Kerala Plus One Accountancy Chapter Wise Questions and Answers Chapter 5 Trial Balance and Rectification of Errors

Plus One Accountancy Trial Balance and Rectification of Errors One Mark Questions and Answers

Question 1.

Which of the following statement is wrong regarding Trial Balance.

(a) Trial balance is a part of the double-entry system.

(b) It is not an account

(c) It is prepared on a specific date

(d) It is prepared to check the arithmetical accuracy of the books of accounts.

Answer:

(a) Trial balance is a part of double entry system.

Question 2.

Sale of machinery is credited to sales a/c is an error of

(a) Commission

(b) Omission

(c) Principle

(d) None of these

Answer:

(c) Principle

Question 3.

Debiting wages account with the amount of wages paid on erection of machinery is an errors of be debited with

(a) Rs. 400

(b) Rs. 800

(c) Rs. 200

(d) None of the above

Answer:

(b) Rs. 800

Question 4.

Which of the errors does not affect the trial balance?

(a) Wrong balancing

(b) Wrong totaling

(c) Writing an amount in the wrong account but in the correct side.

(d) None of the above.

Answer:

(c) Writing an amount in the wrong account but in the correct side.

Question 5.

Instead of debiting Sanoj’s A/c his account was credited by Rs. 400. To rectify this his account should

(a) Omission

(b) Principle

(c) Commission

Answer:

(b) Principles

Question 6.

Trial balance is

(a) An account

(b) A statement

(c) A subsidiary Book

(d) A Principal book

Answer:

(b) A Statement

Question 7.

Agreement of trial balance is affected by>

(a) One-sided errors only

(b) Two-sided errors only

(c) Both a and b

(d) None of these

Answer:

(c) Both a and b

Question 8.

A trial balance is prepared to check the …………… of ledger accounts.

Answer:

Arithmetical accuracy

Question 9.

If purchase of furniture is recorded in the purchase book, it is an error of …………..

Answer:

Principle

Question 10.

If purchase of goods on credit is not recorded in the books, it is an error of …………

Answer:

Omission

Question 11.

An account in which the difference of trial balance is temporarily put is ………… account.

Answer:

Suspense.

Question 12.

Error of …………. does not affect the trial balance.

Answer:

Principle.

Plus One Accountancy Trial Balance and Rectification of Errors Two Mark Questions and Answers

Question 1.

Match the following.

- Installation charges debited to wages account.

- Cash paid to ‘X’ is not posted to his account.

- Cash paid to ‘A’ is posted, to B’s account.

- Sales books and purchase books are undercast by same account.

- The sales book is overcast by Rs. 100.

a. Error of commission

b. Compensating error

c. Error of principle

d. One side error

e. Error of omission

Answer:

- 1-c

- 2-e

- 3-a

- 4-b

- 5-d

Question 2.

Complete the following on the basis of hint given.

- Errors of principle – Rule of accounting is violated

- _____ – Wrong amount is written in subsidiary books.

Answer:

Error of commission.

Question 3.

- One-sided error – Undercast in Sales returns book

- ______ – Purchase of machinery entered in purchase book.

Answer:

Two-sided error.

Question 4.

What do you mean by Trial Balance?

Answer:

Trial balance is a statement that shows either the balance or total amounts of debit items and credit items of all accounts. It is prepared on a particular date to test the arithmetical accuracy of the books of accounts kept under the double-entry system.

Question 5.

Why a trial balance is prepared?

Answer:

A trial balance is prepared:

- To check the arithmetical accuracy of the ledger accounts.

- To help in locating errors

- To provide a basis for preparing the financial statements.

Question 6.

Agreement of Tial balance is proof of the accuracy of books of accounts. Do you agree? Explain.

Answer:

No, the tallying of the trial balance does not mean that no errors have been committed in the accounting records. There can be errors which do not affect the equality of debits and credits and there can be errors which affect the equality of debits and credits.

Question 7.

Furniture purchased for Rs. 10,000 from Nirmal has been recorded as follows:

- Nirmal A/c Dr 10,000

- FurnitureA/c 10,000

- If it is incorrect, rectify it by passing rectification entry.

Answer:

- The journal entry is incorrect.

- Rectification entry is – FurnitureA/c Dr 20,000

- Nirmal A/c 20,000

Question 8.

