Kerala Plus One Accountancy Chapter Wise Questions and Answers Chapter 9 Accounts from Incomplete Records

Plus One Accountancy Accounts from Incomplete Records One Mark Questions and Answers

Question 1.

Single entry system is also known as ………….

(a) Imprest system

(b) Merchandise system

(c) Incomplete system

(d) Cash system

Answer:

(c) Incomplete system

Question 2.

Incomplete records are usually maintained by ………………………

(a) Small traders

(b) Society

(c) Company

(d) Government

Answer:

(a) Small traders

Question 3.

Credit purchase can be ascertained as the balancing figure in the ………………

(a) Total Debtor Account

(b) Total Creditor Account

(c) Statement of Affairs

(d) Balance Sheet

Answer:

(b) Total Creditors Account

Question 4.

Cash received from debtors can be had from ………………. the account.

(a) Total Debtor

(b) Cash Book

(c) Statement of affairs

(d) Both a & b

Answer:

(d) both a & b.

Question 5.

If capital comparison method of single entry system, the profit or loss is ascertained by

(a) Preparing a statement of affairs

(b) Preparing trading and profit & loss A/c.

(c) Preparing a statement of profit or loss

(d) Both a & c.

Answer:

(d) Both a and c.

Question 6.

Incomplete record mechanism of bookkeeping is:

(a) Scientific

(b) Unscientific

(c) Unsystematic

(d) Both b and C

Answer:

(d) Both b and c

Question 7.

Locate the odd one.

(a) Incomplete system

(b) Unsystematic system

(c) Double-entry system

(d) Single entry system

Answer:

(c) Double-entry system.

Question 8.

……….. account are not kept under single entry system.

Answer:

Impersonal

Question 9.

………….. account is prepared to ascertain credit sale.

Answer:

Total Debtors Account

Question 10.

Bill receivable from debtors during the year can be obtained from ………… account.

Answer:

Bill Receivable

Question 11.

Statement of affairs is prepared to a certain ……………..

Answer:

Capital

Question 12.

Find the odd one and state the reason.

- credit sale, sales returns, discount allowed, return outwards.

- Credit purchase, endorsement of the bill, return inwards, return to suppliers.

Answer:

- return outwards – affected by creditors account, all others are affected by debtors A/c.

- return inwards – affected by debtors a/c, all others are affected by creditors A/c.

Question 13.

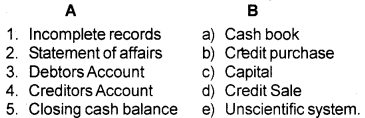

Match the following.

Answer:

- 1 – e

- 2 – c

- 3 – d

- 4 – b

- 5 – a

Question 14.

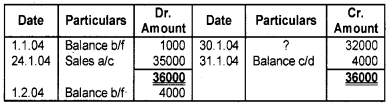

What does the missing item of the account represent?

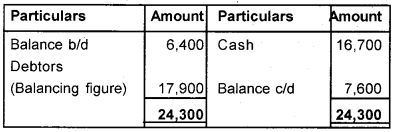

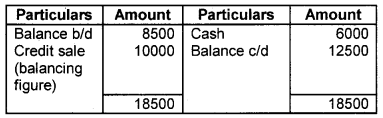

Total Debtors A/c

Answer:

Cash received from Debtors Rs. 32,000

Question 15.

In capital comparison method of single entry system, the profit or loss is ascertained by

(a) Preparing trading and profit and loss A/c.

(b) Preparing statement of affairs.

(c) Preparing statement of profit or loss.

(d) Both b and c.

Answer:

(d) Both b and c

Question 16.

Given the opening and closing balances of bills receivable and cash received on account of bills receivable, balancing bills receivable account will show,

(a) Credit purchase

(b) Credit sales

(c) Bills received during the year

Answer:

(c) Bills received during the year.

Question 17.

Given the opening and closing balance of debtors and the figures of credit sales, the balancing figure of total debtors account will give.

(a) Bills honoured during the year.

(b) Closing balance of bills receivable.

(c) Cash received from debtors.

(d) Cash sales.

Answer:

(c) Cash received from debtors.

Plus One Accountancy Accounts from Incomplete Records Two Mark Questions and Answers

Question 1.

State the meaning of incomplete records.

Answer:

Books of accounts that are not maintained according to the double-entry system are generally referred to as incomplete records. The system is also known as single entry. It is an incomplete, unscientific and unsystematic method of keeping the books of accounts of a trader.

Question 2.

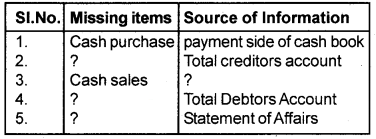

Complete the following table:

Answer:

- 2. Credit purchase – Total creditors account

- 3. Cash sales – Receipt side of cash book

- 4. Credit sales – Total Debtors Account

- 5. Capital – Statement of Affairs

Question 3.

Afire occured in the godown of Mr. Asok who keeps his books under single entry and his goods were partly destroyed. Since the goods were insured, he lodged a claim of Rs. 1,00,000/- to the insurance company, out of which only Rs. 60,000 was admitted. On what ground can the Insurance company’s decision be justified?

Answer:

Since, Mr. Asok maintain incomplete records, it is not reliable and scientific. These accounts are not accepted by the Insurance company. It is one of the limitations of single entry.

Plus One Accountancy Accounts from Incomplete Records Three Mark Questions and Answers

Question 1.

Give any five features of single entry system.

Answer:

- It is an unscientific, unsystematic and incomplete system.

- Mainly personal accounts are prepared by ignoring fully or partially the impersonal accounts.

- It is used by small traders.

- Profit or loss under this system is only an estimate.

- True financial position cannot be ascertained.

Question 2.

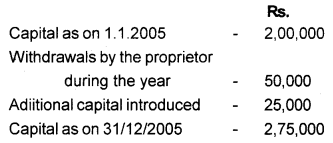

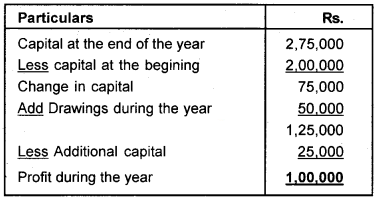

Calculate profit or loss from the following information for the year ended 31.12.2005.

Answer:

Statement of profit or loss for the year ended 31.12.05

Question 3.

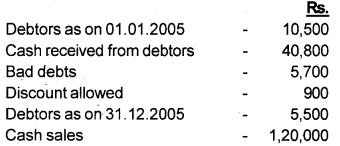

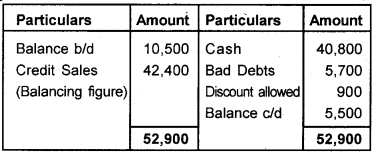

Prepare Total Debtors Account from the following information:

Answer:

Total Debtors Account

Question 4.

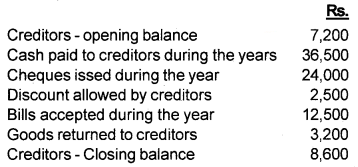

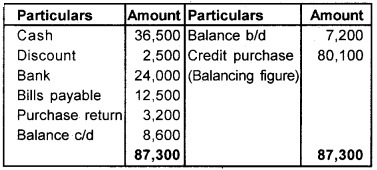

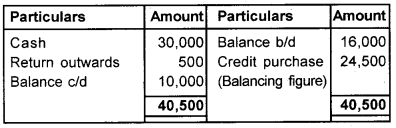

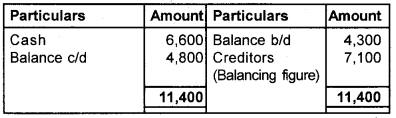

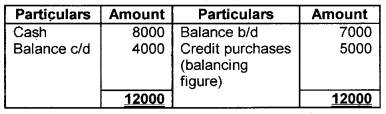

Calculation of credit purchase by preparing Total creditors account.

