Kerala Plus Two Accountancy Chapter Wise Previous Questions Chapter 1 Accounting for Not For Profit Organisation

Plus Two Accountancy Accounting for Not For Profit Organisation 1 Marks Important Questions

Question 1.

Statement for the calculation of revenue of a non¬profit concern is known as ……………………. . (March 2009)

a) Profit & Loss account

b) lncofne& Expenditure account

c) Receipts & Payments account

d) Balance Sheet

Answer:

b) Income & Expenditure account

Question 2.

Income and Expenditure A/c reveals: (March 2010, March 2014)

a) surplus or deficit

b) cash in hand

c) capital fund

d) cash at bank

Answer:

a) surplus or deficit

Question 3.

Receipts and payment account starts with an opening balance of cash or bank – True or False. (March 2010)

Answer:

True

Question 4.

Donation received for a special purpose will be taken to the …………………….. . (March 2010)

a) Income and Expenditure

b) Asset side of the Balance sheet

c) Liability side of the Balance sheet

Answer:

c) Liability side of the Balance sheet

Question 5. March 2010

Income and Expenditure a/c is a

a) Real a/c

b) Nominal a/c

c) Personal a/c

Answer:

b) Nominal a/c

Question 6.

Receipts and payment a/c is a nominal a/c – True or False. (March 2010)

Answer:

False. Real a/c

Question 7.

Subscription received in 2009, relating to the year 2010, will not be shown in the Receipts and Payment account for the year 2010 – True or False. (March 2011)

Answer:

True.

Question 8.

Opening balance of subscription outstanding from members is a/an …………………….. to the club. (March 2012)

a) Liability

b) Asset

c) Income

d) Expenditure

Answer:

b. Asset

Question 9.

State the following items as Revenue Receipt or Capital Receipt (Sep – 2012)

a) Specific Donation

b) Legacies

Answer:

a) Capital Receipt,

b) Capital Receipt

Question 10.

Which one of the following equivalent to the summary of a cash book? (March 2013)

a) Income and Expenditure a/c

b) Profit and Loss a/c

c) Balance Sheet

d) Receipts and Payment A/c ]

Answer:

d) Receipts and Payment A/c

Question 11.

Subscription received in advance is …………………….. . (March 2013)

a) Income

b) Expense

c) An asset

d) A liability

Answer:

d) A liability

Question 12.

The life membership fee is an …………………….. . (Aug 2014)

a) Capital receipt

b) Revenue receipt

c) Revenue expense

d) Specific donation

Answer:

a) Capital receipt

Question 13.

Any revenue expense for which a separate funds is available will be …………………….. . (May 2016)

a) Credited to the separate fund.

b) Debited to Income and Expenditure Account.

c) Capitalised and shown in the balance sheet.

d) Debited to the separate fund.

Answer:

d) debited to separate fund

Question 14.

Outstanding subscription of a club is its …………………….. . (May 2016)

a) liability

b) asset

c) asset or liability

d) bad debts

Answer:

b) asset

Plus Two Accountancy Accounting for Not For Profit Organisation 2 Marks Important Questions

Question 15.

The details of stationery for a manufacturing unit is given below: (March 2012)

Opening stock of stationery 500

Stationery purchase 1,200

Closing stock of stationery 700

Determine the amount of stationery to be debited in the Profit and Loss account.

Answer:

Opening stock of stationery – 500

(+) Purchases – 1,200

– 1,700

(-) Closing stock of stationery – 700

Amount to be debited – 1,000

Question 16.

Ascertain the amount of wages to be debited in the Income and Expenditure account for the year ending 31.12.2011. (March 2013)

Wages paid during the year 2011, ₹ 5,000.

Wages outstanding at the beginning of the financial year, ₹ 500.

Wages outstanding at the end of the financial year, ₹ 600.

Answer:

| Particulars | Amt. (₹) |

| Wages paid during the year (2011) (+) Wages o/s at the end of the year | 5,000 600 |

| (-) Wages o/s at the beginning of the year | 5,600 500 |

| Amt. to be debited in the income & Expenditure A/c | 5,100 |

Question 17.

Amount paid for stationery during 2010 is ₹ 880. Stock of stationery at the end of the year is ₹ 90. What amount will be posted to Income and Expenditure account during the year 2010? (Sep 2013)

Answer:

Amount paid for stationery

during the year – 880

(-) Stock of stationery at the end – 90

Amt. to be posted to income

and expenditure A/c – 790

Question 18.

“Income and Expenditure account begins with an opening balance of cash.” State whether the above statement is true or false, if false correct the same. (May 2016)

Answer:

False. Receipts & Payment a/c begins with an opening balance of cash.

Question 19.

