Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 7 Bill of Exchange

Question 1.

Bills received from debtors during the year can be obtained from the _______ account. (March 2010)

Answer:

Bill Receivable a/c / Total Debtors a/c

Question 2.

There are only two parties in case of a Bill of Exchange. (March 2010)

Answer:

False. Three parties

Question 3.

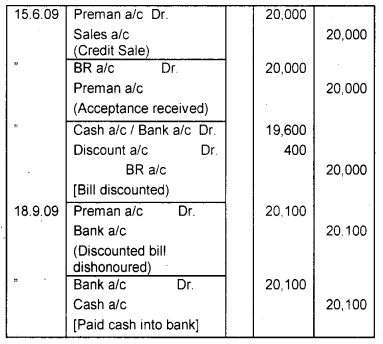

On 15th June, 2009, Naveen sold goods to Preman valued at Rs. 20,000. He drew a bill at 3 months for the amount and discounted the same with his bankers at Rs. 19,600. On the due date, the bill was dishonoured and Naveen paid the bank the amount due plus the noting charge of Rs. 100. Pass entries in the books of Naveen. (March 2010)

Answer:

In the books of Naveen

Question 4.

A bill of exchange is a _______ instrument. (March 2010)

Answer:

Negotiable/credit/creditorship instrument

Question 5.

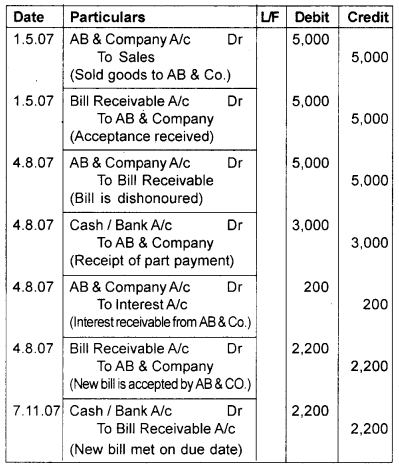

On 1st May, 2007, Rolex Traders sold goods to AB & Company for Rs. 5,000 and drew them a bill of three months for the amount. AB & Co. accepted it and returned to Rolex Traders.

On the due date, AB & Co. expressed their inability to meet the bill and offered Rs. 3,000 in cash and a new bill for the balance with interest of Rs. 200 for 3 months. On maturity, the bill was duly met by AB & Co. Pass the entries in the books of Rolex Traders. (March 2010)

Answer:

Journal Entries in the books of Rolex Traders

Question 6.

A bill is drawn on 20th January 2005, payable after two months. The bill becomes due on _______ (March 2011)

a) 20th March 2005

b) 23rd March 2005

c) 23rd February 2005

d) 20th February 2005

Answer:

b) 23rd March 2005

Question 7.

A bil of exchange is a _______ instrument. (March 2011)

Answer:

Negotiable Instrument

Question 8.

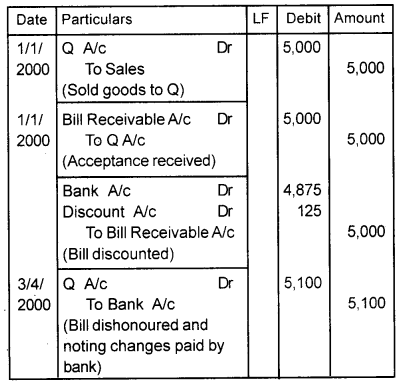

On 1st January, 2000, P sold goods to Q for Rs. 5,000 and drew a bill on him for 3 months. Q accepted the bill and returned it to P. On the same day, P discounted the bill with his bank at 10% per annum. On the due date, the bill was dishonoured and the bankers paid noting charge of Rs. 100. Show the necessary journal entries in the books of P. (March 2011)

Answer:

Journal (In the book of P)

Question 9.

Signing on the back of the instrument for negotiation is called ________ (March 2011)

a) accepting

b) endorsement

c) noting

Answer:

b) Endorsement

Question 10.

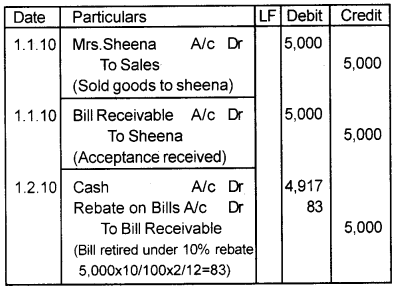

Mrs. Latha sold goods for Rs. 5,000 to Mrs. Sheena on 1-1-2010 and drew a bill for 3 months. The latter accepted the same and retired her acceptance after one month at a rebate of 10%. Journalize the transactions in the books of Mrs. Latha and Mrs. Sheena. (March 2011)

Answer:

Journal (In the book of Mrs. Latha)

Journal (In the book of Mrs. Sheena)

Question 11.

When discounted bills of exchange are dishonoured, the amount of the bill is debited in the ______ account and credited in the account in the ________ books of the drawee. (March 2012)

a) debtors, bank

b) debtors, bills receivable

c) bills payable, creditors

d) debtors, creditors

Answer:

c) Bills payable, Creditors

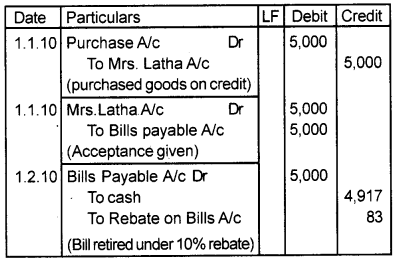

Question 12.

On 1st January, 2010, Raju sold goods to Ravi on credit for Rs.4,000. Raju drew a bill for the same amount for three months and got it accepted by Ravi. On the same date, this bill was discounted with the bank @ 12% p.a. On the due date, the bill was met. Pass the necessary journal entry in the books of Raju. (March 2012)

Answer:

Journal (in the book of Raju)

Question 13.

A bill of exchange is drawn on 29th January, 2012 made payable after ‘2’ months. Calculate the due date of the bill. (March 2012)

Answer:

31-03-2012 or 1-4-2012

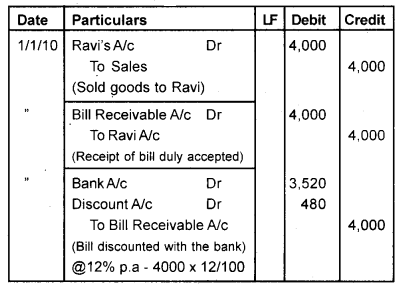

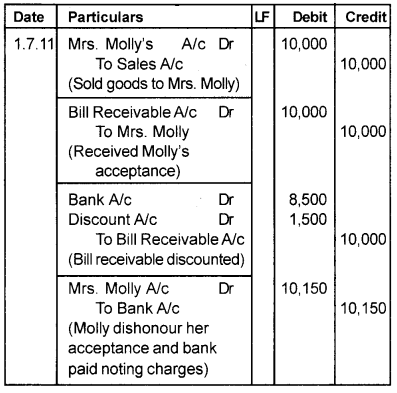

Question 14.

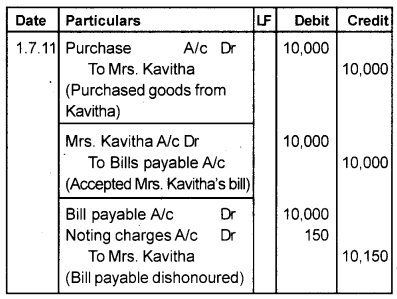

A) On 1st July, 2011, Mrs. Kavitha sold goods to Mrs.Molly for Rs. 10,000 and drew two months bill for that amount which was duly accepted. On 5th July, 2011, Mrs. Kavitha discounted the same with the bank for Rs. 8,500. On the due date, the bill was dishonoured and noting charges of Rs. 150 was paid by the bank. Show the journal entries in the books of both the parties.

