Kerala Plus One Accountancy Chapter Wise Questions and Answers Chapter 6 Depreciation, Provisions and Reserves

Plus One Accountancy Depreciation, Provisions and Reserves One Mark Questions and Answers

Question 1.

Depreciation arises due to ………

(a) Wear and tear

(b) Fall in money value

(c) Fall in the market value of asset

(d) None of these

Answer:

(a) Wear and Tear

Question 2.

Reason for a reduction in the value of a quarry is

(a) Depletion

(b) Wear and Tear

(c) Passage of time

(d) Obsolescence

Answer:

(a) Depletion

Question 3.

Scrap value can also be called as …………….. value.

(a) Realisable

(b) Break-up

(c) Resale

Answer:

(b) Break up

Question 4.

Decrease in the value of intangible asset is termed as …………..

(a) Wear and tear

(b) Depletion

(c) Amortization

(d) Accident

Answer:

(c) Amortization

Question 5.

Under diminishing value method, depreciation is calculated on ……………

(a) Original cost

(b) Written down value

(c) Scrap value

(d) None of these

Answer:

(b) Written down value

Question 6.

Capital profits are used to create ………………

(a) General reserve

(b) Capital reserve

(c) Secret reserve

(d) None of these

Answer:

(b) Capital reserve

Question 7.

Profit on sale of fixed assets is a ………………….

Answer:

Capital profit.

Question 8.

Purpose of Provision is to meet a ………….

Answer:

Liability.

Question 9.

……………… is an appropriation from the profit.

Answer:

Reserve.

Question 10.

……………. are usually created out of business profits which are available for distribution of dividend.

Answer:

Revenue Reserves.

Question 11.

Under the …………….. method, the percentage of depreciation is applied on the original cost of the asset.

Answer:

Fixed Instalment Method

Question 12.

Depreciation is an expense.

Answer:

Non-cash

Question 13.

……………. implies to an existing asset becoming out-of-date on account of the availability of better type of asset.

Answer:

Obsolescence.

Question 14.

Installation, freight, and transport expenses are a part of …………

Answer:

Acquisition cost.

Question 15.

…………….. reserve is a reserve which does not appear in the balance sheet.

Answer:

Secret reserve.

Question 16.

Reserve created for maintaining a stable rate of dividend is termed as ………….

Answer:

Dividend Equalisation Reserve

Question 17.

…………. is created to make for decline in the value of investment due to market fluctuation.

Answer:

Investment Fluctuation Fund.

Question 18.

……………. is a charge against profit.

Answer:

Provision.

Question 19.

Choose odd one and give reason.

(a) Copyright

(b) Goodwill

(c) Building

(d) Patent

Answer:

(c) Building. Others are intangible assets.

Question 20.

Which of the following is a natural cause of depreciation?

(a) Obsolescence

(b) Wear and Tear

(c) Prohibition of an asset by the govt.

(d) None of these

Answer:

(b) Wear and Tear

Plus One Accountancy Depreciation, Provisions and Reserves Two Mark Questions and Answers

Question 1.

Is depreciation an expense like salary or rent etc? How is it distinguished from any other type of expense?

Answer:

In case of depreciation, there is no payment or outflow occurring.

Question 2.

Define Depreciation.

Answer:

Depreciation is defined as “a fall in the value of fixed assets owing to wear and tear, obsolescence, passage of time or exhaustion.”

Question 3.

List out the causes of depreciation.

Answer:

- Wear and Tear

- Obsolescence

- Passage of time

- Depletion

- Accident.

Question 4.

What are the factors affecting the amount of depreciation?

Answer:

There are three basic factors which are required to charge depreciation, they are:

- Cost of Assets

- Estimated Net Residual value or Scrap value or salvage value

- Estimated Useful life

Question 5.

True profit is arrived at only if depreciation is taken into account. Explain.

Answer:

Depreciation is the operating expenses of a physical asset. It should be considered in arriving at the true profit earned during each year.

Question 6.

Mr. Raju running a soda manufacturing company is of the view that ‘‘no depreciation need be provided on

the fixed assets because he does not pay any amount as depreciation to anyone.” As a commerce student, how will you respond to his statement? State reasons.

Answer:

The need for providing depreciation in accounting records arises from conceptual, legal and practical business considerations. Though depreciation is not paid it has to be identified as important business expenditure. The consequence of not providing depreciation as

- Timely replacement of fixed assets become impossible.

- Cost of production cannot be exactly calculated.

- Paying dividend out of capital.

Plus One Accountancy Depreciation, Provisions and Reserves Three Mark Questions and Answers

Question 1.

What are the objectives or needs of providing depreciation?

Answer:

The main objectives of providing depreciation are:

- To ascertain the true result of the business.

- To present true Balance sheet.

- To retain funds for replacement.

- To avoid excess payment of income tax

- To fulfill the legal requirements

Question 2.

“Provision is a must and reserve is an option.” – Elucidate.

Answer:

A provision is created for meeting some expected contingency and can only be utilized for the purpose for which it is meant. Thus provision is the amounts set aside out of profit’s to provide for:

- Depreciation, renewals, or decrease in the value of fixed assets and

- Any known liability of which the amount cannot be determined with substatial accuracy.

A reserve is meant for meeting an unanticipated situation and can also be used in the payment of any future liability or loss. It is an appropriation from profit, which are not earmarked in any way to meet any liability. Thus, provision is a must and reserve is an option.

Question 3.

Explain the terms:

- Depletion

- Scrap value

- Obsolescence

Answer:

1. Depletion:

Assets such as mines, quarries, etc. are of wasting nature. By extraction of these natural depositions, their value is reduced. This reduction in value of natural deposition due to depletion in quantity is a cause of depreciation.

2. Scrap value:

This is the estimated value of a fixed asset at the end of its useful life. It is the amount which is expected to be received when the asset is sold after being removed from service. It is also known as Salvage value or residual or Break-up value of asset.

3. Obsolescence:

As a result of change in fashion or new inventions, some assets may be discarded before their productive life comes to an end. This is called obsolescence.

Question 4.

Explain the concept of secret Reserve.”

Answer:

Secret reserve is a reserve that does not appear in the balance sheet. It may help to reduce profit and also tax liability. Management may resort to creation of secret reserve by charging higher. depreciation than required. It is termed as ‘Secret Reserve’, as it is not known to outside stakeholders. Secret reserve can also be created by way of

- Undervaluation of inventories /stock

- Charging capital expenditure to P/L account

- Making excessive provision for doubtful debts.

- Showing contingent liability as actual liabilities.

Plus One Accountancy Depreciation, Provisions and Reserves Four Mark Questions and Answers

Question 1.

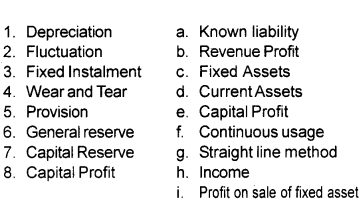

Match the following.

Answer:

- 1 – c

- 2 – d

- 3 – g

- 4 – f

- 5 – a

- 6 – b

- 7 – e

- 8 – i

Question 2.

Discuss the straight-line method and written down value method of depreciation.

Answer:

1. Straight Line Method:

Under this method, a fixed percentage on the original cost of the asset is written off every year so that the value of the asset become zero at the end of its effective working life. The amount of depreciation charged annually will be constant. This method is also known as “Fixed Instalment Method” or“Original Cost method”.

\(Depreciation =\frac{\text { Original cost – Scrap value }}{\text { Expected working life }}\)

2. Written down value method:

Under this method, depreciation is charged on the book value of asset. This method uses a fixed percentage on the book value of the asset at the beginning of every year. The amount of depreciation charged in each period is not uniform and it reduces year after year. This method is also known as “Diminishing value method” or “Reducing Balance method”.

Question 3.

Give any four difference between Fixed Instalment method and Diminishing Value method for providing depreciation.

Answer:

| Fixed Instalment | Diminishing value |

| 1 Amount of depreciation is same every year. | 1. The amount goes on reducing year after year. |

| 2. Depreciation is calculated on original cost | .2. Depreciation is calculated on reducing balance of asset. |

| 3. Value of asset can be written down to zero or scrap value | 3. Value of assets cannot be written down to zero |

| 4. This method is useful for assets of lesser value such as furniture, patents, etc. | 4. This method is useful to the assets with more value and longer life such as buildings, machinery, etc. |

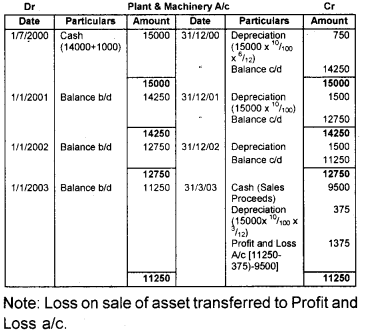

Question 4.

Ram Brothers acquired a machine on 1st July 2000 at a cost of ₹14000 and spent ₹1000 on its installation. The firm writes off depreciation at 10% of the original cost every year. The books are closed on 31st December every year. On March 31, 2003, the machine is sold for ₹9500. Show the machinery account under Fixed Instalment method.

Answer:

Question 5.

John Enterprises has the following balances in its books as of March 31, 2005.

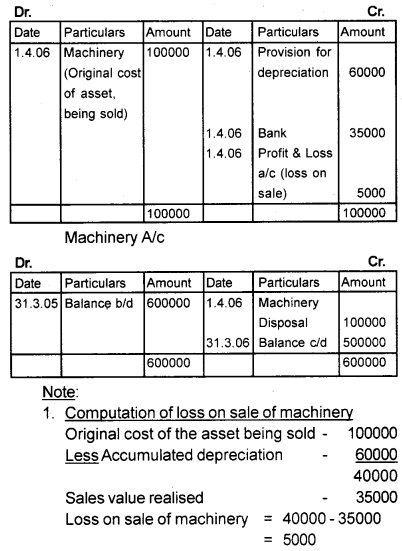

Machinery (Gross value) -₹6,00,000 Provision for depreciation – ₹2,50,000 A machine purchased for ₹1,00,000 on December 1st 2001, having accumulated depreciation amounting to₹60,000 was sold on April 1st 2006 for₹35,000. Prepare Machinery a/c and Machinery Disposal a/c.

Answer:

Machinery Disposal a/c

Question 6.

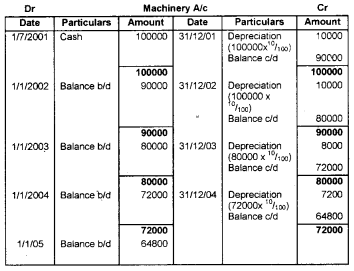

Manjusha Ltd. purchased machinery for ₹1,00,000/ – on 1st January 2001. Depreciation is charged at 10% p.a. on the straight-line method. After two years the company decided to change the method to write down value at 10% p.a. Prepare machinery a/c for first four years assuming that accounts are closed on 31st December every year.

Answer:

Question 7.

Explain Revenue Reserve & Capital Reserve.

Answer:

1. Revenue Reserve:

Revenue reserve are usually created out of business profits which are available for distribution of dividend. It is further classified in to:

a. Specific Reserve:

An amount set aside for meeting a specific purpose or objective is called specific reserve. Eg: Debenture redemption reserve, dividend equalisation reserve, Investment fluctuation reserve, etc.

b. General Reserve:

The amount kept aside is used for the overall improvement of business, it is called general reserve. Eg: Contingency reserve

2. Capital Reserve:

A reserve created out of capital profit is called capital reserve. Usually such reserves are not available for dividend to shareholders. The following are some of the capital profit usually kept as capital reserve.

- Profit on sale of fixed assets

- Premium on issue of shares

- Profit prior to incorporation

- Profit on reissue of shares

- Profit made on purchase of a business.

Plus One Accountancy Depreciation, Provisions and Reserves Five Mark Questions and Answers

Question 1.

Provision is a charge against Profit whereas reserve is an appropriation of Profit.” Comment.

Answer:

The provision means any amount set aside as a charge against profit to meet a loss, the amount of which cannot be determined with substantial accuracy. Reserve refers to amount set aprt from profit and loss account to meet unforeseen contingencies.

The following are the difference between provision and reserve.

| Reserve | Provision |

| 1. It is an appropriation of profit. | 1. It is a charge on profit. |

| 2. Created for meeting unknown liability. | 2. Created for meeting known liability. |

| 3. It increases the amount of working capital. | 3. It is for meeting an anticipated loss or liability. |

| 4. It is available for distribution of dividend. | 4. It is not available for distribution of dividend. |

| 5. It is shown on the liability side of the Balance sheet. | 5. It is usually shown as deduction from the assets concerned. |

| 6. It is not compulsory. | 6. It is compulsory |

Question 2.

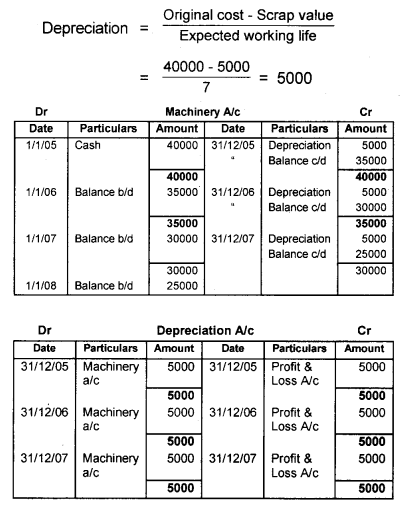

‘X’ Ltd, purchased machinery on 1.1.2005 for a sum of ₹40,000. It is expected to have a working life of 7 years, by the end of which it would get a scrap value of ₹5000. Prepare machinery account in the book of X Ltd. for the last 3 years by providing depreciation under Fixed Instalment Method and also prepare depreciation account for the 3 years.

Answer:

Question 3.

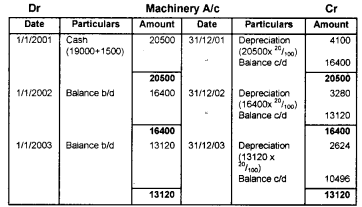

On 1.1.2001, Anil and Co. purchases machinery for ₹19000 and spend ₹1500 for its installation. Show machinery account for 2001, 2002 and 2003 if the company writes off depreciation at 20% p.a. on diminishing balance method.

Answer:

Question 4.

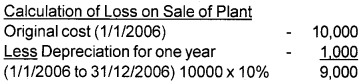

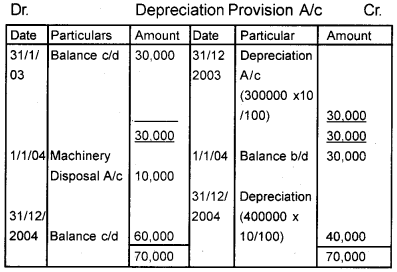

The following data is given to you regarding the asset- Plant of Tinu Ltd. whose accounting year ends on 31st December every year.

- Plant held on 1.1.2006-₹10,000

- Plant bought on 1.1.2007 – ₹20,000

- Plant bought on 1.4.2007 – ₹30,000

- Plant held on 1.1.2006 sold on 1.4.2007 – ₹7000

- Depreciation @ 10% p.a. on original cost method.

- Prepare Plant A/c.

Answer:

Question 5.

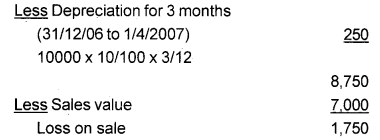

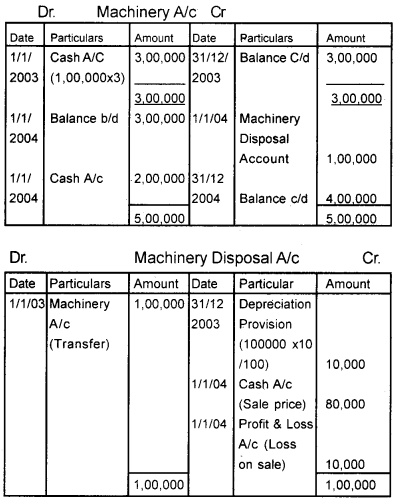

A firm purchased 3 machines of ₹1,00,000 each on 01/01/2003. Depreciation is charged @ 10% p.a. of original cost and accumulated on depreciation provision account. On 01/01/2004 one machine was sold for ₹80,000and a new one was purchased on 1/ 1/2004 for Rs. 2,00,000.

Show Asset Disposal Account.

Answer:

Question 6.

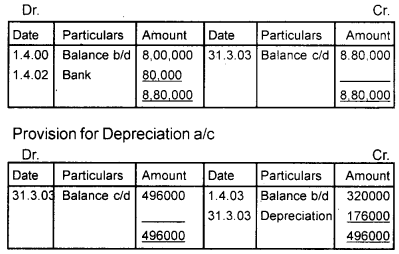

A machine purchased for ₹8,00,000 on April 01, 2000. Depreciation was provided on a straight-line basis at the rate of 20% on the original cost. On April 01, 2002, a substantial modification was made in the machine to make it more efficient at a cost of ₹80,000. This amount is to be depreciated @ 20% on a straight-line basis. Routine maintenance expenses during the year 2003-04 were ₹2000. Draw up the Machinery account, Provision for depreciation account and charge to Profit and Loss account in respect of the accounting year ended on 31.3.2003.

Answer:

Plus One Accountancy Depreciation, Provisions and Reserves Six Mark Questions and Answers

Question 1.

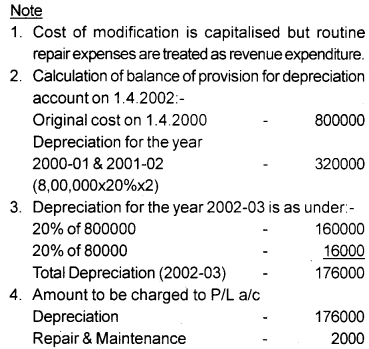

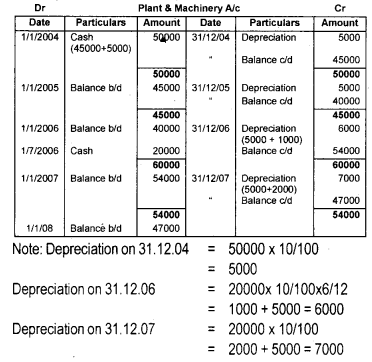

On 1st January 2004, a company bought Plant and Machinery costing ₹45,000 and spent ₹5000 on its erection. Addition is made on 1st July 2006 for the value of ₹20,000. Depreciation is provided @ 10% p.a. Prepare plant and machinery account for 4 years under:

- Fixed Instalment system

- Diminishing Balance method

Answer:

1. Fixed Instalment method

2. Diminishing Balance Method

Question 2.

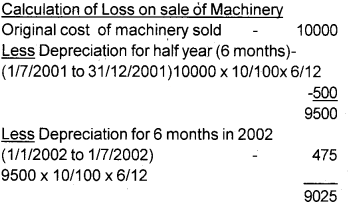

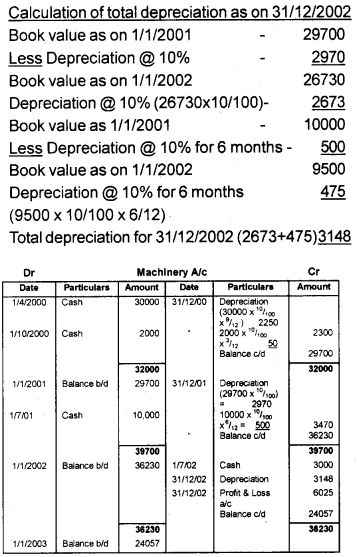

A machine costing ₹30000 was bought on 1/4/2000. Further machinery costing ₹2000 was acquired on 1/10/2000 and another machinery costing ₹10000 was installed on 1/7/2001. On 1/7/2002 the machinery bought on 1/7/2001 was sold for ₹3000. Accounts are closed on 31st December every year. Assuming 10% depreciation p.a.

Prepare Machinery a/c under the diminishing balance method.

Answer: