Kerala Plus One Accountancy Chapter Wise Questions and Answers Chapter 8 Financial Statements – I & Financial Statements – II

Plus One Accountancy Financial Statements – I & Financial Statements – II One Mark Questions and Answers

Question 1.

Closing stock is valued at

(a) Market Price

(b) Cost Price

(c) Market Price or Cost Price whichever is less.

Answer:

(c) Market Price or Cost Price whichever is less.

Question 2.

Carriage inward is debited to …………… account.

(a) Trading account

(b) Profit and Loss Account

(c) Cash Account

Answer:

(a) Trading Account

Question 3.

Balance Sheet is prepared to find out ……………

(a) Capital

(b) Net Profit

(c) Financial position

Answer:

(c) Financial Position

Question 4.

Gross profit is the difference between ……………..

(a) Sales and Purchases

(b) Sales and total cost

(c) Sales and cost of goods sold

Answer:

(c) Sales and cost of goods sold

Question 5.

Interest on capital is ……………… to the business.

(a) Income

(b) Expenses

(c) Asset

Answer:

(b) Expenses

Question 6.

Wages paid before it has become due is shown in the balance sheet as ……………..

(a) Asset

(b) Liability

(c) Expenses

Answer:

(a) Asset

Question 7.

Ameer’s trial balance contains the following information.

- Bad debt Rs.400

- Provision for bad debts Rs. 1600

It is desired to maintain a provision for bad debts at Rs. 1500. The amount to be debited to profit and loss a/c is ………….

(a) Rs. 3500

(b) Rs. 100

(c) Rs. 300

Answer:

(c) Rs. 300

Question 8.

Profit from Profit and Loss account is transferred to …………… account.

(a) Asset account

(b) Capital account

(c) Liability account

Answer:

(b) Capital Account

Question9.

The Financial statements consist of:

(a) Trial Balance

(b) Profit and Loss account

(c) Balance sheet

(d) Both b and c

Answer:

(d) Both b and c

Question 10.

Choose the correct order of ascertainment of the fol¬lowing profits from the profit and loss account:

(a) Operating profit. Net Profit, Gross profit

(b) Operating profit, Gross Profit, Net Profit

(c) Gross Profit, Operating Profit, Net Profit

(d) Gross Profit, Net Profit, Operating Profit

Answer:

(c) Gross profit, Operating profit, Net Profit

Question 11.

Which of the following are not taken into account at the time of calculation of operating profit?

(a) Normal transactions

(b) Abnormal items

(c) Expenses of a purely financial nature

(d) Both a and c

Answer:

(c) Expenses of a purely financial nature

Question 12.

If the insurance premium paid Rs. 1,000 and prepaid insurance of Rs. 400. The amount of insurance premium shown in profit and loss a/c will be:

(a) Rs. 1400

(b) Rs. 1000

(c) Rs. 400

(d) Rs. 600

Answer:

(d) Rs. 600

Question 13.

When the Manager is entitled to a commission of 10% on profits after charging such commission, it is calculated on profits before charging commission by the formula ………….

(a) 10/90

(b) 10/100

(c) 10/110

(d) 90/100

Answer:

(c) 10/110

Question 14.

Profit and Loss Account is an account prepared to find out ………………

Answer:

Net Profit or Net Loss.

Question 15

Income tax paid for the trader from the business is treated as …………..

Answer:

Drawings.

Question 16.

Adjustments are made in the final accounts to satisfy ………. principle of accounting

Answer:

Matching Principle.

Question 17.

Free samples distributed among customer’s will be credited to ……….. account.

Answer:

Advertisement Account.

Question 18.

…………….. is an expenditure of the revenue nature in the current year, the benefit of which accrues gradually or lasts for more than one accounting year.

Answer:

Deferred Revenue Expenditure

Question 19.

EBIT stands for …………………

Answer:

Earnings Before Interest and Tax

Plus One Accountancy Financial Statements – I & Financial Statements – II Two Mark Questions and Answers

Question 1.

Find the odd one and state the reason.

- Wages, carriage, Trade expenses, Freight

- Income tax paid, Salary paid, Rent paid, Wages paid

Answer:

- Trade expense – It is an indirect expense, all others are direct expenses.

- Income tax paid – It is a personal expense of the Proprietor, all others are business expenses.

Question 2.

The sales and cost of goods sold by John Brothers are Rs. 40,000 and Rs. 28,000 respectively. What is the amount of his gross profit?

Answer:

Gross profit = Sales – Cost of goods sold

= 40,000 – 28,000 = Rs. 12,000

Question 3.

What are the financial statements?

Answer:

The term Financial Statements generally refers to two statements prepared at the end of an accounting period for an enterprise. These are Trading and Profit and Loss Account, showing the profitability of the business operations and Balance sheet, showing the financial position of the enterprises.

Question 4.

A new manufacturer incurred huge expenditure in the advertisement. Explain the nature of expenditure.

Answer:

Deferred Revenue Expenditure:

“Expenses incurred today, and the benefit of which accrue gradually in the subsequent year is called Deferred Revenue Expenditure. For example Expenses like advertisement, which may be incurred in one lump sum but the benefit of which will be received only within a series of years. The proportionate amount due the current year must be arrived at and debited to the P/L account. The balance must be shown on the assets side of the Balance sheet.

Question 5.

Calculate the value of cost of goods sold.

- Opening stock – 10,000

- Net purchases – 5,000

- Direct expenses – 2,000

- Closing stock – 10,500

Answer:

Cost of goods sold = Opening stock + Net Purchases + Direct Expenses – Closing stock

= (10,000 + 5000 + 2000) – 10500

= Rs. 6,500

Question 6.

What is Operating profit?

Answer:

Operating profit is the profit earned through the normal operations and activities of the business. Operating profit can be calculated as follows:

Operating profit = (Gross profit – Operating expense) + Operating income.

Or

= Net Profit + Non-operating expenses – Non-operating income.

Examples of non-operating expenses are loss on sale of assets, interest paid etc. Non-operating incomes are dividend received, Profit on sale of assets.

Question 7.

Operating profit earned by M/s. Asoka & Sons in 2010-11 was Rs. 17,00,000. Its non-operating incomes were Rs. 1,50,000 and non-operating expenses were Rs.3,75,000. Calculate the amount of net profit earned by the firm.

Answer:

Net profit = Operating profit – Non-operating expenses + Non operating income = 1700000 – 375000 + 150000 Net Profit =Rs. 1475000

Question 8 .

Explain the treatment of goods distributed as sample to customers.

Answer:

In order to increase sales, goods may be distributed among customers free of cost. Such free goods are in the form of samples for test use. It is in the form of advertisement expense. The amount is to be deducted from the purchases in the trading account. The cost of the sample is to be shown as an expense in the profit and loss account.

Question 9.

To tally a balance sheet, one has to strictly adhere to the basic accounting equation ‘Asset = Liabilities + Captial’. Do you agree with this statement? Substantiate.

Answer:

Every transaction has two aspects which are equal in value but opposite in nature. One of the aspects will form part of liability and the other one asset. Be¬cause of this feature of the accounting equation, a balance sheet is always tallied.

Question 10.

- Closing stock – Rs. 30,000

- Sales – Rs. 1,00,000

Gross Profit 20% on sale

- Purchases – Rs. 60,000

- Direct Wages – Rs. 7000

Find out opening stock.

Answer:

Opening stock = Sales + Closing stock – (Purchases + Direct Expense + Gross Profit)

= 1,00,000 + 30,000 – (60,000 + 7,000 + 20,000)

= 1,30,000 – 87,000 = 43,000

Question 11.

Provide provision for bad debt @ 10% on debtors from the particulars given below.

- Good Debts Rs. 10,000

- Doubtful debts Rs. 50,000

- Bad debts Rs. 1000

Answer:

Provision for doubtful debts = Doubtful debts × % of provision for bad debt

= 50000 × 10/100 = Rs. 5000

Question 12.

Payment received from debtors does not result a change in the total assets. Comment.

Answer:

When the payment is received from debtors the asset, cash is increased and also a corresponding decrease happens on the asset, Debtors. Therefore, there won’t be any change in the value of total assets in effect.

Question 13.

What is meant by provision for discount on debtors?

Answer:

This is a discount which is being allowed by an enterprise to its debtors to encourage prompt payments. Discount likely to be allowed to customers in an accounting year can be estimated and provided for by creating a provision for discount on debtors. Here, it is to be remembered that provision for discount made on good debtors which are arrived at by deducting further bad debts and the provision for doubtful debts.

Plus One Accountancy Financial Statements – I & Financial Statements – II Three Mark Questions and Answers

Question 1.

Distinguish between capital and revenue expenditure.

Answer:

1. Capital expenditure increases earning capacity of business whereas revenue expenditure is incurred to maintain the earning capacity.

2. Capital expenditure is incurred to acquire fixed assets for operation of business whereas revenue expenditure is incurred on the day-to-day conduct of business.

3. Revenue Expenditure is recurring expenditure but capital expenditure is non-recurring by nature.

Question 2.

Differentiate between Direct and Indirect Expenses.

Answer:

1. Direct Expenses:

Means all expenses directly connected with the manufacture, purchase of goods and bringing them to the point of sale. Direct expenses include carriage inward, freight inwards, octroi, clearing charges, wages, factory lighting, coal, water, gas, fuel, import duty, cotton waste, royalty on production, heating, dock dues, customs duty etc.

2. Indirect expenses:

Are those expenses which are incurred after the manufacturing of goods. In other words, Indirect expenses are those expenses that are incurred to operate a business as a whole. Indirect expense include – carriage outward, rent, rates and tax, office expenses, selling and distribution expenses.

Question 3.

Mention the difference between a Balance Sheet and a Trial Balance. (Any two points).

Answer:

| Trial Balance | Balance Sheet |

| 1. It is a list of all account balances | 1. It is prepared with the balances of real and personal accounts only. |

| 2. It is prepared to check the arithmetical accuracy of books of accounts. | 2. It is prepared to ascertain the financial position of the firm. |

| 3. It is prepared frequently. | 3. It is usually prepared annually. |

Question 4.

Calculate closing stock from the following

- Sales – 20,000

- Purchases – 12,300

- Return inwards – 500

- Carriage inwards – 400

- Return outwards – 1,000

- Gross Profit – 8000

Answer:

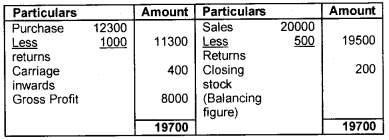

Trading Account

Question 5.

On 1st January 2008, a firm had a stock of goods valued at Rs. 10,000. During the year the following transactions took place.

- Sales – 2,00,000

- Purchases – 1,20,000

- Carriage inwards – 500

- Sales returns – 2,000

- Purchase returns – 1,000

- Find out the amount of Gross Profit.

Answer:

- Gross Profit = Net Sales – Cost of goods sold

- Net sales = 2,00,000 – 2,000 = 1,98,000

- Net Purchase = 1,20,000 -1000 = 1,19,000.

- Cost of goods sold = 10,000 + 1,19,000 + 500 = 1,29,500

- Gross Profit = 1,98,000 – 1,29,500 = Rs. 68,500

Question 6.

What do you mean by Profit and Loss Account?

Answer:

Profit and Loss a/c is an account prepared to find out the net profit earned or net loss incurred by a business during an accounting period. It is debited with all operating expenses and losses and credited with incomes and profit. This account begins with the Gross Profit or Gross Loss brought down from Trading A/c.

If the total of the credit side of this account is more than the total of the debit side, the difference is net profit. If the total of the debit side exceeds the total of the credit side, the difference is net loss. The amount of net profit or net loss transferred to capital account.

Question 7.

From the following information calculate operating profit.

- Cost of goods sold – Rs. 5,00,000

- Administrative expenses – 25,000

- Selling & Distribution expenses – 35,000

- Net sales – 7,50,000

Answer:

- Operating Profit = Gross Profit – (Operating expenses + Operating income)

- Gross Profit = Net sales – Cos of goods sold = 7,50,000-5,00,000 = 2,50,000

- Operating Expenses = Administration expense + Selling and Distribution exp.

- Operating Profit = 2,50,000 – (25,000+ 35,000) = Rs. 1,90,000

Question 8.

What do you mean by Deferred Revenue Expenditure? Can you present it with a suitable example?

Answer:

“Deferred Revenue Expenditure is an expenditure of the revenue nature in the current year, the benefit of which accrues gradually or lasts for more than one accounting year.”

Examples are advertisements of usually high amounts, cost of shifting business to a more convenient location, etc. The amounts spend on such expenses would be spread over the period for which the benefit arises. Suppose if a concern spends Rs. 5 lakh for advertisement and it is expected that the benefit of its lasts for 5 years, the amount to be treated as current year’s expenditure is only one fifth (1/5) of Rs. 5 lakhs ie. Rs. 1 lakh. The balance Rs. 4 lakhs would be treated as an asset.

Question 9.

State the reasons why the following items appear or not in the Profit and Loss A/c.

- Bad debts

- Drawings

- Provision for bad debts.

Answer:

- Bad debts is an indirect expenditure and hence it appears in the Profit and Loss A/c.

- Drawings will reduce capital a/c. Therefore, it cannot be shown in the P/L a/c.

- Provision for bad debt is a charge against profit. Hence it will appear in the P/LA/c.

Question 10.

Mr. Narayanan, an accountant of Samay Ltd wrote off Rs. 2000 as bad debts in the year 2004. The total

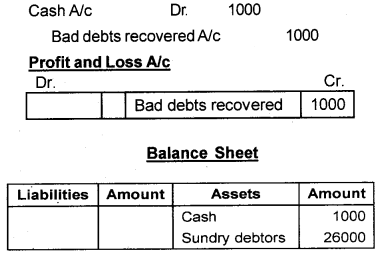

Sundry debtors for the year 2005 is Rs. 26,000. During this year half of the bad debts written off in the last year were recovered. Give Journal Entry for the recovery of bad debts and also show how it will be dealt in the financial statement for the year 2005.

Answer:

Question 11.

What are adjusting entries? Why are they necessary for preparing final accounts?

Answer:

Entries which are given outside the trial balance are called adjustment entries, to record those entries a proper treatment is required according to the double-entry system. Here it is to be remembered that all the adjustments given outside the Trial Balance are posted at two places.

Adjustment is generally done for those items which are omitted or entered with the wrong amount and/or recorded under wrong heads. The following are reasons for recording or. incorporating these adjustment entries in preparation of final account.

- Through these adjustment entries, we come to know the actual figure of profit or loss.

- Because of these adjusting entries, we can assess the true financial position of an organisation based on accrual basis of accounting.

- These adjustment entries enable us to records the omitted entries and help in rectifying all those errors.

- These adjusting entries help in providing depreciation and making different provisions, such as Bad Debts and Depreciation.

Question 12.

What is meant by provision for doubtful debts? How are ‘the relevant accounts prepared and what journal entries are recorded in final accounts? How is the amount for provision for doubtful debts calculated?

Answer:

Provision for doubtful debts is a kind of arrangement about the expect bad debts from the debtors. Generally it is provided after deducting the amount of bad debts from the debtors. As provision for doubtful debts is made after preparing the trial balance, to record it we need a kind of adjustment entry in this regard we prepare debtors account and provision for doubtful debts account. For recording bad debts, the following journal entry is passed.

- Profit and Loss A/c Dr

To Provision for Doubtful Debts A/c (Being provision for doubtful debts is created out of current year profits)

Computation of the Amount of Provision for Doubtful Debts As it is given at the end of a trial balance as an adjustment, little another related adjustment may be there for instance bad debts and discount on debtors. In this case provision for doubtful debt will be created after deducting the figure for bad debts out of the debtor figure.

Plus One Accountancy Financial Statements – I & Financial Statements – II Four Mark Questions and Answers

Question 1.

What is Trading Account? Explain its purpose.

Answer:

The trading account is an account which shows the results of buying and selling of goods or services. It contains summarized form of all the transactions occurring during a trading period. This account is credited with direct incomes and debited with direct expenses.

Trading account is prepared to ascertain the gross result of the business. The gross result of the business is either gross profit or gross loss. If the net sales exceeds cost of goods sold then there is gross profit and if the opposite takes place, there is a gross loss.

Gross profit = Net sales – Cost of goods sold Gross Loss = Cost of goods sold – Net Sales Purposes of a trading account are:

- To ascertain the gross profit or gross loss.

- To enable the management to make a comparison of gross profit or gross loss with that of the previous year.

- To ascertain different ratios such as gross profit ratio, ratio of cost of goods sold to sales etc.

Question 2.

From the following details, prepare Trading Account.

- Opening stock – Rs. 12500

- Purchases – Rs. 22,000

- Purchase returns – Rs.2000

- Wages – Rs. 2000

- Carriage inwards – Rs. 500

- Sales – Rs. 57,000

- Sales returns – Rs. 3,000

- Closing stock – Rs. 15,000

Answer:

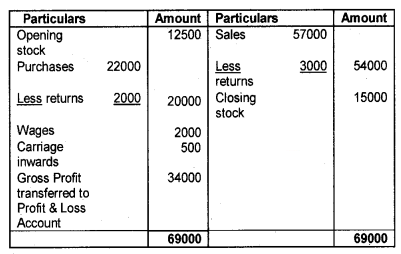

Trading Account for the year ended ………..

Question 3.

What is a Balance Sheet? Explain the needs for preparing Balance Sheet.

Answer:

A Balance Sheet is a statement prepared to ascertain the true position of assets and liabilities as on a particular date. It is prepared at the end of the accounting period, after the preparation of Trading and Profit and Loss account. It is called Balance sheet, as it is a statement prepared with the balance of accounts left after the preparation of Trading and Profit and Loss account.

It gives clear picture of the financial position of the concern. Accounts of Assets, liabilities and Owner’s equity are shown in the Balance Sheet. Items of liabilities and capital are shown on the left side, known as “liabilities” side and the item of assets are shown on the right-hand side, known as “Assets” side of the balance sheet. Balance sheet is prepared with the following objectives.

- To ascertain the financial position of the concern.

- To ascertain the nature of assets and liabilities of the firm.

- To know about the source and application of funds.

- To ascertain working capital as on the date of Balance sheet.

- To ascertain the excess of assets over external liabilities.

Question 4.

What do you mean by Grouping and Marshalling of assets and liabilities?

Answer:

1. Grouping:

The term grouping means putting together items of similar nature under a common heading in the Balance sheet.

2. Marshaling:

Marshaling denotes the order in which the assets and liabilities are shown in the Balance sheet. They are arranged in the following two different ways.

a. In the order of liquidity:

Liquidity means the capacity to raise cash, Under this approach assets are presented in the order of their liquidity. ‘Cash’ being the most liquid item, it is shown as the first item whereas the least liquid item such as ‘Goodwill’ is shown as the last one. The most urgent liability is shown first and the least urgent to pay is shown last.

b. In the order of permanence:

Linder this approach, permanent assets, and liabilities are shown first followed by current assets and liabilities. Joint Stock Companies have to prepare their Balance sheet in the order of permanence. This is just the reverse of the order of liquidity.

Question 5.

Show the treatment in financial statements in respect of the following:

- Outstanding expenses

- Managers commission

- Interest on capital

Answer:

1. Outstanding expenses:

Expenses that have been incurred during the current year, but the payment has not been made is called outstanding expenses. It must be added to respective expense account in the Trading and Profit and Loss account. It will be shown on the ‘liability’ side of the Balance sheet.

2. Managers Commission:

Commission on net profit, at a specific percentage, may be allowed to the manager of a business concern. The commission as a percentage of the net profit may be ‘before’ or ‘after’ charging such commission. In the absence of any special instructions, it is assumed that commission is allowed as a percentage of the net profit before charging such commission.

- If the commission is on the net profit before charging such commission, the formula is

Profit before commission × \(\frac{\text { rate of commission }}{100}\) - If the commission is on the net profit after charging such commission the formula is

Profit × rate/(100 + rate) - The amount of commission must be debited to Profit and Loss account and it must be shown as a liability in the Balance sheet.

3. Interest on capital:

Sometimes interest is paid on the Proprietor’s capital. Interest is allowed at a certain rate on the capital at the beginning of the year. Such interest is an expense to the business and is debited to Profit and Loss Account. It is shown in the liability side by adding the same to capital.

Plus One Accountancy Financial Statements – I & Financial Statements – II Five Mark Questions and Answers

Question 1.

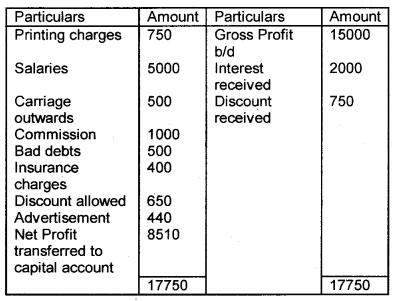

From the following figures, prepare profit and loss account of M/s. Thomas and Sons for the year ended 31.03.2008.

- Gross Profit – 15000

- Printing charges – 750

- Salaries – 5000

- Carriage outwards – 500

- Interest received – 2000

- Bad debts – 500

- Insurance charges – 400

- Discount allowed 650

- Discount received – 750

- Advertisement – 440

Answer:

Profit and Loss Account of M/s. Thomas & Sons for the year ended 31.03.08

Question 2.

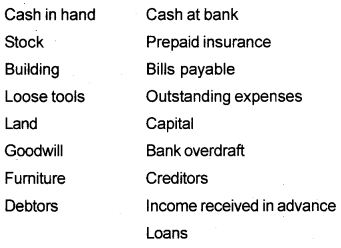

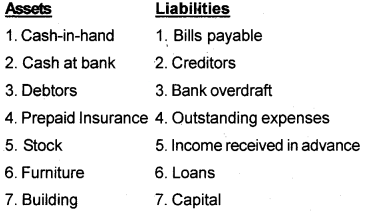

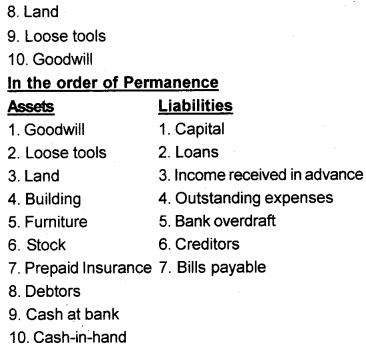

Arrange the following assets and liabilities in the order of liquidity and in the order of permanence.

Answer:

Question 3.

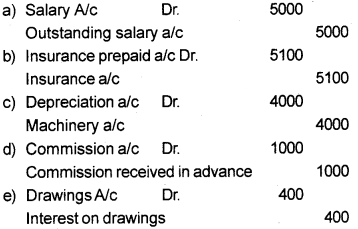

Write the adjustment entries for the following:-

a) Salary outstanding Rs. 5000.

b) Insurance prepaid Rs. 5100.

c) Depreciation of Machinery Rs. 4000

d) The commission received in advance Rs. 1000

e) Interest on drawing Rs. 400

Answer:

Question 4.

What are the closing entries? Give examples.

Answer:

The preparation of trading and profit and loss account requires that the balances of accounts of all concerned items are transferred to it for its compilation. For transferring the balance of all the ledger account to concerned head is done through closing entries.

For examples:

1. Opening stock account, purchase account, wages account, carriage inward account, and direct expense account are closed by transferring to the debit side of the trading and profit and loss account.

The journal entry is:

- Trading A/c Dr

- To opening stock A/c

- To Purchase A/c

- To Wages A/c

- To Carriage inward A/c

- To Direct Expense A/c

2. The purchase return account is closed by transferring its balance to the purchase account. The journal entry is:

- Purchase Return A/c Dr

- To Purchase A/c

3. The sales return account is closed by transferring its balance to the sales account as:

- Sales A/c Dr

- To Sales Return A/c

4. The Sales account is closed by transferring its balance to the credit side of the trading and profit and loss account.

The Journal entry is:

- Sales A/c Dr

- To Trading A/c

Plus One Accountancy Financial Statements – I & Financial Statements – II Six Mark Questions and Answers

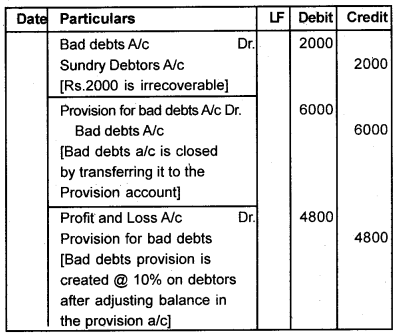

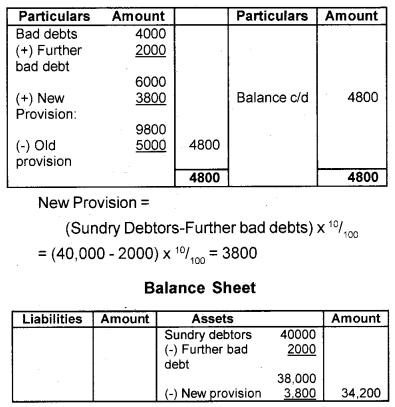

Question 1.

The following are the extracts from Trial Balance of a business.

- Sundry Debtors = 40,000

- Bad debts = 4,000

- Provision for bad debts = 5,000

Additional Information:

- Provide further bad debts Rs. 2000

- Create 10% provision for bad debts.

Pass Journal entries and show how these items will appear in the final accounts.

Answer:

Journal

Question 2.

Show the treatment of prepaid expenses,

depreciation, closing stock at the time of preparation of final accounts.

- When given inside the trial balance.

- When given outside the trial balance.

Answer:

Treatment of prepaid expenses, depreciation and closing stock at the time of preparing the final account.

1. When Given Inside the Trial Balance Prepaid Expenses:

When prepaid expenses are given in the trial balance itself it will be treated as current assets only and will be posted in the Assets Side of the balance sheet. No further adjustment will be required in this case.

Depreciation:

When depreciation is given in the trial balance it will be treated as an expenditure and will be shown in the debit side of the Profit and Loss Account. No further adjustment will be required in this case.

Closing Stock:

When closing stock is given in the trial balance it will purely be treated as assets and will be shown only in the Assets Side of the Balance sheet. No further adjustment will be required in this case.

2. When Given Outside the Trial Balance Prepaid Expenses:

When prepaid expenses are given outside the trial balance it will be treated as an Adjustment and will be posted at two places, first of all, it will be deducted from the concerned expenses in the debit side of Profit and Loss Account and after that, it will be treated as current assets and will be posted in the Assets side of the Balance Sheet.

Depreciation:

When depreciation is given outside the trial balance be treated as an adjustment and will be posted at two places to comply with the rules of the double-entry bookkeeping system. First of all the amount of depreciation will be shown in the debit side of Profit and Loss account as an expenditure and the amount of depreciation will be deducted from the concerned assets in the assets side of Balance Sheet.

Closing Stock:

When closing stock is given outside the trial balance it will purely be treated as an adjustment and will be posted at two places first of all the amount of closing stock will be shown at the credit side of Trading Account and after that it will be shown as an assets in the Assets side of the Balance Sheet.

Plus One Accountancy Financial Statements – I & Financial Statements – II Eight Mark Questions and Answers

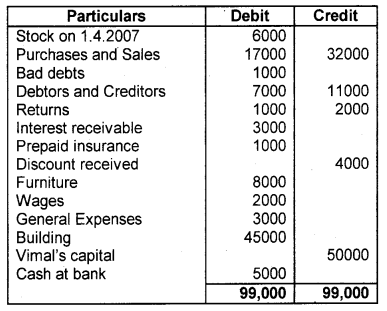

Question 1.

The following is the extract takes from the Trial Balance of Vimal.

Trial Balance as on 31.03.2008

Adjustments:

- Salary outstanding has not been recorded – Rs.8000

- Prepaid insurance was meant for Proprietor’s son.

- Write off further Rs. 200 as bad debts and make a provision for doubtful debts @ 5%.

- Depreciate furniture @ 10%.

You are required to prepare Trading and Profit and Loss Account for the year ended 31.03.2008 and Balance Sheet as on the date.

Answer:

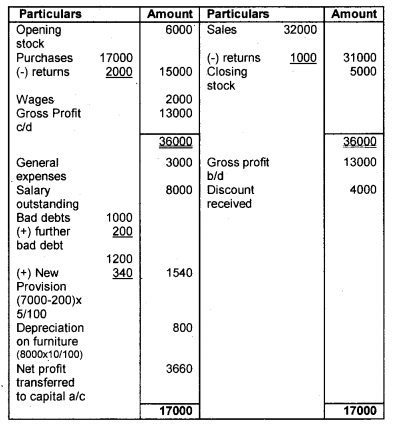

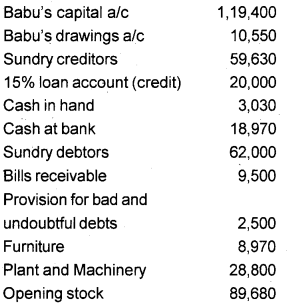

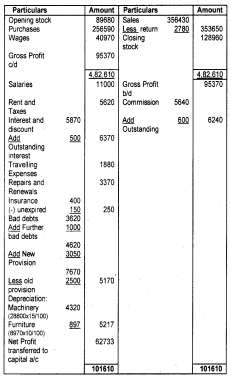

Trading and Profit and Loss a/c for the year ended 31.03.2008

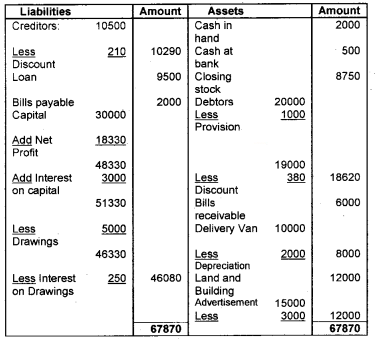

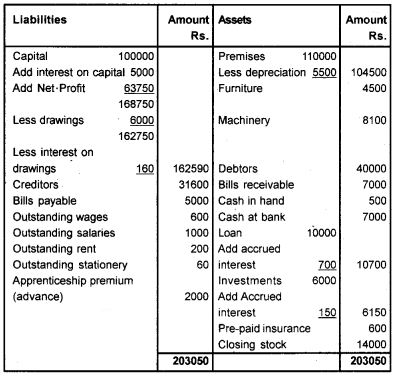

Balance sheet as on 31.03.2008

Question 2.