Answer:

Question 5.

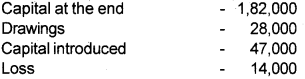

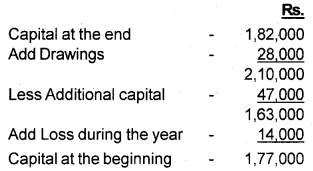

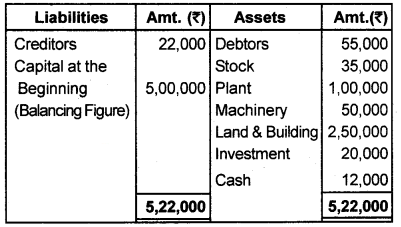

Find out the capital at the beginning.

Answer:

Calculation of Capital at the beginning

Plus One Accountancy Accounts from Incomplete Records Four Mark Questions and Answers

Question 1.

The single entry system of accounting is crude and unsystematic, still is popular among small businessmen. Give reasons.

Answer:

Some businessmen prefer to keep their books under single entry system due to the following reasons.

- The system is suitable to small traders which have mainly cash transactions and do not have many assets and liabilities to be recorded in details.

- The system is economical since lesser number of books are maintained.

- Lack of knowledge about the double-entry system.

- Ignorance of businessmen as to the statutory requirements of keeping proper books of accounts.

- Intentional omission to take advantage of taxation.

Question 2.

What are the difference between Balance Sheet and Statement of Affairs?

Answer:

| Balance Sheet | Statement of Affairs |

| 1. It is prepared on the basis of those books which are maintained under the double-entry system. | 1. It is prepared on the basis of information from incomplete records |

| 2. It is prepared to show the financial position of the concern. | 2. It is usually prepared to find out capital. |

| 3. Value of asset and liabilities in a Balance Sheet are based on ledger balances | 3. Value of assets and liabilities in a statement of affairs are based on estimates |

| 4. Omission of assets or liabilities can easily be found out when Balance sheet disagree. | 4. It is difficult to locate omission of assets or liabilities in statement of affairs. |

Plus One Accountancy Accounts from Incomplete Records Five Mark Questions and Answers

Question 1.

What are the limitations of incomplete records?

Answer:

Following are the limitations of single entry system

- It is not based on the double-entry system, arithmetical accuracy of books of accounts can not proved.

- No clear idea about the financial position.

- Comparison with previous years performance is not possible due to incomplete information.

- It encourage fraud, misappropriation etc. among employess.

- In the absense of nominal accounts, it is difficult to determine the exact profit or loss.

- It is difficult to obtain loans from bank or other financial institution.

Question 2.

Mention the difference between double-entry system and single entry system or incomplete records.

Answer:

The following are the difference between the double-entry system and single entry system.

| Single Entry System | Double Entry System |

| 1. Dual aspects of transactions are not recorded. | 1. Dual aspects of every transaction are recorded. |

| 2. As trial balance is not prepared, arithmetical accuracy can’t be checked. | 2. Trial balance is prepared to check the arithmetical accuracy. |

| 3. Only an estimate of profit can be made | 3. Actual net profit can be Calculated |

| 4. Balance sheet can not be prepared to ascertain the financial position | 4. Balance sheet can be prepared to ascertain the financial position |

| 5. This system is suitable for sole trader who have a few transaction | 5. This is suitable for all types of business all types of business |

Question 3.

Final accounts can be prepared from incomplete records. Explain the procedure.

Answer:

Though the records are incomplete, the trader has to ascertain the profit or loss of his business and the position regarding assets and liabilities. Two methods are adopted for ascertainment of profit or loss. They are:

- Ascertainment of profit or loss by statement of affair method.

- Preparation of profit and loss account and balance sheet under conversion method.

1. Statement of Affair Method:

Under this method, profit or loss can be ascertained by comparing the capital at the beginning and at the end of the financial period. For this purpose, two statements are prepared.

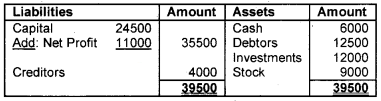

a. Statement of Affairs:

It is a statement prepared by presenting the assets on one side and liabilities on the other side as in the case of a balance sheet. The difference between the totals of the two sides is known as “owners equity or capital”.

Owner equity or capital = Asset – Liabilities

b. Statement of profit or loss:

The statement prepared to ascertain the profit or loss by comparing the opening capital with closing capital is called a statement of profit or loss. If the capital at the end of the year exceeds the capital in the beginning of the year, the difference will be treated as “profit.” On the other hand, If the capital in the beginning of the year is more than that at the end of the year, there is “loss.”

2. Conversion Method:

Under a single entry system, nominal accounts and real accounts (other than cash) are not maintained. Hence it is not possible to prepare the profit and loss account and balance sheet under the system. In such a situation, financial statements are to be prepared by converting accounts under single entry to that under double entry. This method of preparing financial statements is called the conversion method.

Question 4.

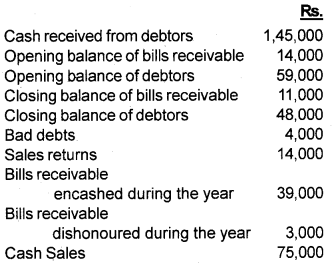

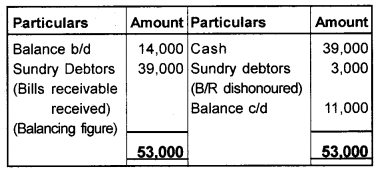

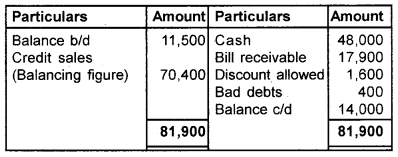

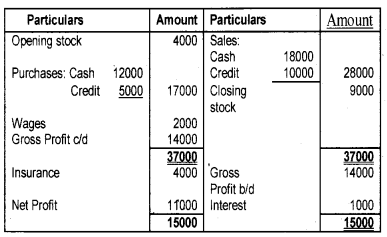

From the following particulars, calculate total sales.

Answer:

Bill Receivable Account

Total Debtors Account

Question 5.

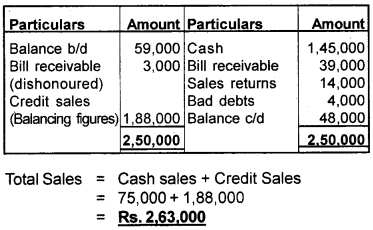

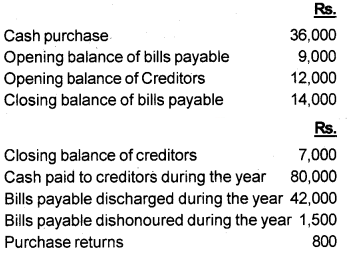

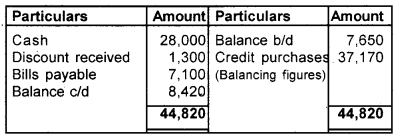

From the following information, calculate the amount total purchase.

Answer:

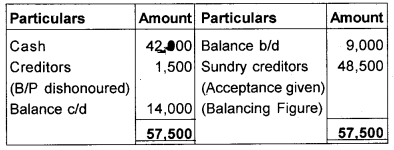

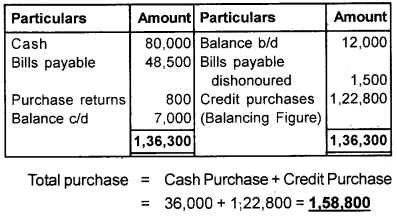

Bills Payable A/c

Total Creditors A/c

Plus One Accountancy Accounts from Incomplete Records Six Mark Questions and Answers

Question 1.

