Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 9 Accounts from Incomplete Records

Question 1.

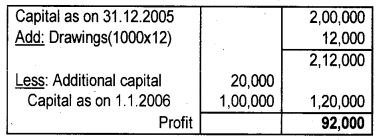

Joseph started his textile shop on 1 st January, 2005 with a capital of Rs. 1,00,000. During the year he introduced Rs. 20,000 as additional capital and his withdrawal was of Rs. 1000 per month.

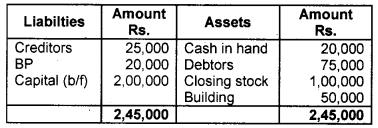

On 31st December, 2005, his position is as follows: Cash in hand Rs. 20,000; Debtors Rs. 75,000; Closing stock Rs. 1,00,000; Building Rs. 50,000; Creditors Rs. 25,000; Bills payable Rs. 20,000. Calculate the profit earned by Joseph in the year 2005. (March 2010)

Answer:

Statement of Affairs as on 31.12.2005

Statement of Profit/Loss

Question 2.

The closing balance of creditors can be ascertained from the ________ (March 2010)

a) Cash account

b) Balance Sheet at the end of the year.

c) Total creditors account

Answer:

c) Total Creditors Account

Question 3.

The amount of credit sale is determined by preparing a total creditors account. (March 2010)

Answer:

False, The amount of credit sale is determined by preparing a total Debtor’s Account.

Question 4.

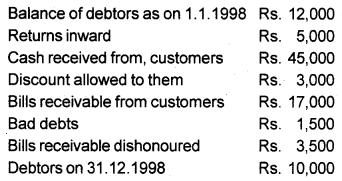

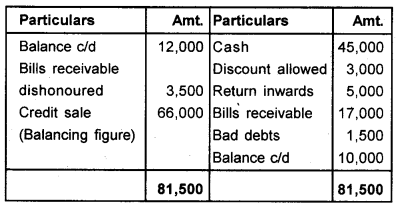

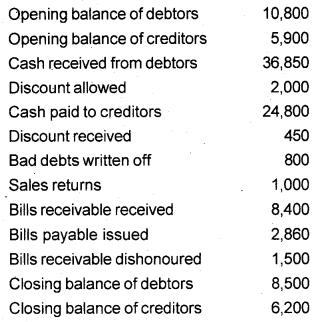

From the following information find out the credit sales: (March 2010)

Answer:

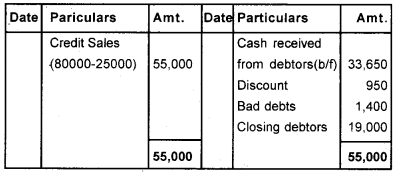

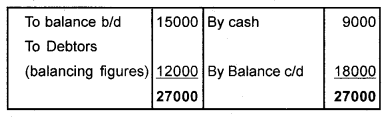

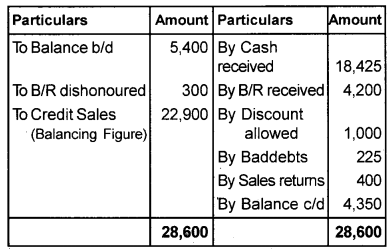

Total Debtors Account

Question 5.

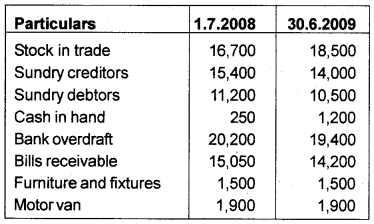

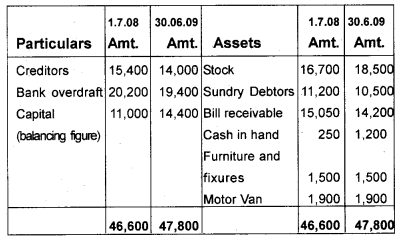

A retail trader had not kept proper books of account but from the following details, you are required to ascertain the profit or loss for the year ended 30th June, 2009 and also to prepare a statement of affairs as on that date. (March 2010)

The drawings during the year amounted to Rs. 2,600. Depreciate furniture by 10% and write off Rs. 300 on motor van. As regards to the debtors, it is ascertained that Rs. 500 are irrecoverable and create a further reserve of 5% for bad and doubtful debts. Also create a reserve of Rs. 700 with respect to bills receivable. (March 2010)

Answer:

Statement of Affairs as on 1/7/2008 & 30/6/2009

Statement of Profit or Loss for the year ended 30/6/2009

Question 6.

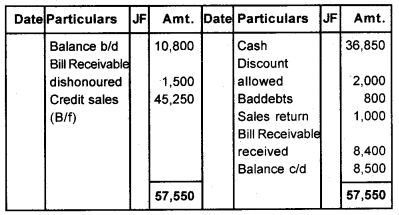

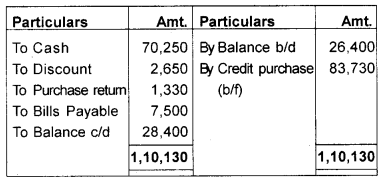

Ascertain the credit sales and purchase from the following figures: (March 2011)

Answer:

Total Debtors A/c

Total Creditors A/c

Question 7.

Statement of affairs is prepared to find out the ________ (March 2011)

a) assets and liabilities

b) capital

c) purchases and sales

Answer:

a) Assets and liabilities OR b) capital

Question 8.

Pooja started her business with Rs. 75,000 and she further introduced Rs. 10,000 while she withdrew Rs. 23,000 for her personal use. The capital at present will be Rs. _______ (March 2011)

Answer:

Rs. 62,000 ie (75,000 + 10,000 – 23,000)

Question 9.

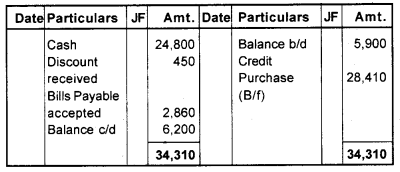

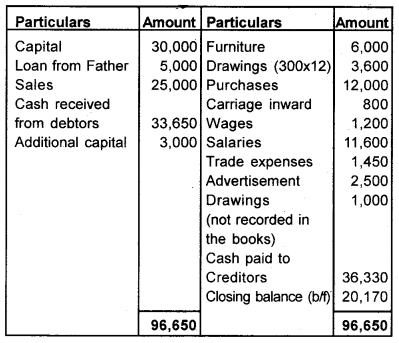

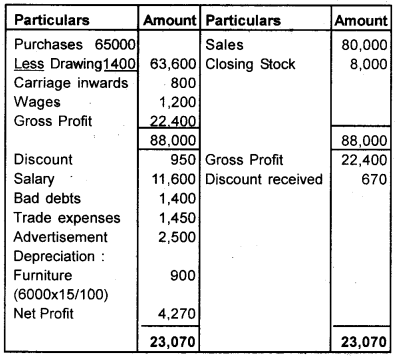

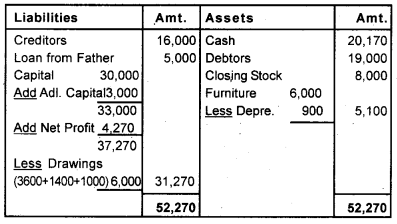

Mr. Kumar commenced business on 1-1-2009 with a capital of Rs. 30,000. On the same day, he bought furniture for Rs. 6,000. During the year, he borrowed Rs. 5,000 from his father for business purposes and introduced further capital of Rs. 3,000. He had withdrawn Rs. 300 at the end of every month for domestic use. From the following particulars obtained from his books, prepare the Trading and Profit & Loss account for the year ending 31-12-2009 and the Balance Sheet on that date. (March 2011)

Mr. Kumar has used goods worth Rs. 1,400 for his private purpose and paid Rs. 1,000 to his son, but not recorded it in the books. On 31-12-2009, his debtors were Rs. 19,000 and creditors were Rs. 16,000. Stock on that date was valued at Rs. 8,000. Furniture is to be depreciated at 15% p.a.

Answer:

Total Debtors A/c

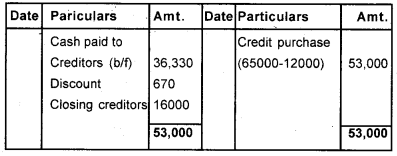

Total Creditors A/c

Cash Account

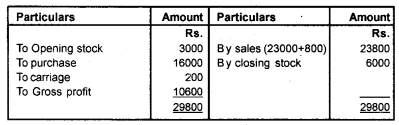

Trading and Profit & Loss A/c for the year ended 31-12-2009

Balance Sheet as on 31/12/2009

Question 10.

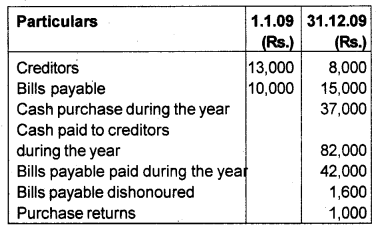

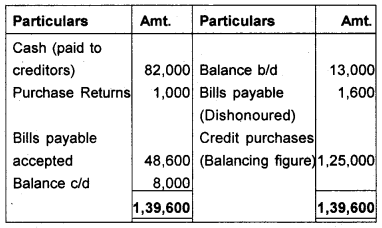

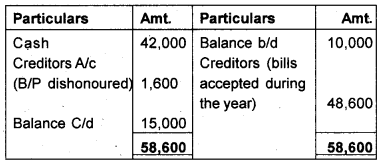

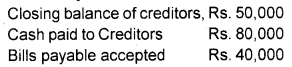

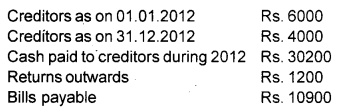

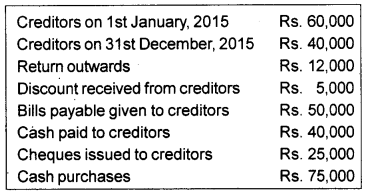

From the following information, find out: (March 2012)

a) Credit purchase by preparing the total Creditors A/c.

b) Total purchase.

Answer:

Total Creditors A/c

Bill Payable A/c

Total purchase = Cash Purchases + Credit Purchases

= 37,000 + 1,25,000

= 1,62,000

Question 11.

If stock at the beginning or at the end is missing, the same can be ascertained with the help of _________ (March 2012)

a) debtors account

b) creditors account

c) statement of affairs

d) Memorandum of Trading Account

Answer:

c) Statement of affairs

or

d) Memorandum of Trading Account

Question 12.

Mr. Sumesh is a retailer whose records are incomplete. You are required to ascertain his profit or loss for the year ended 31S1 December 2011 from the following details. (March 2012)

Answer:

Statement of Profit or Loss for the year ended 31-12-2011

Question 13.

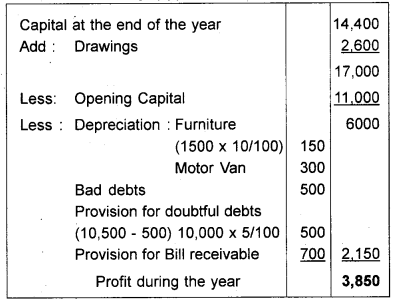

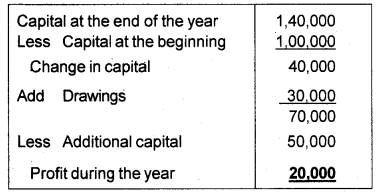

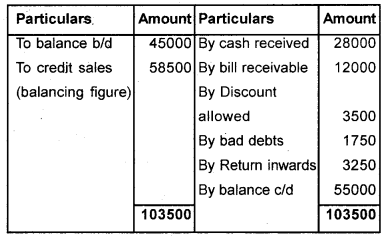

From the following particulars prepare: (Say 2012)

A) Total debtors account and find out credit sales.

B) Total creditors account and find out credit purchases.

C) Bills receivable account.

D) Bills payable account.

Transactions during the year

Cash received from Debtors ₹ 28000, Cash received against bills receivables ₹ 9,000.

Cash paid to suppliers ₹ 13000, Cash sales ₹ 18000, Cash purchases ₹ 12000.

Cash paid against bills payable ₹ 3150, Discount allowed to debtors ₹ 3500, Bad debts are written off ₹ 1,750.

Return inwards ₹ 3250, Discount received from suppliers ₹ 3150, Return outwards ₹ 1,900, Bills payable dishonoured ₹ 750.

Answer:

Total Debtors a/c

Bill Receivable A/c

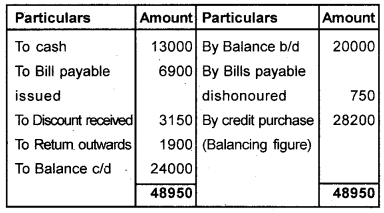

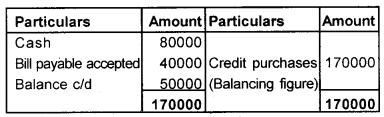

Total Creditors A/c

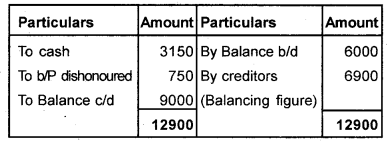

Bill Payable A/c

Question 14.

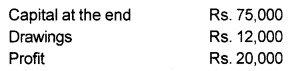

Calculate the Capital at the beginning. (Say 2012)

Answer:

Capital at the beginning = (75,000 + 12,000) – 20,000 = 67,000/-

Question 15.

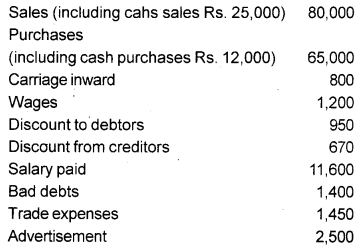

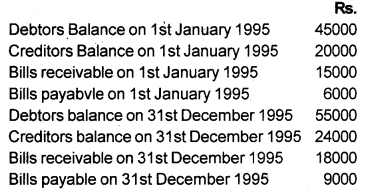

Mr. Kiran, a sole trader does not keep full records of books of accounts. However, the following information is available. You are required to calculate Credit Sales and Credit Purchases by preparing the Total Debtors Account and Total Creditors Account. Also, show the Bills Receivable A/c and Bills Payable A/c. (Say 2012)

Balance on 1st January 2010

Balance on 31st December, 2010

Answer:

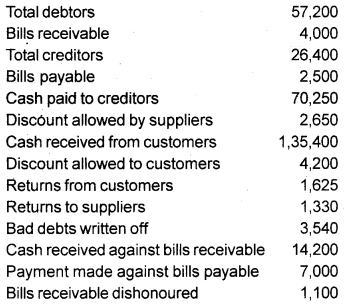

Bills Receivable A/c

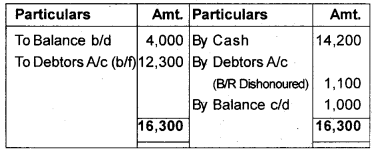

Total Debtors A/c

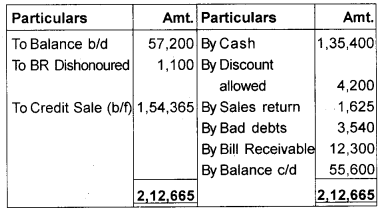

Bills Payable A/c

Total Creditors A/c

Question 16.

Ascertain the amount of total credit purchases from the following. (March 2013)

Answer:

Total Creditors A/c

Question 17.

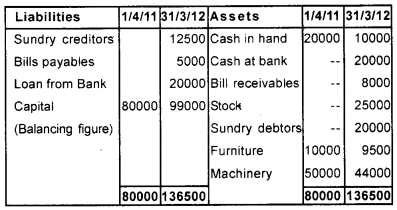

Mr. Sankaran commenced business on 1st April 2011 with cash Rs. 20,000, furniture Rs. 10,000 and machinery Rs. 50,000. On 1st January 2011, he introduced Rs. 20,000 into the business. He withdrew @ Rs. 1,000 per month. His financial position as of 31.3.2012 was as follows. Ascertain the profit for the year ending 31.3.2012. (March 2013)

Assets: Stock Rs. 25,000; sundry debtors Rs. 20000; mahcinery Rs.44,000; cash at bank Rs. 20,000; cash in hand Rs. 10,000; bills receivable Rs. 8,000 and furniture Rs. 9,500.

