Kerala Plus One Accountancy Previous Year Question Paper March 2018 with Answers

| Board | SCERT |

| Class | Plus One |

| Subject | Accountancy |

| Category | Plus One Previous Year Question Papers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 60

General Instructions to Candidates

- There is a ‘cool off time of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and the only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures, and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Answer all questions from question numbers 1 to 9. Each carry one score. (9 × 1 = 9)

Question 1.

Notebooks purchased by a stationery shop comes under ………….

a) Assets

b) Income

c) Purchases

d) Liabilities

Answer:

c) Purchases

Question 2.

Fill in the blank.

………. A/c Dr.

To Thomas & Co. A/c

(Purchased Machinery from Thomas & Co.)

a) Purchase

b) Cash

c) Machinery

d) Goods

Answer:

c) Machinery

Question 3.

Ramesh, a dealer of Television, sold an old furniture to Rafeeque for ₹ 3,000 on credit. Identify the day book to record this transaction.

a) Purcahse day book

b) Journal proper

c) Sales day book

d) Cash book

Answer:

b) Journal proper

Question 4.

Bank Reconciliation Statement is prepared by ………….

a) Bank

b) Depositor

c) Creditor

d) Debtor

Answer:

b) Depositor

Question 5.

Rent paid ₹ 4,500 was entered in cash book as ₹ 5,400. This is an error of …………

a) Principle

b) Omission

c) Compensating error

d) Commissioin

Answer:

d) Commissioin

Question 6.

……….. reserve is not shown in the Balance Sheet.

a) Secret

b) General

c) Revenue

d) Capital

Answer:

a) Secret

Question 7.

James sold goods for ₹ 10,000 to Rajeev and a promissory note was prepared for a period of 2 months and endorsed to Raheem. Who is the drawer of the promissory note?

a) James

b) Rajeev

c) Raheem

d) None of these

Answer:

b) Rajeev

Question 8.

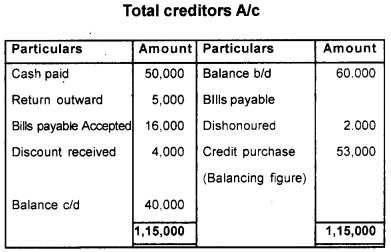

……….. account is prepared by a trader, who does not maintain the double entry system of accounting to find out the value of credit purchase.

a) Total creditors

b) Total debtors

c) Bills receivable

d) Bills payable

Answer:

a) Total creditors

Question 9.

Find the odd one out.

a) Keyboard

b) Mouse

c) MICR

d) Printer

Answer:

d) Printer

Answer any five from question numbers 10 to 15. Each carries two scores. (5 × 2 = 10)

Question 10.

Identify the accounting principles related to the following:

a) Purchased 10 Kg of raw materials for ₹ 5,000 was entered in the books of account as ₹ 5,000.

b) Assets of business are always equal to the claims of owners and outsiders.

Answer:

a) Money measurement concept

b) Dual aspect concept / Duality principle

Question 11.

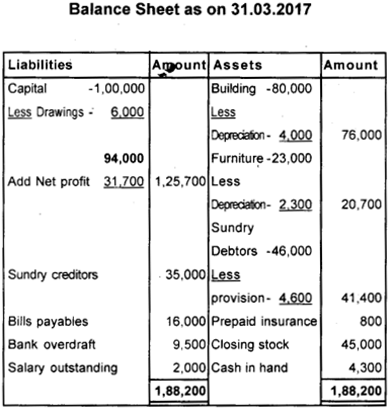

Rectify the following errors.

a) Sold goods for ₹ 7,000 to Sangi & Co., entered in Purchase day book.

b) Rent paid ₹ 4,000 debited to Landlord account.

Answer:

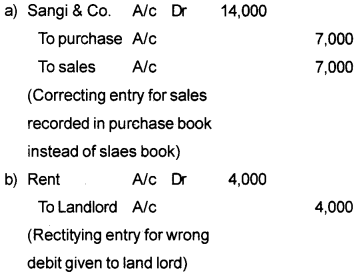

Question 12.

Insurance premium of 6,000 was paid fora period of one year on 1st April 2015. How the transaction will be treated while preparing financial statements for the year ending 31st December 2015?

Answer:

Question 13.

Write any two features of using computers in accounting.

Answer:

a) Speed and accuracy

b) Storage of data and retrival of information

c) Automated document production

d) Real time user interface

Question 14.