On 31st March 2005, when the trial balance of Abi stores was prepared it showed a difference. Inspite of his continuous efforts, the accountant could not locate errors. But the preparation of financial statements cannot be delayed. Is it possible to prepare financial statements with such a trial balance. Can you suggest a solution at the juncture?

Answer:

If the trial balance doesn’t agree even after the repeated efforts, it is better to place the difference under suspense A/c. Otherwise it will cause inordinate delay in tpe preparation of final accounts. However, the suspense a/c has to be later removed by closely scrutinising the books of accounts in due course.

Question 9.

‘Closing stock is normally given out the trial balance’. State the reason.

Answer:

Usually no separate ledger accounts are maintained for stock account. The valuation of stock will be done at the end of a particular period when financial statements are prepared. Therefore it appears out the trial balance.

Question 10.

What are the methods of preparing trial balance?

Answer:

There are three methods of preparing trial balance They are:

- Totals method (Total of each side in the ledger)

- Balance method (Showing the balances of all ledger accounts.

- Totals – cum – balances method

Question 11.

Explain Error of principles with examples.

Answer:

If any accounting rules or principles are violated in recording a transaction, it is an error of principles. This error does not affect the agreement of trial balance.

Examples :-

- Expenses paid for installation of machinery debited to expenses account.

- The sale of building is credited to sales account.

- Amount spent on repair of machinery debited to machinery account.

- Purchase of furniture debited to purchase account.

Plus One Accountancy Trial Balance and Rectification of Errors Three Mark Questions and Answers

Question 1.

When do you open a suspense account? Explain its uses.

Answer:

When all attempts fails to locate errors and the preparation of the final accounts can not be further delayed, the difference in the trial balance is temporarily transferred to an account called “suspense account’’. Uses of suspense Account.

- It facilitates the preparation of financial statements even when the trial balance has not tallied.

- It helps in giving rectifying entries after the preparation of trial balance.

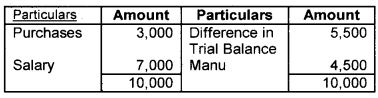

Question 2.

Mr. Murali’s trial balance showed a difference of Rs. 5,500 on the credit side. The following errors were revealed from the books of account.

- The purchase of books were overcast by Rs. 3000.

- The salary paid to Renjith Rs. 7000 has been posted twice.

- Received from Manu Rs. 5000 has been credited Rs. 500.

- Prepare a suspense account.

Answer:

Suspense A/c

Question 3.

Explain Error of omission with Examples.

Answer:

Error of omission:

When a transaction is not entered in the books of original entry or not posted from the books original entry to the ledger, an error of omission is caused. The omission may be complete or partial. If a transaction is not entered in the subsidiary books, it is a case of complete omission as the posting in the ledger accounts are also omitted.

In this both the debit and credit aspects go unrecorded, it does not affect the agreement of Trial Balance. If only one aspect of a transaction is recorded, it is a case of Partial omission. It happens while posting from day books to ledger accounts. This will affect the agreement of Trial balance.

Question 4.

Explain Error of Commission with example.

Answer:

Error of commission:

Errors committed when transactions are incorrectly recorded are called error of commission. These are the errors caused by wrong posting, wrong totaling, wrong balancing, wrong carryforwards, etc. For example- if Rs. 290 received from Ram is credited to his account as Rs. 209, it is an error of commission, Error in posting as to the side of account – Rs. 300 received from Kumar is posted his Debit side.

Question 5.

Explain Error of Principles Error with examples.

Answer:

Error of principles:

If any accounting rules or principles are violated in recording a transaction, it is an error of principles. This error does not affect the agreement of trial balance.

Examples:

- An item of capital expenditure is wrongly debited to a revenue account.

- Sale of building is credited to sales account.

Question 6.

Explain compensating error with examples.

Answer:

Compensating Error:

These errors arise when a mistake made in one direction is compensated by another mistake made in the opposite direction, to the extent of same amount. These errors do not affect the agreement of trial balance.

For example:

If Purchase of goods from ‘X’ for Rs. 800 is credited to his account as Rs.80 and a purchase from T for Rs. 80 is credited to y’s account as Rs. 800.

Question 7.

Name the errors which do not affect the Trial Balance.

Answer:

- Error of complete omission

- Error of principle,

- Compensating Error

- Error of recording in the book of original entry

- Error of posting to wrong account on credit side with correct amount.

Question 8.

Name the errors which affect the Trial Balance.

Answer:

- Errors due to partial omission

- Error of casting

- Posting an amount in the wrong side of an account.

- Posting of a wrong amount

- Wrong totaling or balancing of accounts

Question 9.

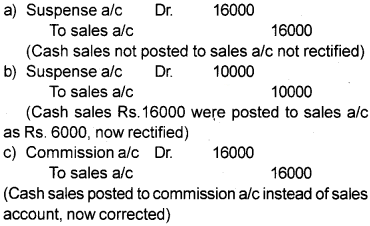

Rectify the following errors:

Cash sales Rs. 16,000

a) were not posted to sales a/c

b) were posted as Rs. 6000 in sales account

c) were posted to commission account

Answer:

Question 10.

Locate the types of errors involved in the following transactions.

- Purchased goods for 10,000 debited to furniture a/c.

- Carriage paid Rs. 1,000 debited to carriage a/c as Rs. 100.

- Amount received from Rajesh Rs. 1,800 has not been entered in the books of accounts.

Answer:

- Error of principle

- Error of commission

- Error of omission

Plus One Accountancy Trial Balance and Rectification of Errors Four Mark Questions and Answers

Question 1.

What are the objectives of preparing a trial balance?

Answer:

A Trial balance is prepared with the following objectives:

1. To ascertain the arithmetical accuracy of ledger accounts:

A Trial balance is prepared to check the arithmetical accuracy of ledger accounts. If the sum of the debit and credit columns of Trial balance is equal, it is assumed that the posting to the ledger accounts is accurate. This is because, for every debit we give an equal credit.

2. To help in ascertaining errors:

Some of the errors in the books of account can be detected by the trial balance. An untallied trial balance indicates that some errors have been committed.

3. To provide a basis for preparing final accounts:

The ultimate aim of maintaining books of accounts is to ascertain the financial result and position of the business. For this purpose profit and loss account and balance sheet are prepared on the basis of trial balance.

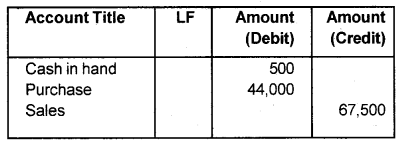

Question 2.

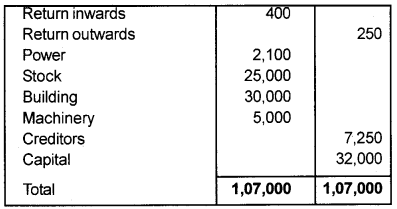

Check the arithmetical accuracy of the ledger account balances from the following.

| Cash in hand | 500 |

| Purchases | 44,000 |

| Sales | 67,500 |

| Return inwards | 400 |

| Return outwards | 250 |

| Power | 2,100 |

| Stock | 25,000 |

| Building | 30,000 |

| Machinery | 5,000 |

| Creditors | 7,250 |

| Capital | 32,000 |

Trial Balance as on …………..

Answer:

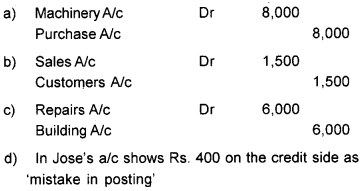

Question 3.

Pass journal entries to rectify the following transactions.

a) Purchase of machinery was debited to purchase a/c Rs. 8,000.

b) Goods sold on credit was recorded twice Rs. 1,500.

c) The repair of building was debited to building a/c Rs. 6,000.

d) Rs. 200 received from Jose posted to the debit of his account.

Answer:

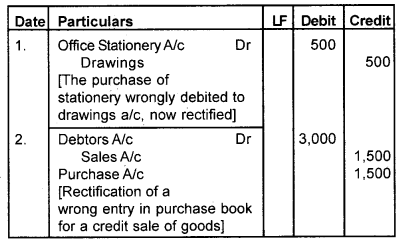

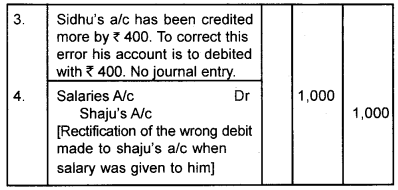

Question 4.

Rectify the following errors:

- Stationery purchased for ₹500 has been wrongly debited to drawings a/c.

- A credit sale of ₹1,500 has been wrongly passed through the purchase book.

- ₹4,000 received from Sidhu have been posted on the credit side of his account ₹4,400.

- Salary ₹10,000 paid to Mr. Shaju was debited to his personal account.

Answer:

Journal

Plus One Accountancy Trial Balance and Rectification of Errors Five Mark Questions and Answers

Question 1.

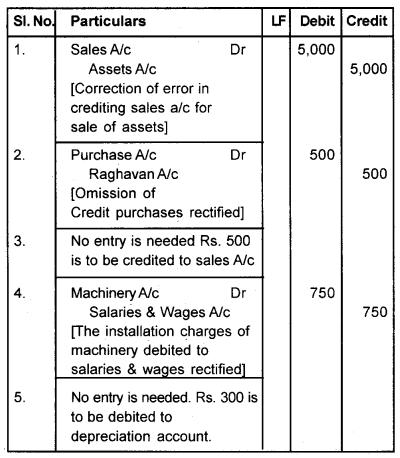

Show how you would correct the following errors, write Journal entries.

- Rs. 5,000 received on the sale of an asset has been credited to sales account.

- A credit purchase of goods amounting to Rs. 500 from Raghavan had not been recorded in the books.

- Sales book was undercast by Rs. 500.

- Wages Rs. 750 paid for the installation of a new machine are debited to salaries and wages account.

- An amount of Rs. 500 written off as depreciation has not been posted to depreciation account.

Answer:

Journal Proper

Question 2.

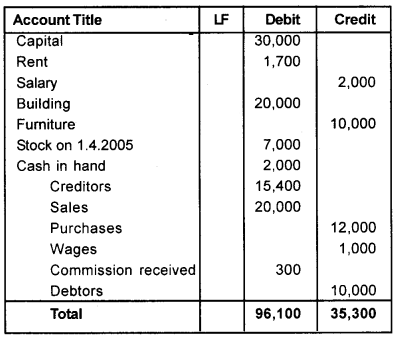

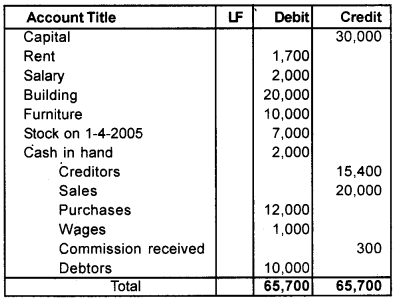

Identify the mistakes crept into the trial balance and redraft it in its proper form.

Trial Balance

Answer:

Question 3.

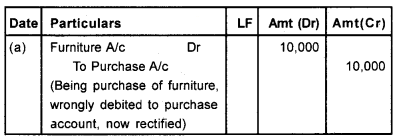

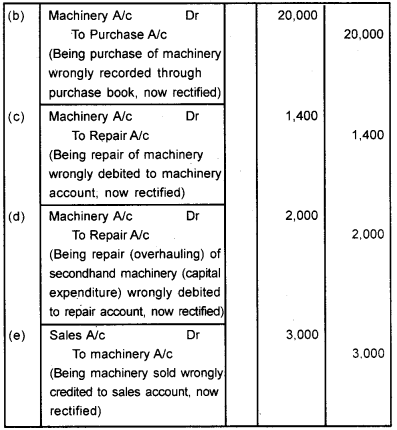

Rectify the following errors

(a) Furniture purchased for ₹10,000 wrongly debited to purchase account.

(b) Machinery purchased on credit from Raman for ₹20,000 was recorded through purchase book.

(c) Repairs on machinery ₹1.400 debited to machinery account.

(d) Repairs on overhauling of secondhand machinery purchased ₹2,000 was debited to repair the account.

(e) Sales of old machinery at book value of ₹3,000 was credited to sales account.

Rectification Entries in Journal

Answer:

Plus One Accountancy Trial Balance and Rectification of Errors Six Mark Questions and Answers

Question 1.

Rectify the following Mistakes.

- The purchase day book is undercast (totaled less) by Rs. 180.

- Sales day book is overcast (totaled more) by Rs. 100.

- The purchase return book is totaled more by Rs. 80.

- Sales return book is less by Rs. 110.

- Rent paid Rs. 600 is omitted to post to rent account.

- The commission received Rs. 40 is omitted and not posted to the commission account.

- Salary paid Rs. 350 is posted twice to salary A/c.

Answer:

1. As the purchase account is less by Rs. 180, It should be debited to the purchase account. It should be shown in the debit side as Undercast in purchase Day Book Rs. 180 Or Mistake in posting.

2. Sales Account is more by Rs. 100. To correct it, Rs. 100 be shown in the debit side of sales A/c as: Overcast in Day Book Rs. 100.

