Kerala Plus One Accountancy Notes Chapter 4 Bank Reconciliation Statement

Summary

Bank Reconciliation Satement

A statement prepared to reconcile the bank balance as per cash book with the balance as per passbook or bank statement, by showing the items of difference between the two accounts.

Causes of difference

Timing of recording the transaction Errors made by a business or by the bank.

Need for Reconciliation

It is generally experienced that when a comparison is made between the bank balance as shown in the firm’s cash book, the two balances do not tally. Hence, we have to first ascertain the causes of difference thereof and then reflect them in a statement called Bank Reconciliation Statement to reconcile (tally) the two balances.

In order to prepare a bank reconciliation statement we need to have a bank balance as per the cash book and a bank statement as on a particular day along with details of both the books.

If the two balances differ, the entries in both the books are compared and the items on account of which the difference has arisen are ascertained with the respective amounts involved so that the bank reconciliation statement may be prepared.

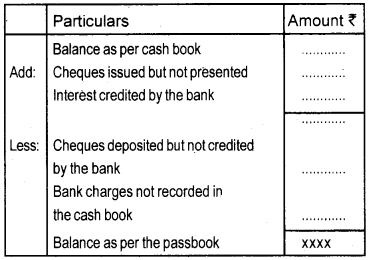

Proforma of bank reconciliation statement

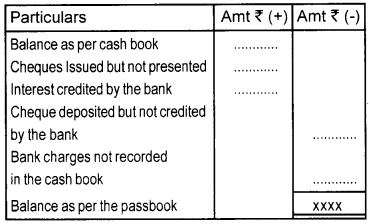

It can also be prepared with two amount columns one showing additions (+ column) and another showing deduction (- column).

Proforma of bank reconciliation statement (table form)

Correct cash balance

It may happens that some of the receipts or payments are missing from either of the books and errors, if any, need to be rectified. This arises the need to look at the entries/errors recorded in both statements and other information available and compute the correct cash balance before reconciling the statements.