Kerala Plus One Business Studies Chapter Wise Questions and Answers Chapter 5 Emerging Modes of Business

Plus One Emerging Modes of Business One Mark Questions and Answers

Question 1.

Carrying business activity through internet is popularly known as _______

Answer:

E-commerce

Question 2.

____________ refers to illegal entry into the web site of an enterprise and thereby damaging data input there.

Answer:

Hacking

Question 3.

____________ are programmes designed to corrupt data in a system.

Answer:

Viruses

Question 4.

Mr. Arun, a retailer pays tax online. Identify this E-Commerce Transaction

Answer:

C2G

Question 5.

Which of the following helps to purchase goods and services without making spot payments and zero balance in the account?

- ATM card

- credit card

- debit card

- Kisan card

Answer:

2. credit card

Question 6.

The advancement of technology helps people for shopping goods for cash without holding cash or making any deposits with banks. How is it possible explain the identified term?

Answer:

Credit card

Plus One Emerging Modes of Business Two Mark Questions and Answers

Question 1.

What do you mean by cryptography? (2)

Answer:

It refers to the art of protecting information by transforming it into an unreadable format called ‘cyphertext’. Only those who processes a secret key can decrypt the message into plaintext.

Question 2.

What are the ethical concerns involved in outsourcing? (2)

Answer:

In the name of cost-cutting, unlawful activities such as child labour, wage discrimination, etc. may be encouraged in other countries.

Plus One Emerging Modes of Business Three Mark Questions and Answers

Question 1.

Anish, an NRI businessman, sends money to his wife, Nisha. She in turn deposits all this money in her bank account. She is very thankful for technology and can withdraw money whenever she is in need of money even after banking hours. What type of technology she might be using? Explain. (3)

Answer:

ATM. From the ATM, customers can withdraw cash from the account by using ATM card. ATM card is a plastic card bearing a number for each customer. The card is to be entered into the machine and enter the PIN. This opens the account and we can deposit cash into it or withdraw from it at any time.

Question 2.

The advancement of technology facilitates shopping -goods for cash without holding cash or making any deposit with banks. How is it possible? (3)

Answer:

It is possible through credit card. A credit card is an instrument issued by a bank in the name of the customer providing for credit up to a specified amount. The sellers get cash from the bank and the buyers have to pay for the purchase within the credit period.

Question 3.

Majority of people in India, even internet users, hesitate shopping through internet. Can you cite a few reasons for their hesitation for buying online? (3)

Answer:

The important reasons forthe hesitation of shopping through internet are:

- Time to deliver goods is too long.

- Disclosure of credit card details is not safe.

- Choices are not very interesting.

Plus One Emerging Modes of Business Four Mark Questions and Answers

Question 1.

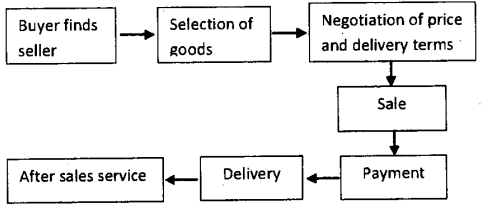

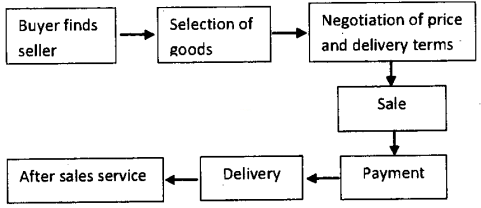

Elaborate the steps involved in online trading. (4)

Answer:

Online Transactions:

Online transaction means receiving information about goods, placing an order, receiving delivery and making payment through medium of internet.

Buying / Selling Process:

Steps involved in online purchase:

1. Register with the online vendor by filling-up a registration form.

2. Place the order for the items put by customer in his virtual shopping cart, an online record of what has been picked up while browsing the Online store.

3. Payment for the purchases through online shopping may be done in a number of ways: i.e Cash on delivery, cheque, net banking transfer, debit/credit card.

Question 2.

Name the resources required for E-commerce. (4)

Answer:

Resources Required for Successful e-Business Implementation:

- Computer system

- Internet connection and technically qualified workforce

- A well-developed web page

- Effective telecommunication system

- A good system for making payments using credit instruments.

Question 3.

Explain any 4 types of outsourcing services. (4)

Answer:

- Financial services.

- Advertising services

- Courier services

- Customer support services

Plus One Emerging Modes of Business Five Mark Questions and Answers

Question 1.

List two examples each for B2B, B2C, B2G and B2E transactions (5)

Answer:

B2B:

- Transactions between businessmen

- Collaboration

- Placing order with suppliers

- Forming joint ventures

- Transfer of goods between branches

- Transfer of goods between suppliers

B2C:

- Business offering services to customers

- Consumer placing order online

- Electronic payment

- Consumers seeking clarification on price, terms etc. (any two)

B2G:

- Payment of taxes

- Application for licence

- Seeking government clearance

B2E:

- Employees salary payments

- Operation of welfare schemes

- Information to employees on business process

- Seeking employees suggestions online

Question 2.

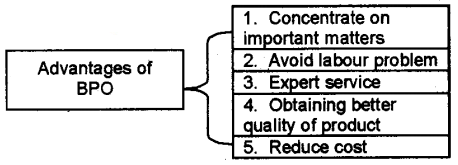

Sankar and Co is a leading can manufacturing company. They are not concentrating on their advertisement due to lack of time. In orderto boost up the sales they made a contract with an advertising agency to make an advertisement which can be released through the media. Analyze this situation. Do you favour this activity of the company? Can you identify the concept and brings out its merit? (5)

Answer:

Business Process Outsourcing (BPO)

Plus One Emerging Modes of Business Six Mark Questions and Answers

Question 1.

State any three differences between e-business and traditional business.

Answer:

| Traditional business | e-business |

| Its formation is difficult | Its formation is easy |

| Investment is very high | Investment is low |

| Physical presence is required | Physical presence is not required |

| Location is important | Location is not important |

| Operating cost is high | Operating cost is low |

| Contact with suppliers and customers is through intermediaries | Direct contact with the suppliers and customers |

| Business process cycle is long | Business process cycle is shorter |

| Inter personal touch is high | Personal touch is less |

| Limited market coverage | Access to the global market |

| Communication is in hierarchical order | Communication is in non hierarchical order |

| Transaction risk is less | Transaction risk is high |

Outsourcing or Business Process Outsourcing (BPO):

Outsourcing is a management strategy by which an organisation contracts out its major non-core functions to specialized service providers with a view to benefit from their expertise, efficiency and cost effectiveness, and allow managers to concentrate on their core activities.

Merits of outsourcing:

- It provides an opportunity to the organisation to concentrate on areas in which it has core competency or strength.

- It helps better utilisation of its resources as the management can focus its attention on selected activities and attain higher efficiency.

- It helps the organisation to get an expert and specialised service at competitive prices. It helps in improved service and reduction in costs.

- It facilitates inter-organisational knowledge sharing and collaborative learning.

- It enables expansion of business as resources saved from outsourcing can be used for expanding the production capacity and diversified products.

Limitations of outsourcing:

- It reduces confidentiality as outsourcing involves sharing a lot of information with others.

- It may be opposed by labour unions who feel threatened by possible reduction in their employment.

- In the name of cost cutting, unlawful activities such as child labour, wage discrimination maybe encouraged in other countries.

- The organisation hiring others may face the problem of loss of managerial control because it is more difficult to manage outside service providers than managing one’s own employees.

- It causes unemployment in the home country.

Question 2.

Evaluate the need for outsourcing and discuss its limitations. (6)

Answer:

Outsourcing or Business Process Outsourcing (BPO):

Outsourcing is a management strategy by which an organisation contracts out its major non-core functions to specialized service providers with a view to benefit from their expertise, efficiency and cost effectiveness, and allow managers to concentrate on their core activities.

Merits of outsourcing:

- It provides an opportunity to the organisation to concentrate on areas in which it has core competency or strength.

- It helps better utilisation of its resources as the management can focus its attention on selected activities and attain higher efficiency.

- It helps the organisation to get an expert and specialised service at competitive prices. It helps in improved service and reduction in costs.

- It facilitates inter-organisational knowledge sharing and collaborative learning.

- It enables expansion of business as resources saved from outsourcing can be used for expanding the production capacity and diversified products.

Limitations of outsourcing:

- It reduces confidentiality as outsourcing involves sharing a lot of information with others.

- It may be opposed by labour unions who feel threatened by possible reduction in their employment.

- In the name of cost cutting, unlawful activities such as child labour, wage discrimination maybe encouraged in other countries.

- The organisation hiring others may face the problem of loss of managerial control because it is more difficult to manage outside service providers than managing one’s own employees.

- It causes unemployment in the home country.

Question 3.

What is online transactions? Explain its steps. (6)

Answer:

On line Transactions:

On line transaction means receiving information about goods, placing an order, receiving delivery and making payment through medium of internet.

Buying / Selling Process:

Steps involved in online purchase:

- Register with the online vendor by filling-up a registration form.

- Place the order for the items put by customer in his virtual shopping cart, an on-line record of what has been picked up while browsing the On-line store.

- Payment for the purchases through online shopping may be done in a number of ways: i.e Cash on delivery, cheque, net banking transfer, debit/credit card.