Kerala Plus Two Accountancy AFS Previous Year Question Paper March 2018 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 40

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part – A

ACCOUNTANCY

I. Answer the following questions from 1 – 5, each carries 1 score. (5 × 1 = 5)

Question 1.

Not for profit organisation identifies legacies of small amount as.

a) Revenue receipts

b) Capital receipts

c) Revenue Payment

d) Capital expenditure

Answer:

a) Revenue receipts

Question 2.

Under fixed capital method all adjustments relating to partners are shown in ………… a/c.

Answer:

Current A/c

Question 3.

Retirement of partner leads to ………… of the partnership

a) dissolution

b) amalgamation

c) reconstitution

d) merger

Answer:

c) reconstitution

Question 4.

Which mode of dissolution is adopted when the business of the firm becomes illegal?

a) Dissolution by agreement

b) Dissolution by court

c) Compulsory dissolution

d) Dissolution on the happening of contingencies.

Answer:

c) Compulsory dissolution

Question 5.

On dissolution of partnership firm the amount paid for unrecorded liability should be debited to

a) Realisation a/c

b) Revaluation a/c

c) Cash a/c

d) Liability a/c

Answer:

a) Realisation a/c

II. Answer any three questions from 6 – 9, each carries 2 scores. (3 × 2 = 6)

Question 6.

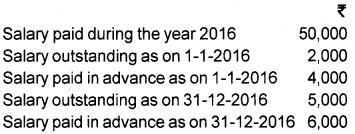

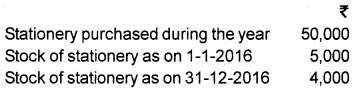

Calculate the amount of salary debited to the income and expenditure account for the year ended 31-12-2016.

Answer:

Question 7.

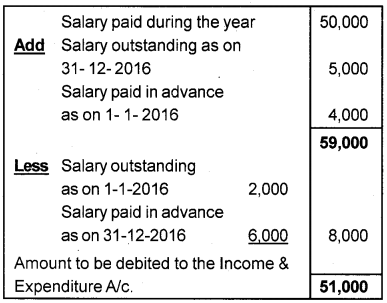

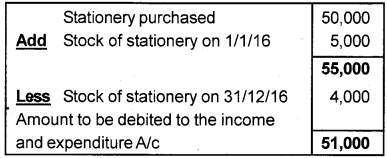

From the following particulars, find out the stationery consumed during the year 2016.

Answer:

Question 8.

Sarath and Sasi are partners in a firm. State whether the claim is valid in the absence of a written agreement.

1) Sarath is an active partner. He wants salary of ₹ 50,000 per year.

2) Sarath has contributed ₹ 50,000 and Sasi ₹ 80,000 as capital, Sarath wants equal share in profits.

Answer:

1) Invalid statement: In the absence of agreement, Sarath is not entitled to any salary.

2) Valid In the absence of agreement, profits and losses are to be shared equally among partners.

Question 9.

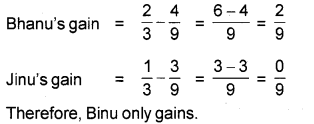

Bhanu, Jinu and Tinu are partners in a firm sharing P & L in the ratio of 4 : 3 : 2. Tinu retires from the firm. Bhanu and Jinu decided to share profits in the ratio of 2 : 1. Calculate gaining ratio.

Answer:

Gaining ratio = New ratio – Old ratio

Old ratio = 4 : 3 : 2

New ratio = 2 : 1

III. Answer any two questions from 10 – 12, each carries 3 scores. (2 × 3 = 6)

Question 10.

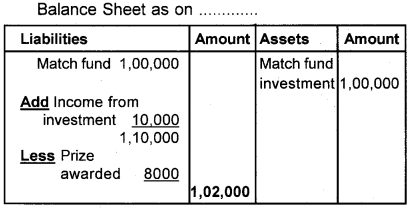

Show the treatment of the following items in the financial statements of a club.

| Details | Debit Amount | Credit Amount |

| Match fund | 1,00,000 | |

| Match fund investment | 1,00,000 | |

| Income from match fund investment | 10,000 | |

| Match prize awarded | 8,000 |

Answer:

→ Match Fund Investment will be shown on the assets side of the Balance sheet.