B) Draw a specimen of the Bill of Exchange and explain any four essential features of it. (March 2012)

Answer:

A) In the book of Mrs. Kavitha

In the book of Molly

B)

The document is a Bill of Exchange.

Features:

- It contains an order to pay money.

- The order should be unconditional.

- The drawer must sign the bill.

- The drawee must be a certain person.

- The order must be for the payment of money only.

- It should be properly stamped.

Question 15.

A bill is noted when it is _______ (Say 2012)

a) Dishonoured

b) Honoured

c) Discounted

d) None of these

Answer:

a) dishonoured

Question 16.

If the acceptor makes payment of the bill before maturity, it is called renewal of a bill. (Say 2012)

Answer:

False. If the acceptor makes payment of the bill before maturity, it is called retiring of the bill.

Question 17.

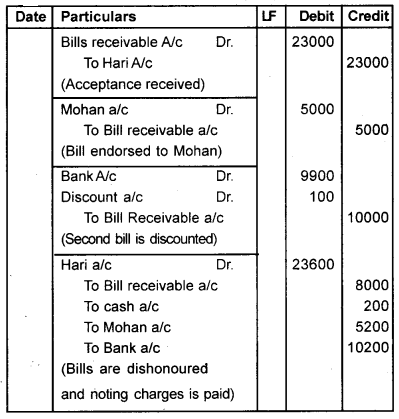

On 1st January 2005, Ram received from Hari three acceptance for ₹ 5,000, ₹ 8,000, and ₹ 10,000 for two months.

The first bill of ₹ 5,000 was endorsed to Mohan. The second bill of ₹ 8,000 was held till the due date, the third bill of ₹ 10,000 was discounted for a discount of Rs. 100. The maturity date of all the three bills was dishonoured. Give journal entries in the books of Ram, noting charge ₹ 200 for each bill. (Say 2012)

Answer:

Journal (in the book of Ram)

Question 18.

Ram sold goods for Rs. 2,000 to Krishna on 10th January, 2010 and he drew a 10 days bill for the same amount. The due date of the bill is: (Say 2012)

a) 10th January, 2010

b) 23rd January, 2010

c) 20th January, 2010

Answer:

b) 23rd January, 2010.

Question 19.

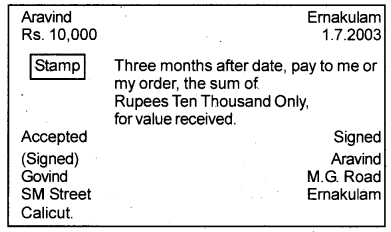

From the given specimen of bill of exchange, identify: (Say 2012)

(i) Drawer

(ii) Drawee

(iii) Due Date

(iv) Amount of the bill.

Answer:

i) Drawer – George Kurian

ii) Drawee – Robert Mathew

iii) Due Date-15th April 2011

iv) Amount of the bill – Rs. 2500/-

Question 20.

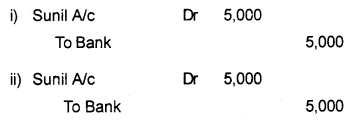

Mr. Akhil sold goods to Mr. Sunil and received a two months bill of exchange for Rs. 5,000. On the due date Mr. Sunil failed to pay the amount of the bill. Pass dishonour entries in the books of Akhil in the following circumstances.

i) If Akhil retains the bill with him.

ii) If he discounted the bill through the bank for Rs. 4,800. (Say 2012)

Answer:

Question 21.

Making payment of the bill of exchange before the due date is called _________ (March 2013)

a) Renewal of the bill

b) Retiring of the bill

c) Discounting of the bill

d) Dishonour of the bill

Answer:

b) Retiring of the bill

Question 22.

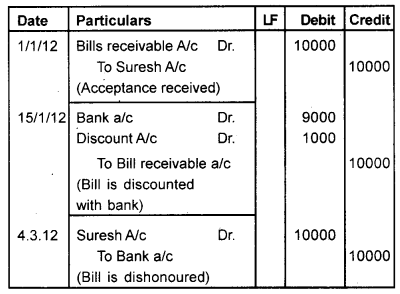

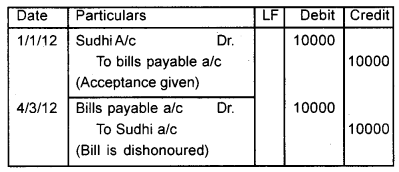

On 1st January, 2012 Suresh accepted the 2 monthly bill drawn by Sudhi for Rs. 10,000. On 15th January, Sudhi discounted the bill with his banker @ 10%. On the due date, the bill was dishonoured. Give journal entries in the books of Suresh and Sudhi. (March 2013)

Answer:

Journal (in the book of Sudhi)

Journal (in the book of Suresh)

Question 23.

A bill dated August 1, 2012 is payable 2 months after date. If the due date is a public holiday, what will be the date of maturity of the bill? (March 2013)

Answer:

3rd October 2012. (If the due date falls on holiday, the due date will be the previous day.)

Question 24.

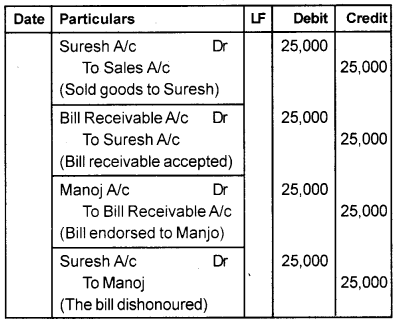

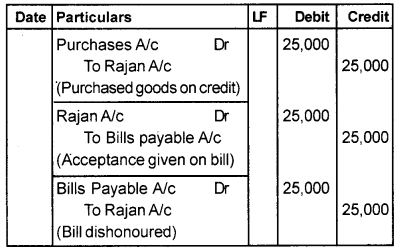

On 1st January, 2012, Rajan sold goods to Suresh for Rs. 25,000 and drew upon him a Bill of exchange for 2 months. Suresh accepted the bill and returned it to Rajan. He then endorsed the bill to Manoj, who discounted the bill with the bank on 15-01-2012 for cash Rs. 24,750. The bill was dishonoured on the due date. Show the journal entries in the books of Rajan and Suresh. (March 2013)

Answer:

Journal (In the Book of Rajan)

Journal (In the Book of Suresh)

Question 25.

A bill of exchange is drawn on _______ (March 2014)

a) debtors

b) Creditors

c) banks

d) None of these

Answer:

a) Debtors

Question 26.

Calculate the due date of the bills in the following cases. (March 2014)

a) Bill drawn on July 1, 2013 for 2 months.

b) Bill drawn on June 30, 2013 for 30 days.

Answer:

a) 4th September, 2013

b) 2nd August, 2013

Question 27.

The drawer of a bill of exchange is always the ________ (March 2014)

a) Debtor

b) endorser

c) Creditor

d) Proprietor

Answer:

c) Creditor

Question 28.

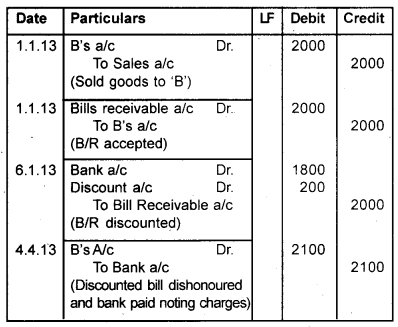

On 01.01.2013, A sold goods to B for Rs. 2000 and on the same day, Adrew upon B a bill of Rs. 2000 for three months. On 06.01.2013, the bill has been discounted and received Rs. 1,800. On the due date, the bill has been dishonored.

Draw up the journal in the drawer’s books. What would the entry have been had the banker spent Rs. 100 for noting the bill? (March 2014)

Answer:

Journal (in the book of ‘A’)

Question 29.

