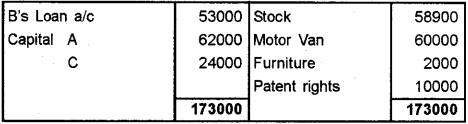

On the date of retirement of C, the Balance Sheet of A, B and C shows the following position: (June 2010)

Balance Sheet

(i) Profits shares in the ratio of capitals.

(ii) Profit and Loss is to be credited to the extent of C, through capital adjustment of partners.

(iii) Bills receivables are collected through a debt collection agency at Rs.9000/-

(iv) Depreciate all fixed assets @ 10%.

Find the amount due to the retiring partner.

Answer:

C’s Capital a/c

Revaluation a/c

Note:

1. Profit and Loss = 24000

C’s share of profit = 24000 x 3/11 = 6545 Rs.6545 is to be credited to the capital a/c of ‘C’ through capital adjustment of A and B.

A’s capital a/c (6545 x 5/8) Dr. 4091

B’s capital a/c (6545 x 3/8) Dr. 2454

To C’s capital a/c 6045

Question 22.

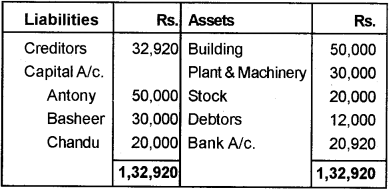

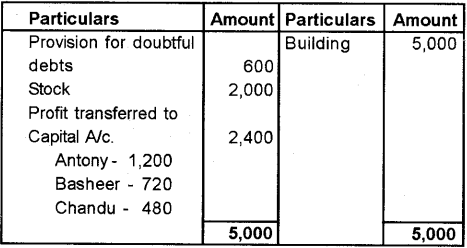

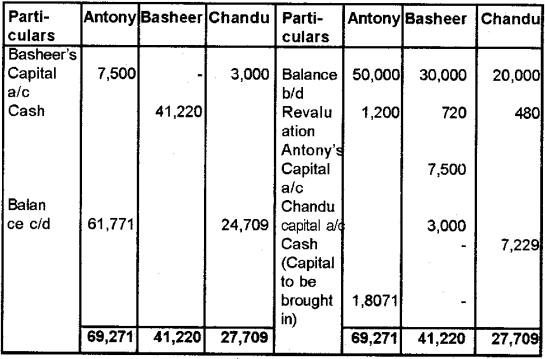

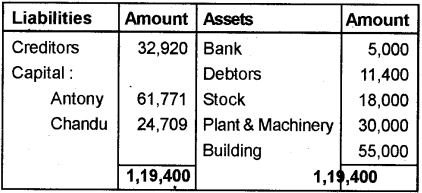

Antony, Basheerand Chandu were partners in a firm sharing profits & losses in the ratio of 5 : 3 : 2. The Balance Sheet of the firm as on 31-03-2008 stood as under: (March 2011)

Basheer has decided to retire from the firm subject to the following conditions.

(1) Provission for doubtful debts be 5%.

(2) Value of building be appreciated by 10%.

(3) Stock be depreciated by Rs. 2,000.

(4) Goodwill of the firm be valued atRs, 35,000.

(5) Basheer shall be paid by bringing sufficient amount by Antony and Chandu so that their capital will be in the profit-sharing ratio.

(6) Bank A/c. shall be maintained with a balance of Rs. 5,000 to meet working capital requirements.

Prepare Revalution a/c, capital A/c and balance Sheet after retirement.

Answer:

Revaluation A/c

Capital A/c

Balance Sheet

Note : Gaining ratio = 5:2

Basheer’s share of Goodwill = 35,000 x 3/10 = 10,500

Question 23.

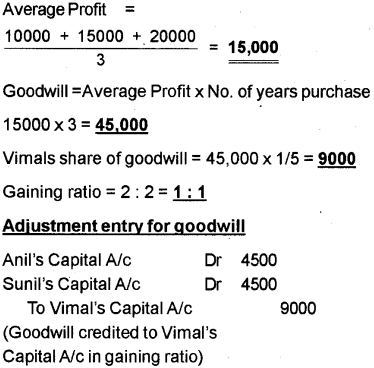

Anil, Sunil and Vimal were sharing profits and losses in the ratio of 2:2:1. On 31st December 2010. (March 2012)

Vimal decided to retire from the business. The goodwill of the firm is valued at 3 years purchase of the average profit of the proceeding 3 years. The profits for the last 3 years were Rs. 10,000, Rs. 15,000 and Rs. 20,000. Find out Vimal’s share of goodwill and also show the journal entry to adjust his share of goodwill.

Answer:

Calculation of Goodwill (Using Average Profit Method)

Question 24.

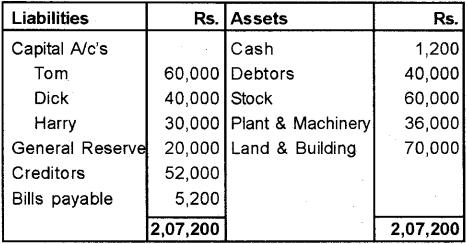

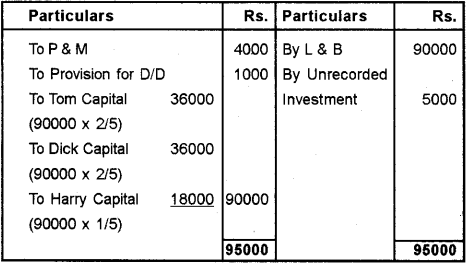

Tom, Dick and Harry were in partnership, who were sharing profits and losses in the ratio of 2:2:1. On 31-03-2012, Harry left the firm as per agreement. From the following details available from their books prepare Revaluation Account. (Say 2013)

Balance Sheet as on 31-03-2012

Land and Buildings had been valued at Rs. 1,60,000. The Plant and Machinery was revalued at Rs. 32,000. The firm has an unrecorded investment of Rs. 5,000 and it was agreed that a provision of Rs. 1,000 be created doubtful debts.

Answer:

Revaluation A/c

Question 25.

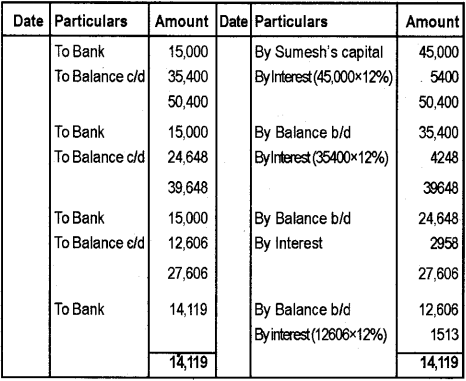

Renjith, Sumesh and Aneesh are partners in a firm. Sumesh retires from the firm. On the date of retirement of Sumesh, Rs, 45,000 become due to him. Renjith and Aneesh promise to pay the amount in instalments. Prepare Sumesh’s loan account, when they agree to pay three yearly instalments of Rs. 15,000 including interest at 12% p.a. on the outstanding balance during the first 3 years and the balance including interest in fourth year. (March 2017)

Answer:

Sumesh’s Loan A/c

Plus Two Accountancy Reconstitution of a Partnership Firm – Retirement/Death of a Partner 8 Marks Important Questions

Question 26.

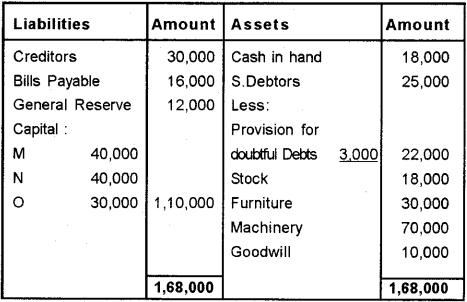

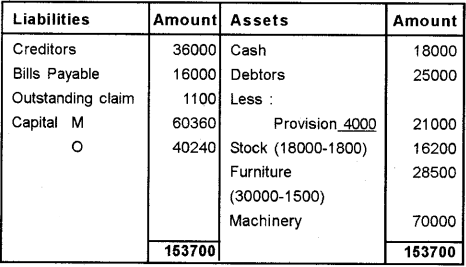

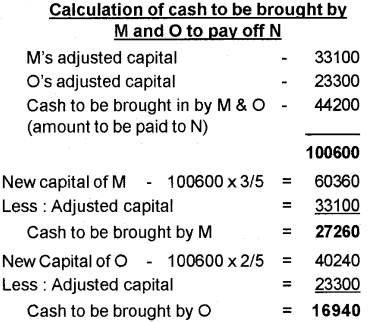

M, N and O are partners in a firm sharing profits in the ratio of 3:2:1. Their Balance Sheet as on 31 st December, 2008 was as under: (March 2012)

Balance Sheet as on 31st December 2008

N retires on 1st January, 2009 on the following terms:

i) Provision for doubtful debts will be raised by Rs. 1,000.

ii) Stock will be depreciated by 10% and furniture by 5%.

iii) There is an outstanding claim for damages of Rs. 1,100 and it is to be provided for in the books.

iv) Creditors will be written back by Rs. 6,000.

v) Goodwill of the firm is valued at Rs. 22,000, which is not to be shown in the books of the new firm.

vi) N is paid in full with the cash brought in by M and O in such a manner that their capitals are in proportion to their profit-sharing ratio 3 : 2.

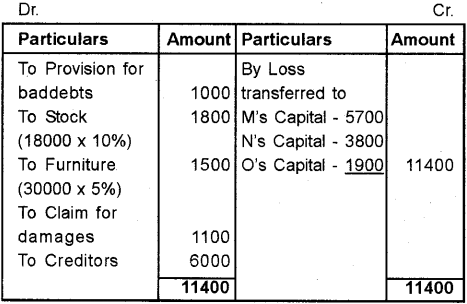

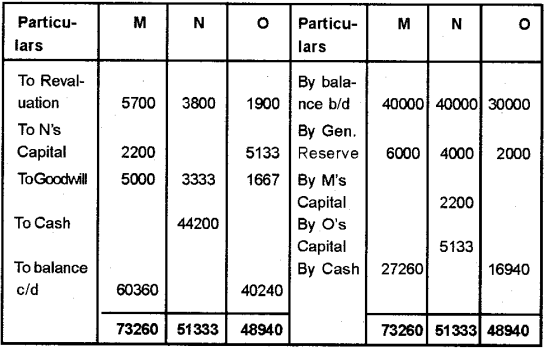

Prepare Revaluation Account, Partner’s Capital Account and Balance Sheet of M and O.

Answer:

Revaluation A/c

Note : If creditors Rs. 6000/- is taken on the credit side of the Revaluation A/c, Revaluation profit will be Rs. 600/-.)

Capital A/c

Balance Sheet

Note:

N’s Share of goodwill = 22000×2/6 = 7333

New ratio = 3:2, Old ratio = 3:2:1

Gaining ratio = New ratio – old ratio

M’s gain = 3/5 – 3/6 = 3/30

O’sgain = 2/5 – 1/6 = 7/30

Question 27.

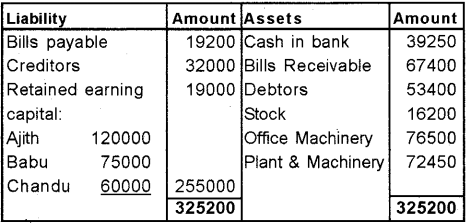

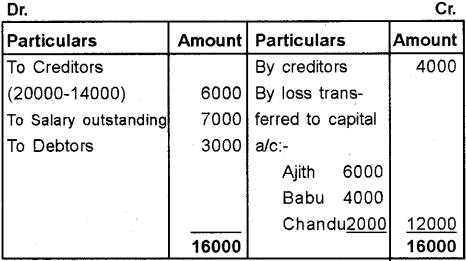

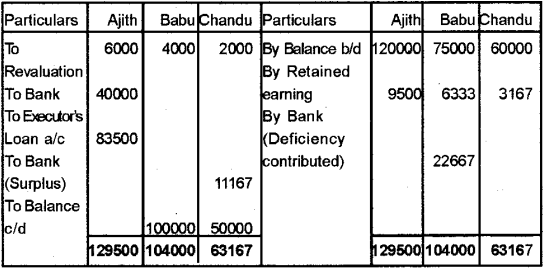

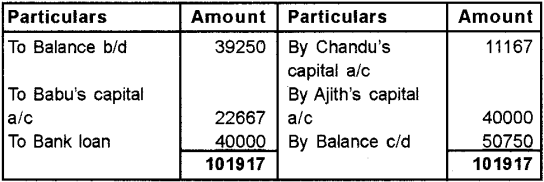

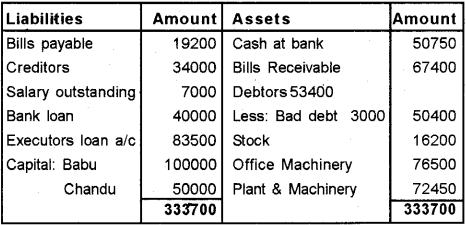

The Balance sheet of Ajith, Babu and Chandu as on 31st March 2008 is given below: (June 2012)

The partners have been sharing profits and losses in 3:2:1. Ajith died on 1st April 2008 and the following adjustments are to be made in the books of accounts.