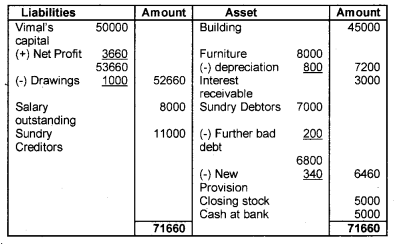

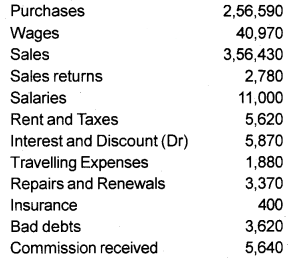

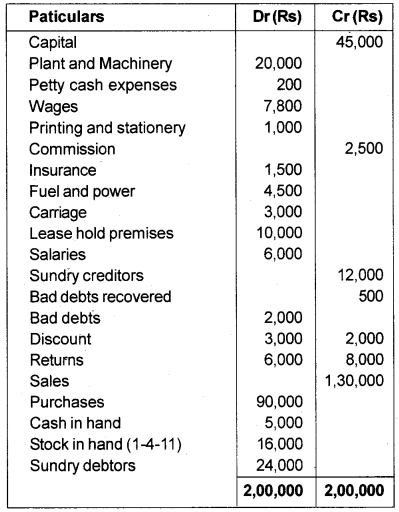

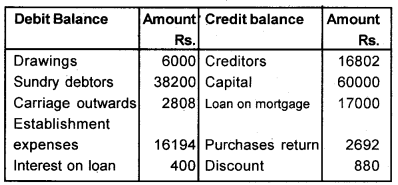

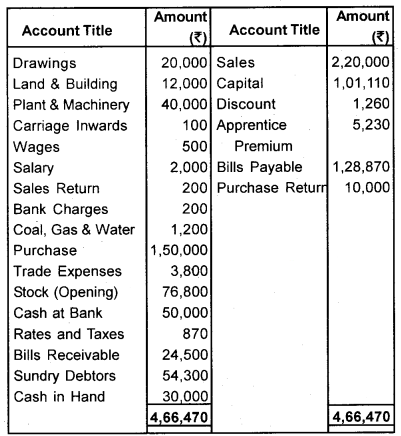

Prepare Trading and Profit and Loss a/c for the year ended 31.03.05 and Balance sheet as on that date from the following balance.

Answer:

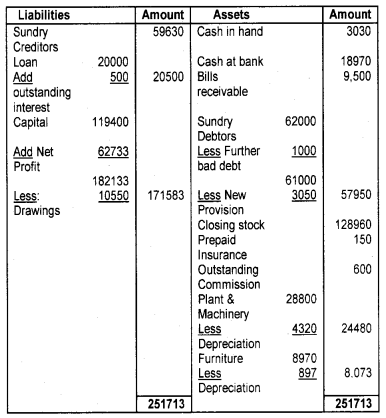

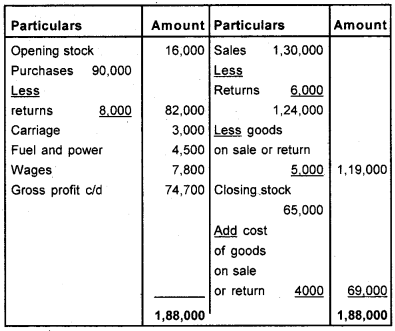

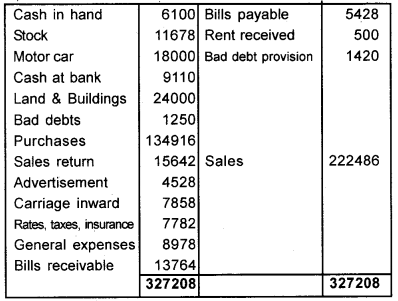

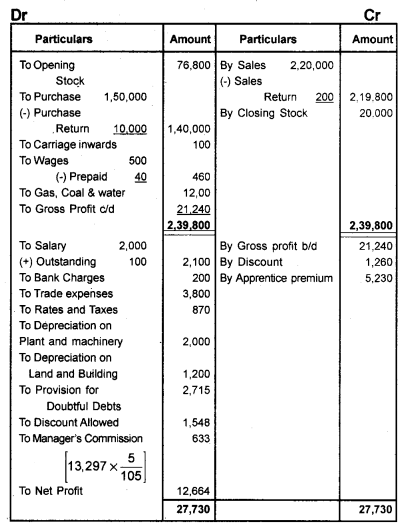

Trading and Profit and Loss A/c of Mr. Babu for the year ended 31.03.05

Balance Sheet of Mr. Babu as on 31.03.05

Question 3.

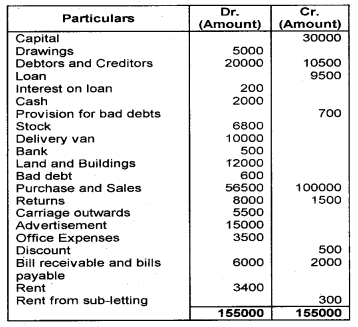

The following is the Trial Balance of Vineeth as on 30.06.2008.

Additional Information:

- Closing stock is valued at Rs. 8750.

- Provide 5% of debtors for bad debts and 2% of debtors and creditors for discount.

- Provide interest on capital at 10% and charge interest on drawings at 5%.

- Depreciate delivery van by 20%.

- Only one-fifth of advertisement is to be treated as expenses of current year.

Prepare Trading and Profit and Loss A/c for the year ended 30.06.2008 and also a Balance Sheet as on that date.

Answer:

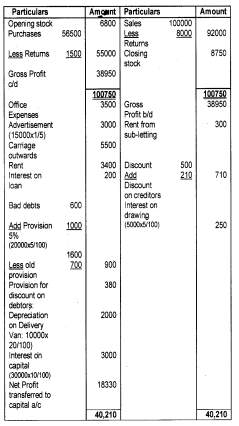

Trading and Profit and Loss A/c for the year ended 30.06.08

Balance Sheet as on 30.06.2008

Note: Discount on Debtors

= (20000-1000) × 2/100 = 380

Discount on Creditors = 10500 × 2/100 = 210

Question 4.

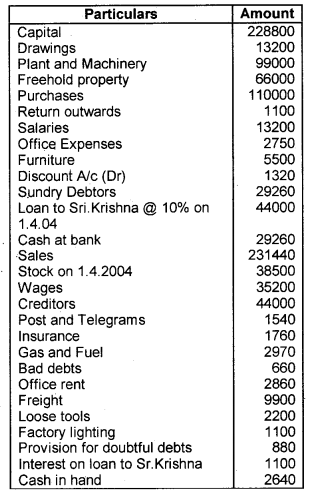

Prepare Trading and Profit and Loss Account for the year ended 31.03.2005 and a Balance Sheet as on that date from the following balances.

Adjustments:

- Stock on 31.03.05 Rs. 72,600.

- Depreciate Plant and Machinery by 33 1/3%, Furniture by 10% and Freehold property by 5%.

- Loose tools valued at Rs. 1,760 on 31.3.05.

- Of the Sundry debtor’s Rs. 660 are bad and should be written off.

- Maintain a provision of 5% debtors for doubtful debts.

- The Manager is entitled to a commission of 10% of the net profits after charging such commission.

Answer:

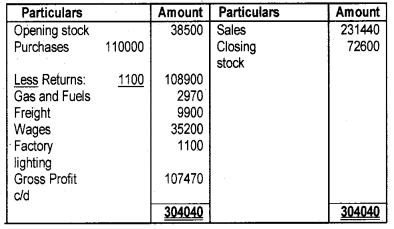

1. Trading and Profit and Loss A/c for the year ended 31.03.2005

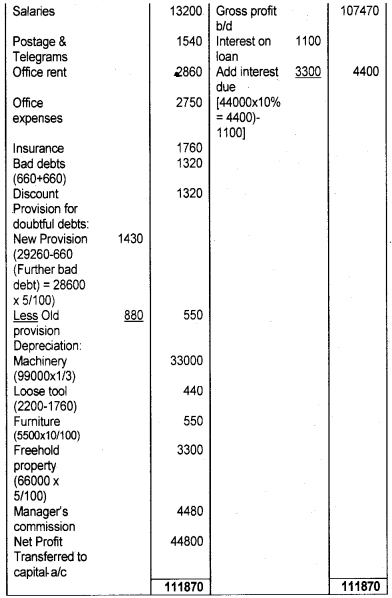

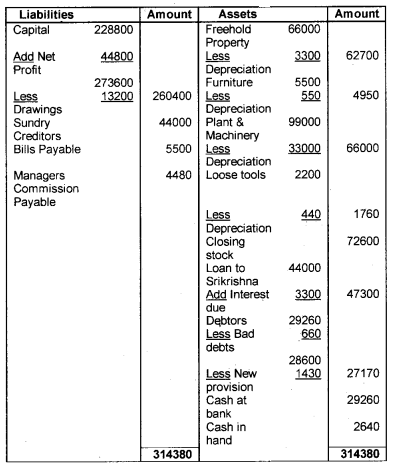

Balance Sheet as on 31.03.2005

Note: Manager’s Commission:

Net Profit before commission = 49280 (111870-62590)

Therefore, Managers commission @ 10% of Net Profit after charging commission = 49280 × 1°/110 = 4480

Question 5.

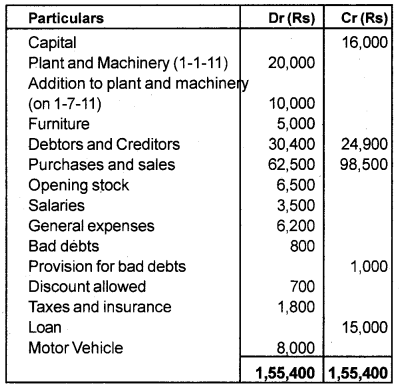

The following is the Trial Balance of Balu as on 31/12/2011.

Adjustments:

- Closing stock Rs. 9,500

- Depreciate plant and machinery at 10% p.a

- Interest on loan at 12% is due for the whole year.

- Write off further Rs.400 as bad debts and provision for bad debts is to be made equal to 5% on debtors.

- Provide 2% for discount on debtors.

Prepare Trading and Profit and Loss A/c for the year ended and Balance sheet as on 31/12/2011.

Answer:

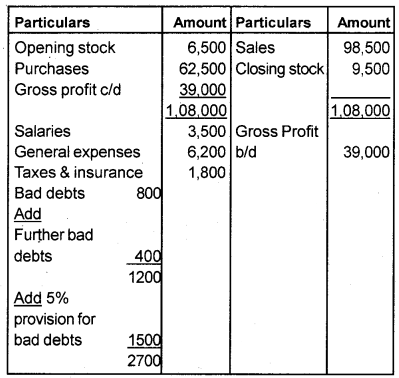

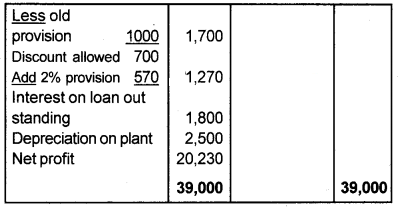

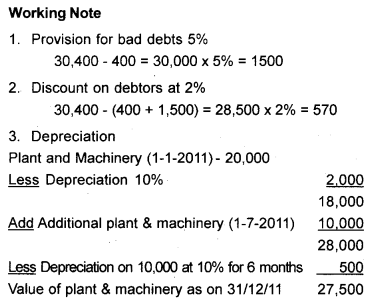

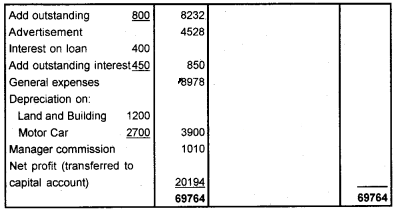

Trading and Profit and Loss Account for the year ended 31/12/2011

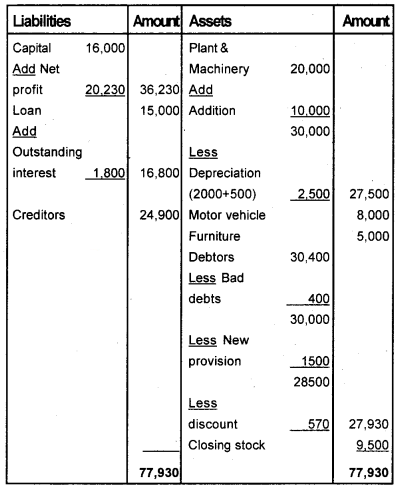

Balance sheet as on 31/12/2011

Question 6.

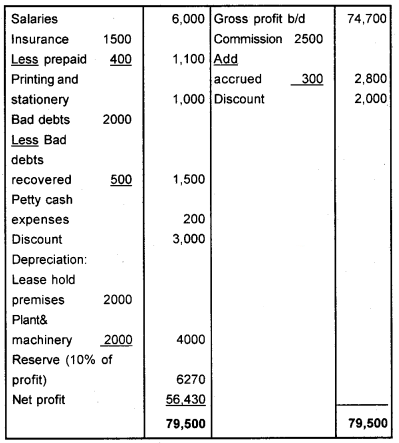

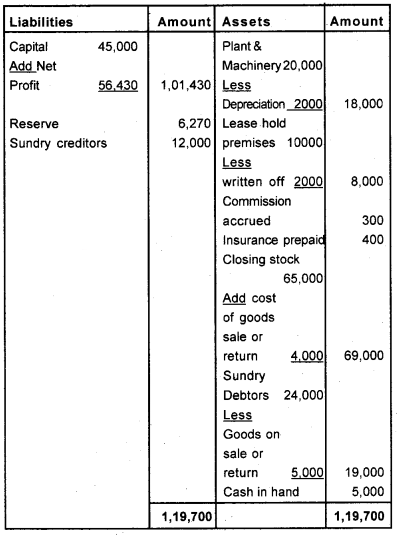

The following is the Trial Balance of Mahesh as on 31/3/11.

