Kerala Plus One Accountancy Notes Chapter 9 Accounts from Incomplete Records

Summary:

Incomplete Records:

Incomplete records refer to a lack of accounting records according to the double-entry system. It is an incomplete, unscientific and unsystematic method of keeping the books of accounts of a trader.

Computation of profit and loss from incomplete records:

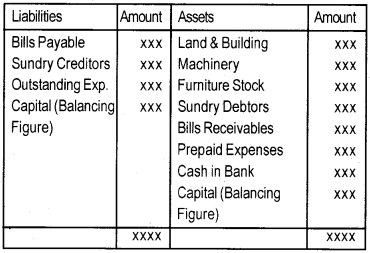

The statement of affairs is used to compute capital when a firm has a set of incomplete records. It shows assets on one side and the liabilities on the other as in the case of a balance sheet. The difference between the totals of the two sides is the capital.

Format of Statement of Affairs:

Statement of Affairs as on …………………

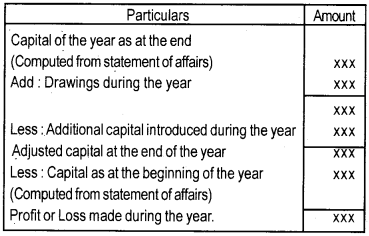

The statement of profit or loss is prepared to ascertain the exact amount of profit or loss made during the year.

Format of Statement of Affairs:

Statement of Profit or Loss for the year ended ………….

Preparation of Profit and Loss Account and Balance Sheet. (Conversion method):

In order to prepare final accounts from incomplete records, we have to find out the missing figures by making further computations and adjustments to the available information. The following are the steps to prepare the final accounts from incomplete records.

(i) Preparation of statement of Affairs.

(ii) Preparation of cash book

(iii) Ascertaining credit purchases and credit sales:-

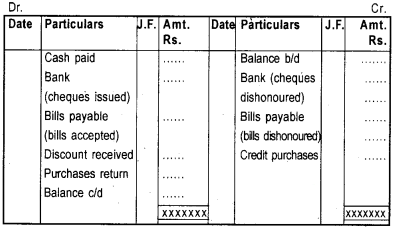

Credit purchase can be ascertained by preparing a statement or by preparing Total creditors Account.

Format of Total Creditors Account:

Format of Total Creditors Account:

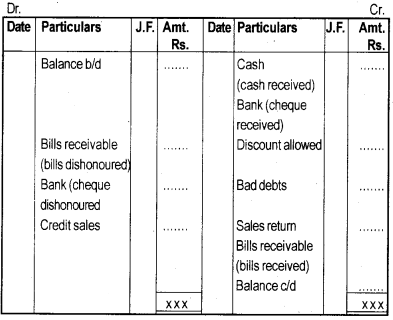

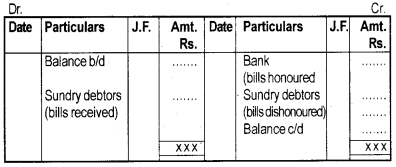

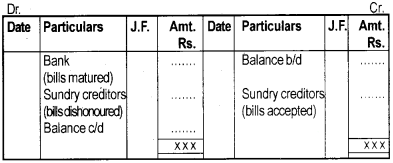

(a) Bills Receivable and Bills payable Accounts are prepared for finding out their opening or closing balances or for finding out the amount of bills accepted or bills received during the year.

(b) The proforma of total bills receivable account and total bills payable account. The proforma of total bills receivable account and total bills payable account is shown.

Total Bills Receivable Account:

Total Bills Payable Account:

(iv) Calculate:

- Total purchase by adding cash purchases and credit purchases.

- Total sales by adding cash sales and credit sales.

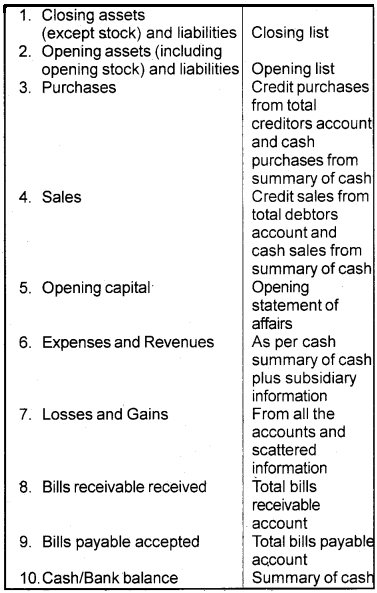

(v) Prepare Trial balance with the given information and missing information ascertained:

The components of the trial balance and their sources of information are summarised below

(vi) Prepare final accounts in the usual manner.