Kerala Plus Two Accountancy AFS Previous Year Question Paper March 2019 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 40

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part – A

ACCOUNTING

Answer all questions from 1 to 4, each carries 1 score. (4 × 1 = 4)

Question 1.

The Balance Sheet of a not for profit organization does not include:

a) Assets

b) Liabilities

c) Owner’s Fund

d) Capital Fund

Answer:

c) Owner’s Fund

Question 2.

Gaining ratio is to be calculated at the time of a partner.

a) admission

b) retirement

c) death

d) both (b) and (c)

Answer:

d) both (b) and (c)

Question 3.

Forming a partnership deed is

a) mandatory

b) not mandatory

c) mandatory in writing

d)None

Answer:

b) not mandatory

Question 4.

Unrecorded liabilities located on admission of a partner will be …………..

a) Debited to Revaluation A/c.

b) Credited to Revaluation A/c.

c) Debited to Capital A/c.

d) Credited to Capital A/c.

Answer:

a) Debited to Revaluation A/c.

Answer any 2 questions from 5 to 8. Each carries ‘2’ scores. (4 × 2 = 8)

Question 5.

Malu, a partner withdrew ₹ 1,000 regularly at the beginning of every month. Calculate interest on drawings @ 6% p.a.

Answer:

Total Amount of drawings = 1000 × 12 = 12000

Interest on drawing = 12,000 × 6.512 × 6100

= 390

Question 6.

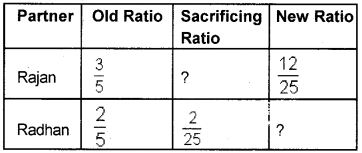

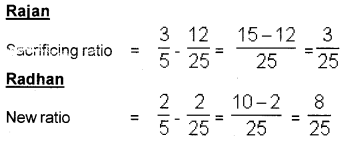

Complete the following table:

Answer:

Question 7.

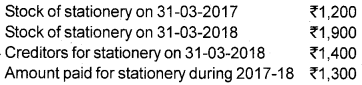

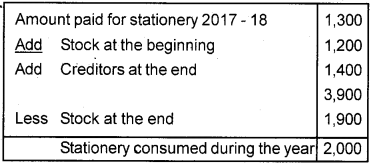

Ascertain the amount of stationery consumed during the year ended 31st March 2018

Answer:

Question 8.

Creditors of a firm were ₹ 21,000, of which creditors for ₹ 10,000 accepted stock worth ₹ 8,000 on full settlement. Remaining creditors were paid at 10% discount. Calculate the amount payable to creditors and pass Journal Entry at the time of dissolution of firm.

Answer:

No entry needed for acceptance of stock worth Rs.8000 by a creditor for Rs. 10,000. So balance due to creditors is 11,000 (21,000 – 10,000). The Remaining creditors were paid at 10% discount.

Amount payable to creditors = 11,000 – 1,100

= 9,900

Journal entry:

Realisation A/c Dr 9,900

To cash A/c 9,900

Answer any 2 questions from 9 to 11. Each carries 3 scores. (2 × 3 = 6)

Question 9.

a) Fill up the following as per hint given:

Hint: Receipts and Payment A/c.: Cash in hand

Income and Expenditure A/c.: ………..?………….

b) Write any two differences between Receipts and Payments A/c.and Income and Expenditure A/c.

Answer:

a) Income and expenditure A/c: Surplus or Deficit

b) i) Receipts and payment A/c is a real A/c whereas Income & expenditure A/c is a nominal A/c

Receipts and payment A/c is a summary of cash book whereas income & expenditure A/c is like a profit and loss A/c.

Question 10.

In which ratio goodwill is shared in the following cases?

i) Amount of goodwill paid by the new partner.

ii) Amount of goodwill paid to the outgoing partner.

Also write any two differences between those ratios.

Answer:

i) Sacrificing ratio ii) Gaining ratio

Difference between sacrificing ratio and Gaining ratio:

i) The ratio in which old partners give up or sacrifice their profit is called sacrifing ratio whereas The ratio in which the continuing partners share the profit of outgoing partner’s profit is called gaining ratio.

ii) Sacrificing ratio is calculated at the time of ad¬mission of a new partner but gaining ratio is calculated at the time of retirement or death of a partner.

Question 11.

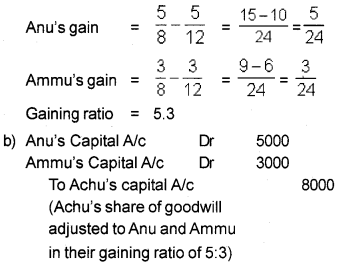

Anu, Achu and Ammu are partners sharing profits in the ratio of 5:4:3. Achu retires and is given ₹ 8,000 as goodwill.

a) Compute the relevant ratio in which goodwill is shared by anu and ammu.

b) Write the Journal Entry.