Anand sports club received Rs. 175000 as subscription for the year ended 31 st March 2016. Consider the following adjustments and mention whether we should add or deduct each items to find out subscription for the year. (March 2017)

Answer:

a) Subscription outstanding on 31st March 2016 Rs. 15,000.

b) Subscription outstanding on 1st April 2015 Rs. 20,000.

c) Subscription received in advance as on 1st April 2015 Rs. 16,000

d) Subscription received in advance as on 31st March 2016 Rs. 12,000

Answer:

a) Subscription outstanding on 31st March 2016 Rs.15000-Add

b) Subscription outstanding on 1st April 2015 Rs. 20,000 – Deduct

c) Subscription received in advance as on 1st April 2015 Rs. 16000-Add

d) Subscription received in advance as on 3181 March 2016 Rs, 12,000-Deduct

Plus Two Accountancy Accounting for Not For Profit Organisation 3 Marks Important Questions

Question 20.

From the following information find out of the amount of subscription to be credited to Income and Expenditure account for the year ending 31st December 2010. (Sep – 2012)

a. Subscription received during the ₹

year 2010 – 12,000

b. Subscription outstanding on

31/12/2010 – 1,500

b. Subscription outstanding on

31/12/2009 – 1,200

d. Subscription received in advance

on 31/12/2010 – 1,800

e. Subscription received in advance

on 31/12/2009 – 750

Plus Two Accountancy Accounting for Not For Profit Organisation 2 Marks Important Questions

Question 15.

The details of stationery for a manufacturing unit is given below: (March – 2012)

Opening stock of stationery – 500

Stationery purchase – 1,200

Closing stock of stationery – 700

Determine the amount of stationery to be debited in the Profit and Loss account.

Answer:

Opening stock of stationery – 500

(+) Purchases – 1,200

– 1,700

(-) Closing stock of stationery – 700

Amount to be debited – 1,000

Question 16.

Ascertain the amount of wages to be debited in the Income and Expenditure account for the year ending 31.122011. (March – 2013)

Wages paid during the year 2011, ₹ 5,000.

Wages outstanding at the beginning of the financial year, ₹ 500.

Wages outstanding at the end of the financial year, ₹ 600.

Answer:

| Particulars | Amt. (₹) |

| Wages paid during the year (2011) (+) Wages o/s at the end of the year | 5,000 600 |

| (-) Wages o/s at the beginning of the year | 5,600 500 |

| Amt. to be debited in the income & Expenditure A/c | 5,100 |

Question 17.

Amount paid forstationery during 2010 is ₹ 880. Stock of stationery at the end of the year is ₹ 90. What amount will be posted to Income and Expenditure account during the year 2010? (Sep – 2013)

Answer:

Amount paid for stationery during the year – 880

(-) Stock of stationery at the end – 90

Amt. to be posted to income and expenditure A/c – 790

Question 18.

“Income and Expenditure account begins with an opening balance of cash.” State whether the above statement is true or false correct the same. (May 2016)

Answer:

False. Receipts & Payment a/c begins with an opening balance of cash.

Question 19.

Anand sports club received Rs. 175000 as subscription for the year ended 31st March 2016. Consider the following adjustments and mention whether we should add or deduct each items to find out subscription forthe year. (March – 2017)

a) Subscription outstanding on 31st March 2016 Rs. 15,000.

b) Subscription outstanding on 1st April 2015 Rs. 20,000.

c) Subscription received in advance as on 1st April 2015 Rs.16,000

d) Subscription received in advance as on 3131 March 2016 Rs. 12,000

Answer:

a) Subscription outstanding on 31st March 2016 Rs. 15000-Add

b) Subscription outstanding on 1st April 2015 Rs. 20,000 – Deduct

c) Subscription received in advance as on 1st April 2015 Rs. 16000-Add

d) Subscription received in advance as on 3151 March 2016 Rs, 12,000-Deduct

Plus Two Accountancy Accounting for Not For Profit Organisation 3 Marks Important Questions

Question 20.

From the following information find out of the amount of subscription to be credited to Income and Expenditure account for the year ending 31st December 2010. (Sep – 2012)

a. Subscription received during the ₹

year 2010 – 12,000

b. Subscription outstanding on

– 31/12/2010 – 1,500

c. Subscription outstanding on

31/12/2009 – 1,200

d. Subscription received in advance

on 31/12/2010 – 1,800

e. Subscription received in advance

on 31/12/2009 – 750

Answer:

| Particulars | Amt. (₹) |

| Subscription received during the year 2010 Add: Subscription o/s on 31/12/10 Subscription received in advance on 31/12/2009 | 12,000 1,500 750 |

| Less: Subscription o/s on 31/12/09 Subscription received in advance on 31/12/10 Amt. of subscription to be credited to Income & Expenditure A/C | 14,250 1,200 1,800 11,250 |

Question 21.

From the given particulars, ascertain the amount to be credited to the Income and Expenditure account for the year ending 2012. (March – 2013)

Subscription received during the year – 18,000

Subscription outstanding on 01.01.2012 – 1,000

Subscription received in advance on 01.01.2012 – 500

Subscription received in advance on 31.12.2012 – 300

Subscription outstanding on 31.12.2012 – 200

Answer:

| Particulars | Amt. (₹) |

| Subscription received during the year Add: Subscription received in advance on 1/1/12 Subscription o/s on 31/12/12 | 18,000 500 200 |

| Less: Subscription o/s on 1/1/12 Subscription received in advance on 31/12/12 Amt. to be credited to the Income & Expenditure a/c | 18,700 1,000 300 17,400 |

Question 22.