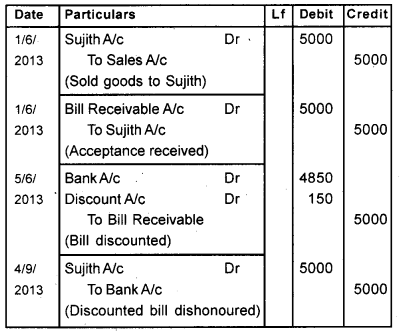

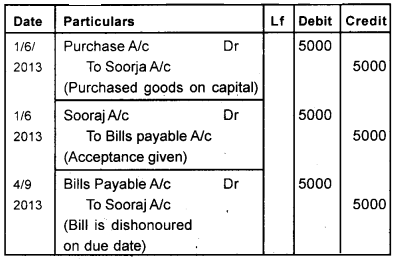

On 1st June 2013, Sujith accepted three months bill drawn by Sooraj for Rs. 5000. on 5th June, Sooraj discounted the bill with his banker @ 12%. The bill was dishonoured on the due date. (March 2015)

a) Calculate the amount of discount.

b) Identify the drawer and drawee in the above bill transaction.

c) Record the necessary journal entries in the books of the drawee and the drawer.

Answer:

a) Amount of discount = \(5000 \times \frac{12}{100} \times \frac{3}{12}\) = 150

b) Drawer is Sooraj

Drawee is Sujith

c) Journal Entries In the Books of Sooraj

Journal Entries In the Books of Sujith

Question 30.

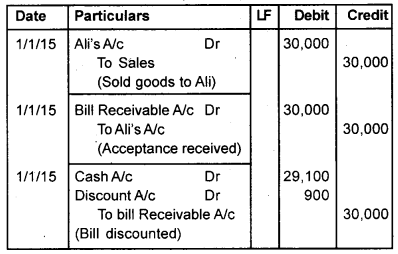

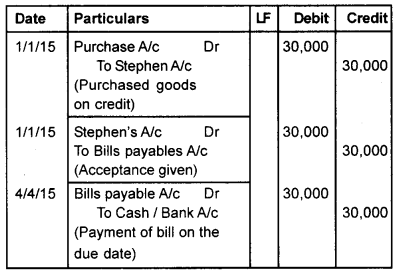

Ali purchased goods for Rs. 30,000 from Stephen on 1st January 2015. A bill was drawn for three months which was accepted by the drawee and returned to Stephen. On the same day, the bill was discounted with the bank @12%. Pass the entries in the books of the drawer and drawee. (March 2015)

Answer:

Journal Entries (In the book of Stephen)

Journal Entries (In the book of Ali)

Question 31.

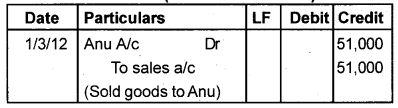

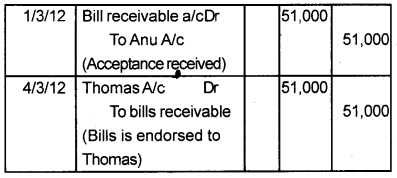

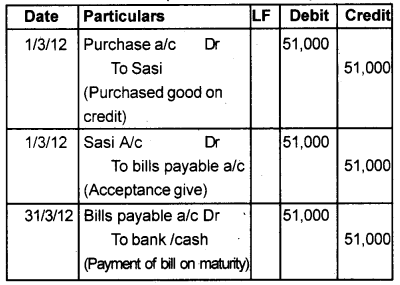

Record the following bill transactions druing the month fo March 2014 in the books of drawer and drawee. (Say 2015)

1-3-2012 Anu purchased goods from Sasi for Rs.51,000

1-0-2012 A bill was drawn and accepted fa the above amount

4-3-2012The bill was endorsed to Mrs. Thomas On the due date the bill is honoured.

Answer:

Journal (In the book of Sasi)

Journal (In the book of Anu)

Question 32.

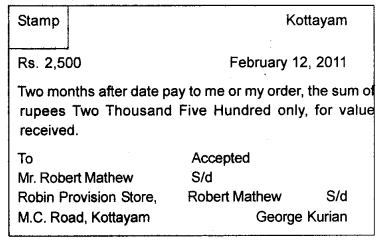

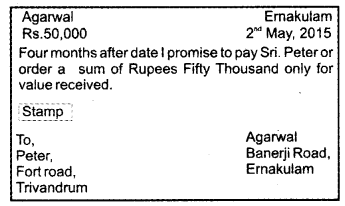

A specimen of a document used in a business is given below. (March 2016)

a) Identify the given document.

b) Write any two difference of the above document with Bill of Exchange.

Answer:

a) Promissory note

b) i) Bill of exchange is drawn by the creditor. But the promissory note is drawn by the debtor.

ii) Bill of exchange contains an order to make payment. But promissory note contains a promise to make payment.

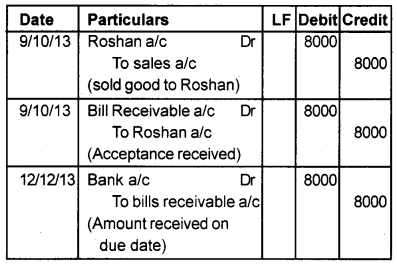

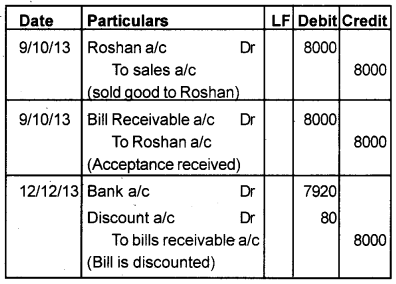

Question 33.

Sajan sold goods for Rs. 8,000 to Roshan on 9th October, 2013 and drew upon him a bill of exchange payable after 2 months. Roshan accepted the bill and returned it to Sajan. Roshan met the bill on maturity date. Pass the journal entries in the books of Sajan under the following situations. (March 2016)

a) Sajan retained the bill till maturity.

b) Sajan discounted the bill with his bank @ 12% p.a. on 9th November, 2013.

Answer:

a) Sajan retained the bill till maturity

Journal (In the book of Sajan)

b) Journal (In the book of Sajan)

Question 34.

When the drawee of the bill of exchange makes the payment before the maturity date of bill it is called _________ (March 2016)

a) dishonour bill

b) discounting of bill

c) retiring of bill

d) renewal of bill

Answer:

c) Retiring of bill

Question 35.

Arun sold goods on credit for Rs. 1,000 to Amal. (March 2016)

a) Who is the debtor in this transaction?

b) Write journal entry on this transaction.

Answer:

a) Amal

b) Amal A/c Dr – 1000

To sales – 1000

Question 36.

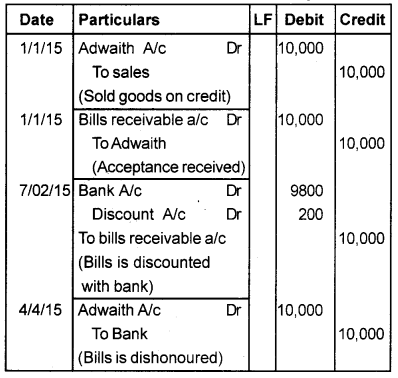

On 1st January, 2015 Arya sold goods to Adwaith for Rs. 10,000 and drew a bill of exchange for 3 months. Adwaith accepted the bill.

On 7th February, 2015 Arya discounted the bill with her bank for Rs. 9,800. But on the date of maturity of the bill, Adwaith was unable to make the payment. Pass the journal entries in the books of Arya. (March 2016)

Answer:

Journal Entries in the book of Arya

Question 37.

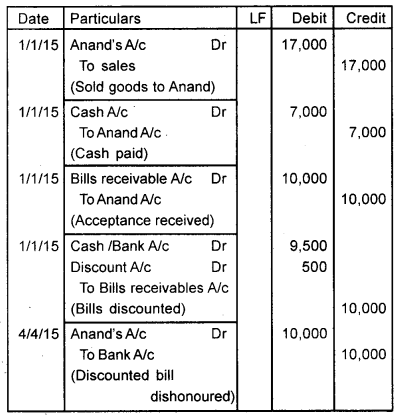

On 01/01/2015 Sachin sold goods worth Rs.17,000 to Mr. Anand. Anand paid rs.7,000 immediately and for the balance, Sachin drew a bill on Anand payable after three months, which was duly accepted. Sachin discounted the bill with the bank for Rs.9,500. On the due date the bill was dishonored. Pass the entries in the books of Sachin. (Say 2016)

Answer:

Journal entries in the book of Sachin

Question 38.

Anu draws a bill on Achu for Rs.3,000 on 1 st January, 2015 payable after 3 months. Achu accepted and returned the bill to Anu. The bill is discounted by Anu on the same day. (March 2017)

a) Calculate the amount of discount in the following cases.

The bill is discounted for Rs. 2900

The bill is discounted @ 12% p.a.

b) Ascertain the maturity date of the above bill.

Answer:

a) i – Rs. 100

ii – \(3000 \times \frac{12}{100} \times \frac{3}{12}\) = Rs. 90

b) Date of Maturity = April 4th, 2015

Question 39.

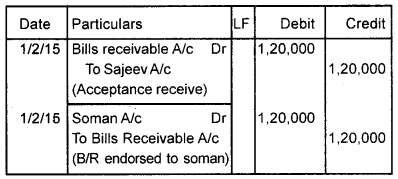

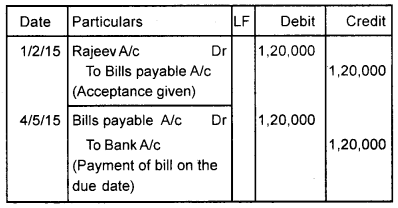

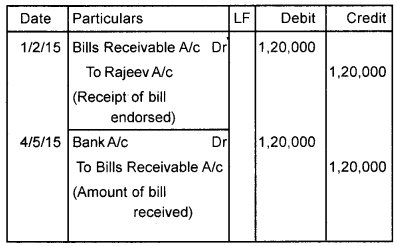

Rajeev drew a bill of Rs. 1,20,000 on Sajeev on 1st February, 2015 for 3 months. Immediately after acceptance, Rajeev endorsed the bill to Soman. The bill was met on maturity. Make journal entries in the books of all the parties. (March 2017)

Answer:

Journal Entries (In the book of Rajeev)

Journal Entries (In the book of Sajeev)

Journal Entries (In the book of Soman)

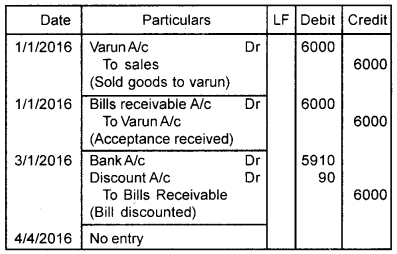

Question 40.

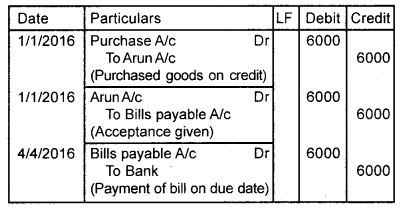

On 1st January, 2016 Arun drew a 3 months bill upon Varun for Rs. 6000. On 3rd January, 2016 Arun discounted the bill with his banker @ 6% per annum. The bill was honoured on the due date. (March 2017)

a) Identify the drawer in the above bill.

b) Record the necessary journal entries in the books of Arun and Varun.

Answer:

a) Drawer – Arun

b) Journal Entries in the book of Arun

Journal Entries in the book of Varun