Kerala Plus One Business Studies Chapter Wise Previous Questions and Answers Chapter 4 Business Services

Question 1.

Nowadays, mass production is carried out by industries in anticipation of demand. Hence goods are stored in warehouses till they are required. Explain any six functions of warehousing. (June – 2008)

Answer:

Warehousing

Warehousing means holding or preserving goods in huge quantities from the time of their purchase or production till their consumption. Warehousing is one of the important auxiliaries to trade. It creates time utility by bridging the time gap between production and consumption of goods.

Functions of Warehousing

1. Warehouse helps in supplying the goods to the customers when it is needed.

2. By maintaining a balance of supply of goods warehousing leads to price stabilization.

3. By keeping the goods in the warehouse, the trader can relieve himself of the responsibility of keeping of goods.

4. The warehouse performs the function of dividing the bulk quantity of goods into smaller quantities.

5. Warehousing helps in the seasonal storage of goods to select businesses.

6. The functions of grading, branding, and packing of goods can be done in warehouses.

7. The warehousing receipt can be used as collateral security for obtaining loans.

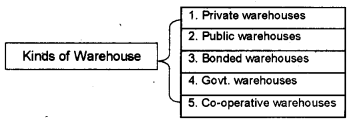

a) Private warehouses: Private warehouses are owned by big business concerns or wholesalers for keeping their own products.

b) Public warehouses: They are owned by some agencies, offer storage facilities to the public after charging certain fees. The working of public warehouses is subject to some govt, regulations. They are also known as Duty paid warehouses.

c) Bonded warehouses: These warehouses are used to keep the imported goods before the payment of import duties. It offers many advantages to the importer, i.e. The importer can releases the goods in part by paying the proportionate amount of duty. The goods can be branded, blended and packed in the warehouse itself.

d) Government warehouses: These warehouses are fully owned and managed by the government. For example, Food Corporation of India, State Trading Corporation, and Central Warehousing Corporation.

e) Co-operative warehouses: Marketing co-operative societies and agricultural oo operative societies have set up their own warehouses for members of their cooperative society.

Question 2.

Venu has a few dishonest employees in his business organisation. He wants to take an insurance policy covering the risk arising from the dishonesty of his employees. Which type of policy does he have to take? (June. 2008)

Answer:

Fidelity insurance

Question 3.

Classify the following banks into appropriate categories. (March – 2009)

a) IDBI

b) HDFC

c) AXIS Bank

d) Canara Bank

e) HSBC

f) CITY Bank

Answer:

| Private Bank | Public Bank | Foreign Bank |

| IDBI HDFC HSBC | Canara Bank | AXIS Bank City Bank |

Question 4.

Mr. Akhil purchased a new car for ₹2,50,000 and insured it with the Oriental Insurance Company and the National Insurance Company for ₹2,50,000 each. On an accident, the car was damaged completely and he claimed compensation from both the companies.

a) Can he get the compensation from both the companies? (March – 2009)

b) Explain the relevant principle of insurance here.

Answer:

a) No. He will not get compensation from both the companies. Mr.Akhil will get the actual loss suffered by him.

b) The principles of insurance applicable here is contribution. In certain cases, the same subject matter is insured with one or more insurer. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him. If the insured claims full amount of loss from one insurance company, he is not eligible to get any amount from other insurance companies.

Question 5.

Which of the following is not a principle of insurance? (March – 2009)

a) Assurance

b) Insurable interest

c) Indemnity

d) Causa Proxima

Answer:

Assurance

Question 6.

