Kerala Plus One Business Studies Notes Chapter 8 Sources of Business Finance

Contents

- Meaning, Nature and Significance of Business finance

- Equity shares – Features -Merits – Demerits

- Preference shares – Features – Types – Merits – Demerits

- Retained earnings – Features – Merits – Demerits

- Debentures – Features – Types – Merits – Demerits

- Public deposits – Features – Merits – Demerits

- Commercial Banks – Features – Merits – Demerits

- Financial institutions – Features – Merits – Demerits

- Trade credit – Features – Merits – Demerits

- Factoring – Features – Merits – Demerits

- Lease financing – Features – Merits – Demerits

- Commercial paper – Features – Merits – Demerits

- International financing – ADR – GDR – FCCB

- Factors affecting the choice of the source of fund Finance is the life blood of any business. The requirements of funds by business to carry out its various activities are called business finance.

Nature of Business Finance:

1. Fixed capital requirements:

In order to start a business funds are needed to purchase fixed assets like land and building, plant and machinery. This is called fixed capital requirement.

2. Working Capital requirements:

A business needs funds for its day to day operation. This is known as working Capital requirements. Working capital is required for purchase of raw materials, to pay salaries, wages, rent and taxes.

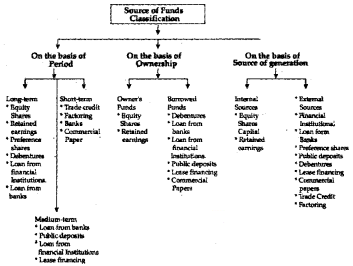

Classification of Sources of Funds:

1. Period Basis:

On the basis of period, the different sources of funds cari divided into 3. They are long-term sources, medium-term sources and short-term sources.

(a) Long Term Sources:

The amount of funds required by a business for more than five years is called long-term finance. Generally this type

of finance is required for the purchase of fixed assets like land and building, plant and machinery furniture etc. It include sources such as shares and debentures, long-term borrowings and loans from financial institutions.

(b) Medium Term Sources:

Where the funds are required for a period of more than one year but less than five years, is called medium-term sources. These sources include borrowings from commercial banks, public deposits, lease Financing and loans from financial institutions. This type of finance is required for modernization, renovation, special promotional programmes etc.

(c) Short Term Sources:

Short-term funds are those which are required for a period not exceeding one year. These sources include Trade credit, loans from commercial banks and commercial papers, etc. Short-term finance is used for financing of current assets such as accounts receivable and inventories.

2. Ownership Basis:

On the basis of ownership, the sources can be classified into ‘owner’s funds’and ‘borrowed funds’.

(a) Owners Fund:

It represent the amount of capital provided by owners and the amount of profit retained in the business. It is a permanent source of capital. Equity shares and retained earnings are the two important sources of ownership capital.

(b) Borrowed Funds:

It refers to funds mobilized from outsiders. It include loans from commercial banks, loans from financial institutions, issue of debentures, public deposits and trade credit.

Such sources provide funds for a specified period, on certain terms and conditions and have to be repaid with interest after the expiry of that period. Borrowed funds are provided on the security of some fixed assets.

3. Source of generation:

Another basis of categorising the sources of funds can be whether the funds are generated from within the organisation or from external sources.

(a) Internal sources:

Internal sources of funds are those that are generated from within the business. eg: ploughing back of profit, disposing of surplus stock etc.

(b) External sources:

External sources of funds are those that are generated from outside the business. eg: issue of debentures, borrowing from commercial banks and financial institutions and accepting public deposits.

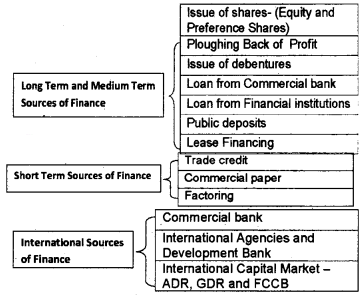

SOURCES OF FINANCE:

- Issue of shares- (Equity and Preference Shares)

- Ploughing Back of Profit

- Issue of debentures

- Loan from Commercial bank

- Loan from Financial institutions

- Public deposits

- Lease Financing

- Long Term and Medium Term Sources of Finance

- Short Term Sources of Finance International Sources of Finance.