Answer:

a) Gaining ratio = New ratio – old ratio

Answer any 1 questions from 12 to 13. Each carries 4 scores. (1 × 4 = 4)

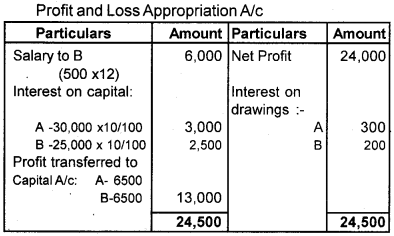

Question 12.

A and Bare partners in a firm. During the year 2017, the firm earned a profit of ₹ 24,000 before charging the following:

i) Interest on capitals @ 10% p.a. (partners capitals – A – ₹ 30,000, B – ₹ 25,000)

ii) Monthly salary payable to B ₹ 500

iii) Interest on drawings – A ₹ 300, B ₹ 200.

Prepare Profit and Loss Appropriation A/c.

Answer:

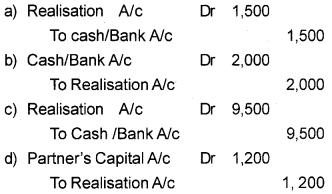

Question 13.

Journalise the following on dissolution of a firm:

a) Realisation expenses paid 1,500.

b) Investments not recorded in the books realised ₹ 2,000

c) Creditors for ₹ 10,000 agreed to accept at 5% discount.

d) Loss on realisation amounted to ₹ 1,200

Answer:

Answer all questions from 14 to 15. Each carries . 5scores. (2 × 5 = 10)

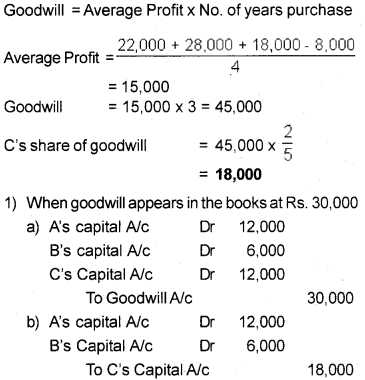

Question 14.

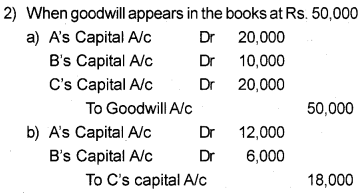

A, B and C are partners sharing profits as 2:1:2. C retires from the firm. Goodwill of the firm is based on 3 years purchase of the average profits of the last 4 years results which were ₹ 22,000, ₹ 28,000, ₹ 18,000 and ₹ 8,000 (loss) respectively.

Compute the value of goodwill and give Journal Entries in the following cases:

i) When goodwill appears in the books at ₹ 30,000.

ii) When goodwill appears in the books at ₹ 50,000.

Answer:

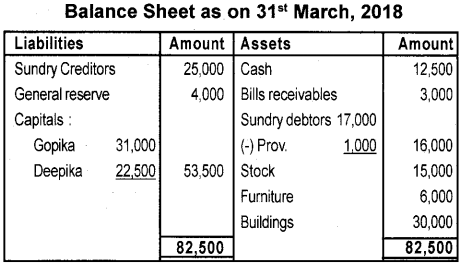

Question 15.

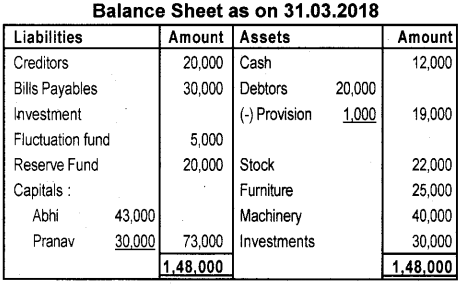

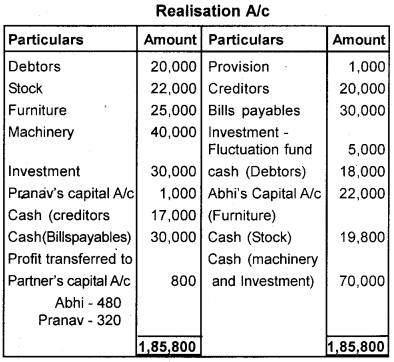

Following is the Balance Sheet of a firm where Abhi and Pranav are partners who share profit in the ratio of 3:2:

Following transactions took place on dissolution of the firm :

i) Debtors realized 90% of the book value.

ii) Abhi took over furniture at ₹ 22,000.

iii) Creditors were paid ₹ 17,000 in full settlement and stock realized at 10% less the book value.

iv) Realisation expenses ₹ 1,000 paid by Pranav.

Prepare Realisation Account.

Answer:

Answer any 1 question from 16 to 17. Each carries 8 scores. (1 × 8 = 8)

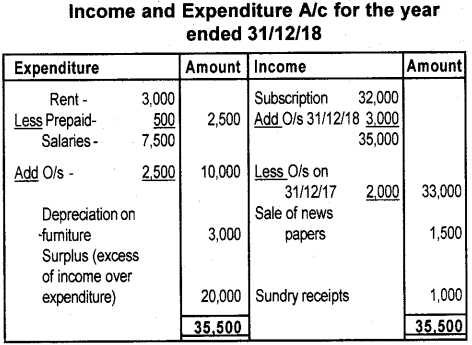

Question 16.

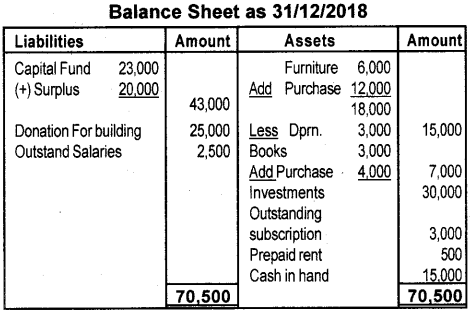

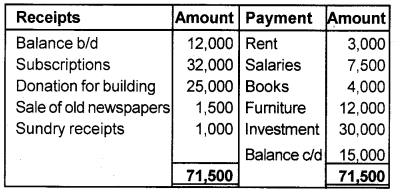

The Receipts and Payments Account of Jubily Club for the year ended 31st December 2018 is given below:

Receipts and payments Account for the year ended 31st December, 2018

Other Information:

1) Subscriptions outstanding as on 31st December, 2017 ₹ 2,000 and on 31st December, 2018 ₹ 3,000

2) Salaries due ₹ 2,500, Rent prepaid ₹ 500.

3) On 31st December, 2017, the club had Furniture ₹ 6,000 and Books ₹ 3,000.

4) Depreciate furniture by ₹ 3,000.

Prepare Income and Expenditure Account and Balance Sheet as on the above date.

Answer:

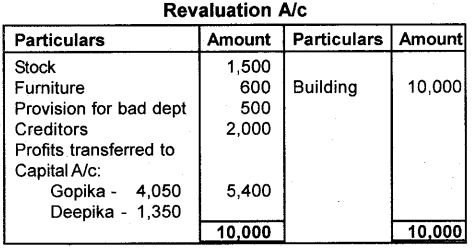

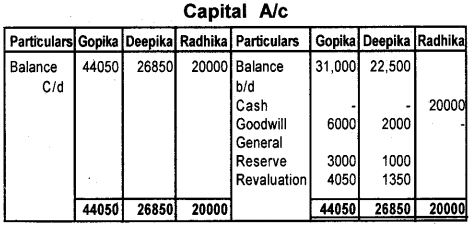

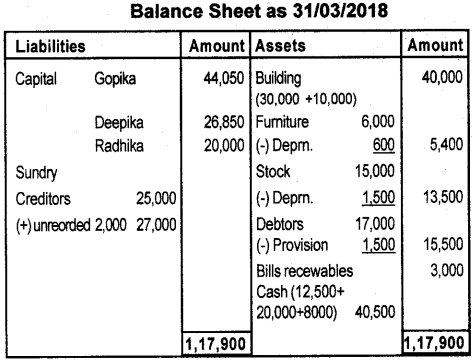

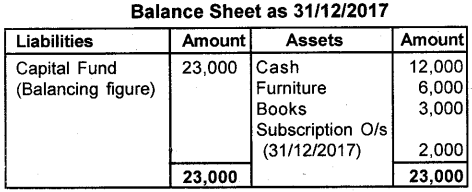

Question 17.

The Balance Sheet of Gopika and Deepika sharing profits in proportion of 3/4 and 1/4 is given below:

Radhika is admitted on the above date as per the following terms:

1) She will bring in ₹ 20,000 for capital and ₹ 8,000 as her share of goodwill for 1/4 share in the profits.

2) Stock and furniture reduced by 10%.

3) Provision for doubtful debts to be increased to ₹ 1,500 and creditors unrecorded to the extent of ₹ 2,000.

4) Buildings revalued at ₹ 40,000.

Prepare necessary Ledger Accounts and Balance Sheet.

Answer: