Kerala Plus One Accountancy Notes Chapter 2 Theory Base of Accounting

Summary:

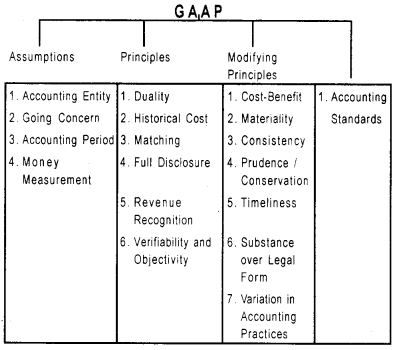

Generally Accepted Accounting Principles (GAAP):

GAAP refers to the rules or guidelines adopted for recording and reporting to business transactions in order to bring uniformity in the preparation and presentation of financial statements. These principles are also referred to as concepts and conventions.

From the practicality viewpoint, the various terms such as principles, conventions, modifying principles, assumptions, etc., have been used interchangeably and are referred to as basic accounting concepts.

Systems of Accounting:

There are two systems of recording business transactions, i.e., double-entry system and single entry system.

Basis of Accounting:

There are two broad approaches of accounting are cash basis and accrual basis. Under cash, basis transactions are recorded only when cash are received or paid, whereas, under accrual basis, revenue or costs are recognised when they Occur rather than when they are paid.

Accounting Standards:

Accounting standards are written statement of uniform accounting rules and guidelines in practice for preparing the uniform and consistent financial statements.