Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 8 Financial Statements – I & Financial Statements – II

Question 1.

Outstanding salaries are shown as _______ (March 2010)

a) Assets

b) Liabilities

c) Capital

d) Expense

Answer:

b) Liabilities

Question 2.

Goods given as samples should be credited to ________ (March 2010)

a) Advertisement account

b) Sales account

c) Purchase account

d) None of these

Answer:

c) Purchase Account

Question 3.

State whether the following is “true” or “false”. If false, correct the same. (March 2010)

Loss of stock on account of fire should be debited to the Trading account.

Answer:

False. It should be debited to P/L a/c or credited to Trading A/c.

Question 4.

Sales are equal to _________ (March 2010)

a) cost of goods sold + profit

b) cost of goods sold – gross profit

c) gross profit – the cost of goods sold

Answer:

a) cost of goods sold + profit

Question 5.

Income tax paid by a sole proprietor on his business income should be ________ (March 2010)

a) debited to the trading account.

b) debited to the profit and loss account.

c) deducted from the capital account in the balance sheet

Answer:

c) Deducted from the capital account in the balance sheet

Question 6.

If a closing stock appears in the Trial Balance, it will appear in the _______ only. (March 2010)

Answer:

Balance Sheet

Question 7.

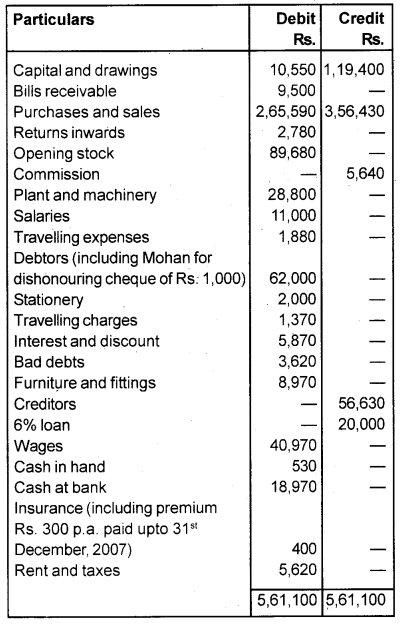

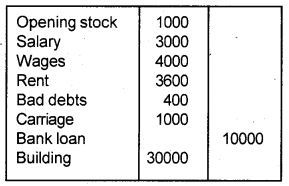

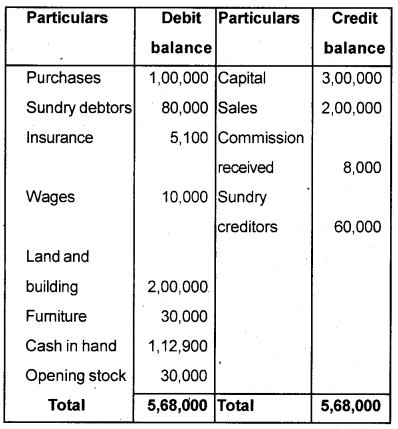

a) The following is the Trial Balance of Mr. Laxmi Narayan as of 30th June 2007. (March 2010)

Adjustments:

a) Stock in hand on 30th June, 2007 was Rs. 1,28,960.

b) Write off half of Mohan’s cheque.

c) Create 5% provision on debtors.

d) Wages include Rs. 1,200 for erection of machine purchased last year.

e) Depreciate plant and machinery by 5% and fixtures and fitting by 10% per year.

f) Commission accrued Rs. 600.

g) Interest on loan for the last two months is not paid.

You are required to prepare the Trading and Profit & Loss Account and also a Balance Sheet as on 30.6.2007.

Answer:

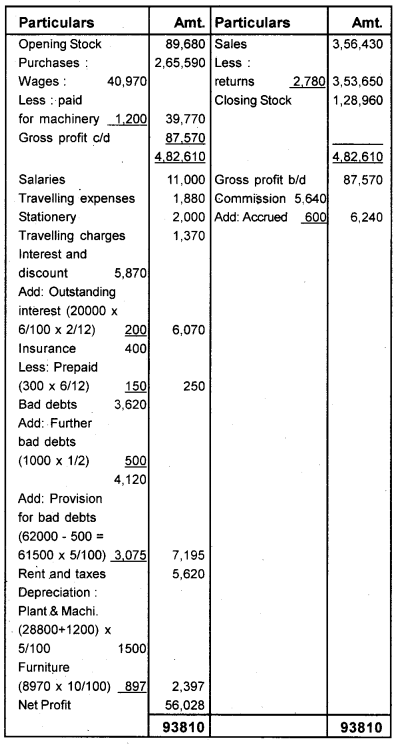

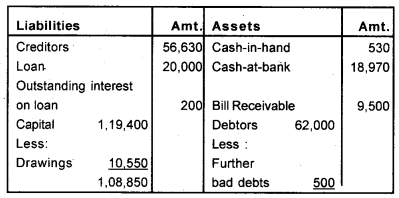

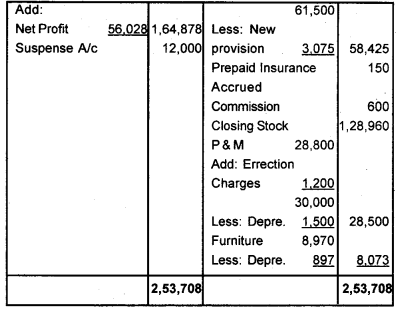

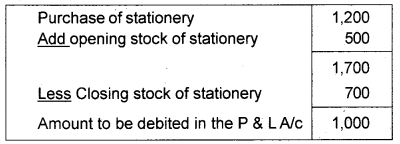

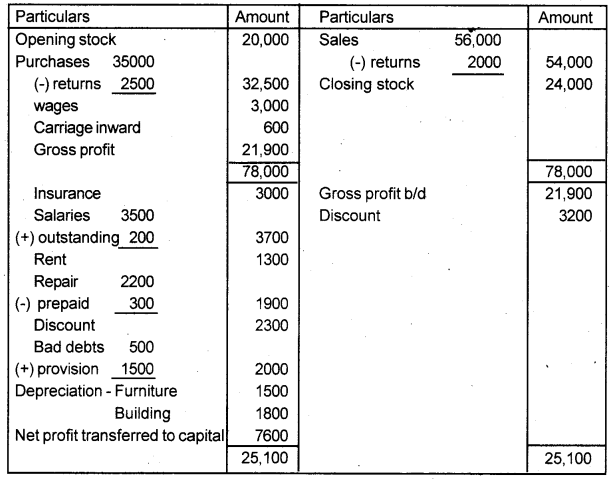

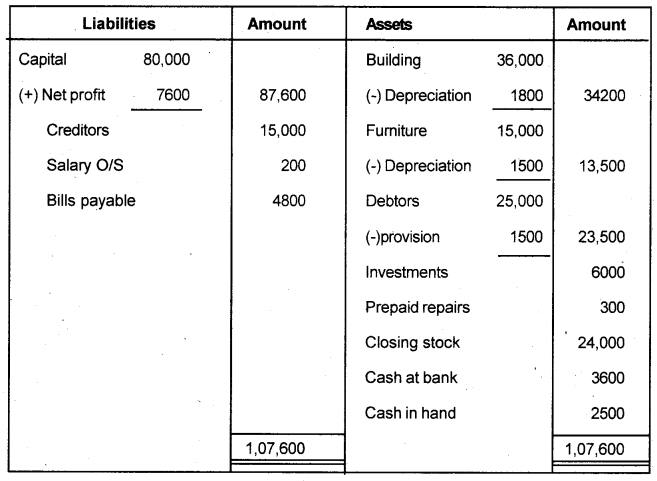

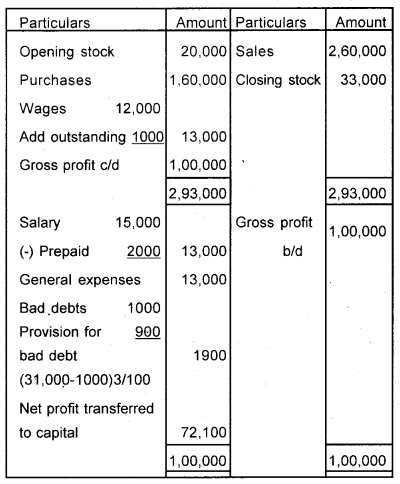

a) Trading and Profit and Loss Account of Mr. Lijin for the year ended 31st Dec. 2005

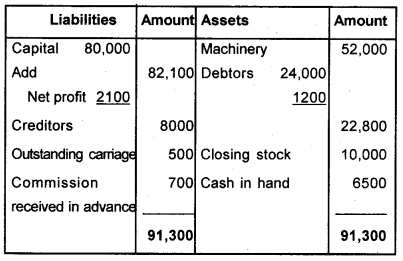

Balance Sheet as on 30/6/2007

Question 8.

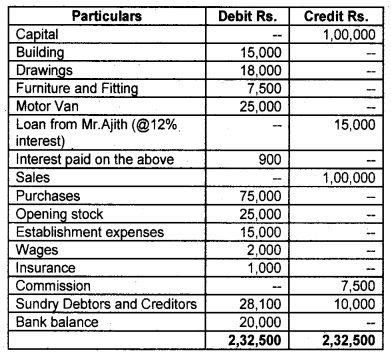

Following is the Trial Balance of M/s. Kasthuri Agencies on 31st March, 2008. Prepare the Trading and Profit and Loss Account for the year ended 31st March, 2008 and a Balance Sheet on that date, after considering the adjustments. (March 2010)

Adjustments:

a) The value of closing stock on 31st March, 2008 was Rs. 32,000.

b) Outstanding wages Rs. 500.

c) Pre-paid insurance Rs. 300.

d) Commission received in advance Rs. 800.

e) Allow interest on capital @ 10% p.a.

f) Depreicate building by 2.5%, furniture and fittings by 10%.

g) Charge interest on drawing Rs. 500. Motor van by 10%.

h) Balance of interest due on loan is also to be provided for.

Answer:

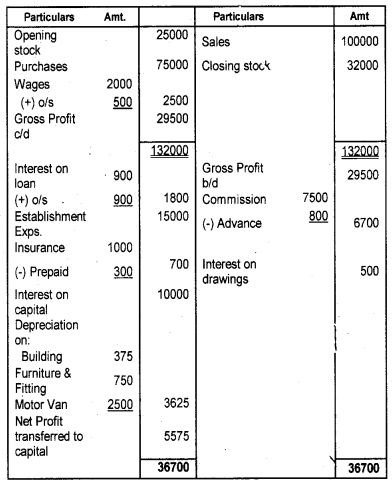

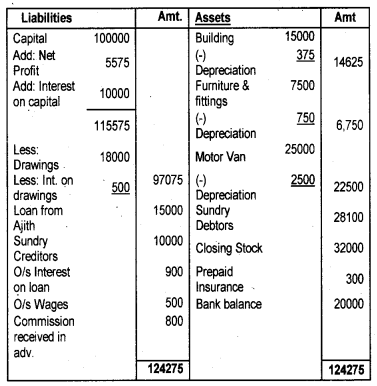

Trading and Profit and Loss Account for the year ended 31.03.08

Balance Sheet as on 31.03.2008

Question 9.

_______ can be computed by deducting the cost of goods sold from sales. (March 2011)

a) Net profit

b) Gross profit

c) Net sales

d) Operating profit

Answer:

b) Gross profit

Question 10.

State whether the following is “true” or “false”. If false, correct the same. (March 2011)

Sales = cost of goods sold + profit

Answer:

True

Question 11.

State whether the following is “true” or “false”. If false, correct the same. (March 2011)

If closing stock appears in the Trial Balance, it will appear in the Trading account only.

Answer:

False, If closing stock appears in the Trial Balance, it will appear in the “Balance sheet” only.

Question 12.

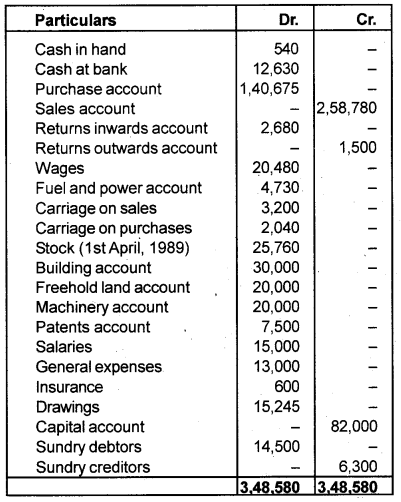

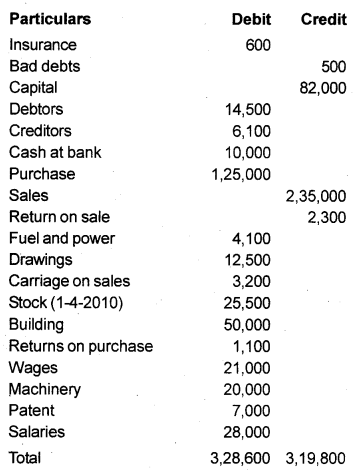

The following is the Trial Balance of Mr. B. Govind on 31st March, 1990. (March 2011)

Taking into account the following adjustments, prepare the Trading and Profit and Loss account and the Balance Sheet for the year ended 31 st March, 1990.

a) Stock in hand on 31st March, 1990 was Rs. 26,800.

b) Machinery is to be depreciated at the rate of 10% and patent at the rate of 20%.

c) Salaries for the month of March, 1990 amounting to Rs. 1,500 were unpaid.

d) Insurance includes a premium of Rs. 170 on a policy expiring on 30th September, 1990.

e) A provision for bad and doubtful debts is to be credited to the extent of 5% on sundry debtors.

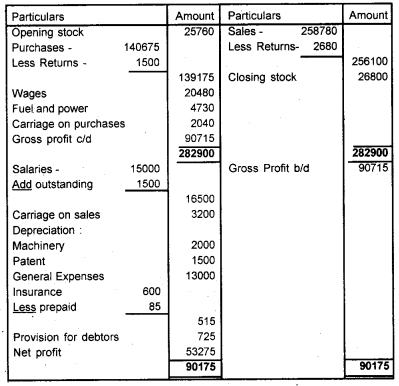

Answer:

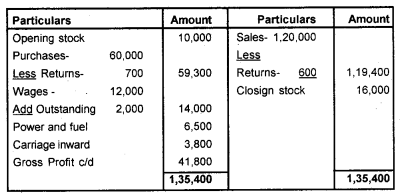

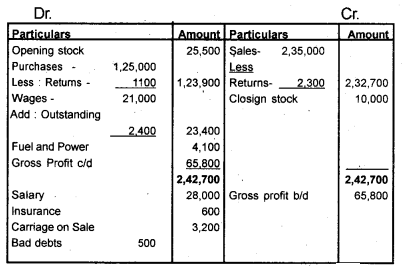

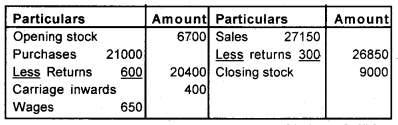

Trading and Profits & Loss Account of Mr. B. Govind for the year ended 31/03/1990

Note: Insurance prepaid = 170 × 6/12 = 85. (April 1990 to September 30th)

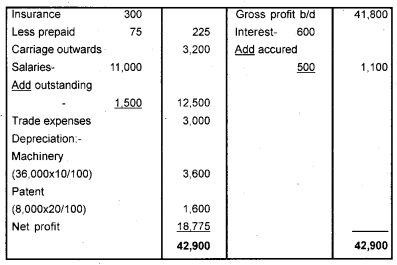

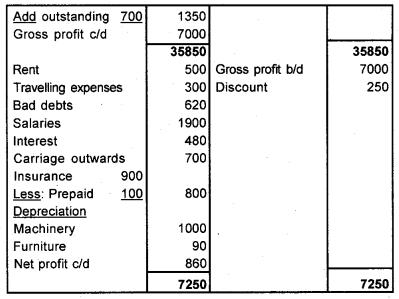

Balance Sheet as on 31/03/1990

Question 13.

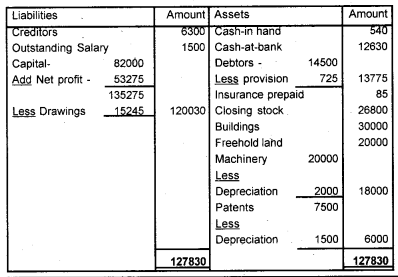

The following is the Trial Balance of Mr. Arun as on 31st December, 2009. (March 2011)

He furnishes the following additional information:

a) Closing stock on 31-12-2009 is Rs. 16,000.

b) Provide for Rs. 1,500 and Rs.2,000 for outstanding salaries and wages respectively.

c) Insurance was prepaid to the extent of Rs. 75.

d) Interest accrued Rs. 500.

e) Machinery and patents are to be depreciated @ 10% p.a. and 20% p.a. respectively.

You are required to prepare the Trading account, Profit & Loss account and the Balance Sheet of Mr. Arun as on 31.12.2009.

Answer:

Trading & Profit and Loss A/c for the year ended 31/12/2009

Balance Sheet as on 31/12/2009

Question 14.

Interest on investment received in advance is shown on the ________ (March 2012)

a) asset side of the balance sheet

b) liability side of the balance sheet

c) credit side of the revenue account

d) none of these

Answer:

b) liability side of the balance sheet

Question 15.

Contingency liabilities are shown on the footnote in the balance sheet as per the _______ accounting principle. (March 2012)

Answer:

Disclosure

Question 16.

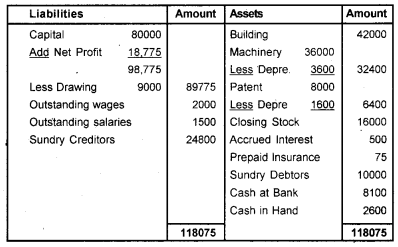

The details of stationery for a manufacturing unit is given below: (March 2012)

Opening stock of stationery Rs. 500/-

Stationery purchase Rs. 1,200/-

Closing stock of stationery Rs.700/-

Determine the amount of stationery to be debited in the profit and loss account.

Answer:

Question 17.

Calculate the amount of operating profit from the following: (March 2012)

Sales less return – 1,30,000

Cost of goods sold – 80,000

Administration expenses – 25,000

Loss on sale of furniture – 20,000

Answer:

Operating Profit = Gross Profit – Operating expenses

Gross Profit = Net sales – cost of goods sold

= 1,30,000 – 80,000

= 50,000

Operating Profit = 50,000 – 25,000 = 25,000

Note: Loss on sales of furniture is non-operating or purely financial nature. So it is excluded while computing the operating profit.

Question 18.

A balance sheet of a sole trader is arranged in the liquidity order. Answer the following, if the trader has all typical assets. (March 2012)

a) First item is shown on the asset side of the Balance Sheet.

b) Last item is shown on the asset side of the Balance Sheet.

Answer:

a) Cash-in-hand is the first item shown on the asset side of the Balance Sheet in order of liquidity,

b) Goodwill is the last item shown on the asset side of the Balance Sheet in the order of liquidity.

Question 19.

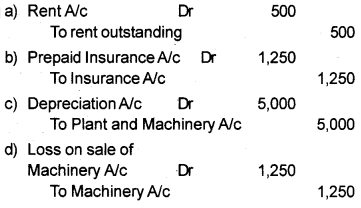

Pass the necessary adjusting entries to record the following transactions in .the books of account on 31st March 2010. (March 2012)

a) Rent due but not paid during the year ended Rs. 500/-

b) Prepaid insurance Rs. 1,250/-

c) Depreciation on plant and machinery Rs. 5,000/-

d) Loss on sale of machinery Rs. 1,250/-

Answer:

Question 20.

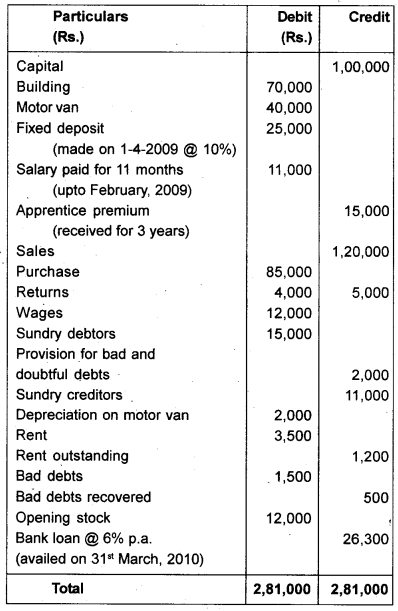

From the following Trial Balance of M/s Usha Agencies on 31st March, 2010, prepare the Trading, Profit and Loss account for the year ended 31st March, 2010 and the Balance Sheet as on that date, making necessary adjustments. (March 2012)

Adjustments:

i) Closing stock Rs. 20,000.

ii) Write off further bad debts Rs. 3,000.

iii) Provide 5% for provision for bad and doubtful debts.

Answer:

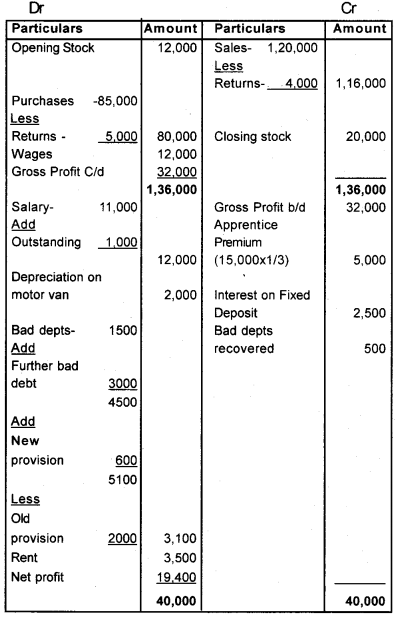

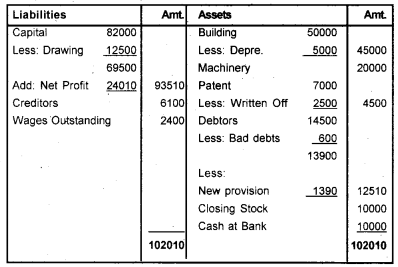

Trading and Profit & Loss Account for the year ended 31/3/2010

Note:

a) New provision for bad & doubtful debts = (15000 – 3000) × 5/100 = 600

b) Interest on fixed deposit = 25,000 × 10/100 = 2500

c) Salary outstanding for one month = 1,000

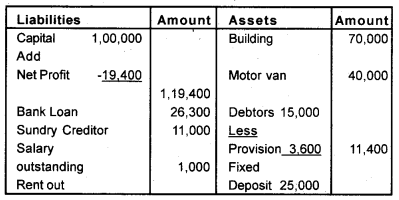

Balance sheet as 31/3/2010

Question 21.