Liabilities: Sundry creditors Rs. 12,500; loan from bank Rs. 20,000; bills payable Rs. 5000.

Answer:

Statement of Affairs as on 01/04/2011 and 31/3/2012.

Statement of Profit and Loss for the year ended 31.3.2012

Question 18.

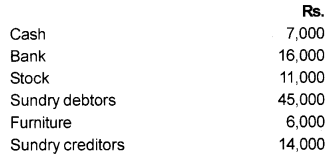

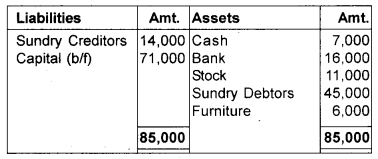

Prasad kept his books under the single entry system. His position as on 31-12-2012 was as follows. (March 2013)

His capital account shows a credit balance of Rs. 54,000 as on 01-01-2012. He introduced an additional capital of Rs. 5,000 during the financial year. He withdrew Rs. 10,000 for personal purposes. As certain his profit for the year ended 31-12-2012.

Answer:

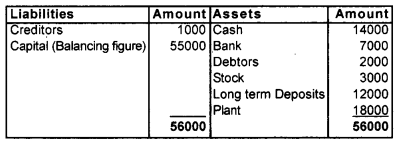

Statement of Affairs as on 31 -12-2012

Statement of Profit or Loss for the year ended 31/12/2012

Question 19.

If the opening capital is less than the closing capital, provided there are no adjustment, the result is _________ (March 2014)

a) a profit

b) a loss

c) drawings

d) expenses

Answer:

a) Profit

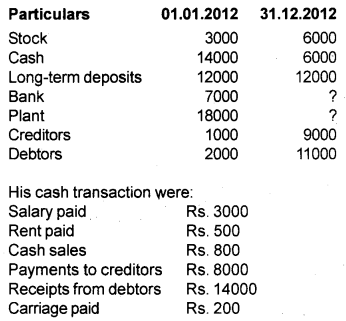

Question 20.

From the following information, find the amount of credit purchase. (March 2014)

Answer:

Total Creditors A/c

Question 21.

The profit or loss under the single entry system is found by/on _______ basis. (March 2014)

a) An estimate

b) Drawing the profit and loss account

c) Drawing the balance sheet

d) the double-entry system

Answer:

a) An estimate

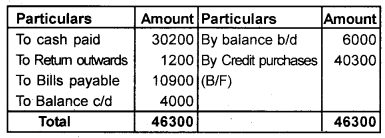

Question 22.

Jaya brothers ¡s a sole trader who invested Rs. 10,000 on 01 .01 .2012 in his business and the same was found at Rs. 18000 at the end of the accounting year. He also withdrew Rs. 6,000 for his private use. Ascertain his profit for the year. (March 2014)

Answer:

Statement of profit/loss for the year ended _______

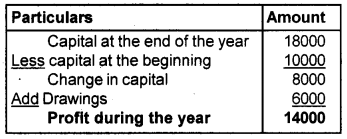

Question 23.

Mr. John, who does not follow the double-entry system gives you the following details for the period ended 31.12.2012. (March 2014)

Other information:

a) Depreciate plant by 10%.

b) Salary outstanding Rs. 1000.

You are asked to prepare the Profit and Loss Account and the Balance Sheet as of 31.12.2012.

Answer:

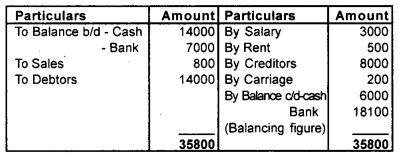

Statement of Affairs as on 01.01.2012

Cash Book

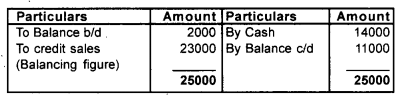

Total Debtors A/c

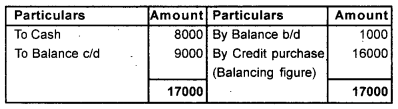

Total Creditors A/c

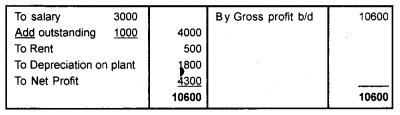

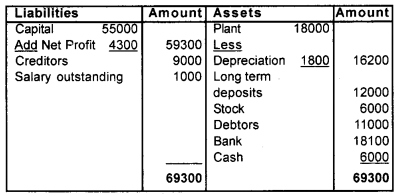

Trading and Profit & Loss A/c for the year ended 31.12.2012

Balance Sheet as on 31.12.12

Question 24.

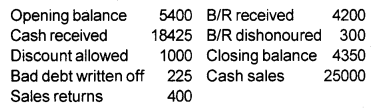

From the given information find the following: (March 2015)

a) Credit sales by preparing the total Debtors account

b) Ascertain the total sales.

Answer:

Total Debtors Account

b) Total Sales = Cash sales + Credit sales

= 25,000 + 22,900

= 47,900

Question 25.

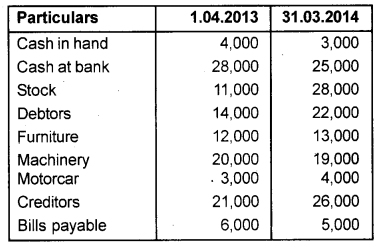

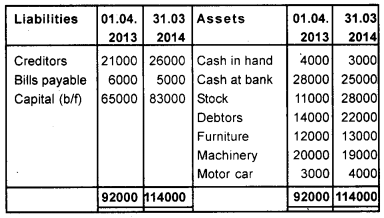

Mr. Thomas keeps his books under the single entry system. On 1 st April 2013, his records indicated the following assets and liabilities. (March 2015)

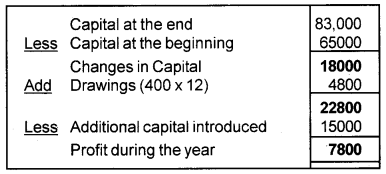

During the year, he introduced Rs. 15000 as further capital and withdrew Rs. 400 every month. Calculate the profit or loss made by him during the year by using the statement of affairs method.

Answer:

Statement of Affairs as of 1/04/2013 & 31/03/2014

Statement of Profit or Loss for the year ended 31/3/2014

Question 26.

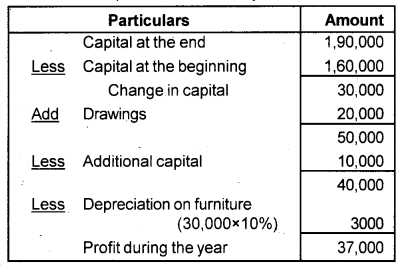

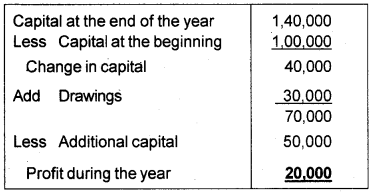

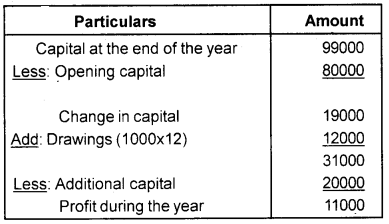

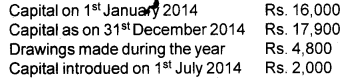

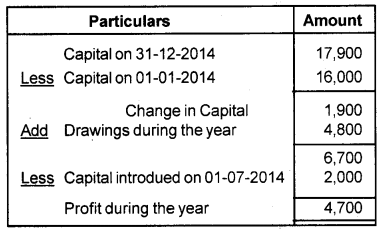

Ascertain the profit from the following: (March 2015)

Answer:

Statement of profit/loss

Question 27.

Credit purchases are calculated by preparing ________ (March 2015)

a) Total Debtors account

b) Total Creditors account

c) Bills Receivable account

d) Bills Payable account

Answer:

b) Total Creditors Account

Question 28.

Which of the following cannot be a posting on the credit side of the debtor’s account? (Say 2015)

a) Discount allowed

b) Bad debts

c) Credit sales

d) Cash received

Answer:

c) Credit sales

Question 29.

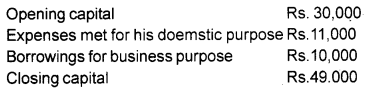

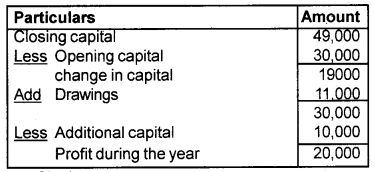

Abu does not follow any perfect system of accounting. He gives you the following information. (Say 2015)

a) Ascertain the net profit

b) What method have you employed for profit computation?

Answer:

a) Statement of Profit or Loss

b) Single entry system

Question 30.

The following information was extracted from the book of Mr. Raveendran, who maintains a single entry system, for the year ending 31st December 2015. (March 2016)

a) Calculate total purchase made by Mr. Raveendran during the year 31st December 2015.

b) While preparing the final account, from where did he get the value of opening capital and expenses made during the year?

Answer:

a) Total creditors A/c

Total purchase = 75,000 + 12,000 = 1,87,000

b) i) Opening capital is calculated by preparing statement of affairs.

ii) Expensens from cash book or cash summary.

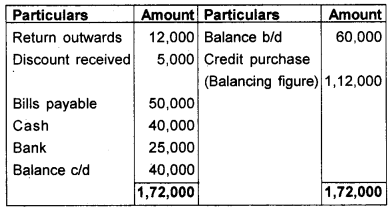

Question 31.

Consider the following information from the books of Mr. Sidique. (March 2016)

a) Profit for the year Rs.60,000

b) Additional capital introduced by him Rs. 50,000

c) Drawings by him this year Rs. 30,000

d) Capital at the end of the year Rs. 2,00,000

Find the capital contributed by him at the beginning of the year.

Answer:

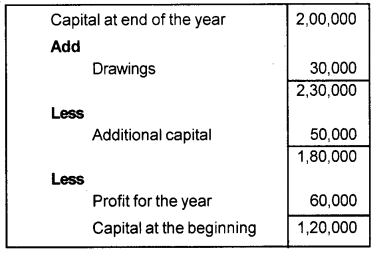

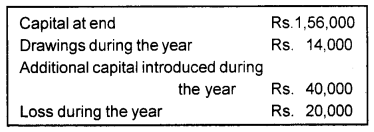

Question 32.

Find the capital at the beginning, from the following information. (Say 2016)

Answer:

Capital at the beginning = Capital at the end + Drawings + Loss during the year – Additional capital

= 1,56,000 + 14,000 + 20,000 – 40,000

= 1,50,000

Question 33.

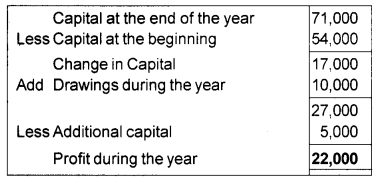

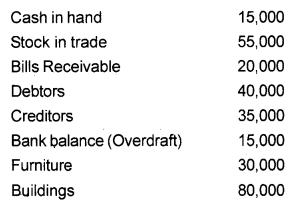

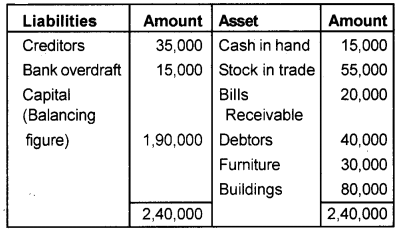

Vimal started a business on 1st January 2014 with an investment of Rs. 1,60,000. He does not maintain proper books of accounts for his business. During the year 2014, he withdrew Rs. 20,000 for personal use and introduced Rs. 10,000 as fresh capital. His position of assets and liabilities as of 31st December 2014 stood as follows. (March 2017)

Prepare a statement of Profit or Loss for the year ended 31st December. 2014, provided that depreciation on furniture is to be charged at 10%.

Answer:

Statement of Affairs as on 31/12/2014

Statement of profit or loss for the year ended 31/12/14