Kerala Plus One Accountancy Chapter Wise Questions and Answers Chapter 2 Theory Base of Accounting

Plus One Accountancy Theory Base of Accounting One Mark Questions and Answers

Question 1.

The rules and guidelines used in preparing accounting reports are called

(a) Accounting rules

(b) Basic rules

(c) Generally Accepted Accounting Principles

Answer:

(c) Generally Accepted Accounting Principles.

Question 2.

An accounting entity is an

(a) Accounting concept

(b) Accounting convention

(c) Modify Principle

Answer:

(a) Accounting concept

Question 3.

The Policy of ‘anticipate no profit and provide for all possible losses’ arises due to the convention of

(a) Matching

(b) Conservatism

(c) Consistency

Answer:

(b) Conservatism.

Question 4.

A business unit is assumed to have an indefinite life comes under

(a) Going concern concept

(b) Business entity concept

(c) Money Measurement Concept

Answer:

(a) Going concern concept

Question 5.

Contingent liabilities are usually shown as a footnote in the balance sheet as per the following accounting principles.

(a) Consistency

(b) Disclosure

(c) Materiality

Answer:

(b) Disclosure

Question 6.

During the lifetime of an entity, accounting produce financial statements in accordance with which basic accounting concept.

(a) Conservation

(b) Matching

(c) Accounting period

(d) None of these

Answer:

(c) Accounting period.

Question 7.

Revenue is generally recognised at the point of sale denote the concept of ……….

(a) Consistency

(b) Objectivity

(c) Revenue Realisation

(d) None

Answer:

(c) Revenue Realisation

Question 8.

Revenue recognition is an /a

(a) Assumption

(b) Principle

(c) Accounting standard

Answer:

(b) Principle.

Question 9.

Accounting standard deals with depreciation accounting is

(a) As-5

(b) As-16

(c) As-6

(d) As-9

Answer:

(c) As-6

Question 10.

The ……….. Principle requires that the same accounting method should be used from one accounting period to the next.

Answer:

Consistency.

Question 11.

Companies must prepare financial statement at least yearly due to the ………….. assumption.

Answer:

Accounting Period.

Question 12.

Accounting standards are issued by ………… in India.

Answer:

Institute of Chartered Accounts of India.

Question 13.

Accounting standards in India are formulated and governed by …………. which was set up in ………

Answer:

Accounting Standard Board (ASB), 1977.

Question 14.

SEBI stands for

Answer:

Securities and Exchange Board of India.

Question 15.

ICAI stands for

Answer:

The Institute of Chartered Accountants of India.

Question 16.

………….. and ………….. generally referred to as the essence of financial accounting.

Answer:

The accounting concepts and accounting standards.

Question 17.

Find the odd one and give a reason,

(a) Dual aspect

(b) Historical cost

(c) Accounting period

(d) Verifiability and objectivity.

Answer:

(c) Accounting period, it is ah accounting assumption, But all others are accounting principles.

Question 18.

Revenue from sale of products is realized when

(a) the sale is made

(b) the cash is collected

(c) the production is completed

(d) the order placed to supply goods.

Answer:

(a) The sale is made.

Question 19.

Accounting principles are generally based on

(a) Practicability

(b) Subjectivity

(c) Convenience in recording

Answer:

(a) Practicability

Question 20.

Normally assets are recorded at cost price. This because

(a) Assets can be realized at the time of winding up.

(b) Historical cost concept.

(c) Going concern concept

(d) All of these

Answer:

(d) All of these.

Plus One Accountancy Introduction to Accounting Two Mark Questions and Answers

Question 1.

Explain the cash system of accounting and the Mercantile system of accounting.

Answer:

Cash system or Receipt Basis:- Under this system, only actual cash receipts and payments are considered. Non-cash items such as outstandings, advances, and credit transactions are ignored. Mercantile system or Accrual Basis. Under this system, all items of income and expenditure, both cash items as well as non-cash items, such as outstanding and accrued incomes and expenses are taken into account.

Question 2.

1. Dual aspect concept – Two aspects of a transaction are recorded.

________________- Expected loss should be taken in to account.

2. Accounting Principles – Principles followed by accountants

___________________- Norms to be observed by the accountant

Answer:

- Principle of prudence or conservatism.

- Accounting Standards.

Question 3.

Explain IFRS.

Answer:

International Financial Reporting Standards (IFRS) are globally accepted accounting standards developed by the International Accounting Standard Board (IASB). IFRS is a set of accounting standards for reporting different types of business transactions and events in the financial statements. The objective is to facilitate international comparison for the true and fair valuation of a business enterprise.

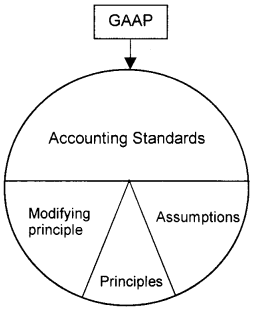

Question 4.

Complete the following circle.

Answer:

Question 5.

What is GAAP?

Answer:

Generally Accepted Accounting Principles and Practices (GAAP), is a set of rules and practices that are followed while recording transactions and in preparing the financial statements.

The accounting assumptions, principles and modifying principles, as well as accounting standards, form the foundation upon which GAAP is built.

Question 6.

“Information delayed is information denied ”. State the principle applicable behind this statement.

Answer:

‘Timeliness principle’:

Timeliness implies that the financial statements are to be prepared and published in time. The relevance, dependability, and utility of the financial information depends on the timely publication of financial statements. The users of financial statements needs timely information.

Question 7.

Fixed Assets are depreciated over their useful life rather than over a shorter period. State the relevant accounting assumption. Explain.

Answer:

‘Going Concern Assumption’:

According to this concept, business will continue its operation long enough to allocate the cost of fixed assets over their useful lives against the income.

Question 8.

Financial Information should be neutral and free from bias. Comment on this statement with reference to the relevant accounting Principle.

Answer:

‘Verifiability and objectivity principle’:

This principle states that the accounting data provided in the books of accounts should be verifiable and dependable.

Question 9.

The sales achieved by a salesman and the commission payable to him is recorded in the books of accounts. But the efficiency and intelligence of salesman is not recorded. Explain the reason with reference to the relevant accounting principle.

‘Money Measurement Concept’:

According to this concept, transactions that can be measured in terms of money only are recorded in the books of accounts. “The skill and intelligence of the salesman is not measurable in money terms.

Question 10.

Timely information, even if it is not cent percent reliable is better than reliable information which is late. Comment on this statement by quoting the accounting principle.

Answer:

‘Timeliness principle’:

Timeliness implies that the financial statements are to be prepared and published in time. The relevance, dependability, and utility of the financial information depends on the timely publication of financial statements. The users of financial statements need timely information.

Question 11.

‘Akash’ places an order on 1.1.2005 with Bino for the supply of machinery for Rs. 5,00,000/-. On receipt of the order, Bino purchases raw materials employ workers, produces machinery and delivers it to Akash on 1.2.2005. Akash makes the payment on 10.02.2005. On which date, the revenue is recognized? Substantiate your answer by quoting the relevant accounting concept. ‘Revenue Recognition Concept’.

Answer:

Revenue is recognized on 1.2.2005, i.e. when the title of goods passes from the seller to the buyer.

Question 12.

Star trading Co.Ltd. buys a piece of land for Rs. 50,00,000. After 2 years the value of land came to Rs. 70,00,000. But the accountant does not consider the increase in the value of Rs. 20,00,000 in the books of accounts and the land remains at Rs. 50,00,000 in the books. Do you agree with the accountant? If so, on what ground?.

Answer:

The accountant’s viewpoint is correct. This is based on the principle ‘Historical cost’. According to this principle, assets are to be recorded at their cost price and this cost is the basis for all subsequent accounting for those assets.

Question 13.

Mr. Muhammed, a sole trader, purchased a TV for Rs. 12,000/- for his domestic use and asks his accountant to record this as a business expense. But the accountant, argues that it is a violation of the accounting principle. Is he right? If so, prove your answer by highlighting the relevant accounting principle.

Answer:

The accountant’s viewpoint is correct because the business is separate from the businessmen as per the ‘‘Accounting Entity Concept”.

Question 14.

Provision for discount on debtors is accounted and provision for discount on creditors is not accounted. Why? State the relevant accounting principle.

Answer:

Accountant anticipates no profit but provide for all possible losses while recording business transaction. Conservatism principle or prudence.

Question 15

Name the systems of recording transactions in the book of accounts.

Answer:

- Double Entry System.

- Single Entry System.

Plus One Accountancy Introduction to Accounting Three Mark Questions and Answers

Question 1.

When a Proprietor purchased furniture at Rs. 10,000 for business purposes, he paid transportation and load¬ing charges of Rs. 1000 for bringing the furniture to the location of business premises. State whether it is possible to add the transportation and loading charges to the purchased price of furniture? What is the underlying principle behind it?

Answer:

1. Yes, it is possible to add transportation and loading charges to the purchased price of furniture.

2. “Historical cost principle” – This principle requires that all transactions should be recorded at their acquisition cost. The cost of acquisition refers to the cost of purchasing the asset and expenses incurred in bringing the assets to the intended condition and location of use.

Question 2.

Mr. Rajan Thomas invested Rs. 5,00,000 in his business. He is treated as a creditor to the extent of Rs. 5,00,000 by the business. Write the relevant accounting assumption and explain it.

Answer:

Accounting Entity Assumption:

This concept assumes that the entity of business is different from its owners. According to this concept, all the transactions of the business are recorded in the books of the business from the point of view of the business as an entity and even the owner is treated as a creditor to the extent of his capital.

Question 3.

An accountant followed a particular method of accounting in one year and in the next year he changes the method. Is it possible to get a better idea about the operation of the business?

Answer:

According to the Principle of “Consistency”, the frequent change in the accounting policies will adversely affect the reliability and comparability of financial information. The users of the financial statements assume that the business unit follows the same accounting principles and practices in preparing the financial statement.

If a change is adopted the business enterprises is required to record the fact as footnotes and to show the impact of such changes on financial affairs.

Question 4.

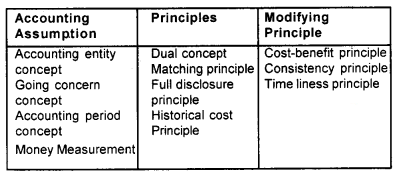

Classify the following into accounting assumptions, principles and modifying principles Accounting entity concept, dual concept, Money Measurement, Matching Principles, going concern concept, Accounting period concept, cost-benefit principle, consistency principle, Full disclosure principle, Timeliness, Historical cost principle.

Answer:

Question 5.

“Proprietor is treated as creditor to the extent of his capital.”

- Write the relevent accounting assumption

- Explain the concerned accounting assumption in relation to the statement given.

Answer:

Accounting Entity Assumption:

This concept assumes that the entity of business is different from its owners. According to this concept all the transactions of the business are recorded in the books of the business from the point of view of the business as an entity and even the owner is treated as a creditors to the extent of his capital.

Question 6.

“For every debit, there is an equal and corresponding Credit”.

- Explain the statement by citing an example.

- State the relevant accounting principle.

Answer:

1. “Every transaction has dual aspect i.e. debit and credit”.

For example Anish started business with Rs. 20,000. The effect of this transaction is that

- It increases cash (asset) Rs. 20,000.

- It increases capital Rs. 20,000.

The above transaction can be shown in the form of an accounting equation as follows Assets = Liabilities = Capital 20,000 = 0 + 20,000.

2. Duality Principle.

Question 7.

When should revenue be recognised? Are there exceptions to the general rule?

Answer:

Revenue is assumed to be realised when a legal right to receive it arises in the point of time when goods have been sold or services has been rendered. There are certain exceptions to the general rule of revenue realisation.

- In the case of construction projects, revenue is realised before the contract is complete.

- When the goods are sold on hire purchase, the amount collected in instalments is treated as realised.

Plus One Accountancy Introduction to Accounting Four Mark Questions and Answers

Question 1.

Mr. Damodar has confusion about the basic accounting assumptions. Can you help him to solve his confusion?