→ The Match Fund will be shown on the liability side of the balance sheet after adjusting income from investment and Match Prize awarded.

Question 11.

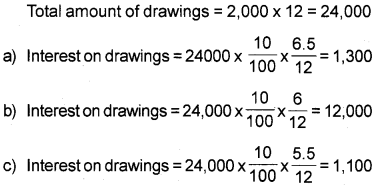

Gokul and Govind are equal partners. Gokul withdrew ₹ 2,000 per month from the business for his personal use. Interest on drawings is to be charged at 10% per annum. Calculate interest on drawings for the year 2016 assuming that money is withdrawn.

1. In the beginning of every month

2. In the middle of every month

3. At the end of every month

Answer:

Note:

(Average period 6.5 months, 6 months and 5.5 months respectively).

Question 12.

Distinguish between Revaluation a/c and Realisation

Answer:

| Revaluation A/c | Realisation A/c |

| 1. Prepared at the time of reconstitution of firm. | 1. Prepared at the time of dissolution of a firm. |

| 2. It is prepared to show the assets and liabilities at their revised values and to know the profit or loss arising therefrom. | 2. It is prepared to know the profit or loss on the sale of assets and payment of liabilities. |

IV. Answer any three questions from 13 – 16, each carries 5 scores. (3 × 5 = 15)

Question 13.

Show the treatment of the following items from a Not for profit organisation.

1. Legacies of small amount

2. Endowment fund

3. Sale of fixed asset

4. Sale of old newspaper

5. Grant for specific purpose

Answer:

1) Legacies of small amount:

It may be treated as income (Revenue receipt) and shown on the income side of the income and expenditure A/c.

2) Endowment fund:

It is a capital receipt and shown on the liability side of Balance Sheet as an item of a specific purpose fund.

3) Sale of fixed assets:

→ Any gain or loss on the sale of asset is taken to the Income and Expenditure A/c of the year.

→ Receipts from the sale of an asset appear in the Receipts and payment A/c of the year in which it is sold.

→ Deduct from concerned asset in the Balance Sheet.

4) Sale of old news paper:

It may be treated as income and shown on the income side of the income and expenditure A/c.

5) Grand for specific purposes:

It may be treated as capital item and shown on the liability side of the Balance Sheet.

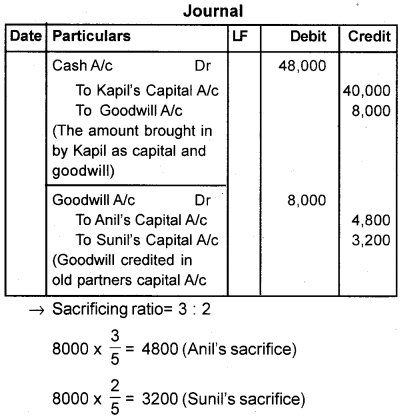

Question 14.

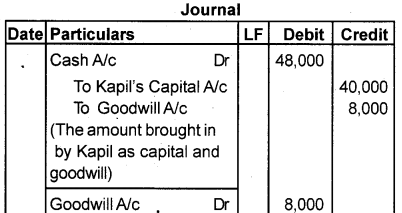

Anil and Sunil are partners in a firm sharing profit and losses in the ratio of 3 : 2. Kapil is admitted for 1/6th share of profits. He is to bring in ₹ 40,000 as capital and 8,000 as his share of goodwill. Give necessary journal entries in the following cases:

1. When the amount of goodwill is retained in the business.

2. When 50% of the amount of goodwill withdrawn by the partners.

Answer:

1) When the amount of goodwill is retained in the business

2) When 50% of the amount of goodwill withdrawn by the partner

Question 15.

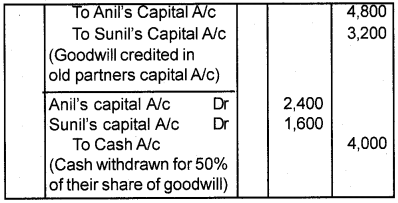

Akhil, Amal and Anand are partners in a firm. Akhil died on 1-1-2010, ₹ 1,00,000 become due to him. Amal and Anand transfer this amount to Akhil’s executors loan a/c. and promises to pay four yearly installments of ₹ 25,000 including interest @ 10% p.a. on the outstanding balance during the first four years and the balance including interest in the fifth year. Prepare Akhil’s executors loan a/c.

Answer:

Note:

→ Yearly instalment of 25000 including interest @10% p.a. on the outstanding balance during the first four years.

Question 16.

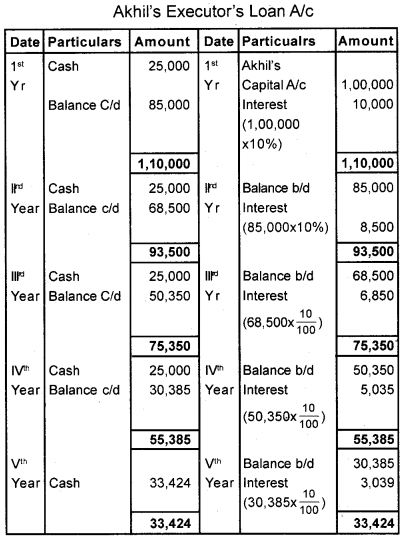

Write Journal entries in the following cases relates to dissolution of partnership firm.

1) Payment of unrecorded liabilities ₹ 8,000

2) Unrecorded investment worth ₹ 10,000 taken over by a partner.

3) Realisation expense of ₹ 5,000 paid by a partner.

4) Unrecorded assets realised for ₹ 5,000

5) Profit on realisation amounting to ₹ 18,000 is to be distributed to Ajil and Bijil in the ratio of 2 : 1

Answer:

V. Answer the following questions which carries 8 scores: (1 × 8 = 8)

Question 17.

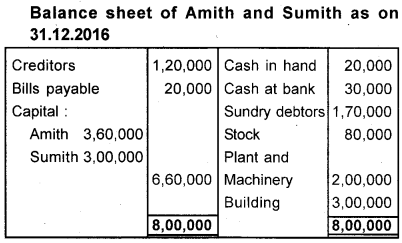

Following is the Balance Sheet of Amith and Sumith who share P & L in the ratio of 2 : 1.

On the date of Balance Sheet, Binith is admitted into the business on the following terms.

1) Binith will bring in ₹ 2,00,000 as his capital and ₹ 1,20,000 as his share of goodwill for 1/4th share in profit.

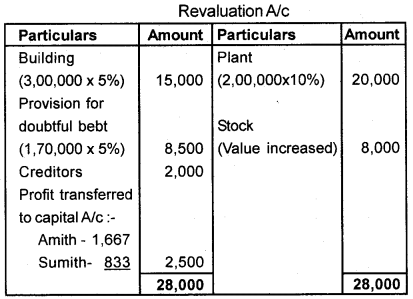

2) Plant appreciated by 10% and the value of building depreciated by 5%.

3) Stock is found undervalued by ₹ 8,000.

4) Create a provision of 5% on Sundry debtors for doubtful debts.

5) Creditors were unrecorded to the extent of ₹ 2,000.

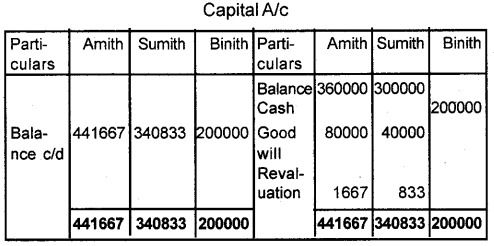

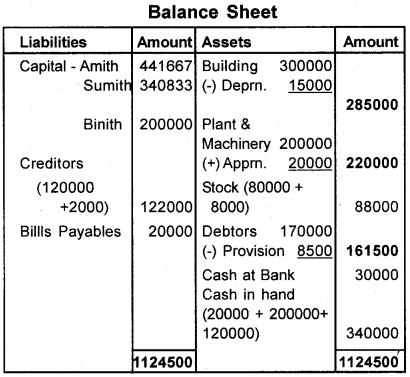

Prepare revaluation a/c, Partners capital a/c. and the Balance Sheet of the new firm after the admission of Binith.

Answer:

Note:

New partner Binith’s Share of goodwill = 1,20,000

Sacrificing ratio = 2 : 1

Amith share of goodwill (sacrifice)

= 120000 × 23 = 80,000

Sumith share of good will (Sacrifice)

= 120000 × 13 = 40,000