Kerala Plus One Business Studies Chapter Wise Questions and Answers Chapter 2 Forms of Business Organisation

1 Mark Questions and Answers

Question 1.

The structure in which there is a separation of ownership and management is called

(a) Sole proprietorship

(b) Partnership

(c) Company

(d) All business

Answer:

(c) Company

Question 2.

Write the name of the form of business organisation found only in India.

Answer:

Hindu Undivided Family

Question 3.

Name the type of Co. which must have a minimum paid-up capital of 5 lacs.

Answer:

Public Company

Question 4.

…… is the oldest and popular form of business organisation.

Answer:

Sole proprietorship

Question 5.

Profits do not have to be shared. This statement refers to ………

(a) Partnership

(b) Joint Hindu family business

(c) Sole proprietorship

(d) Company

Answer:

(c) Sole proprietorship

Question 6.

Quick decision, prompt action and business secrecy are the major features of this form of business. Name it.

Answer:

Sole proprietorship.

Question 7.

Mrs.Anupama is running a bookstall in the high school junction. She is the owner, manager and labourer of her business. She gives personal attention to each and every customer and attracts more customers and earns high profits. Identify the form of organization owned and operated by Mrs Anupama

Answer:

Sole proprietorship

Question 8.

The liability of a sole trader is ………

Answer:

Unlimited.

Question 9.

The maximum number of partners allowed in the banking business is:

(a) Twenty

(b) Ten

(c) No limit

(d) Two

Answer:

(b) Ten

Question 10.

The minimum number of partners required to form a partnership business is

(a) Twenty

(b) Ten

(c) No limit

(d) Two

Answer:

(d) Two

Question 11.

A partner whose association with the firm is unknown to the general public is called

(a) Active partner

(b) Sleeping partner

(c) Nominal partner

(d) Secret partner

Answer:

(d) Secret partner

Question 12.

Mr Isaac contributes capital to partnership business, but not takes part in business, what kind of partner he is?

Answer:

Sleeping partner

Question 13.

Identify the type of partners in the following situation:

- The liability of Sridhar, a 25 years old partner is limited to the extent of his capital contribution.

- Madan has neither contributed any capital nor shares the profits of the firm though he is treated as a partner.

- Sunita has been admitted to the benefits of the firm at the age of 15.

- Sudhir had contributed to capital and shares the profit and loss of the firm. But he does not take part in the day-to-day activities.

- A firm declares that Sachin is a partner of their firm. Knowing the declaration Sachin did not disclaim it.

Answer:

- Limited partner

- Nominal Partner

- Minor partner

- Sleeping Partner/dormant partner

- Partner by holding out.

Question 14.

M, N and P are partnership firm. In this firm ‘P’ contributes capital and take active part in business, while ‘R’ lends only his name and reputation. What type of partners are they?

Answer:

‘P’ is an active partner, ‘R’ is a nominal partner

Question 15.

Name the partner who shares the profits of the business without being liable for the losses.

Answer:

Partner in profit only

Question 16.

The maximum number of partners in a partnership firm except banking business is ……..

Answer:

20

Question 17.

The liability of partners in a partnership business is ………

Answer:

Unlimited

Question 18.

The written agreement of partnership is called ………..

Answer:

Partnership Deed

Question 19.

Partnership formed for the accomplishment of a particular project or for a specified time period is called ………

Answer:

Particular partnership.

Question 20.

Registration of a partnership is ………

Answer:

Optional

Question 21.

The Head of the joint Hindu family business is called

(a) Proprietor

(b) Director

(c) Karta

(d) Manager

Answer:

(c) Karta

Question 22.

The Karta in Joint Hindu family business has

(a) Limited liability

(b) Unlimited liability

(c) No liability for debts

(d) Joint liability

Answer:

(b) Unlimited liability

Question 23.

It is not formed by an agreement or by a contract. But it comes into existence by the operation of Hindu law. Name the type of business organisation.

Answer:

Hindu Undivided Family (HUF)

Question 24.

The members of a Joint Hindu Family business is known as …….

Answer:

Co-parceners.

Question 25.

The liability of all members in H.U.F is ……..

Answer:

Limited

Question 26.