OR

Basic accounting assumption provides a foundation for the accounting process. Explain the Various accounting assumptions.

Answer:

Assumptions constitute the foundation of accounting. It lays down the general principles to be followed while preparing financial statements. There are four accounting assumptions. They are

- Accounting Entity Assumption.

- Money MeasurementAssumption

- Going Concern Assumption

- Accounting Period Assumption

1. Accounting Entity Assumption:

This concept assumes that the entity of business is different from its owners. The business is treated as a unit or entity separate from the person who control it. The proprietor is treated as a creditor to the extent of the amount invested by him on the assumption that he has given money and the business has received it.

2. Money MeasurementAssumption:

According to this concept, transaction that can be measured in terms of money only are recorded in the books of accounts. This helps to record different kinds of economic activities on a uniform basis. A business may have certain events that actually influence its working but is not capable of being expressed in monetary terms and hence, not record in the books of accounts. For eg: quality of products, sales policy, efficiency of M.D., etc.

3. Going Concern Assumption:

According to this concept, the business unit is assumed to have an indefinite life. There is no intention to wind up or end the business in the near future. Thus, considering the business as a perpetual one, its records are separately kept and maintained.

4. Accounting Period Assumption:

Under this concept, the accountings are done on a day-to-day basis are analysed for a particular period to find out the net results of the business as well as the financial position on a specific date.

Plus One Accountancy Introduction to Accounting Six Mark Questions and Answers

Question 1.

As an Accountant, explain the accounting principles you followed while preparing accounting records. Accounting principles are the general rules which govern the accounting techniques. The following are the major principles used in the accounting procedure.

1. Duality Principle:

According to this concept, each and every business transaction has two aspects- a giving aspect and a receiving aspect. The giving aspect of a transaction is called ‘credit’ and the receiving aspect of a transaction is called ‘debt’. Based on the duality principle, accounting equation is developed, ie; Asset = Liabilities + Capital.

2. Historical Cost Principle:

This principle requires that all transactions should be recorded at their acquisition cost. This principle is called historical, because the balance of assets and liabilities is carried forward from year to year to its acquisition cost, irrespective of increase or decrease in the market value of assets.

3. Matching Principle:

Under this concept, all the expenses, as well as the revenues of a particular period, should be accounted or otherwise it should be matched. In other words, it is the process of matching the revenue recognised during the period and the costs should be allocated to the period to obtain the revenue.

4. Full disclosure Principle:

This principle states that all information significant to the users of financial statements should be disclosed. It requires that all facts necessary to make financial statements not misleading must be disclosed.

5. Revenue Recognition Principle:

Revenue is the amount that a business earns through sale of goods or services. This principle helps in ascertaining the amount of revenue and the point of time at which it was realized. This principle is also called revenue realisation principle.

6. Verifiability and Objectivity Principle:

This principle states that the accounting data provided in the books of accounts should be verifiable and dependable. The figures exhibited in the financial statements should have supportive evidence such as bills, vouchers, etc. The evidence substantiating the business transaction should be objective, i.e., free from the bias of the accountants or others.

Question 2.

Explain modifying principles of accounting?

Answer:

There are certain general conventions or principles which supplement the basic principles for the preparation of accounting records and financial statements. They are called modifying conventions or principles. The important modifying principles are:

- Cost-Benefit

- Materiality

- Consistency

- Prudence or conservatism

- Timeliness

- Substance over legal form

- Variation in accounting practices.

1. Cost-Benefit Principle:

This principle is a generally accepted norm that the cost of doing anything must not exceed the possible benefit that may be derived. This is applicable in the case of accounting also. Money spent for undertaking accounting work should definitely provide more benefit than the cost incurred.

2. Materiality Principle:

Materiality means relevance or importance or significance. As per this principle all material facts should be disclosed in the financial statements, but insignificant and immaterial facts need not be disclosed in details. For example, purchase of items like pen, pencil, scissors etc. are to be recorded as assets but practically these items are treated as expenses under the head stationary.

3. Consistency Principle:

Consistency means steadiness or unchanging nature. Accounting policies and practices adopted must be consistent for relatively reasonable period of time. The comparison of the financial statements of one year with that of another year will be effective and meaningful only if accounting practices and methods remain unchanged over year.

4. Conservatism or Prudence Principle This principle:

calls for losses while recording accounting information but at the same time does not permit anticipation of profits. This principle implies that while preparing financial statements all possible losses are to be provided for but incomes can be recognized only when there is certainty. It is base on the principle of prudence that stock is valued at market price or cost price whichever is less and provision is provided for doubtful debts.

5. Timeliness principle:

Timeliness implies that the financial statements are to be prepared and published in time. The relevance, dependability, and utility of the financial information depends on the timely publication of financial statements. The users of financial statements need timely information.

6. Principle of Substance over legal form:

This principle states that transactions and financial events are accounted for and presented in accordance with their substance and economic reality and not merely their legal form.

7. Variation in Accounting practices:

For the preparation of financial statements, the business enterprises are following certain specific guidelines and practices which are called generally accepted accounting principles and practices (GAAP). Certain industries may sometimes deviate from GAAP because of the peculiarity of its operation and practices.

Plus One Accountancy Introduction to Accounting Eight Mark Questions and Answers

Question 1.

What do you mean by Accounting standards? Name the accounting standards issued by ASB.

Answer:

An Accounting standard is a selected set of accounting policies or broad guidelines regarding the principles and methods to be chosen out of several alternatives. Standard conforms to applicable laws, customs, usage and business environment. In India, the Accounting standard Board (ASB) has the authority of issuing Accounting standards.

The sole objective of Accounting standards is to harmonize the diversified policies to make the system more useful and effective. They lay down the norms of accounting policies and practices byway of codes or guidelines to direct as to how the items appearing in the financial statements should be dealt with in the books of account and shown in the financial statements and annual reports.

The ASB has issued 29 accounting standards. They are as follows:

- AS 1 – Accounting Standard 1 – Disclosure of Accounting Policies.

- AS 2 – Accounting Standard 2 – Valuation of Inventories

- AS 3 – Accounting Standard 3 – Cash Flow Statements

- AS 4 – Accounting Standard 4 – Contingencies and Events occurring after the Balance sheet date.

- AS 5 – Accounting Standard 5 – Net Profit or Loss for the period, prior period items and changes in accounting policies

- AS 6 – Accounting Standard 6 – Depreciation Accounting.

- AS 3 – Accounting Standard 7 – Accounting for Construction Contracts

- AS 8 – Accounting Standard 9 – Accounting for Research and Development

- AS 9 – Accounting Standard 9 – Revenue Recognition

- AS 10-Accounting Standard 10-Accounting for Fixed Assets

- AS 11 -Accounting Standard 11 -Accounting for the effects of changes in Foreign exchange rates

- AS 12 – Accounting Standard 12 -Accounting for Government grants

- AS 13-Accounting Standard 13-Accounting for Investments

- AS 14 – Accounting Standard 14 – Accounting for Amalgamations

- AS 15-Accounting Standard 15-Accounting for Retirement Benefit in the Financial statements of Employers

- AS 16 – Accounting Standard 16 – Borrowing costs

- AS 17 – Accounting Standard 17 – Segment Reporting

- AS 18 – Accounting Standard 18 – Related party Disclosures

- AS 19 – Accounting Standard 19 – Leases

- AS 20 – Accounting Standard 20 – Earning per share

- AS 21 – Accounting Standard 21 – Consolidated financial statements

- AS 22 – Accounting Standard 22 – Accounting for taxes on income

- AS 23 – Accounting Standard 23 – Accounting for investments in associates in consolidated financial statements

- AS 24 – Accounting Standard 24 – Accounting for discontinued operations

- AS 25 – Accounting Standard 25 – Interim Financial Reporting

- AS 26 – Accounting Standard 26 – Intangible Assets

- AS 27 – Accounting Standard 27 – Financial Reporting of interests in joint ventures.

- AS 28 – Accounting Standard 28 – Impairment of assets

- AS 29 – Accounting Standard 29 – Provisions, contingent liabilities, and contingent assets