Kerala Plus Two Accountancy AFS Previous Year Question Paper June 2018 with Answers

| Board | SCERT |

| Class | Plus Two |

| Subject | Accountancy |

| Category | Plus Two Previous Year Question Papers Answers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 40

General Instructions to Candidates:

- There is a ‘cool off time’ of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Part – A

ACCOUNTANCY

Answer the following questions from 1 – 5. Each carries 1 score. (1 × 5 = 5)

Question 1.

Receipts and Payment Account is equivalent to ………….

(a) Profit & Loss A/c

(b) Balance Sheet

(c) Trial Balance

(d) Cash Book

Answer:

(d) Cash Book

Question 2.

Under fixed capital method interest on drawing should be shown in …………

(a) Current A/c

(b) Capital A/c

(c) Revaluation A/c

(d) Realisation A/c

Answer:

(a) Current A/c

Question 3.

At the time of admission of a partner General Reserve should be …………..

(a) Debited to Capital A/c of old partners

(b) Credited to Capital A/c of old partners

(c) Allowed remains in the Balance sheet

(d) Debited to Current A/c

Answer:

(b) Credited to Capital A/c of old partners

Question 4.

Where do you record when a partner takes an asset at the time of dissolution?

(a) Debited in partners Capital A/c

(b) Credited in partners Capital A/c

(c) Debited in Realization A/c

(d) Credited in Revaluation A/c

Answer:

(a) Debited in partners Capital A/c

Question 5.

Identify the situation where partnership firm is not compulsorily dissolved.

(a) When partner gives a notice in writing

(b) When all partners except one become insolvent.

(c) When a business become illegal

(d) When all partners except one become insane

Answer:

(a) When partner gives a notice in writing

Answer any 3 questions from 6 to 9, each carries 2 scores. (3 × 2 = 6)

Question 6.

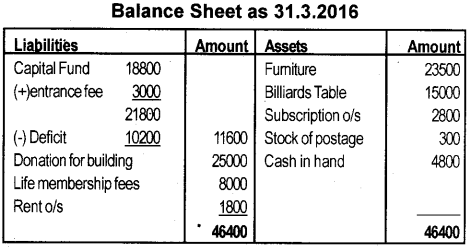

In the year 2015, the subscription received by Janani Sports Club was ₹ 1,00,000. There include ₹ 4,000 for the year 2012 and ₹ 8,000 for the year 2016. On Dec.31.2015 the amount of subscription due was ₹ 10,000. Calculate the amount of subscription to be shown in the Income and Expenditure A/c.

Answer:

Question 7.

Ragam Sports Club received a donation for constructing a pavilion in their ground in the year 2016 – 17. How will you treat this in the books of account?

Answer:

Donation for constructing a pavilion is a specific donation. So it is shown on the liability side of a Balance Sheet.

Question 8.

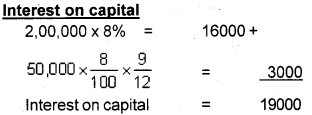

Jayan and Sohan are partners in a firm. Jayan’s capital in the firm showed ₹ 2,00,000 on April-1-2015. He introduced an additional capital of ₹ 50,000 on July-1-2015. Calculate the interest on capital of Jayan if the rate of interest is 8%. Assume the books of accounts are closed on 31st March every year.

Answer:

Question 9.

What are the main factors affecting the value of goodwill?

Answer:

Factors affecting the value of goodwill:

- Nature of business

- Suitable Locations

- Management efficiency

- Requirements of capital

Answer any 2 questions from 10 to 12, each car¬ries 3 scores. (2 × 3 = 15)

Question 10.

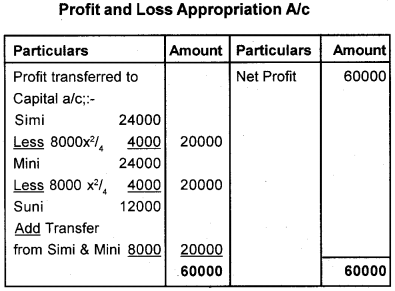

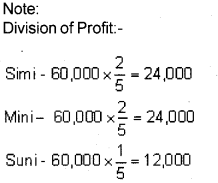

Simi, Mini and Suni are partners in a firm sharing P & L in the ratio 2 : 2 : 1. Suni was guaranteed a minimum amount of ₹ 20,000 as share of profit every year. Any deficiency shall be met by Simi and Mini. The profit for the year were ₹ 60,000 prepare P & L Appropriation a/c.

Answer:

Suni’s share in the profit is Rs. 12,000. But the guaranteed minimum profit is 20000. So the deficiency of Rs. 8000 (20000 – 12000) should be borne by Simi and Mini in their ratio of 2 : 2.

Question 11.

Ayisha, Anagha and Anjana are partners in a firm and Anagha decided to retire from the firm. Can you identify what are the different amounts to be transferred to her account?

Answer:

The amounts to be transferred to Anagha’s account at the time her retirement as follows:

- Credit balance of her capital a/c and current a/c

- Her share of goodwill

- Share in the gain of revaluation of assets and liabilities.

- Share of profit upto the date of retirement

- Interest on capital, salary, commission etc.

Question 12.

Bring out any three differences between dissolution of partnership and dissolution of partnership firm.

Answer:

| Dissolution of Partnership | Dissolution of Firm |

| 1. The business is not terminated. | 1. The business of the firm is closed. |

| 2. Assets and liabilities are revalued and new balance sheet is drawn. | 2. Assets are sold and liabilities are paid off. |

| 3. Books of accounts are not closed. | Books of accounts are closed. |

Answer any 3 questions from 13 – 16, each carries 5 scores. (3 × 5 = 15)

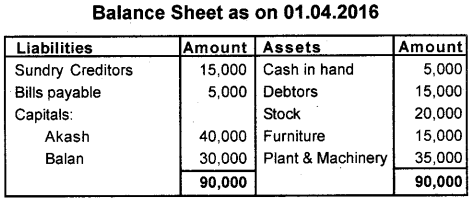

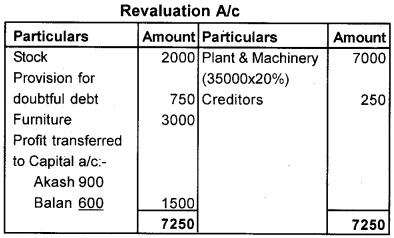

Question 13.

Akash and Balan are partners in a firm who share profit in the ratio 3 : 2. Their Balance sheet on 01.04.2016 stood as follows.

On this date Chandran was admitted on the following terms:

(1) He bring ₹ 20,000 as capital and ₹ 5,000 for goodwill.

(2) The value of stock is reduced by 10%.

(3) The plant and machinery increased by 20%.

(4) 5% provision for doubtful debts is to be created on debtors.

(5) Value of furniture reduced to 12,000

(6) A creditor of ₹ 250 is not likely to be claimed.

Prepare Revaluation A/c.

Answer:

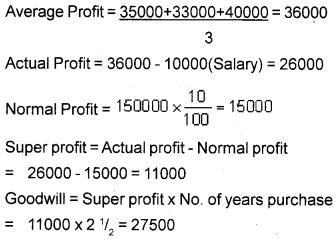

Question 14.

Prakash and Manoj are partners in a firm. Their total capital stands ₹ 1,50,000. The market rate of interest is 10%. Both partners are getting an annual salary of ₹ 5,000 each. The profit for the last 3 years were ₹ 35,000, ₹ 33,000 and ₹ 40,000. The goodwill is to be valued at 21/2 years purchase of last 3 years super profit. Calculate goodwill of the firm.

Answer:

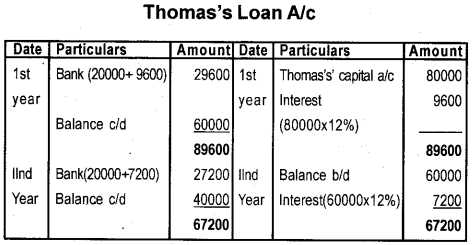

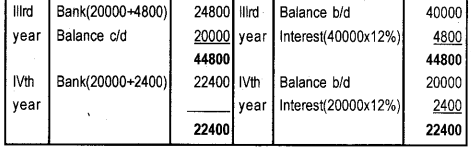

Question 15.

John, Thomas and David are partners in a firm. Thomas decides to retire from the firm. On the date of retirement ₹ 80,000 becomes due to him. John and David promises him to pay the amount in four equal yearly instalments plus interest @ 12% per annum on the unpaid balance. Prepare Thomas’s Loan A/c.

Answer:

Question 16.

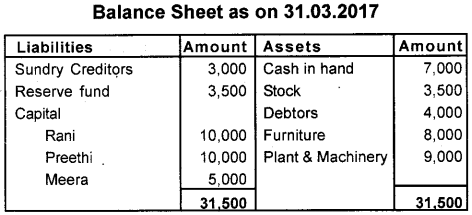

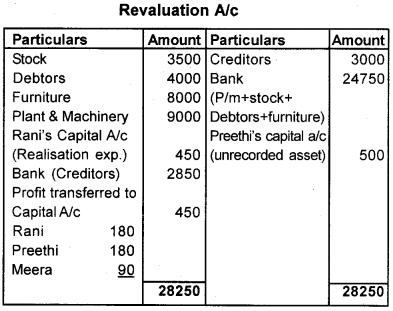

Rani, Preethi and Meera are partners sharing P & L in the ratio of 2 : 2 : 1. Their Balance Sheet as on March 31, 2017 as follows:

They decided to dissolve the business. The assets are realized as follows:

Plant & Machinery ₹ 10,000, Stock ₹ 3,500, Debtors ₹ 3,750, Furniture ₹ 7,500. Realisation expense ₹ 450 is met by Rani. Creditors were paid 5% less. There was an unrecorded assets of ₹ 750, which were taken by Preethi at ₹ 500. Prepare Realization a/c.

Answer:

Answer question No. 17. It carries 8 scores. (1 × 8 = 8)

Question 17.

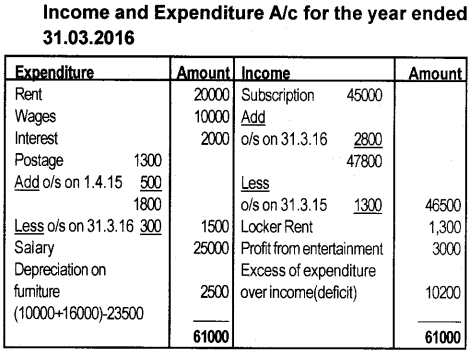

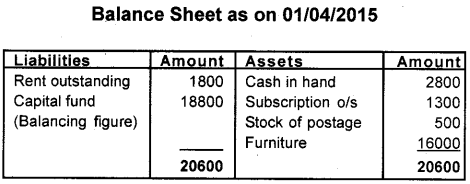

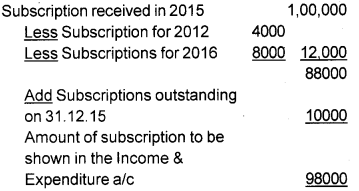

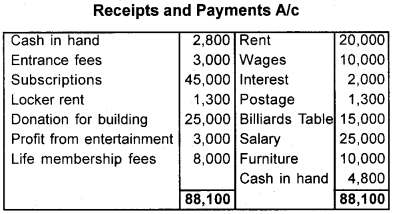

The Receipts and Payment A/c of Thanal Cultural Society for the year ended March 31, 2016 is given below. Prepare Income and Expenditure a/c and Balance Sheet from the information.

Additional Information:

Subscription outstanding on March 31, 2015 is ₹ 1,300 and ₹ 2,800 on March 31, 2016. Rent related to 2015 ₹ 1,800 is still unpaid. The value of postage stamps on 01.04.2015 ₹ 500 and on 31.03.2016 ₹ 300. The Cultural Society owned a furniture for ₹ 16,000 on 01.04.2015 and the value of furniture on 31.03.2016 is ₹ 23,500.

Answer: