Kerala Plus One Business Studies Model Question Paper 1 with Answers

| Board | SCERT |

| Class | Plus One |

| Subject | Business Studies |

| Category | Plus One Previous Year Question Papers |

Time Allowed: 21/2 hours

Cool off time: 15 Minutes

Maximum Marks: 80

General Instructions to Candidates

- There is a ‘cool off time of 15 minutes in addition to the writing time.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and the only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures, and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Answer all questions from 1 to 9. Each carries 1 score. (9 × 1 = 9)

Question 1.

Identify the type of business organisation to which the registration is compulsory.

a) Sole proprietorship

b) Partnership business

c) Joint Stock Company

d) Hindu Undivided Family Business

Answer:

c) Joint Stock Company

Question 2.

Find the odd one from the following,

a) Banking

b) Mining

c) Warehousing

d) Advertising

Answer:

b) Mining

Question 3.

Identify the type of warehouse where the imported goods can be kept prior to the payment of duties and taxes.

a) Bonded warehouses

b) Government warehouses

c) Public warehouses

d) Private warehouses

Answer:

a) Bonded warehouses

Question 4.

A business firm decided to help the affected people in Okhi cyclone. It belongs to ………… responsibility of the business.

а) Discretionary

b) Legal

c) Economic

d) Ethical

Answer:

d) Ethical

Question 5.

Which of the following is known as the birth certificate of a Joint Stock Company?

a) Certificate of Incorporation

b) Memorandum of Association

c) Table A

d) Articles of Association

Answer:

a) Certificate of Incorporation

Question 6.

Fill up the series as per hint given:

a) Capital required for the day-to-day activities of the business – Working capital

b) Capital required for acquisition of fixed assets – ………?…………

Answer:

Fixed capital

Question 7.

The apex banking institution set up to promote

agriculture and rural development in India is

a) SIDBI

b) NABARD

c) BIFR

d) IBRD

Answer:

b) NABARD

Question 8.

Buying and selling of goods and services within the geographical boundaries of a nation is …………

a) External trade

b) Internal trade

c) Entrepot trade

d) International trade

Answer:

b) Internal trade

Question 9.

Identify the import document from the following

a) Letter of credit

b) Bill of lading

c) Bill of entry

d) Certificate of origin

Answer:

c) Bill of entry

Answer any 6 questions from 10 to 16. Each carries 2 scores. (6 × 2 = 12)

Question 10.

Write any two merits of Government Company.

Answer:

- It has a separate legal entity, apart from the Government.

- It enjoys flexibility and autonomy in all management decisions.

Question 11.

Identify the type of e-Business transaction referred in the following cases.

a) A dealer in Kerala places an order through e-mail to Maruti Udyog Ltd. for supply of 20 cars.

b) Ms. Anasooya placed an order for a smartphone through online.

Answer:

a) B2B Commerce

b) B2C Commerce

Question 12.

Explain the concept of business ethics with the help of an example.

Answer:

Ethics is concerned with what is right and what is wrong in human behavior. Business ethics refer to the socially determined moral principles which should govern business activities. Business ethics is the code of conduct followed and performed by every business. Ethical business behavior improves public image, earn’s public confidence and leads to greater success.

Examples of Business Ethics:

- Charging fair prices from customers

- Using fair weights for measurement of commodities

Question 13.

List out any two problems faced by small scale business in India.

Answer:

- Small scale industries find it difficult to get adequate finance from banks and other financial in¬stitutions.

- They are not able to get quality raw materials at reasonable prices.

Question 14.

Name any two products which are suitable for vending machine.

Answer:

- Tea Or Coffee

- Chocolate/Icecreams

Question 15.

Write a short note on Export Processing Zone.

Answer:

Export Processing Zones (EPZs): They are industrial estates, which form special enclaves separated from the domestic tariff areas. These are usually situated near seaports or airports. They are intended to provide an internationally competitive duty free environment for export production at low cost. They can import capital goods and raw materials for production of export goods without license.

Question 16.

State any two objectives of small scale business.

Answer:

- Cottage and rural industries provide employment opportunities in the rural areas especially for the traditional artisans and the weaker sections of society.

- It prevents migration of rural population to urban areas in search of employment.

Answer any 4 questions from 17 to 21. Each carries 3 scores. (4 × 3 = 12)

Question 17.

Identify the types of manufacturing industries mentioned below.

a) Production of cement by combining various ingredients like limestone, silicon etc.

b) Production of petrol, diesel and kerosene from crude oil.

c) Manufacturing of computers using different components.

Answer:

a) Synthetical Industry

b) Extrative Industries

c) Assembling Industry

Question 18.

Explain any three features of departmental undertakings,

Answer:

Features:

- The enterprise is financed by annual appropriation from the budget of the Government and all revenue is paid to the treasury.

- The enterprise is subject to accounting and audit control

- It is subject to the direct control of the ministry.

Question 19.

List out any three differences between Memorandum of Association and Articles of Association.

Answer:

| Memorandum of Association | Articles of Association |

| 1. It defines the object for which the company is formed | 1. They are rules of internal management of the company. They indicate how the objectives of the company are to be achieved |

| 2. It is the main document of the company | 2. It is a subsidiary document of the Memorandum of Association |

| 3. It defines the relationship of the company with outsiders | 3. It defines the relationship of the company with members |

Question 20.

Write any three ways in which a business organisation can enter into International Business.

Answer:

- Contract manufacturing

- Licensing and franchising

- Joint ventures

Question 21.

Explain any three schemes announced by the Government of India in Export-Import Policy (Exim Policy) for the promotion of foreign trade.

Answer:

Foreign Trade Promotion Measures and Schemes.

1. Duty drawback scheme: it refers to the refund of customs and excise duties paid on imported inputs used in the manufacture of export goods.

2. Export manufacturing under bond scheme: Under this facility firms can produce goods without payment of excise and other duties. The firms can avail this facility after giving an undertaking (i.e. bond) that they are manufacturing goods for export purposes.

3. Exemption from payment of sales taxes: Goods meant for export purposes are not subject to sales tax. Income derived from export operations had been exempt from payment of income tax. Now this benefit of exemption from income tax is available only to 100 percent Export Oriented Units (100 percent EOUs) and units set up in Export Processing Zones (EPZs) or Special Economic Zones (SEZs) for selected years.

Answer the following question which carries 4 scores. (4 × 1 = 4)

Question 22.

Match the following:

| A | B |

| a) Indian Railways | i) Government Company |

| b) LIC of India | ii) Multi-National Company |

| c) BHEL | iii) Departmental Undertaking |

| d) Honda Ltd. | iv) Statutory Corporation |

Answer:

| A | B |

| a) Indian Railways | 1) Departmental Undertaking |

| b) LIC of India | 2) Statutory Corporation |

| c) BHEL | 3) Government Company |

| d) Honda Ltd. | 4) Multi-National Company |

Answer any 3 questions from 23 to 26. Each carries 4 scores. (3 × 4 = 12)

Question 23.

Identify the type of partners in the following cases:

a) Mr. Nirmal contributed ₹ 1 lakh as capital in Maithri Traders but do not participate in day to day activities.

b) A well-known person allows Maithri Traders to use his name but doesn’t contribute capital or share profits.

c) Mr. Deepu pretends to be a partner in Maithri Traders, but actually he is not.

d) Mr. Rajesh contributed ₹ 1 lakh as capital in Maithri Traders and participates in the conduct of business.

Answer:

a) Sleeping partner

b) Nominal partner

c) Partner by estoppel

d) Active partner

Question 24.

Write any four benefits of e-Banking.

Answer:

Benefits of e-banking to customers:

- e-banking provides 24 hours, 365 days a year services to the customers of the bank

- Customers can make some of the permitted transactions from office or house or while travelling via mobile telephone

- It creates a sense of financial discipline by recording each and every transaction

- Greater customer satisfaction by offering unlimited access to the bank

Question 25.

Classify the following into long-term and short-term sources of finance.

a) Factoring

b) Retained earnings

c) Preference shares

d) Bank overdraft

e) Commercial papers

f) Debentures

g) Trade credits

h) Equity shares

Answer:

| Long Term Sources of finance | Short Term Sources of finance |

| a) Retained earnings | a) Factoring |

| b) Preference shares | b) Bank overdraft |

| c) Debentures | c) Commercial papers |

| d) Equity shares | d) Trade credits |

Question 26.

“Outsourcing of non-core activities are beneficial to business units.”

Do you agree? Comment on this statement by highlighting your views.

Answer:

a) Yes, I agree

b) Outsourcing or Business Process Outsourcing (BPO):

Outsourcing is a management strategy by which an organisation contracts out its major non-core functions to specialized service providers with a view to benefit from their expertise, efficiency and cost-effectiveness, and allow managers to concentrate on their core activities.

Merits of outsourcing:

- It provides an opportunity to the organisation to concentrate on areas in which it has core competency or strength.

- It helps better utilisation of its resources as the management can focus its attention on selected activities and attain higher efficiency.

- It helps the organisation to get an expert and specialised service at competitive prices. It helps in improved service and reduction in costs.

- It facilitates inter-organisational knowledge sharing and collaborative learning.

Answer any 3 questions from 27 to 30. Each carries 5 scores. (3 × 5 = 15)

Question 27.

“Risk is an essential part of every business.” Explain its causes.

Answer:

Causes of Business Risks:

Business risks arise due to a variety of causes. They are:

- Natural Causes: it includes natural calamities like flood, earthquake, lightning, heavy rains, famine, etc.

- Human Causes: Human causes include dishonesty, carelessness or negligence of employees, strikes, riots, management inefficiency, etc.

- Economic causes: These include change in demand, change in price, competition, technological changes etc.

- Political Causes: Change in Govt, policies, taxation; licensing policy etc.

Question 28.

State any three responsibilities of business towards employees and any two towards consumers.

Answer:

1. Responsibility Towards the workers:

- Providing fair wages

- Providing good working conditions and welfare amenities.

- Respect democratic rights of workers to form unions.

2. Responsibility toward consumers:

- Supply right quality and quantity of goods and services at reasonable prices.

- Averting unfair trade practices like adulteration, poor quality, misleading advertisement etc.

- Inform them about new products, its features, uses and other matters relating to the products.

- To handle the customers grievance promptly.

Question 29.

Who are promoters? Briefly explain any four functions performed by them.

Answer:

Functions of a Promoter:

1. Identification of business opportunity: The first and foremost activity of a promoter is to identify a business opportunity.

2. Feasibility studies: After identifying a business opportunity, the promoters undertake some feasibility studies to determine the viability and profitability of the proposed activity.

- Technical feasibility – To determine whether the raw materials or technology is easily available

- Financial feasibility – To determine the total estimated cost of the project

- Economic feasibility – To determine the profitability of the proposed project

3. Name approval: After selecting the name of company the promoters submit an application to the Registrar of companies for its approval. The selected name is not the same or identical to an existing company.

4. Fixing up signatories to the Memorandum of Association: Promoters have to decide about the members who will be signing the Memorandum of Association of the proposed company.

5. Appointment of professional: Promoters appoint merchant bankers, auditors etc. to assist them in the preparation of necessary documents.

6. Preparation of necessary documents: The promoters prepare certain legal documents which are to be submitted to the Registrar of companies. They are

- Memorandum of Association

- Articles of Association,

- Consent of proposed Directors

- Agreement, if any, with proposed managing or whole time director

- Statutory declaration

Question 30.

Write any five advantage of equity shares as a sources of finance.

Answer:

Merits:

- Equity shares are suitable for investors who are willing to assume risk for higher returns

- Payment of equity dividend is not compulsory.

- Equity capital serves as permanent capital as it is to be repaid only at the time of liquidation of a company.

- Equity shares do not carry any charge on the assets of the company.

- They have right to vote and participate in the management.

- Equity capital provides creditworthiness to the company

Answer any 2 questions from 31 to 33. Each carries 8 scores. (2× 8 = 16)

Question 31.

Identify the business organisations formed voluntarily by a group of people for mutual benefits, following the principle of ‘one man one vote’. Also explain its limitations.

Answer:

a) Co-operative Societies

b) Co-operative Society

The cooperative society is a voluntary association of persons, who join together with the motive of welfare of the members. The basis of cooperation is self help through mutual help, the motto is “each for all and all for each”. The cooperative society is compulsorily required to be registered under the Cooperative Societies Act 1912. At least ten persons are required to form a society. The capital of a society is raised from its members through issue of shares.

Merits:

- Equality in voting status: The principle of ‘one man one vote’ governs the cooperative society.

- Limited liability: The liability of members of a cooperative society is limited to the extent of their capital contribution.

- Stable existence: Death, insolvency or insanity of the members do not affect continuity of a cooperative society.

- Economy in operations: Co-operative society aims to eliminate middlemen. This helps in reducing cost.

Limitations:

- Limited resources: Resources of a cooperative society consists of limited capital contributions of the members.

- Inefficiency in management: Cooperative societies are unable to attract and employ expert managers because of their inability to pay them high salaries.

- Lack of secrecy: As a result of open discussions in the meetings of members it is difficult to maintain secrecy about the operations of a cooperative society.

- Government control: cooperative societies have to comply with several rules and regulations related to auditing of accounts, submission of accounts, etc. It affects its freedom of operations.

Question 32.

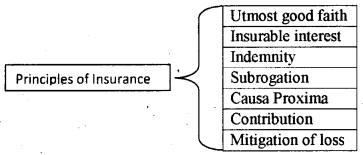

Explain the major principles of insurance.

Answer:

Principles of Insurance

1. Utmost good faith: The insured must disclose all material facts about the subject matter to the insured. Otherwise the insurer can cancel the contract. The insurer must disclose all the terms and conditions in the insurance contract to the insured.

2. Insurable interest: The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

3. Indemnity: All insurance contracts, except life insurance are contracts of indemnity. According to the principle of indemnity, in the event of occurrence of loss, the insured will be indemnified to the extent of the actual value of his loss or the sum insured which ever is less. The objective behind this principle is nobody should treat insurance contract as the source of profit.

4. Subrogation: According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

5. Causa proxima: When the loss is the result of two or more causes, the proximate cause for the loss alone will be considered by the insurance company for admitting the claim.

6. Contribution: In certain cases, the same subject matter is insured with one or more insurer. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him.

7. Mitigation of loss: This principle states that it is the duty of the insured to take reasonable steps to minimize the loss or damage to the insured property. If reasonable care is not taken then the claim from the insurance company may be rejected.

Question 33.

Explain any four services each rendered by wholesalers to manufacturers as well as to the retailers.

Answer:

Services of Wholesalers to Manufacturers:

- Facilitating large scale production: As the wholesalers place bulk orders, the producers are able to undertake production on a large scale and take advantages of economies of scale.

- Risk bearing: Wholesaler deals in goods in their own name and bear variety of risks such as the risk of fall in prices, theft, pilferage spoilage, fire etc.

- Financial assistance: Wholesalers provide financial assistance to the manufacturers by making cash payment for the purchased goods.

- Expert advice: Wholesaler provide various useful information regarding the customer preference, market conditions etc to the manufacturer.

- Help in marketing function: As the wholesalers place bulk orders, it relieves the producer from many marketing activities and he can concentrate on production.

- Storage facilities: Wholesalers hold the goods in their own warehouses. It reduces the burden of storage of goods by the manufacturers.

- Facilitate production continuity: The wholesalers facilitate continuity of production activity throughout the year by purchasing the goods as and when these are produced

Services of Wholesalers to Retailers:

- Availability of goods: The wholesalers make the products of various manufacturers readily available to the retailers.

- Marketing support: They undertake advertisements and other sales promotional activities to induce customers to purchase the goods.

- Grant of credit: The wholesalers generally provide credit facilities to the retailers.

- Specialised knowledge: Wholesalers know the pulse of the market. They inform the retailers about the new products, their uses, quality, prices, etc.

- Risk sharing: Wholesalers sell goods to retailers in small quantities and thus retailers do not face the risk of storage, pilferage, reduction in prices etc.