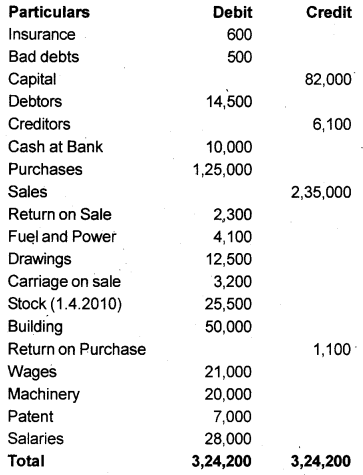

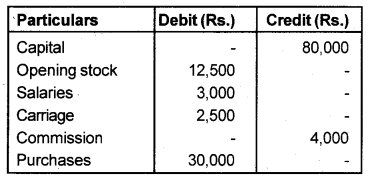

A.Mr. Koya has submitted to you the following Trial Balance as on 31st March, 2011 wherein the totals of the debit and credit balances are not equal. (March 2012)

Trial Balance as at 31st March, 2011

You are required to:

a) Redraft the Trial Balance correctly as at 31st March, 2011.

b) Prepare Trading and Profit and Loss Account for the year ended 31st March, 2011 and Balance Sheet as on that date after taking into account the following additional information.

Additional information:

i) Stock as on 31st March, 2011 worth Rs. 10,000.

ii) Wages for the month of March, 2011 amounted to Rs. 2,400 were unpaid.

iii) Depreciate building at 10% per annum.

iv) Bad debts written off Rs. 600.

v) A provision for bad debts is to be created to the extent of 10% on Sundry Debtors.

vi) Patents are written off by Rs. 2,500.

Answer:

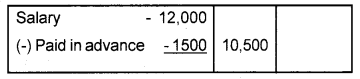

Trial Balance as on 31.3.2011

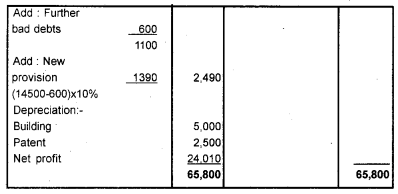

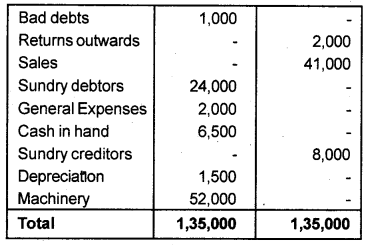

Trading & Profit and Loss A/c for the year ended 31/12/2009

Balance Sheet as on 31/3/2011

Question 22.

The statement showing the financial position of a business is known as ______ (Say 2012)

a) Profit and Loss Account

b) Balance Sheet

c) Income and Expenditure

d) Receipts and Payments Account

Answer:

b) balance sheet

Question 23.

The purpose of preparing the ______ account is to ascertain the financial result. (Say 2012)

Answer:

Profit and Loss A/c or Income and Expenditure a/c

Question 24.

If closing balance of stock appears in the trial balance, it will appear in ______ only. (Say 2012)

Answer:

Assets side of the Balance sheet

Question 25.

Write the treatment of interest on capital, while preparing final account. (Say 2012)

Answer:

Interest on capital debited to Profit and Loss A/c and it is shown in the liability side of the Balance Sheet by adding the same to capital.

Question 26.

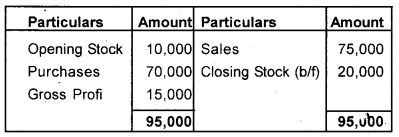

A firm had purchased goods worth Rs. 70,000 and it had an opening stock for Rs. 10,000. It sold a portion of goods for Rs. 75,000 at a Gross Profit of 20%. Find out its closing stock. (Say 2012)

Answer:

Closing Stock = (Opening Stock + Purchases + Gross Profit) – Sales

= (10,000 + 70,000 + 15,000) – 75,000

= 20,000

Gross Profit = 75,000 × 20/100 = 15000

OR

Another Method

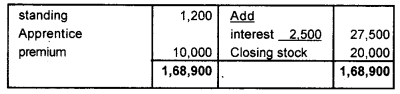

Trading A/c.

Question 27.

Ram Ltd. gives the following items. As a commerce student classify them into revenue expense, capital expenditure and deferred revenue expense. (Say 2012)

Answer:

i) Computer purchased

ii) Salary paid

iii) Huge advertisement expenses

iv) Goods purchased

Answer:

i) Computer Purchased – Capital Expenditure

ii) Salary paid – Revenue Expenditure

iii) Huge Advertisement Expenses – Deferred Revenue Expenditure

iv) Goods purchased – Revenue Expenditure

Question 28.

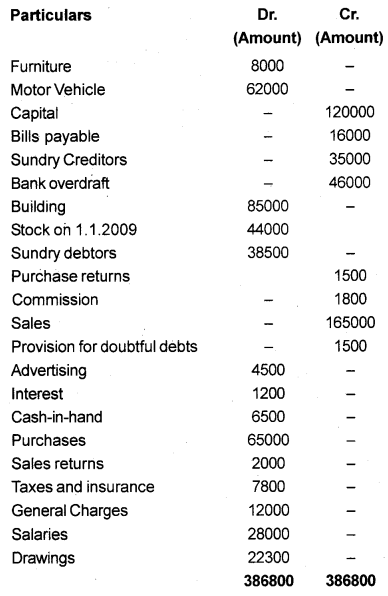

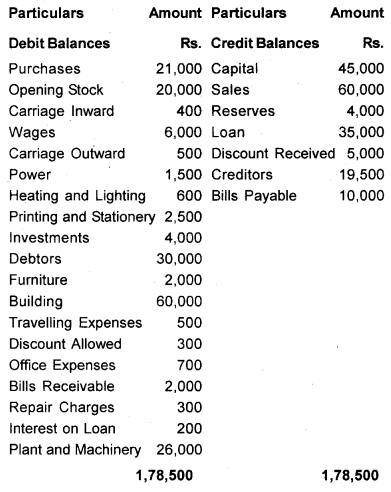

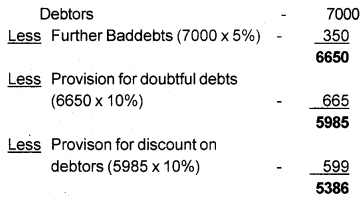

The following Trial Balance is extracted from the books of D.Das on 31st December 2009. (Say 2012)

Trial Balance

The following adjustments are to be made:

a) Provide interest on capital at 5% per annum.

b) Salaries outstanding ₹ 1,200.

c) Insurance prepaid to the extend of ₹ 700.

d) Write off ₹ 1300 as bad debts.

e) The provision for doubtful debts is to be maintained at 5% on debtors.

f) Depreciate motor vehicles at 15% and furniture at 10%.

g) Stock in hand on 31.12.2009 was ₹ 30000.

h) A fire occurred on 26.12.2009 in the godown and the stock of the value of ₹ 6000 fully damaged. It was fully insured and the Insurance company admitted the claim in full.

You are required to prepare a Trading, Profit and Loss Account for the year ended 31 st December 2009 and a Balance sheet on that date after making the above adjustments.

Answer:

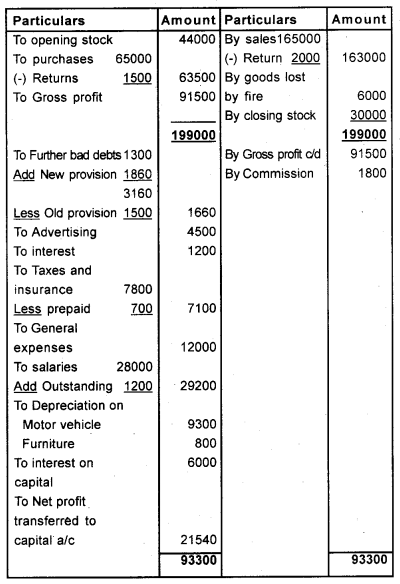

Trading and Profit and Loss A/c for the year ended 31.12.2009

Balance Sheet as on 31/12/2009

Working note

New provision for bad debt = (38500 – 1300) × 5% = 1860.

Question 29.

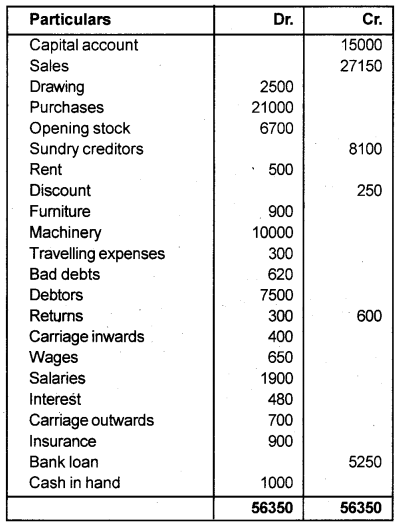

Prepare Trading and Profit and Loss account and Balance Sheet from the Trial Balance of Shri. Govind as on 31st March 2010. (Say 2012)

Adjustments:

1) Stock is valued at Rs. 16,000

2) Allow Interest on Capital @ 6% p.a.

3) Depreciate Furniture by 5% and Plant by 10%

4) Wages are unpaid Rs. 400.

Answer:

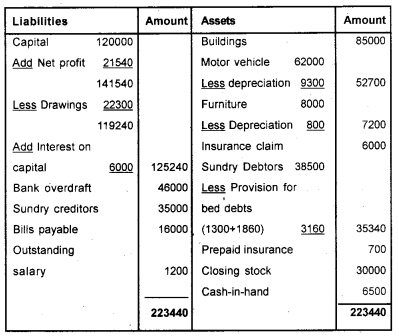

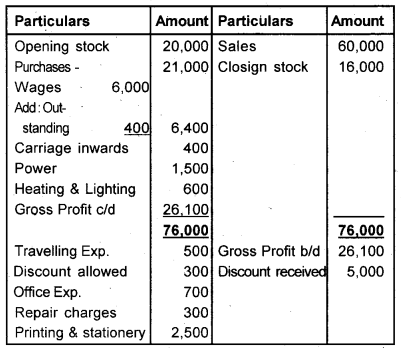

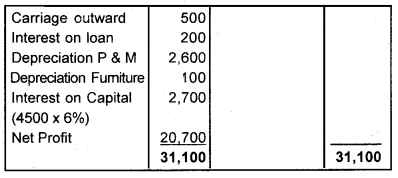

Trading & Profit and Loss A/c for the year ended 31/3/2010

Balance Sheet as on 31/3/2010

Question 30.

While preparing final accounts, outstanding salary is added to the salary account. The accounting principle relevant to this context is _______ (March 2013)

a) Matching

b) Business entity

c) Materially

d) Going concerned

Answer:

a) Matching

Question 31.

Which of the following is not a purpose of preparing a Balance Sheet? (March 2013)

a) To know about the sources and application of funds.

b) To know the financial position of the business.

c) To ascertain the nature and value of the asset owned.

d) To evaluate the profitability of the business

Answer:

d) To evaluate the profitability of the business

Question 32.

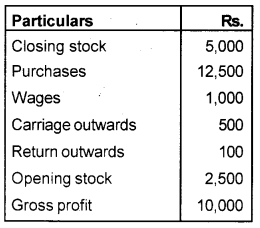

The Trial Balance of a trader has the following information. (March 2013)

a) Bank loan @ 12 %, Rs. 10,000

b) Interest paid Rs. 800 bank loan

Calculate the outstanding amount of interest on the bank loan.

Answer:

Interest on loan = 10,000 × 12/100 = 1200

The outstanding amount of interest on loan = 1200 – 800 = 400

Question 33.

Interest on capital is _________ (March 2013)

a) expenditure for the business

b) expense for the business

c) gain for the business

d) loss of business

Answer:

b) Expenses for the business

Question 34.

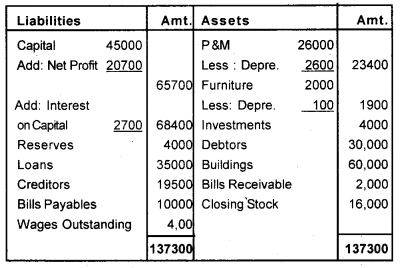

From the following information, ascertain the number of debtors to be posted in the asset side of the Balance sheet. (March 2013)

Given in Trial Balance

Bad debts – Rs. 700

Debtors – Rs. 7,000

Provision for doubtful debts – Rs. 500

Given in Adjustments:

a) Provide 5% for further bad debts.

b) Create provision for doubtful debts @ 10% on debtors.

c) Provision for discount on debtors is to be created @ 10%.

Answer:

The amount to be posted in the assets side of the B/S = 5386

Question 35.

On 31.12.2011, the balance of sundry debtors is Rs. 30,300 and further bad debts are estimated as Rs. 300. 5% of the debtors are expected to be doubtful. What are the adjustments to be required at the time of preparing the Profit and Loss Account? (March 2013)

Answer:

Rs. 300 debited to Profit and Loss Account as bad debts and Rs. 1500 (30300 – 300 = 30000 × 5/100 = 1500) debited to Profit and Loss A/c as provision for bad and doubtful debts.

Question 36.

The Trial Balance of M/s. Arathy as on 31st March, 2012 is given below. Prepare the final accounts. (March 2013)

Adjustments:

a) Closing stock was valued at Rs. 9000.

b) Insurance prepaid is Rs. 100

c) Wages outstanding is Rs. 700

d) Depreciate machinery and furniture by 10%.

Answer:

Trading and Profit & Loss A/c for the year ended 31/3/2012.

Balance Sheet as on 31/3/2012

Question 37.

Cost of goods sold is equal to sales minus _______ (March 2014)

a) net profit

b) net loss

c) gross profit

d) gross loss

Answer:

c) gross profit

Question 38.

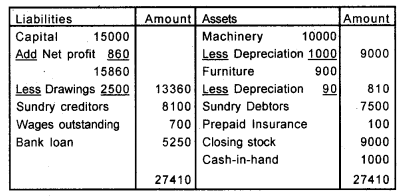

From the Balance sheet given below, calculate: (March 2014)

a. Long term liabilities

b. Current liabilities

c. Fixed assets

Balance Sheet

Answer:

a) Long term liabilities = Debentures + capital

= 20000 + 94400

= 114400

b) Current liabilities = Sundry creditors + Loan (6 months)

= 42000 + 8000

= 50000

c) Fixed Assets = Furniture + Patent

= 30000 + 50000

= 80000

Question 39.

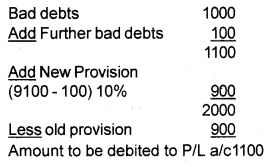

Given below is an extract taken from the Trial Balance of a trader as on 31.12.2012. (March 2014)

Debtors – Rs. 9100

Bad debts – Rs. 1000

Provision for bad debts – Rs. 900

Additional Information:

a) Further bad debts to be written off this year were Rs. 100.

b) 10% is reserved for further bad debts.

How much amount has to be debited to the Profit and Loss account?

Answer:

Question 40.

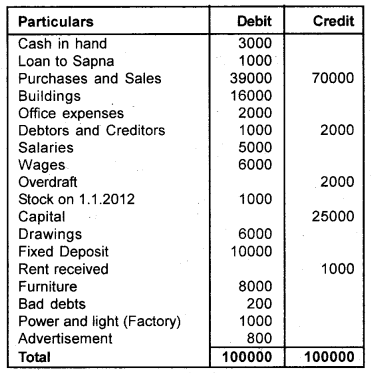

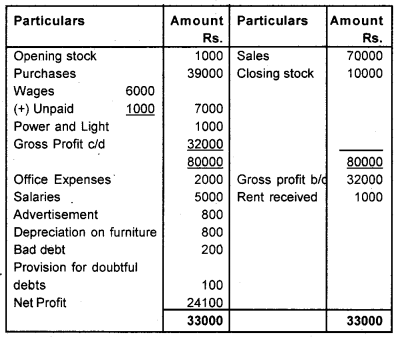

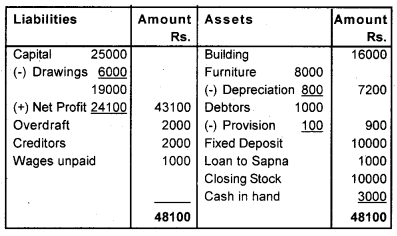

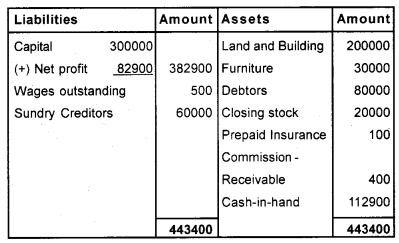

The following are the balances taken on 31st December, 2012, from the books of Mr.Rajendran. Prepare the Trading and Profit and Loss accounts and the Balance Sheet as on that date. (March 2014)

Other information:

1) Stock on 31st December, 2012 was Rs. 10,000.

2) Create a reserve for doubtful debts at 10%.

3) Depreciate furniture by 10%.

4) Wages unpaid were Rs. 1000.

Answer:

Trading and Profit and Loss account for the year ended December 31.12.2012

Balance Sheet as on 31/12/12

Question 41.

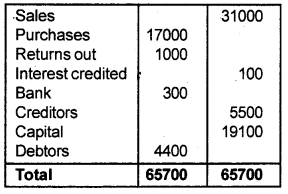

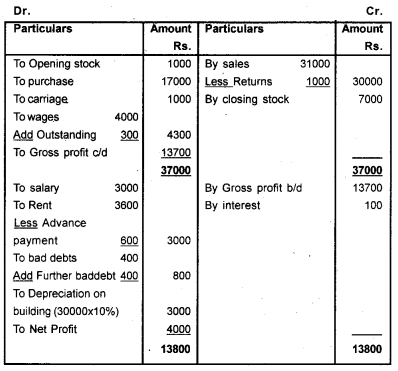

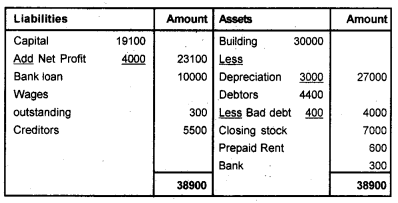

Prepare the financial statements of Rajeevan Stores for the year 2012-13 from the information given below. (March 2014)

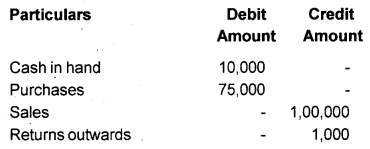

Trial Balance as on 31.03.2013

Adjustments:

a) Closing stock was valued at Rs. 7000.

b) Wages yet to be paid Rs. 300.

c) Rent includes advance payments of Rs. 600 for the next year.

d) Bad debts written off Rs. 400.

e) Depreciate building at 10% per annum

Answer:

Trading and Profit and Loss Account for the year ended 31.3.2013

Balance Sheet as on 31.03.2013

Question 42.

Salary of Rs.8,000 which remains unpaid during the current year is called a/an _________ (March 2015)

a) asset

b) liability

c) capital

d) income

Answer:

b) liability

Question 43.

“Under the liquidity approach, assets which are more liquid are presented at the bottom of the balance sheet”. (March 2015)

a) Is it correct? Justify your answer.

b) Write the following assets in the order of liquidity.

i) Cash in hand

ii) Cash at bank

iii) land and building

iv) Bills receivable

v) Closing stock

vi) Goodwill

Answer:

a) No, Under the liquidity approach, assets are entered up in the balance sheet following the order in which they can be converted into cash.

b) i) Cash in hand

iii) Bills Receivable

iv) Closing stock

v) Land and building

vi) Goodwill

Question 44.

Beena started the business with the following: (March 2015)

a) Classify the assets under appropriate headings.

b) Ascertain her capital.

c) Arrange them in the order of permanence by adding an intangible asset of your choice.

Cash Rs. 20,000, Building Rs. 1,00,000, Bank balance Rs. 10,000, Furniture Rs. 8,000 and Debtors Rs. 3,000.

Answer:

a) Cash – CurrentAsset

Building – Fixed Asset

Bank Balance – CurrentAsset

Furniture – Fixed Asset

Debtors – CurrentAsset

b) Capital = 20,000 + 1,00,000 +10,000 + 8,000 + 3,000 = Rs. 1,41,000

c) In the order of Permanence

1) Goodwill

2) Building

3) Furniture

4) Debtors

5) Bank

6) Cash

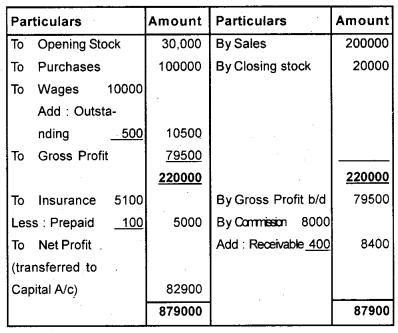

Question 45.

Prepare the trading, Profit, and Loss account and Balance Sheet from the Trial Balance of Mr. Shibu as on 31st March, 2013. (March 2015)

Adjustments:

1) Closing stock was valued at Rs. 20,000

2) Wages outstanding Rs. 500

3) Commission receivable Rs. 400

4) Insurance prepaid Rs. 100

Answer:

Trading and Profit and Loss A/c for the year ended 31/03/2013

Balance Sheet as on 31/03/2013

Question 46.

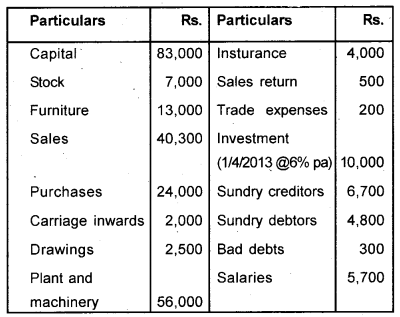

The following balances are taken from the books of Mr. Biswas. (March 2015)

After making the following adjustments, prepare the Trading and Profit and Loss accounts for the year ended 31st March 2014 and a Balance Sheet as on that date.

a) Stock as on 31st March 2014 worth Rs. 20,000.

b) Depreciate furniture @ 20%

c) Salary due but not paid Rs. 1,000.

d) Write-off Rs. 500 as bad debts and create a reserve for bad and doubtful debts @ 10%.

(Hint: Interest on investment accured but not received has to be considered).

Answer:

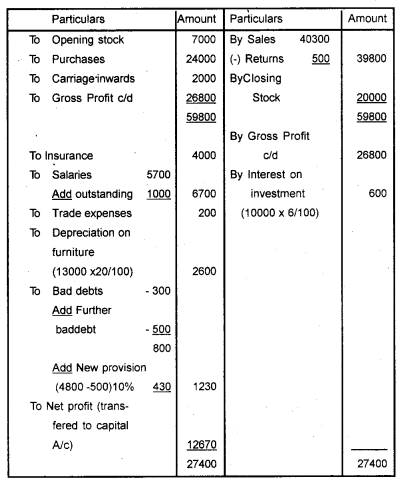

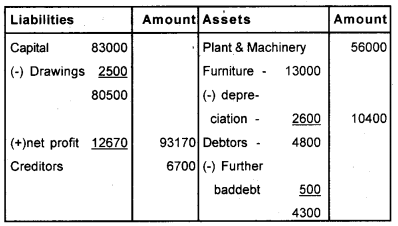

Trading and Profit and Loss A/c for the year ended 31/03/2014

Balance Sheet as on 31/3/2014

Question 47.

In which of the following items, shall commission paid by a business in advance during the year be included? (Say 2015)

a) Current expenditure

b) Current liability

c) Current asset

d) Current income

Answer:

c) Current Asset

Question 48.

The information given below is extracted form ABC Stores during the year 2013-14. (Say 2015)

Purchases – Rs. 4,000

Opening stock – Rs. 6000

Closing stock – Rs. 20,000

Gross profit – Rs. 10,000

Wages – Rs. 4,000

Find the sales during the year.

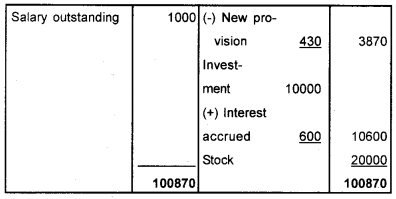

Answer:

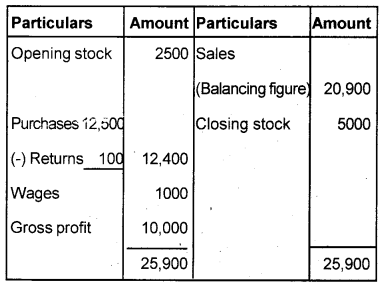

Trading A/c for the year ended ________

Question 49.

Find the ‘sale’ of Mr. Binesh from the following information provided by him for the year ending 31st March 2013. (March 2016)

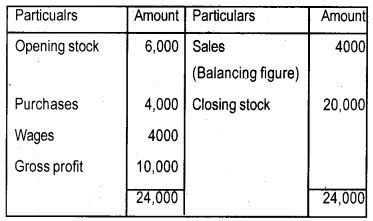

Answer:

Trading A/c for the year ended 31/3/13

Question 50.

Some adjustments are given below. (March 2016)

i) Wages outstanding Rs. 500

ii) Rent received in advance Rs. 450

iii) Further bad debts Rs. 300

a) How these adjustments are treated in the final account?

b) Write the adjustment entry for wages outstanding.

Answer:

a) Wages outstanding: It must be added to the wages account in the trading and profit and loss A/c. It will be shown on the liability side of the balance sheet.

Rent Received in advance: It will be deducted from the rent in profit and loss a/c. It will be shown on the liability side of the balance sheet.

Further Baddebts: It will be added to the baddebt in profit and loss a/c and deduct further bad debts from debtors in assets side of the balance sheet.

b) Wages a/c Dr 500

To wages outstanding a/c 500

Question 51.

a) Explain the term, current liability with an example. (March 2016)

b) Classify the following items into current liabilities and long term liabilities.

(Loan for five years, Creditors, Debentures, Bankover draft)

Answer:

a) Liabilities are payable within one year are called current liabilities

eg. creditors, Bills payable etc.

b) Current liabilities → Creditors, bank overdraft

Long term liabilities → Loan for 5 years, debentures.

Question 52.

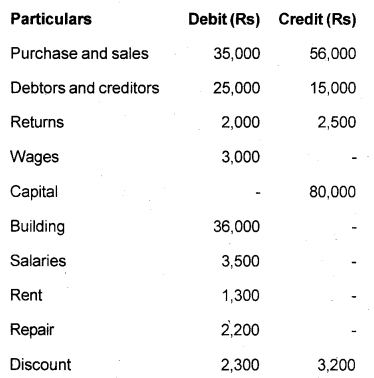

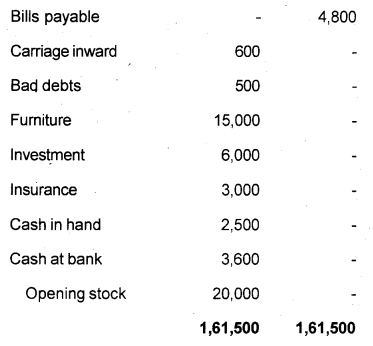

The following balances have been extracted form the books of Kerala Traders for the year ended 31st December, 2014. (March 2016)

Adjustments:

a) Make a provision on debtors @ 6%

b) Salaries outstanding Rs.200. Repairs include Rs. 300 for the year 2015.

c) Depreciate building @ 5% and furniture @ 10%

d) Closing stock Rs. 24,000

Prepare Profit and Loss A/c and Balance Sheet for the year ending 31st December, 2014.

Answer:

Trading and Profit and Loss A/c for the year ended 31/12/2014

Balance Sheet as on 31/12/2014

Question 53.

The following is the trial balance of Ammu Associates for the year ending 31st December, 2014 and other information relating are given to you. Find the working result of business and also show the financial position of them for the year. (March 2016)

Trial Balance of Ammu Associates on 31-12-2014

Additional information:

a) Closing stock is valued at Rs. 25,000

b) Salary of an employee is not paid Rs. 500

c) Further bad debt incurred Rs. 200

d) Provision for bad debt is created at 5% on debtors

Answer:

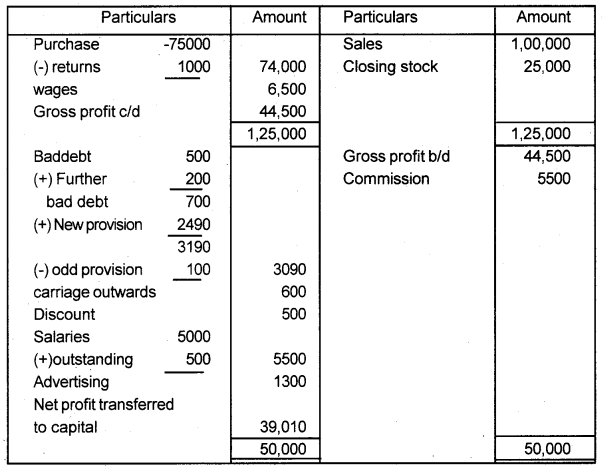

Trading and profit and Loss A/c for the year ended 31/12/14

Balance sheet as on 31/12/2014

Question 54.

Find the odd one out from the following. State the reason. (Say 2016)

a) Rent

b) Salary

c) Wages

d) General Expenses

Answer:

c) wages

Reason: wage is a direct expenses, but all others are indirect expenses.

Question 55.

Ascertain the amount to be debited to prodit and loss.account under the head ‘Salaries’ based on the following information. (Say 2016)

Given in Trial balance:

Salary (Dr) Rs. 12,000

Salary outstanding (Cr) Rs. 2,000

Given in adjustments:

Salary includes Rs. 1,500 paid in advance

Answer:

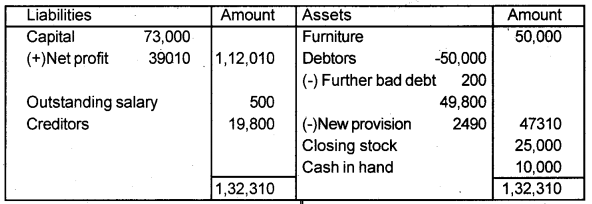

Profit and Loss A/c

Question 56.

The following balances are extracted form the books of a sole trader as on 31/12/2015. (Say 2016)

Additional information

a) Closing stock on 31/12/2015 Rs. 33,000

b) Salary prepaid Rs. 2,000

c) Write off Rs. 1,000 as bad debts and provide 3% for provision for bad and doubtful debts

d) Wages outstanding Rs. 1,000

Prepare a trading and Profit and Loss account and Balance Sheet as on 31/12/2015.

Answer:

Trading and profit and Loss A/c for the year ended 31/12/2015

Balance sheet as on 31/12/2015

Question 57.

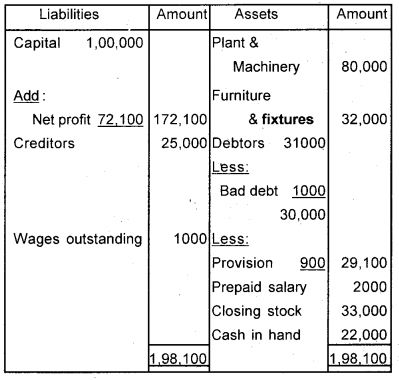

Athul, a commerce student prepared the following diagram showing examples of direct expenses for exhibiting in the class room. Identify the wrong examples appearing in the diagram. (March 2017)

Answer:

Rent

Repairs

Question 58.

“A Balance Sheet is more reliable than statement of affairs”. Explain. (March 2017)

Answer:

A balance sheet is prepared on the basis of those books which are maintained under double entry system. But statement of affairs is prepared on the ba¬sis of information from incomplete records. So a bal¬ance sheet is more reliable than statement of affairs.

Question 59.

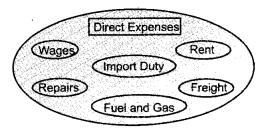

Calculate the value of cost of goods sold and gross profit. (March 2017)

Answer:

Cost of goods sold = (Opening stock + Purchases + Direct exp.) – Closing stock

= 18,000 + 60,000 + 4000 – 20,000

= 62,000

Gross profit = Net sales – cost of goods sold

Net sales = 1,32,000 – 7000 = 1,25,000

Gross Profit = 1,25,000 – 62,000 = 63,000

Question 60.

Opening Stock Rs. 18,000

Purchases Rs. 22,000

Wages Rs. 5,000

Closing stock Rs. 15,000

a) Ascertain cost of goods sold.

b) How much is gross profit, if sales is Rs. 37,500? (March 2017)

Answer:

a) Cost of goods sold = Opening stock + purchases+ Direct expenses – Closing stock

= (18,000 + 22,000 + 5000) – 15,000

= 30,000

b) Gross profit = Sales – Cost of goods sold

= 37500 – 30,000

= 7,500

Question 61.

“Outstanding Expenses are to be accounted for while preparing the financial statements”. (March 2017)

a) Which concept of accounting is mentioned in the above?

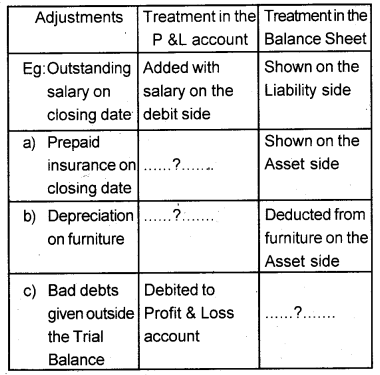

b) Complete the following table.

Answer:

a) Matching Principle

b) i) Prepaid insurance – Prepaid amount deducted from insurance on the debit side of P/L a/c

ii) Depreciation on furniture – Amount of depreciation debited to P/L a/c.

iii) Bad debts given outside the Trial Balance – Deducted from Sundry debtors on the asset side of the B/s

Question 62.

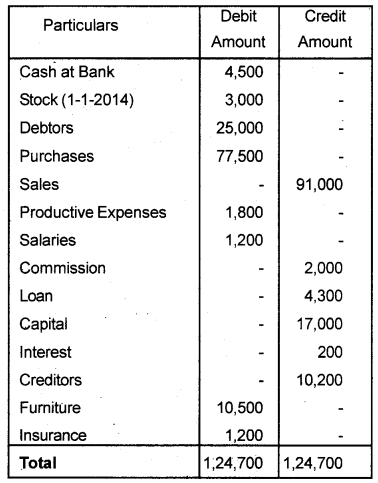

Following is the trail balance of R.K. Traders on 31st December, 2014. Prepare Trading and Profit & Loss account and Balance Sheet taking into account, the adjustments given. (March 2017)

Adjustments:

a) Closing stock was valued at Rs. 2,400.

b) Commission received in advance Rs. 800.

c) Salaries due but not paid Rs. 1,300

d) Depreciate furniture by Rs. 1,500

e) 1/4 of insurance is unexpired

Answer:

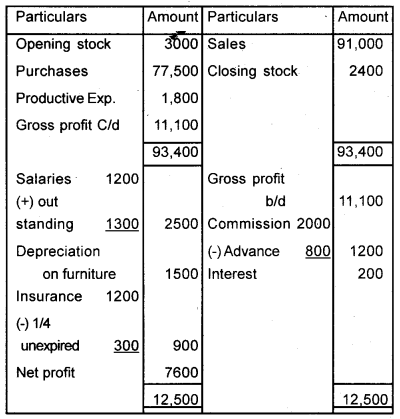

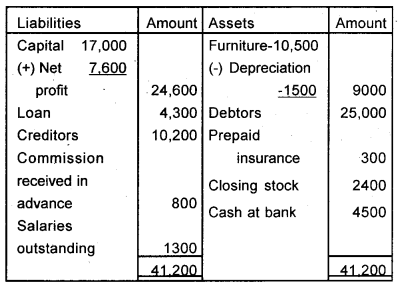

Trading and profit and Loss A/c for the year ended 31/12/14

Balance Sheet as on 31/12/14

Question 63.

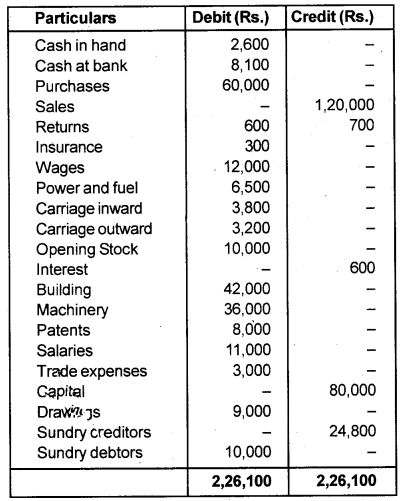

The following is the Trial Balance of Kiran, a trader as on 31st December, 2016. (March 2017)

Trial Balance as on 31/12/2016

Additional Information:

a) Closing stock was valued at Rs. 10,000.

b) Carriage outstanding Rs.500

c) Commission received in advance Rs.700

d) Provide 5% of debtors for bad debts.

Prepare Trading and Profit and Loss account for the year ended 31st December, 2016 and a Balance Sheet as on that date.

Answer:

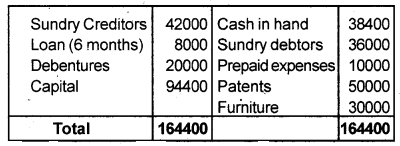

Trading and Profit and Loss A/c for the year ended 31/12/2016

Balance Sheet As on 31/12/2016