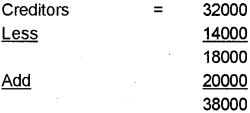

a) A supplier for Rs. 14000 included in creditors is settled at Rs. 20,000.

b) Salary outstanding Rs.7000 is to record.

c) Creditors of Rs.4000 will not be claimed.

d) Bad debts amounting to Rs.3000 be written off.

e) The entire capital of the firm fixed at Rs. 150000 between Babu and Chandu in their new profit sharing ratio by bringing in or paying off cash as the case may be.

f) Rs.40000 is paid to Ajith by arranging a loan from the bank. The balance is transferred to his Executor’s Loan A/c.

Prepare Revaluation Account, Partners Capital Ac-count, Bank Account and the Balance Sheet as on 1st April 2008.

Answer:

Revaluation a/c

Capital A/c

Bank a/c

Balance sheet

Working Note

1. New Profit sharing ratio = 2:1

2. The total capital of the new firm = 150000

New capital of Babu = 150000 x 2/3 = 100000

New capital of Chandu = 150000 x 1/3 = 50000

Required capital of Babu = 100000

Balance existing in account = 77333

(75000 + 6333-4000)

Amount to be brought in by babu = – 22667

Required capital of Chandu = 50000

Balance existing in account = 61167

(60000 + 3167-2000)

Surplus capital withdrawing by Chandu= +11167

3.

Less creditors will not be claimed 4000

Amount to be shown in the Balance sheet = 34000

Question 28.

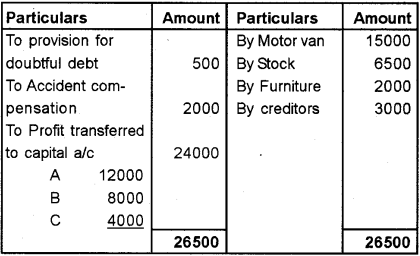

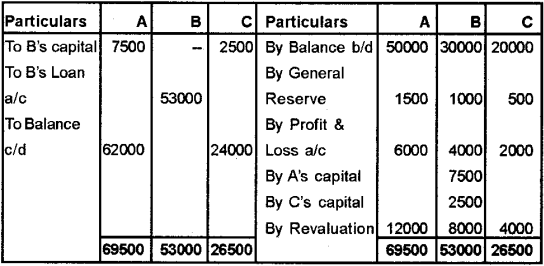

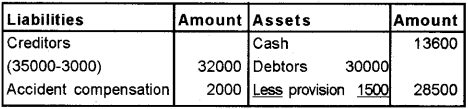

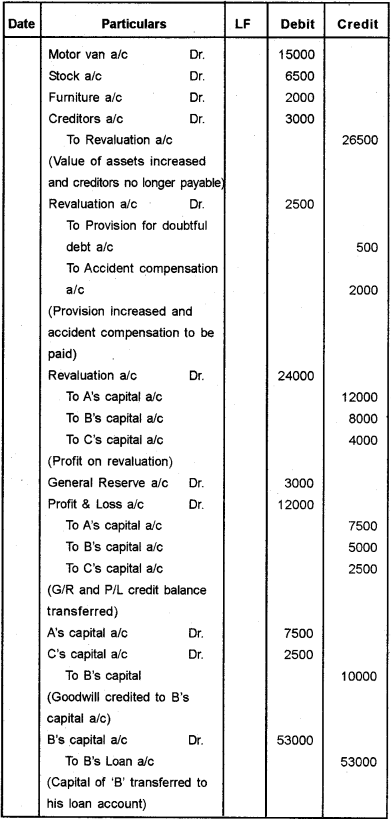

A, B and C were sharing profits losses in the ratio of 3:2:1 and their Balance sheet as on 31st December. 2011 was as follows: (Say 2013 (May)

B retires from the business on 31st December 2011 on the following terms.

a) Goodwill of the firm should be valued at Rs. 30000 and retiring partners share to be adjusted in the capital accounts of other partners.

b) Motor van to be valued at Rs.60000 and Stock to be valued at Rs. 58,900.

c) Provision for doubtful debts to be increased to 5% of debtors.

d) Creditors include Rs.3000 not likely to be claimed and hence be written back.

e) There was the furniture of the value Rs. 2000 to be brought into books.

f) There is a liability of Rs. 2000 for accident compensation to be paid.

g) The relative profit sharing ratio between A and C is to be maintained.

Give journal entries; prepare Ledger Accounts and Balance Sheet of A and C.

