Kerala Plus One Accountancy Previous Year Question Paper Say 2018 with Answers

| Board | SCERT |

| Class | Plus One |

| Subject | Accountancy |

| Category | Plus One Previous Year Question Papers |

Time Allowed: 2 hours

Cool off time: 15 Minutes

Maximum Marks: 60

General Instructions to Candidates

- There is a ‘cool off time of 15 minutes in addition to the writing time of 2 hrs.

- You are not allowed to write your answers nor to discuss anything with others during the ‘cool off time’.

- Use the ‘cool off time’ to get familiar with the questions and to plan your answers.

- Read questions carefully before you answering.

- All questions are compulsory and the only internal choice is allowed.

- When you select a question, all the sub-questions must be answered from the same question itself.

- Calculations, figures, and graphs should be shown in the answer sheet itself.

- Malayalam version of the questions is also provided.

- Give equations wherever necessary.

- Electronic devices except non-programmable calculators are not allowed in the Examination Hall.

Answer all questions from question numbers 1 to 8. Each carry 1 score. (8 × 1 = 8)

Question 1.

State the accounting concept, if a business charges depreciation underwritten down value method and it follows the same method and it follows the same method in the subsequent years.

Answer:

Consistency Principle

Question 2.

Which one of the following events is NOT a business transaction?

a) Furniture purchased for cash

b) Goods are ordered for next month.

c) 10% of debtors are created as bad.

d) Salary outstanding to the employee

Answer:

b) Goods are ordered for next month.

Question 3.

Computer purchased from Mr. X on credit is recorded in the ……..

a) Purchase book

b) Journal proper

c) Cashbook

d) Sales book

Answer:

a) Purchase book / b) Journal proper

Question 4.

As per business entity concept owner of the business is …………..

a) Supplier

b) creditor

c) debtor

d) borrower

Answer:

b) creditor

Question 5.

Find the odd one and state the reason

a) Mouse

b) Monitor

c) Keyboard

d) Pen drive

Answer:

b) Monitor, it is an output device

Question 6.

Find the entity from the following

a) Employee

b) Employee ID

c) Employee name

d) Age

Answer:

a) Employee

Question 7.

Income receivable is ………..

a) an asset

b) a liability

c) a profit

d) a loss

Answer:

a) an asset

Question 8.

Different entities are related to simplify the data storage is termed as ………..

Answer:

Relationship / ER model / Entity Relationship

Answer any 5 questions from question numbers 9 to 14. Each carries 2 scores. (5 × 2 = 10)

Question 9.

Classify the following items as Revenue, Expense, Gain and Profit.

a) Profit on sale of investment

b) Interest received

c) Goods sold at above cost

d) Depreciation

Answer:

a) Profit on sale of investment – Gain

b) Interest received – Revenue

c) Goods sold at above cost – Profit

d) Depreciation – Expense

Question 10.

Arun constructed a building for ₹ 5,00,000 for his new business concern. After 2 years the market value of the building is enhanced to ₹ 8,00,000.

a) If you are the accountant, which amount appear in the books?

b) What is the accounting principle support your recording?

Answer:

a) ₹ 5,00,000

b) Historical cost Principle or Cost Principle

Question 11.

Cashbook is both a Journal and Ledger. Justify your views.

Answer:

Cashbook is basically a Journal because all entries relating to cash are first made in the cash book. But at the same time, it serves the purpose of a ledger since it is drawn in the form of an account.

Question 12.

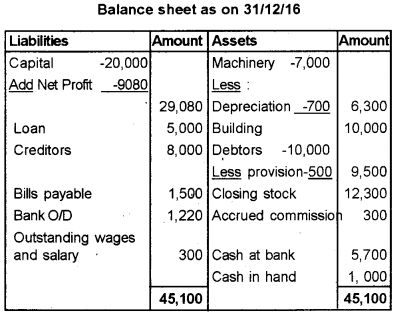

Write the name of the correct computer components in the given box.

Answer:

a) Input

b) Output

c) Memory unit

d) Control unit

Question 13.

Identify the limitations of CAS from the following.

a) Disruptions

b) Scalability

C) Staff opposition

d) Legibility

Answer:

a) Disruptions, c) Staff opposition

Question 14.

Point out any two differences between ‘Provision’ and ‘Reserve’.

Answer:

a) Reserve is an appropriation of profit. But provision is a charge against profit.

b) Reserve is created for meeting unknown liability whereas provision is created for meeting known liability.

Answer any 4 questions from question numbers 15 to 19. Each carries 3 scores. (4 × 3 = 12)

Question 15.

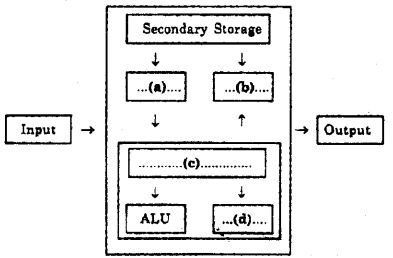

Show the effect of following transactions on Asset, Liabilities and Capital based on accounting equation.

a) Started a business with cash ₹ 1,50,000

b) Rent received ₹ 5,000

c) Purchased goods on credit from Rema ₹ 2,000

d) Paid cash to household expenses ₹ 4,000.

e) Sold goods for cash (cost 10,000) ₹ 13,000

f) Deposited into bank ₹ 25,000

Answer:

Note:

Transactions ‘e’ and ‘f’ are excluded.

Question 16.

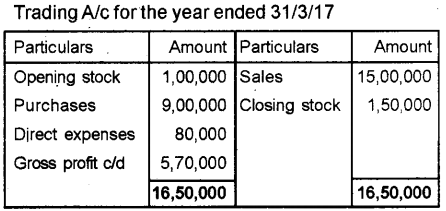

Calculate gross profit from the balances taken from the books of Usha for the year ending 31st March 2017.

| Opening stock | ₹ 1,00,000 |

| Net sales during the year | ₹ 15,00,000 |

| Net purchases during the year | ₹ 9,00,000 |

| Closing stock | ₹ 1,50,000 |

| Direct expenses | ₹ 80,000 |

Answer:

Question 17.

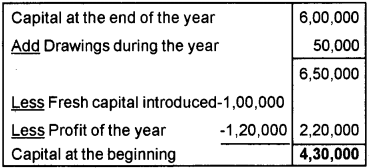

From the following information, calculate the capital at the beginning

| Capital at the end of the year | ₹ 6,00,000 |

| Drawings made during the year | ₹ 50,000 |

| Fresh capital introduced | ₹ 1,00,000 |

| Profit of the current year | ₹ 1,20,000 |

Answer:

Question 18.

Explain briefly about ‘Accounting Reports’.

Answer:

Accounting reports are compilation of financial information that are derived from the accounting records of a business firm. These statements includes the following reports:

- Income statement

- Balance sheet

- Cash Flow statement

Accounting reports are physical form of accounting information. It helps in decision making.

Question 19.

What are the following terms stand for?

a) GAAP

b) IFRS

c) ICAI

Answer:

a) GAAP – Generally Accepted Accounting Principles

b) IFRS – International Financial Reporting Standards

c) ICAI – The Institute of Chartered Accountants of India

Answer any 3 questions from question numbers 20 to 23. Each carries 4 scores. (3 × 4 = 12)

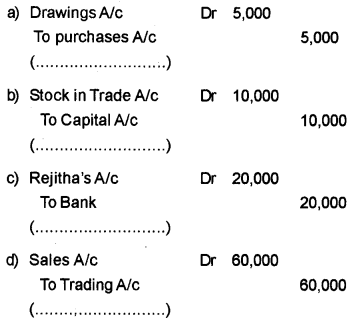

Question 20.

Give narrations for the following journal entry.

Answer:

a) Goods withdrawn for personal use for ₹ 5000

b) Introduced stock into the business

c) Paid cheque to Rejitha amounted to ₹ 20,000

d) Sales account is closed.

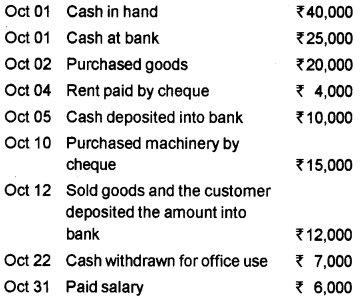

Question 21.

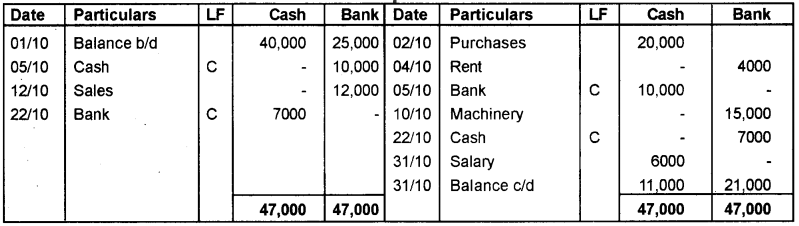

Record the following transactions in a double column cash book.

Answer:

Cash Book

Question 22.

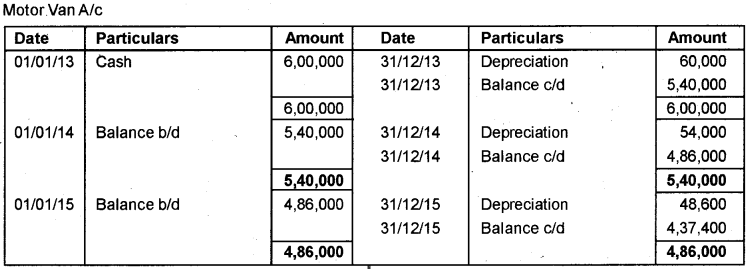

Chandra Traders purchased a Motor Van on 01-01-2013 for ₹ 6,00,000. The firm writes off depreciation at the rate of 10% p.a. on written down value method. Draw up Motor Van account for the first three years.

Answer:

Question 23.

Identify the debit and credit aspects from the following transaction.

a) Insurance premium paid in advance

b) Discount allowed to Mr.Anandu

c) Goods taken for personal use

d) Depreciation written off on Machinery.

Answer:

a) Insurance premium A/c – Debit

Cash – Credit

b) Discount Allowed A/c – Debit

Mr. Anandu A/c – Credit

c) Drawings A/c – Debit

Purchase A/c – Credit

d) Depreciation A/c – Debit

Machinery A/c – Credit

Answer any 2 questions from question numbers 24 to 27. Each carries 5 scores. (2 × 5 = 10)

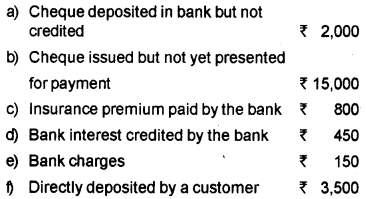

Question 24.

The cash book shows a debit balance of 10,800. On comparing the cash book with passbook the following discrepancies were found. Help them to reconcile the same.

Answer:

Question 25.

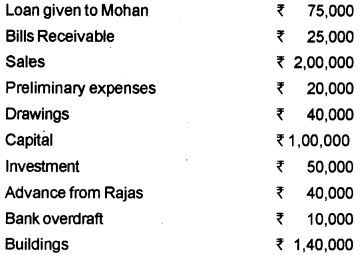

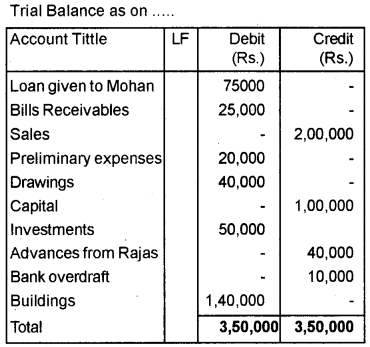

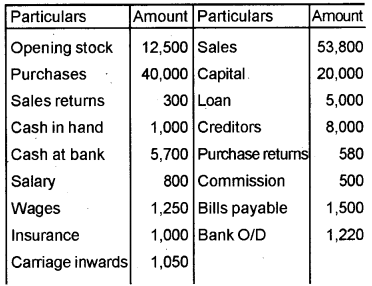

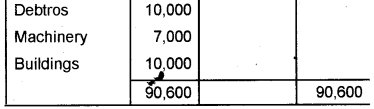

Help Ramu a friend of you to prepare a Trial Balance with the following items.

Answer:

Question 26.

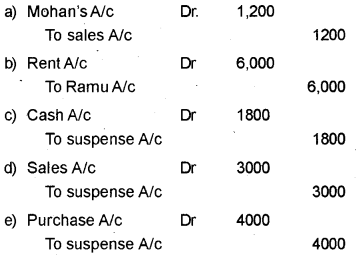

Rectify the following errors.

a) Credit sales to Mohan ₹ 1,200 was not recorded

b) Rent paid ₹ 6,000 was posted to Ramu (LandLond) personal account.

c) Cash sales ₹ 2,000 were posted as ₹ 200

d) Sales book overcast by ₹ 3,000

e) Purchases book under cast by ₹ 4,000

Answer:

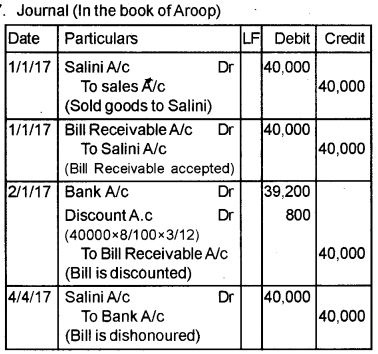

Question 27.

Aroop sold goods to Salini on January, 1st 2017 for ₹ 40,000 and drew upon her a bill of exchange for three months. Salini accepted the bill and returned to Aroop. Aroop discounted the bill by an interest of 8% p.a. on 02-01 -2017. On the due date, the bill was dishonored. Record the necessary entries in the books of Aroop.

Answer:

Answer question number 28, which carries 8 scores. (1 × 8 = 8)

Question 28.

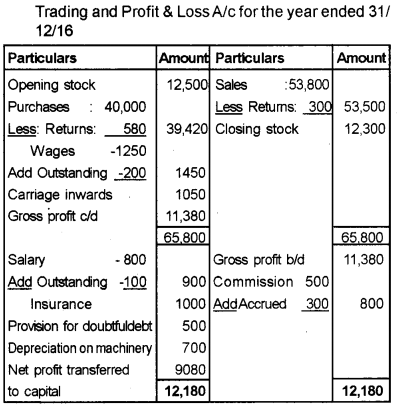

From the following Trial Balance of M/s. Goutham and Son’s as on 31st december, 2016 prepare a Trading and Profit and Loss account and Balance Sheet.

Adjustments

a) Closing Stock ₹ 12,300

b) Outstanding wages 200 and salary ₹ 100

c) Accrued commission ₹ 300

d) Credate 5% provision for bad and doubtful debts.

e) Charge 10% depreciation on Machinery

Answer: