Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 4 Bank Reconciliation Statement

Question 1.

State whether the following is “true” or “false”. If false, correct the same. (March 2010)

The balance as shown by the bank passbook and the balance as shown by the bank column of the cash book are always equal.

Answer:

False, may be different

Question 2.

Passbook is the statement of accounts of the customers maintained by the bank. (March 2010)

Answer:

True

Question 3.

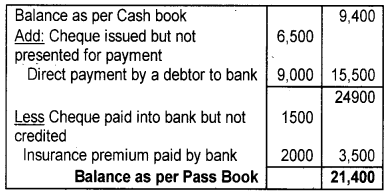

From the following particulars of a business concern, prepare a Bank Reconciliation Statement as of 31 st March, 2004. (March 2010)

a) Bank balance as per cash book Rs. 9,400.

b) During the month, the total amount of Rs. 12,400 was deposited into the bank, out of which one cheque for Rs. 1,500 was entered in the passbook on 2nd April 2004.

c) During the month, cheques for Rs. 15,000 were drawn in favour of creditors, of them one creditor’s cheque for Rs. 6,500 was encashed on 4th April only.

d) A debtor had deposited directly into the bank Rs. 9,000; the same was not recorded in the cash book.

e) As per the agreement, the bank paid an insurance premium of Rs. 2,000 on behalf of the customer, but no entry was recorded in the cash book.

Answer:

Bank Reconciliation Statement as on 31.03.04

Question 4.

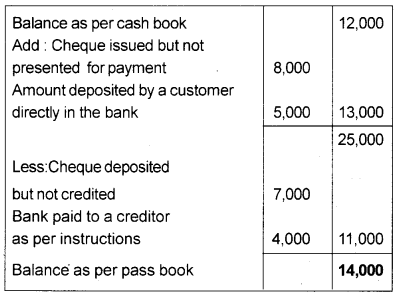

From the following particulars of a business concern, prepare a Bank Reconciliation Statement as of 31st March, 2004, and find out the balance of the passbook on that date. (March 2010)

a) Balance as per the cash book Rs. 12,000.

b) During the month, the total amount of cheque for Rs. 25,000 was deposited into the bank out of which one cheque for Rs. 7,000 had been credited in the passbook only on 2nd April 2004.

c) During the month, cheques of Rs. 18,000 were drawn in favour of creditors. Out of them, one creditor’s cheque for Rs. 8,000 was encashed on 4th April 2004.

d) As per instruction, the bank on 26th March had paid Rs. 4,000 to a creditor, but by mistake, the same has not been recorded in the cash book.

e) According to the agreement on 24th March, a debtor deposited directly into the bank Rs. 5,000, but the same was not recorded in the cash book till 31st March 2004.

Answer:

Bank Reconciliation Statement

Question 5.

Credit balance in the bank column of the cash book means a ______ (March 2011)

a) bank overdraft

b) bank deposit

c) bank balance

d) None of these

Answer:

a) Bank overdraft

Question 6.

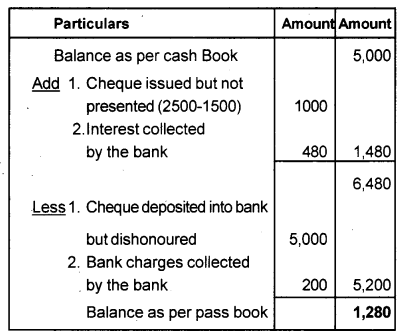

On 31st December 1995, the cash book of Anand and Company showed a bank balance of Rs. 5,000. (March 2011)

From the following information, prepare a bank reconciliation statement showing the balance as per the passbook on that date.

a) Cheques had been issued for Rs. 2,500 out of which cheques worth Rs. 1,500 only were presented for payment.

b) A cheque from Kamal for Rs. 5,000 was paid to the bank on 27th December but was dishonoured and the advice was received on 3rd January 1996.

c) Passbook showed a debt of Rs. 200 for bank charges.

d) Passbook also showed a credit of Rs. 480 collected by the bank as interest.

Answer:

Bank Reconciliation Statement of Anand & company as on 31/12/1995

Question 7.

Sometimes the balances as per the passbook and cashbook do not agree. Illustrate the causes of such disagreements. (March 2011)

Answer:

There are several reasons that contribute to the disagreement of the balance as shown by the cash book and passbook. They are as under:

1. Cheques issued but not presented for payment:

When the trader issues a cheque, he credits its amount immediately in his cash book. The same will be entered in the passbook only on presenting the cheque and making payment by the bank. If the cheque is not presented for payment before the date of preparation of bank reconciliation statement, the balance as per Pass Book will be more than the balance as per Cash Book.

2. Cheque paid in for collection but not collected:

On depositing cheques into the bank for collection, the trader debits the same amount in the bank account. The bank credit the amount in the passbook only on getting the amount collected. Such uncleared cheques make the cash book balance to be more than the passbook balance.

3. Direct payment by a customer to the bank:

Customers of the trader occasionally make some payments directly into the trader’s bank account. The trader may come to know of an only later. But the banker gives immediate credit to the trader on receipt of the amount. If it remains unrecorded in the cash book, the balance as per the passbook will be more than the balance as per the cash book.

4. Interest on deposit credited by the banker:

At regular intervals, banks allow interests on the deposit balance of the trader and credit the amount in the pass book. The same usually remains unrecorded in the cash book. In such a case, the passbook balance will be more than the cash book balance.

5. Interest, dividend, rent, etc. collected by the bank:

Bank collects interest, dividend, rent, etc. on behalf of the customer and credits the same to his account. The trader comes to know of it only on a later date. If such collection remains unrecorded in the cash book, the passbook balance will be more than the cash book balance.

6. Payment made on behalf of the customer:

The banker makes the payment for rent, insurance, etc., for the customer as per standing instructions. The banker debit the trader’s account with such payments. The trader comes to know of it only later. Due to such payments that remain unrecorded in the cash book, the balance as per the pass book will be less than the balance as per the cash book.

7. Bank charges as per Pass Book:

Bank charges and commission for collection of cheques, bills, etc., are debited in the passbook. The corresponding credits are often not given in the cash book. As these items are not entered in the cash book, their balance will be more than that of the pass book.

8. Bills Receivable discounted, but dishonoured:

When a trader discounts bills of exchange, the banker credits the trader’s account with the amount due. The same amount is debited by the trader in cash book. If such a bill is later dishonoured, the banker immediately debit it in the pass book. But the same remains unrecorded in the cash book. This cause the balance as per cash book to be more than the pass book balance.

9. Interest on overdraft debited in pass book:

Periodically the bank calculates interest due by the trader on his overdraft and debits the amount in the pass book. Corresponding credit is often not made by the trader in his cash book. It leads to difference in the balance as per cash book and pass book.

10. Credit instruments credited by bank but not recorded in cash book:

Bills of exchange, promissory notes and other credit instruments collected by bank are credited in the pass book. But if they remain unrecorded in the cash book it may, lead to disagreement between the balance as per the two books.

11. There may also be instance of cheque recorded as paid in for collection but failed to be deposited into the bank, by which the cash book balance will be more than the balance as per pass book.

Question 8.

Credit balance in the passbook means a/an _________ to the depositor. (March 2012)

a) asset

b) liability

c) contingent liability

d) fictitious asset (1)

Answer:

a) Asset

Question 9.

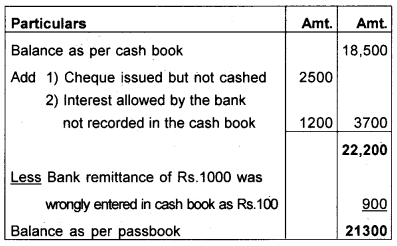

On March 31st, 2011 the cashbook of Eco Travels showed a debit balance of Rs. 18,500. At the same time, its passbook showed a credit balance of Rs. 21,300. On comparing the cashbook with the passbook, the following discrepancies were found. (March 2012)

a) A cheque for Rs. 2,500 issued to Sreedevi on 21st March 2011 has not been cashed till March 31st, 2011.

b) Rs. 1,200 in respect of interest allowed by the bank was not found debited in the cashbook.

c) The bank remittance of Rs. 1,000 was wrongly entered in the cashbook as Rs.100.

Reconcile the cashbook balance with the passbook balance from the above information.

Answer:

Bank Reconciliation Statement as on 31-3-2011

Note: The statement start with pass book balance, we will arrive at the balance as per cash book

i.e, 21,300 – (3700) + 900 = 18500

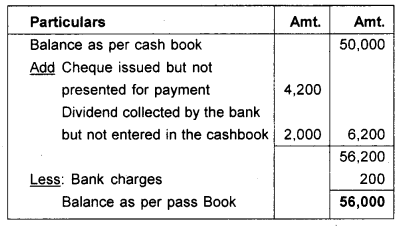

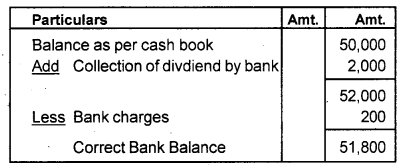

Question 10.

Prepare a bank reconciliation statement and find the correct passbook balance as on 31st March 2010. (March 2012)

a) Balance as per the cashbook on 31st March, 2010 Rs. 50,000/-.

b) Cheque issued but not presented for payment till 31st March, 2010 Rs. 4,200/-.

c) Dividend credited in the passbook which was not recorded in the cashbook Rs.2,000/-.

d) Bank charges entered only in the pass book Rs. 200/-

Answer:

Bank Reconciliation Statement as on 31/03/2010

Computation of correct Bank Balance

Question 11.

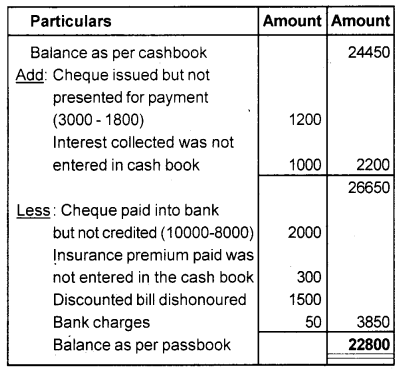

From the following prepare a Bank Reconciliation Statement of Tomy as on 31st March 2003. Balance as per Pass Book on this date was ₹ 22,000 and balance as per cash book was ₹ 24,450. (Say 2012)

1) Cheques amounting ₹ 10,000 was put into bank during March, but credit was given only for ₹ 8,000.

2) The bank paid Insurance Premium of ₹ 300 on March 20th but was not entered in the cash book.

3) A discounted wfl receivable of ₹ 1,500 was dishonoured on March 28, but corresponding entry in cash book was made on 3rd April 2003.

4) Of the cheques amounting ₹ 3,000 issued to creditors, the cheques of Rs. 1,800 only was presented for payment.

5) Bank charge of ₹ 50 appeared only in passbook.

6) Interest collected and credited by the bank ₹ 1,000 was not entered in cash book.

Answer:

Bank Reconciliation Statement as on 31/3/2003

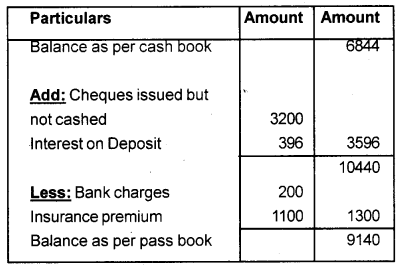

Question 12.

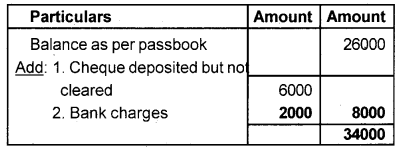

Prepare a bank reconciliation statement from the following details. (March 2013)

a) Balance as per the passbook, Rs. 26,000

b) Cheques deposited but not cleared, Rs. 6,000

c) Cheques issued but not presented, Rs. 300

d) Bank interest credited in the passbook, Rs. 600

e) Bank charges debited in the passbook, Rs. 2,000

Answer:

Bank Reconciliation Statement

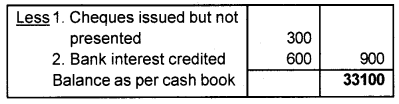

Question 13.

On January 31, 2013, the passbook of Miss. Reshmi showed a credit balance of Rs. 15,000. On verifying the passbook with the cashbook, the following were observed: (March 2013)

a) Cheques issued but not presented January 31, 2013 – Rs. 3,000

b) Cheques deposted but not cleared – Rs. 4,500

c) Bank charges not seen in the cashbook – Rs. 100

d) Insurance premium paid by the bank – Rs. 300

i) Ascertain the cashbook balance as on the above date.

ii) Give any two causes of differences between a cashbook and a passbook other than the four stated above.

Answer:

Bank Reconciliation Statement as on 31-1-2013

b) i) – Interest, dividend etc. collected by the bank.

ii) – Direct payment by the bank on behalf of customer.

iii) – Interest credited by the bank.

iv) – Dishonour of cheque/bill discounted with the bank.

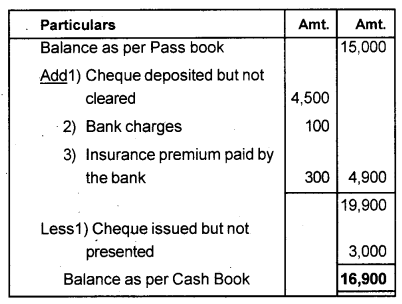

Question 14.

Ascertain the bank Balance as per the passbook of RK Traders from the given particulars. (March 2014)

a) Debit balance as per the cash book – Rs. 6,844

b) Cheques issued but not cashed – Rs. 32,00

c) Bank charges not shown in the cash book – Rs. 200

d) Insurance premium paid by the bank – Rs. 1,100

e) Interest on deposit – Rs. 396

Answer:

Bank Reconciliation Statement as on……

Question 15.

Prepare a Bank Reconciliation Statement on behalf of Lalu Shoe Mart, as on 31.03.2013. (March 2014)

Balance as per cash book as on 31.03.2013 was Rs. 3,000.

Cheque worth Rs. 2,000 issued for rent, so far not presented to bank.

Interest credited to passbook was only Rs. 1,200.

Chinnu, one of our customers, credited Rs. 4,000 to our bank directly.

Bank charges of Rs. 200 were not credited to the cash book so far.

Answer:

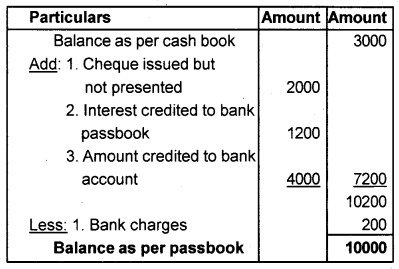

Bank Reconciliation Statement as on 31.03.2013

Question 16.

The Cashbook of Mr. Mathew as on 31/12/2014 shows a difference when compared to the passbook. The following were noticed in this respect. (March 2015)

a) Credit balance as per passbook Rs. 30,000.

b) Cheque issued but not presented worth Rs. 1,000.

c) Two cheques for Rs. 3,700 and Rs. 1,300 were deposited but only the cheque for Rs. 3,700 was credited by the bank.

d) Bank charges of Rs. 100 not recorded in the cashbook.

e) Electricity bill of Rs. 700 paid by the bank on behalf of the customer.

i) Prepare a Bank Reconciliation Statement.

ii) While preparing a cashbook, the bank overdraft will have ______ balance in the bank column of the cashbook (Debit/Credit)

Answer:

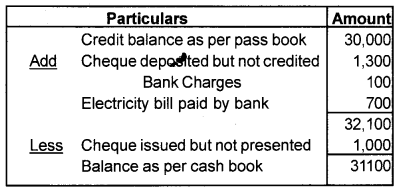

i) Bank Reconciliation Statement as on 31/12/2014

ii) Credit Balance

Question 17.

a) Bank Reconciliation Statement is usually prepared by the _________ (March 2015)

i) bank

ii) account holder

iii) government

iv) None of these

b) Prepare a Bank Reconciliation Statement.

Answer:

a) Account Holder

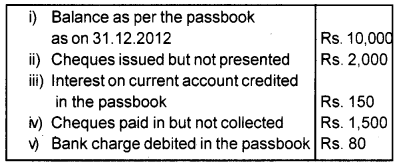

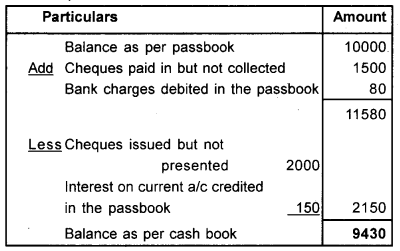

b) Bank Reconciliation Statement as on 31/12/2012

Question 18.

Prepare a bank reconciliation statement as of 31-03-2014. (Say 2015)

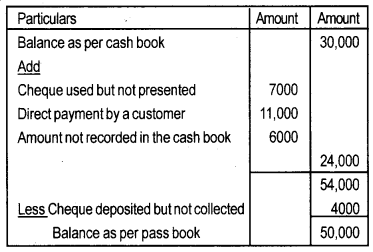

a) Cash book balance as of 31-03-2014 – Rs. 30,000

b) Cheque deposited but not collected – Rs. 4,000

c) Cheque given to Kumar but not presented Rs. 7,000

d) Ravi, a customer made a direct payment to the bank – Rs. 11,000

e) A sum of Rs. 6,000 deposited into the bank not recorded in the cash book.

Answer:

Bank Reconciliation Statement as on 31/03/2014

Question 19.

Credit balance in the bank column of cash book indicates ________ (March 2016)

a) cash at bank

b) overdraft

c) cash in hand

d) None of these

Answer:

b) overdraft

Question 20.

A bank reconciliation statement is prepared to reconcile the cash book and pass book balance on a certain date. (March 2016)

a) This statement is prepared by

b) Write anyone causes for the difference in Passbook and Cashbook.

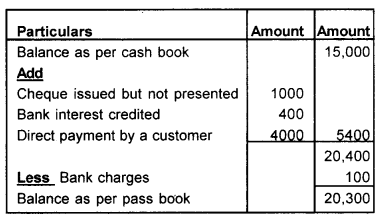

c) Cashbook of Tinu shows a bank balance of Rs. 15,000. On comparing the cash book and pass book the following discrepancies were found.

i) Cheque issued to Deepa but not yet presented for payment of Rs. 1,000.

ii) Bank interest credited by the bank Rs. 400

iii) Divya, a customer directly deposited as. 4,000 to the firm’s bank account.

iv) Bank charges Rs. 100 not entered in the cash book.

Prepare bank reconciliation statement.

Answer:

a) Customer/Businessman/Trader

b) Cheques issued but not presented for payment

c) Bank reconciliation statement

Question 21.

Overdraft as per the cash book on 01/12/2015 Rs. 750. (Say 2016)

The dividend credited by the bank on 31/12/2015 was Rs. 1,250.

New balance as per the cash book will be ____

a) Overdraft as per the cash book Rs. 2,000

b) overdraft as per the cash book Rs. 750

c) balance as per the cash book Rs. 1,250

d) balance as per the cash book Rs.500

Answer:

d) Balance as per the cash book Rs. 500

Question 22.

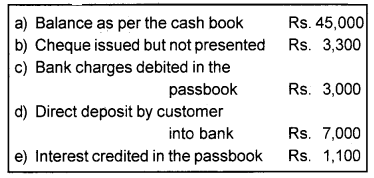

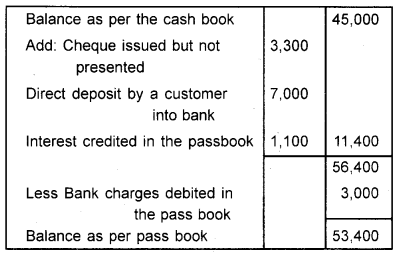

Prepare a Bank Reconciliation Statement as of 31/01/2015, from the following information. (Say 2016)

Answer:

Bank Reconciliation Statement as on 31/01/2015

Question 23.

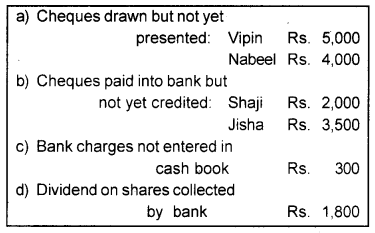

The cashbook of a trader showed a debit balance of Rs. 48000 on 31st January 2015. On comparing the same with bank passbook, the following information was received. (March 2017)

i) Prepare a Bank Reconciliation Statement as of 31st January 2015.

ii) Choose the correct answer from brackets for the following question

A bank reconciliation statement is prepared by ____ (bank/depositor)

Answer:

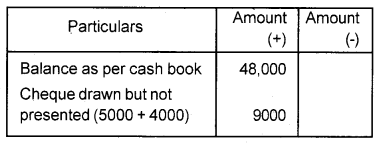

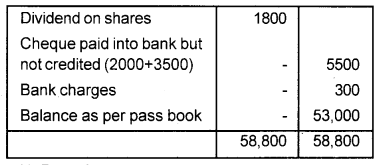

a) Bank reconciliation statement as on 31/01/2015

b) Depositor

Question 24.

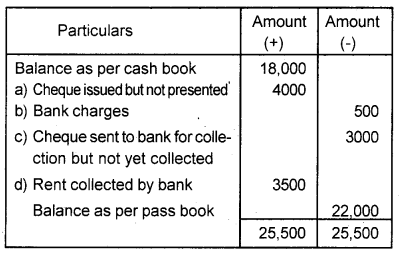

The cashbook of Manu showed a debit balance of Rs. 18,000. On comparing a cashbook with a passbook, the following differences were noted. (March 2017)

a) Cheque issued but not yet presented for payment Rs. 4,000.

b) Bank charges debited in the passbook Rs. 500.

c) Cheques sent to the bank for collection but not yet collected Rs. 3,000.

d) Rent collected and credited by bank Rs. 3,500.

i) Name the statement Manu will prepare in order to reconcile the balance as per cashbook with the passbook.

ii) Prepare that statement to reconcile it.

Answer:

i) Bank reconciliation statement

ii) Bank reconciliation statement as on _______