Adjustments:

- Closing stock Rs. 65,000

- Insurance prepaid Rs. 400

- Commission earned but not received amounts to Rs. 300

- Write off 1/5 of leasehold premises and provide a depreciation of 10% on plant and machinery.

- Debtors include goods of the cost of Rs. 4,000 sent on sale or return basis at an invoice price of Rs. 5,000. The goods are likely to be returned.

- Transfer 10% of net profit to reserve. Prepare Trading and Profit and Loss A/c and Balance Sheet.

Answer:

Trading and Profit and Loss A/c for the year ended 31/3/2011.

Balance Sheet as on 31/03/2011

Note:

Reserve = 10% of net profit

79,500 -16,800 = 62,700 x 10% = 6,270

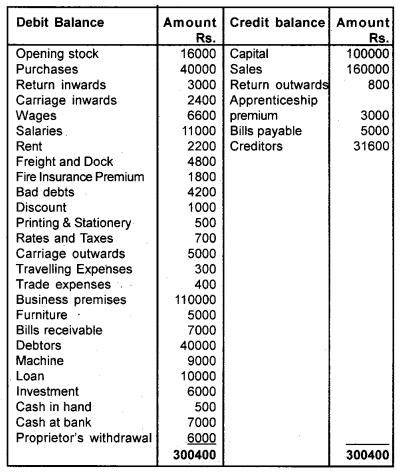

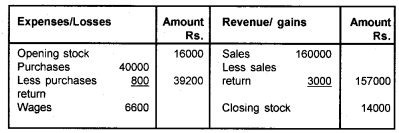

Question 7.

From the following balance extracted from the books of M/s. Hariharan Brother, you are required to prepare the trading and profit and loss account and a balance sheet as on December 31, 2005.

Adjustments:

- Closing stock Rs. 14000

- Wages outstanding Rs.600, Salaries outstandings Rs. 1,000, Rent outstanding Rs. 200.

- Fire Insurance premium includes Rs.1200 paid in July 01, 2005, to run for one year from July 01, 2005, to June 30, 2006.

- Apprenticeship Premium is for three years paid in advance on January 01, 2005.

- The stationery bill for Rs. 60 remains unpaid.

- Depreciation on Premises @ 5%, furniture @ 10%, Machinery @ 10%.

- Interest on loan given accrued for one year @ 7%.

- Interest on investment @ 5% for the half year to December 31, 2005, has accrued.

- Interest on capital to be allowed at 5% for one year.

- Interest on drawings to be charged to him ascertained for the year Rs. 160.

Answer:

Books of Hariharan Bros.

Trading and Profit and Loss account for the year ended December 31, 2005

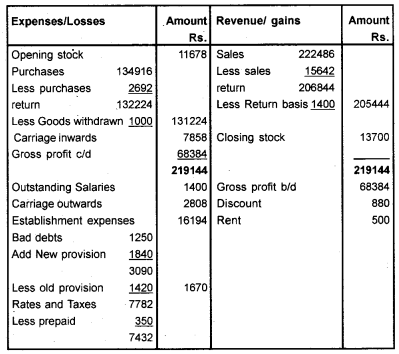

Balance Sheet as at December 31, 2005

Question 8.

Prepare the trading and profit and loss account of M/s.Roni Plastic Ltd. from the following trial balance and a balance sheet as at March 31,2006.

Adjustments:

- Depreciation on land and building at 5% and Motor vehicle at @ 15%.

- Interest on loan is @ 5% taken on April 01, 2005

- Goods costing Rs. 1200 were sent to a customer on sale on return basis for Rs.1400 on March 30, 2006, and has been recorded in the books as actual sales.

- Salaries amounting to Rs. 1400 and Rates amounting to Rs. 800 are due.

- The bad debts provision is to be brought up to @ 5% on Sundry debtors.

- The closing stock was Rs. 13,700.

- Goods costing Rs. 1,000 were taken away by the proprietor for his personal use but not entry has been made in the books of account.

- Insurance prepaid Rs. 350.

- Provide the Manager’s commission at @ 5% on Net profit after charging such commission.

Answer:

Books of Roni’s Plastic Ltd.

Trading and Profit and Loss account for the year ended December 31, 2006

Note: New provision for bad debt = (38200 -1400) 5/100 = 1840

Balance Sheet as on 31.3.2006

Question 9.

From the following balances extracted from the books of Raga Ltd. prepare a trading and profit and loss account for the year ended December 31, 2011, and a balance sheet as on that date.

The additional information is as under

- The closing stock was valued at the end of the year 20,000.

- Depreciation on plant and machinery charged @ 5% and land and building @ 10%.

- Discount on debtors @ 3%.

- Make a provision @ 5% on debtors for bad debts.

- Salary outstanding was? 100 and wages prepaid was? 40.

- The manager is entitled a commission of 5% on net profit after charging such commission.

Answer:

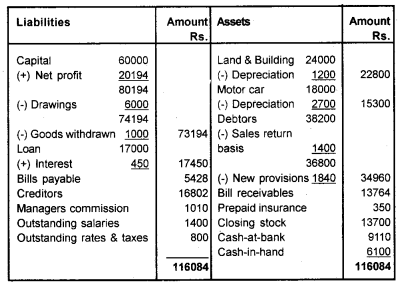

Trading and Profit and Loss Account as on 31st December 2011

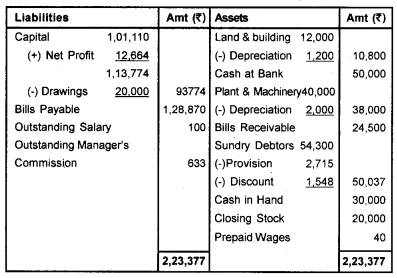

Balance Sheet as on 31st December 2011