3. Purchase Returns Accounts is credited more by Rs. 80. Now it should be debited with the amount as Overcast in Day Book Rs. 100.

4. The effect is that the sales Return Account is less by Rs. 110. It should how be debited with the amount as Mistake in totaling Rs. 110.

5. Rent account should be debited with Rs. 600 as Omission in posting Rs. 600.

6. The commission account should be credited with Rs. 40 as Omission in posting Rs. 40.

7. The salary account is debited more by Rs. 350. It should now be credited with Rs. 350 as Mistake in polling Rs.350.

Question 2.

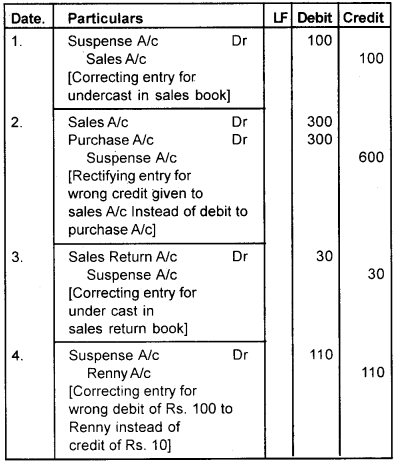

Veeran failed to balance his trial balance the credit side being more by Rs. 420. The difference is placed in a suspense a/c. Later on the following are discovered. Give rectifying entries and also prepare suspense A/c.

- Sales Book was undercast by Rs. 100.

- Goods for Rs. 300 purchased on credit from Raj was wrongly entered in the sales book. The account of Raj was correctly credited.

- The sales return book was undercast by Rs. 30.

- A credit item of Rs. 10 was wrongly debited to Renny’s account as Rs. 100.

Answer:

Journal

Suspense A/c

Question 3.

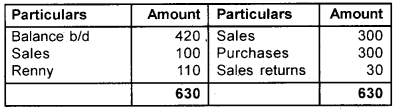

Rectify the following errors:-

a) Discount allowed to Ramesh Rs. 60 on receiving Rs.2000 from him was not recorded in the books.

b) Discount received from Ram Rs. 80 on paying 1900 to him was not posted at all.

c) Bill receivable from Narayan Rs. 1000 was dishonored and wrongly debited allowance account as Rs. 10,000.

d) Cash received from Mohan Rs. 3000 was posted to Naveen as Rs. 1000.

e) Cheques for Rs. 7800 received from Anu in full settlement of his account of Rs. 8000, was dishonored. No. entry was passed in the books on dishonor of the cheque.

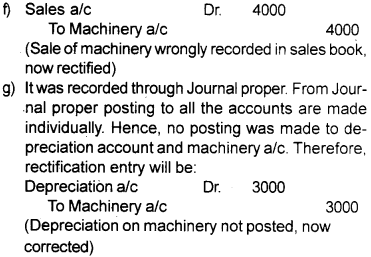

f) Old machinery sold to Kannan at its book value of Rs.4000 was recorded through sales book.

g) Depreciation written off as the Machinery Rs.3000, was not posted at all.

Answer:

Plus One Accountancy Trial Balance and Rectification of Errors Eight Mark Questions and Answers

Question 1.

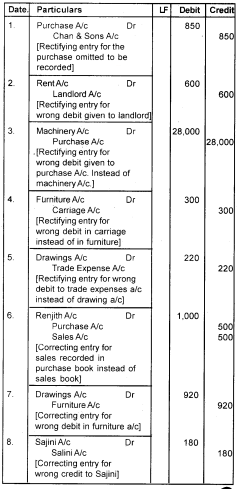

Rectify the following errors by giving correcting entries.

- Credit purchase of goods for Rs. 850 from chand and sons has not been recorded in the daybook.

- Rent paid to landlord is debited in landlord’s account Rs. 600.

- Purchase of Machinery from Precision Machinery Ltd. for Rs. 28,000 is recorded in purchase daybook. j

- Carriage paid on purchase of furniture Rs. 300 is debited in carriage account.

- Private expenses Rs. 200 is debited in Trade Expenses Account.

- Goods sold to Renjith for Rs. 500 has been wrongly recorded in purchase daybook.

- Purchase of furniture for the personal use of the proprietor of Rs. 920 has been debited in furniture a/c.

- Rs. 180 received from Salini has been credited in the account of Sajini.

Answer: