Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 5 Trial Balance and Rectification of Errors

Question 1.

Which of the following errors does not affect the trial balance? (March 2010)

a) Wrong balancing

b) Wrong totaling

c) Writing an amount in the wrong account, but on the correct side.

d) None of these

Answer:

c) Writing an amount in the wrong account, but on the correct side.

Question 2.

The statement containing various ledger balances on a particular date is known as _______ (March 2010)

Answer:

Trial Balance

Question 3.

Sales to Roy worth Rs. 336 posted to his account as Rs. 363 would affect ________ (March 2010)

a) Sales account

b) Roy’s account

c) Cash account

Answer:

b) Roy’s Account

Question 4.

State whether the following is “true” or “false”. If false, correct the same. (March 2010)

All errors affect the agreement of the Trial Balance.

Answer:

False, All errors do not affect the agreement of the trial balance.

Question 5.

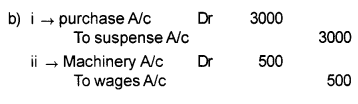

On verification, the following errors are found in the books of Ajith. Help him to rectify the errors. (March 2010)

a) Purchase returns for Rs. 10,000 were entered in the Purchase book.

b) Repairs of motor lorry worth Rs. 2,500 has been debited to the Motor Lorry account.

c) Salary paid to Mujeeb Rs. 10,000 was debited to his personal account.

d) A credit sale of Rs. 15,000 to Ashraf has been wrongly passed through the Purchase book.

Answer:

Question 6.

Installation charge of machinery is debited to _______ (March 2011)

a) Profit and Loss account

b) Income and Expenditure account

c) Machinery account

d) Purchase account

Answer:

c) Machinery account

Question 7.

A sale of old machinery is credited to the sales account. It is an error of ________ (March 2011)

а) principle

b) omission

c) commission

d) None of these

Answer:

a) principle

Question 8.

_______ helps in verifying the correctness of the books of accounts. (March 2011)

Answer:

Trial Balance

Question 9.

Purchase of furniture debited to the sales account is an error of ________ (March 2011)

a) principle

b) commission

c) omission

Answer:

a) Error of Principle

Question 10.

State whether the following is “true” or “false”. If false, correct the same. (March 2011)

If the sale of furniture for Rs. 10,000 to ‘B’ is debited to the sales account, it will not affect the agreement of Trial Balance.

Answer:

False, It will affect the agreement of Trial Balance

Question 11.

State whether the following is “true” or “false”. If false, correct the same. (March 2011)

Tallying of Trial Balance is conclusive proof of the accuracy of the books of account.

Answer:

False, Tailing of Trial Balance is not proof of the accuracy of the books of accounts because there can be errors which do not affect the equality of debits and credits.

Question 12.

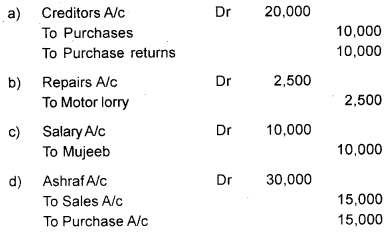

The following errors have been discovered in the books of a firm. You are required to rectify these errors. (March 2011)

a) Rs. 5,000 received on the sale of machinery had been credited to the Sales account.

b) A purchase of goods from T. Rajan for Rs. 2,500 had been credited to the account of B. Rajan.

c) Rs. 1,000 drawn by the proprietor for his personal use has been shown as Trade Expenses.

d) Rs. 500 spent for repairs of machinery was debited to the Machinery account.

e) A credit sale of goods worth Rs. 2,400 to Anand has been wrongly passed through the Purchase book.

Answer:

Journal

Question 13.

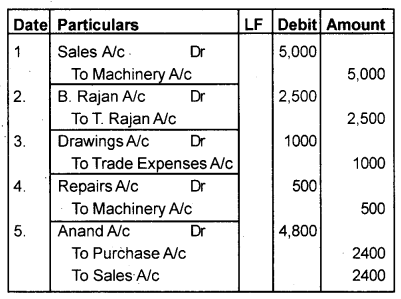

The following errors are found in the book of Miss. Athira. (March 2011)

a) A cheque for Rs. 4,500 given to Mrs. Rajitha debited to Remithi’s account.

b) A sale of land for Rs. 50,000 has been credited to the sales account.

c) A credit purchase of Rs. 4,000 from Mumthas is entered through the sales book.

d) A credit purchase of Rs. 8,900 from Revathi was entered in the sales book as Rs. 9,800.

Help Athira to rectify the errors by suggesting rectification entries.

Answer:

Journal

Question 14.

Purchase of machinery on credit from Mr.Rajan is not recorded in the journal. It is a/an __________ (March 2012)

a) error of omission

b) error of commission

c) compensating error

d) error of principle

Answer:

a) error of omission

Question 15.

Trial balance consists of ledger balance + ________ balance. (March 2012)

Answer:

Trial balance = Ledger balance + Adjusted/Suspense A/c

Question 16.

Which of the following errors will affect the Trial Balance? (March 2012)

a) Errors of complete omission

b) Errors of principle

c) Compensating error

d) Errors of commission

Answer:

d) Errors of commission

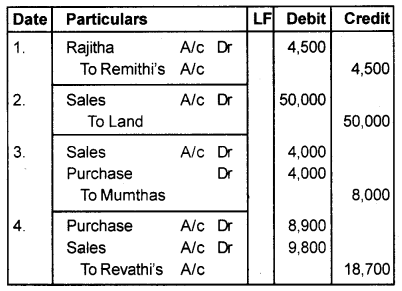

Question 17.

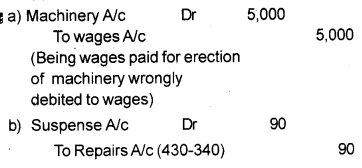

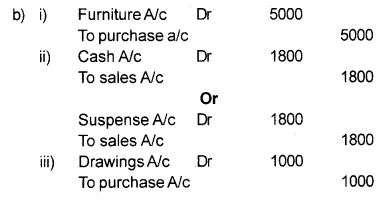

Pass the necessary rectifying entry to correct the errors committed in the following transactions. (March 2012)

a) Wages paid for erecting machinery worth Rs. 5,000 were debited in the wages account.

b) Rs. 340 paid for repairs was debited in the repairs account as Rs. 430/-.

Answer:

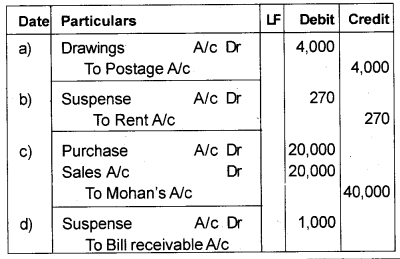

Question 18.

Rectify the following errors: (March 2012)

a) The payment of the proprietor’s personal telephone bill of Rs. 4,000 was debited to the postage account.

b) Rent paid Rs. 1,250 was wrongly posted to the Rent A/c as Rs. 1,520.

c) A credit purchase of goods worth Rs. 20,000 from Mr. Mohan was wrongly passed through the Sales Daybook.

d) Bills Receivable Day Book has been overcast by Rs. 1,000.

Answer:

Question 19.

Sale of furniture is credited to sales account is an error of ______ (Say 2012)

a) Commission

b) Omission

c) Principles

d) None of these

Answer:

c) Principles

Question 20.

The statement containing various ledger balances on a specified date is known as _______ (Say 2012)

Answer:

Trial Balance

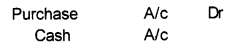

Question 21.

Machinery purchased for Rs. 25,000 has been recorded as follows. (Say 2012)

Whether it is right or wrong? If it is wrong, identify the type of error.

Answer:

Wrong, Error of Principle

Question 22.

State whether the following is “true” or “false”. If false, correct the same. (Say 2012)

Assets minus total outsiders liabilities is equal to owners equity.

Answer:

True

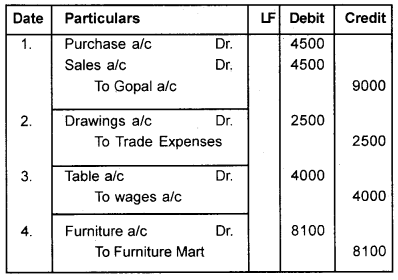

Question 23.

The following errors have been discovered in the books of a firm. You are required to rectify those errors. (Say 2012)

1. A purchase of goods from Gopal amounting to ₹ 4,500 has been wrongly passed through the sales book.

2. An amount of ₹ 2,500withdrawn by the proprietor for personal use has been debited to trade expenses.

3. ₹ 4000 paid for wages to workers for making a table has been charged to the wages account.

4. Furniture purchased on credit from Modern Furniture Mart for ₹ 9,000 has been entered as ₹ 900.

Answer:

Journal (Rectification Entries)

Question 24.

While checking the accounts of Mr. Suresh it was found that some errors are committed by the accountant. Rectify them bypassing proper rectification entries. (Say 2012)

a) Wages paid for the installation of machinery was debited to wages A/c Rs. 2,000.

b) Cash paid to Anitha Rs. 5,000 was debited to Athira’s account.

c) Purchase of goods from Das for Rs. 4,000 was posted on the debit side of Das’s A/c.

d) A bill for Rs. 500 issued was not entered in the bills payable book.

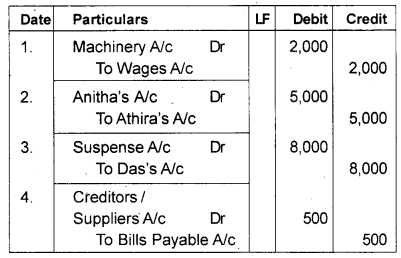

Answer:

Journal Entries

Question 25.

What will be the effect on the trial balance if Rs. 500 is received as interest and correctly entered in the cashbook, but posted to the debit side of the Interest account? (March 2013)

Answer:

It will affect the agreement of Trial Balance. The Debit side of the Trial Balance shows an increase of Rs. 500 and credit side decreased by Rs. 500.

Question 26.

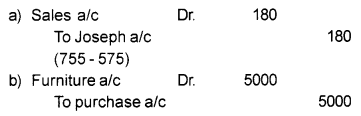

Give the rectifications entries for the following. (March 2013)

a) A sale of Rs. 575 to Joseph was entered in the Sales Book as Rs. 755.

b) Rs. 5000 paid for furniture purchased has been charged to the Purchases account.

Answer:

Question 27.

From the following transactions, identify the type of error. (March 2013)

a) Wages paid for making additions to machinery Rs. 100 was debited to the wages account.

b) Sales account was given an excess credit by Rs. 1,600 and at the same time, rent account was totaled shortly by Rs. 1,600.

c) A credit purchase of Rs. 10,000 from Manju Agencies was not recorded at all.

d) A credit sale of Rs. 5,000 was entered in the sales book as Rs. 50,000.

e) Purchase of Rs. 200 from Lexi Traders was not recorded in the purchases day book.

Answer:

a) Error of Principle.

b) Compensating Error/Error of Commission.

c) Error of omission/Error of complete omission.

d) Error of commission.

e) Error of omission/Error of complete omission.

Question 28.

Errors cancelled by themselves are called _______ (March 2014)

Answer:

a) errors of omission

b) compensating errors

c) errors of principle

d) errors of commission

Answer:

b) compensating errors

Question 29.

Furniture bought on credit is wrongly recorded in the cash book. It is an example of an error of _______ (March 2014)

a) Principle

b) Compensation

c) Commission

d) Omission

Answer:

a) Principle

Question 30.

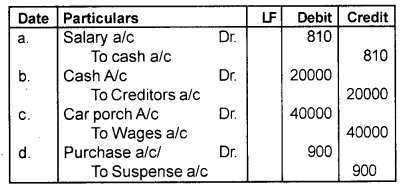

Rectify the following transactions of Baby Stores during the year 2012-13. (March 2014)

a) Salary paid Rs. 900 was recorded as Rs. 90 only.

b) Furniture purchased on credit for Rs. 20000 was recorded through cash book by mistake.

c) Wages worth Rs. 40000 paid for the construction of a car porch were debited to Wages a/c.

d) Purchase book was cast short by Rs. 900.

Answer:

Journal

OR

As the purchase account is less by Rs. 900, it should be debited to the purchase account as “To wrong totaling of Purchase book.” No entry is required.

Question 31.

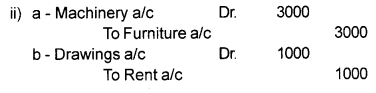

The following errors are located in the books of Carolin. (March 2014)

a) A machine bought for Rs. 3,000 was debited to the Furniture account.

b) Rent of Rs. 1,000 paid for the proprietor’s residence was debited to the Rent account.

i) Identify the types of errors.

ii) Pass the rectification entries.

Answer:

i) a – Error of commission

b – Error of Principle

Question 32.

_______ is a temporary account created when a trial balance is not tallied. (March 2015)

a) Cash account

b) Purchase account

c) Suspense account

d) Sales account

Answer:

c) Suspense account

Question 33.

The following errors are found in the books of Miss Rincy. Help her to rectify the errors. (March 2015)

a) Wages paid for the installation of machinery were debited to the Wages account worth Rs. 5,000.

b) Cash paid to A. Gomez worth Rs. 8,000 was debited to A. Gautham.

c) Cash sales to Mr. Jijo for Rs. 3,000 not entered in the cashbook.

d) Purchase daybook has been overcast by Rs. 500.

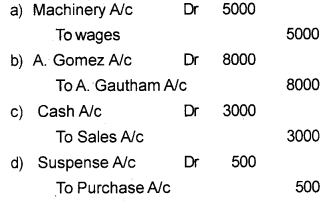

Answer:

OR

Purchase account should be credited with Rs.500/-

Question 34.

The following errors are noticed in the books of accounts of a trader at the time of preparation of a Trial Balance. (March 2015)

a) Sales book was overcast by Rs. 300.

b) Salary paid Rs. 1,500 was wrongly debited to Wages account.

c) Goods sold to Kavitha worth Rs. 2,000 were completely omitted to be recorded.

d) Rent amounting to Rs. 1,200 was received but debited to Rent account as Rs. 120.

i) Pass the rectification entries for the above.

ii) Identify the compensating error from the above.

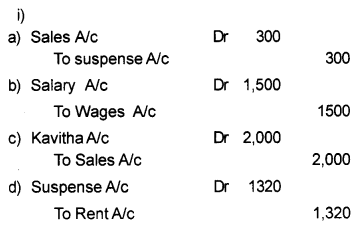

Answer:

ii) Salary paid Rs.1500 was wrongly debited to wages Account – compensating error.

Question 35.

Interest credited to the pass book Rs. 12,000 was found recorded as Rs. 1,200 in the cash book. This error will cause a decline in the cash book by Rs. ________ (Say 2015)

a) 12,ooo

b) 6,000

c) 10,800

d) 1,200

Answer:

c) 10,800

Question 36.

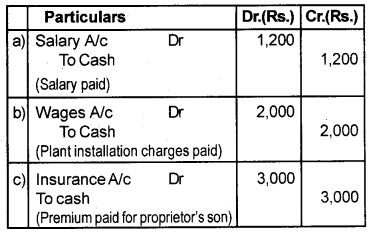

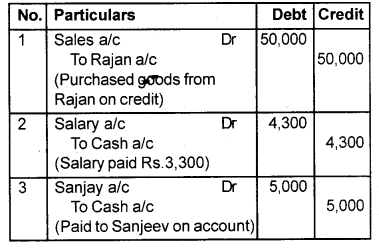

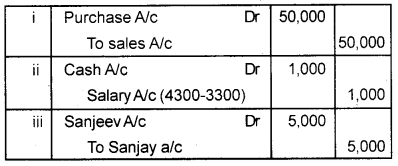

A few journal entries are given below with narration. (Say 2015)

i) Pass the specification entries, if the above is not correct.

ii) Identify the type of errors committed in (b) and (c).

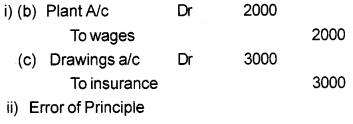

Answer:

ii) Error of Principle

Question 37.

Trial balance is a statement prepared to check the arithmetical accuracy of the business. (March 2016)

a) Name any two types of errors which cannot be disclosed through this statement.

b) Rectify the following errors.

i) Office furniture purchased for Rs.5,000 was posted to the purchase account

ii) Cash sales Rs.2,000 was posted as Rs. 200

iii) Goods are withdrawn by the proprietor for personal use Rs. 1,000 was not recorded in the books.

Answer:

a) Error of principle, compensating error, error due to complete omission.

Question 38.

At the time of preparing the final accounts, the following errors were detected from the books of Swapna. (March 2016)

a) Purchase of furniture for Rs.25,000 entered through purchase book.

b) Sales day book overcast by Rs. 1,000

c) Purchase of goods for Rs. 5,000 not entered in the cashbook.

d) Repairs of machinery Rs. 2,000 entered in machinery account.

i) Rectify the above errors.

ii) Identify the type of errors

Answer:

a) Error of Principle

b) Error of Commission

c) Error of omission

d) Error of principle

Question 39.

Statement prepared to ascertain arithmetical accuracy of accounts. (Say 2016)

a) Bank Reconciliation Statement

b) Statement of Affairs

c) Trial Balance

d) Financial Statements

Answer:

c) Trial Balance

Question 40.

You are required to (Say 2016)

a) Pass rectification entries for the following based on the narration.

b) Which among the following will affect the agreement of Trial Balance?

Answer:

a)

b) Second transaction will affect the agreement of trial balance, (i.e., posting of a wrong amount)

Question 41.

Trial Balance is ________ (March 2017)

a) an account

b) a statement

c) a subsidiary book

d) a principal book

Answer:

b) a statement

Question 42.

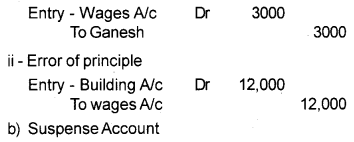

Following errors were noticed in the books of Mr. Prem. (March 2017)

Wages paid Rs. 3,000 to Ganesh was debited to his personal account.

Wages paid for building construction Rs. 12,000 was debited to wages account.

a) Identify the type of error and rectify them.

b) Name the temporary ledger account opened for putting the difference in the trial balance.

Answer:

a) i – Error of commission

b) Suspense Account

Question 43.

Purchases daybook was undercast by Rs. 3,000. Wages paid Rs. 500 in connection with the purchase of machinery have been debited to the wages account. (March 2017)

a) Identify the type of errors committed in the above transactions.

b) Pass the entries to rectify them.

Answer:

a) i) → One side error

ii) → Error of principle/Two side error