Match the column A with column B.

| A | B |

| Data Processing | Data Storage System |

| Front end interface | Convert data into information |

| Reporting system | Link between user and software |

| Back end database | Final output |

Answer:

a) Data processing – Convert data into information

b) Frond end interface – Link between user and software

c) Reporting system – Final output

d) Backend database – Data storage system

Question 15.

Write the name of any two attributes of the entity employee in an organization.

Answer:

| Entity type | Attribute |

| Employee | Employee ID, Employee name Employee age, Employee Dept. etc. |

Answer any three from question numbers 16 to 19. Each carries three scores. (3 × 3 = 9)

Question 16.

In a business organization, goods are known in different names. Write the names used for the goods in the following cases.

a) Goods remaining unused at the end of the year.

b) Goods returned the buyer due to breakage in transit.

c) Goods sold for cash and credit.

Answer:

a) Closing stock

b) Sales return or return inwards

c) Sales

Question 17.

Royal furniture received an order for making a dining table on 10th May 2017 and they complete the work on 15th July 2017. The dining table was delivered to the customer on 20th July 2017 and received the payment on 25th July 2017. On which date this transaction will be recorded in the books of the Royal Furniture? Why?

Answer:

a) 20th July 2017

b) According Revenue Recognition principle, revenue is recognised on 20th July 2017 that is when the tittle of goods passes from the seller to the buyer.

Question 18.

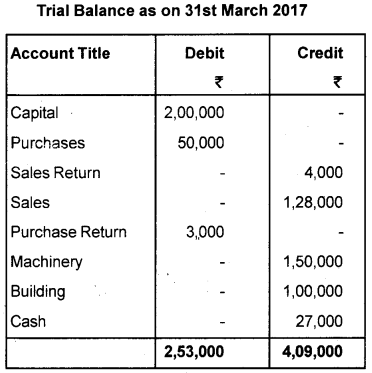

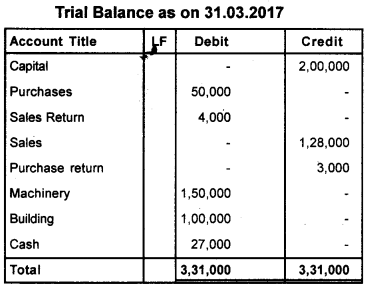

A Trial Balance is given below. Rewrite it, if there is any mistake.

Answer:

Question 19.

Write a short note on key attribute with an example.

Answer:

An attribute which contains unique value for identifying the entity is called identifer or key attribute. eg.

- ‘Roll No.’ as a key attribute of entity type ‘student’ has unique value through which a student can be identified.

- Employee ID (entity type ‘Employee’)

- Code (entity type Account)

Answer any two from question numbers 20 to 22. Each carries four scores. (2 × 4 = 8)

Question 20.

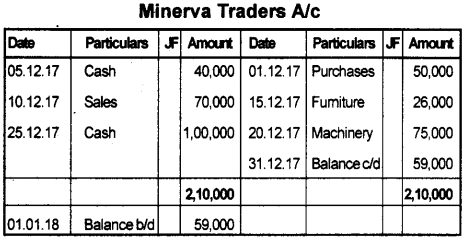

Prepare Minerva Traders A/c from the following information for the month of December 2017.

December 2017

Dec 1 Purchased goods from Minerva Traders ₹ 50,000

Dec 5 Paid ₹ 40,000 to Minerva Traders.

Dec 10 Sold goods to Minerva Traders ₹ 70,000

Dec 15 Purchased Furniture from Minerva Traders ₹ 26,000

Dec 20 Purchased Machinery from Minerva Traders ₹ 75,000

Dec 25 Paid ₹ 1,00,000 to Minerva Traders.

Answer:

Question 21.

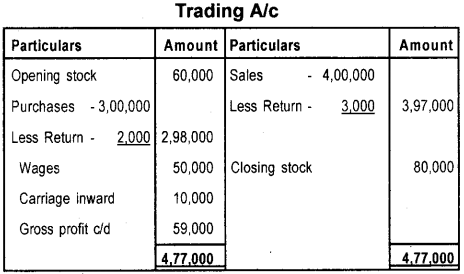

Compute the cost of goods sold and gross profit with the help of the following information.

| Purchases | ₹ 3,00,000 |

| Sales | ₹ 4,00,000 |

| Purchase return | ₹ 2,000 |

| Sales return | ₹ 3,000 |

| Wages | ₹ 50,000 |

| Carriage inwards | ₹ 10,000 |

| Salaries | ₹ 25,000 |

| Stock on 01.01.2017 | ₹ 60,000 |

| Stock on 31.12.2017 | ₹ 80,000 |

Answer:

Cost of good sold = opening stock + Net purchase + Direct exp – closing stock

Net purchase = 3,00,000 – 2,000 (return) = 2,98,000

Direct expenses = 50,000 (wages + 10,000 (carriage inward)) = 60,000

Cost of goods sold = 60,000 + 2,98,000 + 60,000 – 80,000 = 3,38,000

Gross profit = Net sales – cost of good sold

Net sales = 4,00,000 – 3,000 ( return) = 3,97,000

Gross profit = 3,97,000 – 3,38,000 = 59.000

OR

(Gross profit can be calculated by preparing trading A/c)

Question 22.

From the following particulars, find out total purchases:

| Creditors on 1st April 2016 | ₹ 60,000 |

| Creditors on 31st March 2017 | ₹ 40,000 |

| Cash paid to creditors | ₹ 50,000 |

| Return outwards | ₹ 5,000 |

| Bills payable accepted | ₹ 16,000 |

| Discount received | ₹ 4,000 |

| Bills payable dishonored | ₹ 2,000 |

| Cash purchase | ₹ 47,000 |

Answer:

Total purchase = Cash purchase + credit purchase

= 47,000 + 53,000

Total purchase = 1,00,000

Answer question numbers 23 to 24. Each carries fivescores. (2 × 5 = 10)

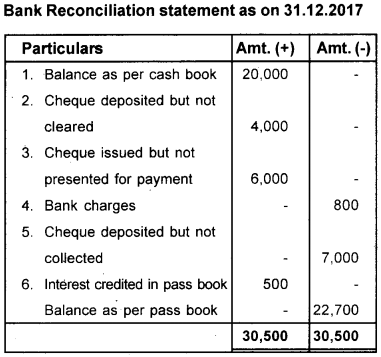

Question 23.

Prepare a Bank Reconciliation Statement as on 31st December 2017.

| Balance as per cash book | ₹ 20,000 |

| Cheques deposited and cleared but omitted to record in cash book | ₹ 4,000 |

| Cheques issued but not presented for payment | ₹ 6,000 |

| Bank charges debited in Passbook | ₹ 800 |

| Cheques deposited but not collected | ₹ 7,000 |

| Interest credited in Passbook | ₹ 500 |

Answer:

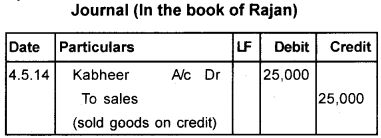

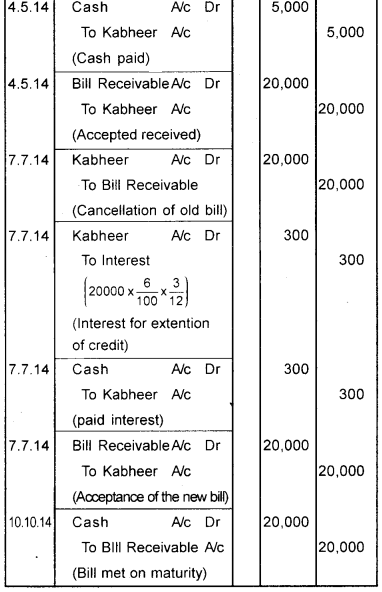

Question 24.

On 4th May 2014 Rajan sold goods to Kabheer for ₹ 25,000. Kabheer paid ₹ 5,000 immediately in cash and accepted a bill drawn by Rajan for the balance amount for a period of 2 months. On maturity date Kabheer requested Rajan to cancel the old bill and to draw a new bill upon him for a period of 3 months. He also agreed to pay interest at 6% p.a. in cash. Rajan agreed and cancelled the old bill and drew a new bill. The new bill was accepted and met by Kabheer on due date. Pass the journal entries in the books of Rajan.

Answer:

Answer any one from question numbers 25 and 26. A question carries six scores. (1 × 6 = 6)

Question 25.

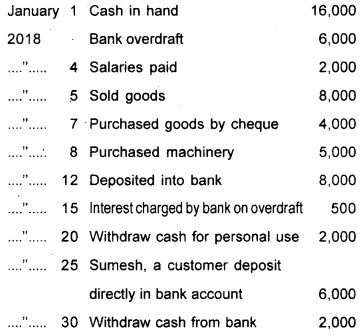

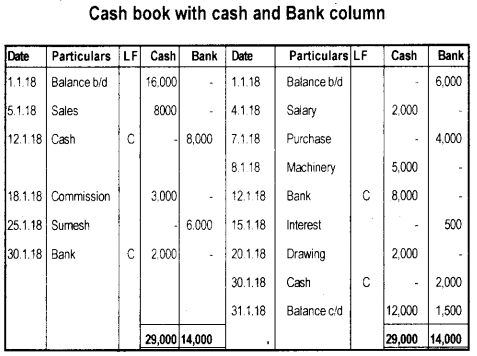

Prepare a double column cash book from the following transactions for the month of January 2018.

Answer:

Question 26.

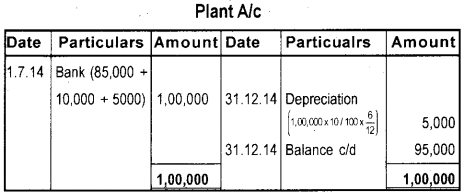

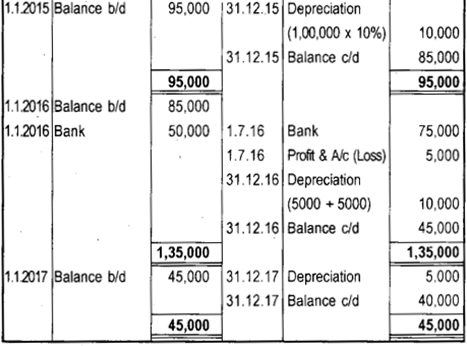

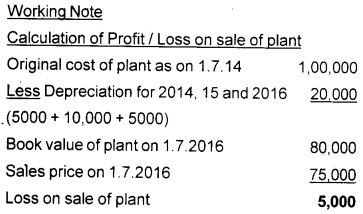

On 1 July 2014 M/s Golden Stores purchased a second hand plant for ₹ 85.000, spent ₹ 10.000 for its overhauling and ₹ 5000 for installation. Another plant was purchased on 1st January 2016 for ₹ 50,000. It was decided to charge depreciation at 10% on original cost. On July 1st 2016 the plant purchased on 1st July 2014 were sold for ₹ 75,000. Prepare a plant account upto 31st December 2017.

Answer:

Answer question number 27, which carries eight scores. (1 × 8 = 8)

Question 27.

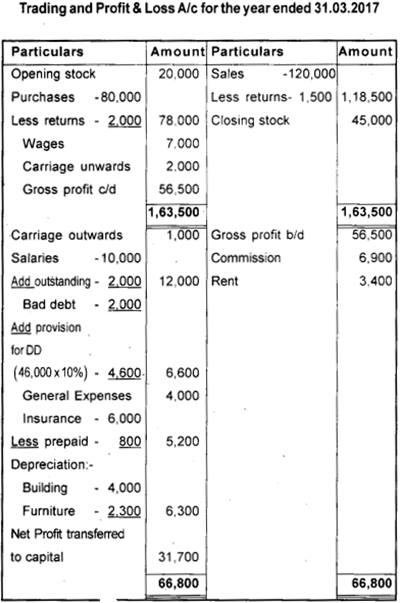

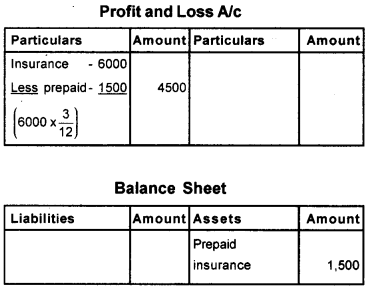

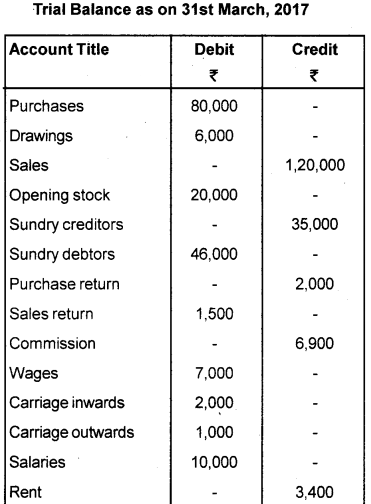

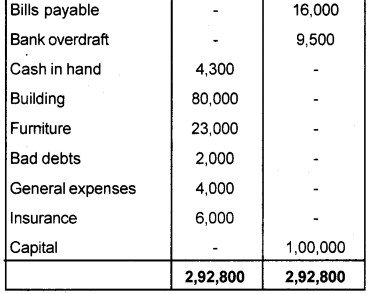

The following is the Trial Balance extracted from the books of Arya Traders for the year ended 31st March 2017.

Answer: