Kerala Plus One Accountancy Chapter Wise Previous Questions and Answers Chapter 3 Recording of Transactions – I & Recording of Transactions – II

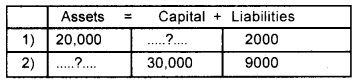

Question 1.

The journal is the book of ________ (March 2010)

a) original entry

b) secondary entry

c) only cash transaction

d) only credit transaction

Answer:

a) original entry

Question 2.

Sales journals record all ________ sales of goods. (March 2010)

Answer:

Credit

Question 3.

All drawings made by the proprietor are debited to the _______ account. (March 2010)

Answer:

Drawing a/c / Capital a/c

Question 4.

State whether the following is “true” or “false”. If false, correct the same.

Sales Return Journal is also known as Return Outward Journal. (March 2010)

Answer:

False.

Sales returns journal is also known as the Return inward journal.

or

Purchase Returns Journal is also known as Return outward journal

Question 5.

Sales Journal records all _______ sale of goods. (March 2010)

Answer:

Credit sales of goods

Question 6.

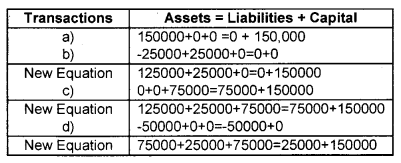

Develop an accounting equation with respect to Ram Traders on 1st January 2004.

a) Started business with a capital of Rs. 1,50,000.

b) On 2nd January 2004, purchased machinery for Rs. 25,000.

c) On 15th January 2004, purchased goods from Raju on credit worth Rs. 75,000.

d) On 20th Feb 2004 paid Rs. 50,000 to Raju. (March 2010)

Answer:

Question 7.

Recording of transactions in the journal is called ________ (March 2011)

a) Posting

b) Journalizing

c) balancing

d) Trial Balance

Answer:

b) Journalizing

Question 8.

Withdrawal of goods by an owner for his private use must be _______ in the Drawings account. (March 2011)

a) debited

b) credited

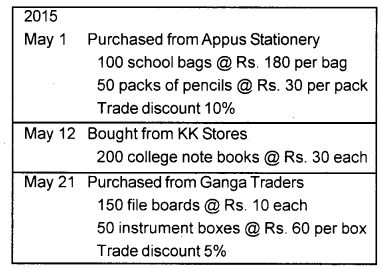

c) deleted

d) not entered

Answer:

a) Debited

Question 9.

The Purchase Day Book contains _______ (March 2011)

a) all purchases

b) credit purchases of goods

c) cash purchases

d) None of these

Answer:

b) Credit purchase of goods.

Question 10.

Which of the following is not a book of original entry? (March 2011)

a) Cashbook

b) Ledger

c) Purchase book

Answer:

b) Ledger

Question 11.

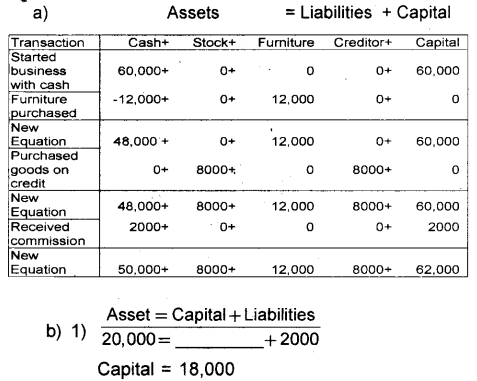

Shyam started the business with Rs. 50,000/-. The value of the total assets at the moment will be Rs. ________ (March 2011)

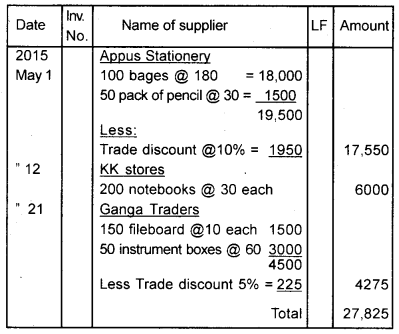

Answer:

Rs. 50,000

Question 12.

State whether the following is “true” or “false”. If false, correct the same.

If the debit side of an account is more than the credit side, it has a credit balance. (March 2011)

Answer:

False, Debit balance

Question 13.

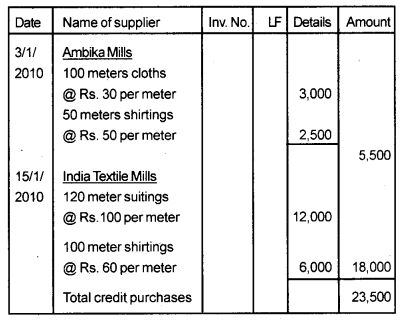

M.S. Brothers carry on business as cloth dealers. From the following, write their Purchase book for January 2010

3rd January 2010: Purchased on credit from Ambika Mills, 100 meters long cloth @ Rs. 30 per meter and 50-meter shirting @ Rs. 50 per meter.

8th January 2010: Purchased for cash from Aravind Mills, 50 meters muslin @ Rs. 40 per meter.

15th January 2010: Purchased on credit from India Textile Mills, 120 meters suiting @ Rs. 100 per meter and 100 meters shirting @ Rs. 60 per meter.

20th January 2010: Purchased laser printer on credit from Bharat Company Ltd. for Rs. 12,000. (March 2011)

Answer:

Purchase Day Book

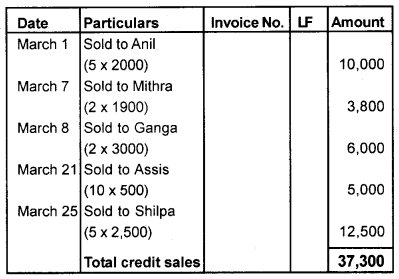

Question 14.

The following are the transactions taken from the books of a furniture dealer. (March 2011)

March 1: Sold to Anil, 5 tables, @ Rs. 2,000 per table

March 7: Sold to Mithra, 2 dressing tables, @ Rs. 1,900 per table.

March 8: Sold to Ganga, 2 dining tables, @ Rs. 3,000 per table.

March 18: Sold to Ameer, a motorcycle for Rs. 14,000

March 21: Sold to Assis, 10 wooden chairs, @ Rs. 500 per chair.

March 25: SoldtoShilpa, 5 wooden tables, @Rs. 2,500 per table

Prepare the sales book for the month of March.

Answer:

Question 15.

Total of the discount column in the payment side of the cashbook is posted to the ________ (March 2012)

a) discount allowed account

b) discount received an account

c) returns inwards account

d) returns outwards account

Answer:

b) Discount Received Account

Question 16.

Fixed asset purchases on credit are recorded in the ______ journal. (March 2012)

Answer:

Special journal/General journal/Journal proper

Question 17.

Cashbook is different from other journals. Explain any four features of a cashbook. (March 2012)

Answer:

Features of a Cash Book

a) It is a daybook used to record all receipts and payments of cash.

b) All receipts of cash are entered on the debit side of the cash book, while all cash payments are entered on the credit side.

c) All entries are made date-wise.

d) A cash book serves the purpose of both journal and a ledger account.

Question 18.

Correct the following statements. (March 2012)

a) Increase in expense is debited in the income account.

b) Increase in liability is debited in the asset account.

Answer:

a) Increase in expense is debited in the expense account

b) Increase in liability is credited in the liability account

Question 19.

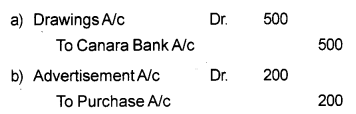

Write the business transaction corresponding to the following entries: (March 2012)

Answer:

a – Withdraw from the bank for personal or domestic uses.

b – Goods distributed as free samples.

Question 20.

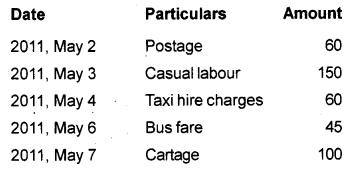

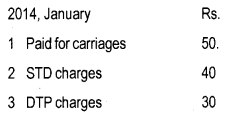

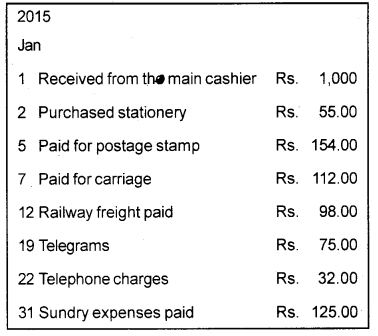

The following transactions took place during the week ending 7th May 2011. How will you record them in the analytical petty cashbook which is maintained with a weekly cash float (interest) of Rs 500? (March 2012)

(Hint: Cash float (imprest) is the amount which the main cashier hands over to the petty cashier in order to meet the petty cash expense of a given week)

Answer:

Analytical Petty Cash Book

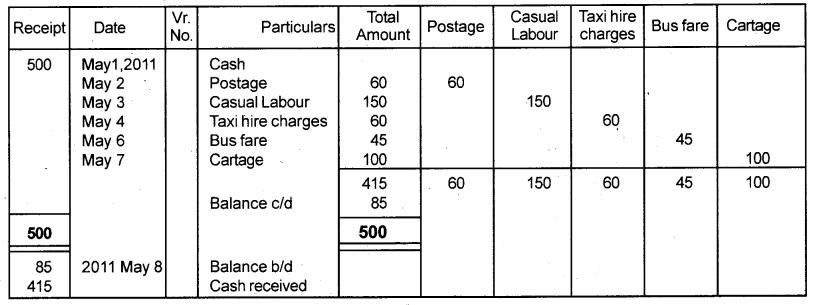

Question 21.

“Accounting equation forms the basis of the accounting process.” Prove that the accounting equation is satisfied in all the following transactions. (March 2012)

a) Mr. Suresh commenced business with cash Rs.40,000.

b) Purchased goods on credit Rs. 6,500.

c) Paid rent Rs.500.

d) Sold goods costing Rs. 6,500 on credit for Rs.8,000.

Answer:

Question 22.

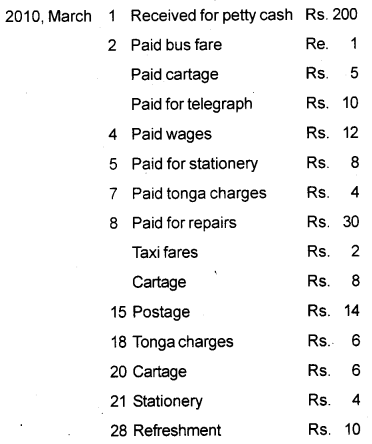

Prepare an analytical petty cash book on the Imprest system from the following. (March 2012)

Answer:

Analytical Petty Cash Book

Question 23.

An asset account will usually show ______ balance only. (Say 2012)

a) Credit

b) Debit

c) Equality

d) None of these

Answer:

b) Debit

Question 24.

The type of account usually having a debit balance is _______ (Say 2012)

a) Capital Account

b) Bills payable

c) Bank Account

d) Depreciation

Answer:

c) bank a/c or d) Depreciation

Question 25.

If both the aspect of the same transaction appears in one account it is called _______ entry. (Say 2012)

Answer:

Contra

Question 26.

Journal is a book of ______ entry, while ledger is the book of _______ entry. (Say 2012)

Answer:

Original/Primary and Secondary

Question 27.

Identify the debit and credit aspects of the following business transaction. Goods took by the owner for his personal use. (Say 2012)

Answer:

Goods took by the owner for his personal use.

Debit – Drawings

Credit – Purchase

Question 28.

List out the appropriate source document for recording the following transactions. (Say 2012)

a) Electricity charges paid

b) Salary paid

c) Deposit of money into a bank

d) Receipt of cash from the sale of goods.

Answer:

a) Receipt from KSEB

b) Payroll or Acquittance

c) Counterfoil of Pay-in-slip

d) Sales bill/Receipt

Question 29.

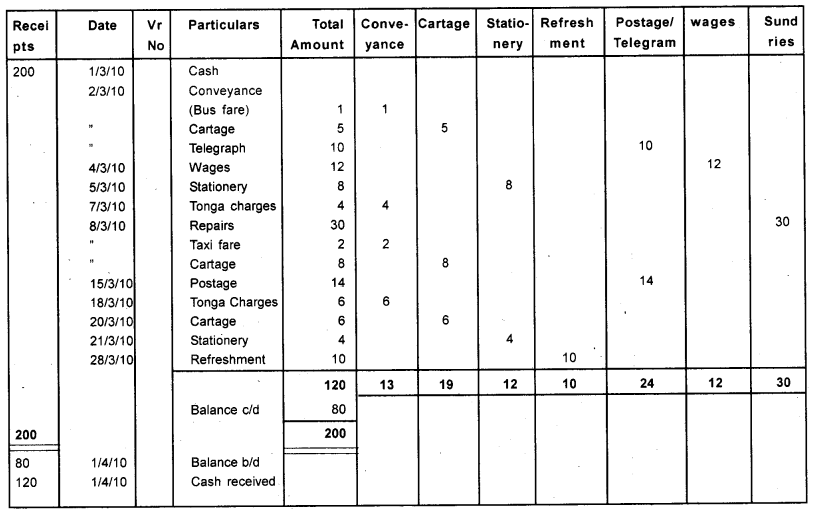

Show the impact of the following transactions on the accounting equation: (Say 2012)

a) On 1st January 2008 Umesh started the business with ₹ 5,00,000.

b) On 5th January 2008 purchased Land for ₹ 1,00,000

c) On 10th January 2008 purchased machinery for ₹ 50,000.

d) On 20th January 2008 purchased goods for ₹ 1,00,000 on credit from Raju.

e) On 25th January 2008 deposited ₹ 2,00,000 in the bank.

f) On 26th January 2008 purchased furniture for ₹ 25,000.

g) On 27th January 2008 introduced Additional Capital of ₹ 50,000.

h) On 30th January 2008 purchased goods for cash ₹ 2,00,000.

Answer:

Assets = Liabilities + Capital

650000 = 550000 + 100000

Question 30.

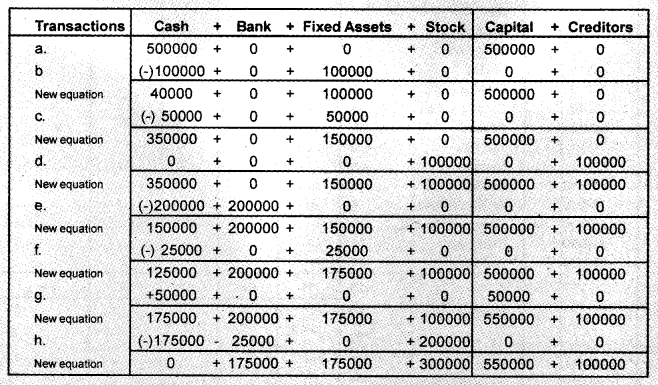

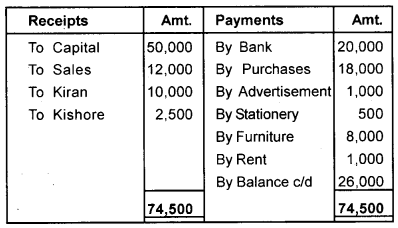

Roy started a business on 1 st April 2010 by investing Rs. 50,000. Help him to find out the closing balance of cash for the month considering the following transactions. (Say 2012)

Answer:

Cash Book

Question 31.

The transaction started the business with cash results in ________ (March 2013)

a) Increase in assets and decrease in assets

b) Increase in assets and a decrease in liability

c) Decrease in asset and increase in liability

d) Increase in asset and increase in liability

Answer:

d) Increase in asset and increase in liability

Question 32.

Purchase of furniture from M/s. Thankam Traders is recorded in _________ (March 2013)

a) Purchase Day Book

b) Cashbook

c) Journal Proper

d) Sales Day Book

Answer:

c) Journal Proper

Question 33.

Accounts that normally have debit balances are _______ (March 2013)

a) Assets, expenses, and revenues

b) Assets, expenses, and owner’s capital

c) Assets, liabilities, and owner’s drawings

d) Assets, owner’s drawings, and expenses

Answer:

d) Assets, Owner’s drawings, and Expenses.

Question 34.

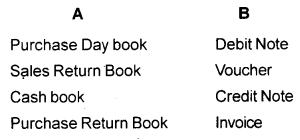

Match the following. (March 2013)

Answer:

Purchase Day Book – Invoice

Sales Return Book – Credit Note

Cash Book – Voucher

Purchase Return Book – Debit Note

Question 35.

Unni purchased goods for Rs. 9818 and the trader allowed a discount of Rs. 18 at the time of purchase. (March 2013)

a) Identify the type of discount.

b) Mention the other types of discounts available and differentiate them from the one stated above.

Answer:

a) Trade Discount

b) Cash Discount/Discount allowed.

Difference between Trade Discount and Cash Discount

| Trade Discount | Cash Discount |

| 1. It is allowed by the seller to the purchaser. | 1. Allowed by the Creditors to the debtor. |

| 2. Encourages bulk purchases. | 2. Encourages prompt payments. |

| 3. Not shown in the books of accounts. | 3. Shown in the books of accounts. |

Question 36.

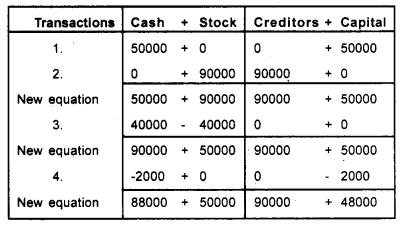

Give the accounting equation after each transaction. (March 2013)

a) Thomas started business with cash Rs. 50,000

b) Purchased goods on credit from Smitha, Rs. 90,000

c) Sold goods for cash Rs. 40,000

d) Paid wages Rs. 2,000

Answer:

Assets = Liabilities + Capital

Question 37.

Journal is prepared on a ______ basis. (March 2014)

a) daily

b) weekly

c) monthly

d) yearly

Answer:

a) daily

Question 38.

If goods are sold for Rs. 12500 and the discount allowed is Rs. 600, what amount will be recorded in the cash book? (March 2014)

a) 12500

b) 11900

c) 13100

d) 600

Answer:

b) 11900

Question 39.

Debit note is a source of document for recording the ________ (March 2014)

a) Sales returns

b) Purchase returns

c) Purchases

d) Sales

Answer:

b) Purchase returns

Question 40.

Complete the following with “Principal Book, Primary Book, First Entry, Second Entry.” (March 2014)

a) Cash book: _________: ___________

b) Cash account: ________: __________

Answer:

a. Cash book – Primary Book, First Entry

b. Cash Account – Principal Book, Second Entry

Question 41.

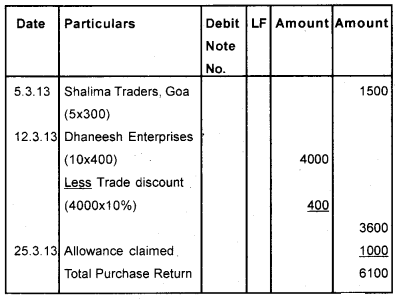

Enter the following transactions in the Purchase Returns book of Morazha Ltd. (March 2014)

2013

March 5: Returned to Shalima Traders, Goa, 5 bags of coffee @ Rs. 300 per bag.

March 12: Returned to Dhanesh Enterprises, Madgoa, 10 chests of tea @ Rs. 400 per chest less trade discount 10%.

March 25: Allowance claimed on account of a mistake in the invoice Rs. 1,000.

Answer:

Purchase Return Book of Morazha Ltd.

Question 42.

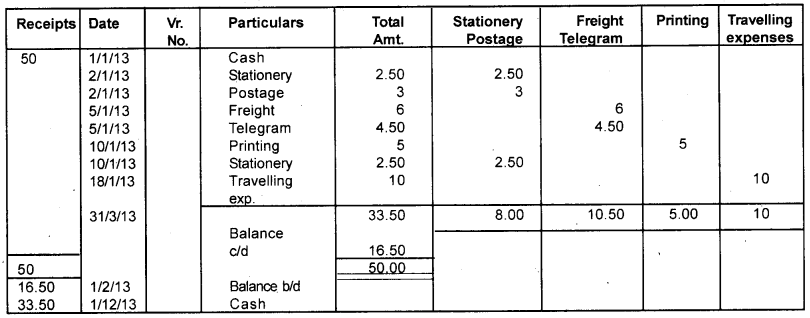

Record the following transactions in the petty cash book. On 1st January 2013, Rs. 50 was given to the petty cash clerk who made the following payments. (March 2014)

Jan. 2 – Stationery Rs.2.50, Postage Rs.3.00

Jan. 5 – Freight Rs. 6.00; Telegram Rs. 4.50

Jan. 10 – Printing Rs. 5, Stationery Rs. 2.50

Jan. 18 – Travelling expenses Rs. 10

Answer:

Analytical Petty Cashbook

Question 43.

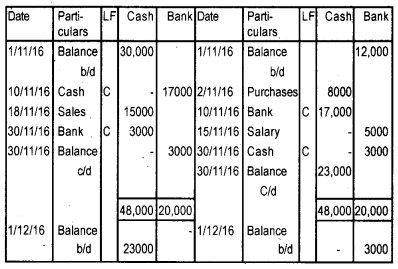

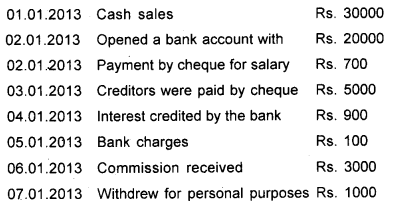

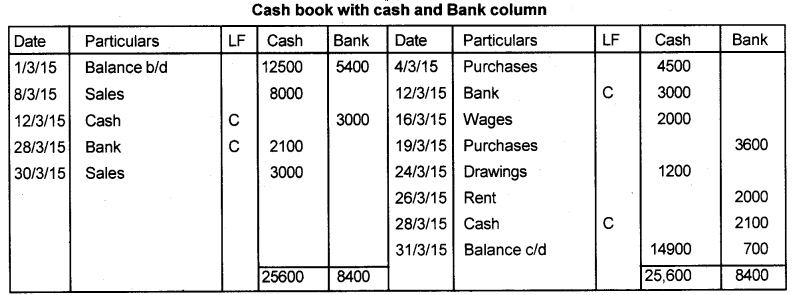

Prepare a double column cash book on behalf of a cloth merchant from the information given below. (March 2014)

Answer:

Cashbook with Cash and Bank columns

Question 44.

_______ is used as a source document for recording purchase returns. (March 2015)

Answer:

Debit Note

Question 45.

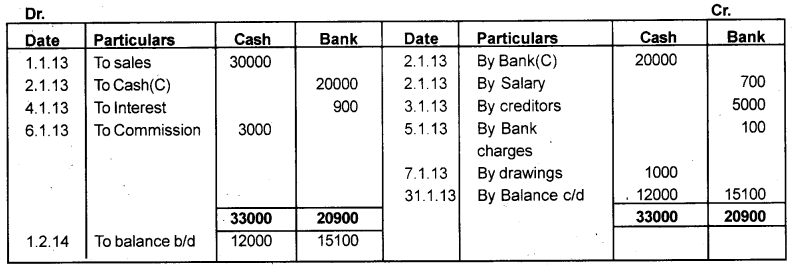

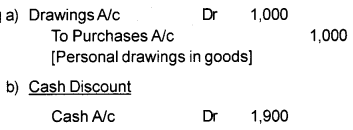

Given below are some journal entries. (March 2015)

a) Give Journal entries to these entries.

b) Explain the type of discount mentioned in the second Journal entry.

Answer:

Question 46.

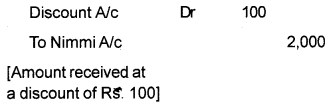

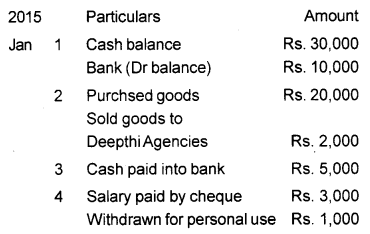

Some transactions relating to a business are given below. (March 2015)

a) Prepare a suitable cashbook from the above.

b) Identify a special Journal where goods are withdrawn by the proprietor for personal use worth Rs. 200 will be recorded.

Answer:

a) Cash Book with cash and Bank column

b) Journal Proper

Question 47.

a) Fill in the blank. (March 2015)

“Deposited money into the bank worth Rs. 5,000”. While posting the above entry into the cashbook, this is treated as a/an _________ entry.

b) Fill in the blank columns.

Answer:

a) a contra entry

b) i. Purchase Day Book

ii. Cash Book

iii. Opening and closing entries, Adjustingentries, Rectification entries, etc.

iv. Sales Return Book

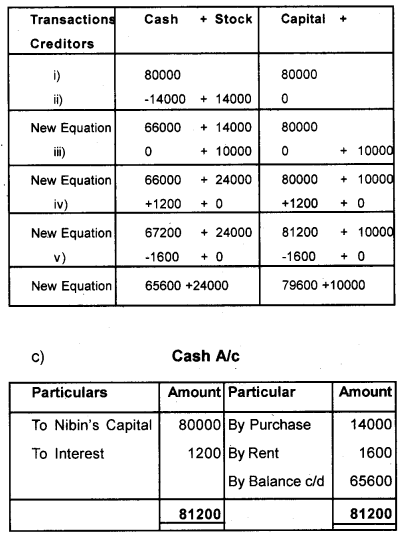

Question 48.

a) Asset = ______ + Capital

b) Show the accounting equations on the basis of the following transactions.

i) Nibin commenced business with cash of Rs. 80,000

ii) Bought goods for cash Rs. 14000

iii) Bought goods on credit Rs. 10000

iv) Received interest Rs. 1200

v) Paid rent Rs. 1,600

c) Prepare a Cash account from the above transactions. (March 2015)

Answer:

a) Assets = Liabilities + Capital

b)

Question 49.

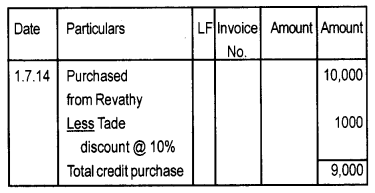

Sathees gives you the following transaction: (Say 2015)

01-07-2014. Purchased goods from Revathy Rs. 10,000. Trade discount @ 10%

a) In which book will this transaction be recorded?

b) Prepare the special journal.

Answer:

a) Purchase journal/Purchase daybook

b) Purchase Daybook

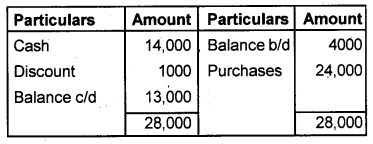

Question 50.

A firm has given you certain particulars relating to Siva Kumar. (Say 2015)

The amount owed to Siva Kumar on 01-01-2014 Rs.4,000

Purchases from him during the year Rs.4,000

Discount received from Siva Kumar Rs. 1,000

Cash paid to him Rs. 14,000

a) Who is Siva Kumar to the business?

b) Prepare Siva Kumar’s account.

Answer:

a) Creditor

b) Sivakumar’s A/c

Question 51.

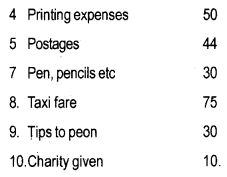

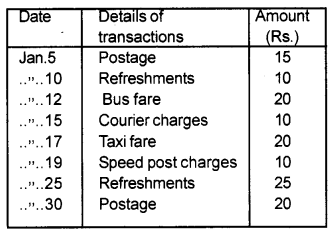

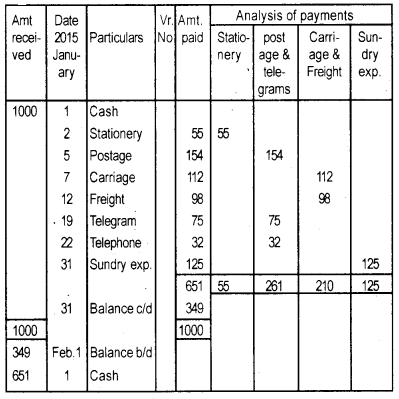

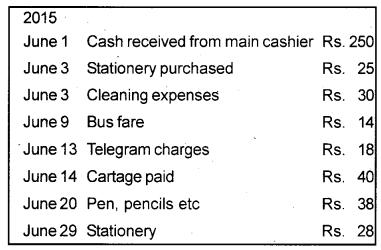

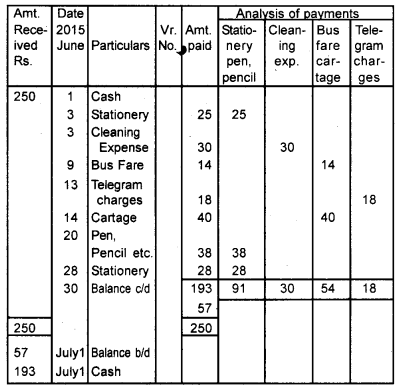

Prepare a petty cash book for the following transactions during the month of January 2014 with a weekly imprest of Rs. 500. (Say 2015)

Answer:

Analytical petty cash book

Question 52.

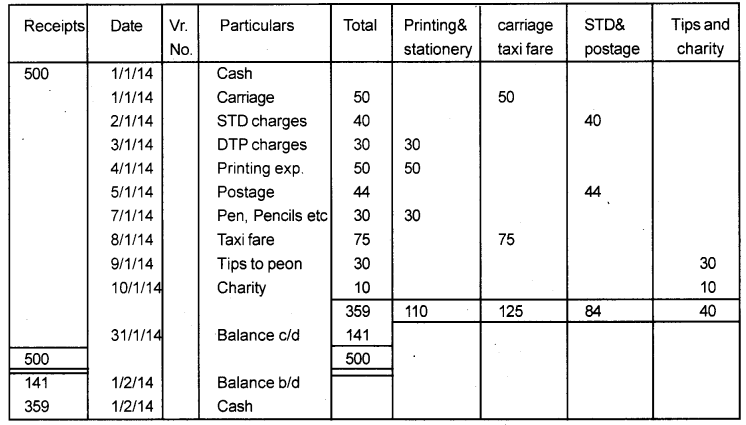

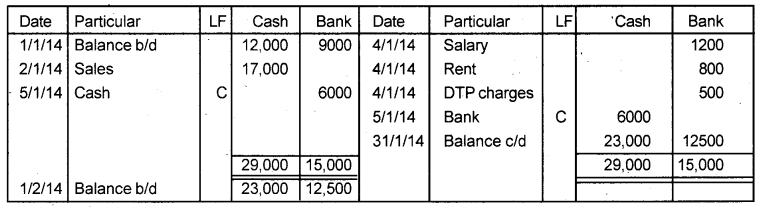

Ravi, a stationery merchant whose cash transactions during the month of January 2014 are as follows: (Say 2015)

1-1-2014 Balance of cash in hand Rs.12,000

1- 1-2014 Bank balance Rs.9,ooo

2-1-2014 Sold goods for cash Rs.17,000

4-1-2014 Payment by cheque for the following expenditure

Salary Rs. 1,200

Rent Rs. 800

DTP charges Rs. 500

05-01-2014 Suresh, a customer has deposited Rs.6,000 into our bank directly.

Prepare a suitable cash book for recording the above transactions.

Answer:

Cashbook with cash and bank column

Question 53.

Purchased goods from Sreejesh for cash. In this transaction which account is credited? (March 2016)

a) Purchase

b) Sreejesh

c) Cash

d) None of these

Answer:

c) Cash

Question 54.

Journal and ledger are two important books maintained in accounting. (March 2016)

a) State any two differences between these books.

b) Purchase office furniture for Rs. 500 by cheque.

The account to be debited is _______

Answer:

a) i) Journal is the book of primary entry whereas ledger is the book of secondary entry.

ii) The process of entering transactions in the journal is called journalizing. The process of recording entries in the ledger is called posting.

b) Furniture Account is debited.

Question 55.

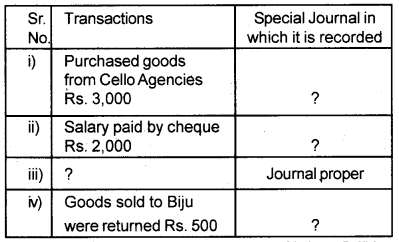

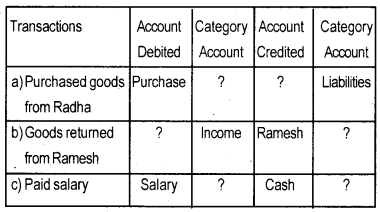

Complete the table given below. (March 2016)

Answer:

a) Expenses, Radha

b) Sales returns, Assets

c) Expenses, Asset

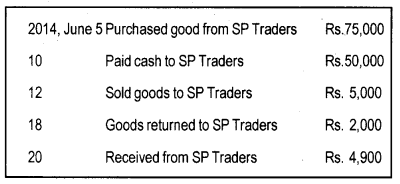

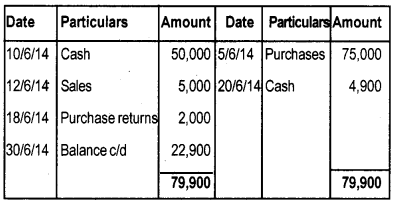

Question 56.

GM Traders has the following transactions with SP Traders. (March 2016)

Prepare SP Trader’s account in the books of GM Traders for June 2014.

Answer:

SP Traders A/c

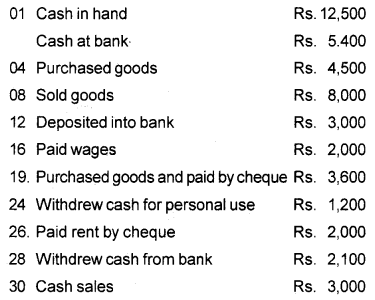

Question 57.

Prepare a cashbook from the following transactions for March 2015. (March 2016)

Answer:

Question 58.

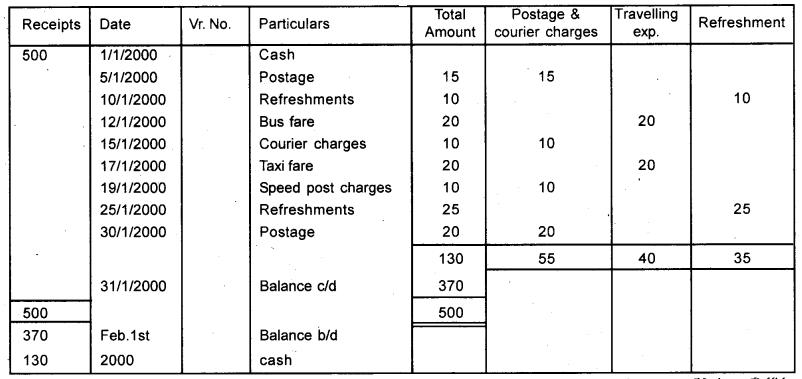

In every organization, a large number of small payments of repetitive nature are there. To record these as a separate cash book is maintained is called petty cashbook. (March 2016)

a) Name the person who prepares this book.

b) What is imprest?

c) Prepare a petty cashbook from the following transactions of Nisha associates for the month of January 2000, under analytical firm given that imprest amount is Rs. 500.

Answer:

a) Petty cashier

b) Imprest is a fixed sum given by the main cashier to the petty cashier at the beginning of the period.

c) Analytical Petty Cash Book

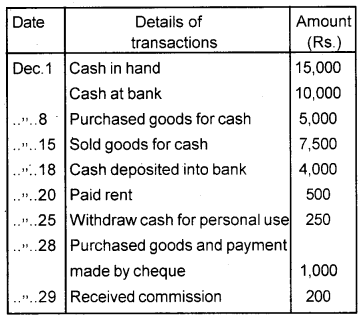

Question 59.

For the quite efficient and accurate recording of a business transaction, the journal is subdivided into special journals. (March 2016)

a) List any two examples for special journals.

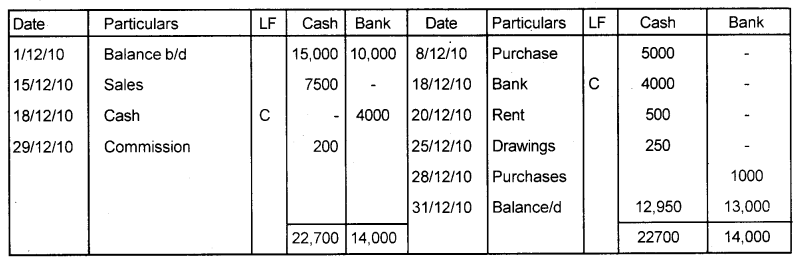

b) Prepare a cash book from the following transactions of grace enterprises for the month of December 2010.

Answer:

a) Cashbook, purchase day book, sales day book, purchase return book, sales return books

b) Cashbook with cash and bank column

Question 60.

Goods withdrawn by the proprietor for personal use are debited to _________ (Say 2016)

a) capital account

b) drawings account

c) stock account

d) purchase account

Answer:

b) Drawings account

Question 61.

Goods returned by customers are also known as ______ (Say 2016)

a) purchase returns

b) returns outwards

c) returns inwards

d) goods in transit

Answer:

c) Returns inwards

Question 62.

Show the accounting equation in the respect of the following transactions. (Say 2016)

a) Started business with cash Rs. 1,00,000

b) Purchased goods from Menon Rs. 30,000

c) Sold goods for cash Rs. 20,000

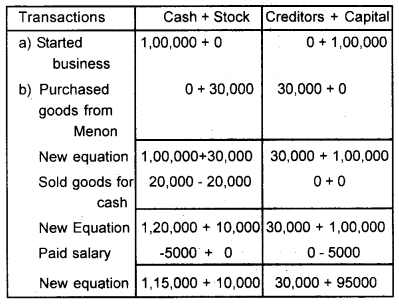

d) Paid salary Rs. 5,000

Answer:

Asset = Liabilities + Capital

Asset = Liabilities + Capital

1,25,000 = 30,000 + 95,000

Question 63.

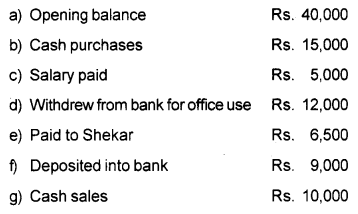

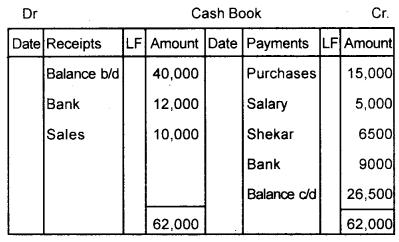

a) Prepare a simple cash book from the following: (Say 2016)

Answer:

Question 64.

Prepare an analytical petty cash book from the following details. (Say 2016)

Answer:

Analytical Petty Cash Book

Question 65.

Journal entry to record salaries paid will include ________ (March 2017)

a) debit cash and credit salaries

b) debit salaries and credit cash

c) debit capital and credit salaries

d) debit salaries and credit capital

Answer:

b) debit salaries and credit cash

Question 66.

JMr. Adwaith started a business with Rs. 2,50,000 as an initial investment. of which he paid Rs. 20,000 for the purchase of furniture, Rs. 25,000 for computers and Rs.40,000 for the stock of goods. He sold goods on credit to Ashok for Rs. 3,000. He also purchased goods from Sudeep on credit for Rs. 15,000. From the above information, identify (March 2017)

a) What is the amount of capital?

b) Who is the debtor and what is the amount receivable from him?

c) What are the fixed assets he bought?

Answer:

a) Capital = Rs. 2,50,000

b) Debtor – Ashok

Amount Receivable – Rs. 3000

c) Furniture and computer

Question 67.

Mr. Mrinal got an appointment as a cashier in a firm for handling only the small payments and expenses. He records these in a separate book. (March 2017)

a) Identify the name of the book prepared by Mr. Mrinal.

b) Prepare the book from the following transactions.

Answer:

a) Petty cash book

b) Petty cash book

Question 68.

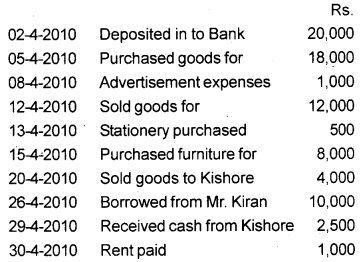

You are given certain transactions of a trader. (March 2017)

Started business with cash Rs. 60,000

Furniture purchased Rs. 12,000

Purchased goods on credit from Abhi Rs. 8,000

Received commission Rs. 2,000

a) Prepare an accounting equation for the above.

b) Supply the missing amounts on the basis of the accounting equation.

Answer:

2) _____ = 30,000 + 9000

Assets = 39,000

Question 69.

Prepare Purchase Book from the following transactions. (March 2017)

Answer:

Purchase Book

Question 70.

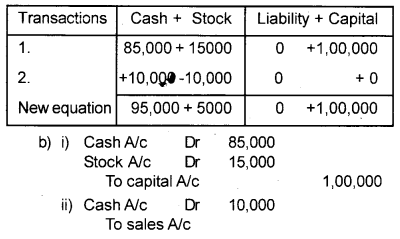

Started business with cash Rs. 85,000 and stock Rs. 15,000. Sold goods for cash Rs. 10,000. (March 2017)

a) Prove that the accounting equation is satisfied in the above transactions.

b) Also pass the journal entries to record the above transactions.

Answer:

a) Assets = Liabilities + Capital

Question 71.

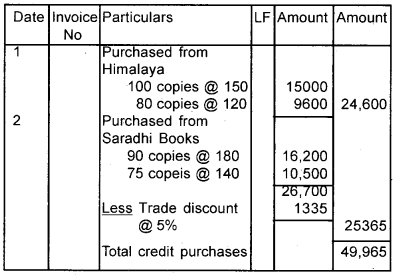

Sethu a dealer in books had the following transactions for the month of June 2016. (March 2017)

a) Purchased books on credit from Himalaya Publishers:

100 copies of Accountancy Text for Class XI @ Rs. 150 per text. 80 copies of Business Studies Text for Class XI @ Rs. 120 per text.

b) Purchased books on credit from Saradhi Books:

90 copies of Accountancy Text for Class XII @ Rs. 180 per text. 75 copies of Business Studies Text for Class XII @ Rs. 140 per text. Trade discount allowed 5%.

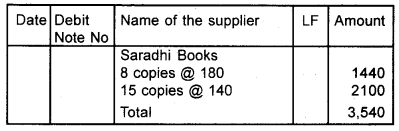

c) Returned to Saradhi Books:

8 copies of Accountancy Text for Class XII @ 180 per text. 15 copies of Business studies Text for Class XII @ Rs. 140 per text.

i) Record the above transactions in the appropriate day books.

ii) Identify the source document for recording the transaction no. (c) above.

Answer:

(i) Purchase Day Book

Purchase Return Book

(ii) Debit note

Question 72.

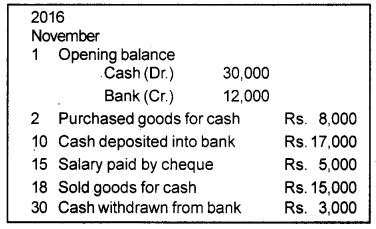

Prepare a double-column cashbook from the details given below. (March 2017)

Answer:

(b) Cashbook with cash and Bank column