A business can raise funds from various sources. They are:

Issue of shares:

The capital of a company is divided into smaller units called share. Those who subscribe the shares of a company are known as ‘shareholders’. Two types shares may be issued by a company to raise capital. They are:

- Equity Shares

- Preference Shares

1. Equity Shares:

Equity shares represents the ownership capital of a company. They do not enjoy any preferential right in the matter of claim of dividend or repayment of capital. Equity share holders do not get a fixed dividend but are paid on the basis of earnings by the company. They bear the maximum risk. Equity shareholders are the owners of the company. They have right to vote and participate in the management.

Merits:

- Equity shares are suitable for investors who are willing to assume risk for higher returns

- Payment of equity dividend is not compulsory.

- Equity capital serves as permanent capital as it is to be repaid only at the time of liquidation of a company.

- Equity shares do not carry any charge on the assets of the company.

- They have right to vote and participate in the management.

- Equity capital provides credit worthiness to the company

Limitations:

- Investors who want steady income may not prefer equity shares.

- The cost of equity shares is generally more as compared to the cost of raising funds through other sources.

- Issue of additional equity shares dilutes the voting power, and earnings of existing equity shareholders.

- Issue of Equity shares is time consuming.

2. Preference Share:

The capital raised by issue of preference shares is called preference share capital. The preference shareholders enjoy a preferential right over equity shareholders in two ways:

- The right to get a fixed rate of dividend.

- The right to claim repayment of capital in the event of winding up of the company.

Preference shareholders generally do not enjoy any voting rights. A company can issue different types of preference shares.

Types of Preference Shares:

1. Cumulative and Non-cumulative Preference Share:

in cumulative preference shares, the unpaid dividends are accumulated and carried forward for payment in future years. On the other hand, in non- cumulative preference share, the dividend is not accumulated if it is not paid out of the current year’s profit.

2. Participating and Non-participating Preference Share:

Participating preference shares have a right to share the profit after making payment to the equity shares. The non-participating preference shares do not enjoy such a right.

3. Convertible and Non-convertible Preference Share:

The preference shares which can be converted into equity shares after a specified period of time are known as convertible preference share. Non-convertible shares cannot be converted into equity shares.

4. Redeemable and Irredeemable Preference Share:

Redeemable preference shares are those where the company undertakes to repay it after a specified period. Where the amount of the preference shares is refunded only at the time of liquidation, are known an irredeemable preference shares.

Merits:

- Preference shares provide reasonably steady income in the form of fixed rate of return and safety of investment.

- Preference shares are useful for those investors who want fixed rate of return with comparatively low risk

- It does not affect the control of equity share holders because they have no voting right.

- Preference shares do not create arty charge on the assets of the company.

- They have a preferential right of repayment of capital over equity shareholders in the event of liquidation of a company.

Limitations:

- Preference shareholders have no voting right.

- The dividend paid is not deductible from profit for income tax.

- These shares may not attract investors who are expecting higher returns.

- The rate of dividend on preference shares is generally higher than the rate of interest on debentures.

Differences between Equity shares and Preference shares:

| Equity Shares | Preference Shares |

| It is compulsory to issue these shares. | It is not compulsory to issue these shares |

| Rate of dividend varies according to the profits of the company | Rate of dividend is fixed |

| Face value is lower | Face value is higher |

| No priority in dividend and repayment of capital | Priority in dividend and repayment of capital |

| It cannot be redeemed | It can be redeemed |

| Risk is high | Risk is low |

| They have voting rights | They do not have voting rights |

| They can participate in the management | They can not participate in the management |

Retained Earnings (Ploughing Back of Profit):

A company generally does not distribute all its earnings amongst the shareholders as dividends. A portion of the net earnings may be retained in the business for use in the future. This is known as retained earnings. It is a source of internal financing or self financing or ‘ploughing back of profits’.

Merits:

- It is a permanent source of funds available to an organization

- No costs in the form of interest, dividend or flotation cost.

- It is more dependable than external sources.

- There is no commitment to pay dividend.

- It increases the financial strength and earning capacity of the business.

- Control over the management of the company remains unaffected.

- It does not require the security of assets.

- It may lead to increase in the market price of the equity shares of a company

Limitations:

- Retained profits cause dissatisfaction among the shareholder because they get low dividend.

- It attract competition in the market

- It may attract government regulations.

- It leads the management to manipulate the value of shares

- It is uncertain source of fund because it is available only when profits are high.

Debentures:

A debenture is a document issued by a company under its seal to acknowledge its debt. Debenture holders are, therefore, termed as creditors of the corrfpany. Debenture holders are paid a fixed rate of interest.

Types of Debentures:

1. Secured and Unsecured Debentures:

Secured (Mortgaged) debentures are debentures which are secured by a charge on the assets of the company. Unsecured (Simple or naked) debentures do not carry any charge or security on the assets of the company.

2. Registered and Bearer Debentures:

In the case registered debentures, the name, address and other details of the debenture holders are entitled in the books of the company. The debentures which are transferable by mere delivery are called bearer (Unsecured) debentures.

3. Convertible and Non-convertible Debentures:

Convertible debentures are those debentures that can be converted into equity shares afterthe expiry of a specified period. On the other hand, nonconvertible debentures are those which cannot be converted into equity shares.

4. First and Second:

Debentures that are repaid before other debentures are repaid are known as first debentures. The second debentures are those which are paid afterthe first debentures have been paid back.

Merits:

- It. is preferred by investors who want fixed income at lesser risk

- Debenture holder do not have voting right

- Interest on Debentures is a tax deductable expense

- It does not dilute control of equity shareholders on management

- Debentures are less costly as compared to cost of preference shares.

- They guarantee a fixed rate of interest

- It enables the company to take the advantage of trading on equity.

- The issue of debentures is suitable when the sales and earnings are relatively stable

Limitations:

- It is not suitable for companies with unstable future earnings.

- The company has to mortgage its assets to issue debentures.

- Debenture holders do not enjoy any voting rights.

- In case of redeemable debentures, the company has to make provisions for repayment on the specified date, even during periods of financial difficulty.

- With the new issue of debentures, the company’s capability to further borrow funds reduces.

Differences between Shares and Debentures:

| Shares | Debentures |

| Shareholders are the owners of the company | Debenture holders are the creditors of the company |

| Shareholders get dividends | Debenture holders get interest |

| Shareholders have voting right | Debenture holders have no voting right |

| No security is required to issue shares | Generally debentures are secured |

| Shares are not redeemable | Debentures are redeemable |

| Share capital is payable after paying all outside liabilities | Debenture holders have the priority of repayment over shareholders |

Public Deposits:

The deposits that are raised by organisations directly from the public are known as public deposits. Rates of interest offered on public deposits are usually higher than those allowed by commercial banks.

Companies generally invite public deposits for a period up to three years. This is regulated by the R.B.I. and can not exceed 25% of its paid up share capital and reserves.

Merits:

- The procedure for obtaining public deposits is simpler than share and Debenture.

- Cost of public deposits is generally lower than the cost of borrowings from banks

- Public deposits do not usually create any charge on the assets of the company

- They do not have voting right therefore the control of the company is not diluted

- Interest paid on public deposits is tax deductable.

Limitations:

- New companies generally find it difficult to raise funds through public deposits

- They are not secured.

- They are costly as most Of the companies have to offer high interest.

- It is an unreliable source of finance as the public may not respond when the company needs money

Commercial Banks:

Commercial Banks give loan and advances to business in the form of cash credit, overdraft, term loans, discounting of bills, letter of credit etc. Rate of interest on loan is fixed.

Merits:

- Commercial Bank provide timely financial assistance to business.

- Secrecy is maintained about loan taken from a Commercial Banks.

- This is the easier source of finance as there is no need to issue prospectus and underwriting for raising funds.

- Loan from a bank is a flexible source of finance.

Limitations:

- Funds are generally available for short periods

- Banks may ask for security of assets and personal sureties for sanctioning loan.

- In some cases, difficult terms and conditions are imposed by banks for the grant of loan

Financial Institutions:

The state and central government have established many financial institutions to provide finance to companies. These institutions aim at promoting the industrial development of a country, these are also called ‘development Bank’.

These are IFCI, ICICI, IDBI and LIC, UTI. This source of financing is considered suitable when large funds for longer duration are required for expansion, reorganisation and modernisation of an enterprise.

Merits:

- Financial Institution provide long term finance which is not provided by Commercial Bank

- These institutions provide financial, managerial and technical advice and consultancy to business firms.

- It increases the goodwill of the borrowing company in the capital market.

- As repayment of loan can be made in easy installments, it does not prove to be much of a burden on the business.

- The funds are made available even during periods of depression, when other sources of finance are not available.

Limitations:

- The procedure for granting loan is time consuming due to rigid criteria and many formalities.

- Financial Institution place restrictions on the powers of the borrowing company.

- Financial institutions may have their nominees on the Board of Directors of the borrowing company thereby restricting the autonomy of the company.

Trade Credit:

Trade credit is a short term source of financing. The credit extended by one trader to another for purchasing goods or services is known as trade credit. The terms of trade credit vary from one industry to another and are specified on the invoice. Trade credit facilitates the traders to purchase goods without irpmediate payment.

Merits:

- Trade credit is a convenient and continuous source of funds

- It does not create any charge on the assets of the firm.

- Trade credit may be readily available in case the credit worthiness of the customers is known to the seller

- Trade credit needs to promote the sales of an organisation.

Limitations:

- It may induce a firm to indulge in overtrading.

- Only limited amount of funds can be generated through trade credit;

- It is generally a costly source of funds as compared to other sources of fund.

Factoring:

Factoring is a method of raising short-term finance for the business in which the business can take advance money from the bank against the amount to be realised from the debtors. By this method, the firm shifts the responsibility of collecting the outstanding amount from the debtors on payment of a specified charge.

There are two methods of factoring-recourse and non-recourse. Under recourse factoring, the client is not protected against the risk of bad debts. Under non recourse factoring, full amount of invoice is paid to the client in the event of the debt becoming bad.

Merits:

- Obtaining funds through factoring is cheaper than bank credit

- Factoring provides steady cash inflow so that the company is able to meet its liabilities promptly.

- It is flexible and ensures cash inflows from credit sales.

- It does not create any charge on the assets of the firm;

- The company can concentrate on important areas of business as the responsibility of credit control is shouldered by the factor.

- Factors may give useful information about the credit standing of customers.

Limitations:

- This source is expensive

- The advance finance provided by the factor firm is generally available at a higher interest cost.

- The factor is a third party to the customer who may not feel comfortable while dealing with it.

Lease Financing:

A lease is a contractual agreement whereby the owner of an asset (lessor) grants the right to use the asset to the other party (lessee). The lessor charges a periodic payment for renting of an asset for some specified period called lease rent.

Merits:

- It enables the lessee to acquire the asset with a lower investment;

- Lease rentals paid by the lessee are deductible for computing taxable profits;

- It provides finance without diluting the ownership or control of business

- The lease agreement does not affect the debt raising capacity of an enterprise;

- Simple documentation makes it easierto finance assets.

Limitations:

- A lease arrangement may impose certain restrictions on the use of assets.

- The normal business operations may be affected in case the lease is not renewed.

- The lessee never becomes the owner of the asset.

Commercial Paper(CP):

It is an unsecured promissory note issued by a firm to raise funds for a short period. The maturity period of commercial paper usually ranges from 90 days to 364 days. Being unsecured, only firms having good credit rating can issue the CP and its regulation comes under the purview of the Reserve Bank of India.