Your are given the various receipts and payments of a hospital. Classify them into capital and revenue. (March – 2013)

a) Consultation fees

b) Payment of salaries

c) Conveyance expense

d) Purchase of medicine

e) Purchase of surgical instruments

f) Life membership subscription for health plan

Answer:

Capital

e) Purchase of surgical instruments (expenditure)

f) Life membership subscription for health plan (receipts)

Revenue

a) Consultation fees (receipts)

b) Payment of salaries (payments)

c) Conveyance expense (payments)

d) Purchase of medicine (payments)

Question 23.

Given below is the data taken from Rupa Sports Club, Kochi during the year 2012. Subscription ₹ 12,000 was received during 2012. (March 2014)

(This includes ₹ 900 related to the last year’s outstanding subscription and also advance subscription ₹ 1,200 from the members forthe next year)

During 2011, subscription advanced was ₹ 2,000 Subscription outstanding in 2012 is ₹ 1,050 How much amount has to be credited to the Income and Expenditure account by way of subscription?

Answer:

| Particulars | Amt. (₹) |

| Subscription received during 2012 Add: Subscription advance in 2011 Subscription o/s in 2012 | 12,000 2,000 1.050 15,050 |

| Less: O/s subscription in 2011 Subscription advance in 2013 | 900 1,200 12,950 |

Question 24.

In the case of a not-for-profit organization, capital fund represents its excess of ………… over ……….. . The excess of income over expenditure is called ………… and the closing balance of Receipts and Payments account represents ……….. . (May – 2016)

Fill in the above blanks with appropriate words (s).

Answer:

i) Assets, Liabilities

ii) Surplus

iii) Cash in hand/Cash at bank/Bank over draft

Plus Two Accountancy Accounting for Not For Profit Organisation 5 Marks Important Questions

Question 25.

The Yuvadhara Arts and Sports Club furnishes the following information before you, seeking your help for preparation of receipts and payments account. Help them to prepare receipts and payments account as a commerce student. (August 2009)

| Subscriptions Donations Entrance fee Taxes Salaries and Wages Locker rent received Cash in hand (opening) | 5,500 3,000 1,000 200 3,500 2,100 2,100 | Electricity charges Telephone charges Honorarium to secretary Sale of old newspaper Insurance premium | 500 450 400 400 150 |

Answer:

Receipts and Payments Account

The Yuvadhara Arts and Sports Club

Dr.

| Receipts | Amt. | Payment | Amt. |

| Balance b/d : Cash in hand Subscriptions Donations Entrance fees Locker rent received Sale of old newspaper | 2,100 5,500 3,000 1,000 2,100 400 | Salaries and wages Taxes Electricity charges Telephone charges Honararium to Secretary Insurance Premium Balance c/d : Cash in hand (balancing figure) | 3,500 200 500 450 400 150 8,900 |

| 14,100 | 14,100 |

Question 26.

a) Calcutta Sports Association extracts the following Receipts and Payments Account forthe year ended 31st December, 2004. After considering additional information, prepare the Income and Expenditure Account forthe year ended 31st December, 2004. (March – 2010)

Receipts and Payments Account for the year ending31st december, 2004

| Particulars | Amount Rs. | Particulars | Amount Rs. |

| To Balance b/d | 1,125 | By Newspapers | 750 |

| To Subscription | 2,900 | By Rent | 250 |

| To Tournament fund | 750 | By Salaries | 1,800 |

| To Life Membership | 1,000 | By Office Expenses | 1,200 |

| To Entrance fee | 100 | By Sports equipment | 1,150 |

| To Donation for building | 1,500 | By Tournament expenses | 450 |

| To Sales of newspaper | 50 | By Balance c/d | 1,825 |

| 7,425 | 7,425 |

Answer:

(a) Income and Expenditure A/c for the year ended 31.12.04

| Expenditure | Amt. | Income | Amt |

| Newspaper Rent Salaries Office Exps. 1200 (+) o/s in -‘04 200 1400 (-) o/s in -‘03 150 Depreciation of sport equipment | 750 250 1800 1250 610 | Subscriptions 2900 (+) o/s in 04 500 3400 (-) o/s in 03 450 (-) advance for 100 05 Sale of newspaper Deficit | 2850 50 1760 |

| 4660 | 4660 |

Note: If the entrance fee is treated as revenue income, Deficit will be Rs. 1660.

Question 27.

From the following particulars of Gandhi Memorial Sports Club, prepare the Income and Expenditure account for the year ended 31st March 2010. (March – 2012)

₹

a. Subscription collected 70,000

(₹ 1,000 for 2009 and ₹ 3,000 for 2011)

b. Subscription due but not received for March, 2010 8,000

c. Donation for constructing building 50,000

d. Entrance fees (60% capitalized) 6,000

e. Salary paid (including ₹ 4,000 for 2009) 16,000

f. Purchase of sports equipment 4,000

g- Sale of old ball and equipment 200

h. Printing, Stationery and Rent 1,000

Adjustments : 50% on sports equipment is written off

Answer:

| Expenditure | Amt.(₹) | income | Amt.(₹) |

| Salary Depreciation on Sports equipment Printing Stationery & rent Surplus | 12,000 2,000 1,000 61,600 | Subscription (66,000 (+) O/s Subscription 8,000) Entrance fees (6000 – 60% x 6000 = 6000 – 3600) Sale of old ball and equipment | 74,000 2,400 200 |

| 76,600 | 76,600 |

Question 28.

Given below is the Receipts and Payments account of Riders Club for the year ending 31st December, 2012, which was formed on January, 2012. (March – 2013)

Receipts and Payments Accounts for the year ending 31-12-2012

| Receipts | Rs. | Payments | Rs. |

| Subscription Donation Life membership fees Legacy Interest | 5,200 1,600 2,000 5,000 160 | Salaries Scholarship General expenses Printing and stationery Furniture Investments , Balance c/d | 3,500 1,480 1,960 340 2,500 2,400 1,780 |

| 13,960 | 13,960 |

Prepare the income and expenditure account of the club for the year ended 31 st December, 2012 and its Balance Sheet as on that date, after taking into account the following information.

a) Sutcriptknsoutstandingason31-12-2O12, Rs, 300.

b) Salaries outstanding, Rs. 330.

e) 5% interest has been accrued on investments kw 6 months.

d) Legacy and life membership fees are to be capitalized.

e) Charge depreciation on furniture 10% p.a.

Answer:

Income and Expenditure Account for the year ended 31-12-2012

| Expenditure | Amt | Income | Amt. |

| To Salaries 3,500 Add: Out-standing 330 To Scholarship To General Exp. To Printing & Stationery To Depreciation on Furniture | 3,830 1,480 1,960 340 250 | By Subscri- option 5,200 Add: Outstanding 300 By Donation By Interest 160 Add: Interest 60 (2400×5/100×6/12) Excess of Expenditure over Income (Deficit) | 5,500 1,600 220 540 |

| 7,860 | 7,860 |

Balance Sheet as on 31112/2012

| Liabilities | Amt. | Assets | Amt. |

| Capital fund : Legacy 5,000 Life membership 2.000 Less : Deficit 540 Salary outstanding | 7,000 6,460 330 | Furniture 2,500 Less : Deere. 250 Subscription outstanding on 31/12/2012 300 Investments Interest accrued Cash | 2,250 2,400 60 1,780 |

| 6,790 | 6,790 |

Question 29.

From the following information of Jubily Arts Club given below, prepare the Receipts and Payments account for the year ended 31st December, 2012 and balance it. (March – 2014)

| ₹ | ₹ | ||

| Cash balance on 1/1/2012 Entrance fees General expense Legacy Donations (specific) | 3,500 6,000 2,800 3,500 5,000 | Salaries Furnitu re Rent received Sports expenses Subscription | 4,000 14,000 2,000 5,500 12,000 |

Answer:

Receipts and Payments alc

for the year ended 31/1 2/2012

| Receipts | Amt. (₹) | Payments | Amt. (₹) |

| Balance Cash Entrance fees Legacy Donations (Specific) Rent received Subscription | 3,500 6,000 3,500 5,000 2,000 12,000 | General expenses Salaries Furniture Sports expenses Balance Cash | 2,800 4,000 14,000 5,500 5,700 |

| 32,000 | 32,000 |

Question 30.

The Evergreen Club was founded on January 1,2008, with 100 members; the annual subscription per member being 250. By the end of that year two (2) members had not paid their subscriptions but nine (9) had paid fora year in advance. Ascertain the amount of subscriptions to be credited to Income and Expenditure account for the year ended December 31, 2008, by preparing a subscriptions account. (May – 2016)

Answer:

Subscription A/c

| Particulars | Amount | Particulars | Amount |

| Subscription in advance (250 x 9) Income and expenditure A/c | 2250 25000 | Banks Subscription in arrear (2 x 250) | 26750 500 |

| 27,250 | 27,250 |

Note: Bank = (98×250)+(9×250)

= 24500+2250=26750

Plus Two Accountancy Accounting for Not For Profit Organisation 8 Marks Important Questions

Question 31.

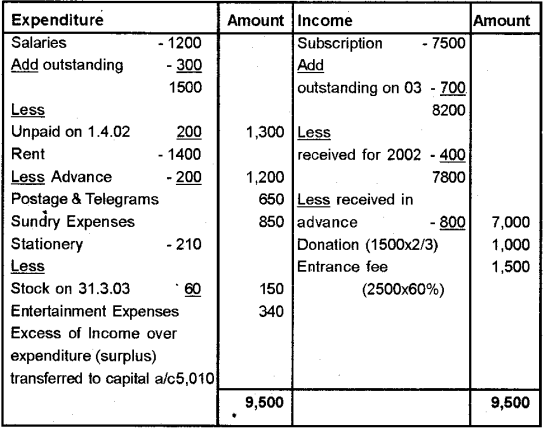

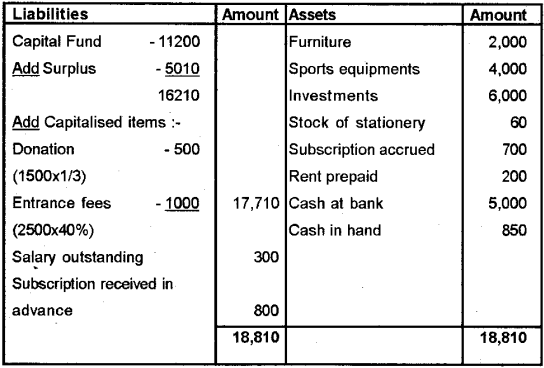

Following is the Receipt and Payment Account of G-Men’s Club for the year ending 31 March 2003 : (August – 2009)

G-Men’s Club

Receipts and Payments Account for the

year ended 31st March 2003

| Receipt | Amount | Payment | Amount |

| To Balance b/d Subscription Donations | 5,000 7,500 1,500 | By Salaries Rent Postage and Telegram | 1,200 1,400 650 |

| Entrance fees | 2,500 | Sundry expenses Stationery Entertainment expenses Investment Cash at bank Cash in hand | 850 210 340 6,000 5,000 850 |

| 16,500 | 16,500 |

You are required to prepare an Income and Expendi¬ture and Balance Sheet as on the above date after making the following adjustment:

a) Subscription outstanding during the year 2003 Rs. 700. Subscription received include Rs. 400 for the year 2002 and received in advance for the year2004 amounting Rs. 800.

b) Rent paid in advance Rs. 200.

c) 1/3 of the donation and 40% of the entrance fee should be capitalised.

d) On 1st April 2002 the club had sports equipment worth Rs. 4,000 and furniture Rs. 2,000.

e) Salaries unpaid on 1st April 2002 Rs. 200 and 31st March 2003 Rs. 300.

f) Stock of stationery on 31st March 2003 Rs. 60.

Answer:

Balance sheet as on 1/04/2002

| Liabilities | Amount | Assets | Amount |

| Outstanding salary Capital Fund (Balancing Figure) | 200 11,200 | Cash Sports equipment Furniture Subscription outstanding | 5,000 4,000 2,000 400 |

| 11,400 | 11,400 |

Income and Expenditure Account for the year ended 31.03.20003

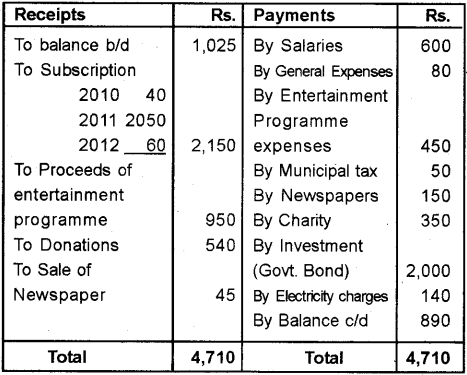

Question 32.

The following are the Receipts and Payments Accounts of Sneha Arts and Sports Club for 31st December, 2011. (March – 2012)

Receipts and Payments Accounts for 31st December, 2011.

Additional information:

a) The Club has 500 members, each paying an annual subscription of Rs. 5.

b) On 31st December, 2011, salaries outstanding amounted to Rs. 50 and municipal taxes amounting to Rs. 40 per annum have been paid upto 31st March, 2012.

c) On 31st December, 2011, the club owned sports equipment valued at Rs. 2,500; furniture worth Rs. 1,500 and musical instruments worth Rs. 1,000.

d) Provide depreciation on sports equipment at 10% p.a.

You are required to prepare the income and expenditure account forthe year ending 31st December, 2011 and the Balance Sheet as on that date.

Answer:

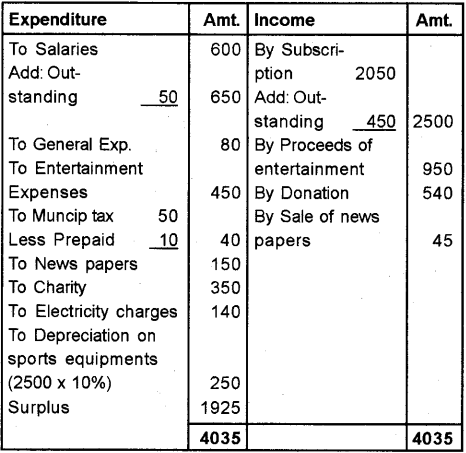

Income and Expenditure Account for the year ended 31-12-2011

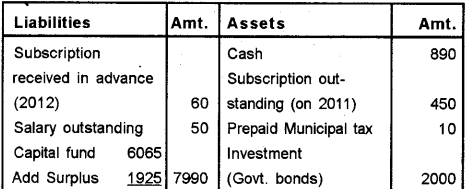

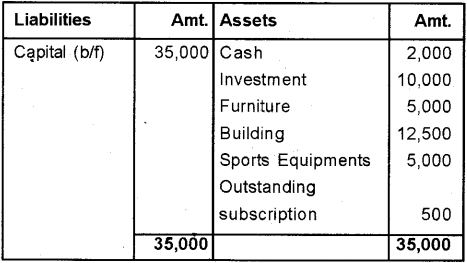

Balance Sheet as on 31/12/2010

| Liabilities | Amt. | Assets | Amt. |

| Capital fund (b/f) | 6065 | Cash Subscription (2010) Sports equipment Furniture Musical Instruments | 1025 40 2500 1500 1000 |

| 6065 | 6065 |

Balance Sheet as on 31/12/2011

| Liabilities | Amt. | Assets | Amt. |

| Capital fund (b/f) | 6065 | Cash Subscription (2010) Sports equipment Furniture Musical Instruments | 1025 40 2500 1500 1000 |

| 6065 | 6065 |

Balance Sheet as on 31/12/2011

Note:

Subscription for 2011

Subscription received – 2050

Add: Outstanding [(500 x 5 = 2500) – 2050] – 450/2500

Question 33.

You are the secretary of Western Sports Club. You are entrusted with the duty of preparation of final accounts of the Club. On 31st Dec. 2010 the books of the club has revealed the following receipts and payments. (September – 2012)

| Receipts | Amount | Payments | Amount |

| Subscriptions Locker rent Building Fund Sale of news paper Interest received Donation (1/3 to be capitalised) | 35,000 1,750 20,000 200 250 1,500 | Salary paid Sundry expenses Entertainment expenses Furniture purchased (1/10/10) Purchase of Library Books News paper Travelling expenses | 11,000 500 250 7,500 750 200 300 |

The books of the club has also revealed the following additional information.

i) The club had a cash balance on 1/1/2010 Rs. 2,000.

ii) Subscription outstanding on 31/12/2010 Rs. 750 and on 1/1/2010 Rs. 500.

iii) Salary prepaid on 31/12/2010 Rs. 500 and locker rent received in advance on 31/12/2010 Rs. 250.

iv) On 31/12/2009 the Club had investment for Rs. 10,000/Furniture Rs. 5,000, Building Rs. 12,500 and Sports Equipments Rs. 5,000.

v) Depreciation is to be provided during the year as follows.

On Furniture 20%, Building at 10% and Sports and Equipment at 15%.

Prepare Receipts and Payment Account, Income and Expenditure Account and Balance Sheet of the Club for the year ended 31st December, 2010.

Answer:

Receipts and Payments A/c for the year ended 31/12/2010

| Receipts | Amt. | Payments | Amt. |

| To Balance b/d To Subscriptions To Locker Rent To Donation for Bid. To Sale of newspaper To Interest received To Donation | 2,000 35,000 1,750 20,000 200 250 1,500 | By Salary By Sundry Expenses By Entertainment Exp. By Furniture By Library books By News paper By Travelling exp. By Balance c/d | 11,000 500 250 7,500 750 200 300 40,200 |

| 60,700 | 60,700 |

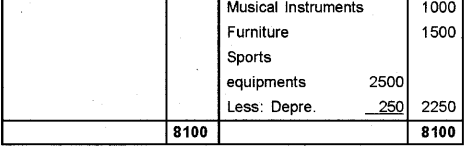

Income and Expenditure Account for the year ended 31-12-2010

Note : Depreciation on furniture = (7,500 x 3/12 x 20%) + (5,000 x 20%) = 1,375

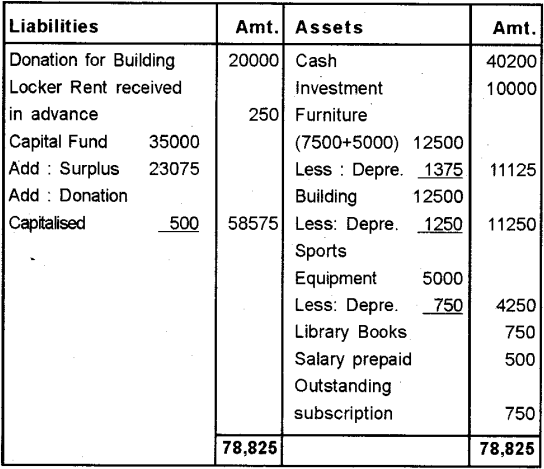

Opening Balance Sheet

Balance Sheet as on 31/1 2/2010

Question 34.

Prepare Income and Expenditure Account and Balance Sheet for the year ending 31-03-2015 from the following information: (March – 2016)

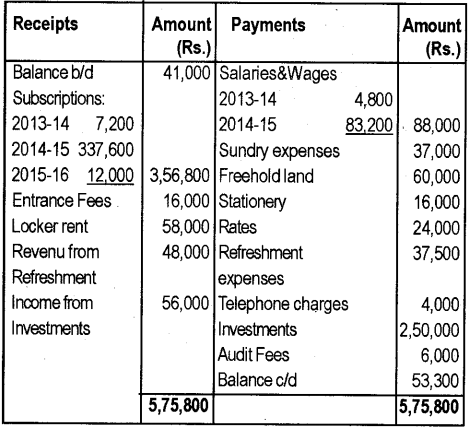

Receipts and Payments Account for the year ending 31-03-2015

Additional Information:

1) There are 1, 800 members each paying an an-nual subscription of Rs. 200. Rs.8,000 were in arrears for 2013-14asonApril 1,2014.

2) On 31-03-2015 the rates were prepaid to June 2015, the charge paid every year being Rs.24,000

3) There was an outstanding telephone bill for Rs.1400 on 31-3-2015

4) Outstanding sundry expenses as on 31-2-12014 totalled Rs.2800

5) Stock of stationery 31-03-2014 was Rs. 2,000 on 31-03-2015 it was Rs.3,600.

6) On 31-03-2014, Building stood at Rs.4,00,000 and it was subject to depreciation @ 2.5% p.a.

7) Investment on 31-03-2014 stood at Rs.8,00,000.

8) On 31-03-2015, income accrued on investments amounted to Rs.1,500.

Answer:

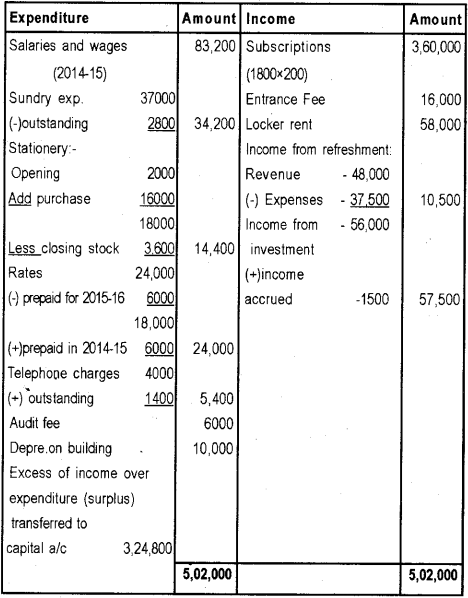

Income and expenditure a/c for the year ended 31 /03/2015

Note:

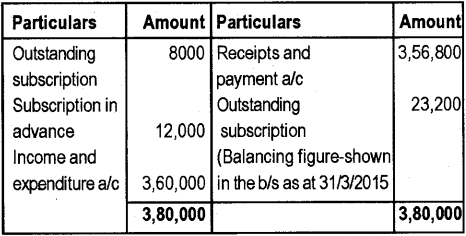

Subscription A/c

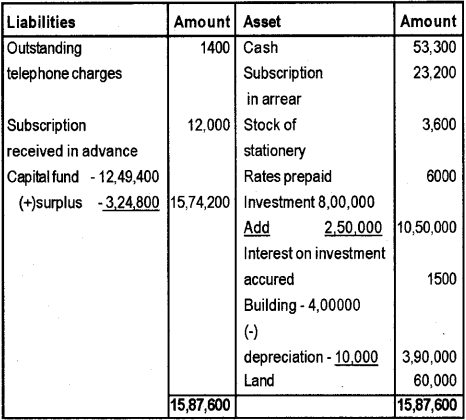

Balance sheet as on 31/03/15

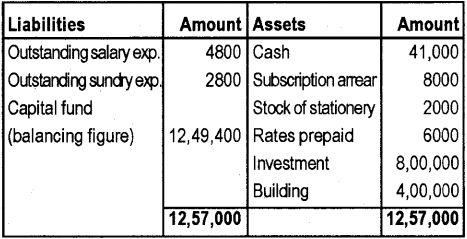

The balance sheet as on 31/3/2014

Question 35.

1) What do you mean by Not-for-Profit Organisations? What are the Accounting Records of such organisations? (March – 2016)

2) Explain the steps involved in the preparation of Receipt and Payment A/c and Income and Ex¬penditure A/c.

Answer:

1) “Not-for-profit organisation is an entity intended to render services to the members of the public without any intention of profit”, eg : sports and arts club, Hospitals, Libraries charitable institutions etc.

a) Non-Profit organisation usually keep ‘a cash book’ in which all receipts and payments are recorded.

b) They maintain ‘a ledger’ containing the ac-counts of all incomes, expenses, assets and liabilities which facilities the preparationof fi¬nancial statements at the end of the account¬ing year.

c) The final accounts of a non-profit organisation consist of the following:

- Receipts and payment Account

- Income and Expenditure Account

- Balance sheet

2) Procedure for preparation of Receipts and payments account as follows.

- This account always starts with opening balance of cash in hand and cash at bank, cash in hand always has a debit balance and hence appears on the debit side as the first item. Cash at bank has either a debit balance or a credit balance (overdraft)

- All receipts made in cash during the accounting year will be shown on the debit side and all cash payments made during the accounting year are shown on the credit side.

- Only actual cash receipts and cash payments are recorded in this account.

- At end of the accounting period, this account is balanced and it shows the closing balance of cash in hand and at bank or bank overdraft, as the case may be.

Procedure for preparing Income & Expenditure as follows:-

- This account is prepared usually in “T” form taking revenue expenses on the debit side and the revenue incomes on the credit side.

- It is also prepared in vertical form. Under this method, the total of revenue incomes are shown first, revenue expenses follow it. After this, the total of expenses is deducted from the total of the incomes for ascertaining the surplus or deficit.

- It is prepared to find out the current year’s surplus or deficit, it does not have any opening balance. Therefore, previous year’s surplus or deficit is not important.

- This account takes only the revenue incomes and revenue expenses. Capital receipts and payments are not taken into account.

- Since it is maintained under accrual basis, current year’s income and expenditures alone are shown.

- Outstanding expenses, accrued incomes, ‘ prepaid expenses, income received in advance, depreciation, provision etc. in the current year are to be suitably adjusted.

- At the end of the accounting yearthe income and expenditure account is balanced and it reflects either a surplus or a deficit which is transferred to capital fund.

Question 36.

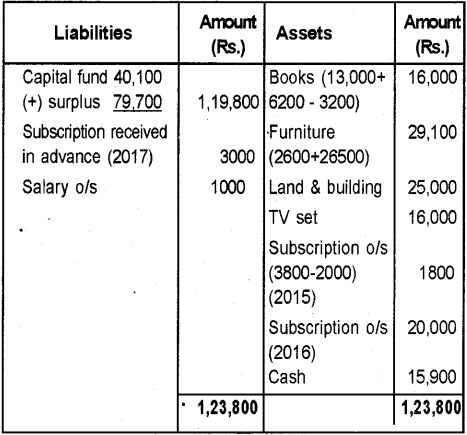

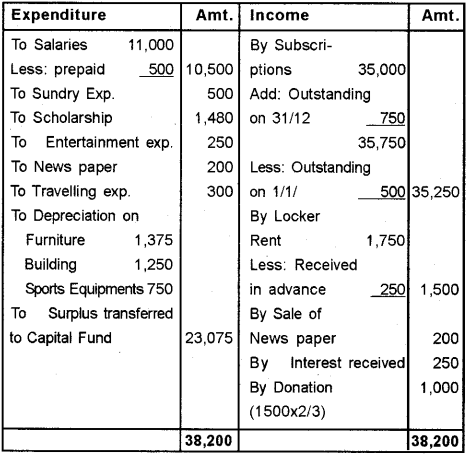

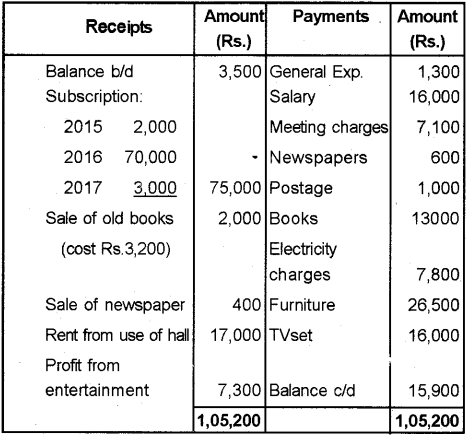

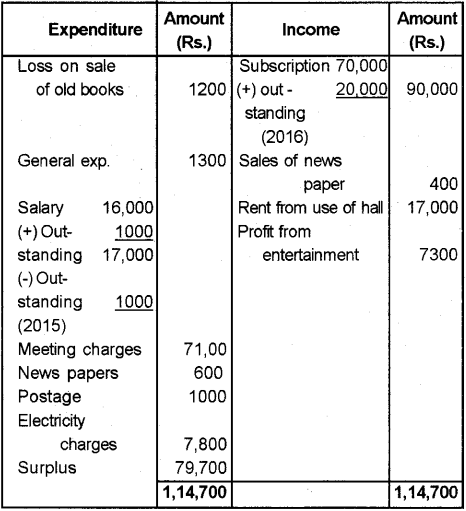

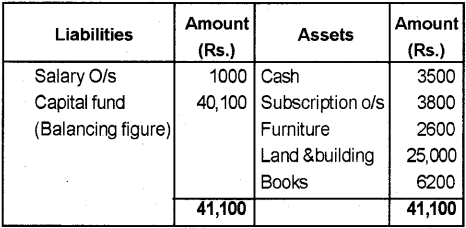

a) From the following Receipt and payment Account of a club, prepare income and expenditure account for the year ended 31st December 2016 and Balance Sheet as on that date: (March – 2017)

Receipt and payment Account for the year ending December 31’s, 2016

Additional Information:

a) The club has 100 members each paying an annual subscription of Rs.900. Subscriptions out¬standing on December 31812015 were Rs. 3,800.

b) On December 31st, 2016, salary outstanding amounted to Rs. 1,000, salary paid included Rs. 1,000 fortheyear2015.

c) On January 1,2016 the club owned land and building Rs.25,000, furniture Rs.2600 and books Rs. 6,200.

Answer:

Income and expenditure AIc for the year ended 31/12/2016

Balance sheet as on 1/1/2016

Balance sheet as on 31/12/2016