Answer:

Revaluation a/c

Capital A/c

Balance sheet

Journal

Note:

1. Old ratio = 3:2:1, As the relative ratio is not changed, the new ratio between A & C is 3:1.

2. Goodwill of the firm = 30000

B’s share of goodwill = 30000 x 2/6 = 10000

Gaining ratio = 3:1

3. Provision for doubtful debts

= 30000 x 5/100 = 1500

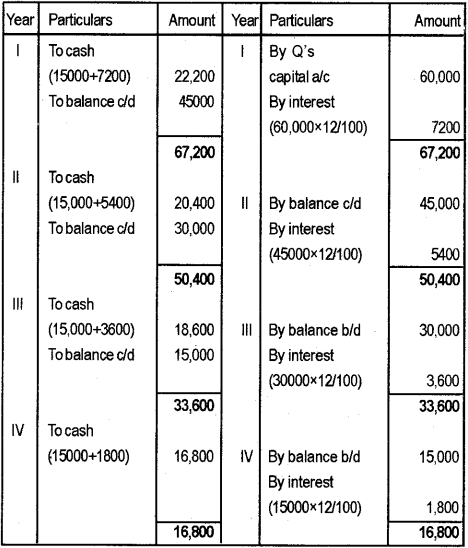

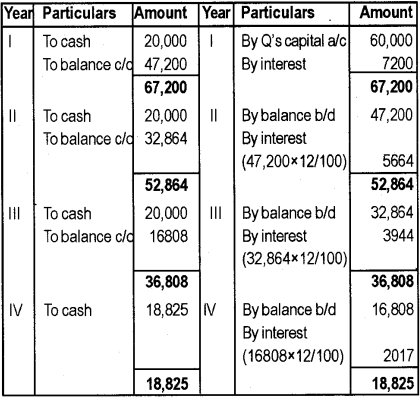

Question 29.

P, Q and R are partners in a firm. Q retires. On his date of retirement, Rs.60,000 becomes due to him. P and R promise to pay him in instalments every year at the end of the year. Prepare Q’s Loan A/c. in the following cases: (March 2016)

a) When the payment is made four yearly instalments plus interest @12% p.a. on the unpaid balance.

b) When they agree to pay three-yearly instalments of Rs. 20,000 including interest @ 12% p.a. on the outstanding balance during the first three years and the balance including interest in the fourth year.

Answer:

a) Q’s Loan A/C

Note: Amount of instalment in each year = 60,000/4 = 15,000

Amount paid each year= Rs.15000 + interest

b) Q’s Loan A/C

Question 30.

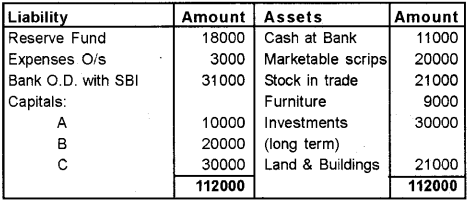

A, B and C are in partnership sharing profits in their capital ratio. The Balance sheet on 15th March, 2013 is given below. (March 2014)

Further information on the retirement of B on 15th June, 2013.

Profits for 3 months Rs. 9000

Drawings-

A Rs. 1,000

B Rs. 2,000

C Rs. 3,000

Interest on Capital @ 5% p.a.

Salary to B Rs. 300 p.m.

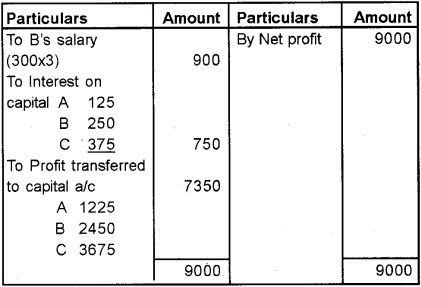

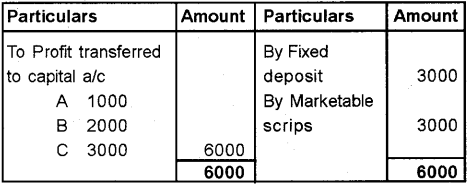

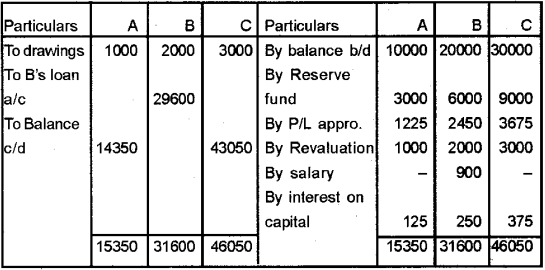

The firm had a fixed deposit worth Rs.3000 which has not accounted so far has to be brought into the books. Marketable scrips were valued at Rs. 23,000. Prepare Profit and Loss Appropriation account, Capital account and Balance Sheet after ‘B’s retirement.

Answer:

Profit and Loss Appropriation a/c

Revaluation a/c

Capital A/c

Balance sheet