In a Co-operative society, the principle followed is

(a) One share one vote

(b) One man one vote

(c) No vote

(d) Multiple votes

Answer:

(b) One man one vote

Question 27.

The main aim of this organization is self-help through mutual help. Identify the type of organizations.

Answer:

Co-operative Society

Question 28.

“Each for All and All for Each” is a basic motto of a form of business organization. Identify the organization.

Answer:

Co-operative society

Question 29.

Voting right in a cooperative society is based on the principle of …………

Answer:

One man one vote

Question 30.

The minimum number of persons to form a co-operative society is ……..

Answer:

10

Question 31.

The membership of a co-operative society is ……….

Answer:

Voluntary.

Question 32.

Registration of a Co-operative society is …….

Answer:

Compulsory

Question 33.

The liability of the members of a cooperative society is ………

Answer:

Limited

Question 34.

The capital of a company is divided into a number of parts each one of which is called …………

(a) Dividend

(b) Profit

(c) Interest

(d) Share

Answer:

(d) Share

Question 35.

Name the following in reference to a joint-stock company

- The smallest unit into which the capital of the company is divided.

- The Act that governs the joint-stock companies in India.

- The sum total of the money contributed by the members of a joint-stock company.

- The official signature of a joint-stock company.

- The elected representatives of the members who manage the day to day affairs of the joint-stock company.

Answer:

- Share

- Companies Act 1956

- Share capital

- Common seal

- Directors

2 Mark Questions and Answers

Question 1.

Compare the status of a minor in a Joint Hindu Family Business with that in a partnership.

Answer:

The basis of membership in the HUF business is birth in the family. Hence, minors can also be members of the business. His liability is limited. In a partnership firm, a minor can be admitted to the benefits of a partnership firm with the mutual consent of all other partners. In such cases, his liability will be limited to the extent of the capital contributed by him.

Question 2.

Sunny Joseph wants to start a private business. Tell him the different forms in which a private business can be organized.

Answer:

There are five forms of business enterprises in the private sector.They are:

- Sole proprietorship

- Joint Hindu Family Business

- Partnership

- Joint Stock Company

- Co-operative Society

Question 3.

Name the form of business organisation where membership is acquired by birth. Explain any two features of such an organisation.

Answer:

- Joint Hindu Family Business

- Joint Hindu Family Business (HUF)

It refers to a form of organisation were in the business is owned and carried on by the members of a joint Hindu family. It is also known as Hindu Undivided Family Business (H.U.F). It is governed by the Hindu Succession Act, 1956. It is found only in India. The business is controlled by the head of the family who is the eldest member and is called Karta. All members have equal ownership right over the property of an ancestor and they are known as co-parceners.

Features

1. Formation:

For a Joint Hindu family business, there should be at least two members in the family and some ancestral property to be inherited by them.

2. Membership:

Membership by virtue of birth in the family.

3. Liability:

The Karta has unlimited liability. Every other coparcener has a limited liability up to his share in the HUF property.

4. Control:

The control of the family business lies with the Karta. He takes all the decisions and is authorised to manage the business.

5. Continuity:

The business is not affected by the death of the Karta as in such cases the next senior male member becomes the Karta.

6. Minor Members:

The basis of membership in the business is birth in the family. Hence, minors can also be members of the business.

Merits

1. Effective control:

The Karta has absolute decision making power. This avoids conflicts among members.

2. Continuity of business:

The death of the Karta will not affect the business as the next eldest member will then take up the position.

3. Limited liability of members:

The liability of all the co-parceners except the Karta is limited to their share in the business.

4. Increased loyalty:

Members are likely to work with dedication, loyalty and care because the work involves the family name.

Limitation

1. Limited capital:

The capital of HUF is limited since the ancestral property only can be used for the business. This reduces the scope for business growth.

2. Unlimited liability:

The liability of Karta is unlimited. His personal property can be used to repay business debts.

3. Dominance of Karta:

There is a possibility of differences of opinion among the members of the Joint Family. It may affect the stability of the business.

4. Limited managerial skills:

The Karta may not be an expert in all areas of management. It may affect the profitability of the business.

Question 4.

What is a Private Company?

Answer:

Private Company:-

A private company means a company which:

- restricts the right of members to transfer its shares

- has a minimum of 2 and a maximum of 50 members

- does not invite public to subscribe to its share capital

- must have a minimum paid-up capital of Rs.1 lakh It is necessary for a private company to use the word private limited after its name.

Question 5.

What is Public Company?

Answer:

Public Company

A public company means a company which is not a private company. As per the Indian Companies Act, a public company is one which:

- has a minimum paid-up capital of Rs. 5 lakhs

- has a minimum of 7 members and no limit on maximum members

- can transfer its shares

- can invite the public to subscribe to its shares. A private company which is a subsidiary of a public company is also treated as a public company. A public company must use the word limited after its name.

3 Mark Questions and Answers

Question 1.

Tristar Traders’ is a real estate partnership firm having partners viz. Haridas, Balakrishnan and Venny. They are equal partners. Due to ill health, Mr.Balakrishnan wants to retire from the business and he asks other partners to admit his 17-year-old son Mr.Renjith into partnership. Mr.Haridas and Mr.Venny agree to admit Mr.Renjith into the partnership.

- Is it possible to admit Mr.Renjith into the partnership? Substantiate.

- What type of partner is Renjith?

Answer:

- Yes. It is possible to admit Renjith into partnership with the consent of all other partners.

- Minor partner.

Question 2.

Explain the status of a minor in a partnership firm.

Answer:

A minor can be admitted to the benefits of a partnership firm with the mutual consent of all. other partners. In such cases, his liability will be limited to the extent of the capital contributed by him in the firm. He will not be eligible to take an active part in the management of the firm. A minor can share only the profits. He can inspect the accounts of the firm.

Question 3.

Mr. Unnikrishnan, a senior member, who looks after the family business, convened a meeting of the family members. He told that the firm is unable to pay its debts. So the personal property of all members must be made available for repaying the debts. All the members disagreed with the suggestion. As a commerce student what will be your opinion?

Answer:

The HUF business is governed by the law of succession. Here Mr. Unnikrishnan, a senior male member of the family runs the business. He is called Karta. The liability of the Karta is unlimited. But the liability of all other co-partners is limited. Only the personal property of the Karta can be used for the payment of business debts.

Question 4.

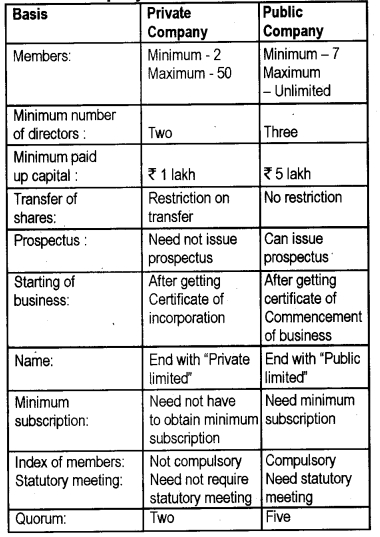

Distinguish between Private limited company and Public limited company.

Answer:

Difference between a public company and private company

4 Mark Questions and Answers

Question 1.

Mr.Jayan, still an unemployed youth, after two years of his post-graduation, decided to start a restaurant. In order to meet the capital requirements, he seeks his father’s help. His father agreed to give sufficient capital but asks him what prompted him to start this sort of a business. Jayan explains the essential factors he has considered for starting the restaurant.

- Identify the business.

- Explain the merits of the proposed business.

Answer:

- Sole Proprietorship

- Advantages of Sole Proprietorship

Sole proprietorship:

Sole proprietorship refers to a form of business organization which is owned, managed and controlled by an individual who is the recipient of all profits and bearer of all risks. It is the most common form of business organization.

Features

- The sole trader is the single owner and manager of the business.

- The formation of a sole proprietorship is very easy. There are no legal formalities to form and close a sole proprietorship.

- The liability of a sole trader is unlimited, i.e. in case of loss, his personal properties can be used to pay the business liabilities.

- The entire profit of the sole trading business goes to the sole proprietor. If there is any loss it is also to be borne by the sole proprietor alone.

- The sole trader has full control over the affairs of the business. So he can take quick decisions.

- A sole trading concern has no legal existence separate from its owner.

- The death, insolvency etc. of a sole trader causes discontinuity of business.

Merits

1. Easy formation:-

The formation of a sole proprietorship is very easy. There are no legal formalities to form and close a sole proprietorship.

2. Quick Decision:

The sole trader has full control over the affairs of the business. So he can take quick decisions and prompt actions in all business matters.

3. Motivation:

The entire profit of the sole trading business goes to the sole proprietor. It motivates him to work hard.

4. Secrecy:

A sole trader can keep all the information related to business operations and he is not bound to publish the firm’s accounts.

5. Close Personal Relation :

The sole proprietor can maintain good personal contact with the customers and employees and thus, business runs smoothly.

Limitations

1. Limited capital:

A sole trader can start business only on a small scale because of limited capital.

2. Lack of Continuity:

Death, insolvency or illness of a proprietor affects the business and can lead to its closure.

3. Limited managerial ability:

A sole proprietor may not be an expert in every aspect of management.

4. Unlimited liability:

The liability of a sole trader is unlimited, i.e. in case of loss, his personal properties can be used to pay off the business liabilities.

5. Suitability:

Sole proprietorship is suitable in the following cases.

- Where the market is limited, localized and customers demand personalized services. Eg. tailoring, beauty parlour etc.

- Where goods are unstandardised like artistic jewellery.

- Where lower capital, limited risk & limited managerial skills are required as in case of retail store.

Question 2.

I am on the look for a few persons who are ready to invest both their skills and money because I believe collective efforts are more fruitful and least bothered about the extent of liability.

(a) What type of business organization is suitable for me?

(b) Explain the procedure in the formation of this business.

Answer:

(a) Partnership

(b) Registration of partnership

According to Indian Partnership Act 1932, registration of a partnership is not compulsory, it is optional. However, they can register with the Registrar of firms of the state in which the firm is situated.

Procedure for Registration:

1. Submission of application in the prescribed form to the Registrar of firms. The application should contain the following particulars:

- Name of the firm

- Location of the firm

- Names of other places where the firm carries on business

- The date when each partner joined the firm

- Names and addresses of the partners

- Duration of partnership.

This application should be signed by all the partners.

2. Deposit of required fees with the Registrar of Firms.

3. The Registrar after approval will make an entry in the register of firms and will subsequently issue a certificate of registration.

The consequences of non-registration of a firm are as follows:

- A partner of an unregistered firm cannot file suit against the firm or other partner.

- The firm cannot file a suit against the third party.

- The firm cannot file a case against its partner.

Question 3.

Certain companies cannot issue an invitation to the public to subscribe to its shares. The maximum shareholders of the company is limited to 50. The transfer of shares of the company is restricted.

(a) Identify the type of company.

(b) Explain the privileges enjoyed by these types of companies.

Answer:

(a) Private Company

(b) Privileges of a private company

- A private company can be formed by only two members.

- There is no need to issue a prospectus

- Allotment of shares can be done without receiving the minimum subscription.

- A private company can start business as soon . as it receives the certificate of incorporation.

- A private company needs to have only two directors.

- A private company is not required to keep an index of members.

- There is no restriction on the amount of loans to directors in a private company.

5 Mark Questions and Answers

Question 1.

Arun, Nisha and Lekshmi, entered into an agreement for starting a supermarket – ‘Mythri’. The other terms and conditions of the business were. mentioned in their deed. While having an official meeting of the partners, Nisha and Lekshmi suggested that the firm should be registered. But Arun contented that, it is not essential to register Mythri. The other two partners disagreed with Arun and maintained that it is essential because they don’t want to bear the consequences. As an expert in this topic,

(a) Whom do you favour? Specify your reasons in support of your judgement.

(b) In your opinion, is there any consequences, if Mythri is not registered. Explain.

Answer:

a) Arun. It is not compulsory to register a partnership firm,

(b) Registration of partnership

According to Indian Partnership Act 1932, registration of a partnership is not compulsory, it is optional. However, they can register with the Registrar of firms of the state in which the firm is situated.

Procedure for Registration:

1. Submission of application in the prescribed form to the Registrar of firms. The application should contain the following particulars:

- Name of the firm

- Location of the firm

- Names of other places where the firm carries on business

- The date when each partner joined the firm

- Names and addresses of the partners

- Duration of partnership.

This application should be signed by all the partners.

2. Deposit of required fees with the Registrar of Firms.

3. The Registrar after approval will make an entry in the register of firms and will subsequently issue a certificate of registration.

The consequences of non-registration of a firm are as follows : –

- A partner of an unregistered firm cannot file suit against the firm or other partner.

- The firm cannot file a suit against the third party.

- The firm cannot file a case against its partner.

Question 2.

Name the following in reference to a joint-stock company.

- The smallest unit into which the capital of the company is divided.

- The Act governs the joint-stock companies in India.

- The sum total of the money contributed by the members of a joint-stock company.

- The official signature of a joint-stock company.

- The elected representatives of the members who manage the day to day affairs of the joint-stock company.

Answer:

- Share

- Companies Act 1956

- Share capital

- Common seal

- Directors

6 Mark Questions and Answers

Question 1.

Distinguish between Joint Stock Company and Partnership.

Answer:

| Partnership Firm | Joint Stock Company |

| 1. Formed by an agreement | Formed by registration |

| 2. Governed by Partnership Act 1932 | Governed by the Companies Act 1956 |

| 3. Registration is optional | Registration is compulsory |

| 4. It has no separate legal existence | It has separate legal existence |

| 5. It does not possess continuous existence | It has perpetual existence |

| 6. Minimum number of persons required is two | Minimum number of persons required is seven (2 in Private company) |

| 7. The liability of partners is unlimited | The liability of shareholders is limited |

| 8. All partners can take part in the management | All shareholders cannot take part in the management |

Partnership Firm Joint Stock Company

1. Formed by an agreement Formed by registration

2. Governed by Partnership Act 1932 Governed by the Companies Act 1956

3. Registration is optional Registration is compulsory

4. It has no separate legal existence It has a separate legal existence

5. It does not possess continuous existence It has perpetual existence

6. Minimum number of persons required is two Minimum number of persons required is seven (2 in Private company)

7. The liability of partners is unlimited The liability of shareholders is limited

8. All partners can take part in the management All shareholders cannot take part in the management

Question 2.

Discuss the factors that determine the choice of form of organisation.

Answer:

Choice of business organisation

The important factors determining the choice of organization are:-

1. Cost and Ease of formation:-

From the point of view of cost, sole proprietorship is the preferred form as it involves least expenditure and the legal requirements are minimum. Company form of organisation is more complex and involves greater costs.

2. Liability:-

In case of sole proprietorship and partnership firms, the liability of the owners/ partners is unlimited. In cooperative societies and companies, the liability is limited. Hence, from the point of view of investors, the company form of organisation is more suitable as the risk involved is limited.

3. Continuity:

The continuity of sole proprietorship and partnership firms is affected by death, insolvency or insanity of the owners. However, such factors do not affect the continuity of cooperative societies and companies. In case the business needs a permanent structure, company form is more suitable.

4. Management ability:

If the organisation’s operations are complex in nature and require professionalized management, company form of organisation is a better alternative.

5. Capital:

If the scale of operations is large, company form may be suitable whereas for medium and small-sized business one can opt for partnership or sole proprietorship.

6. Degree of control:

If direct control over business and decision making power is required, proprietorship may be preferred. But if the owners do not mind sharing control and decision making, partnership or company form of organisation can be adopted.

7. Nature of business:

If direct personal contact is needed with the customers, Sole proprietorship may be more suitable. Otherwise, the company form of organisation may be adopted.

8 Mark Questions and Answers

Question 1.

Prepare a seminar report on the merits of the Joint Stock Company form of business.

Answer:

Joint Stock company

A company may be defined as a voluntary association of persons having a separate legal entity, with perpetual succession and a common seal. It is an artificial person created by law. The companies in India are governed by the Indian. Companies Act, 1956.

The capital of the company is divided into smaller parts called ‘shares’ which can be transferred freely, (except in a private company). The shareholders are the owners of the company. The company is managed by Board of Directors, elected by shareholders.

Features

1. Incorporated association:

A company is an incorporated association, i.e. Registration of a company is compulsory under the Indian Companies Act, 1956.

2. Separate legal entity:-

A company is an artificial person created by law. Company has a separate legal entity apart from its members. It can enter into contracts, own property, sue and be sued, borrow and lend money etc.

3. Formation:-

The formation of a company is a time consuming, expensive and complicated process.

4. Perpetual succession:-

A company has continuous existence. Its existence not affected by death, insolvency or insanity of shareholders. Members may come and go, but the company continues to exist.

5. Control:-

The management and control of the affairs of the company is in the hands of Board of directors who are elected the representatives of the shareholders.

6. Liability:-

The liability of the shareholders is limited to the extent of the face value of shares held by them.

7. Common seal:

The Company being an artificial person acts through its Board of Directors. All documents issued by the company must be authenticated by the company seal.

8. Transferability of shares:-

Shares of a joint-stock company are freely transferable except in case of a private company.

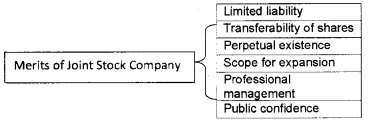

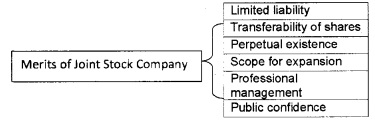

Merits

1. Limited liability:- The liability of the shareholders is limited to the extent of the face value of shares held by them. This reduces the degree of risk borne by an investor.

2. Transferability of shares:- Shares of a public company are freely transferable. It provides liquidity to the investor.z

3. Perpetual existence:- A company has continuous existence. Its existence not affected by death, insolvency or insanity of shareholders.

4. Scope for expansion:- A company has large financial resources. So it can start a business on a large scale.

5. Professional management: A company can afford to pay higher salaries to specialists and professionals. This leads to greater efficiency in the company’s operations.

6. Public confidence:- A company must publish its audited annual accounts. So it enjoys public confidence.

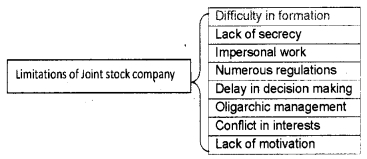

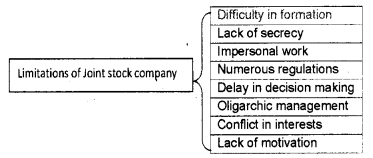

Limitations

1. Difficulty information:-

The formation of a company is very difficult. It requires greater time, effort and extensive knowledge of legal requirements.

2. Lack of secrecy:-

It is very difficult to maintain secrecy in case of a public company, a company is required to publish its annual accounts and reports.

3. Impersonal work:-

It is difficult for the owners and top management to maintain personal contact with the employees, customers and creditors.

4. Numerous regulations:-

The functioning of a company is subject to many legal provisions and compulsions. This reduces the freedom of operations of a company.

5 Delay in decision making:-

A company takes important decisions by holding company meetings. It requires a lot of time.

6. Oligarchic management:-

Theoretically a company is democratically managed but actually it is managed by few people, i.e board of directors. The Board of Directors enjoy considerable freedom in exercising their power which they sometimes ignore the interest of the shareholders.

7. Conflict in interests:-

There may be a conflict of interest amongst various stakeholders of a company. It affects the smooth functioning of the company.

8. Lack of motivation:-

The company is managed by a board of directors. They have little interest to protect the interest of the company.

Types of Companies

A company can be either a private or a public company.

Question 2.

Mrs.Sheela is running a Ladies Beauty Parlour in Calicut City. She is the owner, manager and labourer of her business.

a) What form of organisation Mrs.Sheela owns.

b) State its merits and demerits.

Answer:

a) Sole Proprietorship

(b) Sole proprietorship:

Sole proprietorship refers to a form of business organization which is owned, managed and controlled by an individual who is the recipient of all profits and bearer of all risks. It is the most common form of business organization.

Features

- The sole trader is the single owner and manager of the business.

- The formation of a sole proprietorship is very easy. There are no legal formalities to form and close a sole proprietorship.

- The liability of a sole trader is unlimited, i.e. in case of loss, his personal properties can be used to pay the business liabilities.

- The entire profit of the sole trading business goes to the sole proprietor. If there is any loss it is also to be borne by the sole proprietor alone.

- The sole trader has full control over the affairs of the business. So he can take quick decisions.

- A sole trading concern has no legal existence separate from its owner.

- The death, insolvency etc. of a sole trader causes discontinuity of business.

Merits

1. Easy formation:-

The formation of a sole proprietorship is very easy. There are no legal formalities to form and close a sole proprietorship.

2. Quick Decision:

The sole trader has full control over the affairs of the business. So he can take quick decisions and prompt actions in all business matters.

3. Motivation:

The entire profit of the sole trading business goes to the sole proprietor. It motivates him to work hard.

4. Secrecy:

A sole trader can keep all the information related to business operations and he is not bound to publish the firm’s accounts.

5. Close Personal Relation :

The sole proprietor can maintain good personal contact with the customers and employees and thus, business runs smoothly.

Limitations

1. Limited capital:

A sole trader can start business only on a small scale because of limited capital.

2. Lack of Continuity:

Death, insolvency or illness of a proprietor affects the business and can lead to its closure.

3. Limited managerial ability:

A sole proprietor may not be an expert in every aspect of management.

4. Unlimited liability:

The liability of a sole trader is unlimited, i.e. in case of loss, his personal properties can be used to pay off the business liabilities.

5. Suitability:

Sole proprietorship is suitable in the following cases.

- Where the market is limited, localized and customers demand personalized services. Eg. tailoring, beauty parlour etc.

- Where goods are unstandardized like artistic jewellery.

- Where lower capital, limited risk & limited managerial skills are required as in case of retail store.

Question 3.

Mr.Firoz, a graduate wants to start a business but on certain conditions –

- He does not want to go through a lot of legal formalities.

- He does not care to have unlimited liability.

- He does not bother admitting partners in his business.

- Considering these factors, suggest a form of business suitable to Mr.Firoz.

- Explain its merits and demerits.

Answer:

- Partnership

- Partnership

The Indian Partnership Act, 1932 defines partnership as “the relation between persons who have agreed to share the profit of the business carried on by all or any one of them acting for all.”

Features

1. Formation:-

For the formation of a partnership, agreement between partners is essential.

2. Liability:-

The partners of a firm have unlimited liability. The partners are jointly and individually liable for the payment of debts.

3. Risk bearing:

The profit or loss shall be shared among the partners equally or in agreed ratio.

4. Decision making and control:-

The activities of a partnership firm are managed through the joint efforts of all the partners.

5. Lack of Continuity:-

The retirement, death, insolvency, insanity etc of any partner brings the firm to an end.

6. Membership:-

There must be at least two persons to form a partnership. The maximum number of persons is ten in the banking business and twenty in non-banking business.

7. Mutual agency:-

In partnership, every partner is both an agent and a principal.

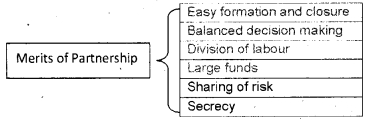

Merits of Partnership

1. Easy formation and closure:-

A partnership firm can be formed and closed easily without any legal formalities.

2. Balanced decision making:-

In partnership, decisions are taken by all partners. So they can take better decisions regarding their business.

3. Division of labour:-

Division of labour is possible in partnership firm. Duties can be assigned to different partners according to their ability.

4. Large funds:-

In a partnership, the capital is contributed by a number of partners. So they can start business on a large scale.

5. Sharing of risk:-

The risks involved in running a partnership firm are shared by all the partners. This reduces the anxiety, burden and stress on individual partners.

6. Secrecy:-

A partnership firm is not legally required to publish its accounts and submit its reports. Hence it can maintain confidentiality of information relating to its operations.

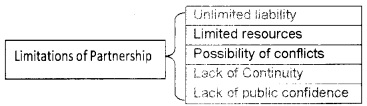

Limitations of Partnership

1. Unlimited liability:-

The partners of a firm have unlimited liability. The partners are jointly and individually liable for the payment of debts.

2. Limited resources:-

There is a restriction on the number of partners. Hence capital contributed by them is also limited.

3. Possibility of conflicts:-

Lack of mutual understanding and co-operation among partners may affect the smooth working of the partnership business.

4. Lack of continuity:-

The retirement, death, insolvency, insanity etc of any partner brings the firm to an end.

5. Lack of public confidence:-

A partnership firm is not legally required to publish its financial reports. As a result, the confidence of the public in partnership firms is generally low.

Question 4.

“A Company is an artificial person created by law”. Based on the above statement, explain the features of a Joint Stock Company.

Answer:

Joint Stock company

A company may be defined as a voluntary association of persons having a separate legal entity, with perpetual succession and a common seal. It is an artificial person created by law. The companies in India are governed by the Indian. Companies Act, 1956.

The capital of the company is divided into smaller parts called ‘shares’ which can be transferred freely, (except in a private company). The shareholders are the owners of the company. The company is managed by Board of Directors, elected by shareholders.

Features

1. Incorporated association:

A company is an incorporated association, i.e. Registration of a company is compulsory under the Indian Companies Act, 1956.

2. Separate legal entity:-

A company is an artificial person created by law. Company has a separate legal entity apart from its members. It can enter into contracts, own property, sue and be sued, borrow and lend money etc.

3. Formation:-

The formation of a company is a time consuming, expensive and complicated process.

4. Perpetual succession:-

A company has a continuous existence. Its existence not affected by death, insolvency or insanity of shareholders. Members may come and go, but the company continues to exist.

5. Control:-

The management and control of the affairs of the company is in the hands of Board of directors who are elected the representatives of the shareholders.

6. Liability:-

The liability of the shareholders is limited to the extent of the face value of shares held by them.

7. Common seal:

The Company being an artificial person acts through its Board of Directors. All documents issued by the company must be authenticated by the company seal.

8. Transferability of shares:-

Shares of a joint-stock company are freely transferable except in case of a private company.

Merits

1. Limited liability:-

The liability of the shareholders is limited to the extent of the face value of shares held by them. This reduces the degree of risk borne by an investor.

2. Transferability of shares:-

Shares of a public company are freely transferable. It provides liquidity to the investor.

3. Perpetual existence:-

A company has a continuous existence. Its existence not affected by death, insolvency or insanity of shareholders.

4. Scope for expansion:-

A company has large financial resources. So it can start business on a large scale.

5. Professional management:

A company can afford to pay higher salaries to specialists and professionals. This leads to greater efficiency in the company’s operations.

6. Public confidence:-

A company must publish its audited annual accounts. So it enjoys public confidence.

Limitations

1. Difficulty information:-

The formation of a company is very difficult. It requires greater time, effort and extensive knowledge of legal requirements.

2. Lack of secrecy:-

It is very difficult to maintain secrecy in case of public company, as a company is required to publish its annual accounts and reports.

3. Impersonal work:-

It is difficult for the owners and top management to maintain personal contact with the employees, customers and creditors.

4. Numerous regulations:-

The functioning of a company is subject to many legal provisions and compulsions. This reduces the freedom of operations of a company.

5 Delay in decision making:

A company takes important decisions by holding company meetings. It requires a lot of time.

6. Oligarchic management:-

Theoretically a company is democratically managed but actually, it is managed by few people, i.e board of directors. The Board of Directors enjoy considerable freedom in exercising their power which they sometimes ignore the interest of the shareholders.

7. Conflict in interests:-

There may be a conflict of interest amongst various stakeholders of a company. It affects the smooth functioning of the company.

8. Lack of motivation:-

The company is managed by a board of directors. They have little interest to protect the interest of the company.

Types of Companies

A company can be either a private or a public company.

Question 5.

Briefly, explain different types of co-operative society.

Answer:

Types of co-operative society

1. Consumer’s cooperative societies:-

The consumer cooperative societies are formed to protect the interests of consumers. The society aims at eliminating middlemen to achieve economy in operations. It purchases goods in bulk directly from the wholesalers and sells goods to the members at the lowest price.

2. Producer’s cooperative societies:-

These societies are set up to protect the interest of small producers. It supplies raw materials, equipment and other inputs to the members and also buys their output for sale.

3. Marketing cooperative societies:-

Such societies are established to help small producers in selling their Products. It collects the output of individual members and sell them at the best possible price. Profits are distributed to members.

4. Farmer’s cooperative societies:-

These societies . are established to protect the interests of farmers by providing better inputs at a reasonable cost. Such societies provide better quality seeds, fertilisers, machinery and other modern techniques for use in the cultivation of crops.

5. Credit cooperative societies:-

Credit cooperative societies are established for providing easy credit on reasonable terms to the members. Such societies provide loans to members at low rates of interest.