Merits:

- A commercial paper does not contain any restrictive conditions;

- As it is a freely transferable instrument, it has high liquidity;

- A commercial paper provides a continuous source of funds.

- They are cheaper than a bank loan.

Limitations:

- Only financially sound and highly rated firms can raise money through commercial papers

- The size of money that can be raised through commercial paper is limited

- Commercial paper is an impersonal method of financing. Extending the maturity of a CP is not possible.

- Issue of commercial paper is very closely regulated by the RBI guidelines.

International Financing:

1. Commercial Banks:

Commercial banks all over the world extend foreign currency loans for business purposes. Standard chartered is a major source of foreign currency loan to the Indian industry.

2. International Agencies and Development Banks:

A number of international agencies and development banks provide long and medium term loans and grants to promote the development of economically backward areas in the world. Eg. International Finance Corporation (IFC), EXIM Bank and Asian Development Bank.

3. International Capital Markets:

(a) Global Depository Receipts (GDR’s):

Uhder GDR, shares of the company are first converted into depository receipts by international banks. These depository receipts are denominated in US dollars. Then these depository receipts are offered for sale globally through foreign stock exchanges.

GDR is a negotiable instrument and can be traded freely like any other security. The holder of GDRs are entitled for dividend just like shareholders. But they do not enjoy the voting rights. Many Indian companies like ICICI, Wipro etc. have raised foreign capital through issue of GDRs.

Feature of GDR:

- GDR can be listed and traded on a stock exchange of any foreign country other than America.

- It is negotiable instrument.

- A holder of GDR can convert it into the shares.

- Holder gets dividends

- Holder does not have voting rights.

- Many Indian companies such as Reliance, Wipro and ICICI have issue GDR.

(b) American Depository Receipts (ADR’s):

The depository receipts issued by a company in the USA are known as American Depository Receipts.

Feature of ADR:

- It can be issued only to American Citizens.

- It can be listed and traded is American stock exchange.

- Indian companies such as Infosys, Reliance issued ADR

Differences between ADR and GDR:

| ADR | GDR |

| They issued and traded in USA | They issued and traded in European capital market |

| Both individual and institutional investors can make investment | Only institutional investors can make investment |

| It can be converted into shares and shares into ADR | Once converted into shares, it cannot be converted back |

| Legal and accounting costs are high | Legal and accounting costs are less |

Foreign Currency Convertible Bonds (FCCB’s):

Foreign currency convertible bonds are equity linked debt securities that are to be converted into equity or depository receipts after a specific period.

The FCCB’s are issued in a foreign currency and carry a fixed interest rate. These are listed and traded in foreign stock exchange and similar to the debenture.

Factors affecting the choice of the source of funds:

The factors that affect the choice of source of finance are

1. Cost:

The cost of procurement of funds and cost of utilising the funds should be taken into account while deciding about the source of funds that will be used by an organization.

2. Financial strength and stability of operations:

In the choice of source of funds, business should be in a sound financial position so as to be able to repay the principal amount and interest on the borrowed amount. When the earnings of the organisation are not stable, it can issue equity shares to collect the fund.

3. Form of organisation and legal status:

The form of business organisation and status influences the choice of a source for raising money.

4. Purpose and time period:

Business should plan according to the time period for which the funds are required. A short-term need can be met through borrowing funds at low rate of interest through trade credit, commercial paper, etc. For long term finance, sources such as issue of shares and debentures are more appropriate.

5. Risk profile:

Business should evaluate each of the source of finance in terms of the risk involved.

6. Control:

business firm should choose a source keeping in mind the extent to which they are willing to share their control over business.

7. Effect on credit worthiness:

The dependence of business on certain sources may affect its credit worthiness in the market.

8. Flexibility and ease:

Another aspect affecting the choice of a source of finance is the flexibility and ease of obtaining funds.

9. Tax benefits:

Various sources may also be weighed in terms of theirtax benefits. For example, while the dividend on preference shares is not tax deductible, interest paid on debentures and loan is tax deductible.