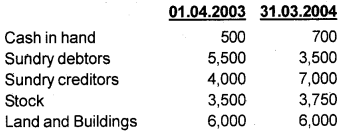

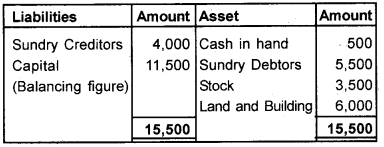

Sumesh keeps incomplete records. You are required to ascertain the profit or loss for the year ending 3-1.3.2004 from the following information.

He had withdrawn Rs. 5,000 during the year and had introduced Rs. 4,000 from the sale of his personal property.

Answer:

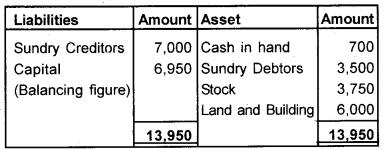

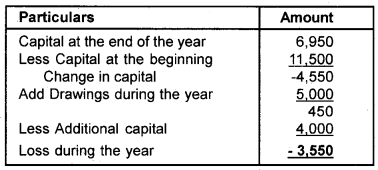

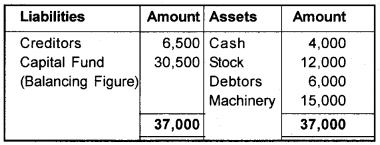

Statement of Affairs as on 01.04.2003

Statement of Affairs as on 31.03.2004

Statement of Profit or Loss for the year ended 31.03.2004.

Plus One Accountancy Accounts from Incomplete Records Eight Mark Questions and Answers

Question 1.

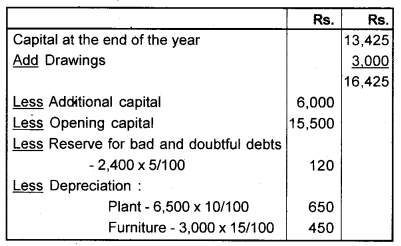

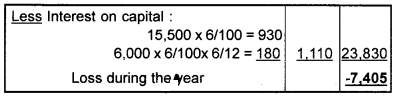

Mr. Murali keeps his books under single entry. He supplies you with the following information from which you are to find out his profit or loss for the year ended 31.3.2007.

He had withdrawn Rs. 3,000 during the year for a private purpose and had introduced fresh capital Rs. 6,000 on 1.10.2006. Bad and doubtful debts provision at 5% is to be made on debtors. Depreciation on plant and machinery at 10% and furniture at 15 % is to be made. Allow 6% interest on capital.

Answer:

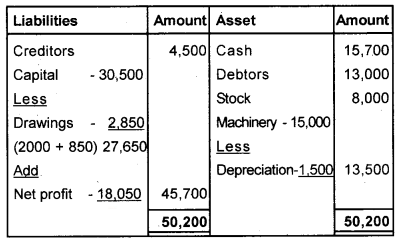

Statement of Affairs of Mr. Murali

Statement of profit or loss for the year ended 31.3.07

Question 2.

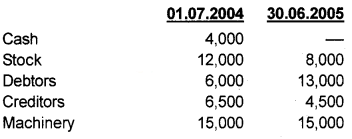

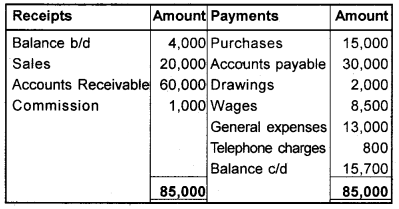

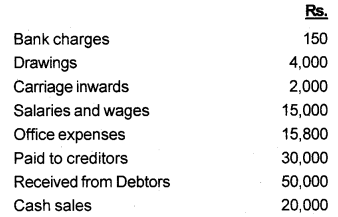

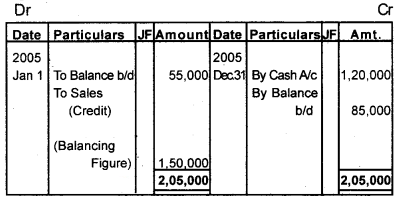

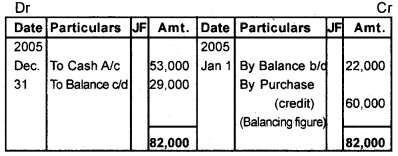

Anil carries on a retailer business and does not keep his books on a double-entry basis. The following particulars are obtained from his books.

His cash transations during the year were given

During the year Anil had taken goods from the business for private consumption which amounted to Rs. 850. Prepare profit and loss account for the year ending 30-06-2005 and a balance sheet as on that date after charging depreciation @ 10% p.a. on the machinery.

Answer:

Statement of Affairs as at 1.7.04

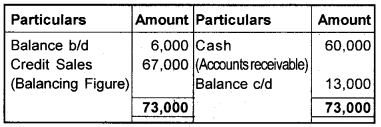

Total Debtors A/c

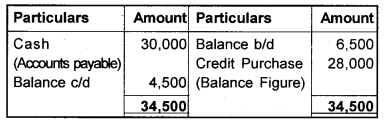

Total Creditors A/c

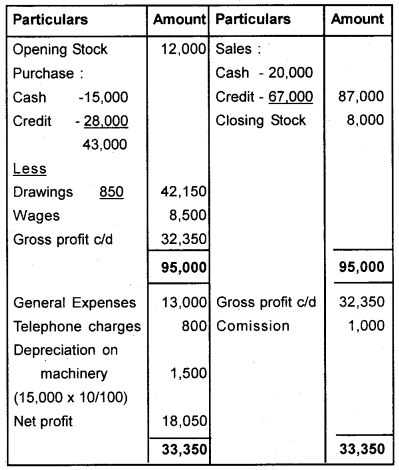

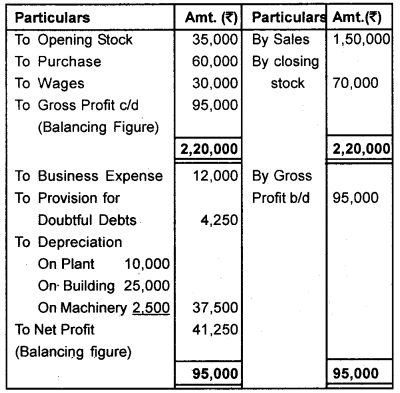

Trading and profit and loss account for the year ended 30.06.05

Balance sheet as on 30.06.05

Question 3.

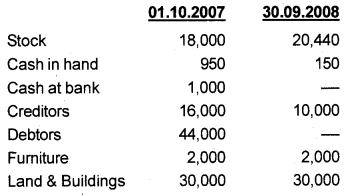

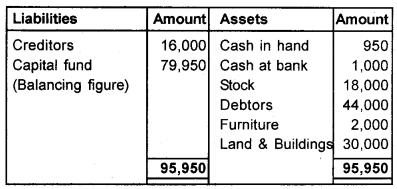

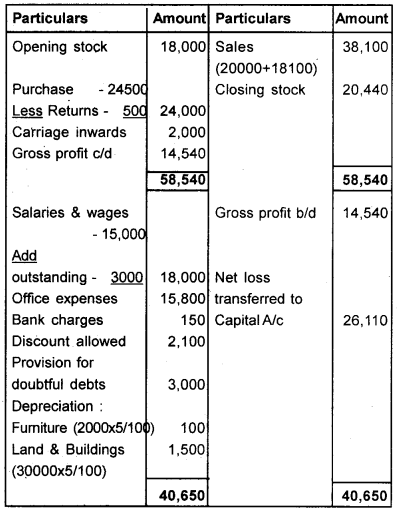

Shankar maintains his book of account on single entry system. Prepare his final accounts from the information supplied for the year ended 30.9.2008 as follows.

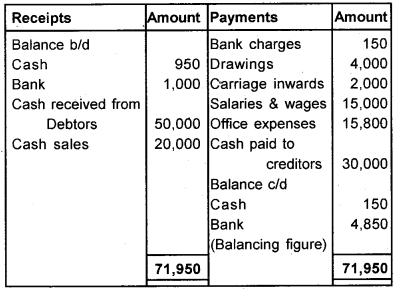

Cash transactions during the year.

Particulars of assets and liabilities are given below:

Additional information:

- Credit sales for the year Rs. 18,100.

- Discount allowed to Debtors Rs. 2,100.

- Return outwards during the year Rs. 500.

- Salaries outstanding on 30.9.2008 Rs. 3,000.

- Provision for doubtful debts is to be created to the extent of Rs. 3,000.

- 5% depreciation is to be provided on furniture and land & buildings.

Answer:

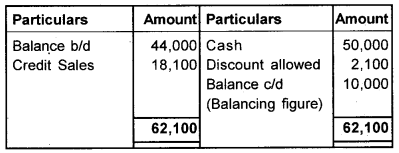

Total Debtors A/c

Total Creditors A/c

Cash Book

Statement of Affairs as at 01.10.2007

Trading and profit and loss A/c for the year ended 30.9.2008.

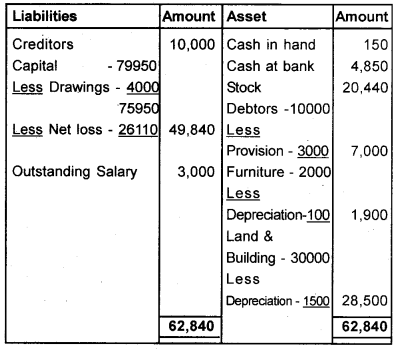

Balance sheet as on 30.09.2008

Question 4.

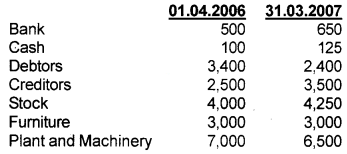

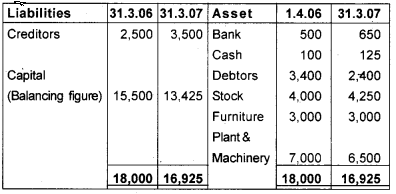

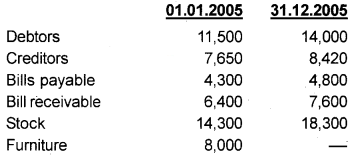

Mr. Giri does not keep his books under the double-entry system. The following are his assets and liabilities as on the opening and closing date of 2005.

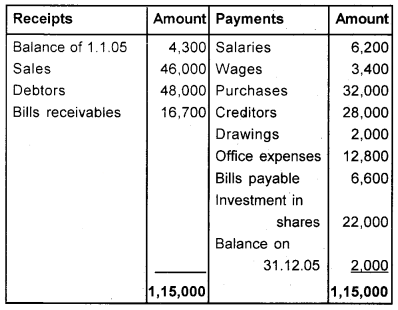

His Cashbook for the year ended 31.12.05 as follows.

Discount allowed to debtors is Rs. 1,600 and discount allowed by creditors is Rs. 1,300. Bad debts written off is Rs. 400. Provision for bad debts is required at 5%. Depreciation @ 10% is required on furniture. Interest accrued on investments amounts to Rs. 2,200. Prepare Trading and profit and loss A/c and Balance sheet for 2005.

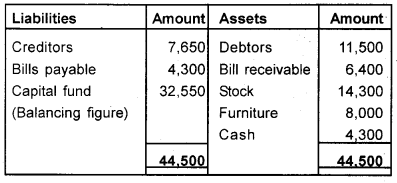

Statement of Affairs as on 01.01.2005

Answer:

Bills Receivable A/c

Bills Payable A/c

Total Debtors A/c

Total Creditors A/c

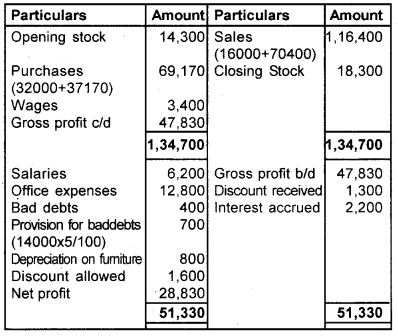

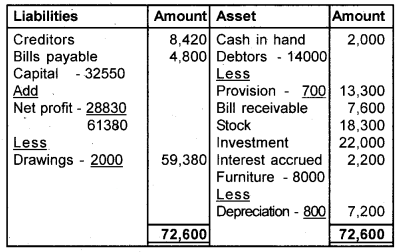

Trading and Profit & Loss A/c for the year ended 31.12.2005

Balance sheet as on 31.12.2005

Question 5.

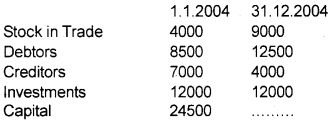

Mr. Binu keeps his books under single entry. From the following information, prepare profit and loss account for the year ended 31st December 2004 and a balance sheet as on that date.

Cashbook

Other Information

Answer:

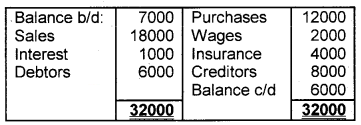

Total Debtors A/c

Total Creditors A/c

Trading and Profit and Loss A/c for the year ended 31.12.2004

Balance Sheet as on 31.12.2004

Question 6.

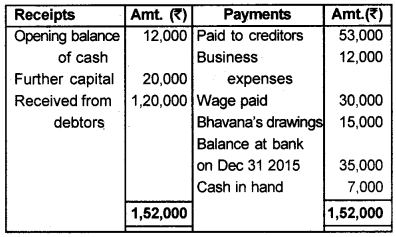

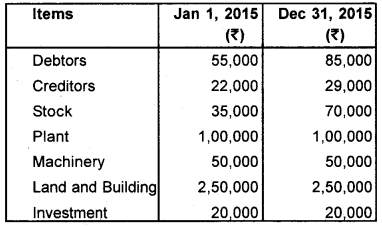

Mrs. Bhavana keeps his books by Single Entry System. You’re required to prepare final accounts of her business for the year ended December 31, 2015. Her records relating to cash receipts and cash payments for the above period showed the following particulars.

Summary of Cash

The following information is also available

All her sales and purchases were on credit. Provide depreciation on plant and building by 10% and machinery by 5%. make a provision for bad debts by 5%.

Answer:

Debtor’s Account

Creditor’s Account

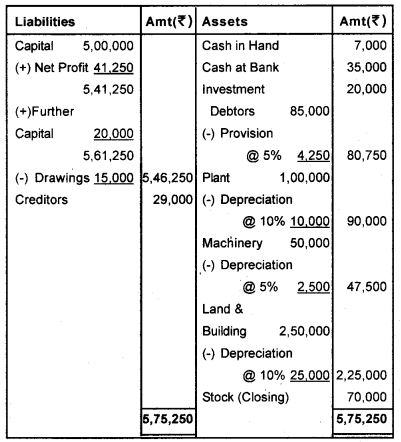

Statements of Affairs as on 31st December 2015

Trading and Profit & Loss Account as on 31st December 2015

Balance Sheet as on 31 December 2015