Babu, a businessman, wants to know the essential principles of insurance. You have to help him by briefly explaining any five principles of insurance. (August – 2009)

Answer:

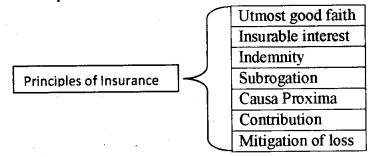

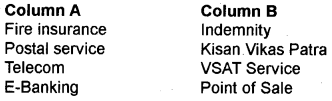

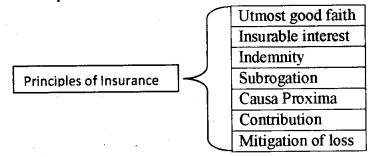

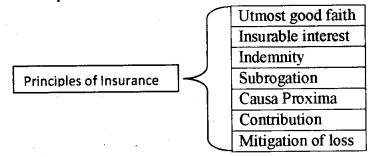

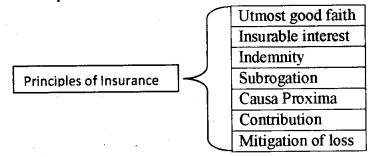

Principles of Insurance

1. Utmost good faith: The insured must disclose all material facts about the subject matter to the insured. Otherwise the insurer can cancel the contract. The insurer must disclose all the terms and conditions jn the insurance contract to the insured.

2. Insurable interest: The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

3. Indemnity: All insurance contracts, except life insurance are contracts of indemnity.

According to the principle of indemnity, in the event of occurrence of loss, the insured will be indemnified to the extent of the actual value of his loss or the sum insured which ever is less. The objective behind this principle is nobody should treat insurance contract as the source of profit.

4. Subrogation : According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

5. Causa proxima : When the loss is the result of two or more causes, the proximate cause for the loss alone will be considered by the insurance company for admitting the claim.

6. Contribution: In certain cases, the same subject matter is insured with one or more insurer. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him.

7. Mitigation of loss: This principle states that it is the duty of the insured to take reasonable steps to minimize the loss or damage to the insured property. If reasonable care is not taken then the claim from the insurance company may be rejected.

Question 7.

A private financial institution has a dishonest cashier. He cannot be terminated from service because of a court order. Which type of insurance the employer has to obtain to cover the risk due to fraud or dishonesty? (August 2009)

Answer:

Fidelity insurance.

Question 8.

M/s Ammu Electronics is a leading electronic showroom in Ernakulam city. Unfortunately, one night, some thieves entered into the shop and looted all electronic goods worth ₹2,50,000. Can you (March 2010)

Answer:

Sip This incident is related to business risk. Risk means chance of loss due to unexpected events. The risks are related with certain factors like changes in consumer tastes and fashions, strike or lockout increased competition, fire, theft, accidents, natural calamities, etc. Although no business enterprise can escape the presence of risk, there are many methods to reduce the risk. For instance, the enterprise may

(a) decide not to enter into a too risky transaction;

(b) take preventive measures like firefighting devices to reduce risk;

(c) take an insurance policy to transfer risk to insurance company etc.

Question 9.

Miss Aami insures her two-wheeler and makes regular payments of premiums. After a few years, she decided to surrender the policy.

Can she do it or not? Justify. (March 2010)

Answer:

No. Only life insurance policies can be surrendered. But general insurance policies cannot be surrendered.

Question 10.

Ms. Jemi Jose has started a new readymade garments unit. She decided to open an account in a nationalized bank. But she has no clear idea about the type of account most suitable to business people. (March 2011)

a) Which account is the most suitable for her?

b) Why?

Answer:

a) Current account

b) There is no limit to the number and amount of deposits and withdrawals.

Question 11.

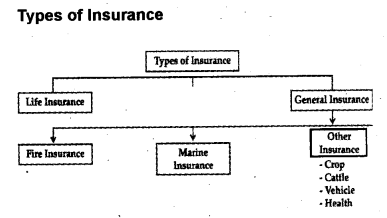

One of your friends intends to become an insurance agent. He wants to know the major differences between life insurance and general insurance. Can you make him understand at least four major differences? (March 2011)

Answer:

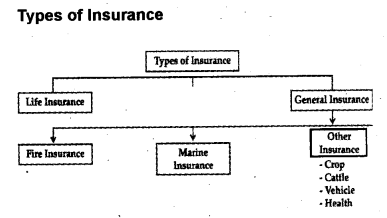

Differences between Life insurance and General insurance

| Life insurance | General insurance |

| Life insurance is a contract of guarantee | General insurance is a contract of indemnity |

| It is a contract of assurance | It is a contract of insurance |

| Its period of coverage is long | Period of coverage is short |

| Surrender of policy is possible | Surrender of policy is not possible |

| Happening of event is certain | Happening of event is uncertain |

| Insurable interest exist at the time of contract | Marine – Insurable interest exist at the time of contract Fire – Insurable interest exist at the time of contract and at the time of loss |

| Medical examination required | Medical examination not required |

Question 12.

Mr. Sathyavan has a few dishonest employees in his business unit. To overcome the risk of dishonesty, which type of insurance policy should he choose? (March. 2011)

Answer:

Fidelity insurance

Question 13.

Match column A With column B and column C. (March. 2011)

| A | B | C |

| 1. E-Commerce | Place utility | Re-export |

| 2. Hindrance of trade | Internet | Protection |

| 3. Enteipot. | Risk | New products |

| 4. Insurance | Innovation | Transport |

| 5. Research and development | Import | Website |

Answer:

| A | B | C |

| 1. E-Commerce | Internet | Website |

| 2. Hindrance of trade | Place utility | Transport |

| 3. Enteipot | Import | Re-export |

| 4. Insurance | Risk | Protection |

| 5. Research and | Innovation | New Products development |

Question 14.

Shibu, a textile dealer wants to know the non-insurable risk from the following. Can you help him to identify it? (March – 2013)

a) Fire

b) Theft

c) Marine perils

d) Change in fashion

Answer:

Change in fashion

Question 15.

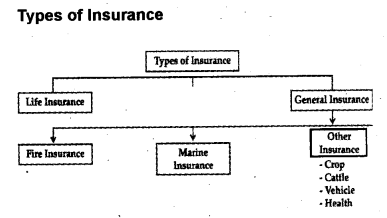

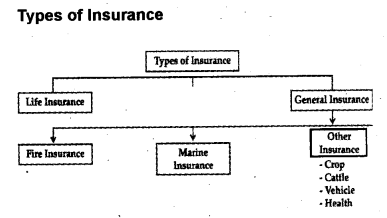

A) Mr. Sibi took an insurance policy from Life Insurance Corporation for ₹ 1,00,000. His car is insured with National Insurance Company for ₹ 5,00,000. (October – 2013)

a) Identify the types of insurance mentioned above.

b) State the important difference between these two forms of Insurance.

Answer:

a) Life insurance and general insurance.

Differences between life insurance and General insurance are

Question 16.

You are invited to present a seminar on “latest trends in banking”. Prepare a seminar paper about the modern facilities offered by banks to their customers. (October – 2013)

Answer:

e-banking is a service provided by many banks, that allows, a customer to conduct banking transactions, such as fund transfer, checking accounts, paying bills, requesting cheque book etc. over the internet using a personal computer, or mobile phone.

The chief electronic services are the following:

- Electronic Funds Transfer (EFT)

- Automated Teller Machines (ATM)

- Point of Sales (PoS),

- Electronic Data Interchange (EDI)

- Credit Cards

- Electronic or Digital cash.

Benefits of e-banking to customers

- e-banking provides 24 hours, 365 days a year services to the customers of the bank

- Customers can make some of the permitted transactions from office or house or while travelling via mobile telephone

- It creates a sense of financial discipline by recording each and every transaction

- Greater customer satisfaction by offering unlimited access to.the bank

Benefits of e-banking to Bank

- e-banking provides competitive advantage to the bank

- e-banking provides unlimited network to the bank

- Work Load on branches can be considerably reduced

Question 17.

Name the type of account opened in a bank with an overdraft facility. (March – 2014)

Answer:

Current Account

Question 18.

The type of insurance policy to cover the risk arising out of fraud and dishonesty of employees is ……… (August – 2014)

Answer:

Fidelity insurance

Question 19.

In a classroom discussion, Saurav mentioned that re-insurance and double insurance are the same. Do you agree? Justify your answer. (August – 2014)

Answer:

No. Reinsurance and double insurance are different. Reinsurance is a contract of insurance entered in to by the insurer with a view to spread a part or whole of the original risk. When the same subject matter is insured with more than one insurer, it is known as double insurance.

Question 20.

Insurance is a contract based on certain principles. Explain any five principles of insurance. (August – 2014)

Answer:

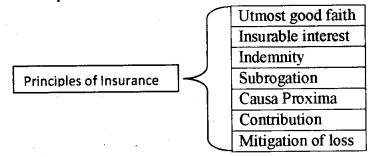

Principles of Insurance

1. Utmost good faith: The insured must disclose all material facts about the subject matter to the insured. Otherwise the insurer can cancel the contract. The insurer must disclose all the terms and conditions jn the insurance contract to the insured.

2. Insurable interest: The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

3. Indemnity: All insurance contracts, except life insurance are contracts of indemnity.

According to the principle of indemnity, in the event of occurrence of loss, the insured will be indemnified to the extent of the actual value of his loss or the sum insured which ever is less. The objective behind this principle is nobody should treat insurance contract as the source of profit.

4. Subrogation: According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

5. Causa Proxima : When the loss is the result of two or more causes, the proximate cause for the loss alone will be considered by the insurance company for admitting the claim.

6. Contribution: In certain cases, the same subject matter is insured with one or more insurer. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him.

7. Mitigation of loss: This principle states that it is the duty of the insured to take reasonable steps to minimize the loss or damage to the insured property. If reasonable care is not taken then the claim from the insurance company may be rejected.

Question 21.

Following are some examples of services. (March – 2015)

i) Banking

ii) Tourism

iii) Communication

iv) Health care

Identify the service/services that can be included

in ‘business services’

a) Only i)

b) i) and ii)

c) i), ii) and iii)

d) i), ii), iii) and iv)

Answer:

Banking and Communication

Question 22.

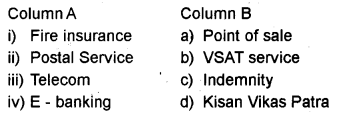

Match column A with column B (March – 2015)

Answer:

Question 23.

“I am a warehouse licensed by the government to accept imported goods prior to payment of tax and customs duty”. Who am I? (March – 2015)

Answer:

Site Bonded warehouse

Question 24.

Mr. Rajesh took an insurance policy on his life. He also took another insurance policy on his own house against the risk of fire. Explain any four differences between these two types of insurance policies. (March – 2015)

Answer:

| Life Insurance | Fire insurance |

| The subject matter of insurance is human life | The subject matter is any asset. |

| It has the elements of protection and investment | It has only.the element of Protection . |

| Insurable interest exists at the time of contract alone. | Insurable interest exists at the time of contract and at the time of loss. |

| Period of coverage is long period | Period of coverage ;s up to one year |

| Life insurance is not a contract of indemnity . | Fie insurance is a contract of indemnity. |

Question 25.

Name the warehouses which accept imported goods prior to the payment of customs duty. (March-2015)

a) Public warehouses

b) Bonded warehouses

c) Private warehouses

d) Co-operative warehouses

Answer:

Bonded warehouses

Question 26.

Match column A with columns B and C. (March-2015)

| Column A | Column B | Column C |

| Transport | Fastest means of communication | Reserve Bank of India |

| Co-operative bank | Banker’s bank | Right time information possible |

| Internet | Rural credit | Quick access to customers |

| Central Bank | Removes hindrance of place | District co-operative bank |

Answer:

| Column A | Column B | Column C |

| Transport | Removes hindrance of place ‘ | Quick access to customers |

| Cooperative bank | Rural credit | District cooperative bank |

| Internet | Fastest means of communication | Right time information possible |

| Central Bank | Banker’s bank | Reserve Bank of India |

Question 27.

Identify the business service, which removes the hindrance of risk. Explain its principles. (March-2015)

Answer:

The business service, which removes the hindrance of risk- Insurance

Principles of Insurance

1. Utmost good faith: The insured must disclose all material facts about the subject matter to the insured. Otherwise the insurer can cancel the contract. The insurer must disclose all the terms and conditions jn the insurance contract to the insured.

2. Insurable interest: The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

3. Indemnity: All insurance contracts, except life insurance are contracts of indemnity.

According to the principle of indemnity, in the event of occurrence of loss, the insured will be indemnified to the extent of the actual value of his loss or the sum insured which ever is less. The objective behind this principle is nobody should treat insurance contract as the source of profit.

4. Subrogation : According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

5. Causa proxima : When the loss is the result of two or more causes, the proximate cause for the loss alone will be considered by the insurance company for admitting the claim.

6. Contribution: In certain cases, the same subject matter is insured with one or more insurer. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him.

7. Mitigation of loss: This principle states that it is the duty of the insured to take reasonable steps to minimize the loss or damage to the insured property. If reasonable care is not taken then the claim from the insurance company may be rejected.

Question 28.

Briefly explain the principles of insurance in the following cases. (March-2016)

a) Mrs. Jaya wishes to insure the life of her friend Suji. But the Life Insurance Company objects it.

b) Mr. Sunil got ₹3 lakhs from the insurance company as compensation for his stolen car. Later he files a suit to recover the stolen car.

Answer:

A brief explanation of the following. Principles of insurance

a) Insurable interest

b) Subrogation

Insurable interest:- The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

Subrogation :- According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

Question 29.

Name the warehouse which is used to keep imported goods till the customs duty is paid. (September – 2016)

a) Government warehouse

b) Public warehouse

c) Bonded warehouse

d) Private warehouse

Answer:

Bonded Warehouse

Question 30.

It is a form of risk management primarily used to safeguard against the risk of financial losses. It helps to minimize risks. (September – 2016)

a) Name the concept.

b) Describe any four principles.

Answer:

Principles of Insurance

1. Utmost good faith: The insured must disclose all material facts about the subject matter to the insured. Otherwise the insurer can cancel the contract. The insurer must disclose all the terms and conditions jn the insurance contract to the insured.

2. Insurable interest: The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

3. Indemnity: All insurance contracts, except life insurance are contracts of indemnity.

According to the principle of indemnity, in the event of occurrence of loss, the insured will be indemnified to the extent of the actual value of his loss or the sum insured which ever is less. The objective behind this principle is nobody should treat insurance contract as the source of profit.

4. Subrogation : According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

5. Causa Proxima : When the loss is the result of two or more causes, the proximate cause for the loss alone will be considered by the insurance company for admitting the claim.

6. Contribution: In certain cases, the same subject matter is insured with one or more insurer. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him.

7. Mitigation of loss: This principle states that it is the duty of the insured to take reasonable steps to minimize the loss or damage to the insured property. If reasonable care is not taken then the claim from the insurance company may be rejected.

Question 31.

………. are licensed by the government to accept ported goods prior to payment of tax and customs (March – 2017)

a) Co-operative warehouse

b) Private warehouse

c) Bonded warehouse

d) Government warehouse

Answer:

Bonded warehouse

Question 32.

This service helps to reduce the impact of loss likely to be caused by uncertain events in a business. (March – 2017)

a) Identify the name of service.

Answer:

b) Explain the principles related to such services.

a) Insurance

b) Principles of Insurance

1. Utmost good faith: The insured must disclose all material facts about the subject matter to the insured. Otherwise the insurer can cancel the contract. The insurer must disclose all the terms and conditions jn the insurance contract to the insured.

2. Insurable interest: The insured must have an insurable interest in the subject matter of insurance. Insurable interest means the interest shown by the insured in the continued existence of the subject matter or the financial loss he is subjected to on the happening of an event against which it has been insured.

3. Indemnity: All insurance contracts, except life insurance are contracts of indemnity.

According to the principle of indemnity, in the event of occurrence of loss, the insured will be indemnified to the extent of the actual value of his loss or the sum insured which ever is less. The objective behind this principle is nobody should treat insurance contract as the source of profit.

4. Subrogation: According to this principle, after the insured is compensated for the loss to the property insured by him the right of ownership of such property passes on to the insurer. This is because the insured should not be allowed to make any profit, by selling the damaged property.

5. Causa Proxima : When the loss is the result of two or more causes, the proximate cause for the loss alone will be considered by the insurance company for admitting the claim.

6. Contribution: In certain cases, the same subject matter is insured with one or more insurers. In case there is a loss, the insured is eligible to receive a claim only up to the amount of actual loss suffered by him.

7. Mitigation of loss: This principle states that it is the duty of the insured to take reasonable steps to minimize the loss or damage to the insured property. If reasonable care is not taken then the claim from the insurance company may be rejected.

Question 33.

a) Explain the different types of banks. (March – 2017)

b) Explain the functions of commercial banks.

Answer:

a) 1. Commercial Banks

2. Cooperative Banks

3. Specialised Banks

4. Central Bank

b) Functions of Commercial Banks

1. Acceptance of deposits: A commercial bank accepts following types of deposits. They are

a) Current deposit: This type of account is usually opened by businessmen.lt carries no interest. There are no restrictions on a number of deposits or withdrawals.

b) Savings deposit: Savings accounts are for encouraging savings by individuals. Banks pay rate of interest as decided by RBI on these deposits. Withdrawal from these accounts has some restrictions.

c) Fixed deposit: Fixed accounts are time deposits with higher rate of interest. They cannot be withdrawn before the maturity period.

2. Lending of funds: The second important function of a commercial bank is to grant loans and advances out of the money received through deposits. These advances can be made in the form of overdrafts, cash credits, discounting trade bills, term loans, consumer credits and other miscellaneous advances.

a) Cash Credit: Under this arrangement, the bank advances loan up to a specified limit against current assets. The bank opens an account in the name of the borrower and allows him to withdraw the money up to the sanctioned limit. Interest is charged on the amount actually withdraw.

b) Bank Overdraft: Overdraft is an arrangement where customers are allowed to withdraw up to a level over and above their deposits in the current account. Interest is to be paid only on the actual amount of overdraft availed by him. OD is granted to businessmen against their current account.

c) Discounting of bill of exchange: Under this, a bank gives money to its customers on the security of a bill of exchange before the expiry of the bill after deducting a small amount of discount.

d) Term Loans: These loans are provided by the banks to their customers for a fixed period. Interest will be charged to the entire amount of loan.

3. Secondary Functions: The secondary functions of commercial banks are as under:

a) Agency Functions

- Cheque facility:Bank collects customers cheque drawn on other bank. There are two types of cheques mainly

Bearer cheques, which are encashable immediately at bank counters Crossed cheques which are to be deposited only in the payees account. - Payment of insurance premium, telephone charges, collection of dividend etc

- Purchase and sale of shares and debentures

- Acting as trustees or executors

- Providing credit information

b) General utility services

- Providing lockers for safe custody of jewellery and others valuables of customers

- Issuing letter of credit, pay orders, bank draft, credit cards, traveller’s cheques to customers.

- Underwriting issues of shares and debentures

- Providing foreign exchange to importers and traveller’s going abroad.

- Bank Draft : It is a financial instrument with the help of which money can be remitted from one place to another. The payee can present the draft on the drawee bank at his place and collect the money. Bank charges some commission for issuing a bank draft.

- Pay Order: It is almost like a bank draft. Banks issue pay order for local purpose and issue bank draft for outstations.